Social Selling: The Operator's Playbook for 2026

You're paying five figures a year for data, and you still can't get a real conversation going with the people who matter.

Social selling fixes that because it earns attention before you ask for time. But it only works when you run it like an operating system: a repeatable daily/weekly routine with targets, spacing, and measurement.

Most guides dodge the cadence reality and tell you to "post more." Here's the operator layer they skip: the latest published benchmark (2026) from 6sense's BDR study (n=262) shows teams average about 21 attempts per contact across channels, with about 5 social touches, 8 calls, and 8 emails, and cadences run about 53 days. This motion isn't replacing outbound. It's making outbound land.

What you need (quick version)

If you do nothing else this week, do these three behaviors:

- 5 meaningful comments/day (on the right people, not random creators)

- 1 trigger-based DM/day (based on a real signal, not "just checking in")

- Weekly list hygiene + multithread (work buying committees, not individuals)

One more expectation reset: social is about five touches inside a 21-attempt reality. Treat it as a channel in your sequence, not a standalone strategy.

Social selling (definition) - and what it isn't

Social selling is using social platforms to turn attention into sales conversations by researching accounts, engaging thoughtfully, and moving to a clear next step.

In plain English, it's a set of repeatable behaviors that turn digital attention into sales conversations: research accounts, engage where buyers already are, build familiarity, then ask for a small next step (usually a meeting, sometimes a referral, sometimes a "send me that").

This applies across LinkedIn, X, and even Instagram depending on your market. The mechanics don't change: list -> engage -> convert. Buyers will skim your profile, your company page, your comments, and your mutual connections as part of how they evaluate you, so you want to show up in that research trail on purpose.

It is:

- Targeted engagement with a defined ICP and account list

- Relationship-building that earns permission for a business conversation

- A way to create "warmth" so calls/emails don't feel random

- A multithreading tool (multithread = engaging multiple stakeholders in the same account)

It isn't:

- Posting generic "thought leadership" and hoping pipeline appears

- Spamming connection requests with a pitch (that's just faster rejection)

- Outsourcing your voice to low-quality automation

- A replacement for calls, email, or a real sequence

If your "social strategy" can't be written into a daily checklist and measured weekly, it's not a strategy.

It's content therapy.

Social selling vs social commerce (don't mix these up)

Social commerce is when the transaction happens inside the platform. Social selling is relationship-building that nudges someone toward a sales process.

| Dimension | Social selling | Social commerce |

|---|---|---|

| Goal | Meeting/convo | In-platform purchase |

| Buyer intent | Consideration | Ready-to-buy |

| Motion | Relationship -> sales | Discovery -> checkout |

| Best for | B2B, complex deals | DTC, impulse buys |

| Success metric | Pipeline created | Revenue per post |

Example: a rep comments on a VP's post, sends a relevant DM, then moves to a call. That's the relationship-building motion you want.

A shoppable post with in-app checkout is social commerce.

How social selling is measured (and why SSI is only a proxy)

SSI (Social Selling Index) is a useful activity proxy.

It isn't the scoreboard.

