PrivCo vs Zintlr (2026): Not True Competitors - Here's How to Choose

Buying the wrong database is a special kind of expensive: you pay for it, onboard it, and then watch your team quietly stop using it because it doesn't match how they actually work. PrivCo and Zintlr get compared like they're interchangeable.

They're not.

PrivCo is company intelligence for private markets (financials, ownership, deals). Zintlr is a prospecting workflow (find people, unlock emails/phones, export, run outbound). If you mix those up, week one tells on you fast.

30-second verdict (and "skip both if...")

Use PrivCo if...

- You sell into U.S. private companies and need financial context to qualify accounts before anyone sends a single email.

- You need revenue/EBITDA trend lines, ownership structures, and deal history for territory planning, partner targeting, corp dev, or investment sourcing.

- Your ICP is mid-market "real businesses." PrivCo's main focus is U.S. private companies over $1M in annual revenue, and 85%+ of its coverage is bootstrapped or family-owned (not VC/PE-backed).

- You want numbers you can defend internally when leadership asks, "Where did this come from?"

- You'll actually run a research workflow (filters -> profiles -> PDFs -> analysis), not endless scrolling and bulk exporting.

Use Zintlr if...

- Your KPI is speed-to-list: build a prospect list, unlock contacts, export, and push into sequences.

- You want zPersonality (DISC/OCEAN) to tailor messaging without writing a novel for every prospect.

- India coverage is a priority. Zintlr is built to win there.

- You run outbound with a steady monthly cadence, because Zintlr credits expire monthly.

- You don't need deep financial modeling. You need more reachable contacts this week.

Skip both if...

- Your KPI is meetings booked and your biggest pain is deliverability + reachability (bounces, dead phones, stale titles).

- Neither tool is built to maximize deliverability or direct-dial reachability as the primary outcome.

Concrete example: if you're deciding whether a private manufacturer is worth targeting based on revenue stability and ownership, that's PrivCo. If you're trying to find 200 operations leaders in India and launch sequences by Friday, that's Zintlr.

PrivCo vs Zintlr side-by-side (what you actually get)

| Category | PrivCo | Zintlr | Winner |

|---|---|---|---|

| What it is | Private company intelligence: financials, ownership, deals | Prospecting database: contact unlocks + buyer insights | Depends (different jobs) |

| Best for | Research + account qualification | High-volume list building + outbound execution | Depends (different jobs) |

| Database scale | 146M data points / 120M contacts / 839K companies | 500M+ profiles / 250M+ professionals / 70M+ companies | Zintlr (raw scale) |

| U.S. private-company depth | Strong focus | Not the focus | PrivCo |

| India prospecting | Not the focus | Core strength | Zintlr |

| Financial depth | Strong (modeled + sourced), plan-dependent years | Minimal (not the point) | PrivCo |

| Contact unlock workflow | Secondary to company profiles | Primary workflow (unlock/export) | Zintlr |

| Cost model | Caps (views/searches/PDFs/contacts) | Seats + monthly credits that expire | Depends (caps vs cadence) |

| "Penalty" you'll feel | Exploration gets throttled | Uneven cadence wastes credits | Tie (different pain) |

| API access | Yes (documented endpoints) | Yes, Enterprise only | PrivCo |

| Best fit for RevOps/BI | Stronger (API + structured company data) | Weaker unless Enterprise | PrivCo |

Operational translation of the throttles:

- PrivCo punishes exploration. If your team clicks around like it's a social feed, caps (views/searches/PDFs) force a tighter research process.

- Zintlr punishes uneven cadence. If you prospect hard in bursts and go quiet the next month, expiring credits turn into wasted spend.

Here's the thing: both "penalties" are predictable. The problem is teams pretend their workflow is one thing during procurement, then behave like something else once the tool's live.

Hot take: if your average deal size is small and you're not doing any diligence beyond "is this a real company," PrivCo is overkill. Spend that budget on reachability and volume instead.

