Extruct AI vs ZoomInfo (2026): Which One Fits Your GTM Motion?

Buying the wrong data tool doesn't fail loudly. It fails slowly: messy lists, stale titles, bounced sequences, and a RevOps person stuck explaining why "more records" didn't turn into more meetings.

Extruct AI and ZoomInfo solve different problems, even though they both start with "find companies." One's built for discovery when your ICP reads like a paragraph. The other's built to standardize a whole GTM machine.

Here's the hook: if you treat them as direct substitutes, you'll either overpay for a suite you won't operationalize, or you'll underbuy and spend weeks doing manual cleanup.

30-second verdict (who should buy what)

Use Extruct AI if...

- You're doing discovery for a weird ICP: "regional HVAC installers with union certifications and a hiring spike in the last 60 days" type stuff.

- You want natural-language search + web intelligence, then you'll activate contacts elsewhere.

- You like credit-based, self-serve pricing and you're fine iterating your search 2-4 times to get a clean list.

- You want a fast trial: Extruct gives 7 days / 100 credits.

Skip Extruct AI if...

- You need a giant, standardized contact database with deep org charts, intent packaging, and enterprise workflows.

- Your team expects "filter -> export -> sequence" with minimal iteration.

Use ZoomInfo if...

- You're running a broader GTM suite: Buyer Intent, WebSights/website visitors, and the newer Copilot tiers with workflows and plays.

- You can handle the buying motion: annual contract is the norm, and 3 seats is a common minimum even if only 1-2 people truly use it.

- You need mature admin controls, governance, and a platform procurement can standardize on.

Skip ZoomInfo if...

- Finance is going to grill you on a $30-50k/year line item for a small team.

- You hate module creep and credit math (and you will, eventually).

Skip both if... you mainly need verified emails + mobile numbers with predictable self-serve economics and no annual contract.

What each product actually is (in one paragraph each)

Extruct AI is a natural-language company discovery engine built for nuanced prompts and research-style enrichment. Instead of forcing you into rigid filters, it pulls signals from unstructured and semi-structured web sources (job posts, news, local registries, company sites, and other public professional web sources). The mental model is "agentic research tables": you define what you mean, Extruct finds candidate companies, scores them against your criteria, and you spend credits on searches and successful enrichment outputs.

ZoomInfo is a full GTM suite anchored by a large B2B database, wrapped in packaging that pushes you into platform workflows: Sales tiers (Professional, Copilot Advanced, Copilot Enterprise) and Marketing tiers (Marketing Demand, ABM Lite, ABM Enterprise). The value isn't just contacts - it's the surrounding system: Buyer Intent, WebSights/visitor identification, buying group views, orchestration/workflows, and enterprise admin/compliance posture. It's designed to be a system of record for prospecting and targeting, not a research agent.

ZoomInfo's still the best "all-in-one" platform in this category.

Most teams don't need all-in-one. They need one motion that works, plus data they can trust.

