Propensity vs ZoomInfo (2026): ABM Activation vs GTM Intelligence

Every growth team hits the same wall: demand gen wants ABM live next week, sales wants direct dials yesterday, and RevOps wants the CRM to stop filling up with junk. That's why "propensity vs zoominfo" gets messy fast.

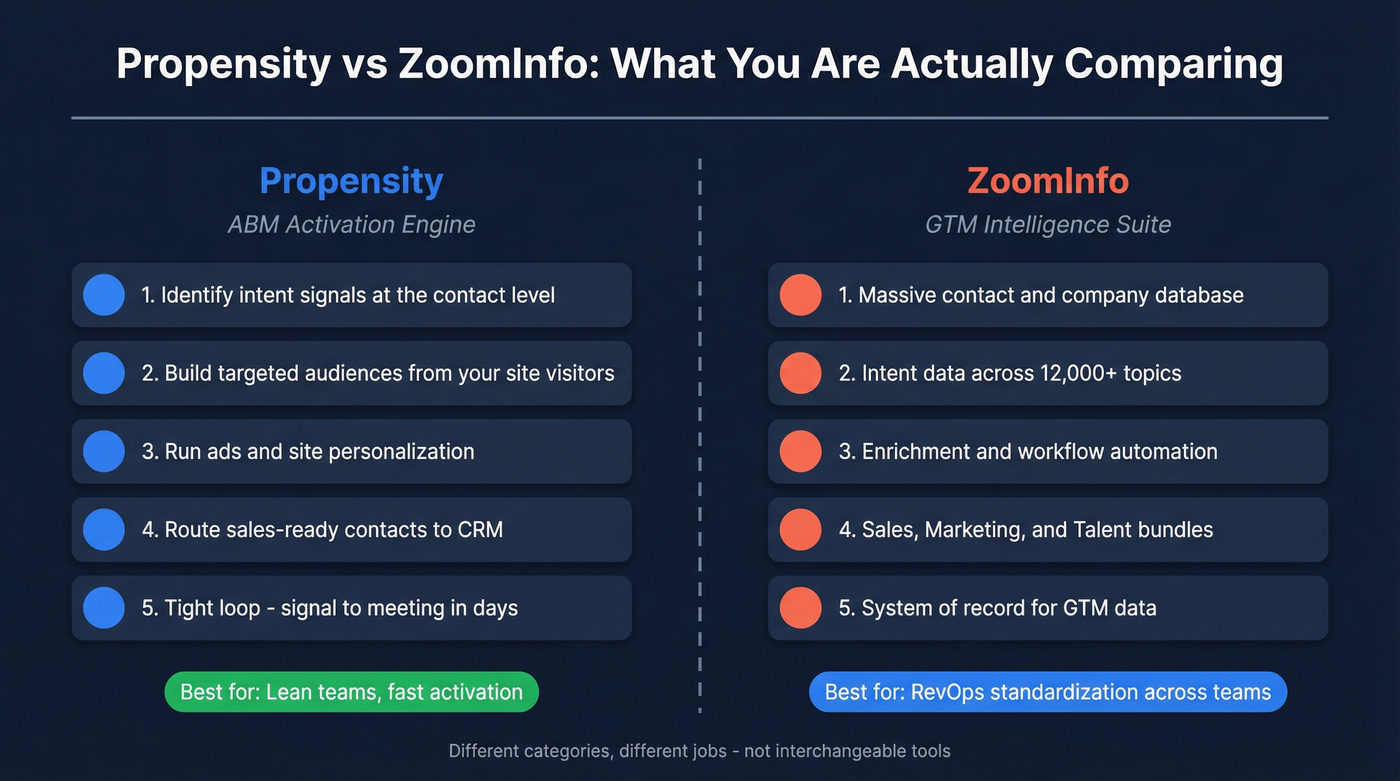

You're not comparing two versions of the same thing. You're comparing an ABM activation engine (Propensity) to a GTM intelligence suite (ZoomInfo) that's packaged into Sales/Marketing/Talent bundles. That packaging mismatch is the whole decision.

Look, here's the thing: most teams don't have a tooling problem. They've got an execution problem.

In our experience, if your average deal size is modest and your team is under ~20 sellers, you probably don't need ZoomInfo MarketingOS. You need a tight ICP, clean routing rules, and a loop that turns signals into meetings without turning the next quarter into a platform rollout.