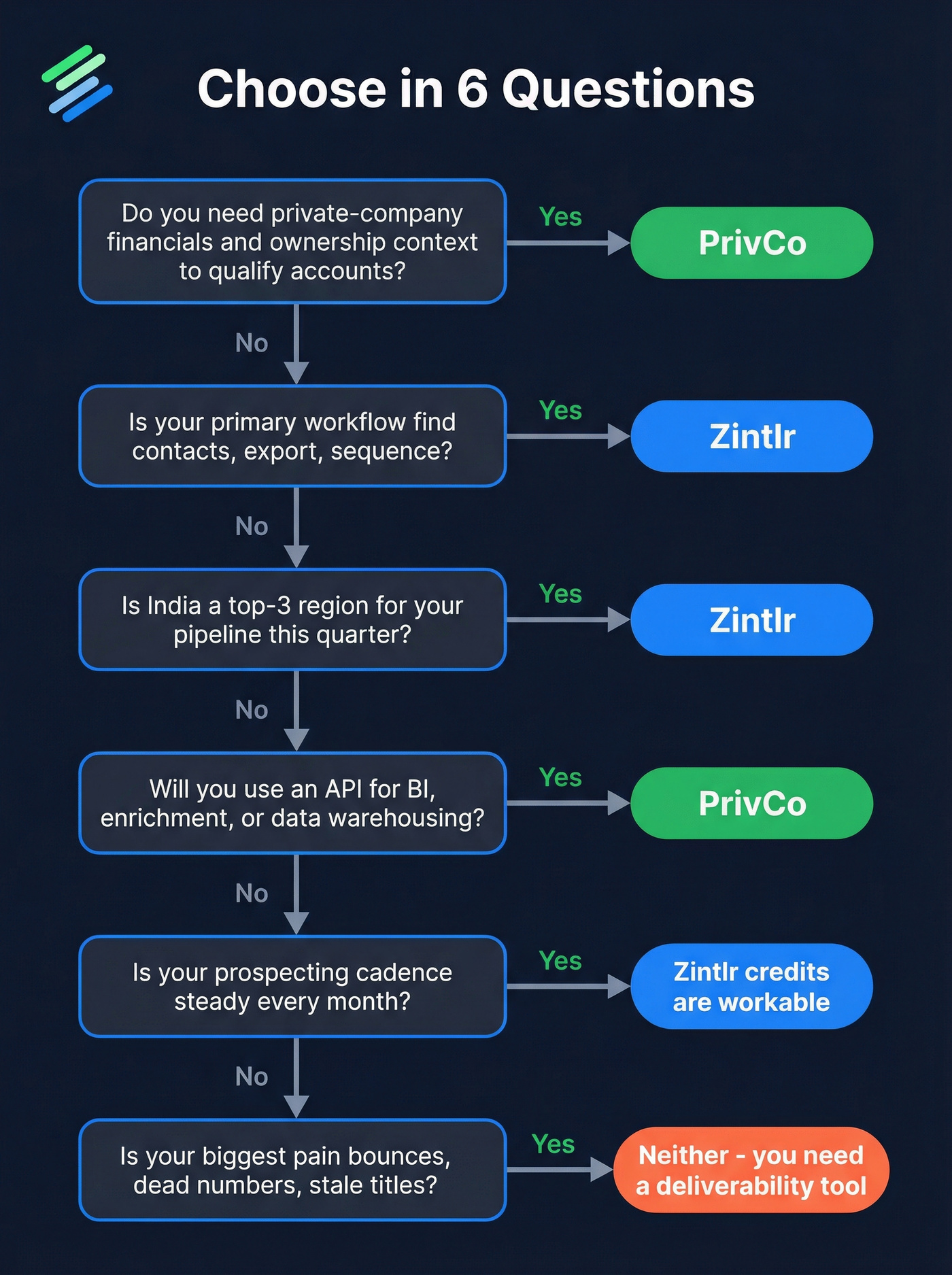

Decision tree: choose in 6 questions (no fluff)

Use this like a pre-purchase checklist. Answer honestly, not aspirationally.

Do you need private-company financials (revenue/EBITDA) and ownership context to qualify accounts? -> Yes: PrivCo. -> No: go to Q2.

Is your primary workflow "find contacts -> export -> sequence"? -> Yes: Zintlr. -> No: go to Q3.

Is India a top-3 region for your pipeline this quarter? -> Yes: Zintlr. -> No: go to Q4.

Will you use an API for BI, enrichment, routing, or data warehousing? -> Yes: PrivCo (Zintlr's API is Enterprise-only). -> No: go to Q5.

Is your prospecting cadence steady every month (not lumpy)? -> Yes: Zintlr's expiring credits are workable. -> No: avoid expiring-credit plans unless you're sure you'll consume them.

Is your biggest pain "we can't reach people" (bounces, dead numbers, stale titles)?

