How BDRs Generate Leads: The 2026 Tactical Playbook

A BDR at a SaaS company I know was working 12-hour days, manually researching every prospect, crafting semi-personalized emails one at a time, and still couldn't hit 15 meetings a week. The company wouldn't give him automation tools because they wanted "personality-driven" outreach. He burned out in four months. That's not a work ethic problem - it's a process problem.

BDRs produce between 46% and 73% of total sales pipeline, with a median of $3M per year per rep. They're the engine. But the engine only runs if the process is right, and in 2026 the process looks different than it did even two years ago. Buyers get 50+ vendor emails a week, AI-generated messages all sound identical, and one enterprise sales vet reported his SDRs making 200 calls a day with zero connections. Meanwhile, 58% of BDR teams expanded in the past year and 35% of companies raised quotas. More reps, higher targets, same broken processes.

The BDRs who win aren't working harder - they're working with better data, sharper targeting, and multi-channel cadences that actually cut through. The #1 resource BDRs request is better contact data. If you fix nothing else, fix your data quality. It's the single biggest lever for pipeline generation, and everything else in this playbook amplifies that foundation.

What BDRs Actually Do (and How They Differ From SDRs)

Most companies use "BDR" and "SDR" interchangeably. The roles are fundamentally different in how they source pipeline.

BDRs own outbound. They build prospect lists from scratch, run cold outreach, and create opportunities where none existed. SDRs qualify inbound - they respond to form fills, content downloads, and webinar registrations. BDRs open doors; SDRs answer the doorbell.

Per 6sense's BDR benchmark report surveying 262 BDRs, 85% primarily or exclusively focus on outbound activities. That means cold calls, cold emails, and social selling - not waiting for marketing to deliver warm leads.

| BDR | SDR | |

|---|---|---|

| Focus | Outbound prospecting | Inbound qualification |

| Lead source | Self-sourced lists | Marketing-generated |

| Key metric | Meetings booked | Speed-to-lead |

| Typical quota | 15-25 meetings/month | Response within 5 min |

| Sales cycle | Longer, strategic | Shorter, transactional |

The distinction matters because the skills, tools, and daily workflows are completely different. A BDR who can't build a prospect list is dead in the water. An SDR who can't respond in five minutes loses 9x conversion potential.

For the rest of this playbook, we're talking about outbound BDRs - the ones who hunt.

