The Best Demandbase Alternatives in 2026 (By Budget + Use Case)

If you're searching for demandbase alternatives, you're probably in one of two moods: (1) "This thing's powerful, but why does it cost like a second headcount?" or (2) "We bought the suite and now nobody uses half of it."

Demandbase isn't some niche tool either. It's rated 4.4/5 on G2 (1,917 reviews), and G2 lists implementation at about 2 months. The recurring complaints are consistent: learning curve, suite complexity, and pricing opacity.

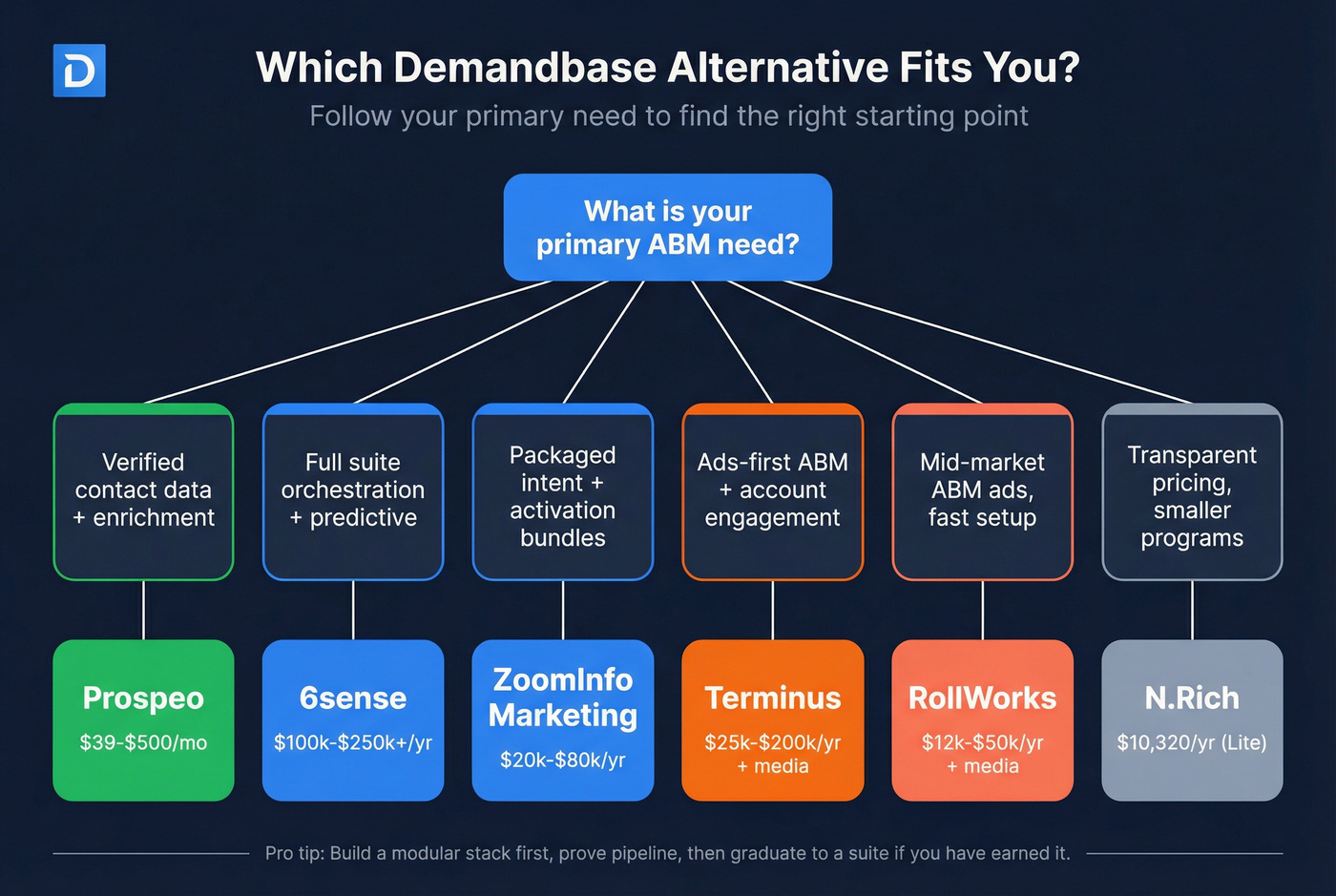

Here's the thing: if your average deal size is modest and you don't have a dedicated ABM owner, buying a full orchestration suite is usually a mistake.