PrivCo gives you financials. Zintlr gives you speed. Neither solves the problem both articles dodge: bounces and dead numbers killing your outbound. Prospeo delivers 98% email accuracy, 125M+ verified mobiles with 30% pickup rates, and a 7-day data refresh - all at $0.01/email.

Stop qualifying accounts you can never actually reach.

What each tool is best for (job-to-be-done fit)

PrivCo's job is simple: understand and qualify a private company that doesn't show up cleanly in public-market datasets. It's built for the messy middle - U.S. private companies where ownership is opaque and financials aren't sitting neatly in filings.

Zintlr's job is equally clear: find people to contact and give you enough context to personalize. It's not trying to win on financial modeling. It's trying to win on getting you to an export that turns into replies.

Three workflows (so you can picture the day-to-day)

1) Analyst / corp dev / partnerships (PrivCo workflow)

- Filter companies by revenue band, industry, geography, ownership type

- Pull profiles + financial snapshots/trends

- Export PDFs for internal memos

- Use deal history and ownership to prioritize outreach or sourcing

This is where PrivCo earns its keep: fewer clicks, higher confidence.

2) SDR manager running high-volume outbound (Zintlr workflow)

- Build a list by role/seniority/company filters

- Unlock emails/phones and export

- Push into sequencing tools and iterate weekly

This is where Zintlr works: speed, throughput, and operational prospecting.

3) India-focused outbound team (Zintlr workflow)

- Segment by Indian regions, industries, and buyer roles

- Use zPersonality as a lightweight personalization angle

- Keep cadence steady so credits don't evaporate

If India is core, Zintlr is the practical choice.

PrivCo vs Zintlr data coverage (company depth vs contact depth)