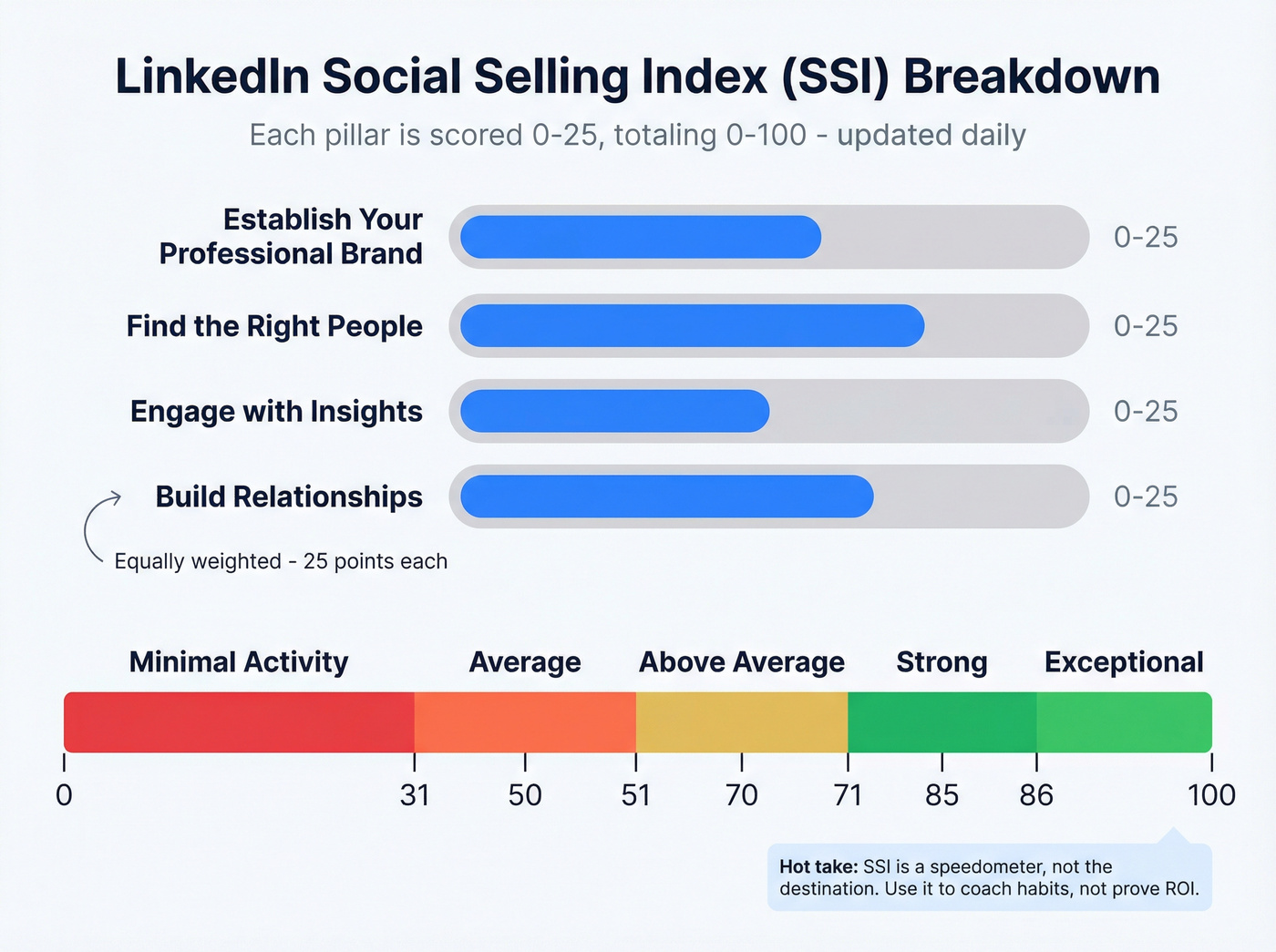

SSI is a proprietary score with four pillars, equally weighted 0-25 each, totaling 0-100, and it's updated daily. The formula's undisclosed, so you're optimizing a black box. The dashboard also shows your industry rank and network rank, which is useful for coaching (and humbling).

The four pillars:

- Establish your professional brand

- Find the right people

- Engage with insights

- Build relationships

A practical "good SSI" range:

- 0-30: minimal activity

- 31-50: average

- 51-70: above average

- 71-85: strong

- 86-100: exceptional

What to track (and what not to)

| Metric | Use it for | Don't use it for |

|---|---|---|

| SSI (0-100) | Activity proxy | ROI proof |

| Comments/day | Consistency | Quality assumption |

| DM reply rate | Message fit | Pipeline forecast |

| New convos/week | Top-of-funnel | Rep performance alone |

| Meetings booked | Output | Full-funnel credit |

| Opps influenced | Influence | Exact attribution |

| Pipeline created | Finance KPI | "Social-only" purity |

Use SSI to coach habits; use pipeline metrics to justify headcount. Anything else turns into performative engagement, and finance will (correctly) refuse to fund it.

What tends to move SSI (without gaming it)

If you want SSI to rise as a byproduct of real work, focus on the levers that map to the four pillars:

1) Establish your professional brand

- Tight headline + About section that states a clear outcome (not a resume)

- A complete profile with proof (case studies, talks, customer logos, projects)

- Consistent posting cadence or consistent commenting cadence (either works)

2) Find the right people

- Build saved lists by ICP + role + trigger (job change, hiring, funding, tech change)

- Follow accounts and stakeholders so their updates show up

- Keep your target list fresh weekly (titles change; initiatives change)

3) Engage with insights

- Comment with a point of view (agree/disagree + why + example)

- Share practical takeaways from the field (what worked, what failed, what surprised you)

- Ask one real question that invites a reply (not a trap question)

4) Build relationships

- Move from public to private only when there's a reason (resource, intro, answer)

- Reply quickly when someone engages (same day wins)

- Keep conversations going with small next steps (send checklist, 10-minute sanity check)

Hot take: if your team chases SSI as a target, you've already lost. SSI's a speedometer, not the destination.