30-second verdict (and when to skip both)

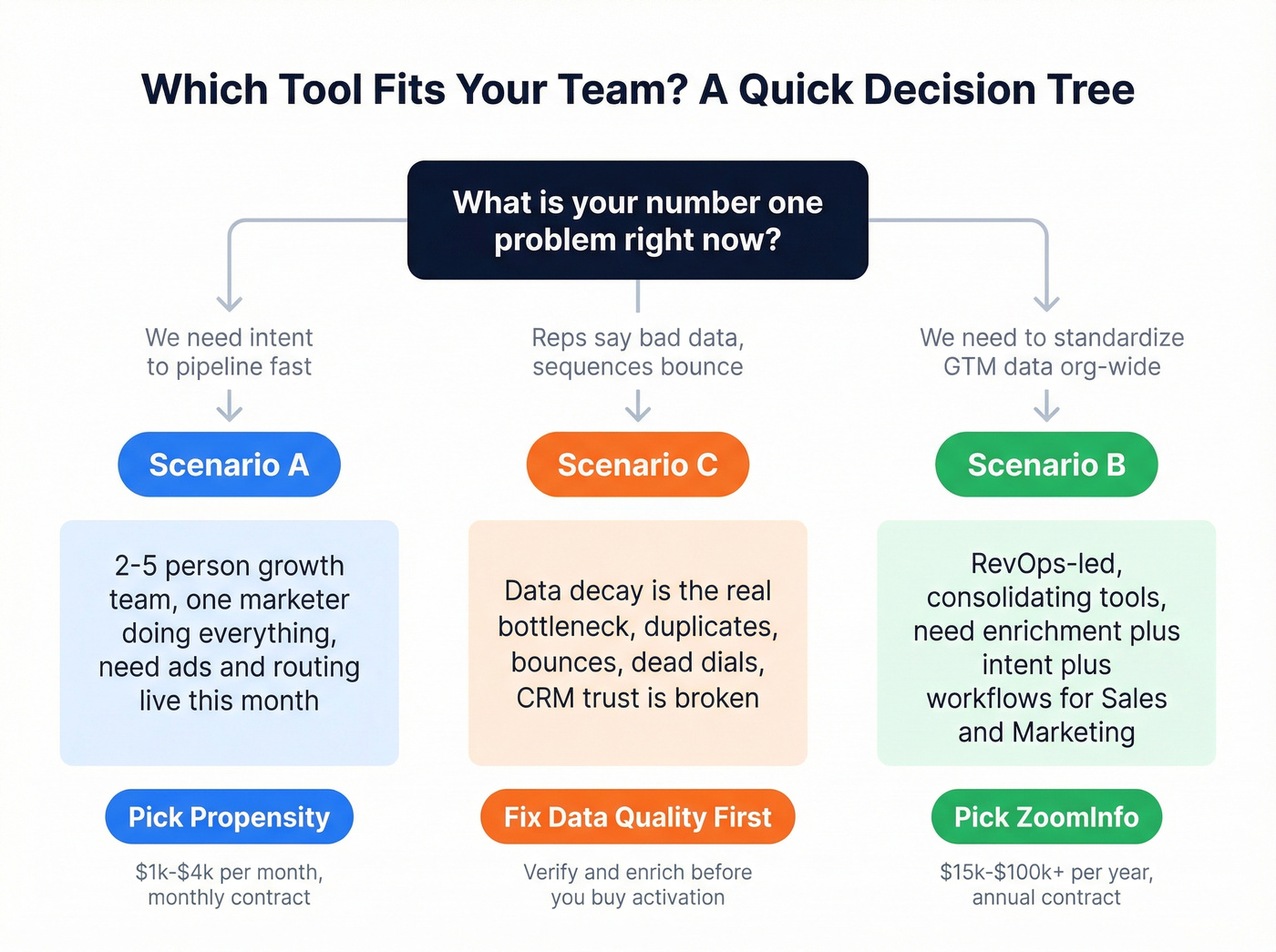

Pick Propensity if you want contact-level ABM activation: identify buyers (including from your site traffic), build audiences, run ads, and route high-intent contacts to sales without a long implementation. Propensity's pricing is public and simple: $1k / $2k / $4k per month, so you can start small and scale once the motion works.

Pick ZoomInfo if you want one vendor for data + intent + enrichment + workflows across Sales and Marketing, and you're willing to buy into enterprise packaging. ZoomInfo positions itself as trusted by 35,000+ companies, which is exactly why standardization-minded buyers gravitate to it. Expect $14,995/year as an entry point for Sales, then $25-30k, $40k+, and $60-100k+ as you add seats and modules.

Skip both (for now) if your real bottleneck is deliverability and CRM trust: bounces, dead dials, duplicates, and reps ignoring the system. Fix the data supply chain first, then choose your activation platform. A fast way to do that is Prospeo ("The B2B data platform built for accuracy"): verify and enrich contacts before you commit to an annual suite.

What you're actually comparing (category + job-to-be-done)

Propensity is best understood as ABM activation: identify who's showing intent (including on your site), build audiences, run omnichannel campaigns, and push sales-ready contacts into your CRM with context.

ZoomInfo is best understood as a GTM intelligence suite that can power ABM, but it's packaged by department and workflow. On ZoomInfo's pricing page, you'll see three solution areas:

- Sales: ZoomInfo Professional, Copilot Advanced, Copilot Enterprise

- Marketing: Marketing Demand, ABM Lite, ABM Enterprise

- Talent: recruiting workflows

We've tested this decision with enough teams to know the pattern: the "best" tool is the one you can actually operationalize with the people you have, not the one with the longest feature list.

Here's the decision tree I use:

- If your #1 goal is "turn intent into ads + site personalization + routed leads this month," choose Propensity.