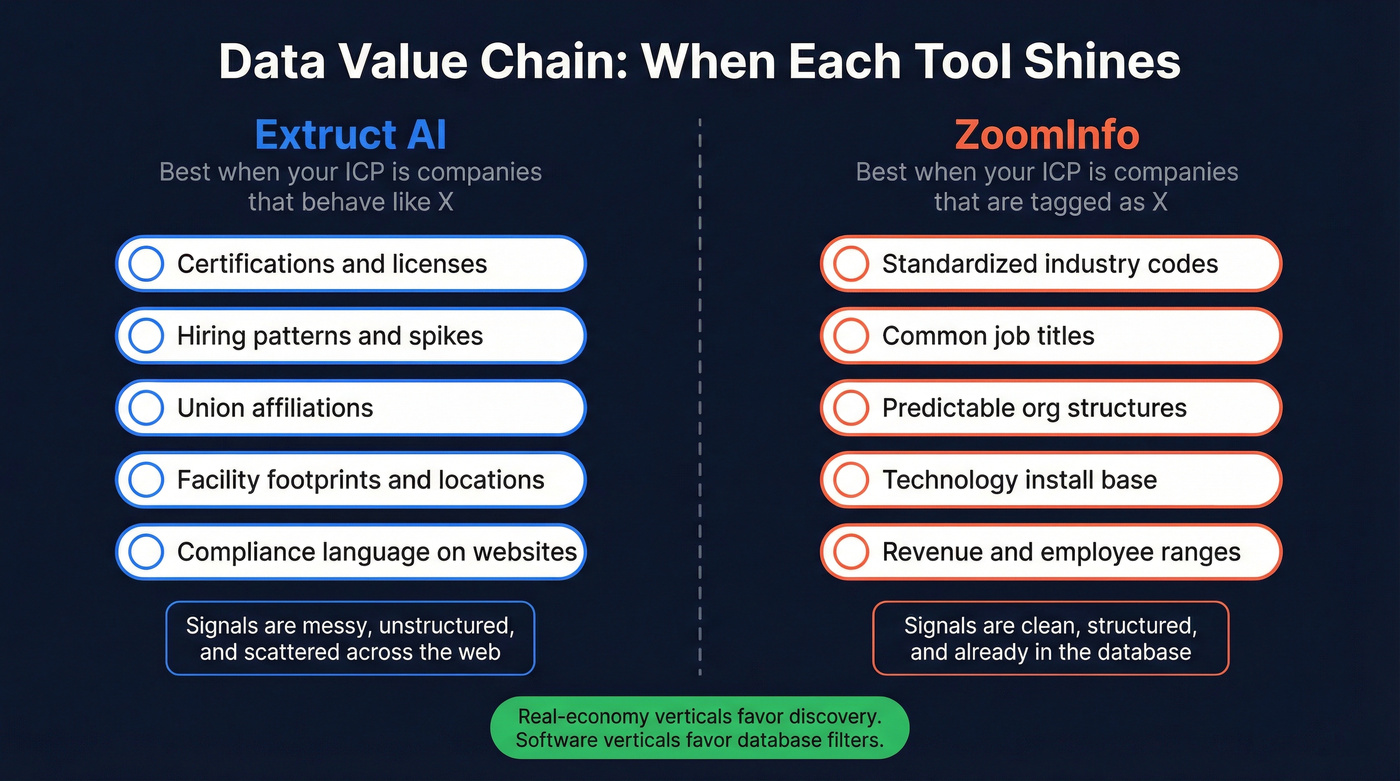

Why these tools feel different in "real-economy" verticals (data value chain lens)

If you sell into software-only categories, ZoomInfo's database-first approach often feels like magic: pick an industry, filter by size, grab titles, go. But in "real-economy" verticals - construction, logistics, healthcare services, regional manufacturing, field services - the signals that matter aren't always clean firmographics. They're messy: certifications, local licenses, union affiliations, facility footprints, hiring patterns, compliance language, and who they actually sell to.

That's the data value chain difference:

- ZoomInfo shines when the market's already well-labeled: standardized industries, common titles, predictable org structures.

- Extruct AI shines when you must create the labels: turn web signals into columns, score fit, and build a list that didn't exist as a filter set.

If your ICP is "companies that behave like X," Extruct is the sharper tool. If your ICP is "companies that are tagged as X," ZoomInfo's faster.

