Lead Database Free Trials (2026): What You Actually Get + How to Test

You start a lead database free trial... then learn the plan you actually need is $15,000/year, and the trial never let you export enough records to prove the data works. That's the dirty secret of most trial pages: they sell access, then throttle the only things that matter.

This article's angle is simple: stop judging trials by "features" and start judging them by mechanics (exports, phones, rollover, and selection caps). You'll finish with a 7-day test plan that produces a yes/no decision, not a pile of screenshots.

Here's the thing: if you can't export enough rows to run a deliverability check and a phone-connect check, you didn't get a trial. You got a product tour.

What a lead database free trial means (and what it doesn't)

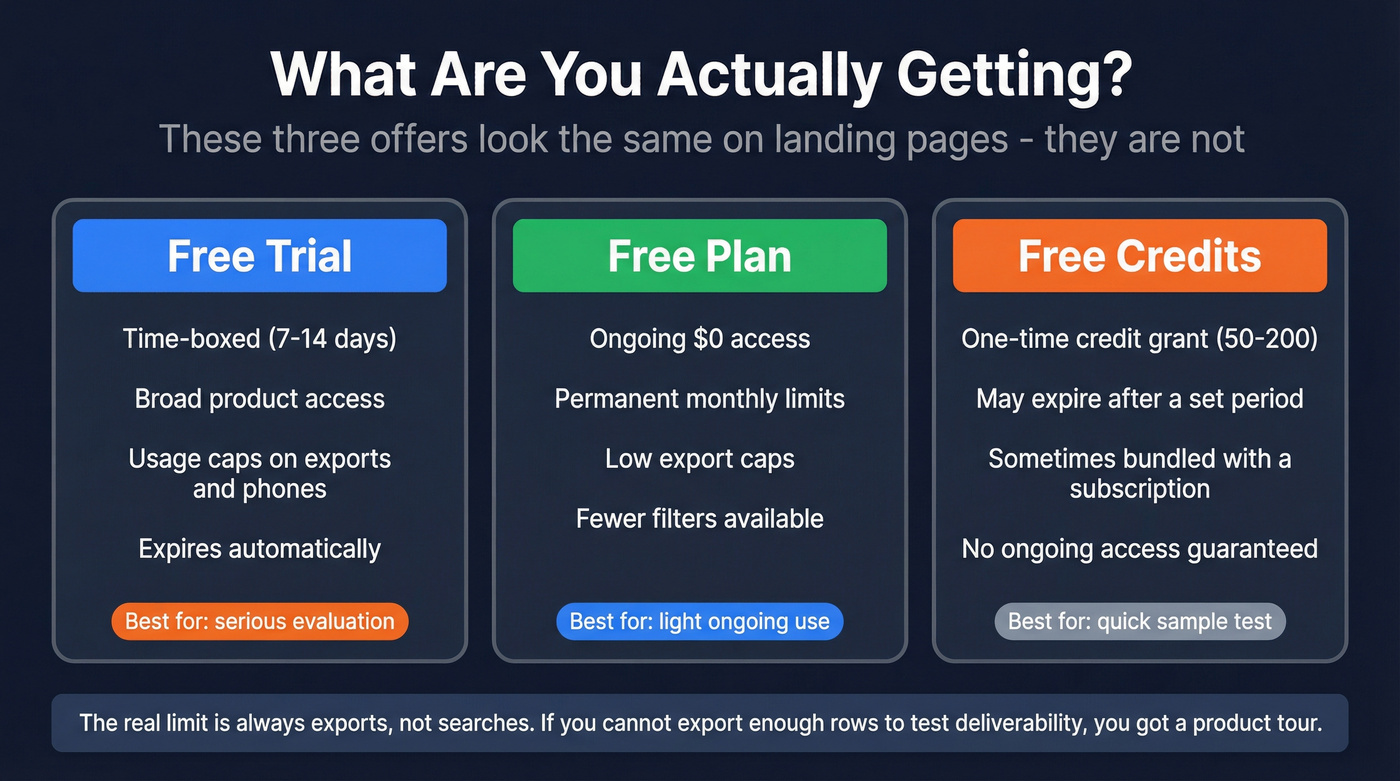

Most pages blur three different offers into one bucket, which is why people feel tricked.

Here's the clean taxonomy:

- Free trial: time-boxed access to a paid plan (7-14 days is common). You get broad product access, but with usage caps (exports, phones, enrichment calls).

