Dubb vs Loom: The Honest Comparison Nobody Else Gets Right

Every dubb vs loom article treats these as direct competitors. They're not. Loom is an async video communication tool that 93 million videos were recorded on in 2025. Dubb is a sales video platform with a built-in CRM that maybe 10,000-25,000 active users rely on. Comparing them head-to-head without acknowledging this is like comparing Slack to Outreach because both send messages.

Here's what actually matters: which one fits your workflow, and whether either one is even the right place to spend your next dollar.

30-Second Verdict

Loom wins if you need simple, affordable async video for team communication, SOPs, or lightweight sales outreach. Starts at $15/user/month (annual).

Dubb wins if you need a dedicated sales video platform with a built-in CRM, multi-CTA landing pages, and granular engagement tracking. Starts at $42/user/month.

Skip both if your real bottleneck isn't the video tool - it's your prospect data. The best sales video in the world bounces if the email is wrong. A personalized Dubb video sent to a dead inbox is just wasted effort. Start with verified contact data, then pick your video platform.

What Each Tool Actually Is

Loom: The Async Video Default

Loom is Atlassian-owned, used by millions, and the tool most people think of when they hear "screen recording." It's fast, frictionless, and designed for internal communication first. SOPs, bug reports, quick demos, async standups - that's Loom's sweet spot.

It's also increasingly pushing into sales. Variables let you personalize videos at scale, Auto-CTA adds conversion elements, and the AI suite handles filler word removal, summaries, and chapters. But as Alex Berman (who's sent 50,000+ video prospecting messages) puts it: "Loom wasn't designed for cold outreach. It was built for async team communication and customer support."

That's not a death sentence for sales use. It just means Loom is a Swiss Army knife where the sales blade is getting sharper - but it's still a Swiss Army knife.

Dubb: The Sales-First Video Platform

Dubb is what happens when you build a video tool specifically for closing deals. It's got a built-in CRM (10K contacts on Pro), customizable landing pages with multiple CTAs, engagement tracking that shows exactly what percentage of your video a prospect watched, and five AI assistants covering everything from script writing to avatar video generation.

The tradeoff? It's more complex, more expensive, and has a fraction of Loom's user base. Dubb's 88% small business user base on G2 tells you who's buying: founders and small sales teams who need an all-in-one video sales stack without stitching together five tools.

