Competitive Takeout: How to Win Competitor Customers in 30 Days (2026 Playbook)

Competitive takeout is how you win customers from competitors without turning your brand into a discount bin.

Do it like an operating system tied to renewal windows and real buyer signals, not a random blast of competitor keywords and "20% off."

We've run this motion with teams that had great product-market fit and still couldn't crack competitor accounts because their timing was off, their list was wrong, and their "offer" was just price. Fix those three things and the whole program starts behaving like a machine.

What you need (quick version)

- Pick one competitor + one segment. "Take out the market" is how you waste a quarter.

- Build an installed-base list and map the buying group (multiple roles).

- Route by intent tier (high/mod/low) into different cadences and assets.

- Lead with a switching plan, not a discount. Migration credits + price lock beat "percent off."

- Ship enablement before ads: battlecard + takeout landing page + 2 sequences.

- Measure as a cohort from Day 1: win rate, cycle time, ASP, discount rate, competitive presence.

If you only do three things this week:

- Build the installed-base list (with install confidence scoring)

- Create the switching-cost offer (migration help + price lock)

- Stand up the baseline vs takeout dashboard

All of this fails if your buying-group contacts bounce, so data quality's non-negotiable. In our experience, the fastest way to kill a takeout push is to torch deliverability in week one and then wonder why "competitor accounts don't respond."

Prospeo is the data-quality layer I'd use here: The B2B data platform built for accuracy.

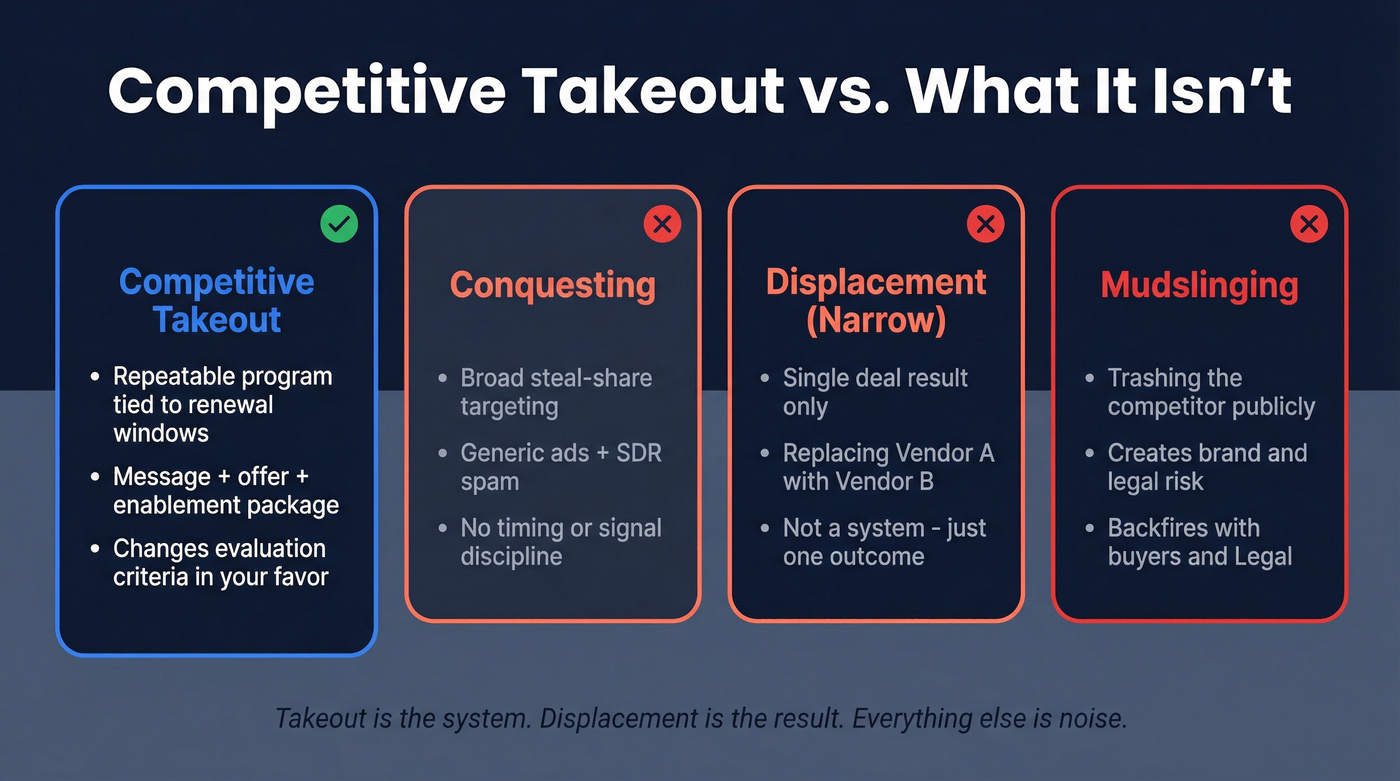

What "competitive takeout" means (and what it isn't)

