Sales Trends in 2026: What's Changing (and What to Do Next)

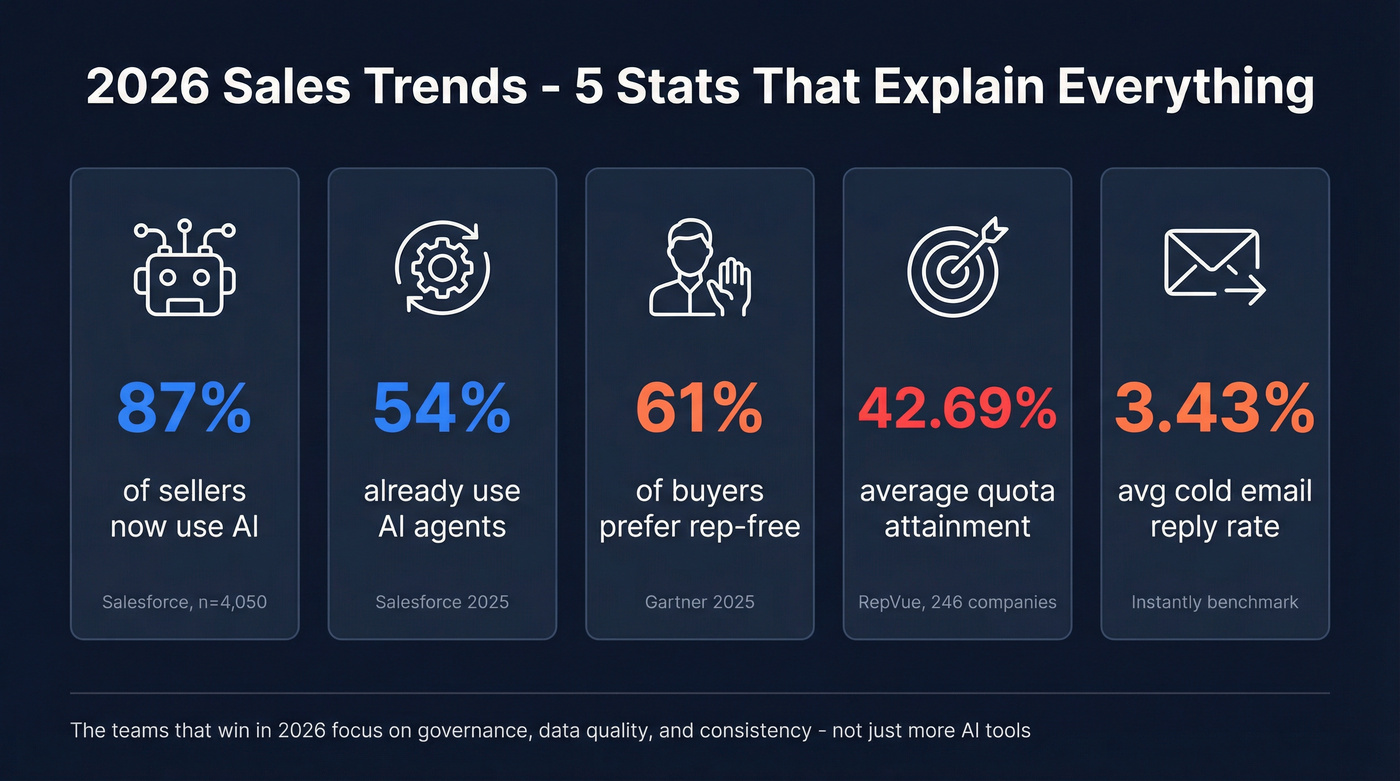

Quota attainment's still ugly: 42.69% on the latest published RepVue Cloud Index (Q2 2025; 246 companies; ~47k ratings). Cold email's just as unforgiving: 3.43% average cold email reply rate. And reps still spend 60% of their time on non-selling tasks.

If you're asking how sales changed since the 2024 cycle, here's the answer: buyers want more control, procurement shows up earlier, and AI's now table stakes. That combo creates a new reality where execution and governance beat hustle.

These sales trends aren't predictions. They're already in your pipeline math.

Sales trends 2026 - quick version (what to act on first)

Use this as your Monday-morning checklist. If you can't check at least 6 of these, you aren't behind on tactics - you're behind on fundamentals.

- Assume buyers want rep-free for big chunks of the journey (Gartner: 61% prefer rep-free overall). Build self-serve paths, not just sequences.

- Treat AI agents as workflow owners, not toys (Salesforce + Gartner). Put guardrails around them now. (If you're evaluating tooling, start with an AI sales agent rubric.)

- Stop chasing "autopilot SDR." Hybrid Human+AI wins; pure AI SDR is still undercooked in production.