- Free plan: ongoing $0 access with permanent limits (monthly credits, low export caps, fewer filters).

- Free credits: a one-time credit grant (often 50-200 credits) that might expire. Sometimes it's bundled with another subscription.

Mini checklist to decode any offer fast:

- Does it cap exports (or "credits used for exports")? That's the real limit.

- Does it cap phones separately from emails? It almost always does.

- Does it cap records you can select at once (a sneaky workflow killer)?

- Do unused credits roll over or reset?

- Does upgrading early end the trial (yes, some tools do this)?

"Unlimited search" is marketing. Exports are the product.

What you need (quick version)

If you're evaluating a lead database, you're not evaluating "features." You're evaluating whether the data survives contact, enrichment, and sequencing in your real workflow, because a cheap dataset isn't cheap if it burns domains and rep time.

Two truths that save weeks:

- Unlimited search is meaningless if exports are capped.

- Phones are the hidden limiter--vendors hand you email volume and ration direct dials like they're gold.

Start here (3 picks that let you learn fast)

- Prospeo: best self-serve option for accuracy and freshness--98% verified emails, 7-day data refresh, and a free tier that's actually usable for testing.

- Lead411: the cleanest "trial math" in the market--7 days / 50 free exports defined upfront, with verified emails + direct phones.

- Saleshandy Lead Finder: a low-friction 7-day no-CC trial plus real-time verification and big bulk exports (great when you need volume quickly).

Use this / Skip this (trial mindset)

Use a trial if you need to:

- Prove bounce rate and connect rate on a small, controlled sample

- Validate ICP filters (industry, headcount, tech stack, intent, job changes)

- Test enrichment into your CRM (or at least a CSV workflow)

Skip the trial and use a free plan if you:

- Only need a handful of contacts per week

- Want ongoing "top-up" data for reps, not a full outbound engine

Skip the tool entirely if:

- Phones are your main channel and the trial hides phone limits

- Exports are capped so low you can't test deliverability (<100 records is too thin)

- The credit system charges the same for junk as for verified data (that's a RevOps tax)

Most free trials cap exports so tight you can't even run a bounce test. Prospeo's free tier gives you 100 credits/month with 98% verified emails, 7-day refreshed data, and zero sales calls. Enough to prove the data works before you spend a dollar.

Run a real deliverability test, not a product tour.

Lead database free trial limits that matter (comparison table)

Database size barely matters during a trial. Mechanics matter: how many usable contacts you can export, whether phones are included, and whether the tool lets you run a real workflow test (filters -> export -> verify -> sequence/enrich).

Table 1 - Core mechanics (what you can actually do)

| Tool | Access type | Length | Export unit | Phone access |

|---|---|---|---|---|

| Lead411 | Free trial | 7 days | Exports | Yes |

| ZoomInfo | Free trial | 7 days (typical) | Usage limits | Yes |

| Saleshandy Lead Finder | Free trial | 7 days | Credits | Yes |

| Apollo | Free trial | 14 days | Credits/actions | Yes (hard cap) |

| ListKit | Free plan | Ongoing | Credits | Limited/plan-based |

| Lusha | Free plan | Ongoing | Credits | Yes |

| Kaspr | Free plan | Ongoing | Credits | Yes |

| SalesIntel | Free trial | 14 days | "Unlimited" credits model | Yes |

| Seamless.AI | Free plan | Ongoing | Credits | Yes |

| BatchLeads | Trial | 7 days | Leads/exports | Yes (vertical-specific) |

| DataToLeads | Free samples | Ongoing | Lists | Some (dataset-dependent) |

| LeadsGorilla | Trial | 7 days | Reports/leads | Some (local-focused) |

| Salesfully | Trial | 5 days | Leads | Dataset-dependent |

Table 2 - Friction (what blocks a real evaluation)

| Tool | Credit card? | Rollover | Key gotcha (the thing that ruins trials) |

|---|---|---|---|

| Lead411 | No | Yes | Trial is 50 free exports total - plan your sample tightly |

| ZoomInfo | No | N/A | Sales-provisioned trial; expect tight export/phone throttles unless you negotiate |

| Saleshandy Lead Finder | No | Yes | Trial credit volume isn't the headline - test export capacity on day one |

| Apollo | No | N/A | 25-record selection cap + 20 phones total; upgrading ends the trial |