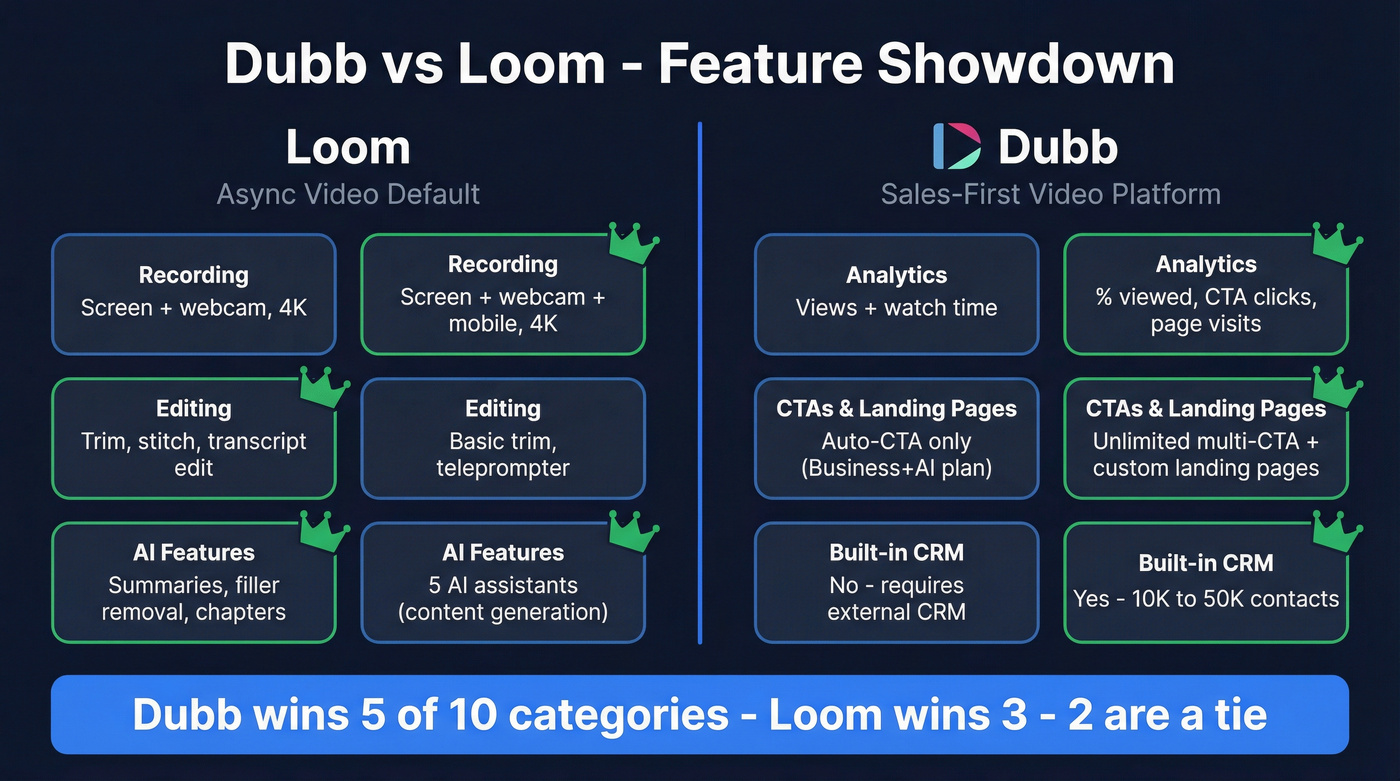

Feature Comparison: Dubb vs Loom Side by Side

| Feature | Loom | Dubb | Edge |

|---|---|---|---|

| Recording | Screen + webcam, 4K | Screen + webcam + mobile, 4K | Dubb (mobile) |

| Editing | Trim, stitch, transcript edit | Basic trim, teleprompter | Loom |

| AI Features | Summaries, filler removal, chapters | 5 AI assistants | Loom (polish) |

| Analytics | Views, watch time | % viewed, CTA clicks | Dubb |

| CTAs | Auto-CTA (Business+AI) | Unlimited multi-CTA | Dubb |

| Built-in CRM | No | Yes (10K-50K contacts) | Dubb |

| Landing Pages | No | Fully customizable | Dubb |

| Personalization | Variables (name swap) | Dynamic personalization | Tie |

| Integrations | Jira, Confluence, SFDC* | Gmail, Outlook, HubSpot, SFDC | Loom (Atlassian) |

| Mobile App | Yes | Yes (Android weaker) | Loom |

*Salesforce integration requires Loom Enterprise.

Dubb wins 5 of 10 rows, Loom wins 3, and 2 are a wash. But tables lie by omission.

Loom's AI suite is genuinely excellent for polishing videos before you send them. Filler word removal alone saves reps from sounding nervous on cold outreach. Edit-by-transcript means you can cut a 3-minute ramble into a tight 90-second pitch without touching a timeline editor.

Dubb's five AI assistants sound impressive, but they solve different problems - content generation rather than content refinement. That distinction matters depending on whether your bottleneck is creating videos or cleaning them up.

The analytics gap is where it gets real. Loom tells you someone watched your video and for how long. Dubb tells you they watched 73% of it, clicked the "Book a Demo" CTA, and then visited your pricing page. For an SDR running 50 video touches a week, that granularity changes how you prioritize follow-ups.