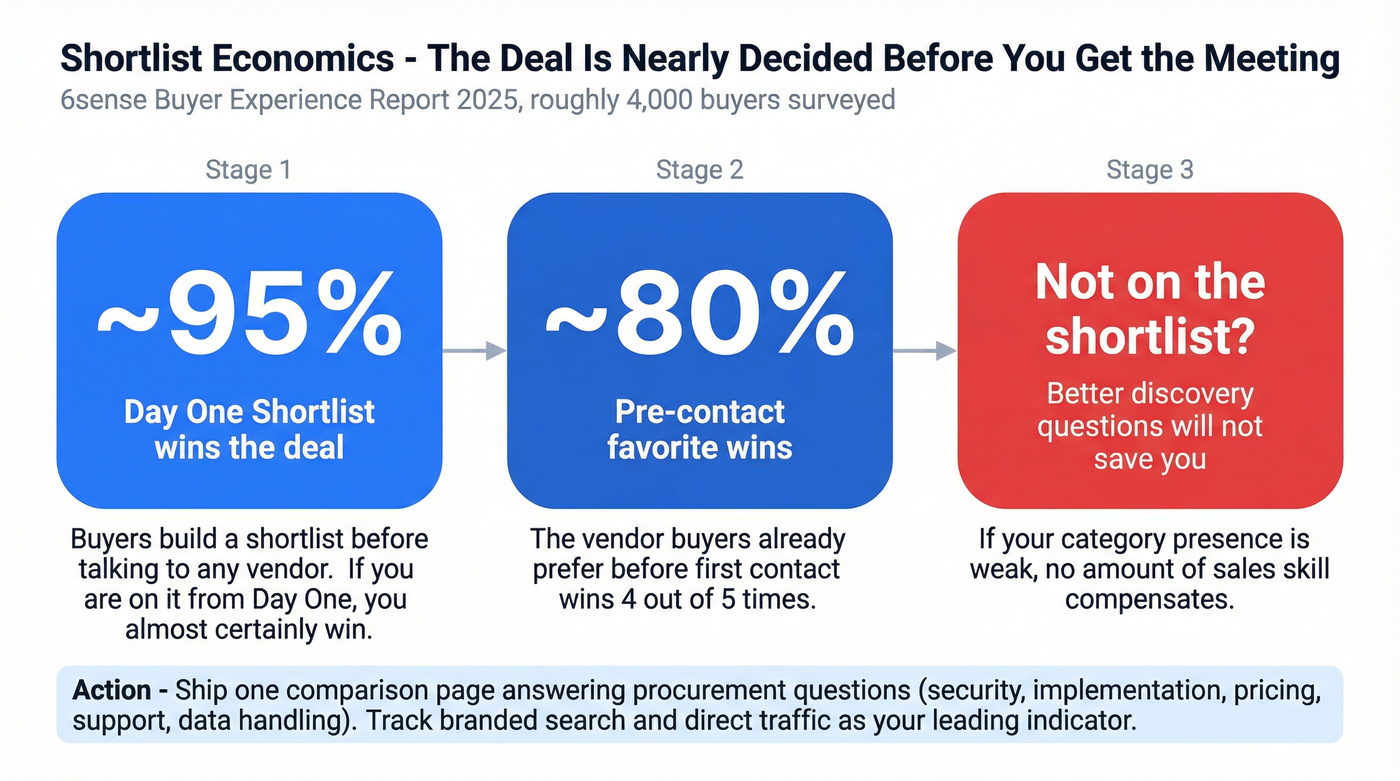

- Win the shortlist before first contact. Pre-contact favorites win most deals; Day One shortlists are nearly unbeatable.

- Outbound isn't dead - irrelevance is. 73% of buyers avoid suppliers who send irrelevant outreach.

- Reset cold email expectations: 3.43% average reply rate. If you're at 5.5%+, you're top quartile.

- Design sequences for follow-ups: 42% of replies come from follow-ups, not the first email. (Use a proven follow up email sequence strategy instead of guessing.)

- Make consistency a revenue lever: 69% of buyers see website vs sales-message inconsistency.