Competitive takeout is a coordinated, cross-functional motion to take customers from competitors when the timing's right, usually when the account's already re-evaluating, frustrated, or nearing renewal.

You win by making switching feel safe: clear outcomes, proof, and a migration path. Lead with "your current vendor is trash" and you'll lose the room (and invite legal headaches).

Where teams get confused is vocabulary.

What it is

- A repeatable program tied to renewal windows and buyer signals

- A message + offer + enablement package (not just a discount)

- A deal-shaping motion: you change the evaluation criteria in your favor

What it isn't

- Conquesting: broad "steal share" targeting with generic ads + SDR spam

- Displacement (narrow): the deal result of replacing Vendor A with Vendor B in one opportunity - takeout is the system that creates those displacement opportunities

- Mudslinging: content that creates brand and trademark risk, including competitor mud slinging sales tactics that backfire with buyers and Legal

Hot take: if your average deal's a few thousand a year and onboarding's light, you probably don't need a fancy "takeout campaign." You need a clean list, a tight offer, and ruthless follow-up around renewal timing.

Why this works in B2B (the market reality)

Most B2B buying isn't greenfield. It's replacement buying with politics.

One widely cited benchmark puts it bluntly: 78% of B2B purchases are renew/replace/enhance decisions. Translation: the buyer already has a vendor, a contract, an implementation story, and scar tissue.

And buyers shortlist early. LinkedIn B2B Institute + Bain research (via MarTech) found 86% of buyers have choices predetermined on Day 1, and 81% end up buying from that Day 1 list. If you show up after that internal alignment, you're not "late." You're invisible.

This motion works when you:

- Show up before the formal evaluation starts

- Give the buyer a safe internal narrative: "We didn't mess up - we upgraded"