One underrated Dubb advantage: Loom's interface is so recognizable that prospects immediately know they're watching a mass-sent video. Dubb's custom-branded landing pages avoid that signal entirely. When every second SDR uses Loom, looking different has value.

Loom's Variables feature deserves credit for narrowing the personalization gap. Record once, swap in prospect names, send to many. It's not as deep as Dubb's system, but for teams doing lightweight personalization, it gets the job done.

You're debating Dubb vs Loom, but neither tool fixes your real bottleneck: bad prospect data. A personalized video sent to a dead inbox is wasted effort. Prospeo gives you 98% verified emails at $0.01 each - so every video you record actually lands.

Fix the data first. Pick the video tool second.

Pricing Breakdown - What You'll Actually Pay in 2026

Loom Pricing

| Plan | Monthly | Annual | Key Limits |

|---|---|---|---|

| Starter (Free) | $0 | $0 | 25 videos, 5-min limit, 720p |

| Business | $18/user/mo | $15/user/mo | Unlimited videos, 4K |

| Business + AI | $24/user/mo | $20/user/mo | AI editing, Variables, Auto-CTA |

| Enterprise | Custom | ~$40-44K/yr ACV | SSO, Salesforce, SLA |

Dubb Pricing

| Plan | Monthly | Annual | Key Limits |

|---|---|---|---|

| Starter (Free) | $0 | $0 | 25 SD videos, basic pages |

| Pro | $42/user/mo | $499/user/yr | HD, CRM (10K contacts), AI suite |

| Pro Plus | ~$90/user/mo | $1,080/user/yr | 4K, automation, 50K contacts |

| Enterprise | Custom | Custom | Salesforce/HubSpot, admin controls |

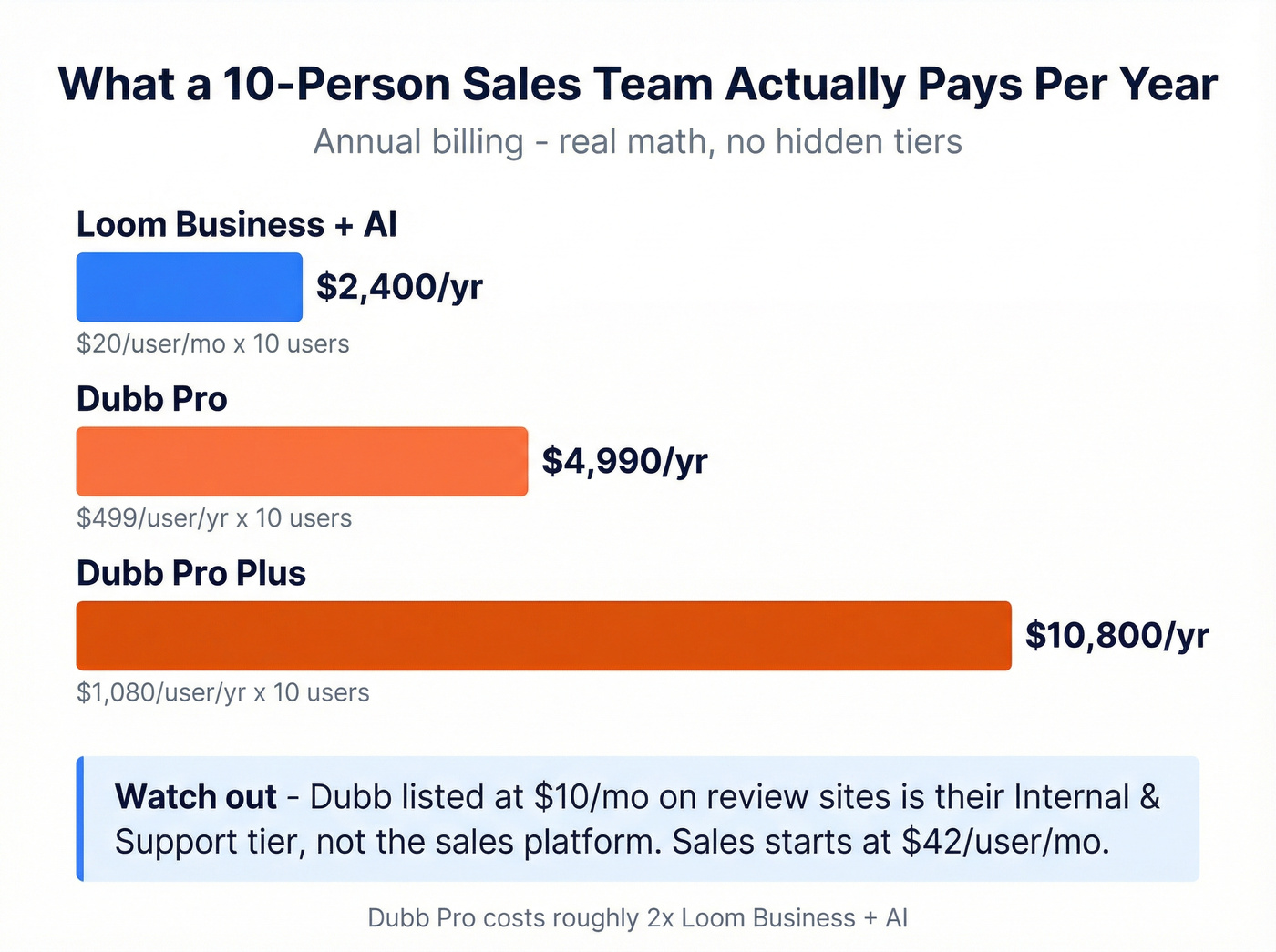

The $10/month confusion: If you've seen Dubb listed at "$10/month" on review sites like Software Advice, that's their Internal & Support tier - a completely separate product line from the Sales/Marketing platform. The sales tool starts at $42/user/month. This trips people up constantly, and Dubb doesn't do a great job clarifying it on third-party sites.

Real math for a 10-person sales team:

- Loom Business + AI (annual): $20/user/month x 10 = $200/month = $2,400/year

- Dubb Pro (annual): $499/user/year x 10 = $4,990/year

- Dubb Pro Plus (annual): $1,080/user/year x 10 = $10,800/year

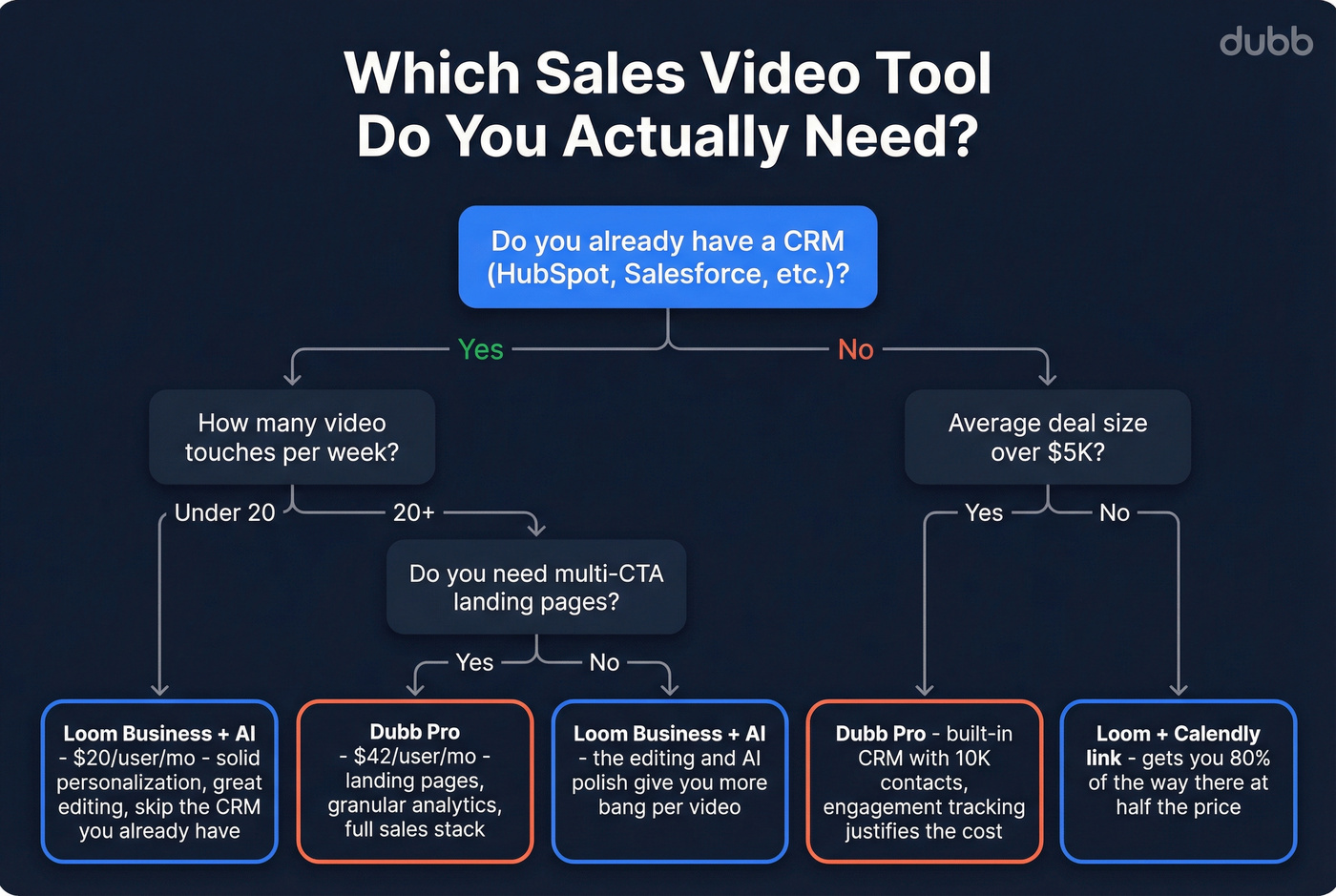

Dubb Pro costs roughly 2x what Loom Business + AI costs. For teams already running HubSpot or Salesforce, you're paying for a CRM you don't need. For teams without a CRM? Dubb's built-in contact management is genuinely useful.

Loom Enterprise at ~$40-44K/year ACV is in a different universe - that's for 100+ seat deployments with SSO and compliance requirements. Most teams reading this are comparing the $20-42/user/month range.

