Global Database Pricing: What It Actually Costs in 2026

Go to Global Database's website and click "Pricing." You'll get a 404 error. Not a "contact sales" page, not a gated PDF - a dead link. That's the state of global database pricing transparency in 2026, and it's probably why you're here.

(Not looking for this? If you need AWS Aurora Global Database or Oracle Globally Distributed Database pricing, you're in the wrong place. This covers Global Database, the B2B company intelligence platform headquartered in the UK.)

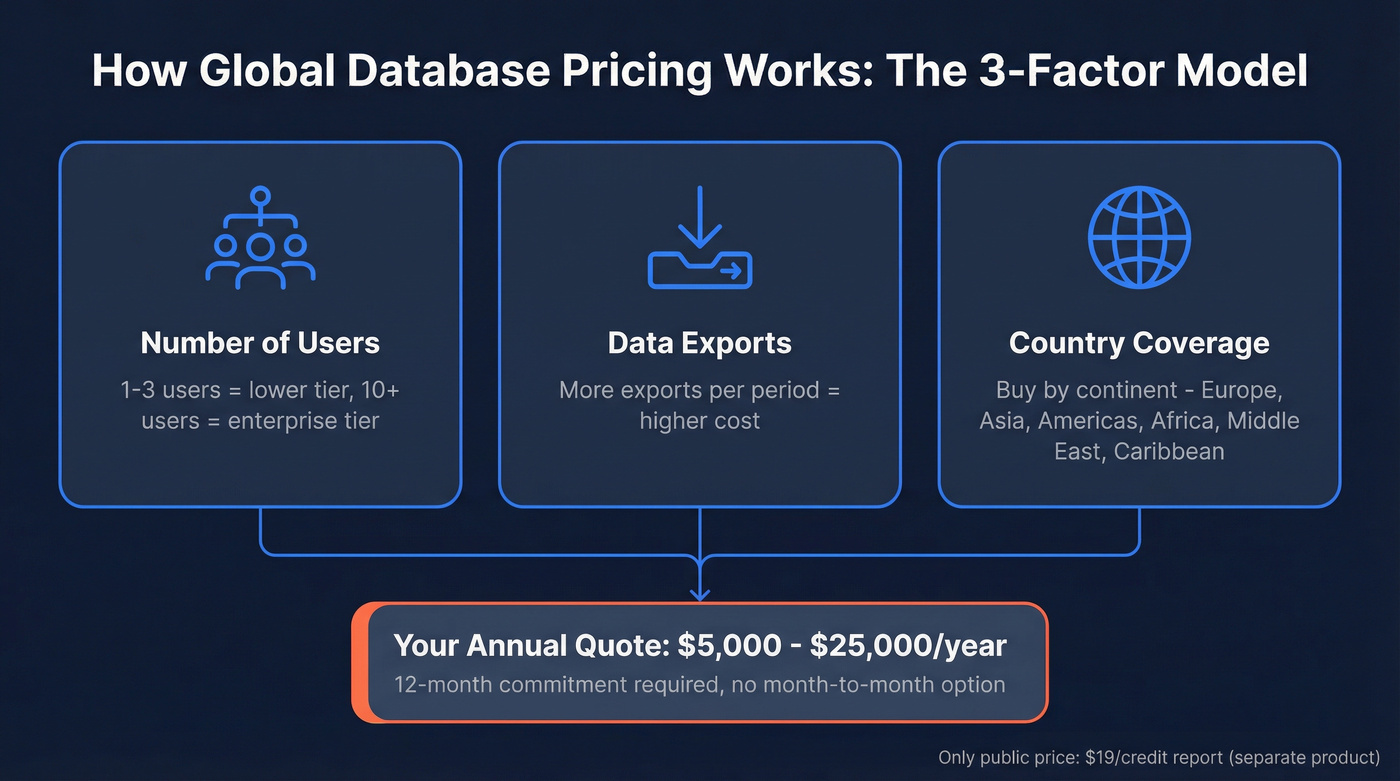

Global Database prices its prospecting platform based on three factors: number of users, number of data exports, and number of countries you need access to. Expect to pay somewhere between $5,000 and $25,000 per year depending on how those three dials are set. The only hard number they publish anywhere? $19 per business credit report. Everything else requires a sales conversation.

