Sales Prospecting vs Business Development: What's the Difference in 2026?

You're told to "do BD," but you're measured on meetings booked this week. So you do what any sane person does: you run outbound, chase replies, and hope nobody asks why your "BD" work looks exactly like SDR work. That's the core sales prospecting vs business development mess - two different jobs, one overloaded label.

That confusion isn't harmless. It breaks comp plans, creates messy handoffs, and turns strategy into random acts of outreach.

Titles are messy; functions matter. In SaaS, "BDR" often means outbound prospecting. In partnerships, "BD" means channels, alliances, and distribution. If you don't separate those two, you'll keep paying people for the wrong outcomes.

Here's my POV in one line: prospecting is a production system. BD is a growth vector. And yes, both can create meetings. Only one compounds.

What you need (quick version)

Use this as your decision checklist when someone says "go do BD" and you need to translate it into an actual plan.

Pick prospecting when:

- You need pipeline this quarter.

- You've got a defined ICP and a clear offer.

- Your bottleneck's top-of-funnel volume or speed-to-lead.

- Your primary output's meetings (or qualified opportunities).

- You can do the math: if you need 20 shows/month, you're building a production line - not "trying outbound."

Pick business development when:

- You need pipeline next quarter and beyond.

- You're expanding into a new segment, region, or channel.

- Your bottleneck's distribution, credibility, or access.

- Your primary output's partner motions (referrals, co-sell, marketplace listings, agencies).

Non-negotiables either way:

- Clear ownership and handoffs (or you'll double-count "wins" and miss the real leak).

- A KPI scorecard that matches the time horizon.

- Clean data. Before you sequence anything, verify emails to protect deliverability - Prospeo's a fast self-serve way to do that.

Definitions: sales prospecting vs business development (operational, not academic)

Most teams don't need another dictionary definition. They need a definition that tells them what to do on Monday.

Sales prospecting is repeatable work: identify target accounts/people, reach out, qualify, and create a sales conversation. It's measured in weekly throughput: contacts touched -> replies -> meetings -> opportunities. Example: a BDR runs a 4-7 touch sequence to a defined buying group and hands a qualified meeting to an AE with clean notes.

Business development is the work of creating new paths to revenue that didn't exist before: partnerships, channels, new markets, strategic alliances, and ecosystem plays. It's measured in leverage: one relationship or integration that creates many future opportunities. Example: a partnerships manager secures a marketplace listing and co-sell agreement, then enables partners to refer and register deals.

I've seen teams argue for weeks about whether "BD" should own outbound, while the real issue was simpler: nobody agreed on the output. Once we wrote down "meetings held" vs "partner-sourced pipeline" and tied each to a time horizon, the org chart basically fixed itself.

Definition box: Sales prospecting

- Goal: create sales conversations now

- Output: meetings / qualified opps

- Horizon: days to weeks

- Motion: outbound + inbound follow-up

Definition box: Business development

- Goal: create new revenue pathways

- Output: partner motions / new channels / market expansion

- Horizon: weeks to quarters

- Motion: partnerships, alliances, marketplace, co-sell

Prospecting vs BD at a glance (comparison table)

The fastest way to stop the internal arguing is to align on what each function's optimizing for.

| Dimension | Sales prospecting | Business development |

|---|---|---|

| Intent | Create demand | Create leverage |

| Time horizon | 0-90 days | 90-365+ days |

| Primary output | Meetings / opps | Partner motions |

| Typical channels | Email, phone, social | Partners, alliances |

| Success metrics | Reply -> meeting -> SQL | Sourced + influenced |

| Attribution model | Contact-level | Account + ecosystem |

Two practical takeaways:

Prospecting's easier to attribute because it's closer to the meeting. That's why it becomes the default "everything job."

BD looks "soft" until you measure it correctly. Partner-influenced pipeline is a real lever in mid-market and enterprise motions, but only if you define influenced rules up front and keep them consistent.