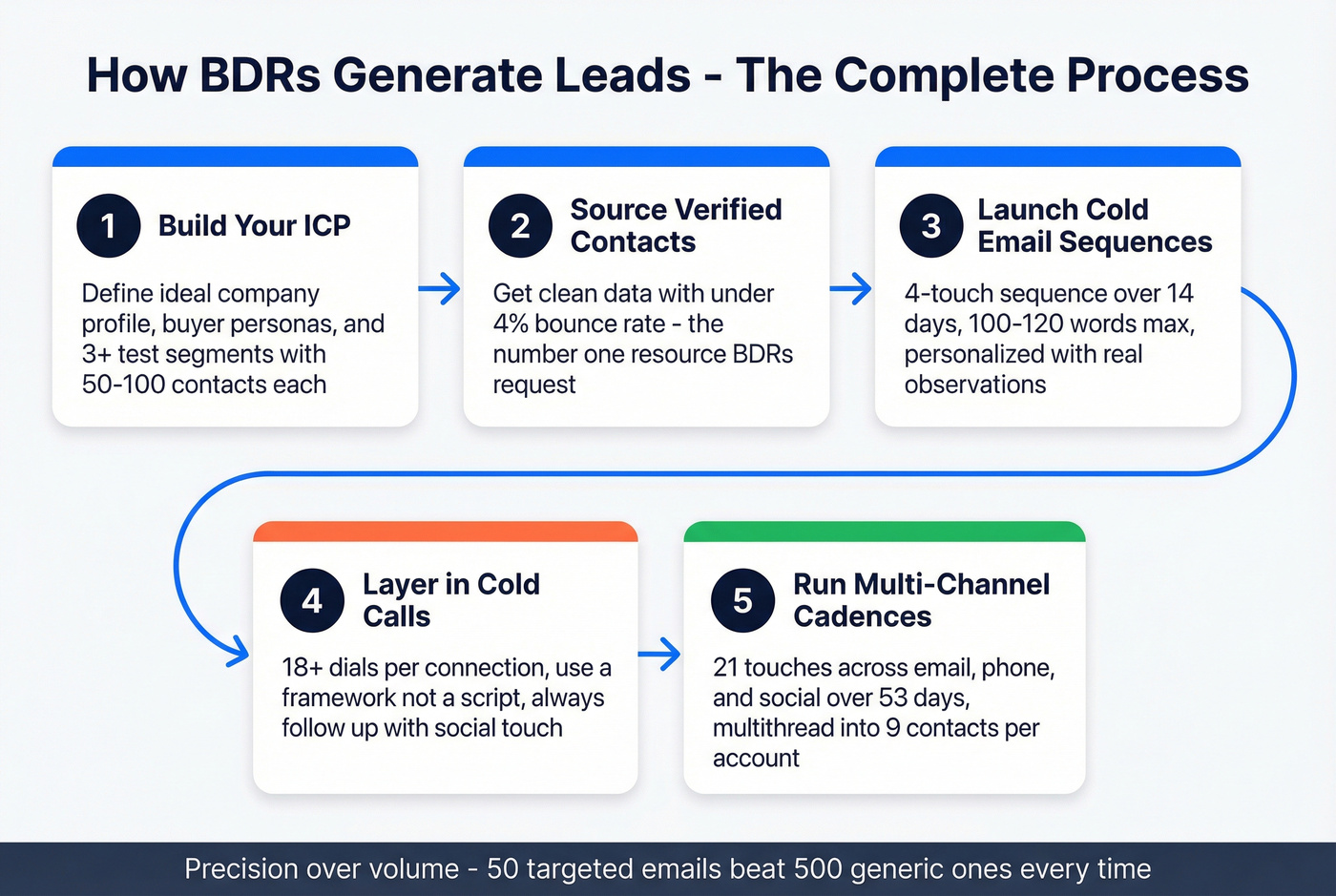

The Step-by-Step BDR Lead Generation Process

Build Your ICP and BDR Lead Profiles Before You Touch a Single Lead

Most BDRs skip this step. They get a territory, open Sales Navigator, and start blasting. That's how you waste three months sending emails to people who'll never buy.

Your Ideal Customer Profile isn't a buyer persona. An ICP defines the company that's a perfect fit. A buyer persona defines the person at that company. You need both, but the ICP comes first. Together, these form your BDR lead profiles - the detailed picture of who you're targeting at the company level and the individual level.

The practical version that works fastest for startups: look at who's actually paid you in the last six months. Search for patterns across these traits:

- Industry fit - go deeper than "healthcare." Insurance? Hospital systems with 250+ beds? Outpatient clinics?

- Company size - employee count, revenue range, department headcount

- Financial ability - funding stage, revenue trajectory, budget signals

- Geographic fit - regions where you have traction or can deliver

- Readiness to buy - growth signals, job postings, tech stack changes

- Ability to scale - can they expand usage over time?

When sales and marketing align on ICP, win rates jump 38% and marketing-generated revenue grows 208%.

Test at least three segments initially. Run 50-100 contacts per segment, measure response rates, and double down on what converts. The ICP isn't a document you write once - it's a hypothesis you validate with outbound data. For enterprise teams, this ICP work feeds directly into an ABM motion: tier your accounts by fit plus intent, then coordinate 90-day sprints across marketing, BDRs, and AEs.

Source Verified Contacts (and Stop Burning Your Domain)

Contact data is the #1 resource BDRs request, ahead of intent data and account intelligence. Bad data doesn't just waste time - it actively destroys your ability to sell.

Almost 20% of cold emails get flagged as spam despite legitimate intent. When your bounce rate runs high, inbox providers notice. Your domain reputation tanks. Suddenly even your good emails land in spam. I've seen this spiral take down entire outbound programs in weeks.

BDRs spend 30-40% of their time on actual outreach. The rest goes to research, admin, and data entry. Better data compresses that ratio hard. When every email you send actually reaches a real inbox, every minute of outreach counts more.

Cold Email That Gets Replies

The average cold email response rate in 2026 is 5.1%. Most campaigns fall between 1-5%. Your email needs to earn every reply.