| ListKit | No | N/A | "Triple-verified" still needs a bounce test; definitions vary by workflow |

| Lusha | No | Up to 2x cap | Phones cost 10 credits each; free plan disappears fast on calling motions |

| Kaspr | No | No | Small free plan; export limits shape what you can validate |

| SalesIntel | No | N/A | "Unlimited" is a model; evaluation is sales-led and workflow-gated |

| Seamless.AI | No | No | Credit burn feels bigger in real workflows than in demos |

| BatchLeads | Yes | N/A | Built for real estate-style workflows, not general B2B prospecting |

| DataToLeads | No | N/A | Samples help you judge list quality, not run a database workflow |

| LeadsGorilla | Yes | N/A | Local audits != contact database; great for agencies, wrong for SDR teams |

| Salesfully | No | N/A | Trial includes 1,000 leads, but "lead" definition/mechanics can be vague |

Default rule when vendors don't publish mechanics: treat it as sales-gated, assume tight export + phone throttles, and don't waste a week hoping it "opens up later."

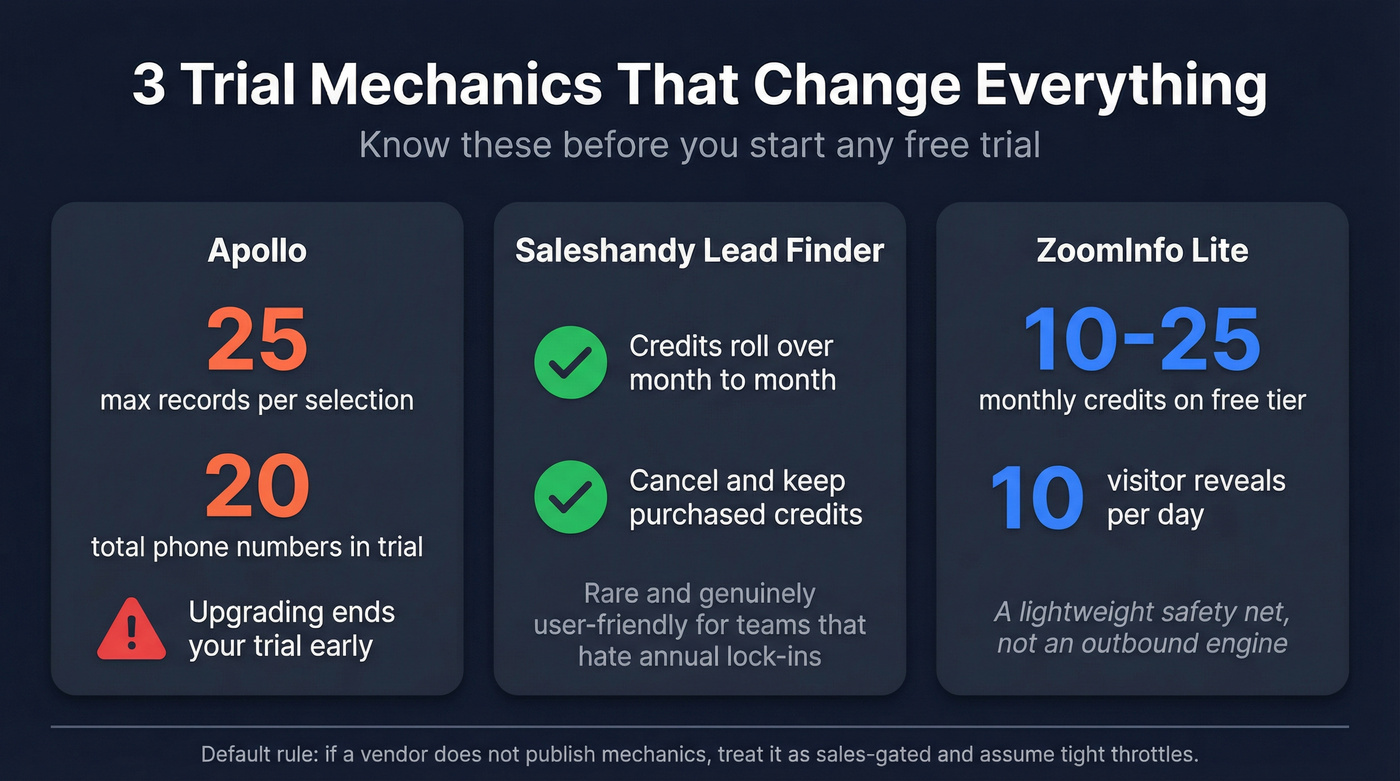

3 trial mechanics that change everything (one-minute cheat sheet)

- Apollo: 25-select cap + 20 phone numbers total + upgrading ends the trial. That combo kills clean testing if calling matters.

