Emelia Pricing (2026): Plans, Credits, and What You'll Really Pay

Emelia pricing looks simple until you try to budget it like an operator. The plan fee is the easy part; the real monthly cost is driven by how many mailboxes you run and how many credits you burn on data.

And yes, the "unlimited" wording trips people up.

If you remember one thing, make it this: your outbound budget usually has three lines, not one.

Emelia pricing at a glance (2026)

Emelia uses a straightforward model: you pay a platform subscription (Start/Grow/Scale), then you optionally buy credits if you want Emelia to find emails, verify emails, find phone numbers, or run certain AI actions. Emelia doesn't charge per email sent; sending volume is constrained by your mailbox provider, not Emelia.

Most pricing pages gloss over the all-in picture. In practice, your spend breaks down like this:

- Emelia plan (fixed)

- Mailbox stack (Google/Microsoft licenses + domains)

- Credit burn (variable, and it spikes fast if you pull phone numbers)

What changes your cost fastest? Mailboxes and phones. Mailboxes because scaling safely means adding inboxes. Phones because Emelia prices them at 50 credits per number, which can chew through bundles in a hurry.

One more note: Emelia's plan grid is in EUR. A lot of directories default to USD, which is why you'll see mismatched numbers floating around.

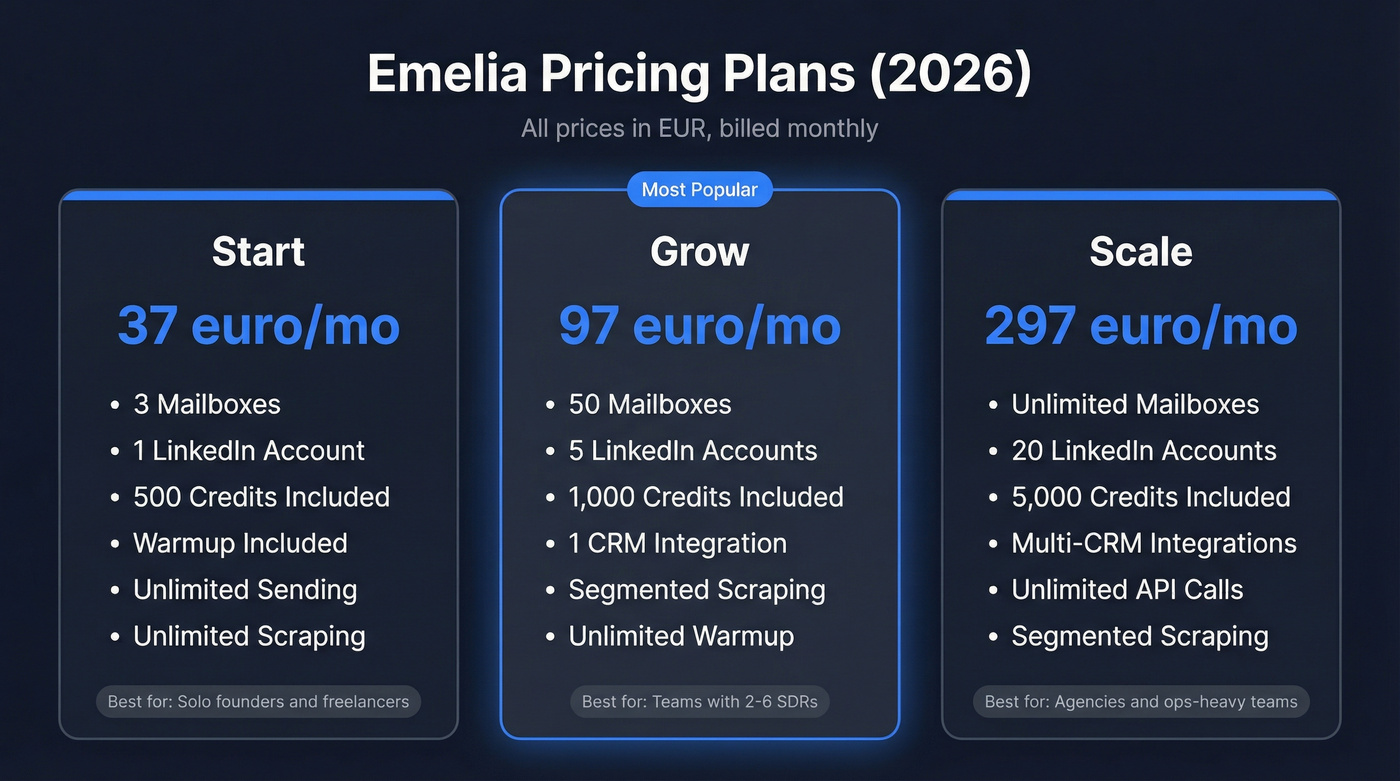

Plan table (monthly)