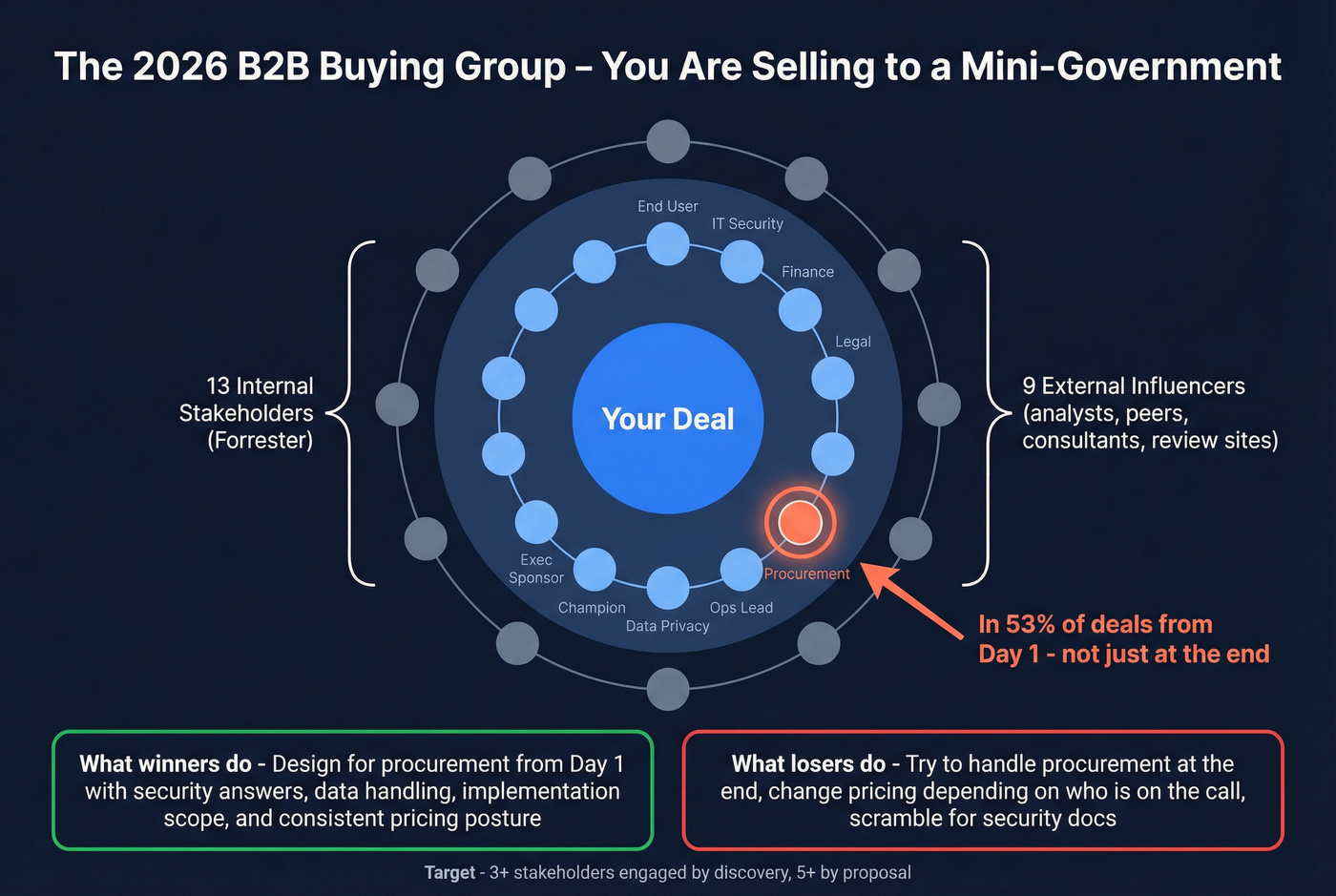

- Assume bigger buying groups + earlier procurement: 13 internal stakeholders + 9 external influencers; procurement's in 53% of cycles from the start.

- Fix data hygiene before you scale anything. High performers cleanse data far more aggressively than underperformers. (Start with a simple data quality scorecard.)

The 2026 snapshot (5 stats that explain the whole year)

These five numbers explain why 2026 feels weird: buyers want control, sellers are leaning on AI, and the teams that win are the ones who clean up the messy middle (data + governance).

| What's happening | The stat (source) | Why it matters | What to do |

|---|---|---|---|

| AI is default | 87% use AI (Salesforce, Aug-Sep 2025, n=4,050) | "No AI" looks dated | Standardize AI use |

| Agents are rising | 54% used agents (Salesforce, Aug-Sep 2025) | Work shifts to workflows | Add agent QA |

| Rep-free preference | 61% prefer rep-free (Gartner) | Less pitch time | Build self-serve pack |

| Quota pressure | 42.69% attainment (RepVue, latest Q2 2025) | Efficiency wins | Tighten ICP |

| Email noise | 3.43% avg reply (Instantly) | Relevance wins | Segment + test |

Salesforce's "State of Sales 2026" numbers come from a double-anonymous survey of 4,050 sales professionals fielded Aug-Sep 2025 across 20+ countries. That's useful because it reflects the mainstream, not a loud corner of the internet.

Two implications most teams miss:

- AI adoption doesn't equal AI advantage. When 87% use AI, the edge comes from governance, data quality, and consistent execution.

- Agents are a performance divider. Salesforce also found top performers are 1.7x more likely to use AI agents - not because agents are magic, but because top teams operationalize them.

Sales trends that will matter most in 2026 (with "what to do" for each)

AI agents move from novelty to workflow owners

Agents are shifting from "help me write an email" to "run this task end-to-end." Gartner expects 40% of enterprise apps to include task-specific agents by the end of 2026, and Salesforce data shows adoption's already mainstream. Agentwashing is the trap: calling an assistant an agent when it can't plan, act, and complete tasks autonomously with guardrails.

Skip "agent automation" if your CRM fields aren't governed. You'll just automate bad inputs faster.

