Sales Pipeline vs Sales Funnel: The Data-Driven Guide Most Articles Won't Give You

In 2026, 69% of reps are missing quota. Win rates have dropped 18% from 2022 levels, and sales cycles have stretched 16% longer. Somewhere in the middle of all that, most sales teams still can't articulate the sales pipeline vs sales funnel distinction - let alone use both to diagnose what's actually broken.

The difference isn't academic. It's the gap between knowing what your reps are doing and knowing where your buyers are dropping off. One without the other is flying half-blind.

Teams who master both grow revenue 28% faster than those who don't.

Here's my hot take: most companies don't have a "closing problem." They have a visibility problem. They're staring at a pipeline board when they should be reading a funnel report - or vice versa. The data below will show you exactly which one you need to fix first.

Quick Answer: What's the Difference?

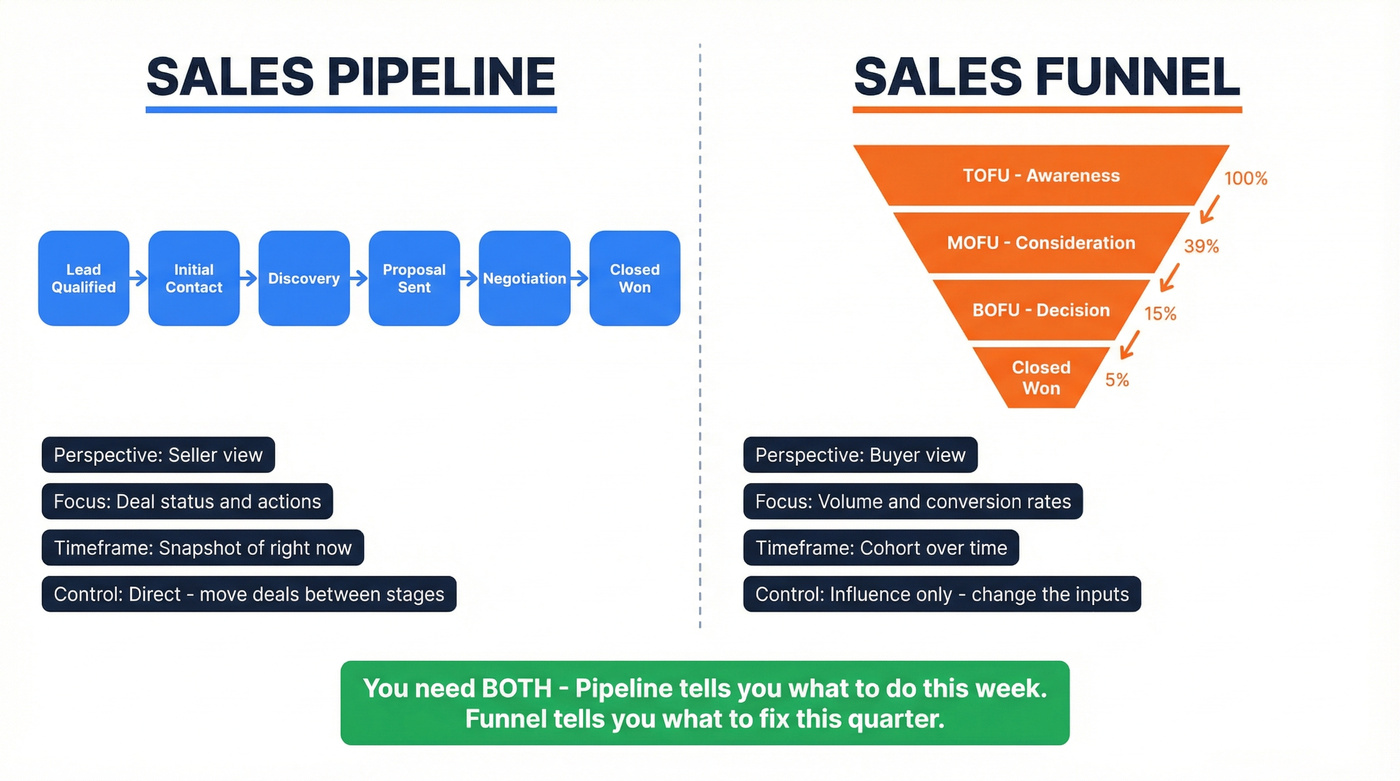

A sales pipeline is the seller's view - it tracks stages, actions, and deal movement from first contact to closed-won. A sales funnel is the buyer's view - it tracks volume, conversion rates, and where prospects drop off. A pipeline report is a snapshot of where deals sit right now. A funnel report is a cohort analysis of how leads moved through stages over time.

