Inside Sales Tips for 2026: A Benchmarks-and-Scripts Playbook

Inside sales in 2026 isn't "work harder." It's math: data quality x message x timing x follow-up discipline. Get the inputs right and the same team suddenly looks twice as good.

We've audited enough inside sales motions to say this out loud: most teams don't have a "reps aren't trying" problem. They've got a list problem, a routing problem, or a coaching problem.

Fix the right one first, and everything else gets easier.

What you need (quick version)

Use this as your "don't overthink it" checklist.

Activity math (rules of thumb)

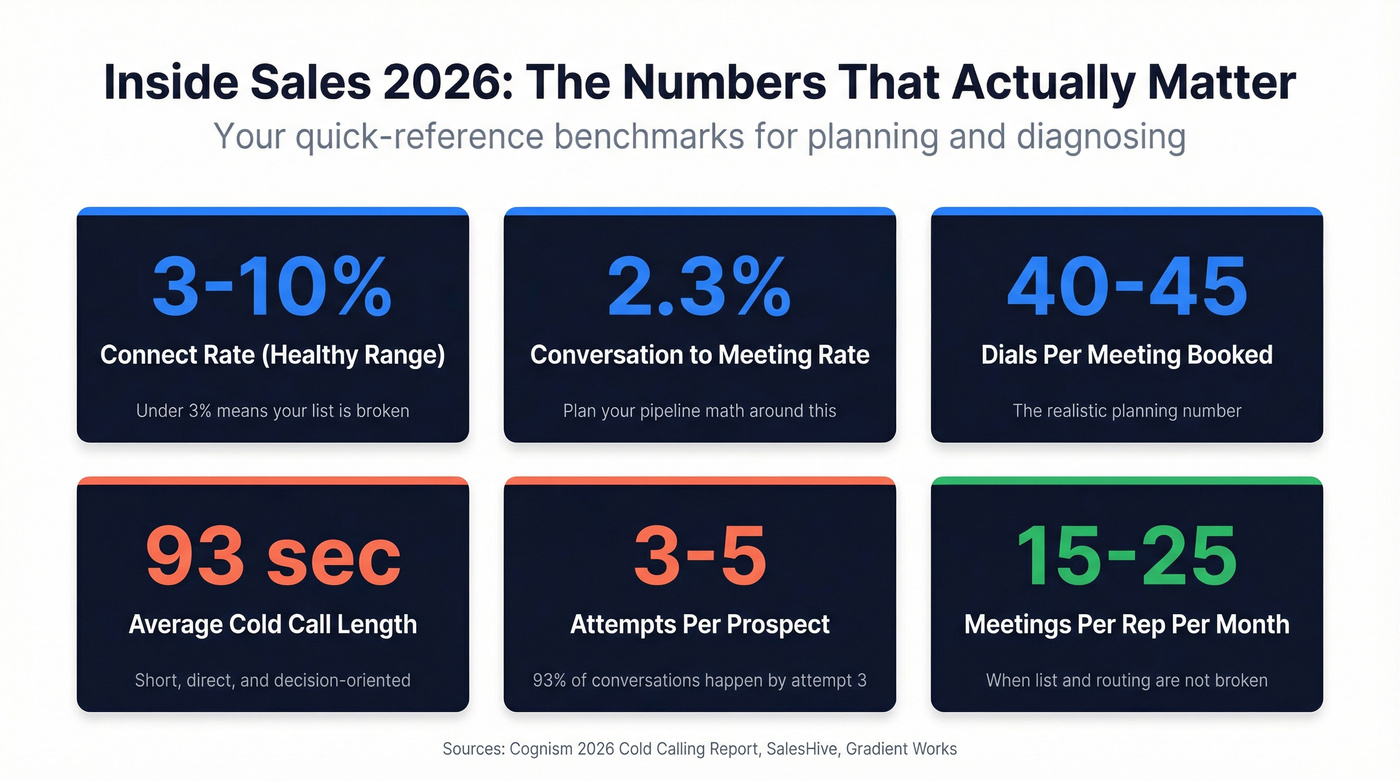

- Connect rate (reach a human): 3-10% is normal. Under 3% = list/caller ID problem.