KPI to watch: % of agent outputs accepted without edits (target 70%+). Change this Monday: Pick two workflows (call summary -> CRM update; research -> draft -> approval) and add an agent QA checklist before anything ships externally.

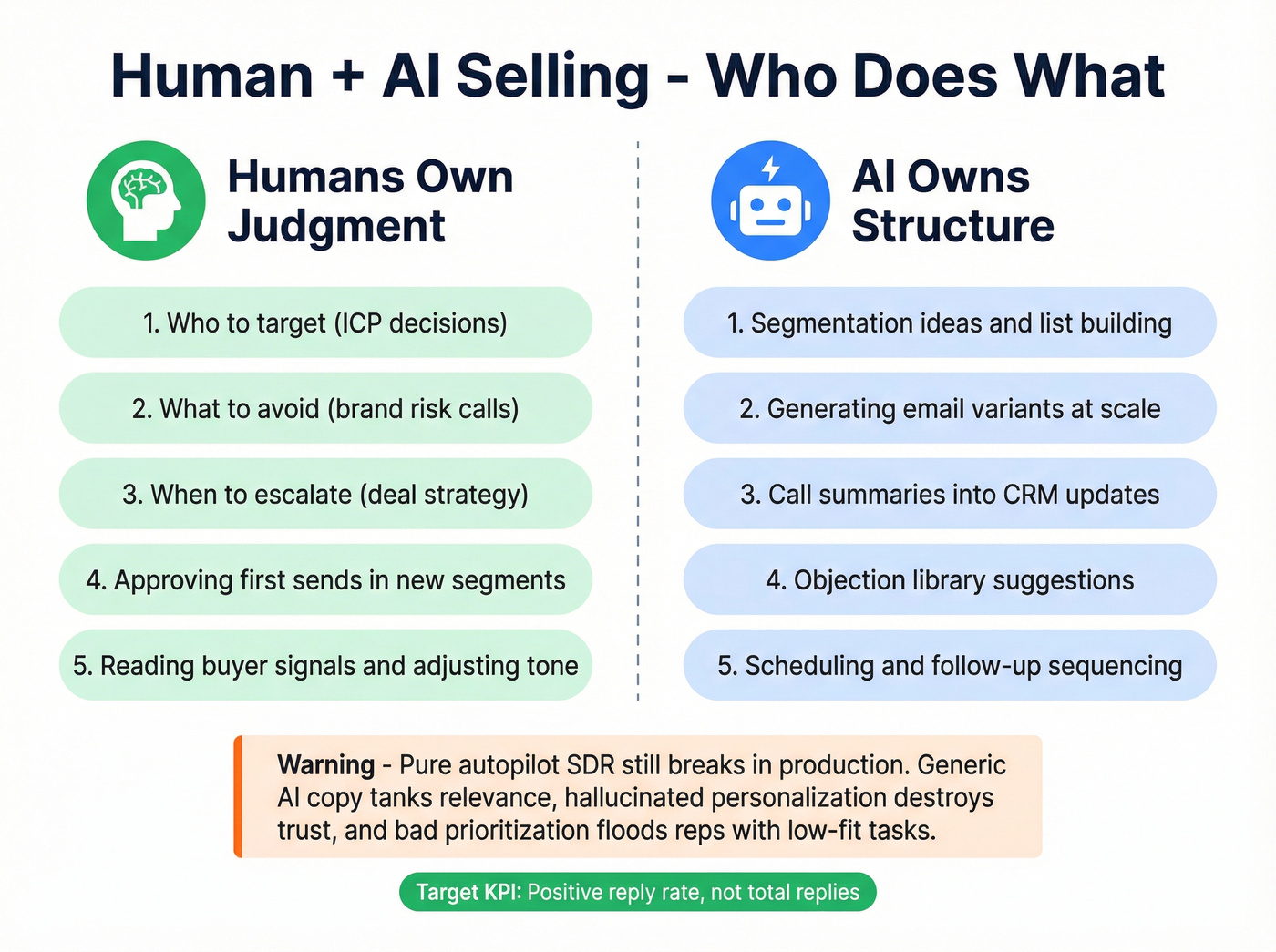

Human+AI selling replaces "autopilot SDR" fantasies

The market sobered up. AI can generate activity, but it also generates generic copy and confident nonsense.

I've watched teams "scale" for a month and only then realize they scaled the wrong message to the wrong list - at 10x speed, with a deliverability hangover that takes weeks to unwind.

Use AI for structure (segmentation ideas, variants, objection libraries). Keep humans on judgment (who to target, what to avoid, what to escalate). That's where enablement earns its keep in 2026: less "make more content," more "make the system run the same way every day." (If you want a concrete system, use AI in sales cadences playbooks.)

Practitioner reality check (what breaks first)

- Generic AI copy tanks relevance fast

- Hallucinated "personalization" destroys trust

- Bad prioritization floods reps with low-fit tasks

One team I worked with ran a Clay + Apollo stack and sat around ~4% replies until they tightened segments and cleaned data - then performance moved without adding volume.