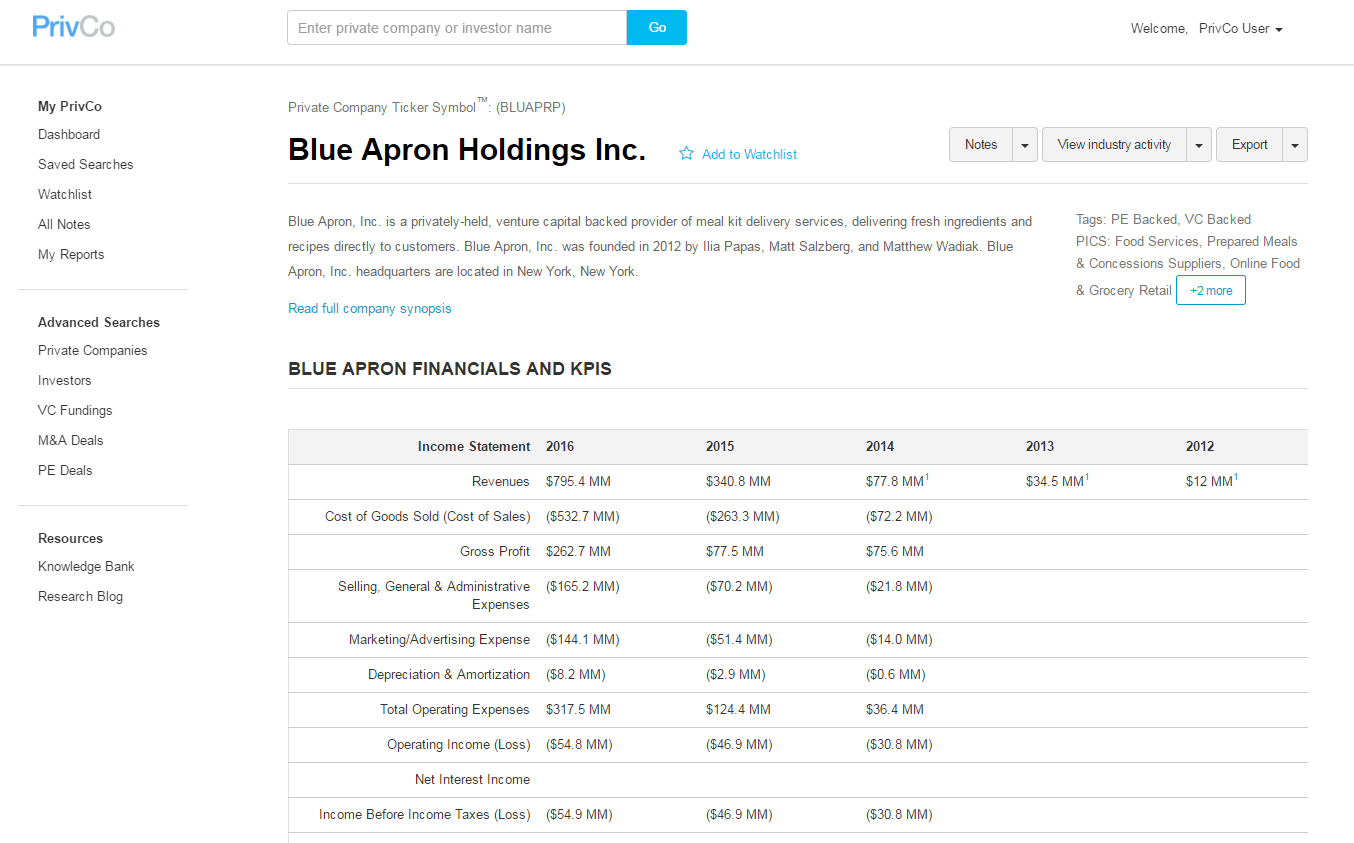

PrivCo data model (financials, ownership, deals)

PrivCo is company-first. The unit of value is a private company profile with financial and ownership context attached, plus contacts connected to that profile.

Packaging matters more than it looks:

- On Select, you get the most recent year of financial data.

- On Enterprise, you get all available years.

That difference decides whether you're doing a quick qualification snapshot or real trend analysis (growth rates, stability, pre/post acquisition changes), which is why two teams can both "have PrivCo" and still get totally different value out of it depending on plan and usage habits.

PrivCo's methodology is also a big part of why teams buy it: curated sources feed AI/ML models (revenue, employees, valuations, growth, deals), and data scientists/engineers verify and update thousands of profiles on a rolling basis. PrivCo positions its dataset as "never blindly scraped," which is exactly the stance you want for private-company financials where scraping produces confident-looking nonsense.

One detail that prevents internal arguments: PrivCo uses post-money valuation unless otherwise stated. That consistency saves time when teams compare numbers across tools.

Per PrivCo's help center, its core coverage is U.S. private companies over $1M in revenue and 85%+ are bootstrapped or family-owned. That's the lens you should assume when you evaluate fit.

Zintlr data model (unlockable emails/phones + buyer insights)

Zintlr is contact-first. The unit of value is a person record you can unlock and export.

The record is designed around outbound actions:

- Unlock email

- Unlock phone

- Unlock personality insights (zPersonality)

- Export to use elsewhere

Those actions consume credits. That's not a footnote. That's the product.

Zintlr also publishes accuracy benchmarks: 92% global accuracy and 98% accuracy for India. If you're buying Zintlr, you're buying the combination of workflow + regional strength, not financial depth.

The "bigger database" trap

Raw size numbers don't predict rep experience.

A "500M profile" database still loses if filters don't match your ICP, unlock costs are high per field, exports are capped, or the data's stale where you sell. Optimize for usable records per week, not marketing-scale totals.