You need both.

What separates this guide from the dozens of surface-level comparisons out there:

- Real conversion benchmarks by industry - stage-by-stage data across B2B SaaS, financial services, healthcare, and more

- The pipeline velocity formula with worked examples and segment benchmarks from 423 B2B SaaS companies

- Qualification frameworks (BANT vs MEDDIC) mapped to when each actually works, plus the funnel diagnostic that tells you whether your problem is at the top, middle, or bottom

What Is a Sales Pipeline?

A sales pipeline is a visual representation of where every active deal sits in your sales process. It's horizontal, it's stage-based, and it answers one question: what needs to happen next to move this deal forward?

When a sales manager pulls up their pipeline, they're looking at a snapshot - how many deals are in discovery, how many proposals are out, what's the total dollar value sitting in negotiation. It's an operational tool built for action, not analysis.

But "pipeline" means different things depending on who's talking. When a VP of Sales says "we need more pipe," they mean dollar value - total revenue sitting in active deals. When a RevOps lead says "our pipeline needs work," they usually mean the stages are poorly defined or deals are stalling. And when a new SDR asks "what's my pipeline?" they might just mean their list of accounts. Understanding this distinction saves you from a lot of confused meetings.

Typical Pipeline Stages

Most B2B pipelines run 5-7 stages. A standard version:

- Lead Qualified - confirmed fit against ICP criteria

- Initial Contact - first meaningful conversation

- Discovery / Needs Analysis - understanding the buyer's problem

- Proposal Sent - formal solution and pricing delivered

- Negotiation - terms, procurement, legal review

- Closed Won / Closed Lost - deal resolved

Each stage should have clear entry criteria. "Proposal Sent" means the prospect has seen pricing and confirmed they're evaluating - not that you emailed a PDF into the void.

What a Real-World Pipeline Looks Like

The textbook version is clean. Reality isn't.

Belkins, a B2B sales agency, runs an 11-stage pipeline worth studying because it reflects what actually happens in complex sales: Appointment Scheduled, Discovery Call, ICP/Due Diligence Analysis, ICP/DD Trial, Highly Qualified, Demo, Contract Sent, Awaiting Payment, Closed Won, Closed Lost, and Future Reengagement.

A few things stand out. They don't start the pipeline at "lead generation" - logging every contact as a deal clutters the pipeline and destroys forecast accuracy. They have a dedicated ICP/DD stage where a researcher analyzes fit after the discovery call. And they include a "Future Reengagement" stage for no-shows and "need more time" prospects, rather than dumping them into Closed Lost.

That level of granularity isn't for everyone. But if your sales cycle runs 90+ days and involves multiple stakeholders, 5 stages probably isn't enough diagnostic visibility.

69% of reps miss quota because deals stall in the pipeline. The #1 cause? Bad contact data that kills outreach before it starts. Prospeo gives you 98% verified emails and 125M+ direct dials so every deal in your pipeline has a real path forward.

Stop diagnosing pipeline leaks caused by bad data. Start with data that connects.

What Is a Sales Funnel?

A sales funnel is the buyer's journey viewed through conversion rates. Wide at the top (lots of awareness), narrow at the bottom (few closed deals), and the shape itself tells you where you're losing people.

Where a pipeline asks "what's happening with this deal?", a funnel asks "of the 1,000 people who entered last quarter, how many made it to each stage - and where did the rest go?"

That's the cohort-based nature of funnel reporting. You're not looking at a snapshot of today. You're analyzing a group of prospects over time to find patterns. And those patterns reveal something pipelines can't: systemic problems.

Funnel leakage - prospects dropping out at specific stages due to poor nurturing, misalignment, or friction - is the concept that makes funnels actionable. If 60% of your MQLs never become SQLs, that's not a closing problem. It's a middle-of-funnel problem, and no amount of pipeline management will fix it. Sometimes the cause is as mundane as leads getting assigned to reps who are on vacation or out of territory - invisible in a pipeline view, obvious in a funnel report.