| Plan | Price | Mailboxes | LinkedIn accts | Credits incl. |

|---|---|---|---|---|

| Start | €37/mo | 3 | 1 | 500 |

| Grow | €97/mo | 50 | 5 | 1,000 |

| Scale | €297/mo | Unlimited | 20 | 5,000 |

Who each plan fits

- Start: Solo founder, freelancer, or one SDR who wants warmup + basic multichannel without paying for team plumbing.

- Grow: The "real team" plan. If you need CRM integration or you're rotating lots of inboxes, this is usually the sweet spot.

- Scale: Agencies and outbound teams running lots of mailboxes, multiple CRMs, and API workflows. It's the only plan that feels built for ops-heavy setups.

What each Emelia plan includes (and what's gated)

The tiers aren't just "more volume." Emelia gates operational features (especially integrations) that matter once you're past the tinkering stage.

It also matters for list-building: segmented scraping (the workflow that helps you work past the classic 2,500-result ceiling) becomes a real advantage once you're doing this every week, not once a quarter, because it turns a "hit a limit and stop" workflow into something you can run continuously without babysitting.

Start (what you get / who should avoid it)

What you get

- Connect 3 mailboxes

- Warmup included

- Unlimited email sending + unlimited actions

- Unlimited scraping + unlimited contacts

- 500 free credits

- 1 LinkedIn account

Use this if

- You're running lean outbound and you're fine living in CSV land for a while.

- You want warmup baked in without paying extra (a lot of tools nickel-and-dime here).

Skip this if

- You need a native CRM integration. You'll outgrow Start the moment you care about clean attribution and lifecycle stages.

Grow (CRM integrations start here)

What you get

- Connect 50 mailboxes

- Unlimited warmup

- Segmented scraping

- 1 CRM integration

- 1,000 free credits

- Up to 5 LinkedIn accounts

Here's the thing: CRM integrations start at Grow. That's the gating lever. Salesdorado calls this out, and it matches Emelia's plan grid: Start is for sending; Grow is for running a system.

Skip this if

- You're an agency that needs to push data into multiple client CRMs. You'll hit the "1 integration" ceiling fast.

Scale (API + multi-CRM + unlimited mailboxes)

What you get

- Unlimited mailboxes

- Multi-CRM integrations

- Unlimited API calls

- 5,000 free credits

- Up to 20 LinkedIn accounts

- Segmented scraping + unlimited warmup + unlimited contacts

Scale is Emelia saying: "Ok, you're doing real ops now."

If you're building workflows (enrichment, routing, dedupe, webhooks), unlimited API calls alone can justify the jump, because the moment you start automating list pulls and enrichment in the background, metered API calls turn into a surprise bill you didn't plan for.

Emelia credits: how add-ons actually work

Emelia's subscription is your "platform access." Credits are your "usage meter" for data and certain actions.

The key point: you don't need credits if you just want to send emails or run actions. If you're sequencing from your own lists, you can run Emelia close to the sticker price.

Where teams get surprised is using Emelia as a data provider: finding emails, verifying, and especially pulling phone numbers. Phone finding is the fastest way to spike spend.

One thing we've tested and genuinely like: subscription credits roll over and one-time credit packs don't expire. That's rare in this category, and it makes budgeting less painful if your list-building comes in sprints.

What consumes credits (conversion table)

| Action | Credit cost | What it means |

|---|---|---|

| Find email | 1 | 1 email found |

| Verify email | 0.25 | 4 checks = 1 credit |

| Find phone | 50 | 1 number = 50 credits |

Two implications that matter in real life:

- Verification is cheap. You can verify 4,000 emails with 1,000 credits.

- Phones are expensive. 1,000 credits buys only 20 numbers.

I've watched a team do a "quick enrichment pass" before a Monday call blitz, toggle on phone finding, and burn through a month's credits before they'd even finished cleaning the CSV. They weren't doing anything wrong; they just didn't realize phones were priced like that.