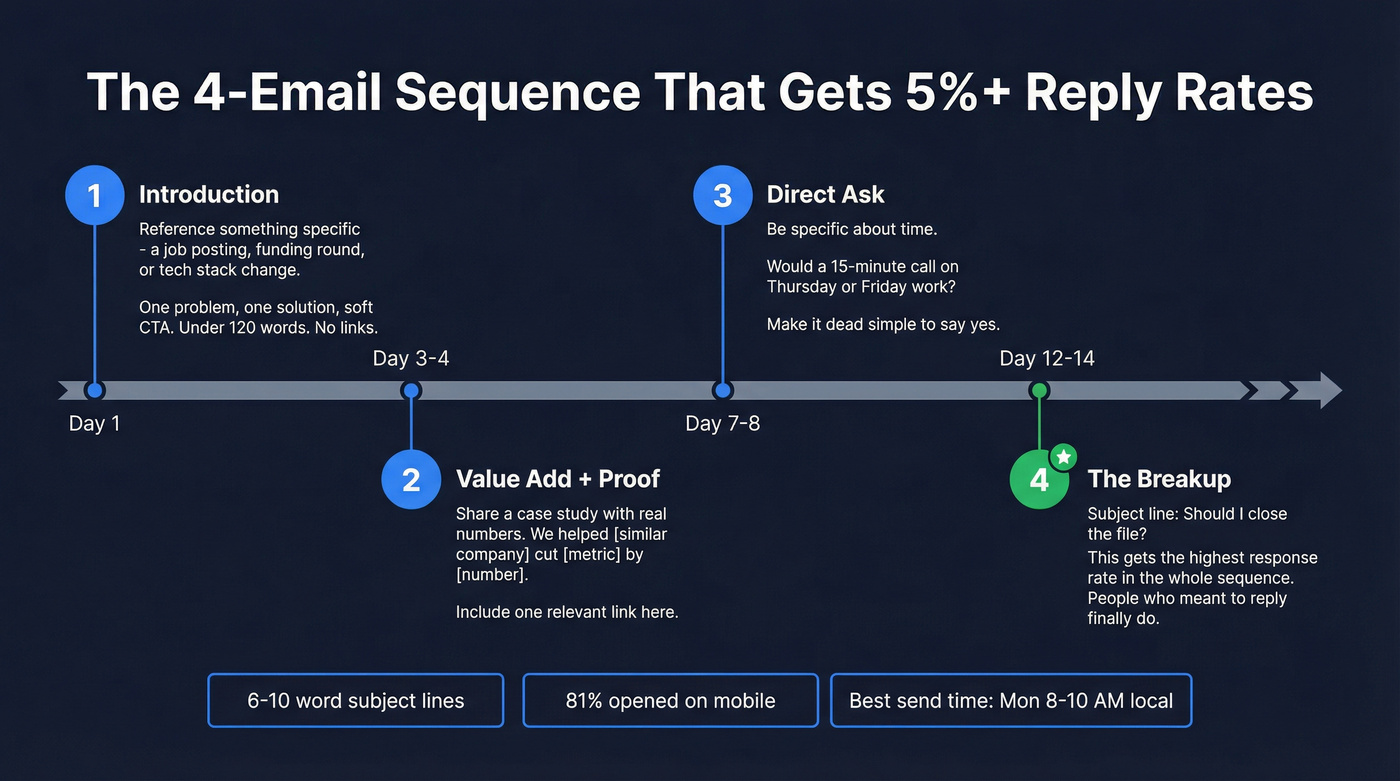

Here's the sequence structure that works:

Email 1 (Day 1): Introduction with a specific observation. Not "I noticed your company is growing" - that's what everyone writes. Reference something concrete: a job posting, a funding round, a tech stack change. One problem, one sentence about how you solve it, one soft CTA. Keep it under 120 words.

Email 2 (Day 3-4): Value add with proof. Share a case study or specific result from a similar company. "We helped [similar company] cut [metric] by [number]." No attachments. No links in the first email - save them for this one.

Email 3 (Day 7-8): Direct ask. "Would a 15-minute call on Thursday or Friday work?" Be specific about the time commitment. Make it easy to say yes.

Email 4 (Day 12-14): Breakup. Subject line: "Should I close the file?" This consistently gets the highest response rate in sequences. People who've been meaning to reply finally do.

The tactical details that separate good from great:

- Subject lines: 6-10 words. Shorter is better. No clickbait.

- Body: 100-120 words max. 81% of emails are opened on mobile - long emails get abandoned.

- Timing and spacing: Monday has the highest open rate. Send between 8-10 AM in the prospect's timezone, with 2-4 business days between touches.

- Authentication: SPF, DKIM, and DMARC are non-negotiable. If your IT team hasn't set these up, stop everything and fix it today.

Precision over volume is the 2026 playbook. Sending 500 generic emails will get you flagged. Sending 50 targeted emails with verified contacts - where bounces stay under 4% - will generate more pipeline and protect your sender reputation.

Cold Calling That Books Meetings

Cold calling isn't dead. 31% of decision-makers report strong ROI from it, and top-performing callers convert up to 15% of conversations into meetings. The problem isn't the channel - it's the execution.

The math is brutal but honest: it takes 18+ dials to connect with one prospect. The daily benchmark is roughly 4.4 actual conversations from a full day of dialing.