Funnel Stages: TOFU, MOFU, BOFU

The classic AIDA model) (Awareness, Interest, Desire, Action) still holds, but modern B2B teams overlay it with a more operational framework:

- Top of Funnel (TOFU): Awareness and Interest. Prospects discover you through content, ads, events, or outbound. Visitor-to-lead conversion averages 1-3%. Strong performance is 5%+. Exceptional is 8-12%. One underrated lever here: form length. A landing page with 1 input field converts at 3.20%; bump that to 5 fields and conversion drops to 0.81%. Every unnecessary field is a leak.

- Middle of Funnel (MOFU): Consideration and Evaluation. Leads are qualified, nurtured, and handed to sales. This is where lead scoring and MQL-to-SQL conversion happens - and where most funnels hemorrhage.

- Bottom of Funnel (BOFU): Decision and Purchase. Qualified opportunities move through proposals, negotiations, and close. Conversion from opportunity to sale runs 20-30%, meaning 70-80% of qualified opportunities still fail to convert.

Funnel Conversion Benchmarks by Industry

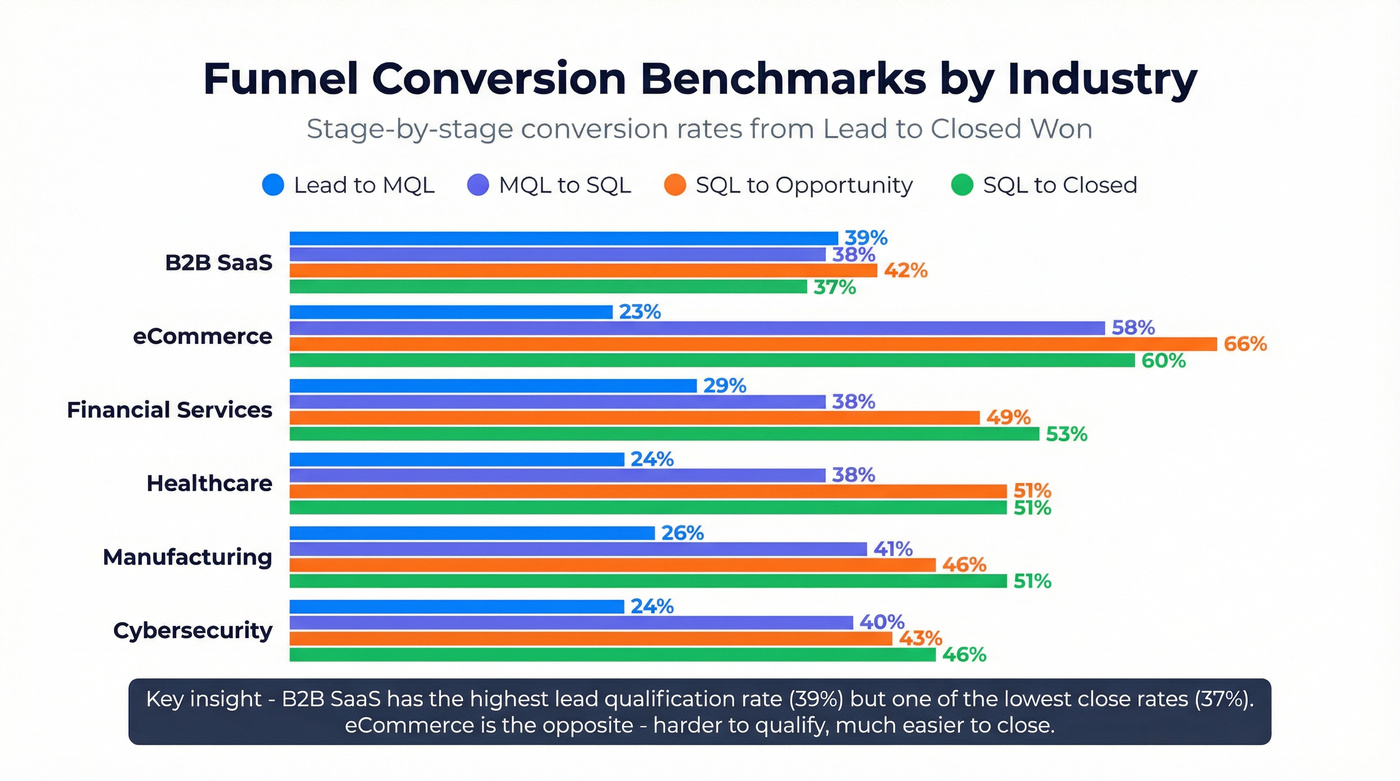

Abstract percentages don't help. Here's what real conversion rates look like across industries, based on First Page Sage's multi-year dataset:

| Industry | Lead-MQL | MQL-SQL | SQL-Opp | SQL-Closed |

|---|---|---|---|---|

| B2B SaaS | 39% | 38% | 42% | 37% |

| eCommerce | 23% | 58% | 66% | 60% |

| Financial Services | 29% | 38% | 49% | 53% |

| Healthcare | 24% | 38% | 51% | 51% |

| Manufacturing | 26% | 41% | 46% | 51% |

| Cybersecurity | 24% | 40% | 43% | 46% |

Look at the spread. B2B SaaS has the highest Lead-MQL rate (39%) but one of the lowest SQL-Closed rates (37%). eCommerce is the opposite - harder to qualify but much easier to close. If you're benchmarking your funnel against "industry averages" without specifying which industry, you're benchmarking against noise.

Pipeline vs Funnel - Key Dimensions Compared

| Dimension | Pipeline | Funnel |

|---|---|---|

| Perspective | Seller's view | Buyer's view |

| Focus | Deal status & actions | Volume & conversion |

| Shape | Horizontal bar | Inverted cone |

| Key metrics | Deal value, count, velocity | Drop-off rates, MQL-SQL |

| Ownership | Sales team + ops | Marketing + sales |

| Timeframe | Current deals (now) | Cohort over time |

| Report type | Snapshot | Cohort analysis |

| Controllability | Direct (move deals) | Influence only |

The controllability row is the one most people miss. You can directly manipulate a pipeline - add deals, move them between stages, remove stalled opportunities. A funnel can only be influenced. You can't force a higher MQL-SQL conversion rate by dragging contacts around in your CRM. You have to change the inputs: better targeting, better content, better qualification criteria.

This is why pipeline management feels more actionable day-to-day, but funnel analysis drives strategic decisions. The pipeline tells you what to do this week. The funnel tells you what to fix this quarter.

Who owns what: Marketing owns TOFU metrics. Sales owns pipeline stages. RevOps bridges both. Customer success feeds expansion revenue back into the funnel. If these teams aren't looking at the same data - and in most companies, they aren't - your diagnosis will always be incomplete.

Why This Distinction Actually Matters (With Data)