Your 5C system needs accurate contact data to convert comments into conversations. Prospeo gives you 98% verified emails and 125M+ direct dials so your DMs and follow-ups actually reach the buying committee.

Turn social touches into booked meetings with data that connects.

The 5C social selling system (daily + weekly operating rhythm)

This rhythm holds up in the real world because it's simple enough to run when you're busy. The 5C system: Clarity, Connect, Conversations, Commenting, Content.

You don't need to max all five. You need to do them consistently.

Clarity (weekly, 20 minutes)

Your reps can't "be helpful" if they don't know who they're for.

Checklist:

- Define your ICP in plain language (industry + size + tech + trigger)

- Pick 2-3 buyer roles (economic buyer, champion, technical)

- Write a one-line outcome statement for your profile headline (outcome > job title)

- Decide your "reason to engage" triggers (funding, hiring, new role, product launch, compliance change)

I've watched teams waste months engaging the wrong titles because their ICP doc was a slide deck nobody used. Put it in the rep's daily workflow, not a wiki.

Connect (daily, 10 minutes)

Connection requests aren't the pitch.

They're the doorbell.

Rules that work:

- Send a small number consistently (think 5-15/day, not 200/day)

- Notes can help, but "mostly blank" often converts better than a forced note

- If you add a note, keep it contextual and short (one sentence)