- Dial-to-meeting rate: plan around ~2.3-2.5% (about 1 meeting per 40-45 dials).

- Attempts rule: you'll get 93% of conversations by attempt 3 and 98.6% by attempt 5 (conversation = you reached them and exchanged words, not voicemail).

Planning band (so reps can pace and managers can staff)

- 40-60 dials/day

- 4-6 conversations/day

- 15-25 meetings/month (per rep, when the list and routing aren't broken)

Execution rules

- Never run net-new cold calls outside a call block. Do 60-90 minute sprints; protect them like a meeting.

- Every call starts with a permission-based opener and ends with a next step (calendar hold or a clean "no").

- Coach to one metric per week: opener, talk ratio, question quality, or next-step rate.

Pipeline hygiene

- One CRM source of truth (no shadow spreadsheets).

- One definition each for: connect, conversation, meeting, qualified meeting, opportunity.

- Better data beats more dials. Teams use verified data sources like Prospeo to lift connect rates before they touch scripts.

Inside sales tips: benchmarks (so you stop guessing)

Benchmarks aren't targets. They're diagnostics, so you can tell whether you've got a skill problem, a list problem, or a process problem.

| Metric | "Normal" in 2026 | What it means |

|---|---|---|

| Connect rate | 3-10% | % dials reaching a human |

| Conversation-to-meeting rate | ~2.3% | Conversations -> meeting booked |

| Dials per meeting | 40-45 | Activity planning |

| Avg cold call length | ~93 sec | Keep it tight |

| Attempts per prospect | 3-5 | Diminishing returns |

Definition (so your dashboard stops lying): a conversation is when you reach the prospect and exchange words (not voicemail, not a gatekeeper transfer that dies).