- Saleshandy Lead Finder: credit rollover plus "cancel and keep purchased credits" is rare and genuinely user-friendly, especially for teams that hate annual lock-ins.

- ZoomInfo Lite: a permanent free tier with 10-25 monthly credits plus 10 visitor reveals/day--useful as a lightweight safety net, not an outbound engine.

You read the gotchas: 25-record selection caps, 20-phone limits, trials that end when you upgrade. Prospeo skips all of that. No credit card, no contracts, 30+ filters, and emails at $0.01 each - with a 7-day refresh cycle that's 6x faster than the industry average.

Judge a trial by what you can export. Start here.

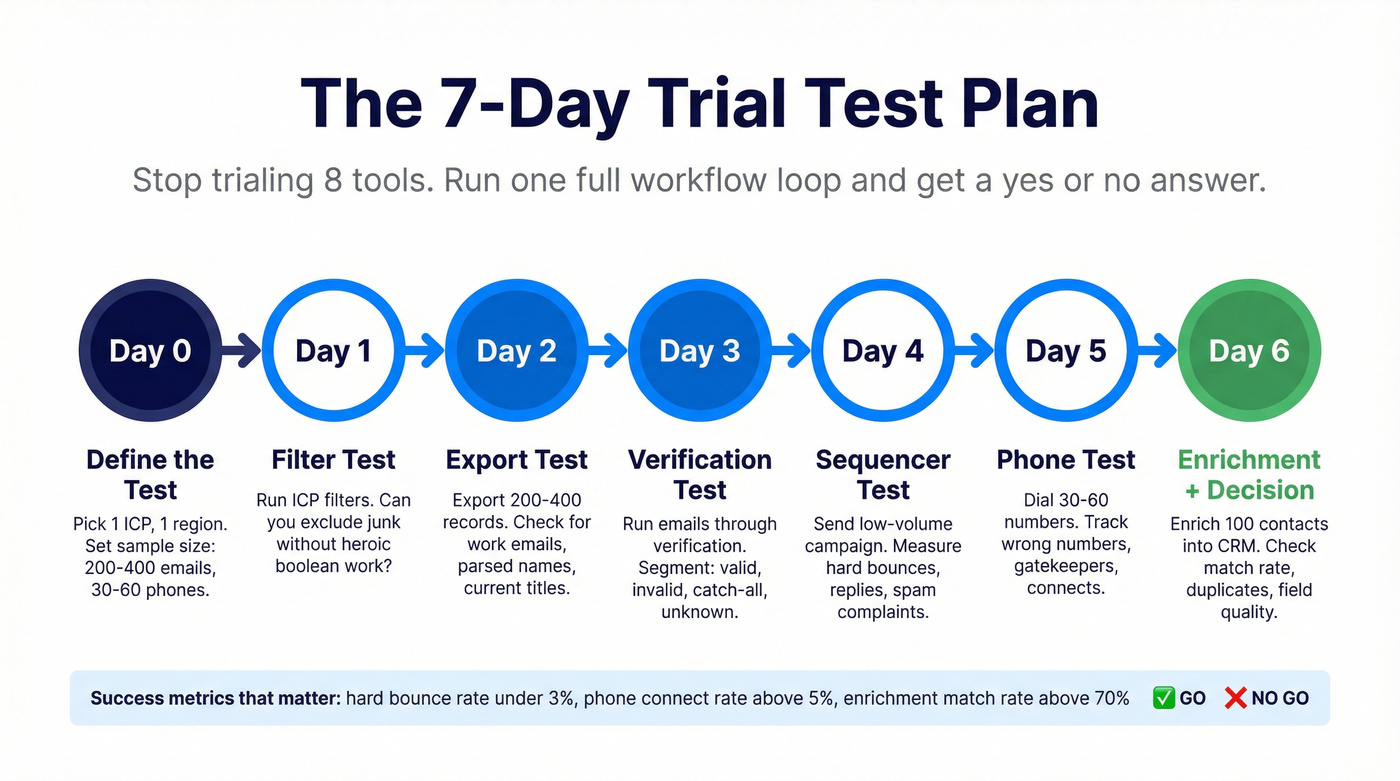

How to test a lead database in 7 days (without fooling yourself)

Stop trialing 8 tools. You'll learn less, not more, because you'll never run a full workflow loop on any of them.