Rollover vs never-expire (why it matters)

Emelia runs two credit behaviors:

- Subscription credits roll over month to month while you're subscribed. If you don't use them, they accumulate.

- One-time pay-as-you-go packs don't expire.

Practical reading:

- If your usage is spiky (big list builds once a quarter), packs are the cleanest way to buy.

- If your usage is steady (weekly enrichment), the €19/mo add-on is a sensible baseline.

What happens to credits if you cancel or downgrade

Emelia is clear about two things on its public pages: unused subscription credits roll over while you're subscribed, and one-time credit purchases don't expire. What's not spelled out publicly is what happens to rolled-over subscription credits after cancellation or a downgrade.

Most SaaS credit systems work like this: one-time packs remain available, while subscription credits stop accruing when the subscription ends. Before you stockpile, check the in-app billing/credits screen so you know exactly what you're buying.

Credit pricing: monthly add-on + pay-as-you-go packs

Emelia gives you two ways to buy credits: a small monthly subscription add-on, or one-time packs.

Monthly credits subscription (€19) breakdown

For €19/mo, Emelia presents a bundle expressed as:

- 1,000 emails found

- 1,000 AI actions

- 20 numbers

- 4,000 verifies

Based on Emelia's conversion rates (1 credit/email, 0.25/verify, 50/phone), that maps to about 1,000 credits worth of usage.

Quick math that matters:

- If you need 40 numbers/month, you're already at ~€38 in credit add-ons (or a pack).

- If you need 10,000 verifications, that's 10,000 x 0.25 = 2,500 credits (packs start to make more sense).