- If your #1 goal is "standardize data + intent + enrichment across RevOps for the next 12-24 months," choose ZoomInfo.

- If your #1 goal is "stop bounces and bad numbers from poisoning outbound," fix data quality first, then pick your activation layer.

Three real-world team scenarios (so you can self-identify fast)

Scenario A: 2-5 person growth team, one marketer doing everything You don't have time for a multi-month rollout or a governance committee. You need: audience creation, site identification, ads, and a clean handoff to sales. Propensity wins because it's built for speed and a tight loop: signal -> audience -> activation -> routed lead.

Scenario B: RevOps-led standardization across Sales + Marketing You're consolidating tools, building consistent fields, and you want one vendor to cover enrichment, intent, and workflows. ZoomInfo wins because it's designed to be a system of record for go-to-market data, not just a campaign launcher. You'll pay for that breadth, but you'll also get real value if you actually run governance (fields, suppression, dedupe, routing) like it's part of the product.

Scenario C: Sales is loud, but the real problem is data decay Reps complain about "bad data," sequences bounce, and pipeline attribution is a mess because records are duplicated or stale. In this scenario, neither Propensity nor ZoomInfo fixes the root cause by itself. You need a verification/enrichment layer and strict suppression rules first, otherwise you'll just scale the mess and call it "ABM."

Propensity vs ZoomInfo: side-by-side comparison (features + workflow outcomes)

<ComparisonTable columns={["Category", "Propensity", "ZoomInfo"]} rows={[ ["Primary job", "ABM activation", "GTM intelligence suite"], ["Best for", "Lean ABM teams", "Suite standardization"], ["Data coverage", "Activation-focused", "Massive database"], ["Intent", "Contact-level activation", "Large-scale intent"], ["Visitor ID", "Site de-anon + routing", "Site Visitor Identification"], ["Activation", "Ads + site + routing", "DSP + orchestration"], ["Enrichment", "CRM sync", "Enrich + workflows"], ["AI", "Audience building", "Copilot tiers"], ["Integrations", "Salesforce, HubSpot", "Salesforce, HubSpot, Marketo"], ["Time-to-value", "Hours to days", "Weeks to months"], ["Pricing", "$1k/$2k/$4k mo", "Quote (annual is common)"], ["Contract", "Monthly", "Annual (common)"], ["Compliance", "GDPR-compliant, consent-driven", "GDPR/CCPA + SOC 2 Type II (per vendor materials)"] ]} />

Notes that matter:

- ZoomInfo's coverage, signal volumes, and accuracy figures are vendor-stated. Treat them as directional, then validate with a pilot.

- Propensity's "contact-level website understanding" shows up clearly in user feedback; validate match rate and persona relevance against your ICP in week one.

- The table hides the real killers: credits, match rate, and governance.

What this table hides (credits, match rate, governance)

Credits change behavior. If exports/enrichment burn credits, reps hoard, ops gates access, and adoption drops.

Match rate beats database size. A "500M contacts" database doesn't help if your ICP match rate is weak or the personas are off.

Governance is the tax you pay either way.

Propensity and ZoomInfo both assume your CRM data is clean. It probably isn't. Prospeo's 5-step verification and 7-day refresh cycle eliminate the bounces, dead dials, and duplicates that sabotage ABM activation - at 90% less than ZoomInfo's cost.

Stop scaling bad data. Verify and enrich before you activate.