The Atlassian Factor - Why This Matters More Than Most Articles Admit

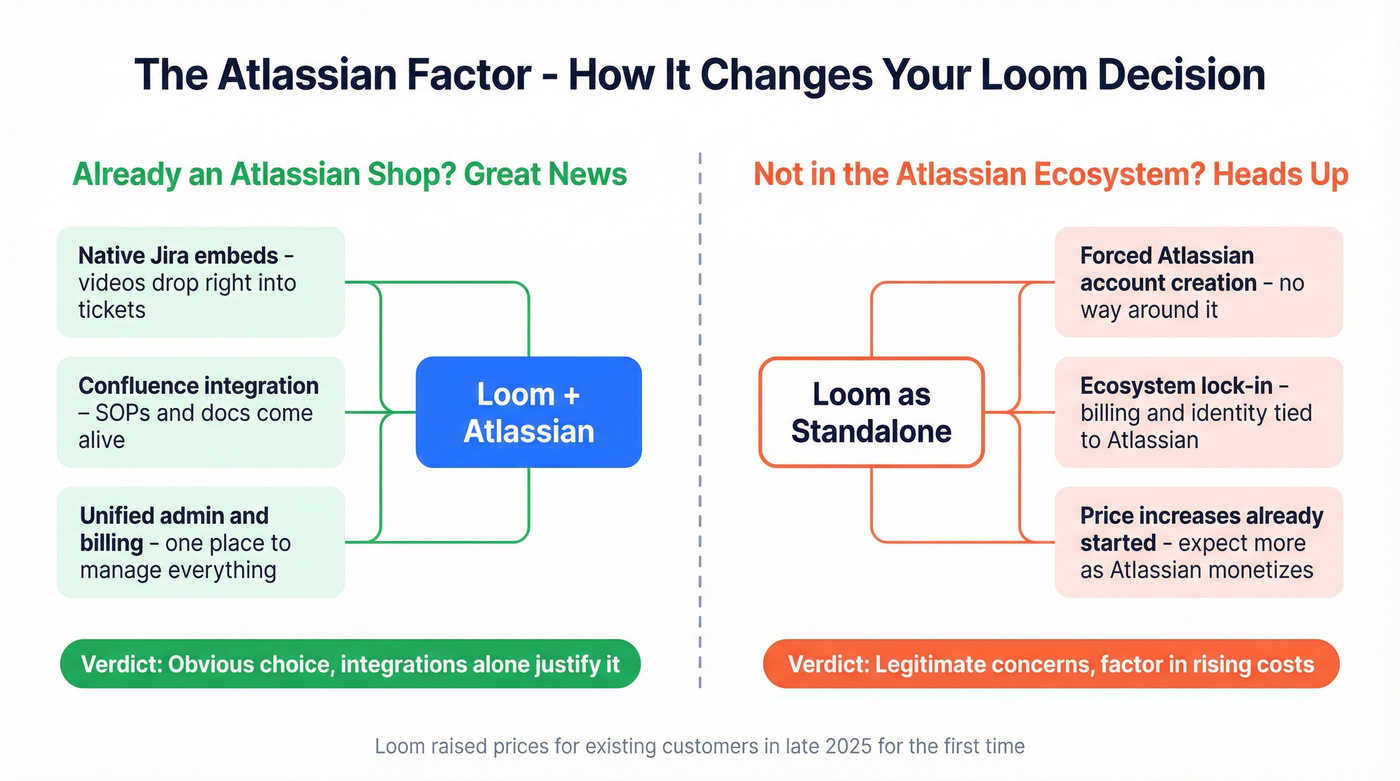

Atlassian owns Loom now, and the changes affect your buying decision more than most comparison articles acknowledge.

New users must create an Atlassian account to access Loom. There's no way around it. Existing accounts are being migrated into Atlassian-managed organizations even if Loom is the only Atlassian product you use. Billing, admin controls, and identity management all move to Atlassian's system.

For teams already in Jira and Confluence, this is a net positive. Loom videos embed natively in tickets and docs. The workflow integration is tight and getting tighter.

For everyone else, it adds friction and lock-in. One sales rep on Reddit put it perfectly: "We don't need their ecosystem for this one tool." That sentiment is widespread.

Loom raised prices for existing customers for the first time, which took effect in late 2025. Some customers got "advantaged pricing" for a gradual transition, but the direction is clear - Loom is becoming an Atlassian product with Atlassian pricing expectations.

What this means practically:

- If you're an Atlassian shop, Loom is the obvious choice. The integrations alone justify it.

- If you're a standalone user or small team, the forced account creation and ecosystem lock-in are legitimate concerns.

- If you're evaluating Loom for the first time, factor in that pricing will keep climbing as Atlassian monetizes the user base.

Sales Use Case Deep Dive - Where Each Tool Actually Wins

B2B prospects receive 100+ emails daily and open fewer than 24% of them. Video cuts through that noise. Teams adding personalized video see 5x higher click-through rates, 3x more replies on cold sequences, and 42% faster deal cycles when video is used at every stage. The question isn't whether to use video in sales - it's which tool matches your workflow.