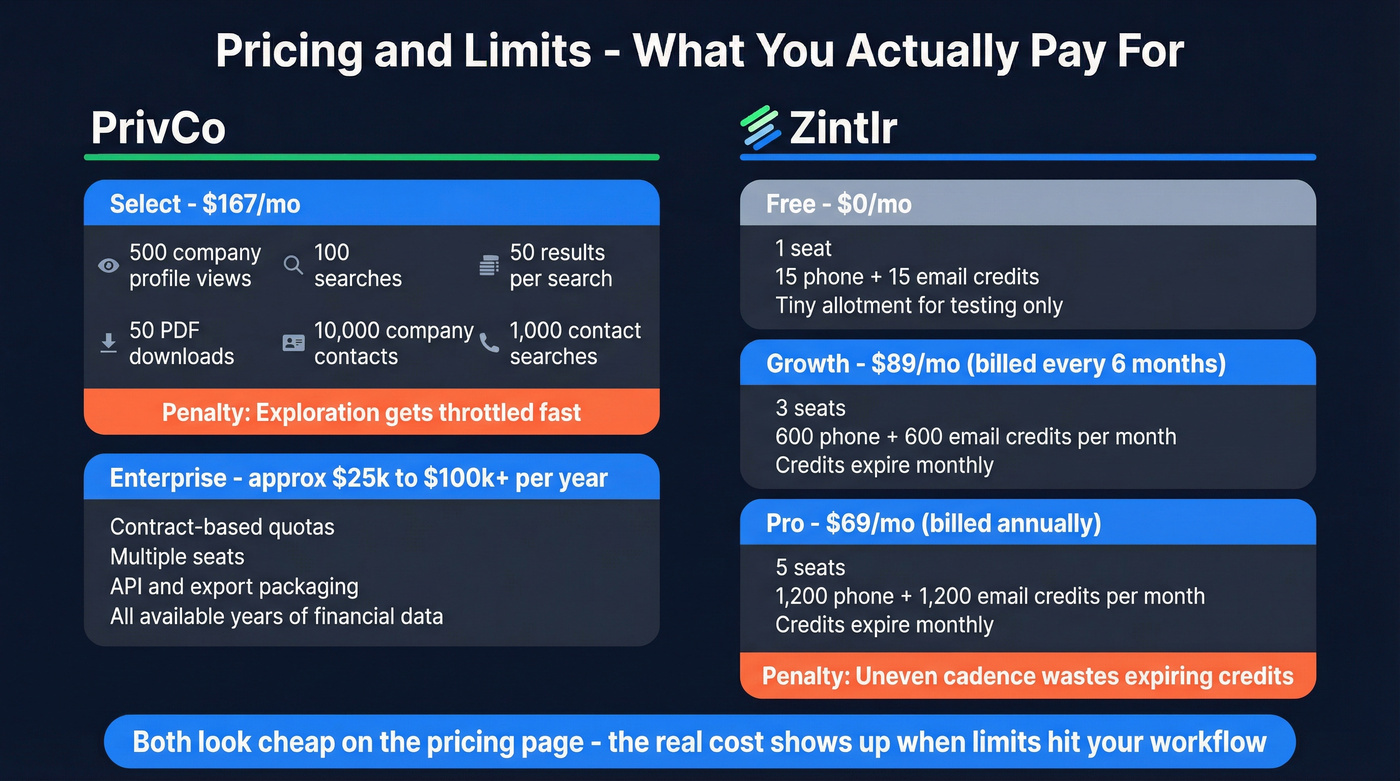

PrivCo vs Zintlr pricing & limits (caps vs expiring credits)

Both tools can look "cheap" on the pricing page. The real cost shows up when limits collide with your workflow.

Pricing + limits table (with the parts vendors bury)

| Tool | Plan | Price | Seats / credits included | How you get throttled | Winner (value) |

|---|---|---|---|---|---|

| PrivCo | Select | $167/mo | 1 seat (typical) | Hard caps on views/searches/results/PDFs + contact/search limits | PrivCo (research ROI) |

| PrivCo | Enterprise | ~$25k-$100k+/year (estimate) | Contract-based | Quotas + seats + API/export packaging | PrivCo (data ops) |

| Zintlr | Free | $0/mo | 1 seat, 15 phone + 15 email credits | Tiny credit allotment | PrivCo (serious work) |

| Zintlr | Growth | $89/mo billed every 6 months | 3 seats, 600 phone + 600 email credits/month | Credits expire monthly; unlocks consume credits | Zintlr (SMB outbound) |

| Zintlr | Pro | $69/mo billed annually | 5 seats, 1200 phone + 1200 email credits/month | Same expiration; higher throughput | Zintlr (team outbound) |

| Zintlr | Enterprise | ~$12k-$60k/year (estimate) | Contract-based | Credit economics + contract terms; API access | Zintlr (governed outbound) |

PrivCo Select limits (the fine print that matters)

PrivCo Select includes monthly limits that are very specific:

- 500 company/investor profile views

- 100 searches

- 50 results per search category

- 50 profile PDF downloads

- 10,000 company contacts

- 1,000 investor contacts

- 1,000 contact searches/list builds

This is why PrivCo isn't a spray-and-pray prospecting tool. It's a research tool with controlled consumption. If your SDR team is used to infinite scrolling and bulk exporting, they'll slam into these ceilings fast.

Zintlr's credit reality (expiration changes behavior)

Zintlr's model is straightforward: you pay for seats, you get monthly credits, you spend credits to unlock/export. Unused credits expire monthly and reset on your billing date.

That expiration mechanic forces discipline. It also creates a predictable failure mode: month-end "use it or lose it" unlocking. I've watched teams burn credits on marginal contacts just to avoid waste, then wonder why reply rates drop.