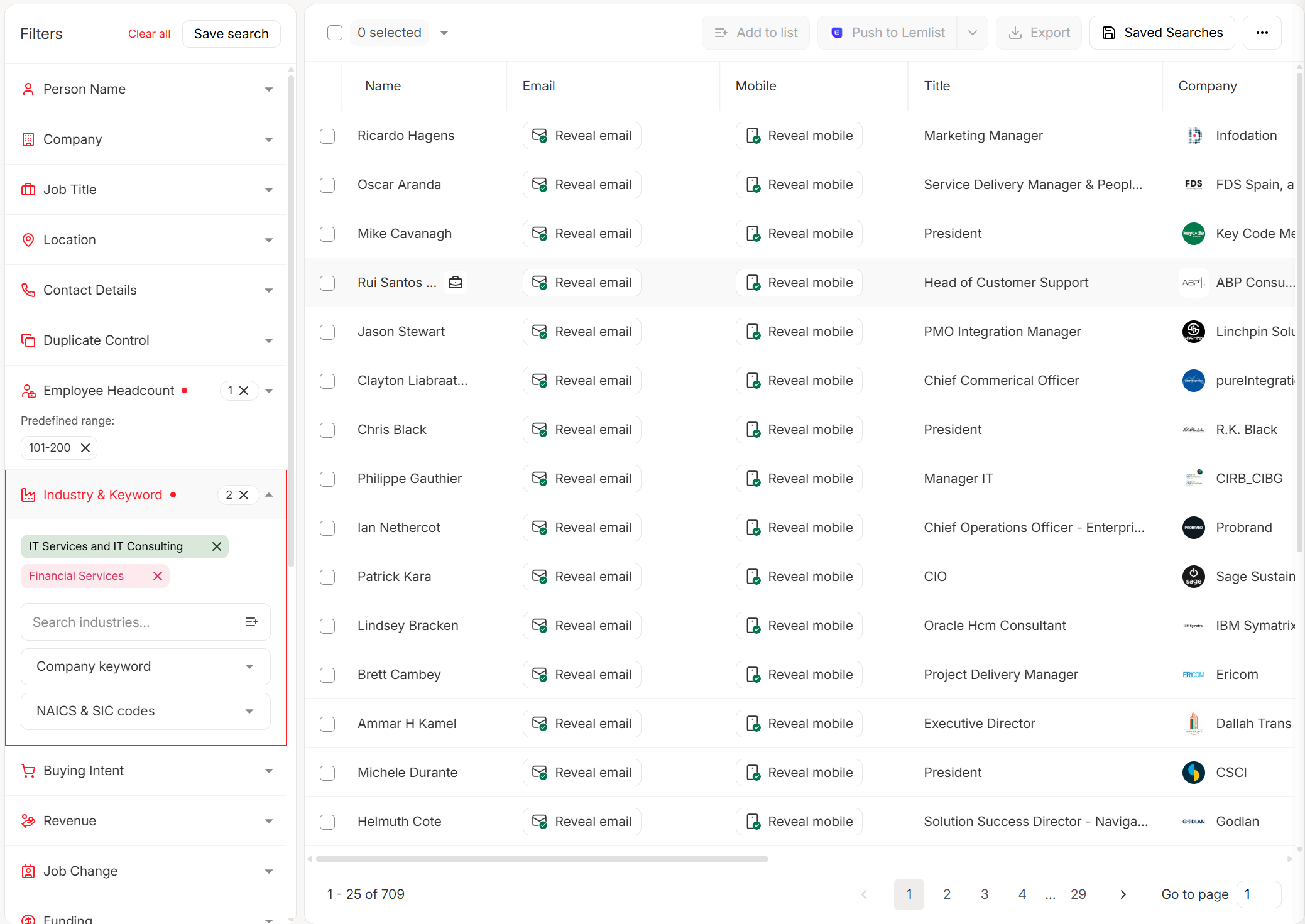

Targeting filters that matter (especially in Sales Navigator):

- Prioritize people who posted in the last 30 days (active buyers are reachable buyers)

- Prioritize time in role < 1 year (assessment window, new initiatives, new vendors)

- Don't overuse "changed jobs in 90 days" - everyone hits them, and their inbox is a warzone

Pricing signal: Sales Navigator starts around $79.99 per user/month. For most outbound teams, it's the best targeting spend.

Conversations (daily, 10-15 minutes)

This is where the motion becomes pipeline.

Checklist:

- Reply to anyone who comments back (same day if possible)

- Move from public -> private when there's a real reason (question, resource, intro)

- Log the conversation in your CRM as an activity tied to the account

CRM note: HubSpot Sales Hub has a free tier and paid plans from about $45/user/month. Salesforce is typically about $25-$165+/user/month depending on edition and add-ons. The point isn't the logo. It's the logging.

If it's not in the CRM, it didn't happen in RevOps land.

Commenting (daily, 15 minutes)

The daily cadence that moves the needle: five meaningful comments/day.

Not "Great post!" comments. Comments that prove you read the thing and have a point of view.

A simple commenting formula:

- Agree/disagree + why

- Add a quick example ("We see this when...")

- Ask one real question

Build three lists:

- Dream accounts (your targets)

- Industry voices (where your buyers hang out)

- Partners/customers (social proof and adjacency)

Content (2-3x/week, 30-45 minutes)

Content's optional for pipeline, but it compounds trust. One post that gets saved and shared inside an account can do more than 50 cold emails, because it travels internally without you being in the room and it gives your champion language they can reuse.

Don't overthink frameworks. The pattern that keeps working is: specific problem + specific fix + specific example.

What to post:

- "What I'm seeing" patterns (anonymized)

- A teardown of a common mistake

- A short story from the field

- A practical checklist

Ops hygiene (monthly, 15 minutes)

This is the unsexy part that keeps your motion healthy:

- Withdraw pending invites monthly (clean your outbound footprint)

- Keep a 3-week re-approach window: if they didn't accept, wait about 3 weeks, then re-engage via a comment or a new trigger

- Refresh lists weekly: remove people who left, add new stakeholders, update titles

Tool stack callout (lightweight):

- Listening/publishing: Hootsuite, Sprout Social (great for monitoring and scheduling; don't turn reps into "content managers")

- Social listening: set keyword alerts for competitor names, category terms, and "hiring for X" signals

- CRM: HubSpot or Salesforce (non-negotiable if you want ROI proof)

- Targeting: Sales Navigator

Messaging that doesn't feel cringe (templates + spacing benchmarks)

Most messages fail for one reason: they're written like an email sequence, not a conversation.