How Global Database Pricing Works

The Three-Factor Model

Global Database doesn't use per-seat or per-credit pricing in the traditional sense. Your quote is built around three variables:

- Number of users on the account

- Number of data exports you need per period

- Number of countries in your coverage package

They sell continent-based packages - Europe, Asia, North America, Latin America, Africa, Caribbean, and Middle East - so you're buying geographic slices of their database. More countries, higher price. Simple math, opaque execution.

All subscriptions run on a yearly license with a 12-month commitment. There's no publicly available month-to-month option. This is standard for enterprise B2B data providers, but it means you're committing real budget before you've had time to validate data quality at scale.

Estimated Costs by Team Size

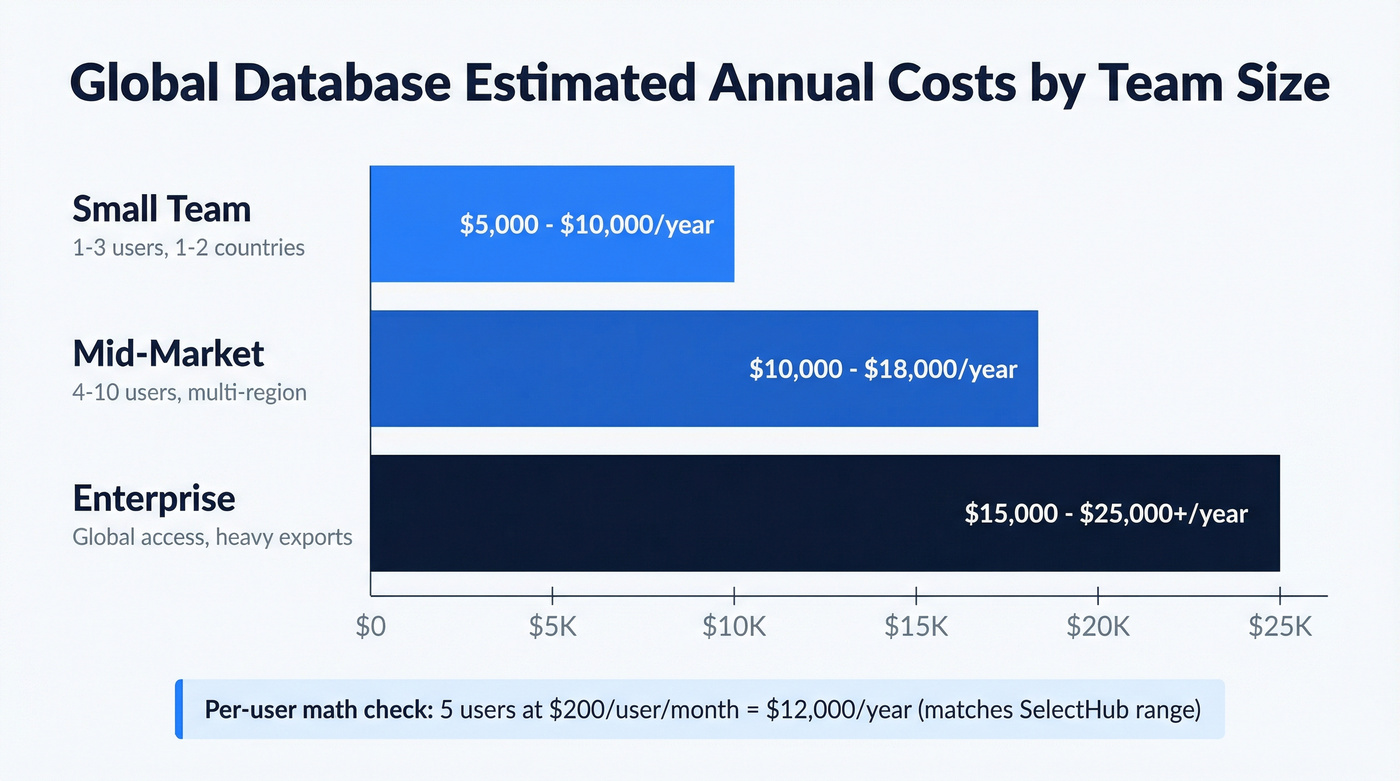

Nobody publishes exact figures because they don't exist in a fixed form. But based on the three-factor model and what mid-market buyers typically pay for comparable B2B data providers, here's what to expect:

- Small team (1-3 users, 1-2 countries): $5,000-$10,000/year

- Mid-market (4-10 users, multi-region): $10,000-$18,000/year

- Enterprise (global access, heavy exports): $15,000-$25,000+/year

SelectHub places Global Database in the $100-$500 range on their normalized pricing scale, which maps to per-user/per-month costs across their evaluated vendors. That math checks out: a 5-user team at $200/user/month hits $12,000/year.

For context, a Reddit buyer shopping for ZoomInfo alternatives described a hard budget ceiling of $10,000 with a preference for $5,000. Global Database's small-team pricing lands right in that zone.

Business Credit Reports - The Only Public Price

The one number Global Database actually publishes: $19 per business credit report on a pay-as-you-go basis, confirmed on their G2 pricing page.

Here's the catch - this is the compliance product (credit scores, financial data, shareholder intel, group structure), not the sales prospecting platform. They're separate products under the same brand. The Business Credit Risk API has a free trial available, but annual API access is priced via quote.

Don't confuse the $19/report price with the prospecting platform. Different products, different problems.

What's Included in a Global Database Subscription

Global Database positions itself as a multi-product platform, not just a contact database. Their client list includes Microsoft, Oracle, Cisco, KPMG, Uber, SAP, and DHL - which tells you the data quality justifies the price for the right buyer. Here's what a prospecting subscription typically includes:

- Sales Prospecting Platform - 195 countries, 100+ search filters, daily data updates, CRM integrations with Salesforce, HubSpot, Pipedrive, Marketo, Mailchimp, Salesloft, and Outreach

- Free Browser Extension - company verification, UBO identification, and financial data on the web

- Data Enrichment - upload CSV/TXT/XLSX files for list enrichment

- Sales Engagement - outbound campaign automation built into the platform

- Tenders & Grants - access to government and private tenders, useful for companies selling into public sector or tracking procurement opportunities

- API Access - for building custom integrations and automating workflows

One Reddit user from 2019 described being able to "download unlimited contacts in xl file without any additional costs." That's a single data point from years ago, but it aligns with the yearly license model rather than a per-credit system.

The platform also includes org charts, financial documents per company, and a follow/notification feature for tracking contact changes. The daily data update claim is notable - most competitors refresh weekly or monthly. One Reddit user reported that the "rate of active emails was never lower than 96%," though I'd want to see that validated across a larger sample before treating it as gospel.

Global Database charges $5,000-$25,000/year behind a sales wall. Prospeo gives you 300M+ profiles with 98% email accuracy at ~$0.01 per email - no annual contracts, no "contact sales" gates.

Stop paying five figures for a database with a 7.5x size discrepancy.