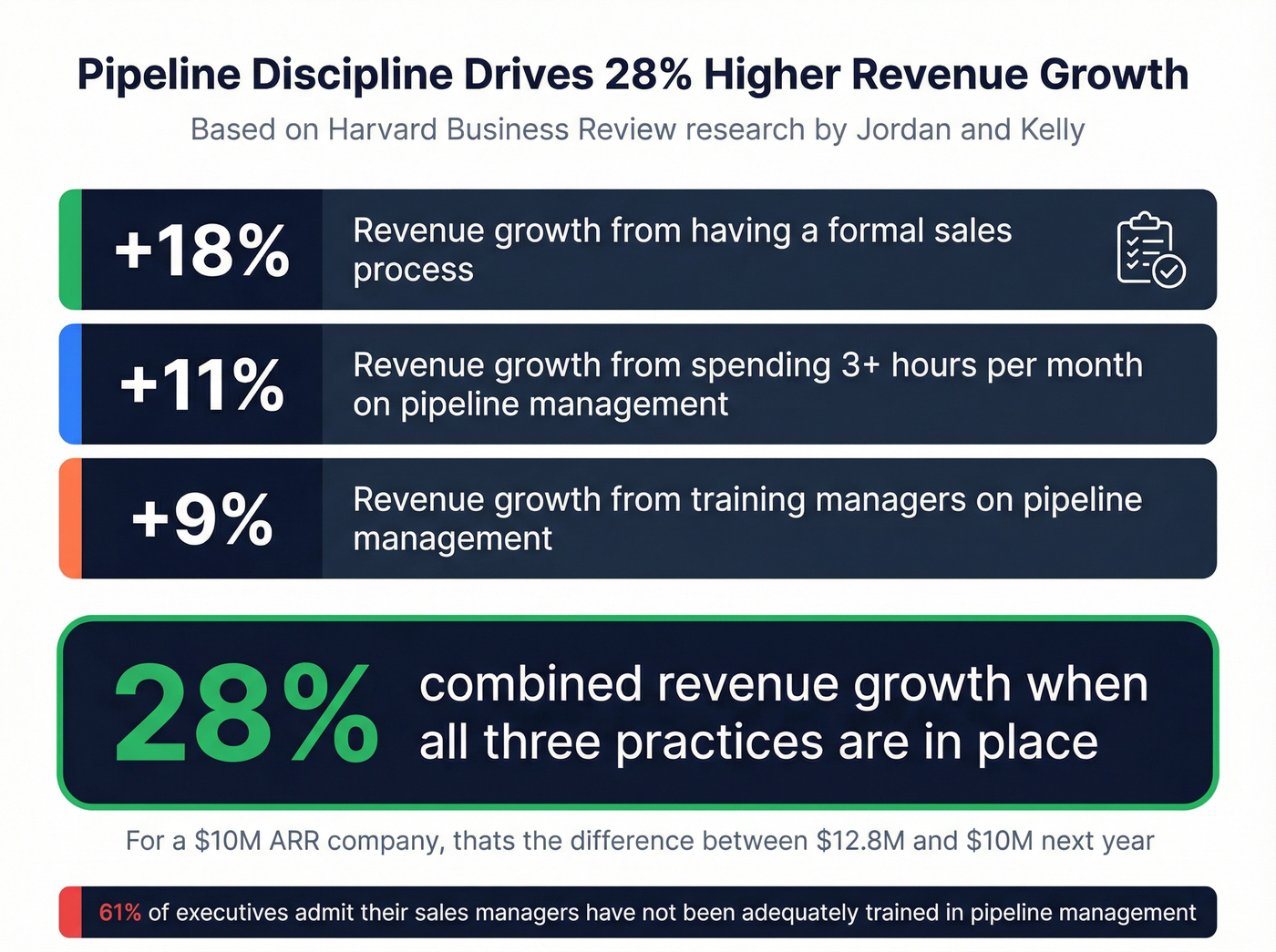

The Revenue Impact of Pipeline Discipline

A landmark HBR study by Jason Jordan and Robert Kelly found three pipeline management practices that compound into 28% higher revenue growth:

- Companies with a formal sales process saw 18% higher revenue growth

- Spending 3+ hours per month on pipeline management added 11%

- Training managers on pipeline management contributed another 9%

For a $10M ARR company, 28% faster growth is the difference between hitting $12.8M and $10M next year.

Yet 61% of executives admit their sales managers haven't been adequately trained in pipeline management. I've seen this pattern over and over: companies invest six figures in CRM software, then let managers run pipeline reviews off gut feeling and stale spreadsheets. It's maddening.

The productivity gap reinforces this. Organizations with 90%+ quota attainment have reps spending 34% of their time actively selling. Lower-performing orgs? Just 23%. That 11-point gap is a pipeline management problem - reps are spending time on deals that should've been disqualified two stages ago.

The AI angle matters too: sellers who partner with AI sales tools are 3.7x more likely to meet quota, and 81% of sales teams are now investing in AI-assisted pipeline management. Teams using AI for forecasting and deal scoring saw 83% revenue growth, compared to 66% for those without. If you're still running pipeline reviews in a spreadsheet, you're competing with one hand tied behind your back.

The "Lost to Indecision" Problem

Here's the contrarian reframe most articles comparing these two concepts miss: 60% of deals aren't lost to competitors. They're lost to indecision. The buyer just... stops.

This is a funnel insight that pipeline views hide. In your pipeline, a stalled deal looks like it's "in negotiation." In your funnel, you'd see that 60% of deals entering Stage 4 never reach Stage 5 - and the pattern has been consistent for three quarters.

You see 200 deals worth $2M in your pipeline. Your funnel shows 12% stage-2-to-stage-4 conversion. That $2M pipeline is really a $240K pipeline. If your forecast doesn't account for funnel conversion rates, you're lying to your board.