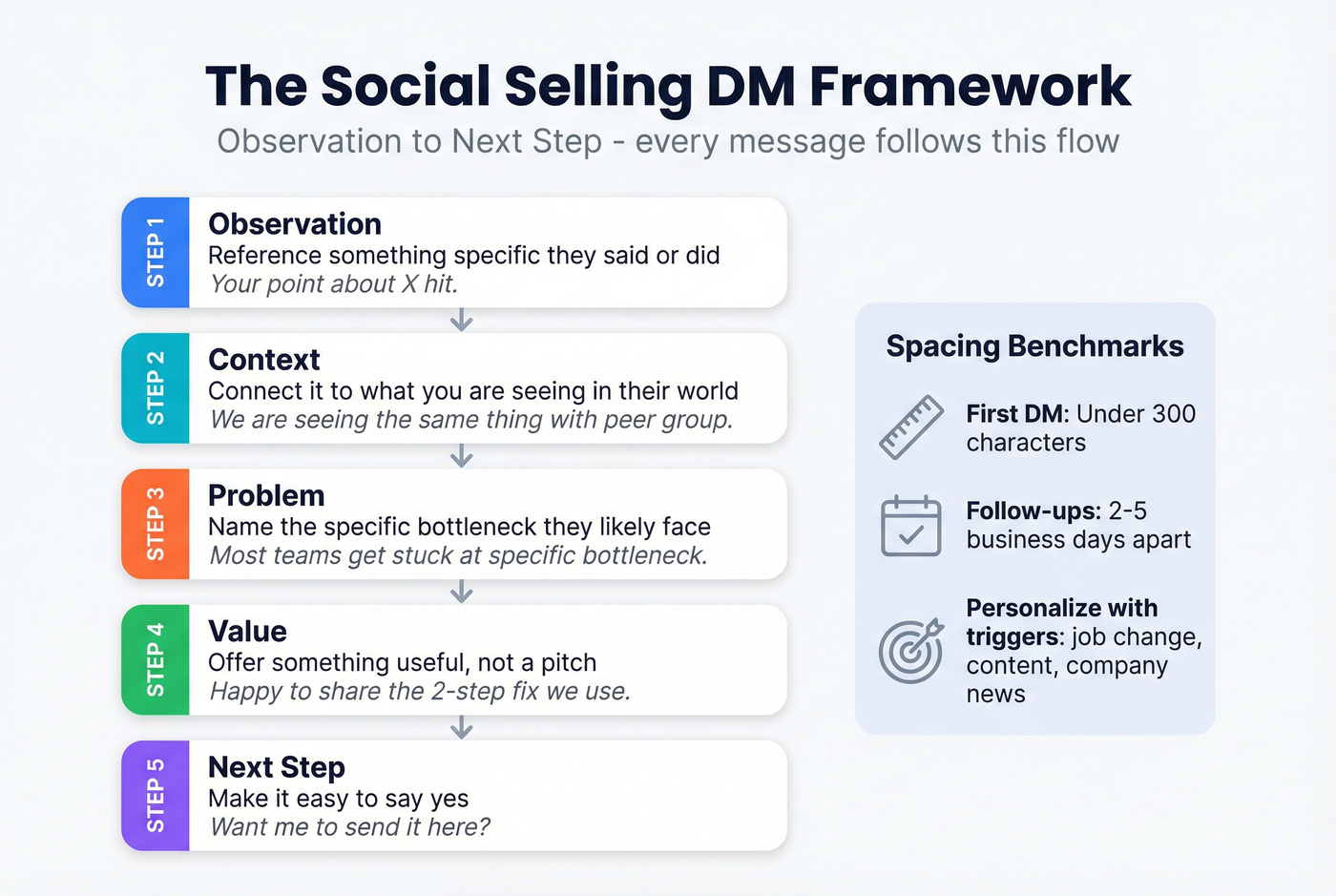

Use this DM framework: Observation -> Context -> Problem -> Value -> Next step

Benchmarks that keep you out of the uncanny valley:

- Keep the first DM under 300 characters

- Space follow-ups 2-5 business days apart

- Personalize using triggers: job change, content they posted, company news, hiring, product launch

Templates (copy/paste, then personalize)

1) After you comment on their post (low friction)

- Observation: "Your point about [X] hit."

- Context: "We're seeing the same thing with [peer group]."

- Problem: "Most teams get stuck at [specific bottleneck]."

- Value: "Happy to share the 2-step fix we use."

- Next step: "Want me to send it here?"

2) New in role (<1 year)

- Observation: "Congrats on the new role at [Company]."

- Context: "New leaders usually get pulled into [priority]."