Every conversation has to count.

Don't use a rigid script. Use a framework:

Opening (first 10 seconds): Lead with context that proves relevance. "I saw your team just posted three SDR roles - sounds like you're scaling outbound. I work with teams doing exactly that." This isn't a pitch. It's a reason to not hang up.

Value direction (next 20 seconds): One sentence about what you do, framed around their likely problem. "We help BDR teams cut list-building time by 80% so reps spend more time selling." Then ask a question: "Is that something you're dealing with right now?"

Handle objections by acknowledging, not arguing. "I totally get that - timing is always tricky. Quick question before I let you go: if you were looking at this in Q2, what would need to be true?" Treat resistance as information, not rejection.

Exit with a clear next step. Either book the meeting or get permission to follow up. "Can I send you a one-pager and circle back Thursday?" beats "I'll follow up sometime."

Follow every call with a social touch - a connection request referencing the conversation. This turns a cold call into a warm relationship. BDRs who pair calls with social outreach see significantly higher conversion rates than single-channel callers.

AI role-play tools like Second Nature or Hyperbound are useful here. Practicing objection handling against an AI that throws curveballs builds muscle memory faster than reading a script ever will.

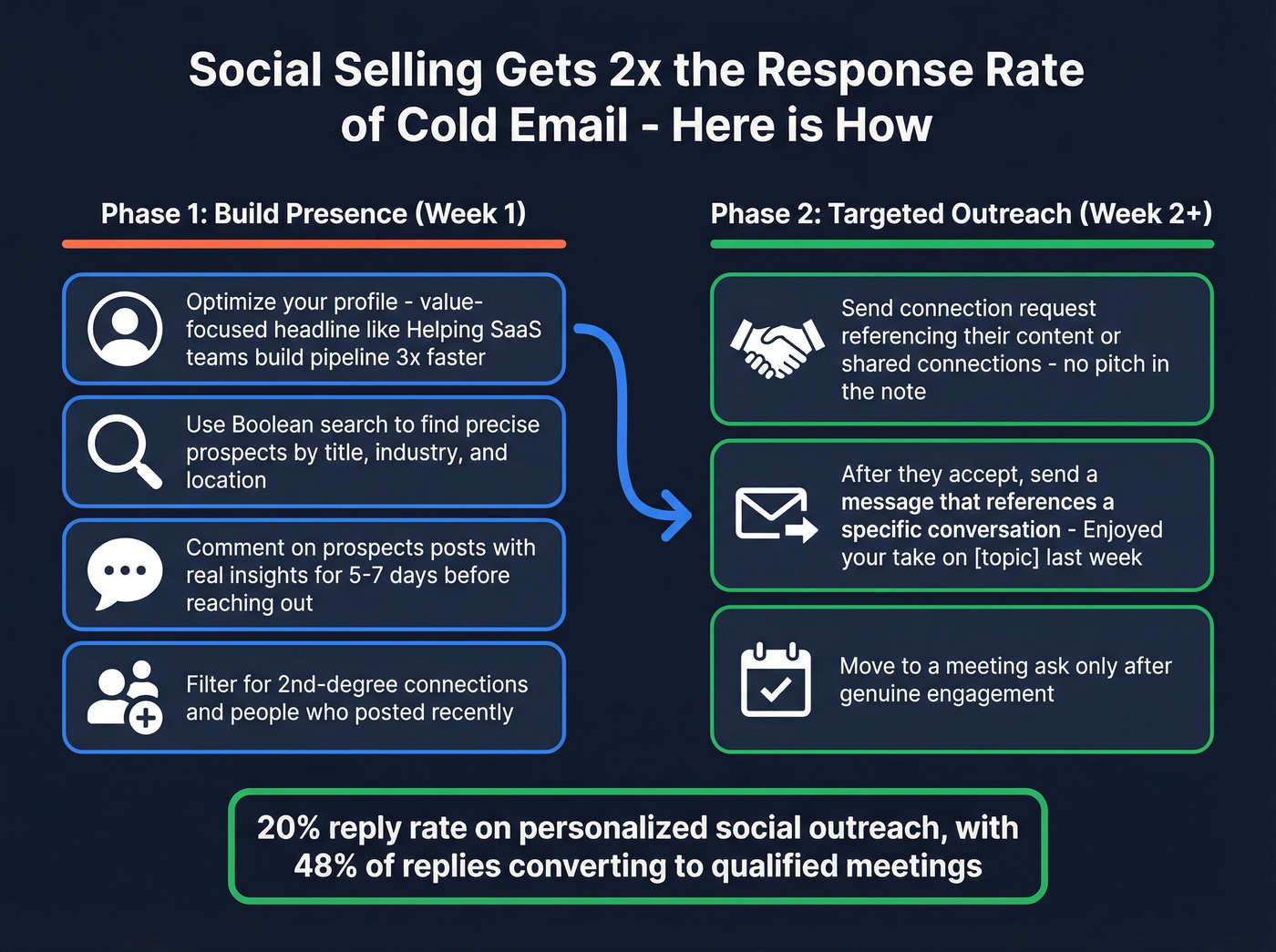

Social Selling and BDR Buyer Engagement on Professional Networks

Social selling delivers 2x the response rate of cold email. SalesBread's data across hundreds of campaigns shows a ~20% reply rate on personalized social outreach, with 48% of those replies converting into qualified meetings or sales conversations.

Those numbers are hard to ignore.

But "social selling" doesn't mean blasting connection requests with a pitch in the note. It means building a presence that makes prospects want to connect with you. Genuine BDR buyer engagement - commenting on their content, responding to their challenges, showing up consistently - is what earns the right to pitch.

Profile optimization comes first:

- Professional headshot (not a company logo, not a vacation photo)

- Value-focused headline - "Helping SaaS teams build pipeline 3x faster" beats "BDR at Acme Corp"

- Compelling About section that speaks to your prospect's problems, not your resume

- Recommendations from people in your target market

Then the tactical work:

Use Boolean search to find precise prospects. A search like Site:linkedin.com/in ("VP Sales" OR "Head of Revenue") ("SaaS" OR "software") "Austin" returns more accurate results than native platform filters, which are notoriously unreliable for keyword matching.

Filter by 2nd-degree connections and people who've recently posted. These are warmer targets - you have mutual connections, and they're active on the platform.

Engagement before outreach matters. Comment on a prospect's post with something substantive - not "Great post!" but an actual insight or question. Do this for a week before sending a connection request. When you do reach out, reference the conversation. "Enjoyed your take on [topic] last week - we're seeing something similar with our customers" lands completely differently than a cold pitch.

The Multi-Channel Cadence (Day by Day)