Comparison table: Extruct AI vs ZoomInfo (features + economics)

| Category | Extruct AI | ZoomInfo | Edge |

|---|---|---|---|

| Core job-to-be-done | Discover niche companies via natural-language + web intelligence | Enterprise GTM suite: database + intent + visitor ID + workflows | Tie (different jobs) |

| Best at | Weird ICP discovery, custom research columns, iterative list building | US depth, packaging breadth, admin/governance, intent + web signals | Extruct (discovery) |

| Company discovery UX | Prompt-based search -> candidates -> scoring | Filter-based search + segments + workflows | Extruct |

| Contact data model | Waterfall enrichment across 20+ sources; people lookup costs credits | Database-first contacts; enrichment/export consumes credits | ZoomInfo (volume) |

| Trial | 7 days / 100 credits | Demo-led; trials are sales-controlled | Extruct |

| Credit rules (baseline) | Search = 1 credit; Enrichment = 1; Email/person = 2 | API + exports consume credits; bundles vary by tier/module | Extruct (simplicity) |

| "Pay only for good results" mechanic | Low-score companies don't consume credits; only successful enrichments count | You pay when you pull/enrich/export records | Extruct |

| API posture | REST API + "AI Research Tables" + flexible schema | Mature APIs + governance; default API gateway 25 rps | ZoomInfo (maturity) |

| "Under Management" rule | Annual credits valid 12 months (credits lifecycle) | Records enriched go Under Management for 12 months | ZoomInfo |

| Compliance posture | Modern SaaS posture; lighter enterprise signaling | Heavy enterprise posture; CA registered data broker + suppression + consumer location/compliance API | ZoomInfo |

| Procurement fit | Self-serve to start; Team plan is "Talk to Founders" | Built for procurement; annual contracts + seat minimum reality | ZoomInfo |

Takeaways that actually matter:

- Extruct's a discovery engine; ZoomInfo's a suite. Treating them as substitutes is how teams overpay.

- ZoomInfo's API throttle (25 rps) is fine until you try to enrich at scale and your unit economics show up on a RevOps dashboard.

- Extruct's credit model is easy to forecast if you enforce scoring gates and stop "just one more run" behavior.

- Deliverability's the hidden boss fight: titles and emails decay fastest in fast-moving functions, and regular refresh is the difference between a clean launch and a bounce problem.

Extruct finds niche companies. ZoomInfo locks you into $30-50K annual contracts. Prospeo gives you 300M+ profiles with 98% email accuracy, 125M+ verified mobiles, and a 7-day data refresh cycle - all self-serve at $0.01/email. No seat minimums. No module creep.

Stop overpaying for suites you'll never fully operationalize.

Workflow bake-off (how you'd run the same task in both tools)

Same assignment in both tools:

"Find 200 US-based companies that sell to hospitals, have a compliance/security angle, are hiring implementation roles right now, and aren't giant enterprises."