- Remove switching fear with a real migration plan and risk reversal

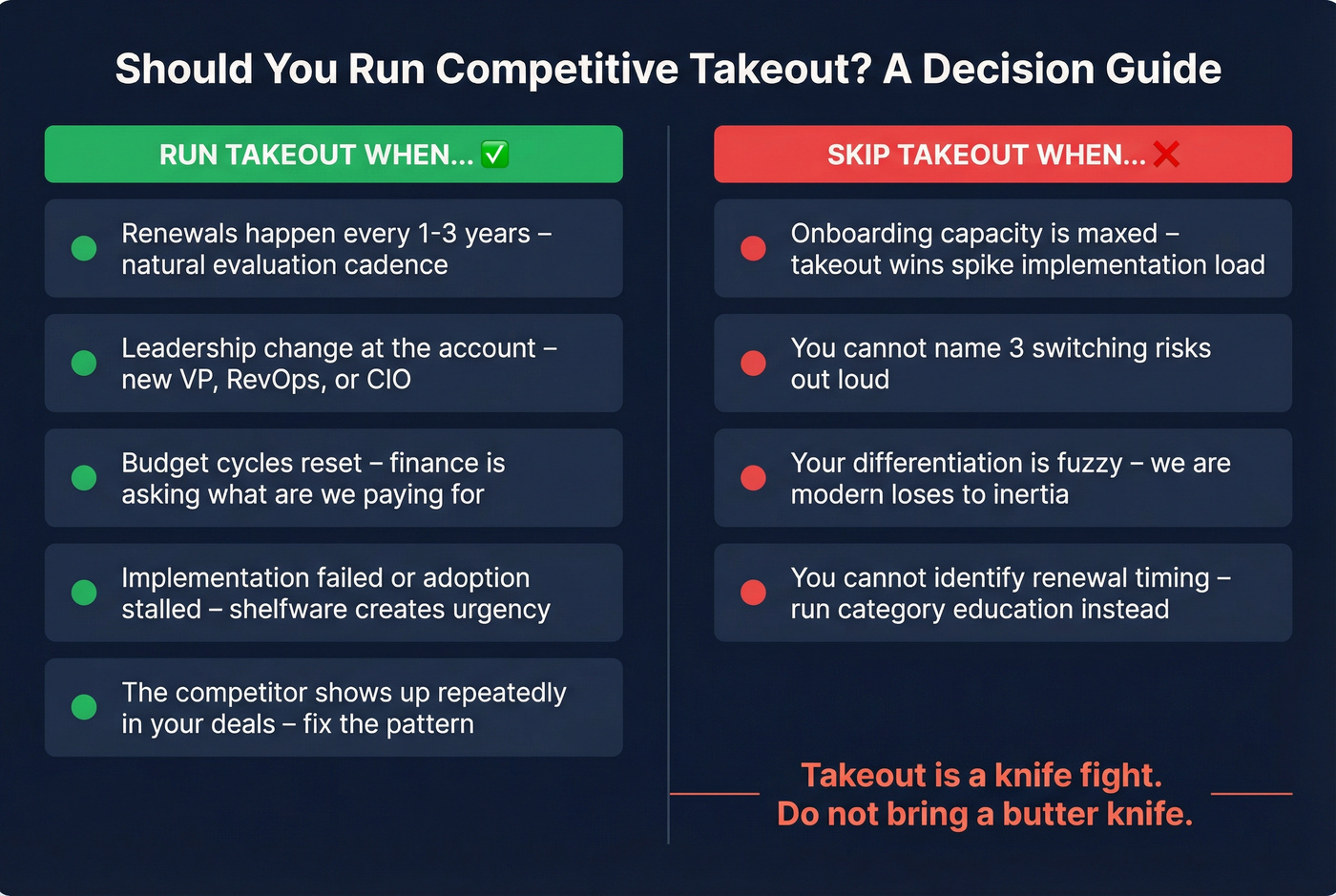

When to run it (and when to skip it)

Use these rules. They'll save you from running "takeout" that's actually just expensive outbound.

Run takeout when...

- Renewals happen every 1-3 years. That's the natural evaluation cadence.

- There's a leadership change (new VP/RevOps/CIO). Vendor swaps are visible wins.

- Budget cycles reset. Finance's already asking "what are we paying for?"

- Implementation failed or adoption stalled. Shelfware creates urgency and embarrassment.

- The competitor shows up repeatedly in deals. Fix the pattern, not the one deal.

Skip takeout when...

- Onboarding capacity's maxed. Takeout wins can spike implementation load.

- You can't name 3 switching risks. If you can't say them out loud, you can't de-risk them.

- Your differentiation's fuzzy. "We're modern" loses to inertia every time.

- You can't identify renewal timing. Don't run takeout - run category education until you can.

Takeout is a knife fight.

Don't bring a butter knife.

Competitive takeout dies when your buying-group contacts bounce in week one. Prospeo's 5-step verification delivers 98% email accuracy and 125M+ verified mobile numbers with a 30% pickup rate - so your SDR sequences actually reach the decision-makers inside competitor accounts, not spam folders.

Stop torching deliverability. Start displacing competitors with data that connects.

Pick the right takeout motion (competitor taxonomy + intent tiers)

You need two lenses at once:

- Competitor type: direct, indirect, status quo

- Buyer readiness: high / moderate / low intent

That combo tells you what to say and where to say it.