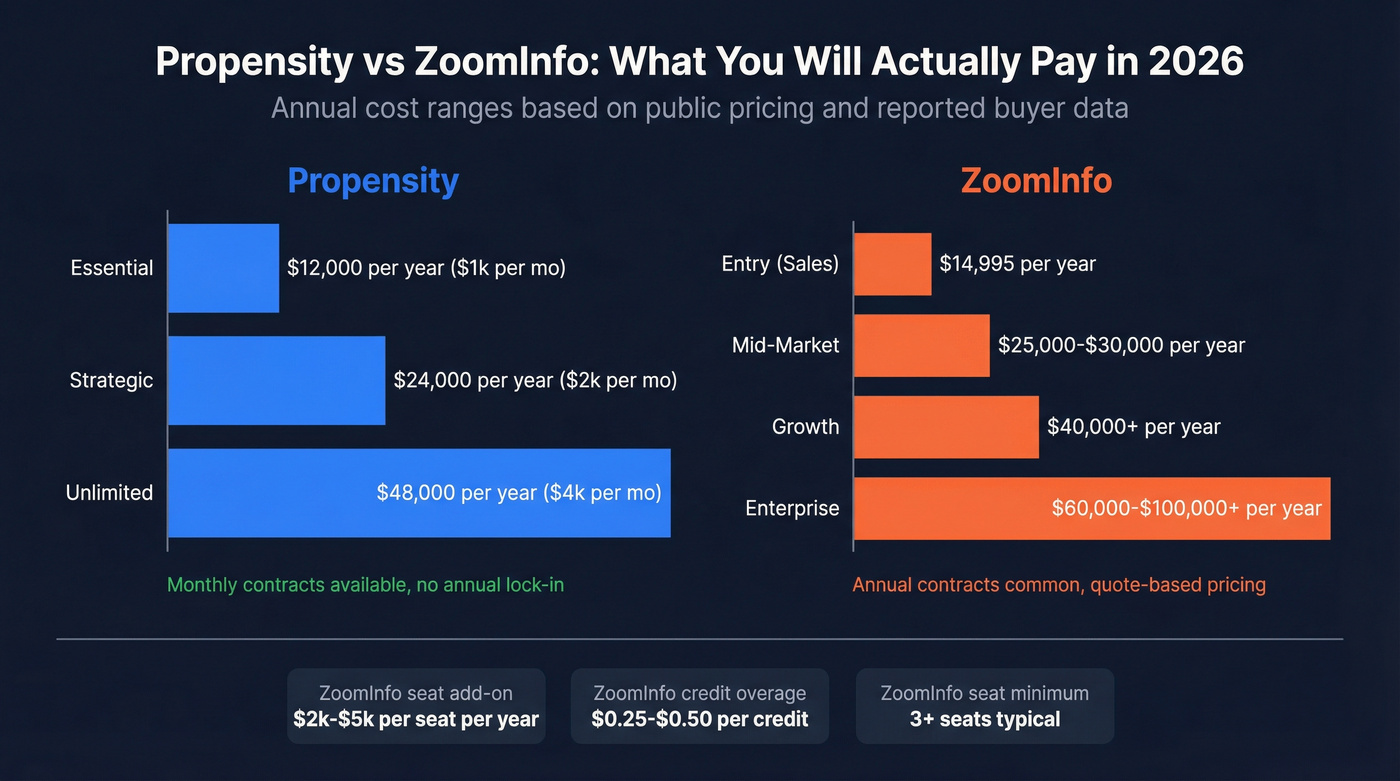

Pricing & TCO in 2026 (what you'll really pay)

Propensity is refreshingly straightforward: Essential $1,000/mo, Strategic $2,000/mo, Unlimited $4,000/mo. Budget it like a growth tool. Prove the motion. Scale it.

ZoomInfo's the opposite experience. The packaging is public, the dollars aren't. You'll start on the pricing page, click "Start free trial," and then you'll get funneled into a quote. That trial is a product-led entry point into an annual agreement, not a month-to-month plan.

If you're sanity-checking costs across vendors, see our breakdown of ZoomInfo pricing.

ZoomInfo Sales: realistic pricing bands

Expect these ranges in 2026:

- $14,995/year: entry point (commonly packaged as a small seat bundle)

- $25-30k/year: common mid-market configuration

- $40k+/year: larger teams, more credits/modules

- $60-100k+/year: enterprise rollouts (seats + intent + add-ons)

What a typical ZoomInfo quote contains (the mechanics buyers miss)

Most quotes boil down to four levers:

- Seat minimums: expect 3+ seats as a common floor

- Credits: packages often start around 5,000 annual credits

- Overages: plan for $0.25-$0.50 per credit when you exceed the bundle

- Extra seats: budget $2k-$5k per seat/year depending on tier and bundle

If you don't govern credits and exports, you don't have a data platform. You've got a surprise invoice.

ZoomInfo MarketingOS reality (pricing opacity + "program" buying)

ZoomInfo Marketing/MarketingOS is where budgets go to die if you walk in without a plan. TrustRadius shows no listed plans and no free version/trial for ZoomInfo Marketing, and one verified user cites ~$30k/year (discounted) as a reference point. That's not "bad." It's a signal that MarketingOS is sold as a program, not a casual add-on you tack onto a sales data contract.