- Problem: "The trap is [common mistake]."

- Value: "I've got a short checklist that helps avoid it."

- Next step: "Worth sending?"

3) Company trigger (funding/hiring/launch)

- Observation: "Saw [Company] is hiring [function] / launched [thing]."

- Context: "That usually means [initiative]."

- Problem: "Teams often underestimate [risk/cost]."

- Value: "We've helped teams handle it without [pain]."

- Next step: "Open to a 10-min sanity check next week?"

Format mix (optional): text -> voice note -> short video

If you want to stand out without getting weird, rotate formats across three touches:

- Text DM (under 300 chars)

- Voice note (15-25 seconds, one point)

- Short video (20-40 seconds, screen-free, one takeaway)

Do this only after you've earned a little familiarity (they engaged, accepted, or replied). If you open with video, you look like you're trying too hard.

Do / don't (so you don't sound like a bot)

Do:

- Ask permission before you drop a link

- Use one specific detail (not three generic ones)

- Make the next step small (send a checklist, one question, 10 minutes)

Don't:

- "Just checking in"

- A paragraph of credentials

- A calendar link in message one

Real talk: if your message could be sent to 500 people unchanged, it's not social selling. It's spam with better branding.

Social selling inside a real outbound cadence (what teams actually do)

This works best when it's one channel inside a real sequence - especially in B2B social selling where deals are complex and buying committees are real.

The latest published benchmark (2026) from 6sense's BDR study (n=262) is the reality check:

- About 21 attempts per contact

- Channel mix: about 5 social / 8 calls / 8 email

- Average cadence length: 53 days

- 90% multithread

- Average 9 people/account

That's the bar. If your "social strategy" is "connect + one DM," you're not even in the same sport.

Sample 21-28 day sequence (social included)

| Day | Channel | Touch |

|---|---|---|

| 1 | Social | View + comment |

| 2 | Trigger-based intro | |

| 4 | Call | Call + VM |

| 6 | Social | DM (short) |

| 8 | Proof + 1 question | |

| 10 | Call | Call |

| 13 | Social | Comment again |

| 16 | Breakup-lite | |

| 20 | Call | Final call |

| 24 | Social | DM with new trigger |

Two operator notes:

- Social touches work best after you've created familiarity (comment first, DM second).

- Multithreading is the whole point. If you're only talking to one person, you're one vacation away from a dead deal.

Skip this if you're selling a $49/month self-serve product with no buying committee and no implementation. You'll still benefit from being visible, but you don't need a 53-day, 21-touch machine.

From engagement -> meeting booked (the execution layer most guides skip)

Most guides stop at "engage more." That's not the hard part.

The hard part is turning engagement into reachable stakeholders across the account fast, while the moment's still warm. In our experience, the teams that win here don't have better copy. They have better follow-through: they map the buying group, get clean contact data, and run a tight omnichannel sequence without waiting two weeks for "the perfect time."

Why it works (the psychology people cite, but sellers forget)

Two forces do the heavy lifting:

- Familiarity: repeated exposure reduces perceived risk ("I've seen this person around").

- Incidental similarity: small shared details (same background, same tools, same constraints) increase trust faster than a generic pitch.

That's why a thoughtful comment can outperform a perfect cold email. You're not trying to go viral. You're trying to become recognizable to the buying group.

The decision tree (what to do next)

Use this when you're deciding whether to comment, DM, call, or multithread:

- Did they engage with you? (liked/commented/replied/viewed profile twice)

- Yes -> DM within 24-48 hours with a trigger-based observation.

- No -> comment again (don't DM yet) or switch to email/call with a tighter trigger.

- Did they reply to your DM?

- Yes -> ask one clarifying question, then propose a small next step (send resource or 10 minutes).

- No -> wait 2-5 business days, then follow up once with a new angle or multithread a second stakeholder.

- Is this a multi-stakeholder problem? (security, finance, ops, technical)

- Yes -> multithread immediately (6-10 stakeholders).

- No -> still add 2-3 adjacent roles so you're not single-threaded.

- Do you have a clear trigger? (hiring, funding, new role, tool change, compliance)

- Yes -> run an omnichannel sequence now.

- No -> stay in public engagement until you earn a reason.

The micro workflow (engaged -> multithread -> sequence -> meeting)

Create an engaged account list Add accounts where someone liked/commented, accepted a connection, replied, or viewed your profile twice in a week.