Build a modular stack, prove pipeline, then graduate to the suite if you've earned it.

Our picks: 3 demandbase alternatives to trial first

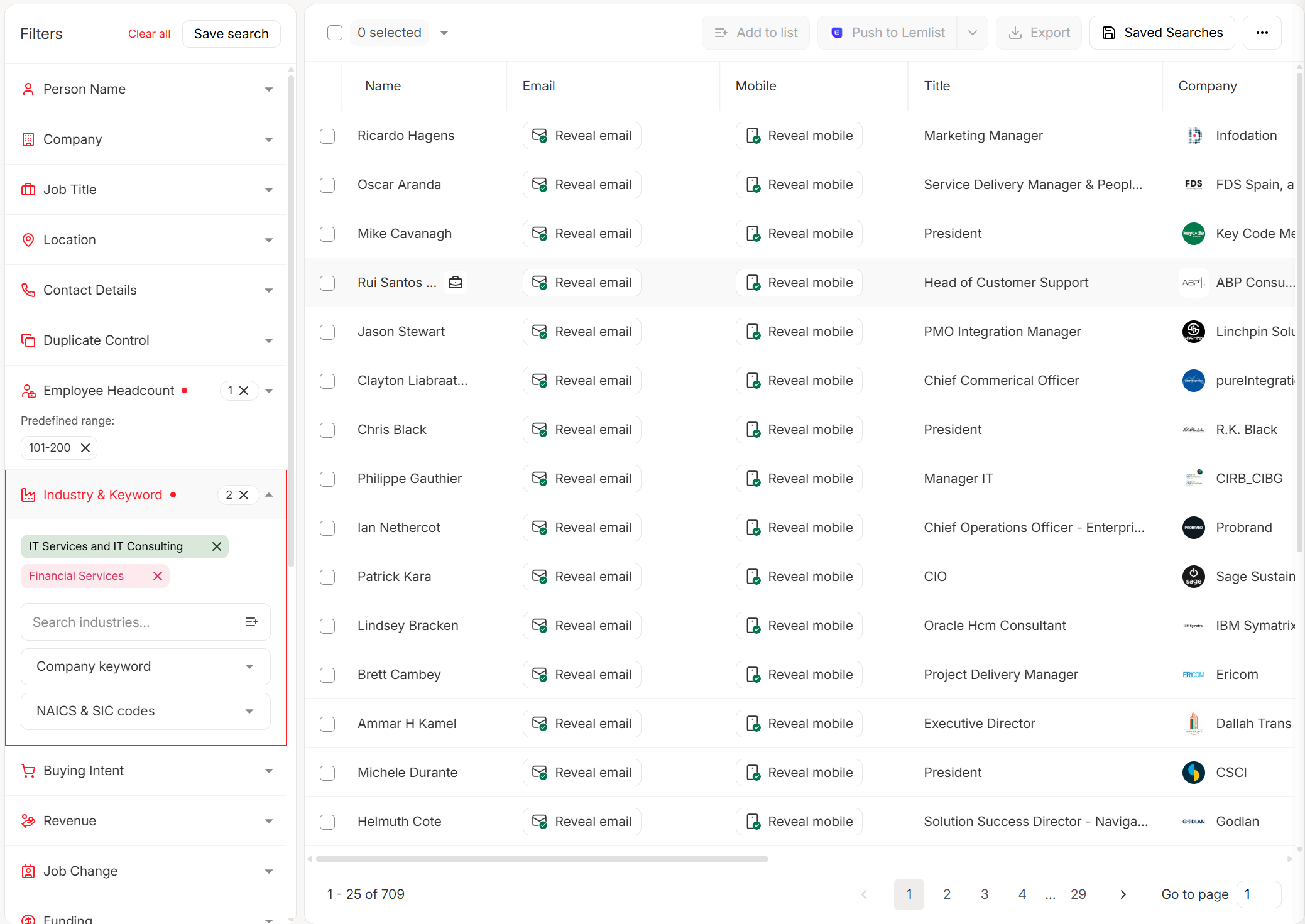

Prospeo - best for turning ABM signals into outreach-ready people

Prospeo is "The B2B data platform built for accuracy", and it's the fastest way to fix the most common ABM failure mode: you finally have "in-market accounts" and... nobody you can actually reach.