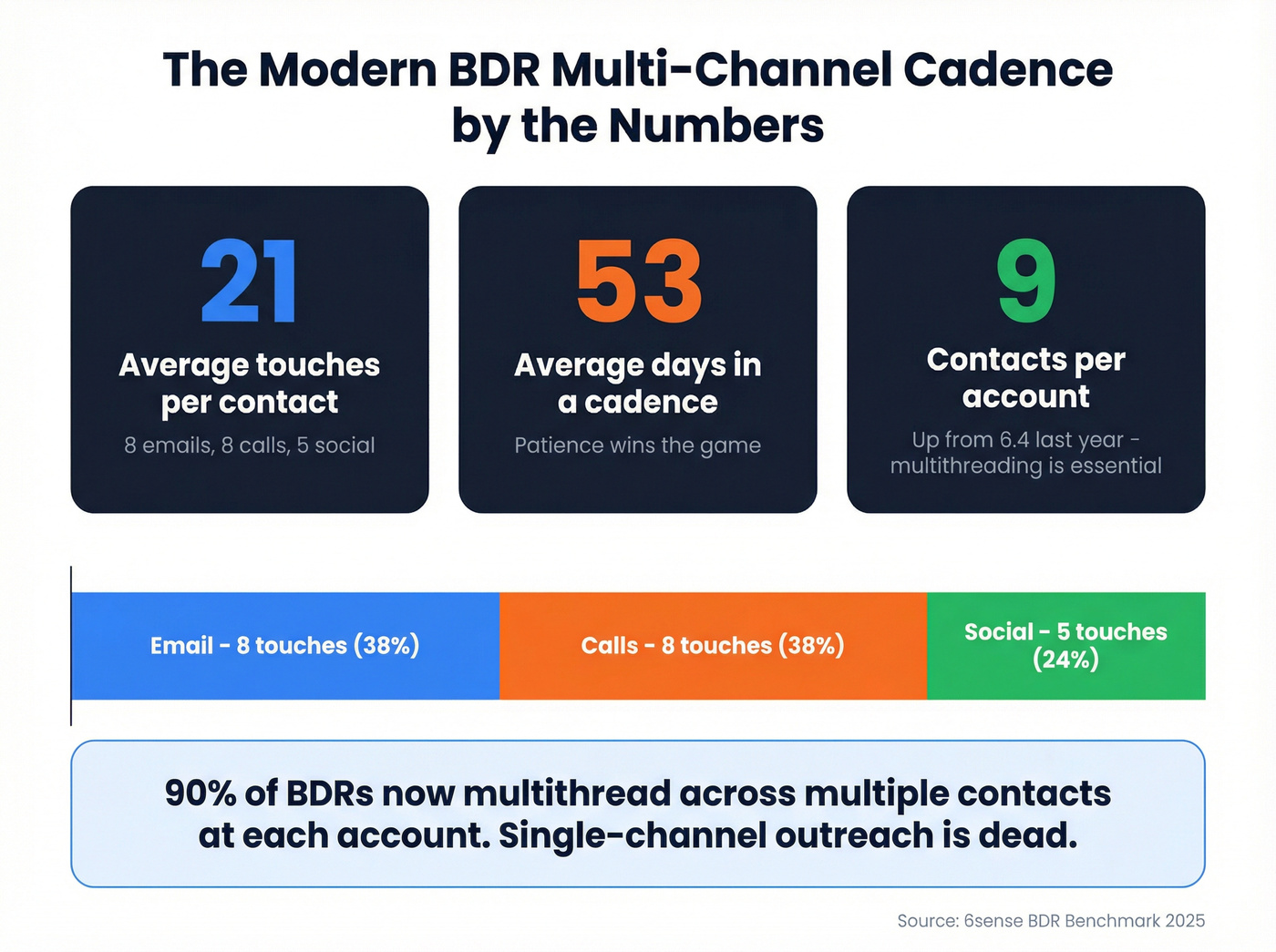

Single-channel outreach is dead. Buyers engage across an average of 10 channels during their journey. BDRs make an average of 21 attempts per contact - roughly 8 emails, 8 calls, and 5 social touches - across a 53-day average cadence. And they multithread into 9 contacts per account, up from 6.4 last year. 90% of BDRs now multithread.

Here's a 10-day cadence framework for cold outbound prospecting:

Day 1: Call after a trigger or signal. Job change, funding announcement, tech stack shift - anything that gives you a reason to reach out. Set expectations: "This'll take 30 seconds."

Day 2: Follow-up email. Recap the value proposition. Attach a one-pager or link to a relevant resource. Keep it under 100 words.

Day 3: Social connection request. Reference their role or recent company activity. No pitch in the connection note.

Day 4: Email with social proof. Share a customer success story from a similar company. Specific numbers beat vague claims every time.

Day 6: Call with a direct question. "What are you currently using for [problem area]?" Leave a voicemail if they don't answer - voicemails prime them for your next email.

Day 8: Email summarizing value. Reference your previous touches. Offer a specific meeting time: "Would a 15-minute Zoom on Thursday at 2 PM work?"

Day 10: Breakup email. "This'll be my last note unless I hear back. If the timing isn't right, no worries - I'll check in next quarter."

Day 30: Light re-engagement. Share something new - an industry report, a product update, an event invite. No pressure. Just stay on their radar.

For inbound leads (MQLs handed to BDRs), compress the cadence: 8-12 touchpoints over 10-15 business days. These prospects already raised their hand - speed matters. For cold outbound, 6-8 touches over 2-3 weeks is the sweet spot before the breakup email.