Sales prospecting vs business development: roles, responsibilities, and handoffs

The biggest operational mistake we see: teams use "BD" as a fancy title for "outbound rep." It feels senior. It sounds strategic. It also destroys clarity.

Stop calling every outbound rep "BD." If the job's measured on weekly meetings, it's prospecting - call it that and pay it that way. If you want a catch-all label for the outbound side, call it what it is: business development prospecting (and separate it from partnerships BD).

A simple taxonomy that works in most SaaS orgs:

- BDR = outbound prospecting (cold)

- SDR = inbound qualification (warm)

- AE = discovery, pipeline progression, close

Then decide whether you also need a BD partnerships role (channels/alliances). That's a different job with different KPIs and a different time horizon.

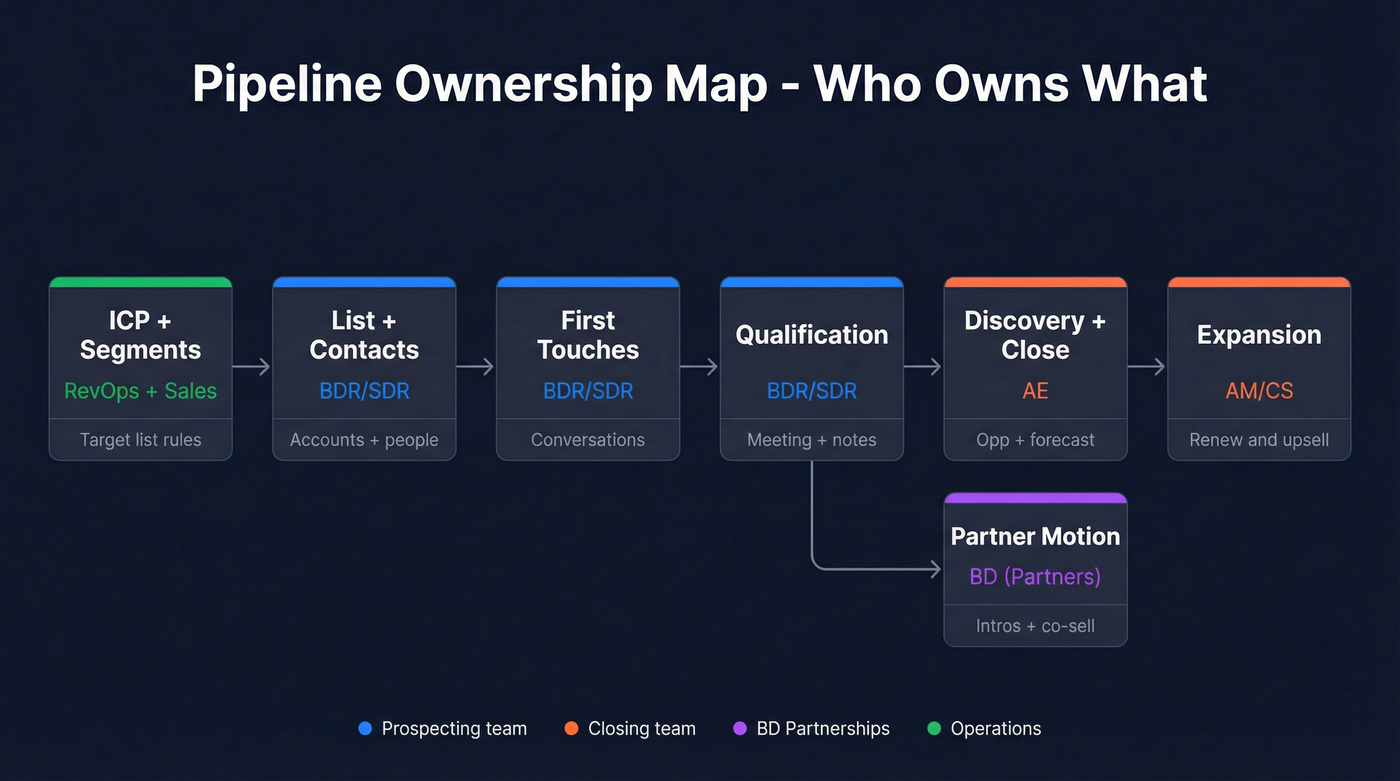

Here's the ownership map I use when I'm cleaning this up with RevOps.