Procurement checklist (ask these before you sign)

Get these answers in writing:

- Credit expiry policy: do credits ever roll over? any grace period? what happens on seat changes?

- Export limits: daily/monthly export caps, file formats, and whether exports include all unlocked fields.

- API terms (if applicable): included endpoints, overage pricing, and support SLAs.

- Data retention: what happens to exported/unlocked data if you cancel?

- DPA + security: DPA availability, subprocessors list, incident response timeline, and opt-out handling.

- Seat governance: SSO, audit logs, admin controls (especially for Enterprise).

Gotchas (read this before you buy)

Look, this is where teams get burned, and it's avoidable.

Gotcha box: the stuff that burns teams

- PrivCo trial contradiction: the pricing page pushes "Start 7-Day Free Trial" for Select, but the help center says there's no free trial and instead offers a free Basic membership that never expires (limited sampling). Plan for Basic access as the reliable free option.

- PrivCo caps aren't "soft": profile views + searches + PDFs are real constraints. Great for focused research, annoying for broad TAM building.

- Zintlr credits expire monthly: if your outbound volume is lumpy (events, seasonal pushes, quarterly sprints), you'll waste credits.

- Zintlr billing cadence is the real price: Growth is billed every 6 months and Pro is billed annually. Budget for the prepay, not the monthly headline.

If you're building TAM once a quarter and then running sequences off that list for weeks, skip expiring-credit plans. You'll resent them.

Integrations & API (who supports data ops workflows)

PrivCo wins for data ops because it has a documented API and is designed to deliver structured private-market data (financials, deals, profiles) into other systems.

Zintlr keeps API access in Enterprise. For most SMB teams, that effectively means "no API," and the workflow stays inside the app plus exports.

PrivCo API: what you can actually hit

PrivCo's API uses an API key passed via the request header:

x-api-key: YOUR_KEY

Useful endpoints include:

- Search

GET https://api.privco.com/v2/search/{name}- Supports query params like

?name=and?website=and pagination viapage

- General profile

GET /v2/general_profile/{profile_type}/{profile_id}

- Financials

GET /v2/financials/{profile_type}/{profile_id}- Includes

growth_rates(1yr/3yr revenue growth, 1yr/3yr employee growth) - Optional filters like

yearandtitle

- Deals (VC + M&A activity)

GET /v2/deals/...

PrivCo also has a usage endpoint so you can track consumption.

Procurement reality: PrivCo doesn't publish rate limits in the public docs. Ask for written monthly quota plus per-minute throttles in the order form or SOW so RevOps isn't guessing later.

Zintlr API: Enterprise gate

Zintlr's API is Enterprise-only. That's a product signal: Zintlr is optimized for in-app prospecting and exports, not as a backend enrichment provider.

If your workflow is "build list -> export -> sequence," Zintlr fits. If your workflow is "enrich CRM nightly, dedupe, score, route," PrivCo is the cleaner starting point.

Compliance, sourcing posture, and trust signals

This section's boring right up until legal gets involved. Then it's the only section that matters.

PrivCo trust posture (sourcing + methodology)

- Curated sources (business journals, trade publications, credible news) feed the dataset.

- AI/ML models estimate revenues/employees/valuations/growth/deals, then data scientists/engineers verify and update thousands of profiles on a rolling basis.

- PrivCo positions its dataset as "never blindly scraped," which is exactly the stance you want for private-company financials.

Buyer guidance: if legal is strict and you're using the data to justify financial narratives (revenue, valuation, ownership), PrivCo's easier to defend internally.

Zintlr compliance posture (GDPR legal bases + DPO)

- Zintlr's GDPR page spells out lawful bases: Consent, Legitimate Interests, and Contractual Necessity.

- They can act as both data controller and processor depending on context.

- DPO contact: [email protected]

- They enumerate data subject rights (access, erasure, objection, portability, etc.) and describe security practices (assessments + incident response).

Buyer guidance: if outbound's the mission, Zintlr's compliance packaging is fine. Your bigger risk is operational - unlocking/exporting lots of contacts without a process for opt-outs and suppression lists.

User sentiment & social proof (what's actually out there)

Neither tool has the review volume you'd want before betting your pipeline on it. That doesn't make them bad. It means you should rely more on a pilot and less on star ratings.