You get 300M+ professional profiles, 143M+ verified emails, and 125M+ verified mobiles, with 98% email accuracy and a 7-day data refresh cycle (the industry average is about 6 weeks). It also includes 15,000 intent topics (powered by Bombora), so you can go from "these accounts are researching" to "here's the buying group, verified, ready for outreach" without duct-taping three tools together.

In our experience, this is where ABM ROI is won or lost: if your contact data's stale, your bounce rate climbs, deliverability tanks, and suddenly your "ABM program" is just expensive reporting.

Pricing expectation: Free tier; most teams land ~$39-$500/mo credit-based. See pricing: https://prospeo.io/pricing

N.Rich - best transparent ABM platform pricing for smaller programs

N.Rich publishes real packaging (topics, seats, ad limits), which makes budgeting sane again. It's a clean account based marketing software choice when you want structure without a six-figure suite.

Pricing expectation: $10,320/yr (LITE) + $1,050 one-time onboarding, or $23,800/yr (GROWTH).

ZoomInfo Marketing - best packaged ABM activation if you want intent + credits bundled

ZoomInfo Marketing is the most "buy a box, get a box" alternative: packaged plans with included credits and intent topics, plus activation. That makes procurement easier than the typical "platform fee + mystery add-ons" dance.

Packaging snapshot: Demand includes 75K included credits and 25 intent topics; ABM Lite includes 100 intent topics; ABM Enterprise includes 150K included credits and unlimited intent topics.

Pricing expectation: ~$20k-$80k/yr, driven by credits, intent topics, and activation modules.

Pick based on your situation (fast decision table)

| Your situation | Best pick | Why | Typical spend |

|---|---|---|---|

| Need identity + intent + orchestration (suite replacement) | 6sense | Closest suite peer to Demandbase for orchestration + predictive workflows | ~$100k-$250k+/yr |

| Ads-first ABM (account lists -> display/retargeting) | Terminus | Strong ABM advertising + account engagement surface area | ~$25k-$200k/yr + media |

| Mid-market ABM ads with faster time-to-live | RollWorks | Ads-first ABM without full-suite overhead | ~$12k-$50k/yr + media |

| Intent-only layer (bring your own activation) | Bombora | Best-in-class third-party intent co-op and topic depth | ~$20k-$80k/yr |

| Content-led ABM (syndication + account engagement) | Madison Logic (ML Platform) | Built for content-driven account programs | ~$30k-$120k/yr |

| RevOps signal routing + automation | Momentum | Turns signals into workflows across your stack | ~$15k-$75k/yr |