KPI to watch: Positive reply rate (not total replies). Change this Monday: Put a human gate on the first 200 sends of any new segment: approve email #1 and follow-up #1 before scaling.

Rep-free buying becomes default for chunks of the journey

Gartner's buyer research shows 61% prefer an overall rep-free buying experience. That doesn't mean "no salespeople." It means buyers want control: pricing posture, product proof, security answers, and a path to value without a calendar hostage situation.

Hot take: if your deal size is in the low five figures or below, bias hard toward rep-free. A heavy sales motion at that price point is usually self-inflicted friction.

KPI to watch: % of opportunities that touch self-serve assets (target 80%+). Change this Monday: Publish a single "Start here" evaluation page (pricing range, implementation outline, security one-pager, proof) and link it everywhere.

Consistency becomes a revenue lever

69% of buyers report inconsistencies between website info and what sellers say. That inconsistency kills trust, slows procurement, and forces buyers to re-validate everything with more stakeholders.

Here's the thing: it's also one of the easiest problems to fix, because it's internal.

Skip new enablement tools if you can't agree on the same ten sentences.

KPI to watch: Message consistency score (spot-check 20 calls/emails/week; target 90% aligned). Change this Monday: Marketing + sales + CS align on one source of truth: top 5 use cases, top 5 disqualifiers, pricing posture, and proof points.

Buying groups get bigger and procurement shows up earlier

Forrester pegs the typical decision at 13 internal stakeholders and 9 external influencers. Procurement's a decision-maker in 53% of cycles and engages from the start. Translation: you aren't selling to a champion - you're selling to a mini-government, and they all vote. (If you want a structure for this, use ABM multi-threading.)

The teams that win don't "handle procurement at the end." They design the deal for procurement from day one, with security answers, data handling, implementation scope, and pricing posture that don't change depending on who's on the call.

KPI to watch: # of engaged stakeholders per opp by stage (target 3+ by discovery, 5+ by proposal). Change this Monday: Add a required CRM field: "Stakeholders engaged (count + roles)" and block stage progression without it.

Trials become the new demo

Forrester data shows 60%+ of buyers use a trial; for $10M+ purchases, 78% do. Trials reduce risk and create internal alignment - but they also expose weak onboarding instantly.

Skip trials if you can't define "success" in one sentence. A vague trial's just a slow no.

KPI to watch: Time-to-first-value (and trial-to-paid conversion). Change this Monday: Create a Day 1 / Day 3 / Day 7 checklist with explicit success criteria and proof artifacts (screenshots, metrics, sign-offs).

Shortlist economics: you must win before first contact

6sense buyer research is blunt: the pre-contact favorite wins ~80% of the time, and the Day One shortlist wins ~95%. Their Buyer Experience Report 2025 surveyed ~4,000 buyers, and the message matches what sellers feel: by the time you "get the meeting," the buyer already has a mental bracket.

This is why "better discovery questions" won't save you if your category presence is weak.

KPI to watch: Branded search + direct traffic trend (and demo requests that mention "already evaluating you"). Change this Monday: Ship one comparison page that answers the procurement questions you keep getting (security, implementation, pricing posture, support, data handling).

Outbound isn't dead - irrelevance is

73% of buyers avoid suppliers who send irrelevant outreach. Outbound still works when it's targeted, timely, and grounded in real triggers (job changes, headcount growth, tech adoption, compliance deadlines). Persona-only targeting is how you end up sounding like everyone else.

My rule: if you can't name the trigger, you don't have a segment - you have a list. (Build triggers from intent signals and job-change data, not vibes.)

KPI to watch: Bounce rate + spam complaint rate (deliverability's the floor). Change this Monday: Create "do-not-send" rules: no missing role, no stale titles, no unverified emails, no generic domains for B2B.

Sales cycles feel longer even when averages compress

Salesforce says 57% of sales pros feel cycles are getting longer. 6sense shows the average cycle dropped to 10.1 months in 2025 (from 11.3). Both are true: averages compress while the distribution gets uglier - more deals stall, more stakeholders weigh in, more procurement loops happen.

Treat stalls like a system problem, not a rep problem.

KPI to watch: % of pipeline over stage-aging threshold (target <20%). Change this Monday: Add a stalled-deal trigger: if no meeting in 14 days, auto-create tasks for stakeholder expansion + a new proof asset + re-qualification.

RevOps orchestration beats "more tools"

Salesforce found 51% say tech/data silos delay or limit AI initiatives. That's the quiet killer: you can't agent your way out of broken fields, duplicate records, and five systems that disagree.

Skip buying another AI layer if you can't answer: "Which system's the source of truth for company size?"

KPI to watch: Lead-to-first-touch time (and routing error rate). (If this is your bottleneck, start with average lead response time benchmarks and SLAs.) Change this Monday: Map lead source -> enrichment -> routing -> sequencing -> meeting -> stages -> handoff, then kill one redundant step and lock field ownership.