PrivCo sentiment (thin)

PrivCo shows 4.0/5 on G2 with 1 review. With a sample size of one, treat it as "presence exists," not "market consensus."

Zintlr sentiment (small but consistent)

Zintlr shows 5.0/5 on Software Advice with 4 reviews. The themes are consistent:

- Accuracy and support get praised ("top notch accuracy," "excellent support").

- zPersonality gets called out as genuinely useful for personalization.

- India prospecting is a recurring win.

- UI/UX and processing speed get criticized.

One wrinkle: Software Advice lists pricing tiers that don't match Zintlr's official pricing page (different tier names and "starting at $49/mo"). Use Zintlr's own pricing page for procurement decisions.

If you're doing outbound, pair either with Prospeo (the accuracy layer)

Outbound has one universal failure mode: bad contact data tanks deliverability and wastes rep time. In practice, most "PrivCo vs Zintlr" decisions end with the same follow-up question: "Cool, but how do we stop bounces and dead numbers?"

That's where Prospeo fits naturally. It's The B2B data platform built for accuracy, and it plays well with either tool because you can treat PrivCo/Zintlr as sources, then verify and enrich before you send.

In our experience, the clean workflow is: source accounts/people in PrivCo or Zintlr -> verify/enrich -> send -> refresh weekly so your sequences don't rot.

What you get, concretely:

- 300M+ professional profiles and 143M+ verified emails

- 125M+ verified mobile numbers with a 30% pickup rate (see our Predictive Dialer guide for calling workflows)

- 98% verified email accuracy

- 7-day refresh cycle (industry average: 6 weeks)

- Transparent, self-serve economics: ~$0.01 per verified email

- Free tier: 75 emails + 100 Chrome extension credits/month

- CRM + CSV enrichment with 83% enrichment match rate and 50+ data points per enrichment

- API workflows with a 92% API match rate

- Native integrations: Salesforce, HubSpot, Smartlead, Instantly, Lemlist, Clay, Zapier, Make

A quick scenario we've seen: an SDR exports 800 contacts from a prospecting tool on Monday, launches sequences Tuesday, and by Thursday deliverability's already sliding because 10-15% of the list is stale. Run that same list through verification and enrichment first, and you stop burning domains on preventable bounces.

If you answered 'yes' to Question 6 - your biggest pain is reachability - neither PrivCo nor Zintlr was built for that job. Prospeo was. 300M+ profiles, 5-step verification, catch-all handling, and spam-trap removal so your sequences actually land.

Book 35% more meetings than Apollo users do with the same effort.

Bottom line

This isn't a "which database is bigger" decision. It's a "which job are you paying for" decision.

Pick PrivCo when financial context and ownership clarity drive your targeting (tie it to your Account Based Marketing Goals so procurement knows what to measure). Pick Zintlr when outbound throughput and India prospecting matter most. And if your real problem is reachability, treat both as sources and put an accuracy layer in front of your sequences, because that's where most teams end up anyway.

FAQ

Does PrivCo really have a free trial?

PrivCo's pricing page promotes a "Start 7-Day Free Trial" CTA for Select, but its help center says there's no free trial and instead offers a free Basic membership that never expires with limited sampling. Plan around Basic as the reliable free option, and treat the 7-day trial as availability-dependent.

Do Zintlr credits expire if we don't use them?

Yes. Zintlr's unused monthly credits expire at month-end and reset on your billing date. That works for steady outbound teams, but it punishes lumpy prospecting cycles where you ramp hard one month and barely prospect the next.

Which is better for India prospecting - PrivCo or Zintlr?

Zintlr is the better fit for India prospecting because it's built as a prospecting database and it publishes a 98% accuracy benchmark for Indian data. PrivCo is primarily focused on U.S. private companies and also includes international companies that have raised funding rounds over $50M.

Can I pull PrivCo data via API for enrichment or BI?

Yes. PrivCo has a documented API using an x-api-key header, with endpoints like /v2/search/{name}, /v2/general_profile/..., /v2/financials/... (including growth_rates), and /v2/deals/.... Ask for written monthly quotas and per-minute throttles in the order form/SOW so your RevOps team can plan usage.

What's a good free option to verify emails/phones after exporting from either tool?

Prospeo's a strong free starting point because it includes 75 verified emails plus 100 Chrome extension credits per month, runs on 98% verified email accuracy, and refreshes data every 7 days. For teams doing real outbound, that's usually enough to cut bounces fast before you scale spend.