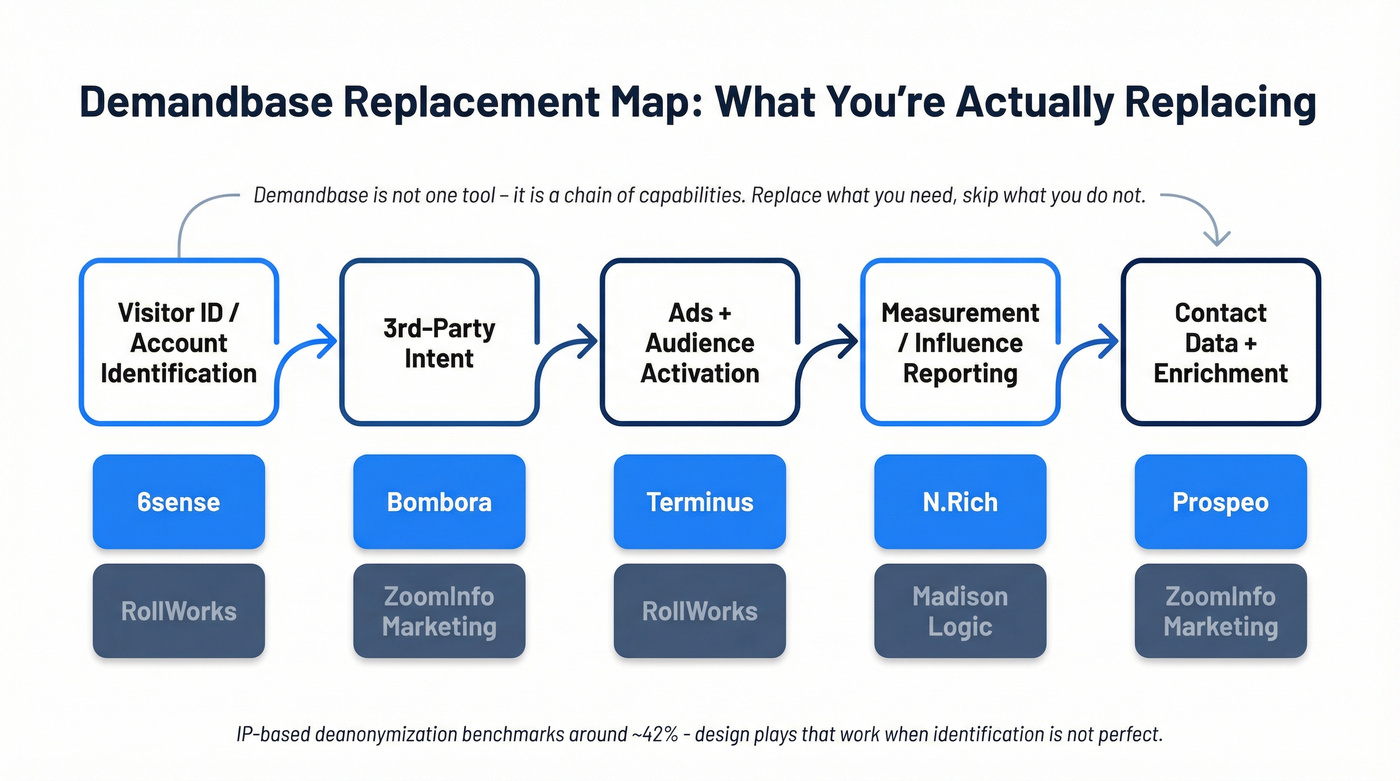

What you're actually replacing (Demandbase -> replacement map)

Demandbase isn't "one tool." It's a chain: identity -> intent -> audiences -> activation -> measurement. When teams churn, they usually want the outcomes, not the suite.

And identity resolution isn't magic. A widely shared benchmark (cited by ZenABM, attributed there to a Syft study) puts IP-based deanonymization around ~42%. That's a useful yardstick for planning and forecasting, because it forces you to design ABM plays that don't collapse when identification isn't perfect.

Replacement map (commitments, not a vague list)

| Demandbase capability | Primary replacement | Secondary add-on | Notes |

|---|---|---|---|

| Visitor ID / account identification | 6sense | RollWorks | Identity quality varies by traffic + ICP |

| 3rd-party intent | Bombora | ZoomInfo Marketing | Topic taxonomy is the whole game |

| Ads + audience activation | Terminus | RollWorks | Media budget is separate either way |

| Measurement / influence reporting | N.Rich | Madison Logic (ML Platform) | Influence is useful; it's not causal attribution |

Demandbase gives you intent signals and account lists. But signals don't book meetings - verified contacts do. Prospeo fills the gap with 143M+ verified emails at 98% accuracy, 125M+ direct dials, and a 7-day refresh cycle so your ABM outreach actually lands.

Stop paying six figures for intent data that bounces. Start reaching real buyers.

Pricing reality check for demandbase alternatives (what drives cost)