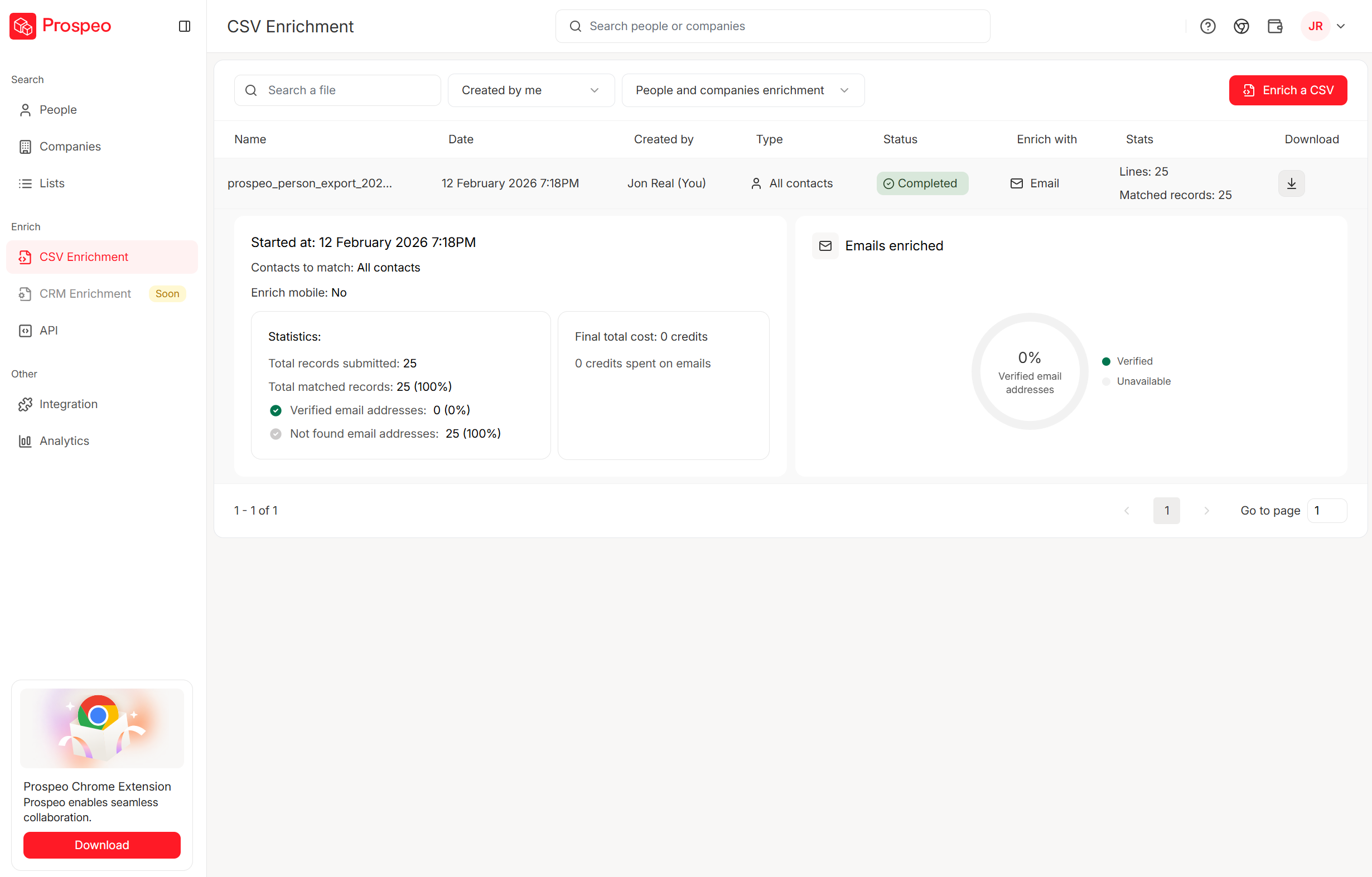

Every 2026 sales trend points to the same root cause: bad data kills execution at scale. AI agents automate garbage faster. Bigger buying groups mean more contacts to verify. Prospeo's 7-day refresh cycle and 98% email accuracy mean you scale on clean data - not hope.

Stop automating bad inputs. Start with data that actually connects.

Benchmarks reality check for 2026

Most teams don't need more motivation. They need calibration.

Instantly's benchmark report puts the average cold email reply rate at 3.43%, with top quartile at 5.5%+ and elite at 10.7%+. That's why "we got 4% replies" can be either decent or disappointing depending on your ICP and offer.

Cognism's outbound dataset is a second gut-check: SDR cold calls get answered 13.3% of the time across 451,895 calls. That's the real world. If your plan assumes 30% answered rates from cold lists, you'll over-hire, over-dial, and under-learn.