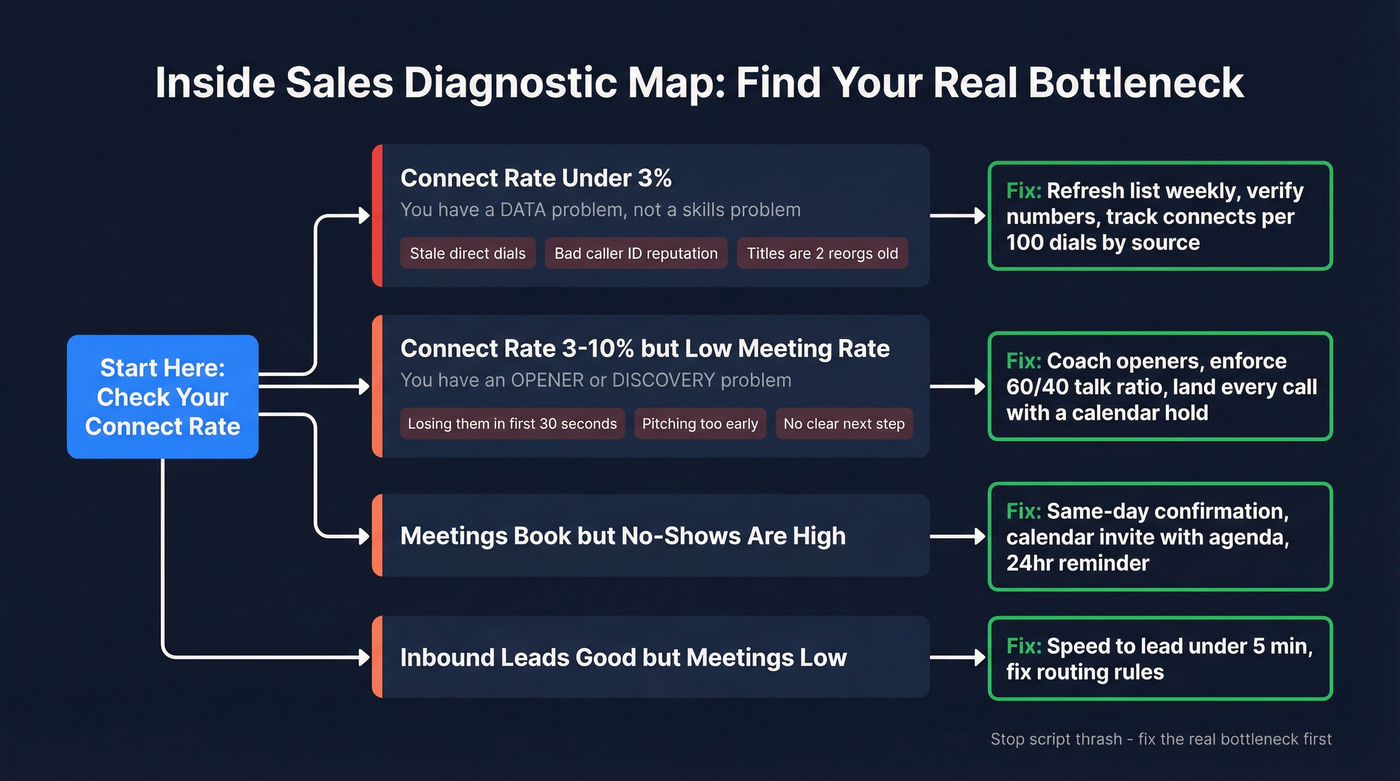

How to read the numbers (the diagnostic map)

Use this to stop script thrash and fix the real bottleneck:

- Connect rate <3% -> Data + deliverability + caller ID issue. My hard rule: don't run script coaching when connects are under 3%. You're training reps on ghosts.

- Connect rate 3-10% but conversation-to-meeting is weak -> Opener + discovery control issue. Reps are reaching people but losing them in the first 30-90 seconds.

- Meetings book but no-shows are high -> Calendar + confirmation issue. You're "booking meetings," not creating attendance.

- Inbound leads are "good" but meetings are low -> Speed-to-lead + routing issue. The lead isn't bad; your response time is.

Where the benchmark numbers come from (in plain English)

- Cognism's 2026 cold calling report pegs conversation-to-meeting success at roughly ~2.3% and average cold call length at ~93 seconds. The modern cold call's short, direct, and decision-oriented.

- SalesHive's benchmark range for connect rate is 3-10%. If you're at 1-2%, you're not "behind" - you're calling bad data.

- The 1 meeting per 40-45 dials heuristic matches the dial-to-meeting planning math most SDR teams can actually execute without burning out.

Field note: In audits, the #1 cause of 1-2% connect rates isn't "reps are scared." It's stale direct dials and titles that are two reorganizations old. Fix the list and the same rep magically "improves."

Fix the real problem first: list quality (not motivation)

If your connect rate should be 3-10% and you're stuck at 1-2%, you're not "behind." You're calling ghosts.

Here's the thing: stale data doesn't just waste dials. It wrecks your week. Reps start dodging call blocks, managers start nitpicking talk tracks, and everyone pretends the problem is "effort" because it's easier than admitting the list is junk.

Gradient's benchmark roundup (pulling from Gartner) puts it bluntly: it can take 18+ dials to connect when you're working cold outbound with stale data. That's an efficiency tax you pay in rep morale, manager time, and pipeline predictability.

Use this if you want your connect rate to move

- Refresh your list weekly, not quarterly. Titles change fast; org charts change faster.

- Segment by likelihood to pick up. Founders, sales leaders, and ops roles answer differently than IT/security.

- Verify before you sequence. Bad emails tank deliverability; bad numbers waste call blocks. (If you need a process, start with an email verification SOP.)

- Track "connects per 100 dials" by list source. If one source is 2% and another is 7%, stop debating scripts and fix procurement.

One scenario we see a lot: a team buys a big list, loads it into a sequencer, and then wonders why connect rate collapses and email bounce spikes in the same week; the reps get blamed, but the real culprit is that the list wasn't verified and half the "direct dials" were office lines or recycled numbers.

Skip this if you like wasting Tuesday mornings

- Buying "more contacts" instead of better contacts.

- Treating catch-all emails as "good enough."

- Calling the same account 10 times because "persistence."

If you want the cleanest lever here, use a tool built for accuracy and freshness. Prospeo's "The B2B data platform built for accuracy" and it's designed for exactly this moment: 300M+ professional profiles, 143M+ verified emails at 98% accuracy, 125M+ verified mobile numbers, and a 7-day refresh cycle (the industry average is 6 weeks). That combo fixes a lot of "our reps aren't converting" drama before it starts.