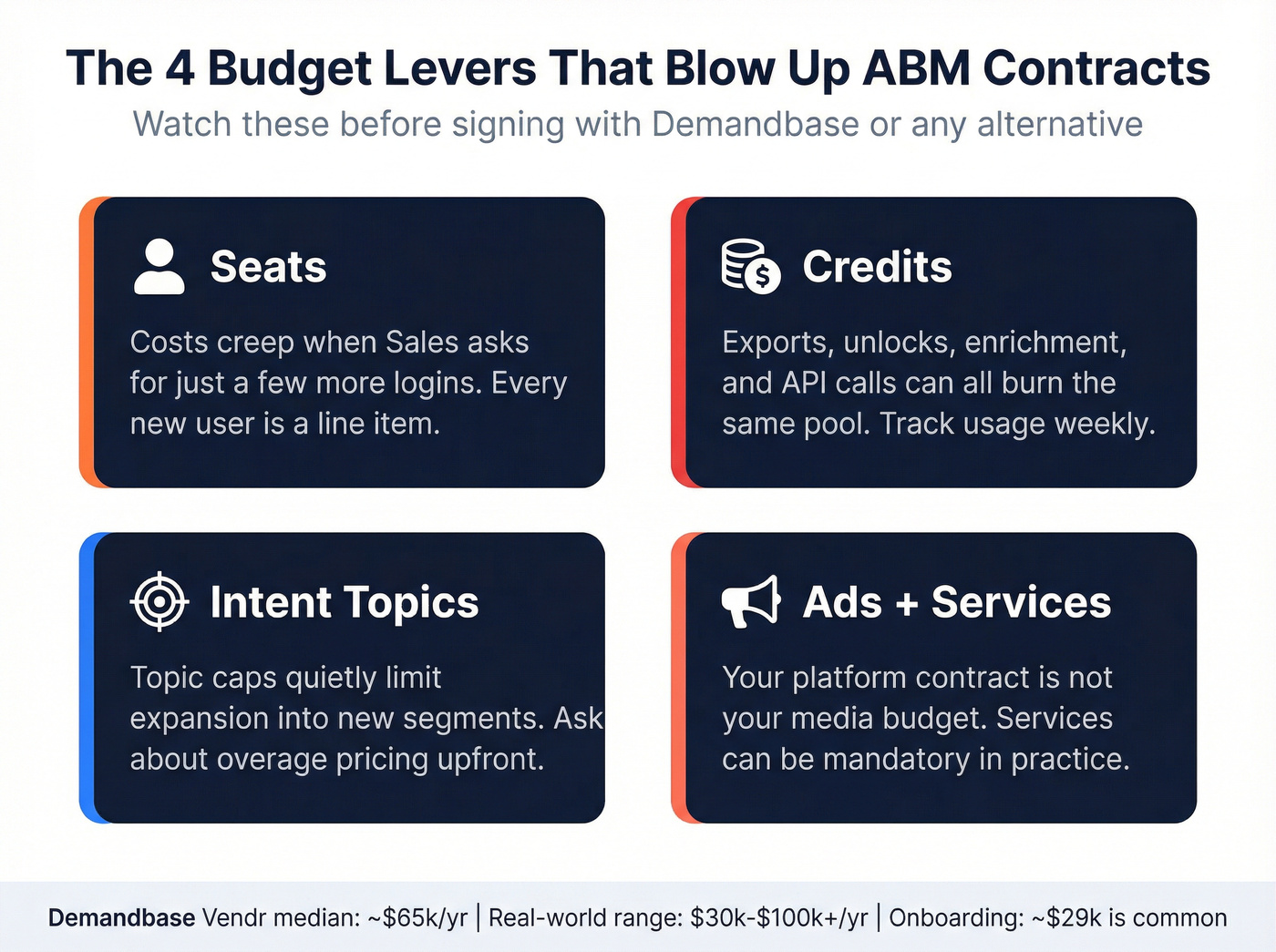

Demandbase pricing follows the enterprise ABM pattern: platform fee + seats + add-ons + ads. ZenABM cites a Vendr median around ~$65k/year, with real-world ranges commonly $30k-$100k+/year depending on modules and activation.

For anchor examples, RB2B points to an AWS Marketplace listing at $215k for 12 months for Demandbase One. Onboarding is often its own line item too; ~$29k shows up often enough that you should assume it's on the table and negotiate it like you mean it.

The four budget levers that blow up contracts

- Seats: costs creep when Sales asks for "just a few more logins."

- Credits: exports, unlocks, enrichment, and API calls can all burn the same pool.

- Intent topics: topic caps quietly limit expansion into new segments.

- Ads + services: your platform contract isn't your media budget, and services can be mandatory in practice.