Identify the buying committee (not just one champion) Map 6-10 stakeholders: economic buyer, champion, technical evaluator, security, finance, ops.

Enrich contacts so you can actually reach them This is where tools like Prospeo come in: once one stakeholder engages, you need verified emails and mobile numbers to reach the rest of the buying committee and run the sequence without burning your domain or wasting call blocks on dead numbers.

Prospeo is the publisher's product ("The B2B data platform built for accuracy"). It includes 300M+ professional profiles, 143M+ verified emails, and 125M+ verified mobile numbers, refreshed every 7 days. Email accuracy is 98%, and mobile pickup rate is 30%, which is exactly what you want when you're multithreading an account under a tight cadence.

Launch an omnichannel sequence Now you run the 21-attempt reality: social touches for familiarity, email for detail, calls for speed.

Log micro-conversions Track "second stakeholder engaged," "security page visit," "implementation doc view," not just meetings.

Scenario: they liked/commented twice then went dark - what now? Don't send "bumping this." Multithread the account, DM with a new trigger, and run a parallel email/call touch to a second stakeholder. Silence from one person isn't silence from the account.

Right before you export/enrich, look for three things: verification status (verified vs risky), mobile found, and export options (CSV or direct CRM enrichment). That's the difference between "we engaged" and "we can actually run a sequence."

Measurement that finance will accept (KPI ladder, micro-conversions, ROI + attribution reality check)

Finance doesn't care that your reps "did more engagement." They care that pipeline moved with acceptable efficiency.

Attribution reality check (so you don't overpromise)

Attribution in B2B is still messy. RevSure's 2026 attribution survey (n=66) shows the market reality:

- About 90% use single-touch or basic multi-touch attribution

- 86%+ can't connect multiple stakeholders to opportunities

- Nearly 90% don't unify anonymous interactions well

So don't pitch this as "perfectly attributable." Pitch it as measurable enough to manage and fund.

The KPI ladder (what to report up, what to coach down)

Think in layers: coach behaviors, report outcomes.

| Layer | KPI | What it tells you |

|---|---|---|

| Leading | Comments/day, DMs sent | Activity consistency |

| Leading | DM reply rate | Message-market fit |

| Mid | Engaged accounts/week | Account momentum |

| Mid | Buying group engaged | Multithread progress |

| Lagging | Meetings booked | Output |

| Lagging | Pipeline created | Finance KPI |

| Efficiency | CAC, CLV:CAC | Board-level health |

Benchmarks that keep you grounded (ranges vary by deal size and motion):

- MQL->SQL: 13-25%

- SQL->Opp: 40-60%

- Sales cycle: 60-180 days

- CLV:CAC: 3:1 or better

Micro-conversion mapping (the missing layer)

Micro-conversions are the bridge between "activity" and "pipeline." They're the signals that an account is moving, even when attribution can't assign perfect credit.

Examples that correlate with real deals:

- Repeat visits to pricing, security, or implementation pages

- A second stakeholder from the same account engaging within 7 days

- Movement from high-level content to technical content

- Multiple assets consumed in a short window

- A champion engaging, then new stakeholders appearing (forwarded internally)

This is momentum analysis (tracking account movement), not credit assignment. It's how you justify investment without pretending you have perfect tracking.

Simple ROI model (include labor + tools)

Use a basic ROI formula finance recognizes:

ROI % = ((Pipeline value x Win rate x Gross margin) - Total cost) / Total cost x 100

Where total cost includes:

- Rep time (hours/week x fully loaded hourly rate)

- Tools (Sales Navigator, scheduling, CRM seats, data)

- Enablement (training time, playbook upkeep)

Worked example (clean math):

- 6 reps spend 30 min/day on social selling = about 10 hrs/week total

- Fully loaded cost $80/hr -> about $3,200/month labor

- Tools: Sales Navigator (about $79.99/user/mo) -> about $480/month

- Total cost ~= $3,680/month (~$11,040/quarter)

If the motion creates $240k pipeline/quarter, at 25% win rate and 80% gross margin:

- Expected gross profit = $240k x 0.25 x 0.80 = $48,000

- ROI = (48,000 - 11,040) / 11,040 = about 335%

That's how you win budget: pipeline math, not likes.