Warm context without creeping them out (the easiest way to sound relevant)

Most "cold" calls don't fail because the pitch is bad. They fail because the buyer can't answer one question: "Why you, why now?"

You don't need to be weird or overly personal. You need a safe trigger: something business-relevant that justifies the interruption.

Here are five warm-context angles that work without crossing the line:

- Job change / new leader "Congrats on the new role - quick question: are you keeping the current process for {{area}} or evaluating changes in your first 90 days?"

- Funding / expansion "I saw you're expanding - when teams scale, {{problem}} usually shows up. Are you already feeling that?"

- Hiring signal (open roles, headcount growth) "Noticed you're hiring for {{role}} - does that mean you're building {{function}} in-house, or trying to reduce manual work before the team ramps?"

- Tech stack change / install "A lot of teams that adopt {{category}} run into {{downstream issue}}. Is that on your radar yet?"

- Compliance / deadline / renewal window "If you've got a deadline around {{date/quarter}}, teams usually need {{lead time}} to avoid fire drills. Are you already planning for that?"

Field note: The best warm context is the one that naturally leads to a yes/no question. If your "context" requires a two-minute explanation, it's not context. It's a pitch.

If your connect rate is stuck under 3%, don't coach scripts - fix your list. Prospeo delivers 300M+ profiles with 98% email accuracy and 125M+ verified mobile numbers on a 7-day refresh cycle. That's the difference between 1-2% connects and 7%+.

Stop training reps on ghosts. Start with data that actually connects.

What to say in the first 10 seconds (copy/paste openers)

Gong analyzed 300M+ cold calls and put numbers behind what most teams argue about: openers matter, and "polite" isn't the same as "effective."

Opener 1: Permission-based (11.18% success rate)

"Hey {{FirstName}}, it's {{Name}} with {{Company}}. This is a cold call - do you have 30 seconds for me to tell you why I'm calling, and you can tell me if it's worth a follow-up?"

My stance: If a rep can't book meetings with this opener, they're pitching too early. Fix the first 30 seconds before you touch the deck.

Opener 2: Peer-context ("heard the name tossed around?") (11.24% success rate)

"Hey {{FirstName}} - quick one. Have you heard the name {{Company}} tossed around at all?"

Use this when you've got any market presence or a clear category. It creates momentum without sounding like a commercial.

Opener 3: "How's your day going?" (7.6% success rate)

"Hey {{FirstName}}, how's your day going?"

This is fine for inbound, referrals, event leads, and reactivations. On pure cold outbound, it's a weak start because buyers know what's coming.

Opener to avoid: "Did I catch you at a bad time?" (2.15% success rate)

"Did I catch you at a bad time?"

It hands them the exit and frames you as an interruption. If you want permission, ask for a small window (30 seconds) and earn the next step.

Call execution tips that top reps actually hit (benchmarks + coaching)

This is where inside sales teams leak wins: not the opener, but the next 90 seconds.

Gong's analysis of 326K sales calls (10+ minutes) gives you coaching targets that are measurable, not vibes.

Benchmarks that matter

- Baseline talk/listen is 60/40.

- Closed-won calls average 57% talk.

- Lost deals average 62% talk.

- Winners ask 15-16 questions per call; losers ask ~20.

Counterintuitive point: asking more questions isn't automatically better. The best reps ask fewer questions that force specificity: numbers, timelines, decision process, and consequences.

The interactivity rules (the part most teams skip)

Talk ratio's a lagging indicator. Interactivity is what you coach day-to-day.

Use these three rules in call reviews:

- No monologue longer than 20-25 seconds. If a rep talks for 45 seconds straight, they're presenting, not selling.

- A check-in every ~45 seconds. Simple prompts: "Is that fair?" "How does that compare to you?" "Worth digging into?"

- If talk time's >60% in the first 3 minutes, the rep's pitching too early. First 3 minutes should be: opener -> reason -> one sharp question -> confirm relevance.

Field note: The fastest way to improve a mediocre rep is to cut their explainer in half. Most inside sales calls don't need better persuasion. They need better pacing.

Coaching checklist (what "good" sounds like)

- Start with a hypothesis: "The reason I'm calling is I'm seeing {{trigger}} and it usually creates {{problem}}."