Here's the thing: each channel reinforces the others. A prospect who sees your name in email, hears your voice on a call, and reads your comment on their post is far more likely to engage than one who just gets emails. Multi-channel isn't about more volume - it's about more surface area.

This article proves it: bad data destroys BDR pipeline. Prospeo delivers 98% email accuracy with a 7-day refresh cycle, so every email in your sequence hits a real inbox. Bounce rates under 4%? That's the baseline, not the goal.

Stop burning your domain. Start booking meetings with verified contacts.

Qualify and Hand Off

Not every meeting is a qualified opportunity. The best BDRs don't just book meetings - they qualify hard enough that 74% of their handoffs are Opportunities, not raw Leads or Accounts. The average lead-to-opportunity conversion rate in SaaS is about 12-13%, and 22% of BDR-sourced opportunities close as won deals.

The framework you use depends on your sales motion:

| BANT | MEDDIC | CHAMP | |

|---|---|---|---|

| Stands for | Budget, Authority, Need, Timeline | Metrics, Economic Buyer, Decision Criteria, Decision Process, Identify Pain, Champion | Challenges, Authority, Money, Prioritization |

| Best for | Transactional, shorter cycles | Enterprise, complex deals | Challenger/consultative |

| When to use | Sub-$15K deals, single decision-maker | $50K+ deals, buying committees | Mid-market, multi-stakeholder |

| Key question | "Do you have budget allocated?" | "What metrics define success?" | "What's your biggest challenge?" |

Look, the framework matters less than the discipline. BDRs who qualify rigorously before handing off save AEs hours of wasted discovery calls and keep close rates healthy. A "meeting booked" that turns into a no-show or a dead-end isn't a win - it's a tax on the sales team.