We've tested trials where the UI looked great, the filters looked "enterprise," and then the export cap was so tight we couldn't even build a 200-contact sample without burning the entire allowance on day one. That isn't evaluation; it's theater, and it's infuriating when you're trying to make a budget call with real consequences for deliverability and rep time.

A 7-day plan works because it forces outcomes: bounce rate, enrichment match, and phone connect. It also shows whether a vendor's "unlimited" pitch is unlimited access or just unlimited browsing with tight export gates.

Day 0: Define the test (before you touch any UI)

- Pick one ICP and one region. Don't mix SMB + enterprise or US + EMEA in the same test.

- Define your minimum viable sample:

- Emails: 200-400 contacts is enough to see bounce patterns.

- Phones: 30-60 dials is enough to see if numbers are real and relevant.

- Decide the workflow you'll actually run:

- CSV -> sequencer (Smartlead/Instantly/Lemlist) for email testing

- CSV -> dialer for phone testing

- CSV -> CRM import for enrichment/duplication testing

Day 1: Filter test (ICP fit)

Run the same filters in each tool and sanity-check the results.

You're looking for:

- Can you filter by role seniority and department cleanly?

- Can you exclude junk (students, freelancers, agencies) without heroic boolean work?

- Do you get enough results without loosening the ICP until it's meaningless?

If the tool can't produce a believable list without you gaming the filters, the data won't magically improve after you pay.

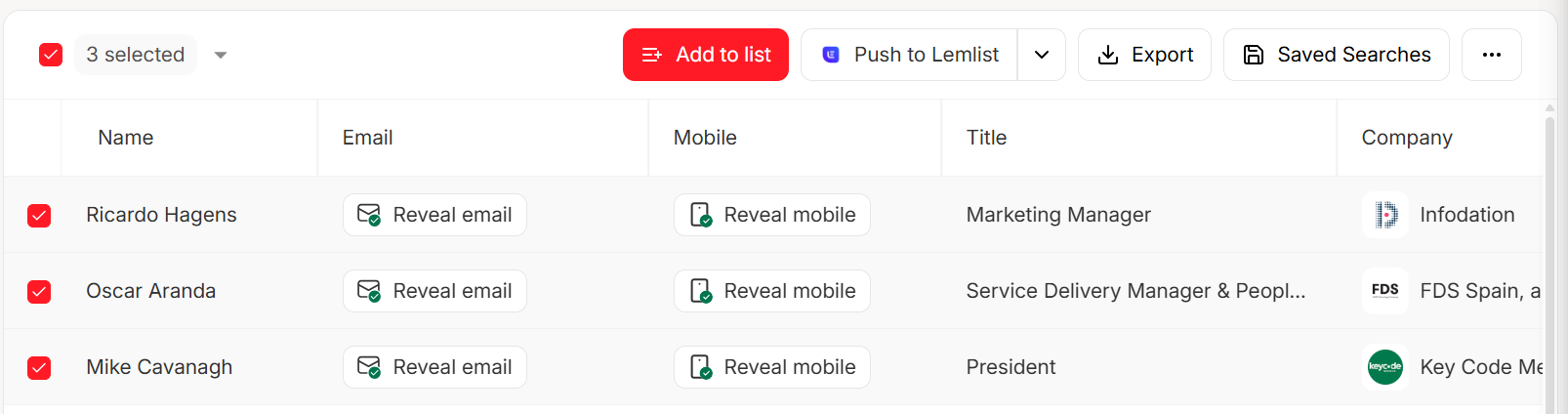

Day 2: Export test (the "unlimited search" trap)

Export 200-400 records and inspect the fields.

Check:

- Do you get work emails or lots of generic inboxes?

- Are names properly parsed (first/last), or is it messy?

- Are titles current, or obviously stale?

If a tool caps exports so low you can't hit 200, that's not a trial. It's a teaser.

Day 3: Verification test (separate from "found email")

Treat verification as its own track. This is where most teams fool themselves.

- Run the exported emails through verification (or use a tool that verifies in real time).

- Segment results: valid, invalid, catch-all, unknown.

- Keep a suppression list for anything invalid or risky.