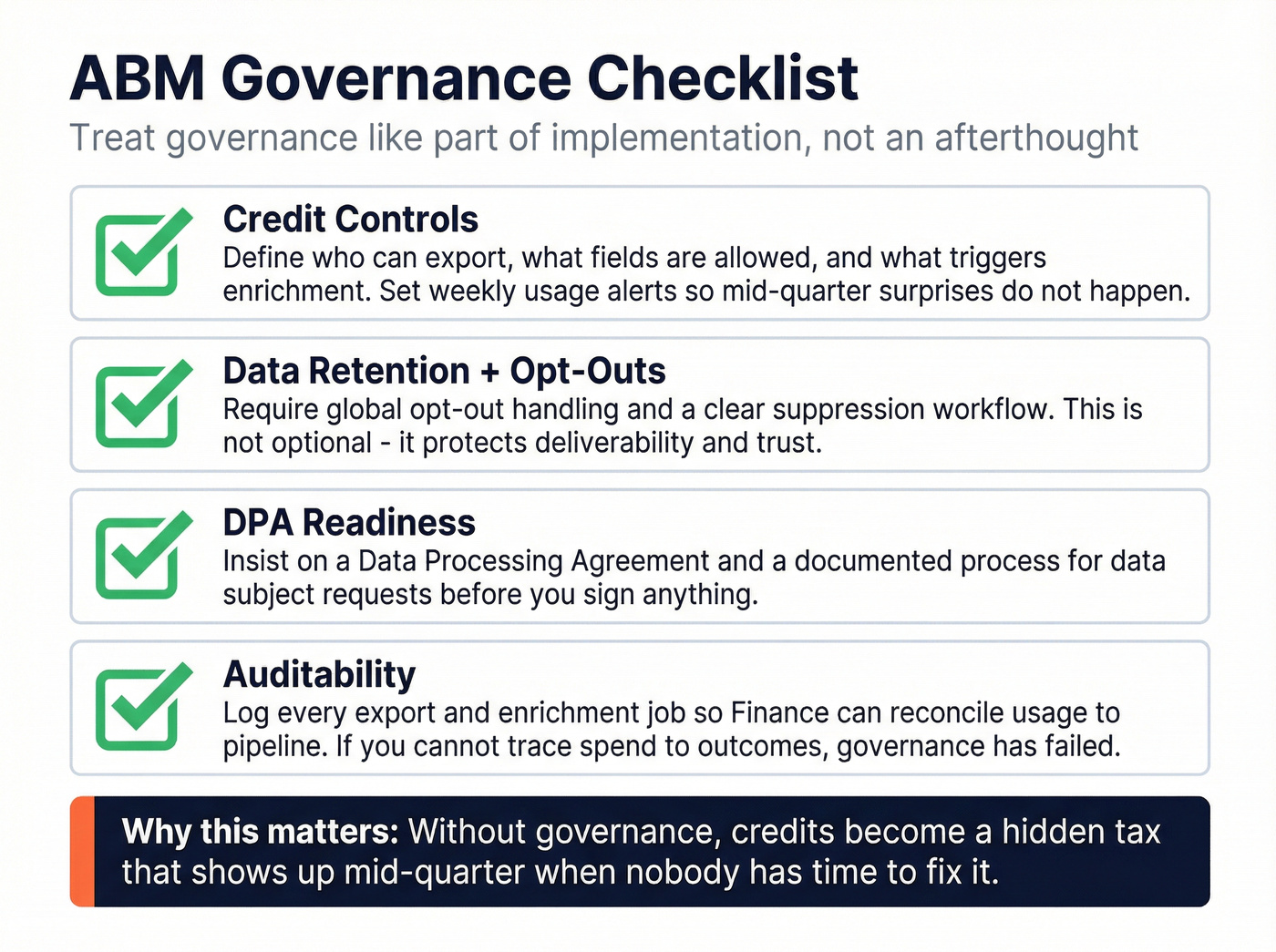

Governance that prevents credit burn + compliance surprises

If you want ABM to stay profitable, treat governance like part of implementation:

- Credit controls: define who can export, what fields are allowed, and what triggers enrichment.

- Data retention + opt-outs: require global opt-out handling and a clear suppression workflow.

- DPA readiness: insist on a DPA and a documented process for data subject requests.

- Auditability: log exports/enrich jobs so Finance can reconcile "usage -> pipeline."

The best demandbase alternatives (Tier 1 list)

Below are the Tier 1 options we'd put in a real evaluation. Each one replaces a meaningful chunk of Demandbase, just in different ways.

1) Prospeo - best for verified emails, direct dials, and fast enrichment

I've seen ABM teams do everything "right" on paper (intent topics, account lists, ads, routing) and still lose because the contact layer was a mess: old titles, dead inboxes, and generic numbers that never pick up. Prospeo fixes that part of the chain quickly, and it does it with numbers that actually hold up in production.

Prospeo includes 300M+ professional profiles, 143M+ verified emails, and 125M+ verified mobiles. Data stays fresh on a 7-day refresh cycle, and email quality is the headline: 98% email accuracy. For ops teams, enrichment is built to run at scale: 92% API match rate, 83% enrichment match rate, and 50+ data points per enrichment, so your CRM doesn't drift into "we'll clean it later" territory.