What to report weekly vs monthly (so leadership trusts it)

Weekly (operator dashboard)

- Comments/day per rep (and 3 "best comments" examples)

- DMs sent + DM reply rate

- Engaged accounts added

- Buying group engaged count (stakeholders per account)

Monthly (exec/finance dashboard)

- Meetings booked from engaged accounts

- Pipeline created + pipeline influenced (define the window)

- Win rate and cycle time for socially engaged accounts vs baseline

- Efficiency: cost per meeting, cost per opp created

If you can't answer "what changed this month?" with those numbers, you don't have a program.

You have activity.

Guardrails (what to avoid so you don't burn trust-or accounts)

This motion's fragile. You're borrowing attention.

Don't waste it.

Use / skip rules

Use:

- Earned relevance: comment first, DM second

- Signals: ask for time only after a real trigger or engagement

- Human pacing: follow-ups 2-5 business days apart

- Multithread: engage multiple stakeholders, not one hero

Skip:

- Pitch slapping: pitching in the invite or first message It's the digital version of walking up at an event and asking for 30 minutes before you've even said hello.

- Asking for a call until you've had more than about 2 messages and there's a clear signal a call would help

- Qualification interrogation ("What's your budget/timeline?") in chat

- Copy-paste automation vibes (same structure, same cadence, same everything)

Compliance + ops sidebar (don't get cute)

- Don't share credentials or let someone impersonate you. Delegated "commenting" and account access is a fast way to lose trust and risk account restrictions.

- If multiple people need access, use separate browser profiles, strict password management, and clear ownership. Treat account access like security, not convenience.

- Keep automation light. The moment your activity stops looking human, platforms throttle you and prospects ignore you.

Enterprise rollout model (Pilot -> Team -> Program)

If you're rolling this out beyond a few hungry reps, governance matters.

Stage 1: Pilot (2-5 reps, 30 days)

- One ICP, one segment, one cadence

- Track leading indicators + engaged accounts

- Ship a weekly "wins + examples" recap (screenshots of comments/DMs)

Stage 2: Team (10-30 reps, 60-90 days)

- Standard lists, triggers, and message frameworks

- Manager coaching on comment quality (not just volume)

- CRM logging rules + basic attribution definitions

Stage 3: Program (30+ reps, ongoing)

- Enablement library (approved examples, talk tracks, objection handling)

- Cross-functional alignment (RevOps + Marketing + Sales)

- Quarterly review: pipeline impact, efficiency, and what to cut

Opinion: most "enterprise social selling programs" fail because they start at Stage 3. They buy tools, mandate posting, and skip the pilot. Start small, prove pipeline, then scale.

Social selling FAQ (2026)

What is social selling in simple terms?

Social selling is building familiarity on social platforms and turning it into a sales conversation using a repeatable routine: targeted comments, trigger-based DMs, and a clear next step like "send the checklist" or "10 minutes." For most reps, 30 minutes/day is enough to create measurable account engagement within 2-4 weeks.

Is SSI a good way to measure social selling success?

SSI is a daily-updated 0-100 activity proxy across four pillars (0-25 each), so it's useful for coaching consistency, not proving ROI. For reporting, use meetings booked, buying-group engagement (aim for 6-10 stakeholders per target account), and pipeline created.

How long does social selling take to generate pipeline?

You'll see early signals in days (replies, profile views, engaged accounts), but pipeline takes weeks because real cadences are long. The latest published benchmark (2026) from 6sense shows about 21 attempts per contact over about 53 days with about 5 social touches, so plan for a 30-90 day ramp.

What tools help turn engagement into booked meetings?

To convert engagement into meetings, you need targeting, a CRM, and verified contact data for multithreading. Sales Navigator helps you find active stakeholders, HubSpot or Salesforce makes influence measurable, and Prospeo helps you reach the full buying committee with verified emails and mobile numbers while the account's warm.

Multithreading buying committees means nothing if your emails bounce. Prospeo refreshes data every 7 days - not 6 weeks - so the triggers you spot on LinkedIn lead to real conversations, not dead inboxes.

Stop warming up prospects socially just to bounce their inbox.

Summary: run social selling like an operating system

If you want this to work in 2026, stop treating it like "post more" and start treating it like a cadence: clarity on ICP, daily commenting, trigger-based DMs, and fast multithreading into a real omnichannel sequence. Track SSI for habits, but justify the program with meetings, buying-group engagement, and pipeline created.

That's social selling that survives finance, not just your feed.