A quick scenario we've seen: a team exports 300 "found" emails, launches, then blames their sequencer when bounces spike; the real issue was that "found" meant "pattern-guessed," and nobody ran verification or suppressed catch-all risk before sending, so the domain took the hit instead of the vendor.

Day 4: Sequencer test (deliverability reality check)

Send a low-volume campaign (or use a warmed domain) so you're not mixing data quality with deliverability chaos.

Measure:

- Hard bounce rate (the signal)

- Reply rate (secondary signal)

- Spam complaints (stop immediately if you see them)

Strong opinion: if your "trial success" metric is opens, you're grading the wrong test.

Day 5: Phone test (separate scorecard)

Phones aren't "nice to have." They're the fastest way to expose stale data.

- Pull 30-60 phone numbers (direct dials if possible).

- Have one rep run a consistent call block.

- Track: wrong numbers, gatekeepers, voicemail rate, and connects.

If your average deal size is modest and you're not running a serious call motion, you don't need an enterprise phone dataset. Spend that money on better sequencing and verification.

Day 6: Enrichment test (CRM/CSV)

Take 100 of the exported contacts and enrich them back into your CRM or a clean CSV.

You're checking:

- Match rate (how many records come back with usable data)

- Duplicate behavior (does it create new contacts instead of updating?)

- Field quality (industry, employee count, tech stack, HQ location)

Day 7: Decide with a simple rule

- If bounce is green and phones are workable: keep it.

- If bounce is yellow: keep testing only if the tool's verification/enrichment can fix it.

- If bounce is red: move on.

Don't negotiate with bad data.

Quality scorecard (what "good data" looks like during a trial)

A trial should end with a scorecard, not a gut feel. This one forces clarity.

Email quality (deliverability proxy)

Use hard bounce rate as your first-pass yardstick:

- <2% bounce = good

- 2-5% bounce = warning

- >5% bounce = red flag

Industry benchmarks (useful for calibration, not excuses): Listmint compiled benchmarks citing WebFX industry averages.

- IT/tech/software services: 0.90%

- Advertising/marketing: 1.10%

- Financial services: 1.20%

Phone quality (connect proxy)

Track these on 30-60 dials:

- Connect rate (someone answers and it's the right person/company)

- Wrong number rate

- "No longer there" rate (stale titles/tenure)

A database can have "lots of phones" and still be useless if they're old or routed.

Freshness (staleness proxy)

Ask one question: how often is the dataset refreshed?

Stale titles and job changes create more wasted rep time than missing contacts. Freshness is the unsexy metric that decides whether reps trust the tool after week two.

Enrichment match (RevOps proxy)

If you're enriching CRM records, you want:

- 80%+ match rate on a well-formed list (name + company + domain)

- Consistent field mapping (titles, departments, company size)

If match rate is low, the tool becomes a CSV factory instead of a system your RevOps team can run.

Shortlist: lead databases with real free trials/free access (mini-reviews)

Below are the options worth considering when you specifically care about trial mechanics (exports, phones, rollover, and whether you can actually test quality).

Prospeo (Tier 1)

Prospeo is the B2B data platform built for accuracy. If your top priority is stopping bounces and wasted rep cycles, this is the most straightforward place to start because it's self-serve and the quality signals are built into the workflow.

You get 300M+ professional profiles, 143M+ verified emails, and 125M+ verified mobile numbers, backed by 98% email accuracy and a 7-day data refresh cycle (the industry average is about 6 weeks). The Chrome extension has 40,000+ users, and the platform's used by 15,000+ companies, which matters because it usually correlates with fewer "mystery mechanics" and more battle-tested workflows.

The free tier is practical for evaluation: 75 emails + 100 Chrome extension credits/month. And once you're past the trial phase, the unit economics stay simple: about $0.01/email, and mobile numbers cost 10 credits per number. For ops teams, enrichment isn't an afterthought either: 83% enrichment match rate and 92% API match rate, returning 50+ data points per contact.

Best for: accuracy-first outbound, fast list QA, and teams that refuse sales-led gating.

Lead411 (Tier 1)

Lead411's trial is honest about the unit that matters: exports. You get 7 days with 50 free exports, and those exports include verified emails and direct phones, so you can run a clean test without guessing what "a credit" means.

Paid pricing is refreshingly sane for SMBs: Spark starts at $49/mo for 1,000 exports/month, and unused paid-plan exports roll over. It's not a giant platform, and that's the point: less bloat, more usable contacts.

