The Operator's Guide to Building Outbound Sales Teams in 2026

Your CEO just pulled you into a room and said, "We need outbound." Maybe pipeline's drying up. Maybe inbound plateaued two quarters ago. Maybe the board wants 3x growth and everyone's looking at you.

The problem? 70% of B2B reps missed quota in 2024 - the most recent year with complete data - per Xactly Insights. Meanwhile, 36% of B2B tech companies reduced SDR headcount in the past year while only 19% grew their outbound teams. Most outbound sales teams fail not because outbound doesn't work, but because they're built wrong - wrong sequence, wrong economics, wrong data.

This isn't a motivational guide about "the power of cold calling." It's the operational blueprint I wish someone had handed me the first time I was told to build an outbound function from scratch.

What You Need to Know (Quick Version)

If you're short on time, here's the cheat sheet:

- Don't hire SDRs first. Start with a founding AE who can close and document a repeatable process. SDRs amplify a playbook - they don't create one.

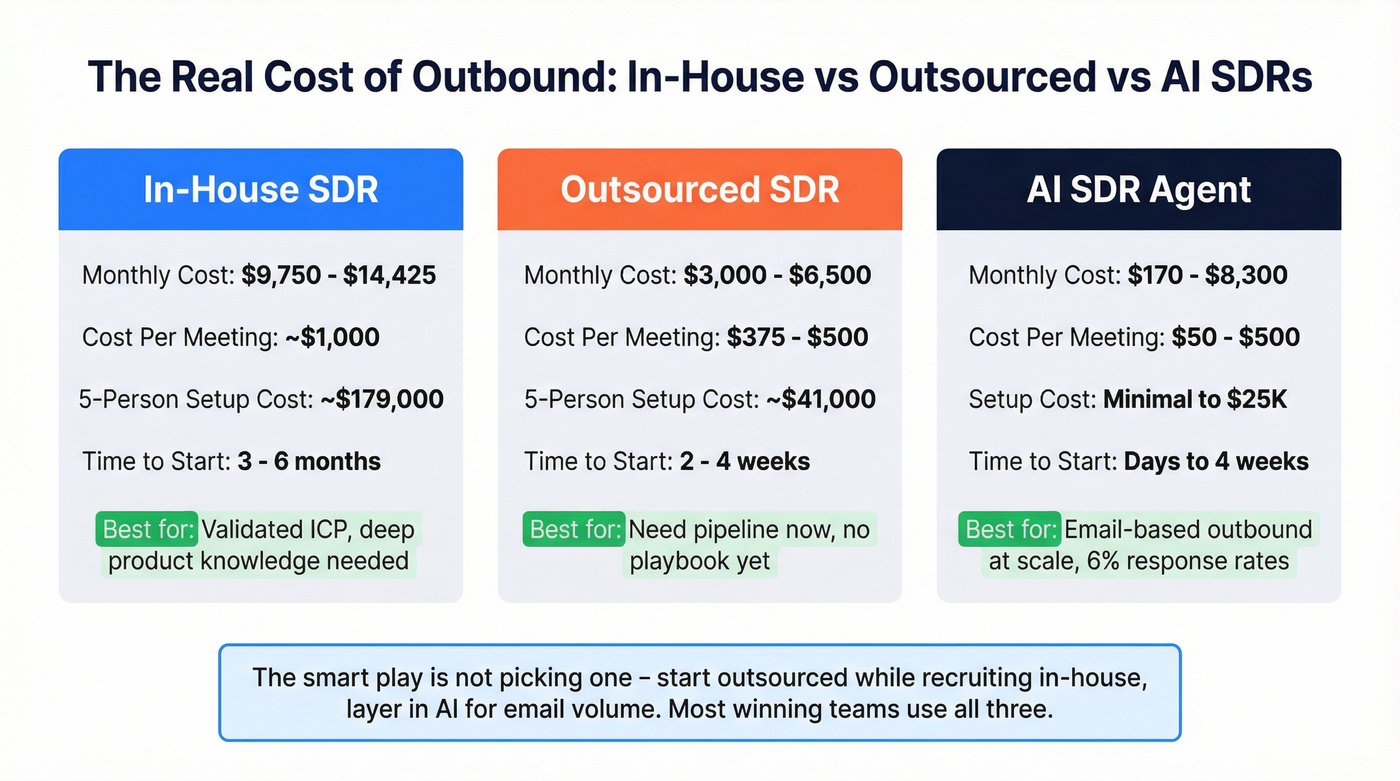

- Budget $9,750-$14,425/month per in-house SDR (fully loaded with tools, management, and benefits). Outsourced runs $3,000-$6,500/month. Know the tradeoffs before you commit.

- Multi-channel cadences convert at 4-7%, roughly 3x single-channel. If your team is email-only, you're leaving pipeline on the table.

- Your data stack matters more than your dialer. Outbound reps lose hundreds of hours per year to bad data. Start with verified contact data or nothing else in your stack will matter.

- Track 5-7 KPIs, not 15. Teams focused on the right metrics hit 91% quota attainment vs. 73% for teams tracking fewer than three.

Now let's break each of these down.

When Outbound Actually Makes Sense (and When It Doesn't)

Here's a truth most outbound vendors won't tell you: not every company needs a dedicated prospecting team. If your average deal is $5K and your high-intent inbound leads convert at 70-80%, adding SDRs will just add cost without moving the needle.

And let's address the elephant in the room: outbound isn't dead. Lazy outbound is dead. The spray-and-pray model from 2019 deserves its grave. What works in 2026 is research-driven, multi-channel, data-verified outbound that earns attention instead of demanding it.