| Stage | Primary owner | Output | SLA / handoff |

|---|---|---|---|

| ICP + segments | RevOps + Sales | Target list rules | Quarterly |

| List + contacts | BDR/SDR | Accounts + people | Weekly |

| First touches | BDR/SDR | Conversations | Daily |

| Qualification | BDR/SDR | Meeting + notes | 24 hrs |

| Discovery + close | AE | Opp + forecast | Weekly |

| Expansion | AM/CS | Renew/upsell | Monthly |

| Partner motion | BD (partners) | Intros + co-sell | Biweekly |

Prospecting (Sales Development) ownership

This is the "production system" side. It's supposed to be boring - in a good way.

- List building: pull accounts that match ICP, then map the buying group (not just one title).

- Research: 2-3 relevant hooks (trigger, tech stack, hiring, initiative).

- First touch: send email #1 or call with a clear reason + clear ask.

- Qualification: confirm pain, authority, timeline, and next step.

- Meeting set: calendar booked with agenda.

- Handoff notes: why they took the meeting, what they care about, who else is involved, what to avoid.

Here's the thing: teams hit activity targets and still miss pipeline because handoffs are sloppy. AEs walk into discovery blind, the prospect resets the conversation, and the "meeting booked" turns into a no-op.

Business Development ownership

This is where you build leverage and distribution.

- Partnerships/channels: agencies, consultancies, tech partners, marketplaces, resellers, affiliates.

- Co-marketing + co-sell: webinars, joint case studies, partner-led events, account mapping.

- Market expansion: new segment, new region, new vertical motion.

- Deal registration: rules for who gets credit and when.

- Partner enablement: messaging, pitch decks, referral paths, training, partner portal hygiene.

Real talk: BD without enablement is just networking.

If partners don't know who to refer, how to position you, and how to get paid or credited, nothing compounds.

The handoff mechanics that prevent pipeline leakage (template)

If you want prospecting to feel predictable, treat the handoff like a product spec - not a Slack message.

Meeting handoff checklist (required fields)

| Field (in CRM or meeting note) | Required? | Why it matters |

|---|---|---|

| Segment + ICP fit reason | Yes | Stops "not our buyer" disco calls |

| Trigger / why now | Yes | Gives AE an opening that isn't generic |

| Persona + role in buying | Yes | Clarifies champion vs evaluator vs signer |

| Pain statement (in their words) | Yes | Keeps discovery anchored |

| Current workflow/tools | Yes | Speeds up qualification and positioning |

| Stakeholders named + missing | Yes | Enables multi-threading early |

| Timeline + next milestone | Yes | Prevents "circle back next quarter" drift |

| Objections raised | Yes | Lets AE preempt landmines |

| Assets sent (links) | Yes | Avoids duplicate follow-ups and confusion |

| Clear next step + date | Yes | Creates momentum and accountability |

SLA: handoff completed within 24 hours of booking. If it's not in the CRM by then, it didn't happen.

AE feedback loop (non-negotiable): AEs tag meetings as Good / Wrong ICP / No-show / Not ready with one sentence of why. That single loop improves targeting faster than any "more personalization" workshop.

AE/AM/RevOps responsibilities

BD and prospecting don't work if the rest of the machine's sloppy.

- AE: run discovery, multi-thread the buying group, progress stages, close cleanly.

- AM/CS: expansion motions, referenceability, partner-friendly customer stories.