Pipeline Velocity - The Metric That Bridges Both

Pipeline velocity is the single metric that connects pipeline mechanics to funnel outcomes. It answers: how much revenue moves through your pipeline per day?

The Formula and a Worked Example

Pipeline Velocity = (# Opportunities x Avg Deal Size x Win Rate) / Sales Cycle Days

Worked example:

- 100 qualified opportunities

- $10,000 average deal size

- 20% win rate

- 50-day average sales cycle

100 x $10,000 x 0.20 / 50 = $4,000/day

That's $4,000 in revenue moving through your pipeline every day - roughly $1.46M annualized.

The power of this formula is that it exposes which lever matters most. A common mistake: pushing for more deals while ignoring win rate. A 50% increase in opportunities with a 30% drop in win rate is a net negative. Aggressive discounting to close faster - cutting cycle by 20% but discounting 25% - hurts velocity too.

The fastest lever? Reducing sales cycle length, which has a 28% impact on velocity.

What Good Velocity Looks Like

Based on Optifai's benchmark study of 423 B2B SaaS companies:

| Segment | Velocity Range | Notes |

|---|---|---|

| SMB (<$15K deals) | $4,500-$7,000/day | Shorter cycles, lower ACV |

| Mid-Market ($15-100K) | $12,000-$18,000/day | Balance of volume + size |

| Enterprise ($100K+) | $25,000-$50,000/day | Fewer deals, much larger |

| Median (all) | $8,200/day | ~$3M annualized |

| Top quartile | $19,500+/day | 2.5x bottom quartile |

| Bottom quartile | <$2,800/day | Usually a win rate problem |

The 2.5x gap between top and bottom quartile is striking. The difference usually isn't deal size or opportunity count - it's win rate and cycle length. Bottom-quartile teams run unqualified deals through long cycles and wonder why velocity is low.

How to Build and Manage Your Pipeline and Funnel Together

Pick the Right Qualification Framework

BANT (Budget, Authority, Need, Timing) was created by IBM in the 1960s. MEDDIC (Metrics, Economic Buyer, Decision Criteria, Decision Process, Identify Pain, Champion) came later for complex enterprise sales. Both still work - but for very different situations.

Use BANT when:

- You're running high-velocity inbound

- Sales cycles are under 45 days

- Deals involve 1-2 decision makers

Use MEDDIC when:

- You're selling enterprise with buying committees

- Sales cycles run 90+ days

- The "champion" inside the account matters more than the budget holder

Skip MEDDIC if you're selling $500/month SaaS to SMBs. It'll slow you down for no reason. But if you're selling enterprise with BANT, you're leaving money on the table. Modern buyers arrive with 90% of their research done - a BANT checklist feels like an interrogation. MEDDIC forces you to understand the buyer's decision process, not just their budget.

Run Pipeline Reviews That Don't Waste Everyone's Time

I've sat through pipeline reviews that were 45 minutes of a manager asking "what's the update on Acme Corp?" for every deal on the board. That's not a review. That's a status meeting.

Effective pipeline reviews need:

- A clear agenda - review stalled deals, at-risk deals, and deals advancing. Skip healthy ones.

- Data, not gut feeling - if a deal has been in "proposal" for 3x your average cycle at that stage, it's stalled. The CRM knows this. Use it.

- Qualification pressure - every deal should justify its stage. If it can't, move it back or remove it.

- Documented action items - "Follow up with the champion" isn't an action item. "Send the ROI calculator to Sarah by Thursday and confirm the security review timeline" is.

The operational details matter more than the review format: contacting leads within 5 minutes of inbound interest increases conversions by 100x, and multi-channel outreach delivers 287% higher response rates than single-channel. Companies with aligned sales and marketing teams see 38% higher win rates.

Two implementation mistakes kill pipeline management before it starts. First, failing to customize your CRM stages to your actual sales process - the default stages are never right. Second, not integrating your pipeline tool with the rest of your stack. A pipeline that doesn't talk to your email tool, your dialer, and your data sources is a pipeline built on manual entry. Which means it's a pipeline built on lies.

If you want a tighter operating rhythm, a documented pipeline review cadence is the easiest win.

Diagnose Where Your Funnel Leaks

Every funnel leaks. The question is where - and the fix depends entirely on the answer.