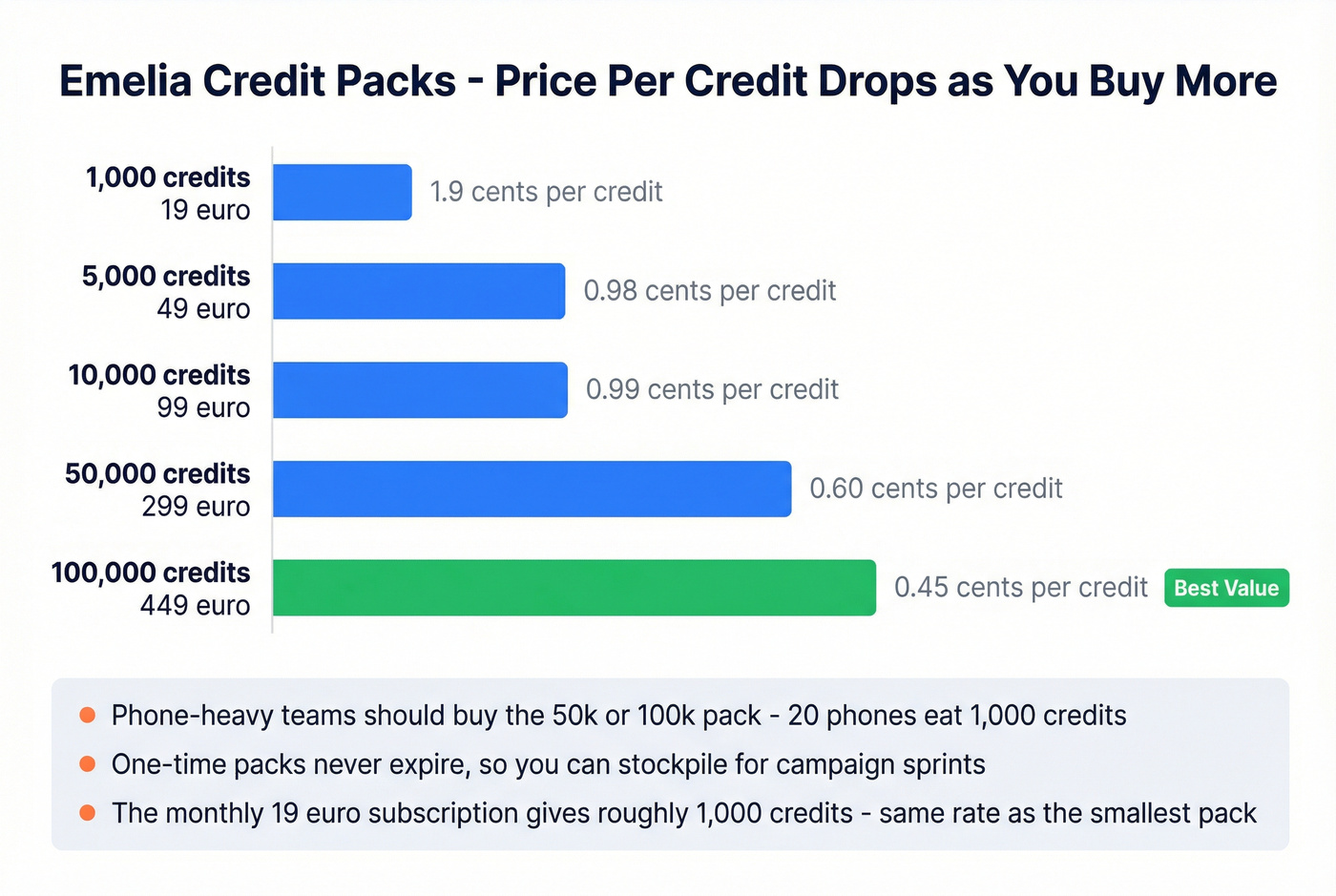

Pay-as-you-go packs table (and when packs beat subscription)

| Pack size | Price |

|---|---|

| 1,000 credits | €19 |

| 5,000 credits | €49 |

| 10,000 credits | €99 |

| 50,000 credits | €299 |

| 100,000 credits | €449 |

When packs beat the subscription:

- You're doing phone-heavy enrichment (because 50 credits/number adds up fast).

- You're doing big one-time verification on a legacy list.

- You want to stockpile credits for a campaign sprint without adding a recurring line item.

Emelia charges 50 credits for a single phone number. Prospeo gives you access to 125M+ verified mobiles with a 30% pickup rate - plus 143M+ emails at 98% accuracy. No credit math gymnastics, no surprise burns.

Stop doing credit conversion math. Get verified data at $0.01 per email.