Hidden Costs and Add-Ons to Watch For

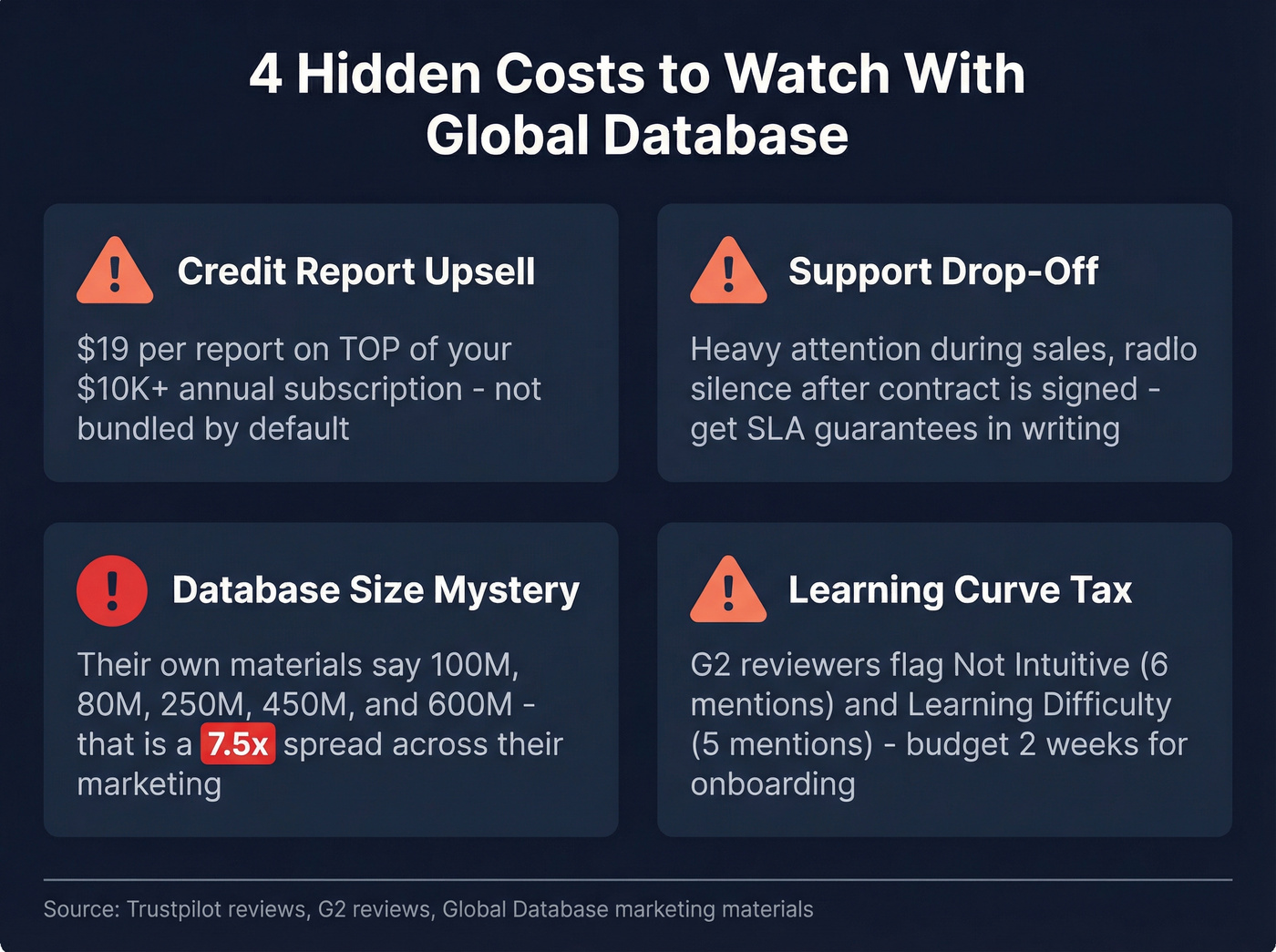

The credit report upsell. One Trustpilot reviewer put it bluntly: "After your subscription you still have to pay for credit reports etc. which paying double if you were initially looking for the credit report." If you need both prospecting data and credit reports, confirm upfront whether credit reports are bundled or billed separately. Getting hit with $19/report charges on top of a $10,000+ annual subscription stings.

The post-sale support drop-off. Another Trustpilot pattern: "Account manager was very helpful till the time of opening the account, after that very poor service." I've seen this play out across dozens of B2B data vendors - heavy attention during the sales cycle, then radio silence once the contract's signed. Push for SLA guarantees in writing.

The database size question mark. This one's genuinely confusing. Global Database's own competitor comparison page references "100 million verified contacts from 80+ countries." Their G2 profile says 80M+ business profiles. An InfobelPRO comparison lists them at 250 million companies. Datarade shows 450M direct contacts and 400M company profiles. And the homepage? 600M+ companies worldwide.

That's a 7.5x spread across their own marketing materials. When you're paying five figures for sales intelligence, you deserve to know which number is real.