The feedback loop most teams skip: Set up a weekly 15-minute sync with your AEs to review which meetings converted and which didn't. Ask what made the good ones good. This is how you calibrate your qualification criteria over time - and it's the single fastest way for a new BDR to improve handoff quality.

BDR Benchmarks - What Success Looks Like in 2026

Numbers without context are useless. Here's what top-performing BDR teams actually hit, compiled from the 262-BDR benchmark study, Bridge Group, and Gartner data:

| Metric | Benchmark | Context |

|---|---|---|

| Activities/day | 80-100 total | Calls + emails + social |

| Calls/day | 40-50 | Yields ~4.4 conversations |

| Emails/day | 10-40 | Quality over volume |

| Meetings booked/month | 15-25 | Varies by ACV |

| Show rate | 80% | ~12 held meetings/month |

| Quota attainment | 88% average | Top BDRs hit 95%+ |

| Lead-to-opportunity | 12-13% | Across SaaS |

| Opp close rate | 22% | BDR-sourced deals |

| Pipeline/year | $3M median | Per BDR |

| Cadence length | 53 days avg | Before giving up |

| Attempts per contact | 21 | 8 email, 8 call, 5 social |

| Attempts per contact | 21 | 8 email, 8 call, 5 social |

Two benchmarks that should alarm every sales leader:

Average lead response time is 42 hours. Only 7% of teams respond within five minutes. But responding in five minutes makes you 9x more likely to convert. That's not a marginal improvement - it's an order of magnitude. If your BDRs handle any inbound, speed-to-lead should be a non-negotiable SLA.

BDRs who feel supported by their organization achieve 95% of quota vs 80% for those who don't. "Supported" means tools, training, data, and realistic expectations. Only 50% of companies offer formal sales training - which explains why so many BDRs miss quota despite having the raw talent. Companies that hand BDRs a phone and a territory without investing in their stack are leaving 15 points of quota attainment on the table.

56-68% of SDRs achieve quota overall. That means 32-44% are missing. In most cases, it's not a talent problem - it's a systems problem.

Real talk: if your average contract value is under $10K, you probably don't need a dedicated BDR team at all. Automate the top-of-funnel with good data and sequences, and let AEs handle the conversations. BDRs deliver the most ROI on $25K+ deals where the outbound research and multithreading justify the headcount.

The BDR Tool Stack (With Pricing)

You don't need 15 tools. You need 4-5 that work together. Here's the stack we'd recommend for a mid-market sales development team:

| Tool | Category | Starting Price | Best For |

|---|---|---|---|

| Apollo.io | All-in-one prospecting | Free tier; ~$49/mo paid | SMB teams wanting simplicity |

| Cognism | Phone data + compliance | ~$15-25K/year | European mobile numbers |

| Sales Navigator | Social prospecting | ~$99/mo | Finding and engaging prospects |

| Saleshandy | Email sequencing | $25/mo | Budget-friendly sequences |

| Clay | Data enrichment | ~$150-500/mo | Technical enrichment workflows |

| Gong | Call intelligence | ~$100-150/user/mo | Coaching and call analysis |

| Outreach/Salesloft | Enterprise sequencing | ~$120+/user/mo | Multi-channel at scale |

Apollo.io is the easiest all-in-one for smaller teams. Free tier is generous, paid plans start around $49/mo. The database is large but accuracy runs lower - match rates sit around 79% for emails, which means more bounces. Good for teams that want prospecting plus sequencing in one tool and can tolerate some data quality tradeoffs.

Sales Navigator at ~$99/month is essential for social selling. The search filters aren't perfect (use Boolean search as a workaround), but the ability to filter by company size, seniority, and recent activity makes it indispensable for building targeted prospect lists.

Cognism is the play for European phone data. If you're selling into EMEA, their mobile number coverage and GDPR compliance setup are best-in-class. Not cheap at $15-25K/year, but the phone connect rates in Europe justify it.

Saleshandy starts at $25/month for cold email sequencing - budget-friendly and gets the job done. Clay is the enrichment tool for technical teams who want to build custom waterfall workflows. Gong and Outreach/Salesloft round out the stack for call intelligence and enterprise sequencing.

Total stack cost for a mid-market BDR: $200-500/month. A team pulling 5,000 emails/month pays roughly $50/month with Prospeo vs. $15-40K/year for ZoomInfo. The unbundled approach wins for most teams.