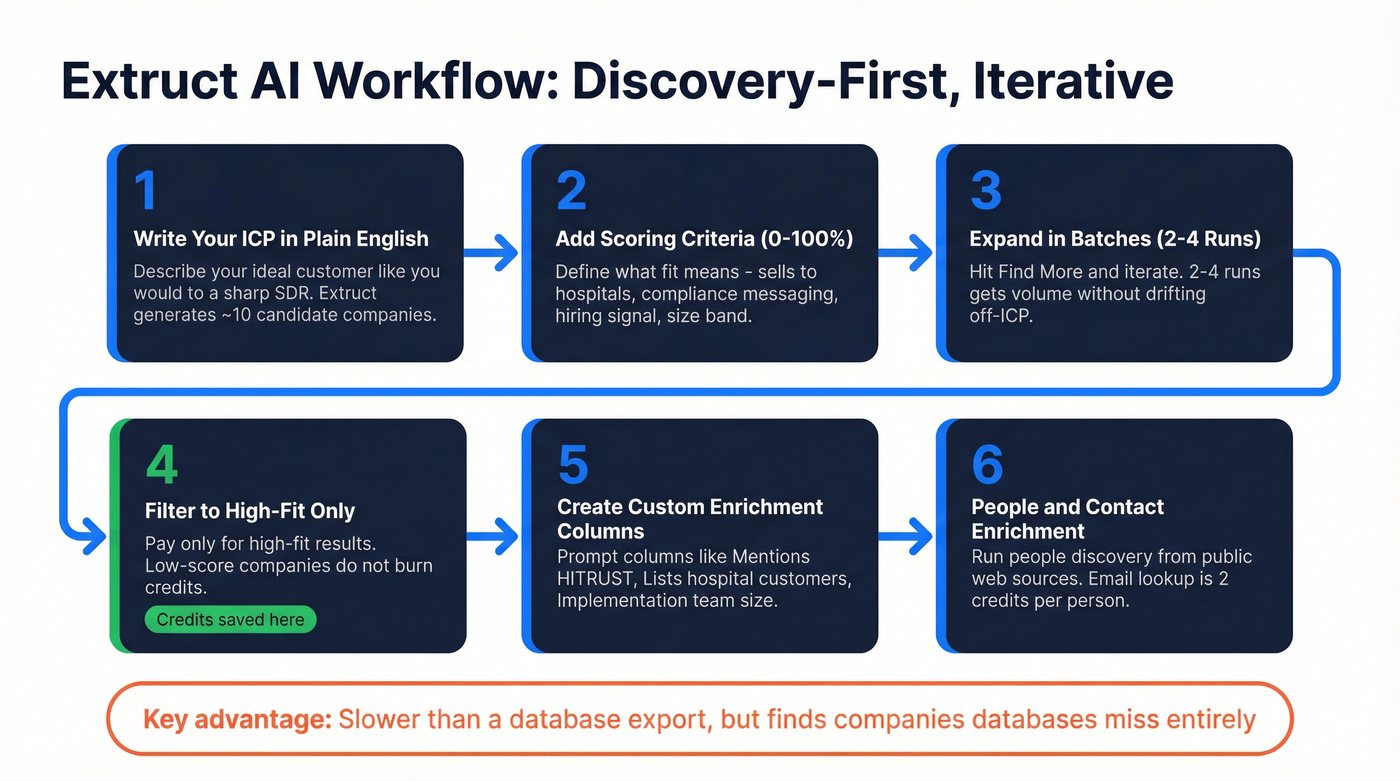

Extruct AI workflow (discovery-first, iterative)

- Write the ICP in plain English. You type the prompt like you'd explain it to a sharp SDR. Extruct generates an initial set of ~10 candidate companies.

Add scoring criteria (0-100%). You define what "fit" means: sells to hospitals, compliance/security messaging, hiring signal, size band, etc. Each criterion gets a 0-100% score.

Expand in batches (2-4 runs). You hit "Find More" and iterate. In practice, you'll do 2-4 runs to get enough volume without drifting off-ICP.

Filter to high-fit and only pay for that.

The key mechanic: you pay only for high-fit results. Low-score companies don't burn credits, so exploration stays cheap if your scoring's strict.

Create custom enrichment columns. This is where Extruct earns its keep. You can prompt columns like "Mentions HITRUST," "Mentions SOC 2," "Lists hospital customers," "Implementation team size," and populate a research table you can actually use.

Then do people + contact enrichment. Once the company list's real, you run people discovery from public professional web sources and waterfall enrichment. Email/person lookup is 2 credits per person.

We've tested this style of workflow with teams selling into regulated services, and the biggest win isn't "more accounts" - it's fewer arguments about why an account's on the list, because the scoring columns make the reasoning visible.

My opinion: Extruct's slower than a database export, but it finds companies databases miss - and that's the whole point.

ZoomInfo workflow (database-first, filter and export)

Start with firmographic filters. Industry, size, geography, keywords, technologies - whatever you can express cleanly in the UI.

Layer intent and web signals (if you bought them). If you're on Copilot Advanced/Enterprise, you'll use Buyer Intent clusters, website visitors (WebSights), job posting changes, and buying group filters.

Build a saved segment and export/enrich.

ZoomInfo's home turf: repeatable segments, admin controls, and workflows that feed your CRM/sequencer.