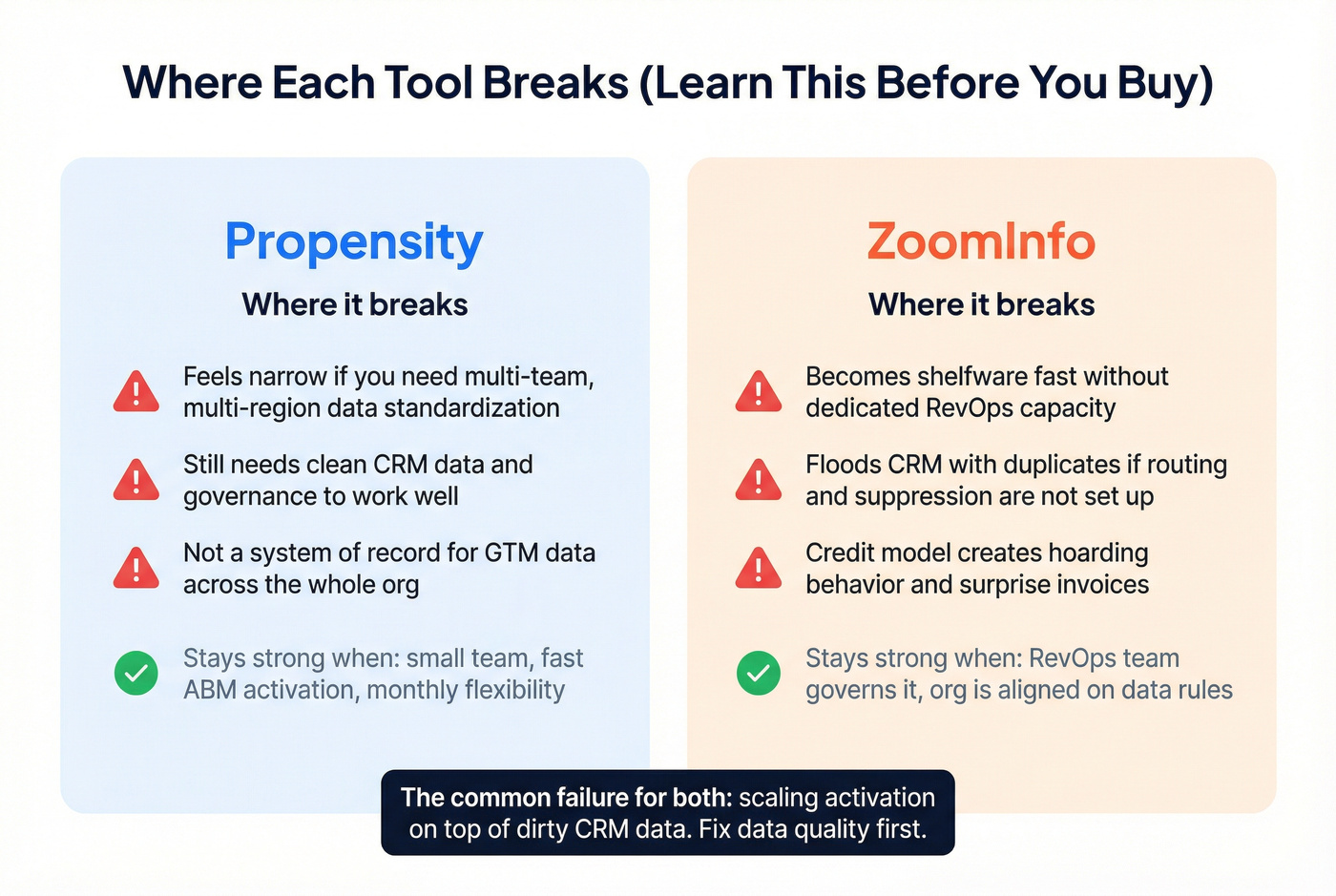

Where each tool breaks (so you don't learn the hard way)

Where Propensity breaks: If you need a single vendor to standardize data across multiple teams and regions, Propensity can feel narrow. You'll still need strong data quality governance and a clean CRM to get the best results.

Where ZoomInfo breaks: If you don't have RevOps capacity, ZoomInfo becomes shelfware fast. And if sales and marketing aren't aligned on routing and suppression, you'll flood the CRM with duplicates and burn trust, which is the fastest way I've seen a "premium data tool" turn into a line item everyone resents.

Procurement gotchas (clip-and-send to your buyer)

Confirm before signature

- Contract term (annual vs monthly)

- Seat minimums and seat expansion pricing

- Credit bundle size + overage unit cost

- What's included vs add-on (intent, visitor ID, Copilot, Marketing modules)

- Auto-renew language + renewal notice window (often ~60 days)

That renewal window is where teams get trapped. Put it on the calendar the day you sign.

Data, intent signals, and "contact-level ABM" (what it really means)

ZoomInfo's intent story is big: 12,000+ topics, a 5,000-site co-op, and 1B buying signals/month (vendor-stated). ZoomInfo also markets "verified direct dials and email addresses with 95%+ accuracy" (vendor-stated). The promise is simple: identify demand, find the people, activate them.

Propensity's pitch is different: less "biggest database," more "identify real buyers and activate them." It's built around contact-level intent + contact-based advertising + visitor de-anonymization, then syncing high-intent contacts into your CRM with context.

If you want a practical breakdown of what to do with these signals, start with intent signals.