The learning curve tax. G2's AI-summarized cons flag "Not Intuitive" (6 mentions) and "Learning Difficulty" (5 mentions). That's not a software cost - it's a time cost. If your reps spend two weeks figuring out the interface instead of prospecting, that's real money lost.

What Users Actually Say About the Value

Global Database's review profile is polarized in a way I rarely see with B2B data tools.

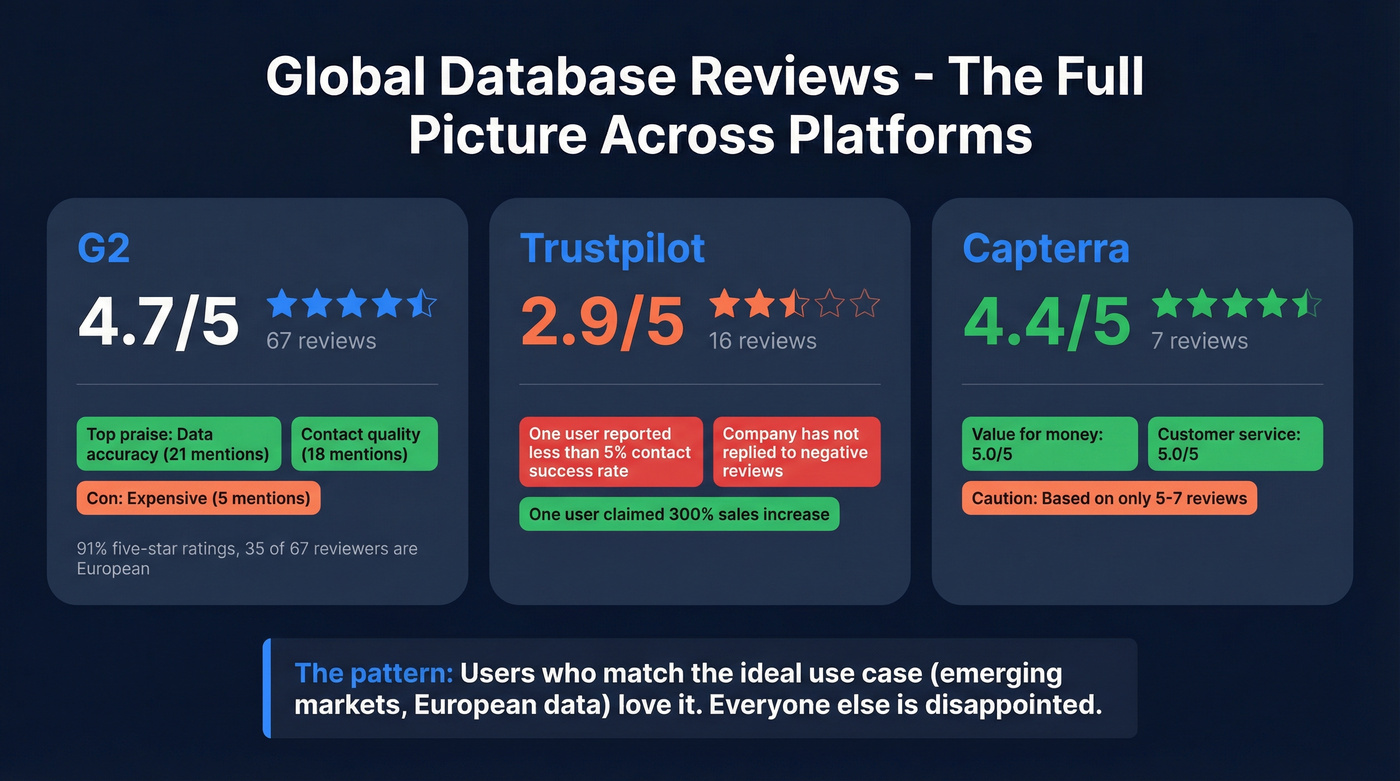

G2: 4.7/5 with 67 reviews. Overwhelmingly positive - 91% five-star ratings. One reviewer called the data accuracy "unparalleled." Top praise centers on data accuracy (21 mentions) and contact information quality (18 mentions). But dig into the cons and "Expensive" appears 5 times, alongside filtering issues and complex usability. The user base skews European (35 of 67 reviewers), which makes sense given the company's UK headquarters and emerging market focus.