- Operationalize with governance. Suppression, compliance posture, admin roles, and standardized fields matter when you've got 20-200 sellers touching the same system.

Here's the thing: teams buy Copilot tiers, then never wire intent into routing, prioritization, or sequencing. That drives me nuts because it's the easiest way to waste money in this category.

I've seen a mid-market org pay for visitor ID and intent for two quarters, then still run "spray and pray" outbound because nobody owned the playbook, nobody owned the fields, and the CRM mapping was "we'll fix it later." Later never showed up.

Practical take: if your ICP can't be expressed as filters, ZoomInfo turns into an expensive guessing machine. Extruct turns it into a research problem you can solve.

Pricing reality in 2026: what you'll pay in year 1

ZoomInfo: list prices, real discounts, and the seat minimum reality

ZoomInfo doesn't publish dollars publicly, but procurement benchmarks are consistent. List pricing commonly shows $14,995 / $29,995 / $35,995 annually depending on tier assumptions, and the "entry" package often assumes 3 seats.

Discounts are real: 30-65% off list happens when you negotiate hard, bundle, or time it right. The tradeoff is contract gravity: renewals creep up, and cancellation windows are strict (60-day notice is a common gotcha).

What you should expect to pay in practice:

- Small team (3 seats, minimal add-ons): ~$12k-$25k/year after discounting

- Mid-market setup (more seats + intent/visitor modules): ~$25k-$60k/year

- Bigger rollout (sales + marketing tiers, more modules): $60k-$150k+/year

Common add-ons and benchmarks that change the bill fast:

- Additional user license (list): ~$2,500/year per user

- Global Data add-on: $9,995 (common benchmark)

- Credit unit economics: roughly ~$0.60/credit at low volume down to ~$0.20/credit at scale

If you're not going to operationalize intent, visitor ID, and workflows in the first 90 days, don't buy them "for later." Later rarely comes.

Common buyer complaints (pattern-level, not edge cases)

ZoomInfo buyers complain about the same four things over and over:

- Auto-renew and cancellation windows that punish indecision

- Renewal uplift even when usage didn't grow

- Module creep ("we just need contacts" turns into a suite)

- Credit confusion once you connect the API, run exports, and start doing real enrichment

None of this makes ZoomInfo bad. It means you need a scope owner - someone who says no, measures usage, and defends the contract line-by-line.

Extruct AI: posted pricing + credits you can model

Extruct's refreshingly direct:

- Basic: $49/month (includes 12K credits/year)

- Pro: $415/month (includes 120K credits/year, includes API access)

- Team: per-seat, CRM sync, dedicated support; expect ~$3k-$12k/year depending on seats and volume

- Trial: 7 days / 100 credits

One important detail: on Extruct's pricing page, Team is "Talk to Founders." It's positioned as per-seat with bi-directional CRM sync, Slack support, and a pilot guarantee, so treat it as a guided rollout, not just "more credits."

Mini-math: what Extruct credits feel like in the real world

A simple motion might look like:

- 30 searches to iterate prompts and variants -> 30 credits

- 500 company enrichments -> 500 credits

- 300 people lookups (2 credits each) -> 600 credits

That's ~1,130 credits for a meaningful pilot. You can forecast this without a procurement spreadsheet, which is exactly why Extruct's easy to trial honestly.

Extruct AI vs ZoomInfo: API, credits, and RevOps predictability (the part that breaks budgets)

ZoomInfo API: throughput is capped, and credits have multiple ceilings

ZoomInfo's API mechanics are concrete:

- Default rate limit: 25 requests/second (Premium 30 rps; Premium+ 35 rps)

- Default record limit per credit purchased: 25 records/credit (Premium 50; Premium+ 100)

- Default request limit per credit purchased: 100 requests/credit (Premium 200; Premium+ unlimited)

- Credit consumption: first enrichment of a record consumes 1 credit, then it's Under Management for 12 months (re-enrichment during that year doesn't consume another credit)

The Under Management rule's genuinely useful for keeping CRM data fresh without paying twice. But it doesn't remove the operational ceilings, and those ceilings show up in two places at once: engineering throughput (rate limits) and finance predictability (how many unique records you can touch per credit, plus how chatty your integration can be before you hit request limits).