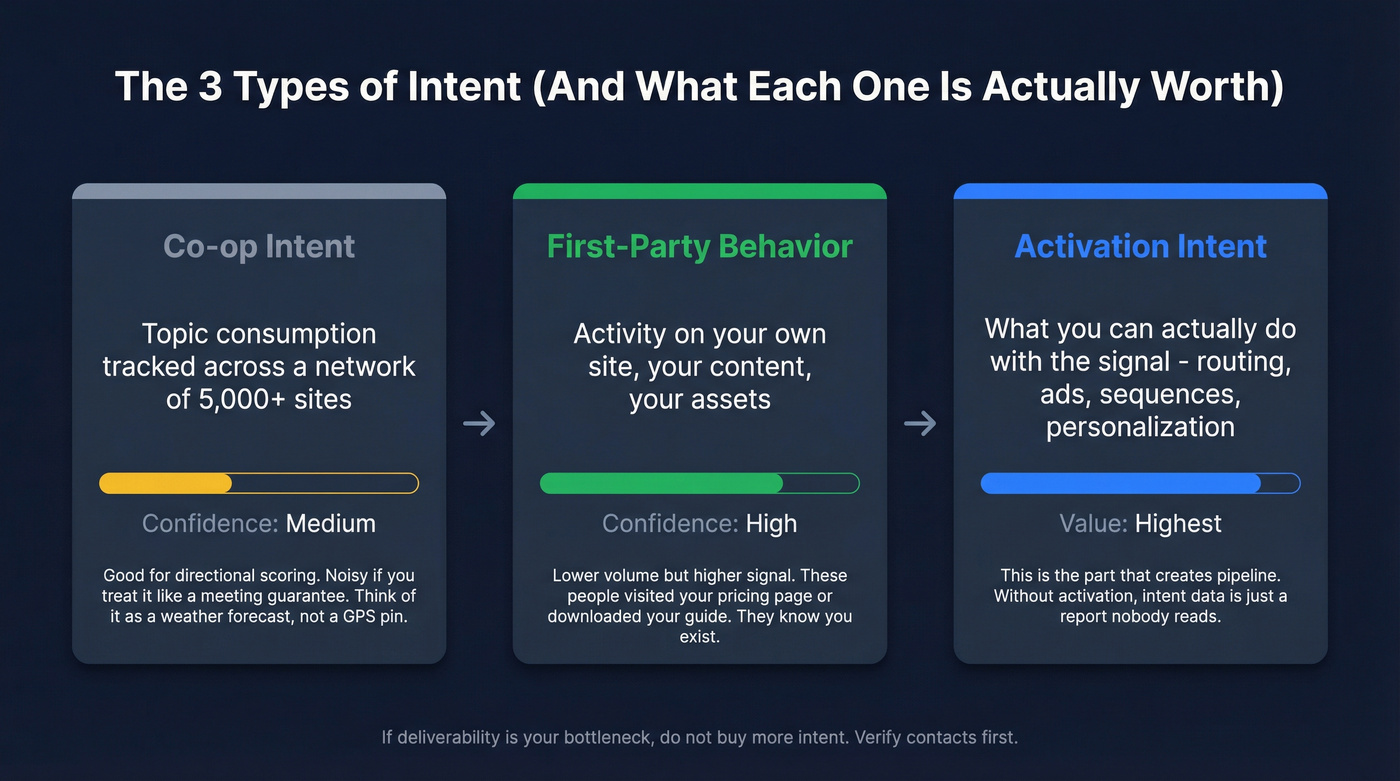

Three types of intent you must separate

- Co-op intent (topic consumption across a network): great for directional "in-market" scoring; noisy if you treat it like a meeting guarantee.

- First-party behavior (your site + your assets): higher confidence, lower volume.

- Activation intent (what you can do with it): routing, ads, sequencing, personalization. This is the part that creates pipeline.

If deliverability's your bottleneck, don't buy more intent. Verify contacts before you enroll intent-flagged leads into sequences so your activation loop doesn't die on bounce rates, spam complaints, and reps quietly turning the tool off.