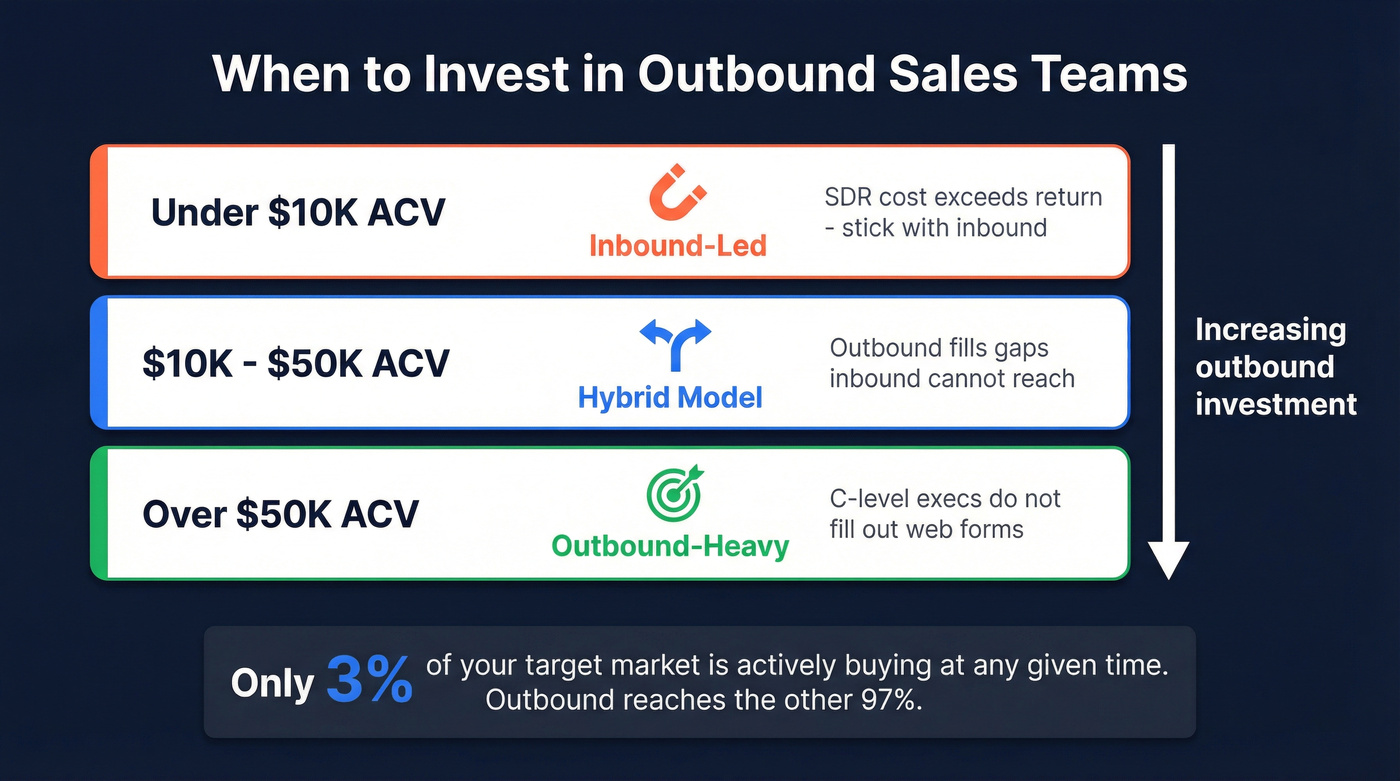

Only 3% of your target market is actively buying at any given time. Inbound captures the ones already raising their hand. Outbound goes after the other 97%.

The decision comes down to deal size and buyer behavior:

| Deal Size | Typical Motion | Why |

|---|---|---|

| Under $10K | Inbound-led | SDR cost exceeds return |

| $10K-$50K | Hybrid | Outbound fills gaps inbound can't reach |

| Over $50K | Outbound-heavy | C-level execs don't fill out web forms |

Inbound converts at 70-80% for high-intent leads (demo requests, pricing page visits). Outbound converts at 5-10%. The math looks bad until you realize outbound reaches people who'd never enter your funnel otherwise. C-level executives at enterprise accounts aren't Googling your category and submitting contact forms. They respond to direct, consultative outreach - or they don't respond at all.

Outbound typically generates 30-45% of total sales pipeline for B2B companies. That's not a rounding error. It's the difference between hitting your number and missing it.

The best teams don't replace inbound - they complement it. Outbound warms accounts that later convert through inbound. Inbound signals like website visits, content downloads, and pricing page hits feed outbound targeting. The companies growing 2.5x faster aren't picking one channel. They're running both with shared data and aligned targeting, creating a flywheel where each motion makes the other stronger. An outbound SDR who knows a prospect visited the pricing page yesterday has a fundamentally different conversation than one dialing cold.

Here's my hot take: if your average contract value sits below $25K, you probably don't need a dedicated outbound team at all. A hybrid model where AEs do targeted prospecting with good data and AI assistance will outperform a specialized SDR team that's too thin to function. But once your ACV crosses $25K, your sales cycle runs longer than six weeks, and your buyers include multiple decision-makers, you need outbound. Full stop.

Team Structure and Roles

Core Roles - SDR, BDR, AE, Sales Manager, GTM Engineer

Let's kill the terminology confusion first.