If you enrich at scale (nightly jobs, routing, dedupe, multi-object sync), those ceilings become budget line items.

Extruct API: flexible schema and research tables (treat it as discovery automation first)

Extruct's API is built around a programmable research layer:

- Create/manage AI Research Tables

- Define schemas via natural-language prompts

- Run discovery + enrichment programmatically for niche market mapping, scoring, and CRM enrichment

If ZoomInfo's API is "retrieve known fields at scale," Extruct's API is "generate the fields you wish existed." Extruct's docs emphasize schema flexibility and research tables; they don't publish public rps throttles in the same way ZoomInfo does, so treat Extruct as discovery/qualification automation first, not a bulk enrichment firehose.

RevOps predictability checklist (use this before you productionize either)

Unit economics (define these or you'll lose the argument later):

- What's your unit of work: company discovered, company enriched, person enriched, email verified, mobile found?

- What's your expected weekly volume by unit?

- What's your cost-per-activated-contact target (not cost per record pulled)?

Failure modes that quietly wreck budgets:

- Retry storms: enrichment fails -> job retries -> credits burn twice

- Field overwrite fights: "best guess" enrichment overwrites hand-entered CRM truth

- Duplicate inflation: same company appears under multiple domains/aliases

- Over-enrichment: enriching every lead when only 20% ever gets sequenced

- No suppression propagation: opt-outs don't flow across tools, creating compliance risk

If you can't explain your enrichment flow on one whiteboard - including retries and dedupe - you're not ready for an API-driven rollout.

Data quality, freshness, and deliverability risk (what happens after export)

The real pain behind this comparison is simple: teams export "good" contacts, then sequences bounce, reps complain, and RevOps gets blamed.

Extruct AI: quality depends on your scoring discipline

Pros

- You define what "fit" means and score it, which cuts garbage-in dramatically.

- You enrich custom fields that correlate with conversion (certifications, compliance language, hiring signals).

Cons

- Sloppy criteria produce sloppy lists. Natural language is powerful, but it rewards precision.

- Contact enrichment is still enrichment - verification matters before you send at volume.

ZoomInfo: broad coverage, but staleness is the tax

Pros

- Big database + standardized fields make repeatable segments easy.

- Under Management supports a sane re-enrichment cadence.

Cons

- Staleness shows up as bounce risk and wrong titles. That's the cost of any large database at scale.

- The suite encourages volume. Volume plus stale emails is how domains get burned.

Risk controls I'd actually implement

- Verify emails before launch, especially for new domains or new sending infrastructure.

- Track bounce rate by data source (not just by campaign).

- Use a 7-day freshness expectation for fast-changing roles (sales leadership, RevOps, IT/security).

- Measure connect/pickup rate separately from "phone present." A phone number that never picks up is a vanity field. If calling is core to your motion, pair this with a predictive dialer strategy that fits your compliance needs.

Compliance & governance (GDPR/CCPA, suppression, procurement fit)

If you sell into regulated regions or you've got real procurement scrutiny, governance isn't optional - it's part of the product.

Procurement checklist (ask these questions up front)

- Are you a registered data broker where required (for example, California)?

- Do you support a master suppression list that propagates opt-outs from CRM/MAT?

- Is there a consumer location and compliance API for location/notice/opt-out status?

- What's your process for GDPR notice, opt-out, and honoring lawful basis?

- Can you sign a DPA and support security reviews without stalling for months?

- How do you handle "do not contact" across multiple workspaces/teams?

- What's your policy for data retention and deletion when a contract ends?