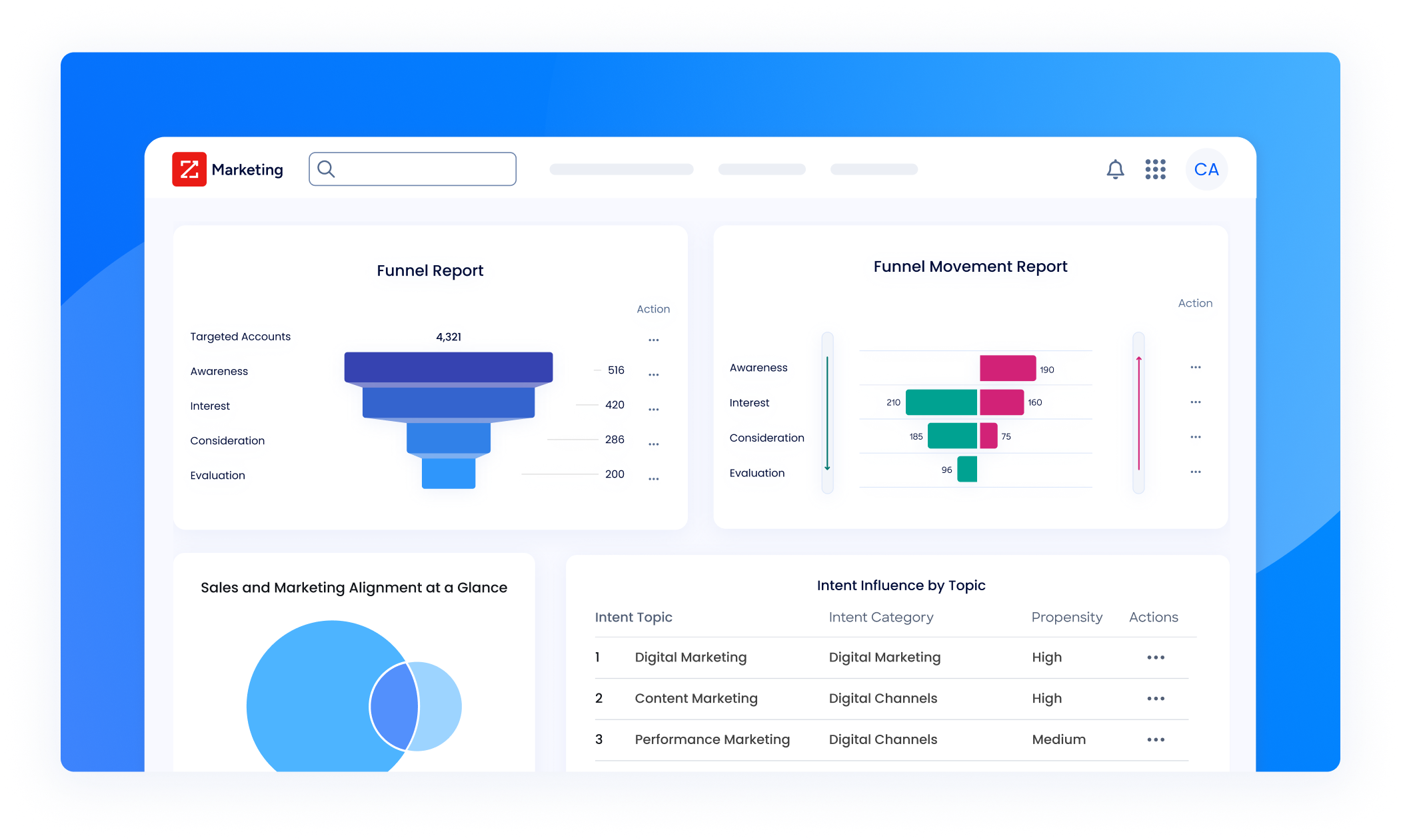

What to validate in week 1 (so you don't get fooled by dashboards)

- Latency: how fast a signal appears after behavior

- Match rate: % of target accounts producing usable contacts

- Role relevance: right personas vs random employees

- Routing quality: correct owner + correct sequence

- Meeting attribution: signals -> touches -> meetings without spreadsheet gymnastics

Here's a real scenario I've watched play out: a team lights up a shiny intent dashboard, exports a few thousand "in-market" contacts, and blasts them into sequences. Two weeks later deliverability tanks, reps complain the numbers are wrong, and marketing swears "intent doesn't work." Intent wasn't the problem. Bad contact data was.

Copilot: useful, noisy, not mandatory

ZoomInfo Copilot can be genuinely helpful, especially for reps who need guidance on who to call, what to say, and what changed in an account. But don't buy Copilot because it sounds like the future. Buy it because you've got the operational maturity to use it.

Here's what you'll feel in the first month:

- Setup time's real. Copilot value shows up after you've cleaned fields, defined ICP, and aligned routing. If your CRM's messy, Copilot amplifies mess.

- False positives are the tax. AI-driven recommendations create noise unless you tune filters and feedback loops. Reps ignore it if it cries wolf.

- Cost stacks fast. Copilot sits in higher tiers, and it often rides along with the same seat/credit economics that already drive TCO.

My recommendation: pilot Copilot with a small rep pod (3-5 users), measure meetings created per rep, and only then expand. If you can't prove lift, skip it and spend the budget on data hygiene + activation.

What users complain about (and how it hits pipeline)

ZoomInfo has massive review volume, which is both good (signal) and brutal (every flaw is documented). On G2 for ZoomInfo Sales, the negative tags that jump out include Outdated Data (219), Inaccurate Data (219), and Outdated Contacts (198). That's not a dunk. It's what happens when you operate at scale.

A common ZoomInfo-style complaint sounds like:

"Great coverage, but you still have to verify - too many contacts are outdated."

Pipeline impact is predictable:

- Reps stop trusting the tool and go rogue.

- Bounce rates climb, hurting deliverability.

- Dialing time increases because numbers route to dead lines or the wrong desk.

- Ops spends cycles cleaning instead of building.

Propensity's review base is much smaller, and that matters for interpretation. On G2 comparisons, Propensity sits at 29 reviews (skewed Small Business: 62.1% of reviews) while ZoomInfo Sales is at 8,997 reviews (skewed Mid-Market: 48.2%), so complaint volume isn't apples-to-apples.

A common Propensity-style positive sounds like:

"Easy to use and the support team helps you get live quickly."

If you're choosing based on user sentiment, here's the practical takeaway: ZoomInfo wins on breadth; Propensity wins on speed and usability. Decide which one you'll actually run.

If you're trying to quantify whether the data is “good enough,” this deep dive on ZoomInfo accuracy helps set expectations.

Implementation, integrations, and time-to-value

If you're choosing based on "how fast can we see meetings," implementation beats feature checklists.

G2's benchmarks are a solid gut check: ZoomInfo SalesOS is ~4.5/5 (8,997 reviews) with ~1 month implementation, and ZoomInfo Marketing is ~4.4/5 (181 reviews) with ~2 months implementation. That matches reality: Sales can get value quickly; Marketing drags because you're stitching together audiences, channels, forms, routing, and attribution.