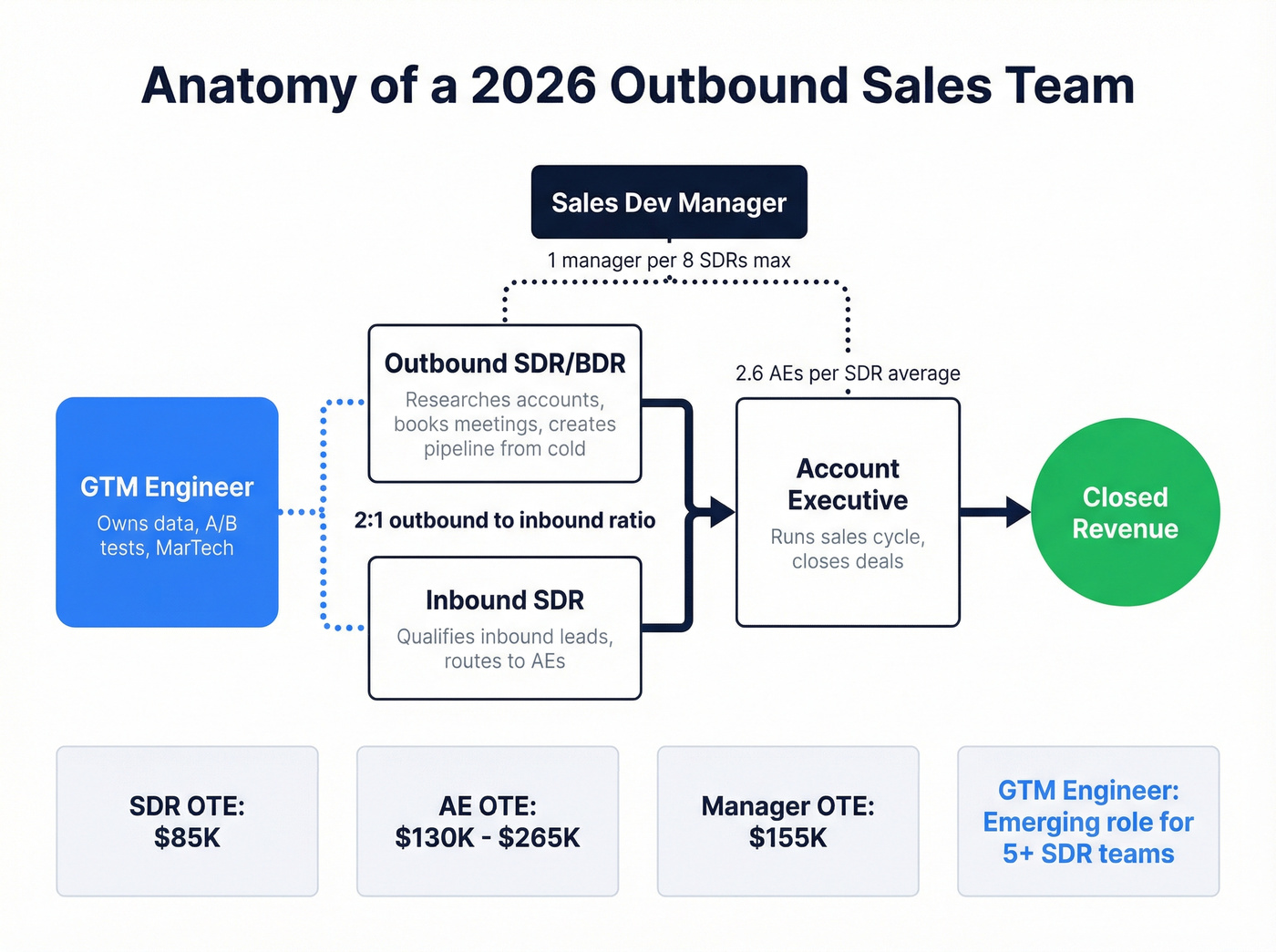

BDRs focus on outbound prospecting - building lists, researching accounts, creating pipeline from cold. SDRs traditionally handle inbound lead qualification, though many companies use "SDR" as the catch-all title. For this guide, I'll use SDR to mean the outbound prospecting role unless I specify otherwise.

Account Executives close deals. They take qualified opportunities from SDRs and run them through the sales cycle. The average ratio is 2.6 AEs per SDR, per Blossom Street Ventures. For outbound-heavy teams, plan 2 outbound SDRs for every 1 inbound SDR.

Sales Development Managers coach, not just manage. One manager per 8 SDRs is the standard span of control. Go beyond that and coaching quality drops off a cliff.

GTM Engineer is the emerging role for 2026. Part RevOps, part growth hacker - they own A/B testing cadences, orchestrating MarTech, running predictive analytics, and optimizing the outbound machine. If you're building a team of 5+ SDRs, this role pays for itself within a quarter.

Specialization vs. Hybrid - A Decision Matrix

Should your reps do everything (prospect, qualify, close) or should you specialize?

| Factor | Specialize | Stay Hybrid |

|---|---|---|

| ACV | Over $50K | Under $25K |

| Sales cycle | 3+ months | Under 6 weeks |

| Decision-makers | 5+ per deal | 1-2 per deal |

| Team size | 10+ people | Under 10 |

| Product complexity | High | Low-medium |

The case for specialization is compelling when it works. One SaaS company transformed their outbound role from "dialer" to "researcher" - shifting from 100 calls per day to 20 deeply researched accounts. Their qualified opportunity rate jumped from 2% to 18% in four months. That's not a typo. Nine times the conversion.