- RevOps: governance - fields, SLAs, routing, attribution, and "source of truth."

The governance piece matters more than people admit. If you don't protect original source fields and define influenced rules, your sourced + influenced totals will magically add up to 160%. Then nobody trusts the dashboard, and your partner program turns into a credit fight.

You just defined prospecting as a production system. Every production system breaks without clean inputs. Prospeo gives your BDRs 300M+ profiles with 98% verified emails, 125M+ direct dials, and 30+ filters to nail your ICP - refreshed every 7 days, not 6 weeks.

Stop losing meetings to bad data. Build the pipeline machine.

How to structure prospecting vs BD by company stage

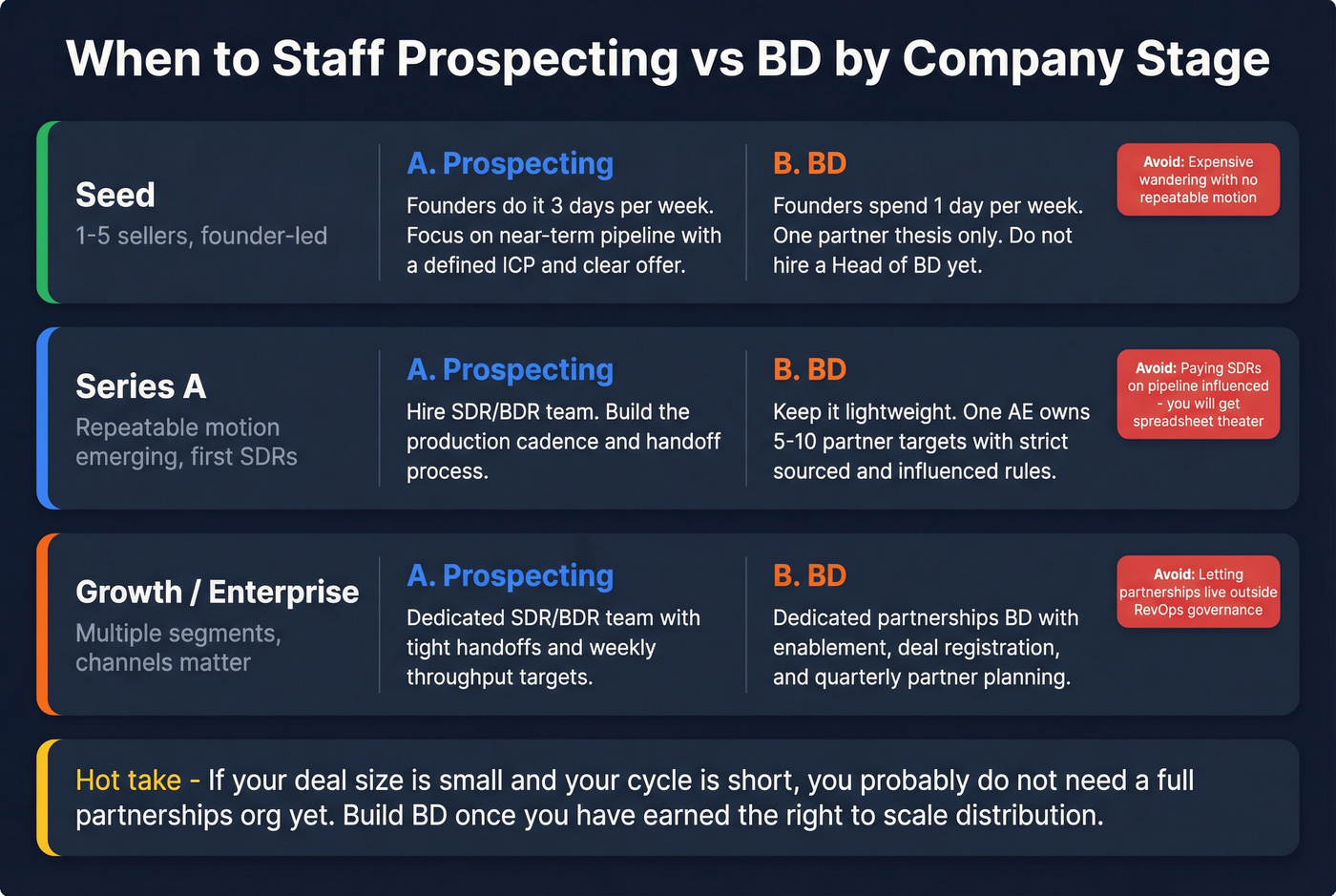

Most "prospecting vs BD" arguments are org-design problems wearing a terminology costume. Here's a clean way to staff it by stage.

Seed (founder-led sales, 1-5 sellers)

- Default: founders do BD and prospecting, but on a schedule.

- What works: 3 days/week prospecting for near-term pipeline; 1 day/week BD for leverage (one partner thesis only).

- What to avoid: hiring a "Head of BD" before you've got a repeatable ICP + offer. That role becomes expensive wandering.

Series A (repeatable motion emerging, first SDRs)

- Default: hire SDR/BDR for prospecting first; keep partnerships lightweight.

- What works: one AE owns a small partner motion (5-10 targets) with strict sourced/influenced rules.

- What to avoid: paying SDRs on "pipeline influenced." You'll get spreadsheet theater.

Growth / Enterprise (multiple segments, channels matter)

- Default: split the functions.

- What works: dedicated partnerships BD with enablement + deal reg + quarterly partner planning; SDR/BDR team runs a production cadence with tight handoffs.

- What to avoid: letting partnerships live outside RevOps governance. If it's not in CRM with rules, it isn't real.

Hot take: if your deal size is small and your sales cycle's short, you probably don't need a full partnerships org yet. You need clean data, fast routing, and relentless prospecting. Build BD once you've earned the right to scale distribution.