Best for: export-defined trials and small teams that want phones included.

ZoomInfo (Tier 1)

ZoomInfo's still the enterprise default because it's broad and operationally sticky once you wire it into your GTM stack. The free trial is usually no credit card required and often runs around 7 days, but it's sales-provisioned, so export and phone access depend on what you negotiate up front.

After the trial, the pricing fork is real: most mid-market setups land around $15k-$40k/year depending on seats and modules (intent, web visitor, enrichment, and so on). It's worth it if you'll use the platform across teams. If reps only use the search bar, it's expensive shelfware.

ZoomInfo Lite is a decent fallback: 10-25 credits/month plus 10 visitor reveals/day. It's not outbound at scale, but it's handy when you need occasional confirms.

Best for: teams that want a full GTM platform and will actually use it.

Saleshandy Lead Finder (Tier 1)

If you want the lowest-friction way to run a real trial this week, Saleshandy Lead Finder is a strong pick. It's 7 days, no credit card, and it's built for execution: real-time email verification and bulk export up to 10,000 prospects at once.

Paid plans are SMB-friendly and predictable: $35/mo (500 credits), $69/mo (1,000 credits), and $119/mo (2,500 credits), with rollover. The standout detail is rare: if you cancel, you can still use purchased credits.

Best for: founders/SMBs who want a no-CC trial and simple credit math.

Apollo (Tier 2)

Apollo's an SMB default because it's easy to adopt and pricing is approachable (roughly $49-$99/user/month depending on tier). The trial is 14 days, but the mechanics are the story: you can only select 25 records at a time, and you only get 20 phone numbers total during the trial. Upgrade early and the trial ends.

Best for: email-first outbound teams that want an all-in-one workflow tool.

ListKit (Tier 2)

ListKit offers a free plan with 100 credits and paid plans that ramp fast - about $83/mo, $253/mo, or $508/mo (billed yearly as shown, credit-based). It markets "triple-verified leads" and big lead counts, which is useful if you want to skip a separate verification step.

Best for: high-volume outbound programs that want speed and simple exports.

Lusha (Tier 2)

Lusha's free plan makes credit economics painfully clear: 70 credits/month, where email costs 1 credit and a phone number costs 10 credits. Paid plans commonly land around $39-$99/user/month depending on package, and rollover stacks up to 2x your monthly cap while subscribed.

Best for: teams that want transparent costs and quick contact pulls.

Kaspr (Tier 2)

Kaspr works well as a lightweight contact pull tool with a small but explicit free plan: 15 B2B emails, 5 phones, and 5 direct emails per month. Paid starts around $49/mo (annual) or $65/mo (monthly), with tiered export allowances (Starter's often positioned around 12,000 exports/year).

Best for: quick lookups and list completion when you don't need a full platform.

Salesfully (Tier 3)

Salesfully runs a 5-day trial with 1,000 leads (once-only). Pricing is advertised as $29/month.

Gotcha: trial mechanics are vague. Define what counts as a "lead" before you compare it to export- or credit-based tools.

SalesIntel (Tier 3)

SalesIntel sells an "unlimited data and enrichment" model with a 90-day refresh and "up to 95% accuracy" marketing. It also positions its dataset as 22M+ accounts and 18M+ human-verified contacts, supported by a large research team and a 90-day re-verification cycle. Expect $12k-$30k/year depending on seats and package.

Gotcha: "unlimited" still comes with packaging and workflow constraints; the evaluation is sales-led.

Seamless.AI (Tier 3)

Seamless.AI offers a free plan with 1,000 credits per user/year (granted monthly) and exports. Paid is negotiated; a realistic range is $5k-$25k/year depending on seats and terms.

Gotcha: credit burn accelerates when you run real workflows instead of one-off lookups.

BatchLeads (Tier 3)

BatchLeads is built for real estate lead intel and skip-tracing-style workflows, not general B2B prospecting. Expect $119-$749/month depending on plan (plus enterprise custom).

Skip this if you're doing standard B2B SDR outbound. It's great in its lane, but it's the wrong lane for most teams reading this.

DataToLeads (Tier 3)

DataToLeads offers free samples and niche datasets; pricing commonly falls around $49-$300/month depending on list type and volume.

Gotcha: useful for sampling and list buying, not for testing a live database workflow.