But specialization has a cost: handoff friction, longer ramp times, and the overhead of managing multiple roles. If you're a 6-person sales team selling a $15K product with a 4-week cycle, a hybrid model where AEs do their own prospecting will outperform a specialized team that's too thin to function.

Most teams under 10 people should start hybrid and specialize as they scale. The mistake is specializing too early and creating roles you can't fill or manage.

You just read that outbound reps lose hundreds of hours per year to bad data. Prospeo's 98% verified email accuracy and 7-day refresh cycle mean your SDRs spend time selling, not chasing bounces. At $0.01 per email, even a 5-person team stays under budget.

Stop building a $10K/month team on a broken data foundation.

The Economics of Outbound

Compensation by Role - 2026 Benchmarks

Here's what you're actually paying outbound sales professionals, based on RepVue's salary data:

| Role | Base | OTE | Top Performers | Quota Attainment |

|---|---|---|---|---|

| SDR/BDR | $60K | $85K | $128K | 57.3% |

| SDR Manager | $100K | $155K | $205K | 71.6% |

| SMB AE | $70K | $130K | $269K | 44.8% |

| Mid-Market AE | $90K | $175K | $391K | 43.9% |

| Enterprise AE | $135K | $265K | $628K | 40.9% |

| Sales Manager | $150K | $280K | $508K | 51.3% |

A few things jump out. Less than half of AEs hit quota at every level. That's not a hiring problem - it's a systemic one. The gap between median OTE and top performer comp is massive, which means your comp plan design matters more than most leaders realize.

For SDR comp plans specifically: set the quota-to-OTE ratio at 3-5x. An SDR with $85K OTE should carry $255K-$425K in pipeline generation quota. Pay monthly, not quarterly - SDRs are early-career and need faster feedback loops. And compensate them for what they control: meetings held and qualified opportunities, not closed revenue.

Pipeline Math - What One SDR Actually Produces

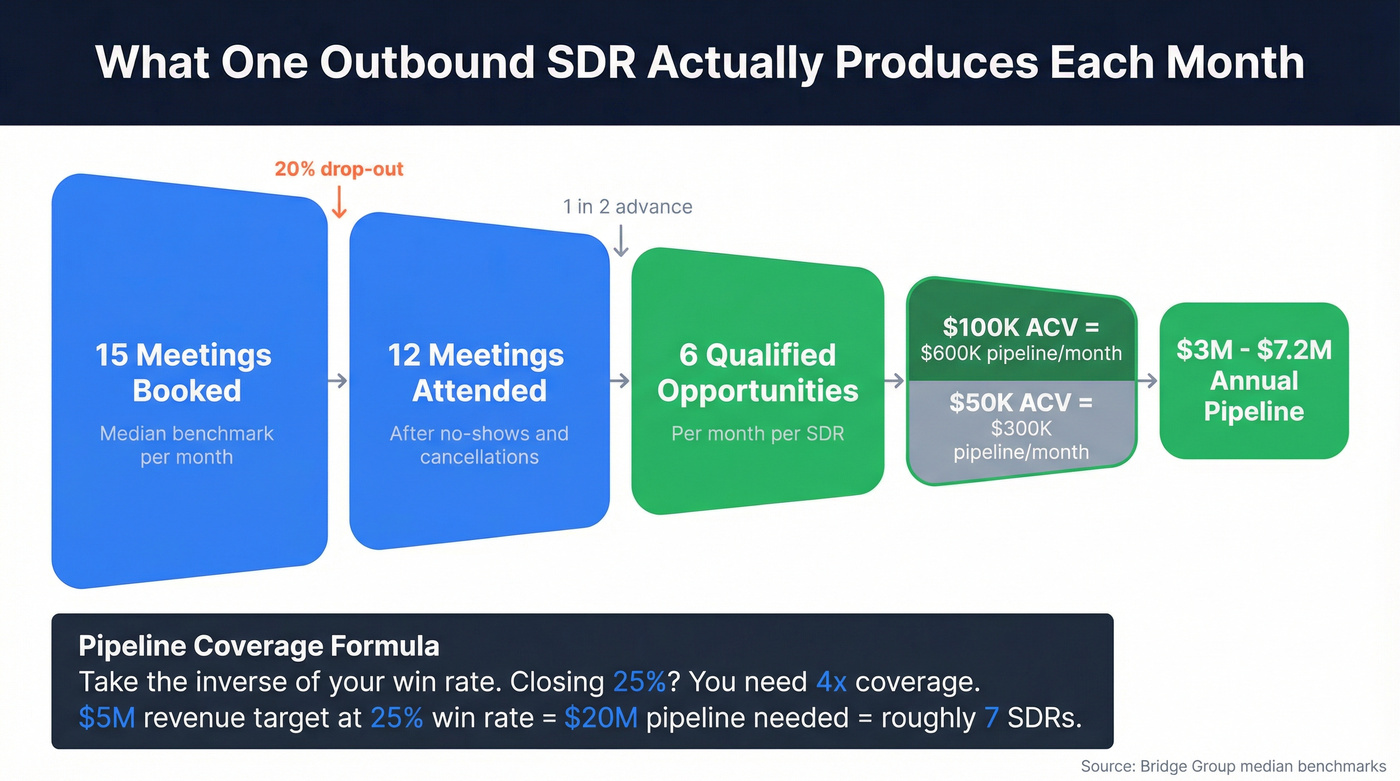

The Bridge Group's median is $3M in pipeline per SDR per year. That's the realistic baseline. Here's how the math stretches at larger deal sizes:

- 15 meetings booked per month (median benchmark)

- 20% drop-out rate - 12 meetings actually attended

- 1 in 2 attended meetings leads to a next step

- 6 qualified opportunities per month

- At $100K average deal value - $600K in new pipeline per month

Annualized at $100K ACV, that's $7.2M in pipeline from one SDR. At $50K ACV, it's $3.6M - right in line with the Bridge Group benchmark. The difference comes down to deal size, win rates, and how aggressively you qualify.