KPIs and 2026 benchmarks (what "good" looks like)

If you measure prospecting like BD, you'll kill it. If you measure BD like prospecting, you'll also kill it - just slower and with more internal politics.

Prospecting KPIs (activity -> conversion)

Email benchmarks are a useful reality check: average reply rates sit in the low single digits, top performers separate themselves with targeting and list hygiene, and most replies come from the first message. That means your first email isn't "step one of seven." It's the whole bet.

Call benchmarks are even more brutal. If your connect rate's under 3%, don't "call more." Fix your list and your numbers, because you're paying reps to listen to ringing.

Speed-to-lead still matters for inbound. If you're running inbound SDR, fast response is one of the only unfair advantages left, and it's wild how many teams still treat it like a nice-to-have instead of an SLA.

Capacity reality (the benchmark everyone ignores): reps spend a huge chunk of their week on non-selling work (admin, research, internal). That's why list quality, routing, and templates aren't "nice to have"--they're how you get selling time back, and they're often the difference between hitting plan and missing by 30%.

Prospecting KPI scorecard (benchmarks)

| KPI | What it tells you | 2026 "good" |

|---|---|---|

| Reply rate | List + offer fit | ~3-4% |

| Top quartile reply | Strong execution | 5%+ |

| Top 10% reply | Elite targeting | 10%+ |

| Positive reply rate | Message quality | Track weekly |

| Meeting rate (per sent) | CTA + routing | Track weekly |

| Show rate | Meeting quality | Track weekly |

| Speed-to-lead (inbound) | Inbound edge | <5 min |

| Bounce rate | Deliverability | Track weekly |

One rule to run this table: if you're below average, don't add volume - fix targeting and list hygiene first. Volume only amplifies what's already broken.

And if most replies come from email #1, treat it like the product. Follow-ups are distribution.

BD/partnership KPIs

Partner programs fail for two reasons: no thesis, and no measurement discipline.