Top-of-funnel leak (Awareness to Lead): If 35% of your emails bounce - common with stale databases - your pipeline value is inflated, your funnel metrics are skewed, and your reps waste hours chasing dead leads. This is a data quality problem, not a strategy problem. Tools like Prospeo with 98% email accuracy and a 7-day data refresh cycle fix this at the source, ensuring the contacts entering your pipeline are real before a single rep touches them.

Middle-of-funnel leak (Lead to Qualified Opportunity): Up to 55% of leads are neglected due to poor qualification. The fix isn't more leads - it's better nurturing sequences, faster response times, and clearer MQL-to-SQL handoff criteria between marketing and sales. A clean lead qualification process prevents most of this.

Bottom-of-funnel leak (Opportunity to Closed): Remember, 60% of deals die from indecision. The fix here is champion enablement - giving your internal advocate the business case, the ROI calculator, and the competitive comparison they need to sell internally. Closing skills matter, but they matter less than arming the champion.

Tools for Managing Your Pipeline and Funnel

You don't need a $50K platform to manage pipelines and funnels effectively. Here's what works at each price point:

| Tool | Best For | Starting Price | Key Feature |

|---|---|---|---|

| HubSpot CRM | Startups, free tier | Free | Drag-and-drop pipeline |

| Pipedrive | Visual pipeline mgmt | ~$14/user/mo | Kanban-style boards |

| Prospeo | Prospecting data layer | Free (75 emails/mo) | 98% email accuracy |

| Salesforce | Enterprise complexity | $25-$80/user/mo | Einstein AI forecasting |

| Zoho CRM | Best overall value | $14/user/mo | Zia AI + deep customization |

| Freshsales | All-in-one SMB | Free-$15/user/mo | Built-in phone + email |

HubSpot's free CRM is the obvious starting point if you're under 10 reps and don't need advanced forecasting. Pipedrive is the best pure pipeline visualization tool - its kanban boards make deal movement intuitive in a way Salesforce never will. Salesforce is the enterprise default for a reason, but it's overkill (and overpriced) for teams under 50.

If you're evaluating options, start with a modern B2B sales stack view so your CRM, data, and outreach tools actually connect.

Your funnel conversion benchmarks mean nothing if you're feeding TOFU with unverified contacts. Prospeo's 7-day data refresh and 5-step verification keep bounce rates under 4% - so your funnel metrics reflect real buyer behavior, not data decay.

Clean data in, accurate funnel insights out. That's the difference.

FAQ

Is a sales pipeline the same as a sales process?

No. A sales process is the methodology - the repeatable steps reps follow to move a deal forward. A pipeline is the visual representation of where deals currently sit within that process. You can have a documented sales process without a pipeline tool, but you can't build a meaningful pipeline without an underlying process defining what each stage means.

What's the difference between a marketing funnel and a sales funnel?

A marketing funnel covers awareness through lead capture - everything from first touch to MQL. A sales funnel picks up from qualified lead through closed deal. In practice, they're one continuous funnel with a handoff point. The distinction matters organizationally (who owns which metrics) but the buyer experiences one journey, not two.

How many stages should a sales pipeline have?

Most B2B pipelines have 5-7 stages. The right number depends on your sales cycle complexity. If your average deal closes in under 30 days, 5 stages is plenty. Enterprise cycles running 90+ days with multiple stakeholders need 7-9 stages for the granularity to spot where deals stall. More stages give more diagnostic visibility but add CRM overhead for reps.

Can you track both pipeline and funnel in the same CRM?

Yes. Most CRMs - HubSpot, Salesforce, Pipedrive - show pipeline as a kanban board view and funnel as a conversion report. Same underlying data, different lenses. The key is configuring your CRM to capture stage timestamps so you can run cohort-based funnel reports, not just snapshot pipeline views.

What's a good pipeline velocity for B2B SaaS?

Median pipeline velocity for B2B SaaS is $8,200/day across 423 companies benchmarked. SMB segment: $4,500-$7,000/day. Mid-Market: $12,000-$18,000/day. Enterprise: $25,000-$50,000/day. Top quartile companies achieve 2.5x the velocity of bottom quartile - the gap is usually driven by win rate and cycle length, not deal volume.