What each supports (practical view)

ZoomInfo

- Strong procurement fit: it's built to answer these questions.

- It's a registered data broker in California, supports suppression lists, and offers a compliance posture enterprise legal teams recognize.

- If you need standardized governance across many sellers, ZoomInfo's the safer default.

Extruct AI

- Better fit when you're doing research-style discovery and enrichment and you're not trying to standardize a global suite.

- Governance is more about how you operationalize outputs (where you store, who exports, how you suppress) than about platform bureaucracy.

- It works best when a single owner (RevOps or a growth lead) controls prompts, scoring, and list QA.

Best-fit scenarios + decision tree (don't default to "buy both")

"Buy both" is what vendors want. It's also how stacks get bloated and nobody owns outcomes.

Decision tree (fast and blunt)

Do you need a suite (intent + visitor ID + workflows) and can you handle annual contracts? -> Yes: ZoomInfo -> No: keep going

Is your ICP hard to express as filters (it's basically a paragraph)? -> Yes: Extruct AI -> No: keep going

Do you already have target accounts and mainly need accurate emails + mobiles fast? -> Yes: choose an accuracy-first verification/enrichment layer -> No: keep going

Do you need enterprise governance across many teams and strict compliance workflows? -> Yes: ZoomInfo -> No: Extruct AI is usually the better starting point

Scenarios (what I'd recommend)

Weird ICP can't be expressed as filters. Pick Extruct AI. You'll waste less time fighting dropdowns and more time defining what "fit" means.

You're running ABM with real sales/marketing alignment, and you'll use intent + visitor ID. Pick ZoomInfo. The suite breadth is the point - if you operationalize it. (If you're pressure-testing your ABM program, map it to measurable Account Based Marketing goals before you buy more modules.)

You're expanding internationally and need governance + procurement comfort. ZoomInfo's the safer default for standardization, especially when multiple regions and teams need consistent rules.

You're warehouse-first (data team owns GTM data) and you care about custom fields. Extruct AI's the better bet for generating the columns you actually want (signals, qualifiers, "why this account"), then pushing curated outputs downstream.

Finance questions a $30-50k spend for a few reps. Start with Extruct AI to prove the motion. If you later need suite workflows, negotiate ZoomInfo from a position of strength.

You're standardizing tooling for a 100+ seller org. ZoomInfo wins because governance and procurement matter more than clever discovery.

7-day pilot plan (how to evaluate without getting trapped)

You can evaluate both without signing a long-term deal - if you run a disciplined test.

Day-by-day checklist

Day 1: Define the test

- Pick 1 ICP and 1 region.

- Define "activated contact" (verified email + correct title + usable phone if required).

- Set a target: 200 companies, 400 contacts.

- Define your "done" rule: you stop when you hit the target, not when the list "feels perfect."

Day 2-3: Build lists

- In Extruct: use the 7 days / 100 credits trial and iterate prompts until scoring's stable.

- In ZoomInfo: build the closest equivalent segment using filters + any intent + web signals you already own.

- Track time-to-list in minutes, not vibes.

Day 4: Enrich + dedupe

- Push both outputs into a staging sheet/CRM sandbox.

- Dedupe by domain + company name normalization.

- Log cleanup time: title normalization, missing fields, wrong HQ, duplicates.

Day 5: Verify and launch a controlled sequence

- Verify emails before sending (this is where deliverability's won).

- Run a small sequence (50-100 contacts) with identical copy and sending setup.

- Keep the same rep(s) and same channel mix so you're comparing tools, not behavior.

Day 6: Measure

- Bounce rate (hard + soft)

- Reply rate

- Meeting rate (even 1-3 meetings is signal at this volume)

- Time-to-list (hours, not days)

- Cost-per-activated-contact

- "Ops tax": how many records required manual fixes before they were usable

Day 7: Decide

- If Extruct wins on "new companies found" and fit quality, keep it as discovery.