Real talk: if you're paying for intent and orchestration but your reps are still guessing who to contact, you're lighting money on fire.

Pricing expectation: Free tier; most teams spend ~$39-$500/mo credit-based. Enrichment details: https://prospeo.io/b2b-data-enrichment

2) 6sense - best suite-style orchestration (closest to a Demandbase replacement)

If you want a single system to run account stages, routing, and orchestration at scale, 6sense is the closest peer to Demandbase. It's built for teams that can commit to governance: stage definitions, handoffs, and consistent play execution.

How packaging works in practice: it's sold as bundles (for example, Sales Intelligence + Data Credits, or Sales Intelligence + Predictive AI). That bundle choice matters because it determines whether "data access" is a built-in utility or a metered constraint that turns every export into a mini budget meeting.

Pricing expectation: ~$100k-$250k+/yr is a realistic band for serious deployments, driven by seats, predictive modules, and credit usage.

Skip this if you don't have an owner for the stage model and routing rules.

3) ZoomInfo Marketing - best packaged intent + activation bundles

ZoomInfo Marketing wins when you want packaged plans and a big activation engine without a bespoke "platform fee mystery box." The packaging is unusually concrete (credits + intent topics + activation), which makes procurement and forecasting easier than most ABM suites.

The tradeoff is governance. If exports and enrichment aren't controlled, credit consumption becomes the hidden tax that shows up mid-quarter, right when nobody has time to re-architect the program.

Pricing expectation: ~$20k-$80k/yr, driven by credits, intent topics, and activation scope (ads/audiences). Best for: teams that want a suite-like experience but prefer packaged plans over custom proposals.

4) Terminus - best ads-first ABM platform (expect a sales-led buying process)

Terminus is the pick when your ABM motion is fundamentally advertising + account engagement, and you want a platform built around that reality. It covers a lot of the same activation surface area as Demandbase, but the buying experience is more opaque.

TrustRadius notes Terminus has no public pricing and no free trial, so assume negotiation time and scoping calls.

Pricing expectation: ~$25k-$200k/yr depending on package size, seats, and modules; media spend is separate and services can add cost. Watch-outs: if you don't have someone who owns ads + measurement, it turns into an expensive dashboard.

5) RollWorks (AdRoll ABM) - best mid-market ABM ads when you want speed

RollWorks is a solid mid-market choice when you want to get live quickly and keep the stack lighter than Demandbase. It's ads-first, straightforward to operate, and fits teams that care more about activation than orchestration theory.

One detailed G2 review calls out reporting constraints like a 90-day lookback, manual reporting overhead, and pacing that needs attention. If your sales cycle's longer than 90 days, prioritize platforms with journey visibility that matches your reality, or you'll end up rebuilding reporting in spreadsheets anyway.

Pricing expectation: ~$12k-$50k/yr plus separate media spend, driven by account volume and ad activation.

Tier 2 and Tier 3 options (good, but not full-suite replacements)

These are strong tools, but they don't replace Demandbase end-to-end. That's fine. Most teams shouldn't try to replace it end-to-end.

Bombora - best intent-only layer (pair with your activation)

Bombora is the intent specialist: big co-op scale, deep topic taxonomy, and clean "plug-in" intent signals for your stack. It's the right choice when you already have outbound or ads working and you just need better "who's researching what" inputs.

Pricing expectation: ~$20k-$80k/yr, driven by topic access, integrations, and usage.

Madison Logic (ML Platform) - best for content-led ABM programs

ML Platform fits teams where content syndication and content-driven engagement are the engine, not an add-on. It's strongest when you already have a content machine and want account-based distribution and measurement around it.

Pricing expectation: ~$30k-$120k/yr, driven by program scope, features, and number of accounts managed.

Momentum - best for signal-driven RevOps workflows

Momentum is for teams that treat ABM like operations: signals in, actions out, clean routing, and automation across tools. It works best when your team already lives in a consistent prospecting workflow and can operationalize signals daily.

Pricing expectation: ~$15k-$75k/yr, driven by seats, connected data sources, and analytics depth.

Foundry ABM - best managed/programmatic ABM option

Foundry ABM is worth a look if you want more managed execution and you're comfortable with a narrower footprint than the big suites. It's less "build your own orchestration" and more "run a program with a partner."

Pricing expectation: ~$25k-$150k/yr, driven by managed scope, audience size, and program services.