LeadsGorilla (Tier 3)

LeadsGorilla is local lead gen + audits, often priced around $47-$199/month (sometimes positioned as a deal).

Gotcha: it's not a classic contact database. Treat it as an agency tool.

Pricing realism: what you'll pay after the trial (and why)

Trials are short. Your budget pain is long.

Pricing models decide whether the tool stays useful after the honeymoon:

- Credit-based: predictable unit economics, but phones get expensive fast.

- Export-based: simple to understand; great for teams that live in CSVs.

- "Unlimited": sounds great, hides packaging and fair-use constraints - ask directly whether you're getting unlimited downloads or just unlimited browsing with capped exports.

Practical baseline ranges:

| Tool | Model | Typical cost after |

|---|---|---|

| Prospeo | Credits | ~$0.01/email; mobiles cost 10 credits/number |

| Lead411 | Exports | $49/mo (Spark) |

| Saleshandy Lead Finder | Credits | $35 / $69 / $119 per month |

| Apollo | Per-seat | ~$49-$99/user/mo |

| ListKit | Credits | ~$83+/mo (billed yearly as shown) |

| Lusha | Per-seat + credits | ~$39-$99/user/mo |

| Kaspr | Per-seat | ~$49-$65/user/mo |

| ZoomInfo | Contract | ~$15k-$40k/yr |

| SalesIntel | "Unlimited" credits model | ~$12k-$30k/yr |

| Seamless.AI | Sales-led | ~$5k-$25k/yr |

Worked example #1: cost per usable email (the only email metric that matters)

Let's say you need 1,000 usable emails for a month of outbound.

Tool A charges $0.01/email and you see 98% valid after verification.

- You buy ~1,021 emails to net 1,000 usable (1,000 / 0.98).

- Cost ~= $10.21.

Tool B charges $0.01/email but you see 90% valid after verification.

- You buy ~1,112 emails (1,000 / 0.90).

- Cost ~= $11.12.

That difference looks tiny until you scale, and until you price in domain damage.

Worked example #2: cost per connected call (phones are where budgets go to die)

Assume you want 20 real connects (right company/person) from cold calling.

- If your connect rate is 10%, you need 200 dials.

- If phone reveals cost the equivalent of $0.10 per number, your phone data cost is $20 (200 x $0.10).

- If your connect rate is 5%, you need 400 dials and your phone data cost doubles to $40.

This is why phone caps in trials are such a big deal: without enough phone volume, you can't estimate your real cost per connect.

Unit economics you should compute every time:

- Cost per usable email (post-verification)

- Cost per connected call (phones x connect rate)

- Cost per enriched CRM record (match rate x completeness)

FAQ

Do lead database free trials usually require a credit card?

Most B2B lead database trials run without a credit card, but expect a business email gate and tighter export/phone limits until you're provisioned. If the vendor doesn't publish caps, assume you'll get limited exports and a small phone allowance during the trial.

What's the difference between "free trial," "free plan," and "free credits"?

A free trial is time-limited access to paid features (usually 7-14 days), while a free plan is ongoing $0 access with fixed monthly limits. Free credits are a one-time (or tiny monthly) allowance that often runs out in a single export. Use trials to test workflows; use free plans for light prospecting.

What bounce rate is "good" when testing a new database?

Under 2% hard bounce is good, 2-5% is a warning, and over 5% is a red flag. To avoid noisy results, test at least 200 contacts with the same sending setup (domain, copy, and ramp) so the data quality, not your deliverability variables, drives the outcome.

What's a good free alternative for verifying emails during a trial?

If you want verification without sales gating, Prospeo's free tier is a practical option: 75 emails plus 100 extension credits per month, with 98% verified email accuracy. If you're comparing tools, verify the same exported list across providers and keep anything invalid or risky on a suppression list.

What compliance checks should I do during a trial (GDPR/CCPA)?

Document a lawful basis (legitimate interest) and keep targeting role-relevant contacts, then confirm you can maintain a suppression list across exports and tools. Ask for a DPA, avoid personal/consumer addresses, and make sure you can delete records on request. If a vendor can't explain sourcing and opt-out handling clearly, don't scale.

Summary: pick the trial that lets you prove quality fast

A lead database free trial is only useful if it lets you export enough contacts to measure bounce rate, enrichment match, and phone connect in your real workflow. Prioritize transparent export units, clear phone caps, and freshness, then run the 7-day plan so you're deciding on outcomes instead of demo vibes.