One more benchmark that changes how you build cadence: Cognism's channel mix shows outbound activity is dominated by calls (57%), then social touches (27%), then email (15%). If your cadence's email-only, you're behind before copy even matters.

| Metric | "OK" | "Good" | "Great" |

|---|---|---|---|

| Cold email reply rate | ~2-3% | 5.5%+ | 10%+ |

| Sequence length | 4-7 | 4-7 | 4-7 (tighter) |

| Replies from follow-ups | ~42% | ~42% | ~42% (consistent) |

| Best send day (B2B cold email) | Tue-Wed | Tue-Wed | Wed peak |

| Cold call answered (SDR) | ~10-13% | 13.3% | 15%+ |

| Sales cycle baseline | 60-120d | 60-120d | <60d mid-mkt |

How to use benchmarks without lying to yourself:

- Use them to spot broken inputs, not to judge rep effort. If bounce is high, your list's the problem.

- Track deltas, not absolutes. Moving from 2.5% to 4.0% reply rate is a real win if you didn't change volume.

- Benchmark by segment. One "average reply rate" across three ICPs is how teams make the wrong decision with confidence.

AI agents - what's real vs "agentwashing" (and the governance buyers will demand)

The market's about to get loud. Every vendor will slap "agent" on a feature that's basically a prompt template.

Here's the clean distinction:

- Assistant: helps a human do work (draft, summarize, suggest).

- Agent: plans and executes steps across systems (pull data, decide next action, take action, log results).

- Human-in-the-loop: the only safe default for external actions in 2026.

Buyer skepticism's rising, not falling. Forrester/Digital Commerce 360 coverage shows GenAI research makes buyers more confident (36%) and less confident (20%) at the same time. Procurement's even more skeptical: 28% report less confidence after GenAI research. That's why governance's now a buying requirement, not an IT nice-to-have.

I feel strongly about this: don't buy an "agent platform" first. Standardize two workflows, define approvals, then evaluate vendors. Otherwise you'll end up with a shiny agent that can't ship anything without someone babysitting it, and everyone quietly stops using it.

Governance buyers will ask for in 2026

- Audit logs: what the agent did, when, and why

- Data boundaries: what it can access/export

- Human approvals for external actions

- Model + prompt versioning (reproducibility)

- Security artifacts (SOC2, DPA, retention)

- Failure modes: what happens when data's missing or conflicting?

Internal controls that actually work (and keep deals moving):

- Default-deny permissions for any write action in CRM or outbound tools

- Named owners for prompts/workflows (no "shared doc" chaos)

- Golden fields (ICP, persona, stage) with locked definitions

- Sampling QA: review 20 agent outputs/week like you review calls

Gartner also predicts 2,000+ "death by AI" legal claims by end of 2026 due to insufficient AI risk guardrails. That's not a sales stat. It's a procurement objection you can either preempt or suffer through.

Data quality: the hidden sales trend in 2026

Sales teams love to talk about personalization. Personalization fails for one unsexy reason: the underlying data's wrong.

Salesforce shows 74% of orgs are focusing on data cleansing, and the split's brutal: 79% of high performers prioritize data hygiene vs 54% of underperformers. Combine that with sellers spending 60% of their time on non-selling tasks, and every bad record becomes a tax on the most expensive labor in your company.

Why "personalization" fails with stale data

If the title's wrong, your opener's cringe.

If the company size's wrong, your use case is wrong.

If the email's wrong, your domain reputation gets cooked - and then even the good emails stop landing.

Stale data's how "personalized" becomes irrelevant at scale.

The minimum viable data hygiene loop (weekly)

This loop holds up in production. We've run stack bake-offs for outbound teams; the "best AI" lost when duplicates and unverified emails flooded the CRM in week one.

- Verify: remove invalid/catch-all risks before sending (use an email verification list SOP)

- Dedupe: stop creating multiple contacts per person/company

- Enrich: fill missing firmographics + role data for segmentation (see lead enrichment tools)

- Refresh: update titles, job changes, and company signals weekly

Do this weekly loop before you touch volume. It compounds.

Tooling note (keep it practical)

Mini-workflow (what I'd implement first):

- Build a list using filters (role + geo + technographics + growth/intent).

- Verify emails/mobiles in real time before any send.

- Enrich missing fields for segmentation and routing.

- Export into your CRM/sequencer with clean field mapping.

What to measure (so it's not vibes):

- Bounce rate target: <3-5% (if you're getting hard bounces, review email deliverability basics)

- Duplicate rate in CRM: <1% of new contacts

- Enrichment coverage: 80%+ for key fields

- Time saved per rep/week: 2-4 hours

Pricing's credit-based and transparent: ~$0.01/email, with a free tier (75 emails + 100 extension credits/month), no contracts, cancel anytime. Details: https://prospeo.io/pricing.