BDRs spend 60-70% of their time on everything except outreach. Prospeo's 30+ search filters - intent data, job changes, tech stack, headcount growth - let you build laser-targeted prospect lists in minutes, not hours. At $0.01 per email, scaling outbound costs less than your coffee.

Source verified contacts faster than your competitors can dial.

AI for BDRs - What to Use and What to Skip

60% of BDRs now use AI tools, and 62% believe AI enhances their productivity. But there's a growing gap between what works and what's noise.

| ✅ USE | ❌ SKIP |

|---|---|

| Call transcription and coaching - Gong-style tools that analyze calls, flag objection patterns, and help managers coach reps. Highest-ROI AI use case for BDRs right now. | Fully autonomous AI BDRs - The "AI white noise" problem is real. When every company uses AI to blast outreach, buyers tune out. As one Reddit veteran put it: "With ChatGPT, everyone sounds exactly the same." |

| Email drafting assistance - AI generates first drafts you then personalize. Saves 10-15 minutes per sequence. The key word is "drafts." | AI personalization at scale - Sounds great in demos. In practice, AI-personalized emails that reference a prospect's latest post feel creepy when everyone's doing it. Diminishing returns fast. |

| AI role-play for cold call practice - Faster feedback loops than waiting for a manager's ride-along. | Replacing BDR headcount with AI - AI handles research and drafting. Humans still need to make the calls, read the room, and build relationships. |

| Predictive account scoring - Layering intent data with firmographics to prioritize which accounts to hit first. | Any tool that promises "set it and forget it" - Outbound requires human judgment. Full stop. |

AI is a multiplier, not a replacement. A BDR with great data, a solid cadence, and AI-assisted research will outperform a team of AI agents sending thousands of generic emails. The winners in 2026 aren't the teams with the most automation - they're the teams with the best signal-to-noise ratio.

BDR Best Practices B2B Teams Should Adopt Now

If you've read this far, you have the tactical playbook. Here are the BDR best practices B2B teams consistently get wrong - and the fixes that drive the biggest impact:

- Validate your ICP quarterly. Markets shift, and the lead profiles that converted last quarter will underperform next quarter. Revisit your data every 90 days.

- Protect your domain above all else. A burned sender reputation takes months to recover. Use verified data, warm up new domains gradually, and keep bounce rates under 4%.

- Multithread from day one. Don't rely on a single contact per account. The benchmark is 9 contacts per account - spread across different roles and seniority levels.

- Invest in coaching, not just tools. BDR success correlates more strongly with organizational support than with individual talent. Weekly call reviews and AE feedback loops compound over time.

- Measure held meetings, not booked meetings. A booked meeting that no-shows is a vanity metric. Track what actually turns into pipeline.

Skip the fancy dashboards until you've nailed these five things. I've seen teams spend $50K on analytics platforms while their reps are still sending emails to dead addresses.

FAQ

How do BDRs generate leads step by step?

BDRs follow a systematic outbound process: define an ICP, source verified contacts, run multi-channel cadences combining email, calls, and social touches, qualify using frameworks like BANT or MEDDIC, and hand off to AEs. The average rep makes 21 attempts per contact and multithreads into 9 contacts per account.

How many meetings should a BDR book per month?

Top-performing BDRs book 15-25 meetings per month with an 80% show rate, yielding roughly 12 held meetings. Teams closing $50K+ deals need fewer meetings than teams working four-figure contracts. Median BDR-generated pipeline runs about $3M per year.

What's the difference between a BDR and an SDR?

BDRs own outbound prospecting - they build lists, run cold outreach, and create opportunities from scratch. SDRs qualify inbound leads from marketing like form fills and demo requests. Many companies use the titles interchangeably, so always ask about the actual day-to-day responsibilities.

What tools do BDRs need to generate leads effectively?

A mid-market BDR needs 4-5 core tools: a verified contact database like Prospeo (98% email accuracy, free tier available), a social prospecting platform, an email sequencer, and call intelligence software. Total cost runs $200-500/month - far less than legacy platforms at $15-40K/year.

How long does it take for a new BDR to ramp?

Expect 3-6 months to full productivity. Average BDR tenure is about 18 months, so ramp time eats a significant chunk of the effective selling window. Reps who feel supported by their organization hit 95% of quota versus 80% for those who don't - invest in onboarding, tools, and coaching early.

That BDR I mentioned at the start? He eventually moved to a company that gave him verified data, an email sequencer, and a structured cadence. He hit 22 meetings in his first full month. The difference wasn't talent - it was process. Now you know how BDRs generate leads when the system is built right. Follow this playbook, and the pipeline follows.