Where Dubb Wins

Use Dubb if you're running a dedicated video-first sales motion and need everything in one place.

Dubb's multi-CTA landing pages are the killer feature. A prospect watches your video and sees a booking link, a pricing PDF, a case study, and a chat widget - all on one page. That's not something you can replicate in Loom without external tools. The engagement tracking (percentage viewed + CTA clicks) lets reps prioritize follow-ups based on actual interest signals, not just "they opened the email." The built-in CRM with 10K contacts on Pro means solo founders and small teams can skip a separate CRM entirely.

Skip Dubb if you already have a CRM, your team does fewer than 20 video touches per week, or you don't need landing pages.

Where Loom Has Caught Up

Use Loom if you want solid sales video capabilities without paying the Dubb premium.

Loom's Variables feature lets you record once and personalize for many prospects - swap in names, company details, and custom fields. Auto-CTA adds conversion elements to every video. Combined with AI editing (filler word removal, silence trimming, transcript-based cuts), a rep can produce polished, personalized outreach videos fast.

The Salesforce integration (Enterprise only) and native Jira/Confluence integrations make Loom the better fit for teams embedded in those ecosystems.

Skip Loom for sales if you need granular engagement analytics, multi-CTA landing pages, or a built-in CRM. Loom's analytics are still views + watch time - useful, but basic compared to Dubb's percentage-viewed tracking.

Hot take: If your average deal size is under $5K, you probably don't need Dubb-level analytics. A Loom video with a Calendly link in the email body gets you 80% of the way there. Save the Dubb budget for when your deal sizes justify the per-seat premium.

What Real Users Say

Loom User Sentiment

G2: 4.7/5 (2,331 reviews) | Capterra: 4.7/5 (514 reviews)

The good: ease of use dominates. G2 reviewers mention "ease of use" 335 times. One Software Advice reviewer nailed it: "Screen capture quality is crisp, the editor is simple for trims, and the AI features save real time." A Seamless.AI rep credits Loom with helping close "well over 6 figures in software" from $60-120/month in personal spend.

The bad: recording issues are the #1 con on G2 with 146 mentions. One Reddit user didn't mince words: "Loom crippled our progress. The recording was choppy and we had to download its application to use it, and it still crashed a lot." A marketing agency owner on r/agency called Loom "AMAZING" but added it's "been lagging a bunch lately." The free plan's 5-minute limit and 25-video cap frustrate teams who outgrow it quickly.

Loom's reliability issues are a pattern, not an anomaly. If your sales workflow depends on recording 20+ videos a day without crashes, test thoroughly before committing.

Dubb User Sentiment

G2: 4.6/5 (566 reviews) | Capterra: 4.8/5 (102 reviews)

The good: customer support gets exceptional marks - 13 G2 mentions and 4.7/5 on Capterra. One insurance founder's review captures the Dubb experience: "The only CON is that there are so many features, I FAIL to use them all." Capterra rates Dubb higher than Loom on value-for-money (4.8 vs 4.5) and functionality (4.8 vs 4.5). Dubb's negative review rate on Capterra is under 1%.

The bad: learning curve is the top complaint (11 combined G2 mentions). The feature density that power users love overwhelms newcomers. Android app performance is spotty - four G2 mentions for choppy playback. And the auto-renewal policy has burned people. One Capterra reviewer wrote: "they said no we dont do refunds." That's a trust issue Dubb needs to fix.

The sentiment gap tells a clear story: Loom is loved for simplicity but frustrates with reliability. Dubb is loved for depth but frustrates with complexity. Pick your poison.

Who Should Pick Which - Scenario-Based Recommendations

Solo founder or freelancer - Loom Free or Business ($15/mo annual). You don't need a CRM in your video tool. You need fast recording and a clean link to share. Loom's simplicity is the feature.