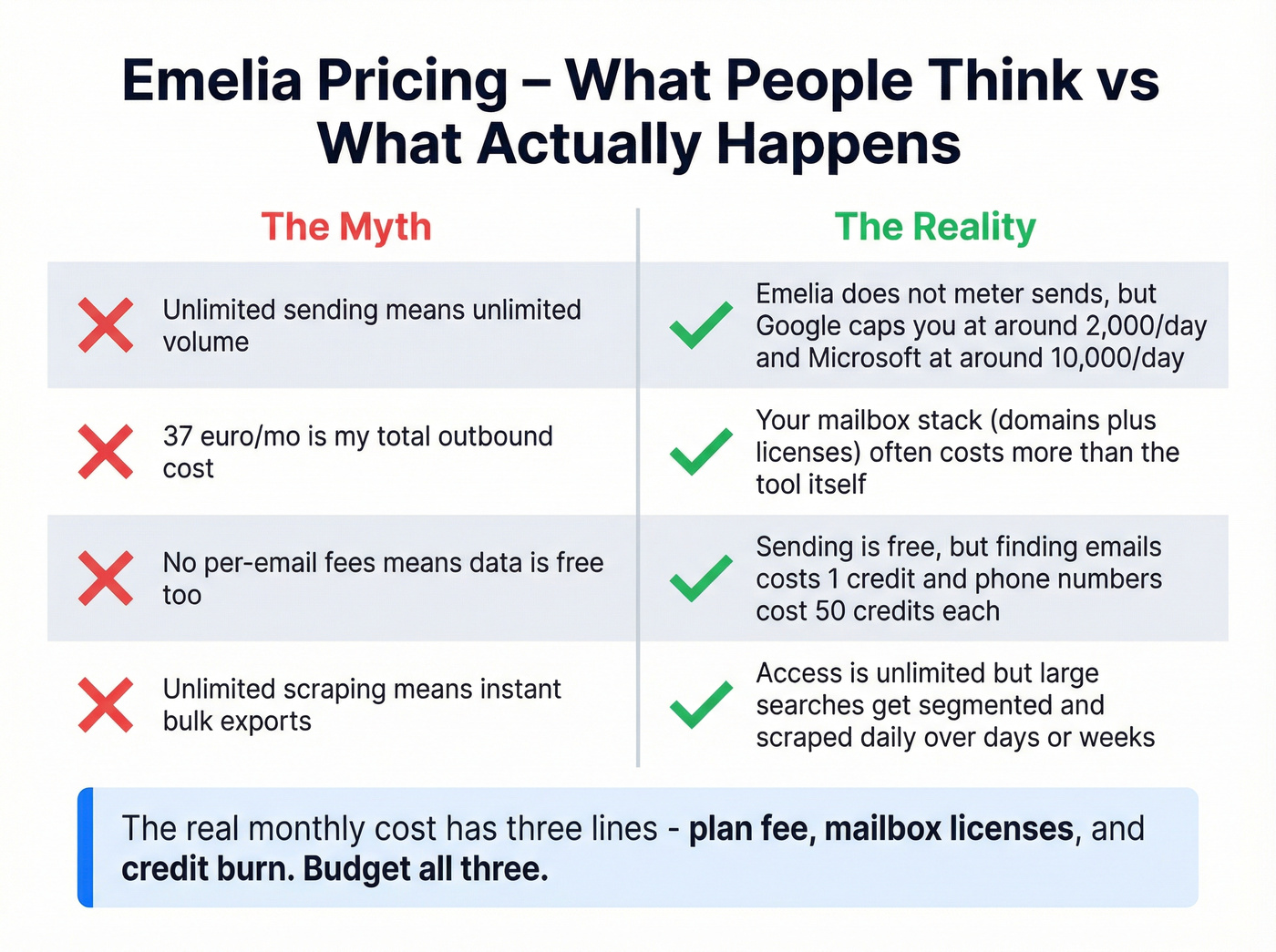

The biggest pricing misunderstanding: "Unlimited sending" isn't unlimited volume

Emelia's plans say "unlimited sending," and that's true in the sense that Emelia won't charge you per email sent.

But Emelia connects to your mailbox. It doesn't run its own SMTP servers. So your mailbox provider is the real limiter.

Typical provider caps you'll run into:

- Google Workspace: ~2,000/day

- Free Gmail: ~500/day

- Microsoft 365/Office 365: up to ~10,000 recipients/day

These caps vary by plan, account age, compliance posture, and sending method. Treat them as typical ceilings, not promises.

Myth vs reality (quick table)

| Claim | Reality |

|---|---|

| "Unlimited sending" | Emelia doesn't meter sends, but your provider caps daily volume. |

| "€37/mo is my outbound cost" | Your mailbox stack often costs more than the tool. |

| "No per-email fees" | True for sending, but data actions consume credits, especially phones. |

| "Unlimited scraping" | Access is unlimited; segmentation + daily scraping means exports happen over time. |

Why you end up paying for more mailboxes (with real numbers)

Mailbox rotation is the hidden budget line.

If you want to send more without torching deliverability, you add inboxes and spread volume. Emelia makes that operationally easy (multi-sender rotation), but you still pay for extra mailbox licenses, extra domains (often), and warmup time and monitoring.

A conservative planning range: ~$6-$25 per mailbox per month depending on provider and plan. At 20 mailboxes, that's roughly $120-$500/month before you buy a single credit pack.

Look, mailbox sprawl is the most expensive way to "feel productive." If your average deal size is modest and outbound isn't already working, don't rush to 30-50 inboxes. Fix your list quality and offer first.

Scraping pricing reality: "unlimited" vs segmented scraping (and the 2,500 limit)

Emelia's scraping language is another place people misread the fine print.

Sales Navigator exports have a well-known 2,500 results ceiling per search. Emelia's approach (as described in its hub documentation) is to slice a large search and scrape it daily over time so you can go beyond that cap.

Operationally, you're not getting 30,000 leads instantly. You're getting a managed drip of results designed to keep the workflow consistent.

What it looks like in practice:

- You launch a scrape from a big search.

- Emelia breaks it into smaller chunks.

- It scrapes daily until it completes the full set.

- There's a SPLIT button that separates already-scraped results from what's left.

We like the segmentation workflow; we hate that "unlimited" hides the time-to-export reality. If you're buying Emelia mainly for scraping, plan around days or weeks, not minutes.