Trend-to-playbook mapping (copy, cadence, enablement, RevOps)

This is how you turn "interesting trends" into an operating system. Pick the 3-4 rows that match your bottleneck, assign an owner, and run them like weekly sprints until the KPI stabilizes.

| Trend | What to change | KPI | Owner | Tool category |

|---|---|---|---|---|

| Rep-free journey | Eval pack + proof path | Asset touch % | Marketing | CMS + product |

| Procurement early (53%) | Procure-ready docs | Stage aging | AE | Enablement |

| Inconsistency (69%) | One messaging source | Consistency score | Enablement | CI/enablement |

| Shortlist economics | Pre-contact proof | Branded demand | Marketing | SEO + reviews |

| Outbound relevance | Trigger segments | Pos reply rate | SDR | Sequencer |

| Data hygiene | Verify -> dedupe -> enrich | Bounce + dupes | RevOps | Verification/enrichment (Prospeo) |

| Agent governance | Approvals + audit logs | Edit-accept % | RevOps/IT | CRM + security |

| Trial success | MAP + success criteria | Time-to-value | CS/AE | Product + CS ops |

Tool notes (no pricing games, just how they fit):

- Outreach / Salesloft: best when you need sequencing plus governance and task orchestration across a larger SDR org.

- Gong: fastest way to catch inconsistency in the wild and turn coaching into measurable behavior change.

- Highspot: strong enablement layer when procurement readiness and asset delivery are the bottleneck.

- Clay: great orchestration glue for teams building a hybrid stack and automating enrichment/routing logic across tools.

- Salesforce Sales Cloud / HubSpot: where field governance and "agent-in-CRM" workflows live or die.

What to do in the next 30 days (operator plan)

This is the plan I'd run with a small RevOps + SDR leader pod. It improves results without pretending you can AI your way out of fundamentals.

Week 1: Fix inputs

- Lock your outbound ICP to 2-3 segments max.

- Define required fields (title, function, seniority, geo, employee band, trigger).

- Build your first list, then verify + enrich before sending.

- Set a bounce-rate stoplight: >5% = stop and fix data.

Where AI helps: Salesforce sellers expect agents to cut research time by 34% and drafting by 36%. Good. Redeploy that time into better segmentation rules and better proof assets - not more volume.

Week 2: Fix relevance system

- Map each segment to one pain + one proof.

- Add "do-not-send" triggers:

- missing role clarity

- unverified email

- no trigger signal

- stale titles

- Write two offers per segment: one "fast value," one "strategic value."

Week 3: Fix cadence + channel mix

- Build sequences in the 4-7 touch range. (If you need examples, use a B2B cold email sequence template.)

- Treat follow-ups as mandatory: 42% of replies come from them.

- Add calls and social touches where it fits. Cognism's channel mix is clear: calls (57%) dominate outbound activity, then social (27%), then email (15%).

- Calibrate call expectations: 13.3% answered is normal across 451,895 SDR calls. Use that to diagnose list quality and timing, not rep effort.

Week 4: Fix governance + consistency

- Run a consistency audit: website, deck, outbound copy, and what AEs say on calls.

- Publish an AI usage policy:

- what AI can draft

- what must be human-approved

- what data can't be pasted into tools

- Add lightweight agent governance: approvals for external sends, logging, and versioning.

Sales trends 2026 FAQ

What are the biggest sales trends in 2026?

The biggest sales trends in 2026 are AI agents moving into real workflows, buyers preferring rep-free evaluation, larger buying groups with procurement involved early, and outbound shifting from volume to relevance. To act on them, standardize 2 workflows, tighten to 2-3 ICP segments, and run a weekly data loop so deliverability stays under 5% bounce.

What's a good cold email reply rate in 2026?

A good cold email reply rate in 2026 is 5.5%+ (top quartile), while 10%+ is elite; the overall average is 3.43%. If you're stuck at 2-4%, don't "write better"--fix segmentation and list quality first, then scale follow-ups since ~42% of replies come after email #1.

Are AI sales agents replacing SDRs in 2026?

AI agents aren't replacing SDRs in 2026; they're replacing chunks of SDR work like research, drafting, summarization, routing, and CRM updates. The safest winning model is human-in-the-loop: agents execute steps, humans own approvals and targeting decisions, with a measurable goal of 70%+ agent outputs accepted without edits.

What's a good free tool for cleaning outbound data before sending?

A good free way to clean outbound data is to verify emails, enrich missing fields, and refresh records weekly before you send - aiming for <3-5% bounce. Prospeo's free tier includes 75 emails + 100 extension credits/month with real-time verification and a 7-day refresh cycle, which is ideal for small teams running real campaigns.

Rep-free buying and 3.43% reply rates mean every outbound touch has to land. Teams using Prospeo book 35% more meetings than Apollo users because 98% accuracy protects deliverability while 30+ filters nail the right segment before you send a single email.

Relevance starts with verified contacts, not better subject lines.

Sales in 2026 rewards teams that act like operators, not tool collectors.

Run the weekly hygiene loop before you send another sequence, and treat these sales trends like execution requirements, not content topics.