Your scorecard should separate:

- Partner-sourced (partner originated the deal)

- Partner-influenced (partner helped it progress/close)

BD KPI scorecard (partnerships/channels)

| KPI | What it tells you | 2026 "good" |

|---|---|---|

| Partner-sourced pipe | Net-new creation | Track monthly |

| Partner-influenced | Leverage on deals | Track monthly |

| Activation rate | Partners doing work | Track monthly |

| Attach rate | Partner present in deals | Trend up monthly |

| Deal registrations | Co-sell volume | Trend up monthly |

| Co-sell velocity | Speed to close | Faster than non-partner deals |

Add leading indicators so you're not waiting a quarter to learn you're failing:

- Enablement completions (certifications, training attendance)

- Partner portal activity (logins, asset downloads)

- Co-marketing shipped (webinars/events delivered, not "planned")

Strong opinion: don't buy an ecosystem platform to "fix" partnerships. Define sourced vs influenced in your CRM, enforce deal registration rules, and run a cadence. Tools amplify governance; they don't replace it.

Prospecting playbook (2026 workflow you can run weekly)

This is a weekly operating system we've tested across SMB and mid-market teams. It's built around a simple flow: ICP -> triggers/buy signals -> multichannel cadence -> tight handoff -> AE feedback loop.

Define ICP and segments

Keep it simple: 2-3 segments max per quarter.

- Firmographics: industry, employee band, region, revenue band.

- Technographics: tools they use (or must replace).

- Buying group: who feels the pain vs who signs.

- Triggers (your "why now"): funding, exec hire, headcount growth, new product launch, compliance change, job postings.

If you can't name your top 3 triggers, you're not doing prospecting - you're doing hope.

Build the list (data freshness matters)

List building is where most teams quietly lose the quarter.

Stale data creates bounces (deliverability damage), wrong titles (bad targeting), duplicates (CRM mess), and wasted calls (wrong numbers). Even a great sequence can't outrun a bad list, and once your bounce rate spikes, you're not "a little less efficient"--you're risking a deliverability spiral that takes weeks to unwind.

Verify + enrich before sequencing (deliverability guardrail)

This is the step teams skip when they're under pressure. It's also the step that makes prospecting predictable.

Prospeo, "The B2B data platform built for accuracy," fits this workflow cleanly: 300M+ professional profiles, 143M+ verified emails, and 98% email accuracy on a 7-day refresh cycle. It runs real-time verification (including catch-all handling) with spam-trap and honeypot filtering, so you stop burning domains on bad addresses, and you can layer intent across 15,000 topics to prioritize accounts that are already in-market.

If you're building lists often, the 7-day refresh cycle matters more than people think, because it keeps you from emailing last quarter's org chart and wondering why your "personalization" isn't landing.

Run a 4-7 touch cadence

A simple weekly cadence that works:

- Touch 1 (Email #1): tight, specific, <80 words. Make it count.

- Touch 2 (Call): same day or next day, reference the email subject.

- Touch 3 (Email): add one new proof point (customer, metric, or trigger).

- Touch 4 (Call + voicemail): short and direct.

- Touch 5 (Email): "close the loop" with a clear off-ramp.

- Optional touches 6-7: only if you've got a new trigger or new angle.

Use/skip notes (opinionated for a reason):

- Use personalization when you've got a real trigger.

- Skip fake personalization ("saw you're passionate about innovation"). It hurts more than it helps.

- Use multichannel if your list has verified phones.

- Skip calling if your connect rate's sub-3%--fix list quality first.

BD playbook (partnerships/channels without attribution chaos)

BD works when it's treated like a product: clear ICP, clear value exchange, clear measurement, and a cadence that doesn't depend on heroics.

Pick a partner thesis

Start with one thesis, not five "maybe" ideas.

Examples:

- Referrals: consultants/agencies that already advise your ICP.

- Co-sell: complementary tech with overlapping accounts.

- Marketplace: integration + listing where buyers already shop.