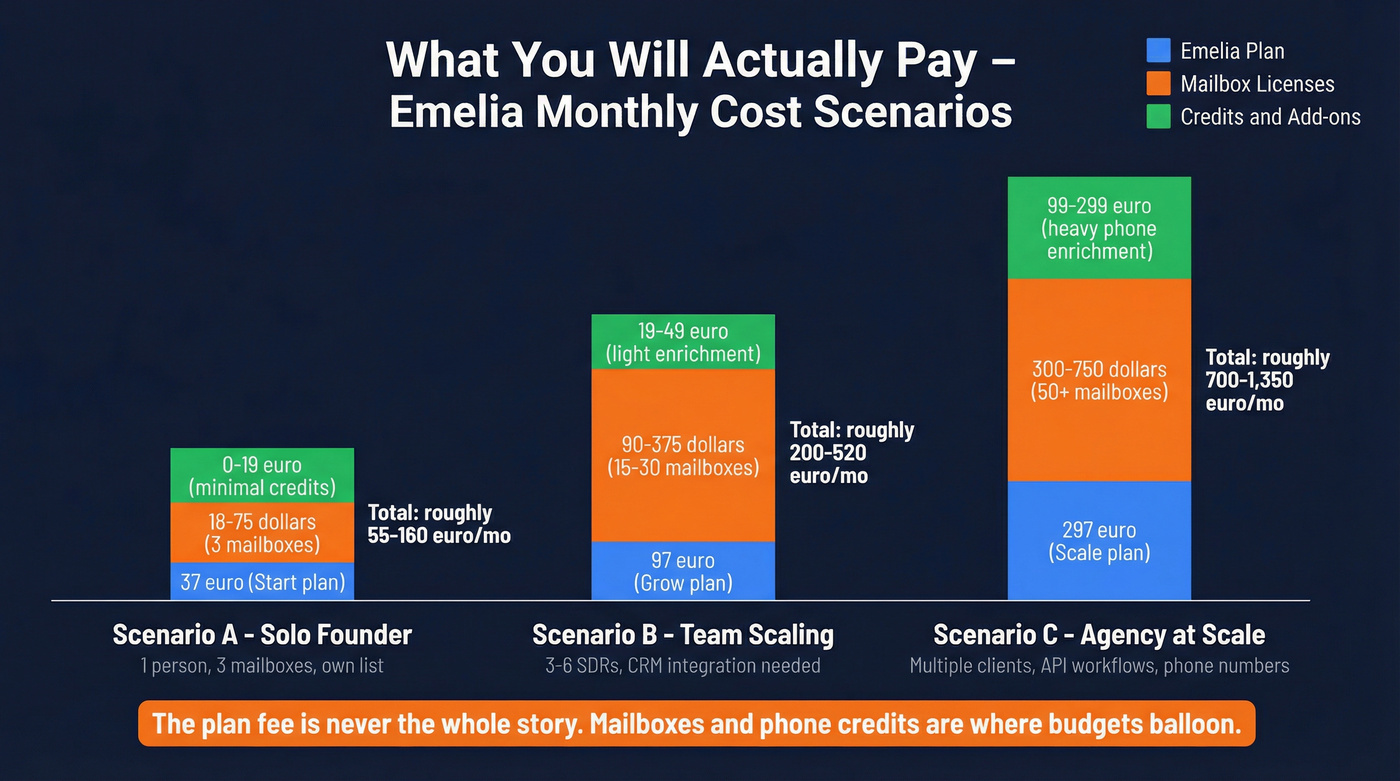

Emelia pricing: true cost scenarios (what you'll pay in month 1)

These are back-of-the-napkin scenarios, but they answer the real question: plan + mailboxes + credits.

Scenario A (lean outbound)

Setup

- 1 person

- 3 mailboxes

- Mostly sending + warmup

- Minimal data usage (you already have a list)

Month 1 cost (typical)

- Emelia Start: €37

- Credits: €0-€19

- Mailboxes: 3 x $6-$25 = $18-$75

- Domains (optional): $0-$30

All-in estimate: ~€37 + $18-$124 (plus VAT if applicable)

What surprises people

- Nothing, usually. This is where the tool is genuinely great value.

Scenario B (team scaling)

Setup

- 3-6 SDRs

- 15-30 mailboxes total (rotation + ramp)

- Need CRM integration

- Light enrichment (find/verify as you build lists)

Month 1 cost (typical)

- Emelia Grow: €97

- Credits: €19-€99 (monthly add-on or a 10k pack if you're building lists aggressively)

- Mailboxes: 15-30 x $6-$25 = $90-$750

- Domains (often): $20-$100

All-in estimate: ~€116-€196 + $110-$850 (plus VAT if applicable)

Credit math example

- Verify 8,000 emails: 8,000 x 0.25 = 2,000 credits

- Find 1,000 emails: 1,000 x 1 = 1,000 credits

- Total: 3,000 credits

In deliverability cleanups, we've seen teams blame the outreach tool for cost creep when it was really mailbox sprawl plus enrichment habits.