- If ZoomInfo wins on repeatability and suite workflows, negotiate hard and lock scope to what you'll implement in 90 days.

Success metrics mini-table (copy/paste)

| Metric | Target | Extruct AI | ZoomInfo |

|---|---|---|---|

| Coverage (contacts found per 100 companies) | 150-250 | ||

| Bounce rate (hard) | <3% | ||

| Cost per activated contact | <$1-$3 | ||

| Time-to-list (200 companies) | <3 hours | ||

| API throughput (if used) | Meets weekly volume |

Third option: Prospeo as the accuracy-first activation layer (emails + mobiles)

Look, most "data tool" debates are really deliverability debates in disguise.

Prospeo is "The B2B data platform built for accuracy": 300M+ professional profiles, 143M+ verified emails, 125M+ verified mobile numbers, and 98% verified email accuracy, all on a 7-day refresh cycle (industry average: 6 weeks). It's used by 15,000+ companies and 40,000+ Chrome extension users, and it stays self-serve (no annual contracts).

If Extruct finds niche accounts or ZoomInfo exports volume, Prospeo's the step that turns "records" into verified, sendable contacts, and it does it without turning your budget into a year-long contract negotiation.

You'll see verified vs invalid status, mobile availability, and an export flow that maps fields into your CRM or sequencer. If you're comparing other activation tools, you can sanity-check pricing and constraints with Wiza pricing and a side-by-side like DitLead vs Apollo.io. If you're also weighing other list-building and enrichment vendors, compare notes with PrivCo vs Zintlr and Leadmine vs ninjapear.

The article nails it: deliverability is the hidden boss fight. Stale data from 6-week refresh cycles kills your sequences. Prospeo refreshes every 7 days, runs 5-step verification with spam-trap removal, and teams book 26% more meetings vs ZoomInfo and 35% more vs Apollo.

Fresh data wins meetings. Stale data burns domains.

FAQ: Extruct AI vs ZoomInfo

Does Extruct AI replace ZoomInfo for contact data?

Extruct AI can replace ZoomInfo when your main need is niche company discovery and research-style qualification, then you activate contacts in another tool. ZoomInfo still wins for standardized contact volume plus intent, website visitor identification, buying group workflows, and enterprise governance across larger teams.

How do ZoomInfo credits work with the "Under Management" 12-month rule?

ZoomInfo uses 1 credit the first time you enrich a record, then keeps it Under Management for 12 months so re-enrichment during that window doesn't cost another credit. You still have operational limits like a default 25 requests/second API rate limit and caps such as 25 records per credit and 100 requests per credit unless you're on Premium tiers.

Is Extruct AI pricing really self-serve (and what's the Team plan likely to cost)?

Extruct's Basic ($49/mo) and Pro ($415/mo) are self-serve with posted credit rules, and the trial is 7 days with 100 credits. Team is "Talk to Founders" and is positioned as per-seat with bi-directional CRM sync, Slack support, and a pilot guarantee; in practice, expect roughly $3k-$12k/year depending on seats and usage.

What should I ask ZoomInfo sales before signing an annual contract?

Ask for seat minimums, included credits by module, overage pricing, API limits, and exactly what Copilot tier features you're buying. Then ask about renewal uplift expectations, auto-renewal language, and cancellation notice windows. Finally, force a 90-day implementation scope list - what you'll actually wire into routing, sequencing, and reporting.

If I choose Extruct or ZoomInfo, what's the fastest way to verify emails and add mobiles?

Summary: choosing between Extruct and ZoomInfo

In the extruct ai vs zoominfo decision, the clean split is this: pick Extruct AI when your ICP's nuanced and you need discovery, scoring, and custom research columns; pick ZoomInfo when you need a standardized GTM suite with intent, visitor ID, workflows, and enterprise governance.

Then protect deliverability. Verified contact data is what turns a "list" into pipeline.