The pipeline coverage formula is simple: take the inverse of your win rate. Closing 25%? You need 4x coverage. Closing 20%? You need 5x. If your annual target is $5M in new revenue and your win rate is 25%, you need $20M in pipeline. At $3M per SDR per year, that's roughly 7 SDRs.

Win rates below 15% mean your funnel is leaky. Fix qualification before you add headcount.

In-House vs. Outsourced - The Real Numbers

Human SDR Models:

| Factor | In-House | Outsourced (Dedicated) | Pay-Per-Meeting |

|---|---|---|---|

| Monthly cost | $9.7K-$14.4K | $3K-$6.5K | $175-$350/mtg |

| Cost per meeting | ~$1,000 | $375-$500 | $175-$350 |

| Setup cost (5-person team) | ~$179K | ~$41K | Minimal |

| Time to start | 3-6 months | 2-4 weeks | 1-2 weeks |

AI SDR Models:

| Factor | Basic AI SDR | Enterprise AI SDR |

|---|---|---|

| Monthly cost | $170-$670 | $4.2K-$8.3K |

| Cost per meeting | $50-$150 | $200-$500 |

| Setup cost | Minimal | $10K-$25K |

| Time to start | Days | 2-4 weeks |

Stop treating this as a religious debate. The right answer is almost always "both, at different stages."

Outsource when you need pipeline yesterday and don't have a playbook yet. The 2-4 week ramp time vs. 3-6 months for in-house is the real differentiator. Build in-house when you've validated your ICP, have a working cadence, and need reps who deeply understand your product and market. Many teams start outsourced while recruiting their first in-house SDRs. That's not a compromise - it's smart sequencing.

AI SDR Economics - What's Replaceable and What Isn't

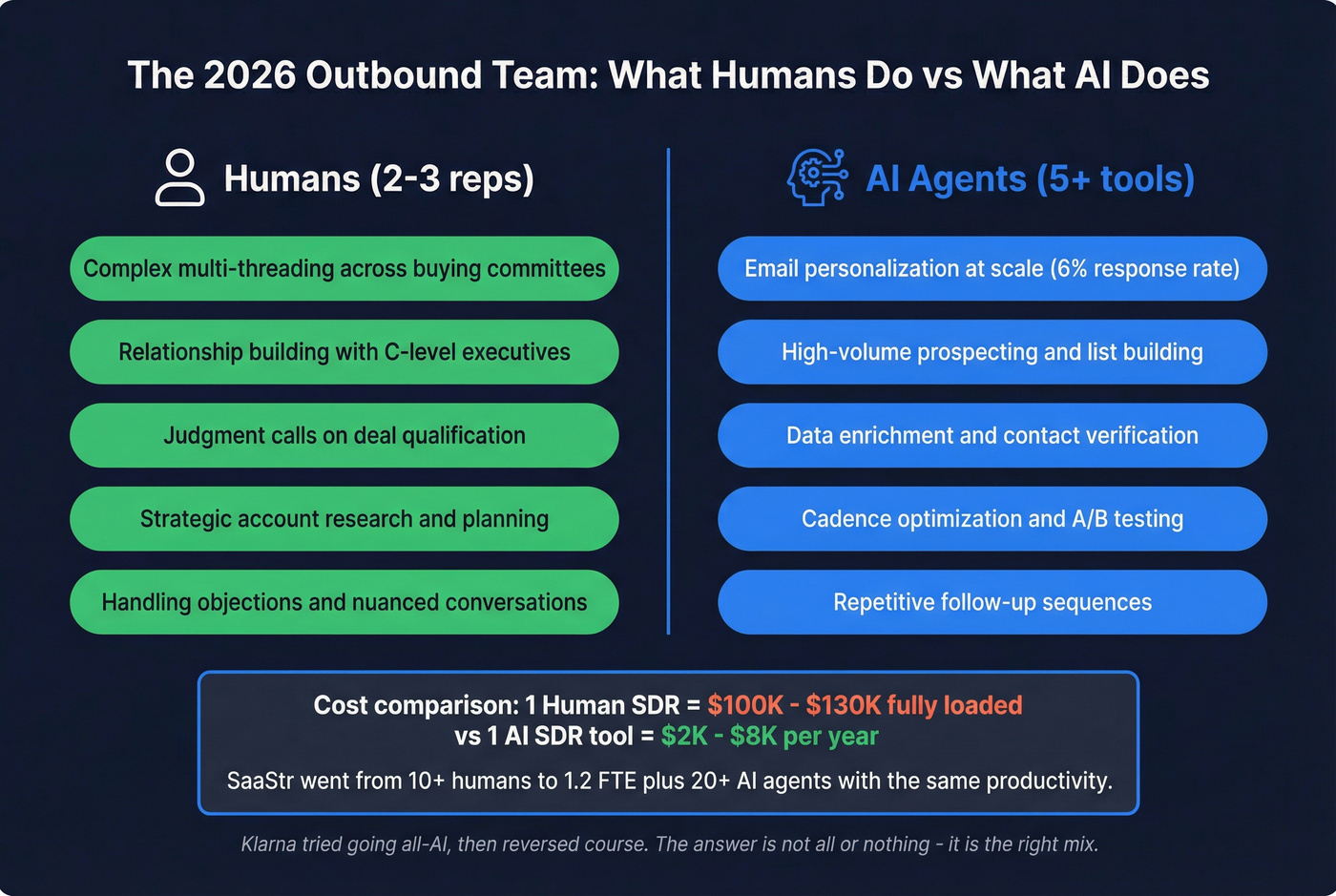

SaaStr went from 10+ humans in sales to 1.2 FTE and 20+ AI agents, with the same net productivity. They budgeted $500K for AI agents vs. $10K on CRM. Roughly 1 in 5 B2B companies now use some form of AI SDR tooling, and that number is climbing fast.