Trustpilot: 2.9/5 with 16 reviews. A completely different story. One reviewer reported a less than 5% contact success rate. Another described a "fraudulent transaction" requiring four unanswered calls. The company hasn't replied to negative reviews, which is never a good look. On the positive side, a November 2024 reviewer wrote that it "improved our conversation rates significantly saving us time and money," and another claimed a 300% sales increase.

Capterra: 4.4/5 with 7 reviews. The standout here is a perfect 5.0/5 value-for-money score - though that's based on just 5 reviews. Customer service also scored 5.0/5.

Here's the pattern: users who get Global Database working well for their specific geography and use case love it. Users who expect plug-and-play simplicity or US-centric coverage tend to be disappointed. The value perception depends almost entirely on whether you're buying it for what it's actually good at - emerging market company data - or trying to use it as a general-purpose prospecting tool.

How Global Database Compares to Alternatives

| Tool | Est. Annual Cost | Database Size | Free Tier | Best For |

|---|---|---|---|---|

| Prospeo | Free-~$500/yr | 300M+ profiles | 75 emails/mo | Email accuracy + self-serve |

| Global Database | $5K-$25K/yr | 600M+ claimed | Guided trial | Emerging markets |

| Apollo.io | Free-$1,200+/user/yr | 275M+ contacts | Yes | Budget + sequences |

| ZoomInfo | $15K-$40K+/yr | 321M professionals | No | Enterprise US data |

| Cognism | $1.5K-$25K/yr | 400M profiles | No | EU phone-verified |

| Lusha | ~$350/user/yr | 100M+ profiles | Limited | Quick lookups |

| UpLead | ~$1,200/yr | 19M+ companies | 7-day trial | Accuracy guarantees |

For cost-per-1,000-rows context, a Lobstr.io analysis benchmarked the major players: ZoomInfo at $1,800, Cognism at $150, Apollo at $100, and Lusha at $80. Global Database doesn't appear in that analysis, but based on its positioning, expect it to land somewhere in the $150-$500 range per 1,000 contacts depending on your plan.

The industry benchmark: 75% of businesses rely on third-party data to fill gaps in their CRM, and most 20-person sales teams spend $25,000-$60,000 annually on sales intelligence tools. Global Database's mid-market cost ($10,000-$18,000) leaves room in that budget for complementary tools.

Here's how the alternatives actually stack up:

ZoomInfo is the enterprise default - and the most expensive. A 10-seat contract with intent data can run $30,000-$40,000+/year. Deepest US database, broadest feature set, highest price tag. Customers routinely negotiate 50% discounts off initial quotes, so never accept the first number.

Apollo.io is the budget play, and it's not close. Free tier, paid plans from $59/user/month scaling to $99+ for Professional and Organization tiers, and built-in email sequences. The database covers 275M+ contacts, though real-world email accuracy runs lower than advertised. Best for early-stage teams that need prospecting and outreach in one tool and can tolerate some bounce.

Cognism wins for European phone-verified contacts. Platinum plans start at $1,500-$10,000/year for small teams, but Diamond tier with mobile verification pushes to $25,000+. The renewal trap is real: third-party estimates peg annual increases at 10-15%. Ask your rep directly what Year 2 costs before signing Year 1.

Lusha is the quick-lookup tool at roughly $29/user/month (~$350/year). Good for individual reps who need a phone number fast. Not built for bulk prospecting - if you're exporting more than a few hundred contacts per month, you'll burn through credits immediately.

UpLead runs about $99/month with a 95% data accuracy guarantee and a 7-day free trial. Smaller database (19M+ companies) but strong for US SMB targeting. Skip this if you need international coverage - the database thins out fast outside North America.

Is Global Database Worth the Cost?

Here's my honest take: Global Database is one of the few B2B data platforms that actually justifies quote-based pricing - but only if you're buying it for emerging markets. If your average deal size is under $10,000 and you're selling exclusively into the US or Western Europe, you don't need this platform.