- Resellers: partners who can package you into a bigger service.

Your thesis should answer:

- Who's the partner?

- Why do they care now?

- What do they get (revenue, retention, differentiation)?

- What's the first joint motion (webinar, referral, integration, account mapping)?

I've watched a team spend two months "building partnerships" that were really just pleasant calls and vague promises. The fix wasn't more outreach. It was shipping one concrete motion: a referral path with an SLA, a one-pager partners could forward, and a deal registration rule that stopped the internal credit fight before it started.

Define partner-sourced vs partner-influenced (with examples)

Use the sourced/influenced logic consistently.

- Partner-sourced: the deal wouldn't exist without the partner. They introduce a net-new prospect, bring you into the first call, or invite you to a customer event where the opportunity starts.

- Partner-influenced: the opportunity started elsewhere, but the partner helps you win - introductions to stakeholders, buying committee intel, championing, or co-selling into procurement.

Governance rule I enforce: protect the original source fields, and report sourced + influenced in a way that doesn't double count. If totals exceed 100%, your dashboard becomes fiction.

Partner enablement checklist (the stuff that makes BD compound)

If you want partners to perform, give them a kit they can actually use:

- Partner one-pager: who it's for, 3 pains, 3 outcomes, 2 proof points

- Referral path: a simple form + where it goes + response SLA

- Deal registration rules: what qualifies, how long it's protected, who gets credit

- Pitch deck + talk track: 10 slides max, with "when to bring us in"

- Mutual action plan template: shared steps for co-sell deals

- Enablement cadence: monthly training + quarterly planning for top partners

Skip this if you're not willing to do enablement. Seriously. You'll end up with a "partner program" that's just a spreadsheet of logos and a calendar full of calls that never turn into pipeline.

Scorecard + operating cadence

Keep the cadence boring and consistent:

- Weekly: partner pipeline review (registrations, next steps, stuck deals)

- Biweekly: activation review (who's sending, who's dormant, what enablement's missing)

- Monthly: sourced vs influenced rollup + attach rate + "what to double down on"

If you're not willing to say "these 3 partners are dead weight," you don't have a program - you've got a contact list.

Skills and traits: who's good at prospecting vs who's good at BD?

This is where hiring goes sideways: leaders hire for the title, not the temperament.

Great prospectors (SDR/BDR) tend to be:

- Process-obsessed (they love a cadence and a scoreboard)

- Resilient (rejection doesn't derail the week)

- Fast iterators (they test subject lines and hooks like a growth marketer)

- Comfortable being "unsexy" (they win by consistency, not charisma)

Great BD/partnerships people tend to be:

- Strong negotiators with long-cycle patience

- Excellent at stakeholder management (legal, product, marketing, sales, partner teams)

- Enablement-minded (they build assets and motions, not just relationships)

- Comfortable with ambiguity (they can create a path where none exists)

Hiring guidance I stand by:

- If you don't have repeatable outbound yet, hire prospecting first.

- If your product already wins in a segment and you need distribution, hire BD.

- If you hire BD before you've got a crisp ICP and offer, you're paying someone to search for strategy.

Compensation and incentives: what to pay for (not titles)

Comp plans are where this gets painfully real.

Prospecting comp (SDR/BDR)

- Typical base range (US SaaS): $42,000-$61,600

- Typical OTE: $70,000-$110,000

- Variable should pay on: meetings held, SQLs, and a small quality modifier (AE acceptance rate or stage-2 conversion).

- Avoid: paying SDRs on closed-won. It's too delayed and it encourages sandbagging handoffs.

BD partnerships comp

- Typical base range (US SaaS): $63,500-$110,328

- Typical OTE: $120,000-$200,000+

- Variable should pay on: partner-sourced pipeline (primary), partner-sourced revenue (when cycle allows), and activation milestones (first X registered deals, first X sourced opps).