The math is brutal for traditional SDR economics: a human SDR costs $100K-$130K fully loaded. A basic AI SDR tool runs $2K-$8K annually. Enterprise AI SDR platforms with dedicated support hit $50K-$100K - still cheaper than one human.

For email-based outbound, AI agents are hitting 6% response rates - comparable to or better than human SDRs.

But here's the contrarian take: Klarna went all-in on AI, then reversed course and started hiring humans again. The 2026 outbound team isn't "all AI" or "all human." It's 2-3 humans, 5+ AI agents, and one person obsessed with data quality. The humans handle complex multi-threading, relationship building, and the judgment calls AI still botches. The AI handles volume, personalization at scale, and the repetitive work that burns out SDRs in 14 months.

Hiring and Onboarding

Your First Sales Hire Is Not an SDR

This is the mistake I've seen sink more early-stage outbound efforts than any other.

The founder or VP of Sales decides to "build outbound" and immediately posts an SDR job listing. Three months later, the SDR is floundering because there's no playbook, no ICP definition, and no one to learn from.

Frank Golden's framework is the right one: your first sales hire should be a founding AE - someone who can prospect, qualify, demo, and close. This person creates the v1 playbook that SDRs will eventually execute. That playbook covers:

- ICP definition (who you're actually selling to)

- Account targeting criteria

- Outreach methods that work for your market

- Sales stages and exit criteria

- Objection handling scripts

- Communication examples - a "library of what great looks like"

Don't hire SDRs until this playbook exists and you've proven the process is repeatable.

Onboarding That Doesn't Fail

A practitioner on r/salesdevelopment put it bluntly: "I've worked at 7 companies and sales onboarding was a disaster almost everywhere." The common pattern? Access to a content hub, a few shadow sessions, a product deck, a script - then you're expected to perform.

The critical gaps that kill new reps:

- Unclear ICP - reps don't know who to call or why

- No structured 30-day plan

- No learnings from lost deals - reps repeat the same mistakes

- No analysis of why current clients were won

- Scattered documentation across Notion, battlecards, videos, and hearsay

If your onboarding plan is "shadow someone for a week and read the wiki," you're going to burn through SDRs every 14 months. SDR annual turnover averages 35%, and replacing a bad hire costs 2.5x their salary. At $85K OTE, that's $212K per failed SDR - in hiring costs, training time, lost productivity, and severance.

Here's a 30-60-90 framework that actually works:

| Phase | Quota Target | Focus | Meeting Goal |

|---|---|---|---|

| Month 1 | 20-30% | Product knowledge, ICP deep-dive, shadow calls, first outreach with manager review | 3-4 |

| Month 2 | 40-60% | Independent prospecting with weekly coaching, refine messaging | 5-7 |

| Month 3 | 70-90% | Full cadence execution, multi-channel outreach, developing personal style | 8-10 |

| Month 4+ | 100%+ | Full productivity, contributing to playbook updates, mentoring newer hires | 12-15 |

New SDRs typically book their first qualified meeting within 3-4 weeks. Don't confuse early wins with full ramp. Consistent productivity takes 3-4 months.

Building Your Outreach Cadence

The days of "send 500 emails and pray" are over. 63% of buyers are more likely to engage with personalized outreach relevant to their industry or role. Multi-channel cadences convert at 4-7%, roughly 3x higher than any single channel alone.

Here's a 17-21 day cadence framework based on what practitioners like Morgan J Ingram and Florin Tatulea recommend:

| Day | Channel | Action |

|---|---|---|

| 1 | Social | Connection request (no note - higher accept rate) |

| 2 | 75-100 words, ask for interest not a meeting | |

| 3 | Phone + Email | Cold call, voicemail, follow-up email |

| 5 | Phone | Call, no voicemail - give time to respond |

| 7 | Phone | Call, no voicemail |

| 7-10 | Video | Personalized Loom or Vidyard (only after engagement signals) |

| 10 | Highly personalized, persona-specific | |

| 14 | Social | Engage with prospect's content (comment, like) |

| 17 | Breakup email |

The optimal range is 8-12 touchpoints per cadence. Fewer than 8 and you're giving up too early - it takes 16+ touches per account to break through. More than 12 and you risk annoying the prospect into blocking you.

Build three cadence tiers:

- Highly personalized - for your top 20% of target accounts. Custom research, personalized videos, account-specific pain points. One tactic gaining traction: build a narrow ABM list using Clay for enrichment, then send a short Loom mini-audit of the prospect's current setup instead of a cold pitch. Time-intensive but highest conversion.

- Persona-based - for your target titles across good-fit accounts. Personalized by role and industry, not by individual.

- Standard - for new accounts entering your pipeline. Template-driven with merge fields, designed for volume.