Propensity gets you to "live campaigns" faster because it's built for launch velocity. You'll still do real work (pixels, CRM sync, scoring, routing), but you're not signing up for a multi-quarter platform program.

Integration table-stakes (don't accept less)

- CRM: Salesforce (SFDC) / HubSpot

- MAP: Marketo (and equivalents)

- Sequencing: Salesloft / Outreach

- Ads: social + programmatic (DSP) connections

- Governance: field mapping, dedupe rules, suppression lists

A simple workflow that actually works:

- Mon: define ICP + target accounts, set routing + suppression

- Tue: launch audiences + site tracking, validate visitor identification quality

- Wed: push high-intent contacts to CRM, enroll in sequences

- Thu: review meetings + false positives, tighten scoring/persona filters

Compliance & procurement checklist (GDPR/CCPA/SOC2/DPA + opt-out)

Procurement asks the same questions no matter which tool you pick. Have answers ready, and don't let "ABM" language distract from the basics: sourcing, lawful basis, opt-out, retention, and security controls.

If you need a field-ready legal/ops baseline, use this GDPR for Sales and Marketing guide as a reference.

ZoomInfo procurement checklist

- Privacy policy: updated Oct 13, 2026 (effective Oct 20, 2026) on ZoomInfo's legal site

- Sourcing model: web scanning/search technology, licensed third-party data, in-house research (surveys/phone interviews), and customer contributions

- Opt-out: handled via the ZoomInfo Trust Center

- DPA: available via ZoomInfo's published Data Processing Addendum (including standard contractual clauses (SCCs) / UK addendum where applicable)

- Security: ZoomInfo positions SOC 2 Type II compliance in its materials - ask for the current report and scope

Propensity procurement checklist

- DPA + subprocessors: get the list and change-notification terms

- Retention + deletion: how long data's stored and how deletion requests are handled

- Consent model: especially for any contact-level identification and visitor de-anonymization workflows

- "Double-verified" contacts: require a clear definition (method + cadence + what "verified" means operationally)

Treat contact-level identification as higher-scrutiny in legal review. If a vendor can't clearly explain consent model, sourcing, and opt-out mechanics, don't ship it.

Third option (skip-both): Prospeo as the accuracy + freshness layer

If your ABM motion keeps failing at the last inch - bounces, stale records, dead dials - you don't need another dashboard. You need better inputs.

Prospeo is "The B2B data platform built for accuracy." It gives you 300M+ professional profiles, 143M+ verified emails, and 125M+ verified mobiles, with 98% email accuracy and a 7-day refresh cycle (industry average: 6 weeks). It's self-serve, contract-free, and built for the unglamorous work that actually moves pipeline: verifying, enriching, and keeping your CRM clean enough that reps trust it.

Use it like a bake-off layer: verify a sample of the contacts you're about to activate (from any source), suppress the invalid ones, enrich the rest with 50+ data points, then push clean records into your CRM so your sequences and ABM routing don't get kneecapped by bounce rates.

If you want to compare verification options before you commit, see our ranked list of email verifier websites.

If you're in Scenario C - reps complaining about bad data, sequences bouncing, pipeline attribution broken - neither ABM platform fixes that. Prospeo does: 98% email accuracy, 125M+ verified mobiles, and CRM enrichment returning 50+ data points per contact.

Fix the data supply chain for $0.01 per email. No annual lock-in.

FAQ

Can I trial Propensity or ZoomInfo before signing?

Propensity offers a free trial (and a free intent data sample of your top 100 in-market accounts), while ZoomInfo's "Start free trial" for Sales typically leads into an annual agreement once you move past evaluation. If you want month-to-month flexibility, Propensity's $1k/$2k/$4k tiers are the simpler path.

What should we test in the first 2 weeks to prove ROI (intent -> meetings)?

Test signal latency, ICP match rate, persona relevance, routing accuracy, and meeting attribution using a controlled set of 50-100 target accounts and one sequence per persona. If you can't show a measurable lift in booked meetings by week 2, your scoring, personas, or data quality needs fixing before you scale spend.

Is ZoomInfo Marketing the same thing as an ABM platform?

Yes. ZoomInfo Marketing is an enterprise ABM platform with buyer intent, site visitor identification, audience building, and cross-channel activation (including DSP). The tradeoff is rollout time and budget: plan for roughly 6-8 weeks of implementation work and a program-level spend (often cited around ~$30k/year).

What's a good "data quality first" option before we buy an annual suite?

Prospeo's a strong first move because it verifies and enriches contacts with 98% email accuracy and a 7-day refresh cycle, and it's self-serve with no contracts. Start by verifying a few thousand records, suppress invalid contacts, then measure bounce rate and connect rate improvements before committing to a bigger platform.

Decision recap (what I'd do in your seat)

If you came here for a clean "propensity vs zoominfo" answer: pick Propensity when you need ABM activation fast and you'll actually run campaigns weekly. Pick ZoomInfo when you're standardizing GTM data across teams and you've got RevOps capacity to govern seats, credits, and workflows.

And if your CRM's already untrusted, fix data quality first. Otherwise you'll just activate bad records at scale and call it "ABM."