SDR team doing cold outreach (5-15 reps) - Dubb Pro ($499/user/year). The CTA landing pages, engagement tracking, and built-in CRM justify the premium. Your reps need to know who watched 80% of the video vs. who bounced at 10 seconds. That's pipeline intelligence.

Team already in the Atlassian ecosystem - Loom Business + AI ($20/user/month annual). The Jira and Confluence integrations work natively. You're already managing accounts through Atlassian. Adding Loom is a natural extension, not a new vendor relationship.

Enterprise sales org (50+ reps) - Neither. Look at Vidyard ($59/user/month). Account-based analytics, deep CRM integration, AI avatars in 25+ languages, and heat maps showing where prospects drop off. At scale, you need reporting that rolls up to the account level, and neither Loom nor Dubb does that well.

Budget-conscious sales team - Loom Business + AI at $20/user/month (annual). You get Variables for personalization, Auto-CTA for conversion, and AI editing for polish. That's 80% of what Dubb offers at roughly half the price. I've seen teams start here and only upgrade to a dedicated sales video tool when they've proven the video outreach motion works.

Other Alternatives Worth Considering

If you need enterprise-grade sales video: Vidyard at $59/user/month. Deep CRM integration, account-based analytics, AI avatars in 25+ languages, and heat maps showing exactly where prospects lose interest. The go-to for 50+ rep teams that need reporting rolling up to the account level.

If personalization volume is your bottleneck: Sendspark at $39/seat/month renders unique video versions with prospect info embedded - name, company, logo - without re-recording. A fundamentally different approach than either Loom or Dubb.

If trust sells your product: BombBomb at $36/month is built for relationship-based sales. Real estate agents, insurance brokers, mortgage originators - industries where the human connection matters more than the CTA. Less flashy, more personal.

If you want video in email sequences on a budget: Hippo Video runs ~$20-30/user/month with solid email thumbnail embedding and integration with major sequencing tools. I haven't tested this one deeply enough to recommend it confidently, but it's worth evaluating if the Dubb price tag is a dealbreaker. Bonjoro is another option for personalized 1:1 outreach - more manual, but the personal touch lands well in high-ACV sales.

Dubb tracks that a prospect watched 73% of your video. Great - but that only matters if you reached a real inbox. Prospeo's 7-day data refresh and 143M+ verified emails mean your SDRs stop wasting video touches on bounced contacts.

Stop recording videos for inboxes that don't exist.

FAQ

Is Dubb really worth 2x the price of Loom?

For dedicated sales teams needing CRM tracking, multi-CTA landing pages, and engagement analytics showing exact video watch percentages - yes, the premium pays for itself. For everyone else, Loom Business + AI at $20/user/month covers 80% of sales use cases at half the cost.

Does Loom work for sales outreach in 2026?

Yes. Loom's Variables and Auto-CTA features make it viable for prospecting videos, proposal walkthroughs, and follow-ups. The main gaps compared to Dubb are analytics depth (views vs. percentage watched) and the lack of customizable landing pages with multiple CTAs.

Why does Dubb show up as $10/month on some review sites?

Dubb runs two separate product lines. The $10/month price is their Internal & Support tier - a completely different product from the Sales/Marketing platform, which starts at $42/user/month. Always check Dubb's pricing page directly before budgeting.

What changed with Loom after the Atlassian acquisition?

New users must create an Atlassian account, and pricing increased for existing customers starting late 2025. Jira and Confluence integrations improved significantly. For Atlassian shops it's a net positive; for standalone users it adds forced account creation and ecosystem lock-in.

How do I make sure my sales videos actually get seen?

Verify email addresses before sending any video outreach - unverified sends bounce and damage your sender reputation. Tools like Prospeo offer 98% email accuracy with a 7-day data refresh cycle, and the free tier includes 75 email credits per month so you can start validating contacts immediately.