- For influenced pipeline: use it as a dashboard metric, not the main paycheck. Otherwise you'll create endless attribution arguments.

One comp-plan mismatch I see constantly: companies give someone a "BD Manager" title, a partnerships-style base, and then slap on an SDR meetings quota. That role churns fast because it's two jobs with one calendar.

Prospecting math + cost reality (plan capacity like an operator)

Outbound feels emotional until you do the math.

A blunt model for cold email looks like this: per 1,000 emails you get a small number of replies, a smaller number of positive replies, and then a fraction of those turn into booked calls and shows. So if your goal's 20 shows/month from cold email, you're not "sending a few sequences." You're building a production line: list volume, deliverability, and consistent execution, with enough slack that one bad list pull doesn't wipe out your month.

Cost-wise, a basic outbound stack can be surprisingly cheap compared to paid acquisition. The hidden cost is bad data. If your bounce rate spikes, you'll burn domains and lose weeks rebuilding deliverability.

That's not a line item. It's a quarter-killer.

What usually goes wrong in real orgs (and how to fix it fast)

Five failure modes show up over and over:

- "BD" becomes a dumping ground. Anything unclear gets labeled BD. Fix: rename roles by output (meetings vs partners) and align KPIs.

- Handoffs are vibes. Meetings get booked with no context. Fix: enforce the handoff template and AE feedback loop.

- Activity replaces strategy. Teams add touches instead of improving targeting. Fix: if reply rate's weak, tighten ICP and triggers before scaling volume.

- Partnerships run without governance. Deals get "influenced" into existence. Fix: sourced vs influenced definitions + deal registration rules in CRM.

- Comp plans reward the wrong behavior. People optimize for what pays. Fix: pay prospectors for held meetings/SQLs; pay BD for sourced pipe + activation.

FAQ

Is sales prospecting the same as sales development?

Sales prospecting is the activity, while sales development is the role/team that runs it end-to-end (list, outreach, qualification, and handoff) with weekly KPIs. In practice, prospecting's the "doing," and sales development's the operating system that makes it repeatable.

Can one person do both prospecting and business development?

Yes - in small teams, one person can cover both as long as you time-box it with two calendar blocks and two scorecards. A simple split is 3 days/week on near-term outreach and 1 day/week on one partner thesis; without that separation, urgent meeting goals crowd out long-horizon work every time.

What KPIs should an SDR/BDR be measured on vs a BD partnerships role?

SDR/BDR KPIs should be conversion-based: reply rate, meetings held, show rate, bounce rate, and inbound speed-to-lead (<5 minutes). Partnerships KPIs should be leverage-based: partner-sourced pipeline, activation rate, deal registrations, and attach rate - reviewed monthly, not daily.

What's the difference between partner-sourced and partner-influenced pipeline?

Partner-sourced pipeline is net-new creation where the partner originates the opportunity (intro, first meeting, or partner event that starts the deal). Partner-influenced pipeline is when the deal starts elsewhere but the partner materially helps it move or close (stakeholder intros, co-sell support, procurement help), and you should track it separately to avoid double counting.

What's a good free tool for verified emails before outbound?

Prospeo includes a free tier with 75 verified emails plus 100 Chrome extension credits per month. If you're comparing options, prioritize verification quality over "more contacts," because a high bounce rate costs you weeks in deliverability recovery.

Closing

If your team keeps mixing these motions, you'll keep getting mismatched KPIs and random results. Decide what you're building for the next 30 days: a prospecting production system (weekly list -> sequence -> handoff -> feedback loop) or a BD growth vector (one partner thesis -> enablement kit -> deal registration -> sourced/influenced reporting).

Do one well, then add the other.

Sloppy handoffs start with sloppy data. When your BDR hands an AE a meeting built on a verified contact with 50+ enrichment data points, discovery actually works. Prospeo's CRM enrichment fills the gaps at $0.01/email - no contracts, no sales calls.

Give your reps contacts that convert, not bounce.