Scenario C (data-heavy: phones + verification)

Setup

- You're using Emelia as a data layer: phone + verification at scale

- You want direct dials for a call-first motion

Month 1 cost (illustrative)

- Emelia Grow or Scale: €97-€297

- Credits: €99-€449+ depending on phone volume

- Mailboxes: 10-40 x $6-$25 = $60-$1,000

All-in estimate: ~€196-€746 + $60-$1,000 (plus VAT if applicable)

Phone + verify example

- Pull 200 phone numbers: 200 x 50 = 10,000 credits

- Verify 20,000 emails: 20,000 x 0.25 = 5,000 credits

- Total: 15,000 credits

At that point, your subscription is the cheap part. Your credit strategy is the whole game.

VAT, taxes, and what you'll see at checkout (EU buyers)

If you're in the EU/UK, VAT is the most common "wait, why is it higher?" moment.

- SaaS prices are typically shown ex-VAT on pricing grids.

- At checkout, VAT is usually added unless you enter a valid VAT ID (reverse charge for eligible B2B purchases).

- Emelia is operated by BRIDGERS SAS (France) and issues invoices accordingly; expect the invoice to reflect the VAT treatment your business qualifies for.

Before you commit internally, do a quick checkout run with your billing details so finance sees the exact tax line item.

When a data-first tool is cheaper than an all-in-one

If Emelia credits become the bottleneck, keep Emelia focused on sequencing and add a dedicated data layer.

Prospeo is "The B2B data platform built for accuracy": 300M+ professional profiles, 143M+ verified emails, and a 7-day refresh cycle (the industry average is about 6 weeks). In our experience, this setup is the cleanest way to keep unit economics sane: you run sequences in Emelia, and you source/verify contacts in a system that's built for accuracy and freshness first.

Your outbound budget shouldn't have three surprise line items. Prospeo's all-in-one platform includes email finding, verification, mobile numbers, and 30+ search filters - refreshed every 7 days, not 6 weeks.

One platform, transparent pricing, 98% email accuracy. See why 15,000+ teams switched.

What reviewers consistently praise (and what they ding)

Independent reviews are thin for niche outbound tools, but there's still a pattern.

- Pricing clarity: Salesdorado rates Emelia 4.5/5 and highlights that the tiering is easy to understand once you separate subscription vs credits.

- Operational usefulness: reviewers tend to like that Emelia bundles warmup and supports multi-mailbox workflows without turning everything into an enterprise contract.

- The common complaint: the word "unlimited" creates the wrong expectation. Sending is capped by providers, and scraping/exporting happens over time via segmentation.

That's not a deal-breaker. It's just a reminder to budget like an operator, not like a pricing page.

Pricing confusion audit (why you'll see conflicting numbers online)

You'll see Emelia pricing described three different ways online, and it's annoying because it makes you second-guess the real model.

What to trust:

- Canonical tiers: €37 / €97 / €297 from Emelia's site.

- Mailbox-based directory framing: things like "$20 per connected address" show up in directories (often displayed in USD). That's an interpretation of how costs scale, not the checkout model.

- Partner/legacy numbers: you'll also find "19€/address" style pricing on partner pages. That's older packaging or partner framing, not how most buyers purchase today.

Real talk: the cost does scale with mailboxes in practice, so those "per address" descriptions aren't totally wrong. They're just not how Emelia sells it now.

Final checklist: keep Emelia pricing predictable

- If you need a native CRM integration, start on Grow (integrations are gated there).

- If you're sending high volume, budget for more mailboxes first; provider limits drive scaling more than the tool does.

- Treat credits as optional unless you're doing finder / verify / phone / AI.

- If your usage is steady, add the €19/mo credits bundle.

- If your usage is spiky or phone-heavy, buy packs (they don't expire).

- Don't confuse "unlimited sending" with "unlimited deliverable volume." Your mailbox provider sets the ceiling.

Concrete next step: open your provider's sending-limit page, decide how many inboxes you can responsibly run this quarter, then pick one credit strategy (monthly add-on for steady use, packs for sprints). That's how you keep Emelia pricing predictable.