- Ask fewer, sharper questions: aim for 15-16, but make them decision-relevant.

- Keep turns short: you talk, they talk, you summarize, they confirm.

- Land the plane: every call ends with a calendar step or a clear disqualify.

If you're coaching a team, ignore the mythical "golden ratio." Use 60/40 as the baseline, then coach toward ~57% talk by tightening stories and enforcing monologue limits; those changes show up in conversion, not just "better calls."

Follow-up rules: how many attempts, and when to stop

Most inside sales teams don't have a follow-up strategy. They've got anxiety.

Cognism's attempt curve is the simplest discipline you can enforce:

- 93% of conversations happen by call attempt 3

- 98.6% happen by call attempt 5 (conversation = you reached them and exchanged words, not voicemail)

Rules that keep you sane

- Attempt 1-3: tight spacing (Day 1, Day 3, Day 6) with a consistent angle.

- Attempt 4-5: spread it out (Day 10, Day 14) and change the channel (email + voicemail).

- After attempt 5: stop the call loop. Move them to nurture or wait for a new trigger.

Mini decision tree

- Connected but "not now"? Ask for timing + permission to follow up; set a dated task.

- No connect after 3? Verify the number/email and try a different persona.

- No connect after 5? Pause outreach until you've got a new reason to call.

When to call: a weekly call-block plan (based on 1.4M calls)

ZoomInfo analyzed 1.4M outbound calls and the results match what most floor managers feel: Tuesday-Thursday is where pipeline gets made.

Key takeaways:

- Tuesday + Wednesday drive 44% of demos

- Monday has the best call-to-demo efficiency at 1.19%

- Friday is worst across volume, connects, and demos

A weekly call-block template you can steal

| Day | Call blocks | Goal |

|---|---|---|

| Monday | 1-2 blocks | High-intent follow-ups |

| Tuesday | 2-3 blocks | New outbound + follow-ups |

| Wednesday | 2-3 blocks | New outbound (heavy) |

| Thursday | 2 blocks | Clean-up + second attempts |

| Friday | 0-1 block | Admin + nurture + prep |

Hot take: Friday outbound isn't "bad." It's a tax. If you're going to pay it, spend it on warm follow-ups and reschedules, not net-new cold calls.

Inside sales tips for inbound: the 5-minute rule + routing discipline

Inbound inside sales is a race. Most teams lose it before the rep even sees the lead.

The HBR audit of 2,241 companies found that responding within 1 hour makes you 7x more likely to qualify a lead than responding even an hour later, and 60x more likely than waiting 24 hours+. Best-in-class is <=5 minutes.

Drift found only 7% of teams respond within 5 minutes. And 55% take 5 days+, so "we'll get back to you" often means "never."

SLA checklist (what to enforce)

- Speed-to-lead SLA: first touch in <=5 minutes during business hours.

- Routing rules: one owner, instantly. No round robin limbo.

- Fallback: if no response in 2 minutes, route to backup rep.

- Calendar-first for high intent: demo requests get a booking link immediately, then a call.

- Hard requirement: every inbound lead gets a disposition within 24 hours (worked, recycled, disqualified). No orphan leads.

One sentence that'll save you a quarter: if you can't answer "who owns this lead right now?" in five seconds, your routing's broken.

How to enforce it (RevOps-friendly, not wishful thinking)

- Create a single "Inbound - New" queue with an auto-timestamp field (lead created time).

- Alerting: Slack/Teams alert at minute 0; escalation alert at minute 3; manager alert at minute 10.

- Ownership: assign by territory/segment first; only round-robin when segment's unknown.

- Coverage: define lunch coverage and end-of-day coverage. Inbound doesn't care about your calendar.

- QA: review 10 random inbound leads/week and score: time-to-first-touch, number of attempts, and whether the rep asked a next-step question.

Response-time benchmarks (so you can shame your dashboard)

Chili Piper reports average response times by company size:

| Segment | Avg response time |

|---|---|

| Small (1-300) | 48 min |

| Medium (301-2500) | 1h 38m |

| Large (2501+) | 1h 28m |

If you're sitting at 48-98 minutes, you're not "average." You're donating pipeline to competitors who call in 5.