HubSpot Marketing Hub - ABM-lite inside your CRM (not a Demandbase replacement)

HubSpot's excellent for lifecycle, lists, and reporting, and it's the fastest path to ABM-lite if your team already lives there.

Pricing expectation: ~$1k-$5k/mo, priced by tier and marketing contacts; add intent/ads separately.

Clearbit / Breeze Intelligence - enrichment add-on (not a Demandbase replacement)

Clearbit/Breeze is useful for enrichment and identification to improve routing and forms, but it won't replace ABM orchestration.

Pricing expectation: ~$12k-$60k/yr, usually priced by usage/volume and plan tier.

Common stack recipes (lean pairings that don't recreate suite bloat)

The easiest way to waste money after leaving Demandbase is rebuilding it with three vendors and twice the integration work. These pairings stay lean:

- Suite replacement path: 6sense + Bombora (if you want independent intent depth)

- Ads-first path: Terminus + Bombora

- Mid-market ads path: RollWorks + Bombora

- Content-led path: Madison Logic (ML Platform) + a CRM-native lifecycle tool (HubSpot/Marketo)

- RevOps automation path: Momentum + your existing data/intent sources

One scenario we see a lot: a mid-market team tries to copy an enterprise ABM playbook, buys orchestration, buys ads, buys intent, then realizes nobody owns the weekly operating rhythm, so the tools become shelfware while the SDR manager goes back to spreadsheets to hit this month's number.

My recommendation for most mid-market teams: start ads-first or intent-first, prove meetings and pipeline, then decide if you need orchestration.

Implementation + measurement realism (get value in 30 days)

Demandbase's ~2 months implementation time is normal for a suite. Your goal's simpler: ship one working ABM motion in 30 days.

What users complain about (and why it matters)

- Demandbase: G2 sentiment repeatedly flags complexity/learning curve, which slows time-to-value.

- Terminus: TrustRadius highlights pricing opacity (no public pricing / no free trial), which slows buying and scoping.

- RollWorks: a detailed G2 review calls out reporting limits (90-day lookback) and manual reporting, which can clash with long sales cycles.

30-day plan (boring on purpose, effective in practice)

- Days 1-3: Lock ICP + 100-500 accounts. Small enough to execute, big enough to learn.

- Days 4-7: Choose 10-25 intent topics with a defined rep action. If there's no action, it's noise.

- Days 8-14: Build two plays and wire routing. One inbound-ish (retargeting + SDR follow-up), one outbound-ish (surge + job change/headcount growth).

- Days 15-21: Launch, then hold the line on scope. Two plays beat ten half-built ones.

- Days 22-30: Measure like an adult. Track meetings created, opps opened, and pipeline touched. Influence reporting's directional; don't pretend it's causal attribution.

Most teams churning off Demandbase don't need another suite - they need the contact layer that actually converts. Prospeo delivers 300M+ profiles, 15,000 Bombora intent topics, and 92% API match rates at ~$0.01/email. No contracts, no six-month implementation.

Go from in-market account to verified buying committee in minutes, not months.

FAQ

Why do teams switch from Demandbase most often?

Teams switch because cost and complexity compound. Many contracts land in the $30k-$100k+/year range (ZenABM cites a Vendr median around ~$65k/year), implementation takes about 2 months on G2, and adoption lags when the suite feels heavier than the day-to-day workflow. That combo delays ROI.

What's the closest 1:1 alternative to Demandbase - 6sense or Terminus?

For most teams, 6sense is the closest suite-style replacement for orchestration, account stages, and predictive workflows, while Terminus is the closest match when your ABM motion is primarily ads-first activation. If you want "one platform to run plays," lean 6sense; if you want "ads + engagement hub," lean Terminus.

What's a good Demandbase alternative for a $30k-$45k budget?

For a $30k-$45k annual budget, a modular setup usually wins: run RollWorks for ads-first ABM or N.Rich for a structured platform, then add Bombora only if you truly need deeper intent signals. Aim for 1-2 plays that create meetings, not a "perfect" orchestration model.

What's a good free option to start building ABM lists and outreach?

Summary: choosing between demandbase alternatives without recreating suite bloat

The best demandbase alternatives aren't "the closest suite." They're the tools that replace the specific link in your chain that's breaking: identity, intent, activation, contacts, or measurement.

If you're mid-market, start with a lean motion you can run weekly, then expand only after you've earned the complexity (and the contract).