Regional differences matter. Cold calling is more accepted in the US than EMEA. Triple-touch on Day 1 (call + email + social) can feel intrusive in DACH markets. APAC generally needs fewer touchpoints. Adjust your cadence to the market, not the other way around.

Don't overlook referrals as an outbound channel. Referrals convert 71% better than cold outreach and close 69% faster. Most teams ignore this entirely.

Keep cadences centrally managed - max 4-6 per team. A monthly cadence committee (management plus your top 2-3 SDRs) reviews performance and iterates. The playbook should be a living document, not a PDF from 2023.

The Tool Stack That Actually Matters

CRM

HubSpot is a strong default for SMB and mid-market teams. Salesforce is the enterprise standard when you need deeper customization and complex workflows. Don't overthink this - your CRM is plumbing, not strategy.

Sales Engagement

Outreach or Salesloft at $110-$165/user/month. Don't spend three months evaluating - they're 90% the same product. Pick based on what integrates cleanly with your CRM.

Data and Enrichment

This is where your stack lives or dies. I've watched teams spend $40K on a sequencing platform and then feed it garbage data. The sequencer doesn't matter if 20% of your emails bounce.

You can filter by buyer intent across 15,000 topics, technographics, recent job changes, and funding signals - which means you're building lists of people who are actually in-market, not just people who match a title. Build a targeted list, verify every contact, and push directly to Smartlead, Instantly, Lemlist, or your CRM. Pricing starts free (75 verified emails/month), and paid plans run roughly $0.01 per lead. For a team of 5 SDRs, that's the difference between a few hundred dollars a month and $15K+/year on enterprise alternatives. The results speak for themselves: Snyk's 50-person AE team cut bounce rates from 35-40% to under 5% and grew AE-sourced pipeline 180% after switching.

Apollo is the best free-tier prospecting tool on the market. A massive B2B database, built-in sequencing, and paid plans from $49-$99/user/month. It's the obvious starting point for teams that want prospecting and sequencing in one platform. The tradeoff: email accuracy runs lower (around 79%), and phone data is thinner. Good for volume prospecting, less reliable for high-stakes outreach where every bounce hurts your domain.

Our recommendation: Prospeo for verified emails and mobiles, Apollo for prospecting sequences, Clay for enrichment workflows. That's your data stack.

Conversation Intelligence, Deliverability, and AI Tools

Gong at $115-$135/user/month for conversation intelligence. It's not close - the deal intelligence and call analysis are in a different league.

Smartlead or Instantly for email deliverability infrastructure. If you're running cold outbound at any volume, you need dedicated sending infrastructure with inbox rotation. Both run $30-$100/month depending on volume.

Lavender for email coaching - it often doubles reply rates by catching the mistakes reps don't see (too long, too formal, buried CTA).

Clay for enrichment workflows - waterfall enrichment across multiple data sources, automated research, and AI-powered personalization. Runs $150-$500/month depending on credits.

Sales Navigator at $100-$180/user/month. Essential for account research and social selling, especially in enterprise. Every $1 spent on social selling yields $5 in ROI - making it one of the highest-return line items in your stack. (If you want the data, see these social selling statistics.)

Common Room deserves a mention for teams investing in community and intent signals. Companies using it report 30% more meetings per rep and 74% more pipeline in a single quarter. It's not a must-have for every team, but if your buyers are active in communities, Slack groups, or open-source ecosystems, it's a force multiplier.

Full Tool Stack Pricing Table

| Category | Tool | Price Range | Notes |

|---|---|---|---|

| CRM | HubSpot/Salesforce | $100-$150/user/mo | Pick based on complexity |

| Engagement | Outreach/Salesloft | $110-$165/user/mo | Pick based on CRM + workflow |

| Data | Prospeo | Free-$0.01/lead | 98% email accuracy, weekly refresh |

| Data | Apollo | Free-$99/user/mo | Best free tier, built-in sequencing |

| Data | ZoomInfo | $15K-$40K+/yr | Enterprise-grade, annual contracts |

| Intelligence | Gong | $115-$135/user/mo | Best-in-class call analytics |

| Deliverability | Smartlead/Instantly | $30-$100/mo | Inbox rotation, warm-up |

| Email coaching | Lavender | $29-$49/user/mo | Doubles reply rates |

| Enrichment | Clay | $150-$500/mo | Waterfall enrichment workflows |

| Social selling | Sales Navigator | $100-$180/user/mo | Account research, social selling |

| Community signals | Common Room | Not public | Intent from community activity |

Blended stack total: $475-$1,000 per rep per month. That's on top of compensation. Factor it into your budget from day one.

Data Quality - The Silent Killer of Outbound Prospecting

Every tool vendor claims 95% accuracy. Then you upload their data and bounce 20% of your emails.

I've seen it happen more times than I can count.

B2B data degrades 22-30% annually. People change jobs, companies get acquired, emails get deactivated. In high-turnover industries like tech and staffing, decay hits 70%. Your "fresh" list from three months ago is already rotting.

The cost is staggering: reps lose 546 hours per year - that's 68 full working days - to bad data. Researching contacts that don't exist, calling disconnected numbers, sending emails that bounce.

But the worst damage isn't wasted time. It's domain reputation. A 20% bounce rate destroys your sender reputation with Google and Yahoo. Since their February 2024 requirements kicked in, you need SPF, DKIM, and DMARC authentication, and spam complaints below 0.3%. One bad list can tank your deliverability for months.

Use separate subdomains for cold outreach - never send cold emails from your primary domain.