A daily inside sales operating system (the boring part that wins)

If you want consistent pipeline, run a consistent day. Here's a simple rhythm that works for most SDR/inside sales roles:

- 08:30-09:00 List build + prioritization (today's 30-50 targets; tag warm triggers)

- 09:00-10:15 Call block #1 (net-new + attempt #2s)

- 10:15-10:30 Fast admin (log outcomes, set tasks, update dispositions)

- 10:30-11:15 Email block (only to people you called; keep it tight)

- 11:15-12:00 Inbound coverage / follow-ups

- 13:00-14:15 Call block #2 (different time zone/time window)

- 14:15-14:30 Voicemails + close-the-loop messages

- 14:30-15:00 Meeting prep + handoffs

- 15:00-15:30 QA: listen to 1 call, score it, pick 1 fix for tomorrow

- 15:30-16:00 Clean pipeline (no-shows, reschedules, recycle/disqualify)

My opinion: most teams don't need a new script. They need protected call blocks and ruthless dispositions.

A complete inside-sales cadence you can run this week (outbound + inbound)

Highspot's guidance is directionally right:

- Outbound cadence: 6-8 touches over 2-3 weeks

- Inbound cadence: 8-12 touches over 10-15 business days

Each touch needs a job: create awareness, earn a response, confirm fit, or close the loop.

Micro-assets: subject lines + voicemails (steal these)

3 subject lines

- Trigger-based: "Quick question about {{trigger}}"

- Proof-based: "How teams cut {{pain}} by {{result}}"

- Breakup: "Close the loop?"

Voicemail #1 (first attempt, 12-18 seconds)

"Hey {{FirstName}}, it's {{Name}} at {{Company}}. Calling because {{trigger}} usually leads to {{problem}}. I'll send a quick email too - if it's relevant, just reply 'yes' and I'll send times."

Voicemail #2 ("close the loop," 10-15 seconds)

"Hey {{FirstName}}, {{Name}} again. If {{problem}} isn't a priority right now, no worries - I'll close this out. If it is, reply to my email with 'yes' and I'll send two options."

Outbound cadence (6-8 touches / 2-3 weeks)

Day 1

- Call + voicemail (if no answer)

- Email #1 (80-120 words): problem + trigger + 1 question

Day 3

- Call

- Email #2: one proof point + CTA for a 15-min fit check

Day 6

- Call + voicemail

- Email #3: "wrong person?" (ask for redirect)

Day 10

- Call (different time block)

- Email #4: breakup (polite, direct) "I'm going to close the loop. If solving {{problem}} is a priority this quarter, reply 'yes' and I'll send times. If not, I'll stop reaching out."

Day 14-18

- One final call or a value touch (short teardown, benchmark, or relevant case)

Field note: The "wrong person?" email is the highest-leverage touch in the whole sequence. It's the fastest way to multi-thread without sounding desperate.

Inbound cadence (8-12 touches / 10-15 business days)

Minute 0-5

- Call immediately

- Email with calendar link + "what to expect" agenda (3 bullets)

Day 1

- Call again (different time)

- Voicemail: confirm you'll try once more today

Day 2-3

- Email: 2-3 qualifying questions (make it easy to reply)

- Call

Day 5

- Email: customer example + "is this the outcome you want?"

Day 7-10

- Call + voicemail

- Breakup email: "Should I close your request?"

Day 12-15

- Final attempt + route to nurture

Stale direct dials cost you 18+ attempts per connect and destroy rep morale. Prospeo refreshes every 7 days - not every 6 weeks - so your Tuesday call blocks hit real buyers, not recycled office lines. At $0.01/email, better data costs less than one wasted hour.

Replace your ghost list with verified contacts in minutes.

Discovery + qualification: pick the framework by deal size (with prompts)

Frameworks aren't religion. They're tools. Pick the one that matches the complexity of the deal.

The decision rule (simple and practical)

- BANT: best for SMB triage and inbound qualification when you need to sort fast.

- MEDDPICC: best for enterprise and multi-stakeholder deals where procurement, security, and internal politics can kill you late.

- SPICED: best for clean discovery that gets to impact and timing without sounding like an interrogation.