Full stop.

Buy Global Database if you need company intelligence in emerging markets - Africa, Southeast Asia, Latin America, the Middle East. This is where it genuinely differentiates. ZoomInfo's strength is the US. Cognism owns Western Europe. Global Database covers 195 countries with government registry-sourced data that most competitors simply don't have.

Skip Global Database if you're focused exclusively on US or EU markets, your budget is under $5,000/year, or you need self-serve access without a sales conversation. For US/EU-only prospecting, you'll get better data from ZoomInfo or Cognism at comparable or lower prices with more mature platforms.

The contrarian play: instead of buying one bundled platform that does prospecting, credit reports, data enrichment, and engagement at a premium, assemble a stack. Use a best-in-class email/phone tool like Prospeo for contact data, a separate intent provider, and your existing CRM for engagement. In our experience evaluating B2B data providers, teams that unbundle typically get better data quality at a lower total cost - and they're not locked into a single vendor's renewal cycle.

One number that should inform every B2B data purchase: 70.3% of contact data decays annually. That means roughly two-thirds of the contacts you export today will be stale within 12 months. Global Database claims daily updates, but if email validation happens on a longer cycle, you're still working with outdated emails for weeks at a time. A 7-day refresh cycle is the difference between a 3% bounce rate and a 25% bounce rate that tanks your domain reputation.

How to Get the Best Deal on Global Database

If you've decided Global Database fits your needs, here's how to negotiate:

Lead with competitive quotes. ZoomInfo customers routinely get 50% off initial pricing. Bring competing quotes from Apollo, Cognism, or any self-serve alternative to your negotiation. Quote-based vendors leave 20-30% margin for negotiation - but only if you show up with numbers.

Ask for credit reports in the base price. The upsell trap is real. If you need both prospecting data and credit reports, insist they're bundled. Don't accept "that's a separate product" without pushing back.

Request a database size guarantee in writing. Given the 80M-to-600M discrepancy across their own marketing materials, get your sales rep to commit to a specific number of accessible records for your geography. Put it in the contract.

Start with a single-country license. Don't buy global access upfront. Start with your primary market, validate data quality for 2-3 months, then expand. This limits your downside if the data doesn't perform.

Push for a real trial. Global Database's "free trial" is a guided demo request, not a self-serve signup. Push for at least 14 days with real export credits so you can test data quality against your ideal customer before committing $10,000+.

Get renewal pricing in writing. Cognism renewals reportedly increase 10-15% annually. Ask your Global Database rep directly: "What will my renewal price be?" If they won't commit, assume it's going up and negotiate a multi-year rate lock.

Global Database refreshes daily but users report a 2.9/5 on Trustpilot. Prospeo refreshes every 7 days with 5-step verification, and teams book 26% more meetings than with ZoomInfo. 143M+ verified emails, self-serve from day one.

Get verified global data without the hidden costs or the 404 pricing page.

FAQ

Does Global Database have a free trial?

Sort of - it's a guided demo, not a self-serve signup. You submit a request form and a sales rep walks you through the platform. No public information exists on trial duration or export limits. Push for at least 14 days with real export credits to validate data quality against your actual target accounts before signing an annual contract.

What's the cheapest plan available?

The smallest likely configuration - one user, one country, limited exports - runs an estimated $5,000-$10,000/year based on the three-factor pricing model. No public plans exist. If your budget is under $5,000, self-serve alternatives like Apollo.io (free tier) or Prospeo (75 free emails/month) are better fits.

Does Global Database require an annual contract?

Yes. All subscriptions run on a 12-month yearly license with no publicly available month-to-month option. This is standard for enterprise B2B data platforms but limits flexibility if you're testing a new market or running a short campaign. Negotiate a multi-year rate lock to avoid surprise renewal increases.

Why does the pricing page return a 404 error?

Nobody outside the company knows. The /pricing URL has been broken, and all pricing is handled through sales conversations. This is common for enterprise B2B data platforms but frustrating for teams trying to compare costs quickly - and one reason quote-based vendors lose deals to self-serve alternatives with published plans.