This is why data refresh cycles matter more than database size. When the industry average between updates is 6 weeks, a weekly refresh cycle means your contact data stays current through job changes, company moves, and email deactivations. The difference between a healthy sender reputation and spending three months rebuilding one often comes down to whether your data provider verified that email this week or last month.

SDR Performance Benchmarks and KPIs

Activity and Conversion Benchmarks

Based on Optif.ai's analysis of 939 B2B SaaS companies, here's what good looks like:

Daily activity targets:

- 50-80 outbound calls

- 30-50 cold emails

- 15-25 social touches

- 140-170 total activities (top quartile)

Channel conversion rates:

| Channel | Conversion Rate | Notes |

|---|---|---|

| Cold call | 2.0-3.5% | Best for immediate engagement |

| Cold email | 0.8-2.0% | Volume play, needs great copy |

| Social DM | 2.0-4.5% | Highest per-touch, lowest volume |

| Multi-touch | 4.0-7.0% | 3x single-channel performance |

Meeting benchmarks:

- Top quartile: 12-15 qualified meetings/month

- Median: 8-10

- Bottom quartile: 4-6

- Elite 10%: 18+

Qualified meetings should be 60-70% of total booked calls. If you're booking 15 meetings but only 9 are qualified, you've got a targeting problem, not an activity problem.

The KPIs That Actually Matter

Teams tracking 5-7 core KPIs achieve 91% average quota attainment vs. 73% for teams tracking 0-3 metrics. That's an 18-point gap from simply measuring the right things.

Use a 4-category framework:

| Category | Who Owns It | Key Metrics |

|---|---|---|

| Revenue & Growth | Execs | Revenue, growth rate, win rate |

| Pipeline Health | Managers + Reps | Pipeline value, velocity, coverage |

| Sales Efficiency | Managers | Cost per meeting, cycle length, CAC |

| Activity & Forecast | Reps | Calls, emails, meetings, forecast accuracy |

Different roles need different dashboards. Reps should see Activity + Pipeline. Managers should see Efficiency + Forecast. Execs should see Revenue + Growth. Don't give everyone the same 15-metric dashboard - they'll ignore all of it.

The 7 metrics that actually matter for outbound specifically: connect rate, meeting rate, lead-to-opportunity conversion, pipeline value, sales cycle length, cost per meeting, and outbound ROI.

Vanity metrics warning: open rates, emails sent, and calls made are noise without conversion context. An SDR making 100 calls a day with a 0.5% meeting rate is less productive than one making 40 calls with a 5% rate. Track outcomes, not activity theater.

Common Mistakes That Kill Outbound Sales Teams

1. Generic templates for every prospect. Rosalyn Santa Elena from RevOps Collective nails it: the most common error is using the same template regardless of company, persona, or pain point. If you aren't relevant, you won't get replies.

2. Not standing out in crowded inboxes. Alper Yurder from Flowla calls this the #1 challenge in outbound today. Ambiguous subject lines, vague value props, and "just checking in" follow-ups get deleted on sight.

3. Running 2019 playbooks in 2026. If your strategy is still "100 dials a day with no enrichment," you're competing against teams using AI-powered research, intent signals, and multi-channel cadences. The game changed.

4. Broken onboarding. SDR turnover averages 35% annually. Every failed hire costs $212K+. Invest in structured ramp or pay the attrition tax. There's no third option.

5. Single-channel reliance. Email-only outbound converts at 0.8-2%. Multi-channel hits 4-7%. That's a 3x multiplier, not a marginal improvement. If your team isn't calling and engaging socially alongside email, you're leaving pipeline on the table.

6. Ignoring data quality. Hundreds of hours per rep per year vanish to bad data. Fix your data before you fix your messaging.

7. Misalignment between inbound and outbound. When inbound and outbound teams target the same accounts with different messaging - or worse, don't share intelligence at all - you get overlap, confusion, and wasted effort. Shared ICP definitions, shared account lists, shared CRM data. Non-negotiable.

Multi-channel cadences convert 3x higher - but only if your contact data actually connects. Prospeo gives your outbound team 143M+ verified emails and 125M+ direct dials with a 30% pickup rate. That's the difference between 2% and 18% conversion.

Equip your outbound team with data that books 26% more meetings.

FAQ

How many SDRs do I need per AE?

The average ratio is 2.6 AEs per SDR. For outbound-heavy teams, plan 2 outbound SDRs per 1 inbound SDR. Use the inverse of your win rate to calculate pipeline needs, then divide by $3M per SDR annually to size the team.

How long does it take for a new SDR to ramp?

Expect 3-4 months to full productivity. Month 1 targets 20-30% of quota, Month 2 hits 40-60%, Month 3 reaches 70-90%. First qualified meetings typically come in weeks 3-4, but consistent output takes the full ramp period.

Should I outsource my SDR team or build in-house?

Outsource for speed - 2-4 weeks to start at $3K-$6.5K/month. Build in-house for control - 3-6 months to start at $9.7K-$14.4K/month. Many teams start outsourced while building in-house capability. It's not either/or.

What's the most important tool for outbound sales teams?

Your data platform. Bad contact data wastes 546+ hours per year per rep and destroys domain reputation. A tool with 98% email accuracy and weekly data refresh - like Prospeo's free tier (75 verified emails/month) - lets you validate your ICP before committing real budget.

Are AI SDRs replacing human SDRs in 2026?

For email-based outbound, AI handles 60% of routine work at a fraction of the cost ($2K-$8K/year vs. $100K-$130K). But the winning model is 2-3 humans plus AI agents, not full replacement. Humans still own complex multi-threading and relationship building.