I've watched teams force MEDDPICC on smaller deals and slow themselves down. I've also watched teams use BANT on enterprise and act surprised when "budget confirmed" didn't stop legal from stalling the deal for 60 days.

Copy/paste prompts (SPICED)

- Situation: "What changed that made you look at this now?"

- Pain: "Where's the current process breaking - people, time, risk, or cost?"

- Impact: "If nothing changes, what's the cost over the next 90 days?"

- Critical Event: "Is there a date this needs to be live by?"

- Decision: "Who else needs to weigh in before you can move forward?"

Copy/paste prompts (MEDDPICC)

- Metrics: "What metric has to move for this to be a win?"

- Economic Buyer: "Who owns the budget and signs the agreement?"

- Decision Criteria: "What are the top 3 must-haves vs nice-to-haves?"

- Decision Process: "Walk me through steps from 'yes' to signature."

- Paper Process: "What does procurement/legal/security need, and how long does each step take?"

- Identify Pain: "What's the business consequence if this stays the same?"

- Champion: "Who benefits personally from getting this done - and has influence?"

- Competition: "What happens if you do nothing, or stick with the current vendor?"

30/60/90 plan for new inside sales reps (manager-ready)

A ramp plan isn't onboarding docs. It's milestones + leading indicators that predict revenue before revenue shows up.

Day 0-30: Foundation + reps don't touch the gas yet

Milestones

- ICP + product certification (quiz + live scenario)

- Systems: CRM stages, activity logging, task hygiene

- 10 roleplays scored to threshold (opener, objection, close for next step)

- Shadow 10 calls + debrief with a rubric (what worked / what didn't / what to try)

Leading indicators

- Call structure adherence (opener -> reason -> question -> next step)

- Data hygiene: 0 missing fields on created leads/contacts

Day 31-60: Controlled volume + coaching loops

Milestones

- Run full cadences with manager QA on first 50 touches

- Start owning inbound follow-up blocks

- Weekly call review (2 wins, 2 losses)

Leading indicators

- Connect rate trending toward 3-10%

- Conversation-to-meeting rate approaching ~2.3% (or improving week over week)

Day 61-90: Autonomy + predictable output

Milestones

- Own a segment (industry, geo, or persona)

- Build a personal talk track library (openers, objections, proof points)

- Hit consistent activity targets without quality drop

Leading indicators

- Stable talk/listen ratio near 60/40 baseline (or better)

- Consistent next-step conversion (calendar holds per conversation)

FAQ

What's a realistic inside sales connect rate in 2026?

A realistic inside sales connect rate in 2026 is 3-10% (dials that reach a human). Under 3%, fix list quality, number validity, and calling windows before you rewrite scripts. Over 7-10% usually means tighter ICP, better data, or warmer triggers.

How many times should you call a prospect before stopping?

Call a prospect 3 times by default, and cap it at 5 attempts unless you've got a new trigger. You'll get 93% of conversations by attempt 3 and 98.6% by attempt 5 (conversation = you reached them and exchanged words, not voicemail). After 5, move them to nurture.

What's the best cold call opener to use right now?

Use a permission-based opener or a peer-context opener. Gong's 300M+ call analysis shows the permission-based opener hits 11.18% success, and "heard the name tossed around?" hits 11.24%. Avoid "Did I catch you at a bad time?" - it performs at 2.15%.

What talk-to-listen ratio should inside sales reps aim for?

Aim for a 60/40 baseline, then coach toward ~57% talk on calls that convert. Reps should avoid monologues longer than 20-25 seconds and add a check-in about every 45 seconds to keep the buyer engaged. If talk time's >60% early, they're pitching too soon.

What tool helps improve connect rates by fixing bad contact data?

Use a tool that verifies emails and mobile numbers and refreshes records weekly so you stop dialing wrong numbers and bouncing emails. Prospeo does this with 98% verified email accuracy, 125M+ verified mobile numbers, and a 7-day data refresh cycle (industry average: 6 weeks). Teams also use it to enrich CRMs with 50+ data points per contact.

Pick one lever this week: data refresh, opener standardization, or an attempt cap. Measure it on Friday.

That's how inside sales stops feeling chaotic and starts feeling predictable.