Competitor type x buyer state x best message x best channel

| Competitor type | Buyer state | Best message | Best channel |

|---|---|---|---|

| Direct | High intent | Proof + migration | SDR + exec email |

| Direct | Mod intent | Differentiation | Retarget + webinar |

| Direct | Low intent | Category POV | Content + nurture |

| Indirect | High intent | Reframe problem | SDR + workshop |

| Indirect | Mod intent | Educate category | Video + ads |

| Indirect | Low intent | "Why now" story | Newsletter |

| Status quo | High intent | ROI + urgency | SDR + call |

| Status quo | Mod intent | Risk reversal | Direct mail |

| Status quo | Low intent | Insight + benchmark | Report + nurture |

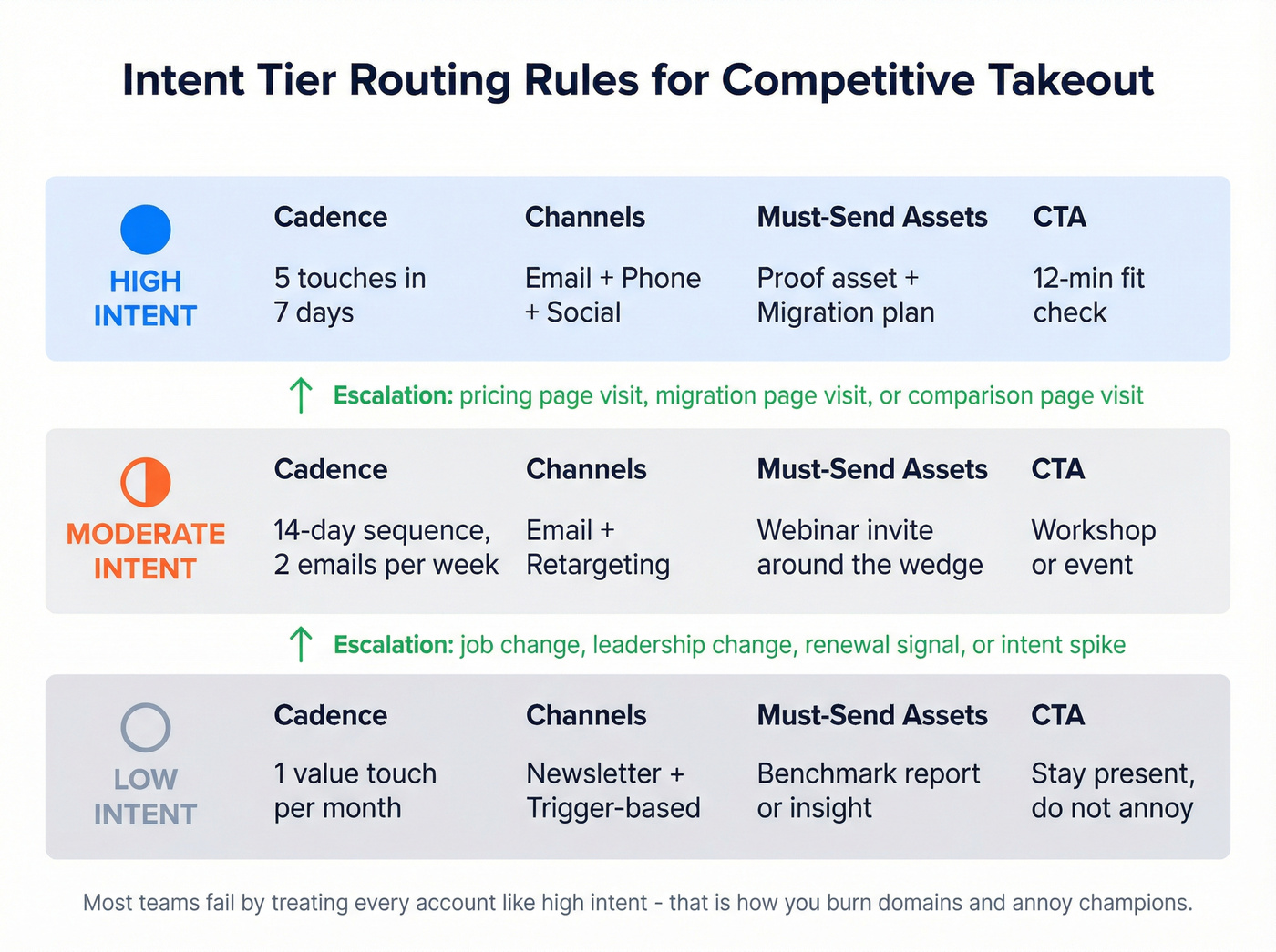

Routing rules (operational, not vague)

High intent (treat like an active deal)

- Cadence: 5 touches in 7 business days

- Channels: email + phone (or email + social voice note if phones are weak)

- Must-send assets: 1 proof asset + 1 migration asset

- CTA: "12-minute fit check" or "migration feasibility" (not "want a demo?")

Moderate intent (build preference before the evaluation)

- Cadence: 14-day sequence (2 emails/week)

- Channels: email + retargeting

- Anchor moment: invite to one webinar/workshop built around the wedge

- Escalation rule: if they hit pricing page / migration page / comparison page -> promote to high intent

Low intent (stay present, don't annoy them)

- Cadence: 1 value touch/month

- Channel: newsletter + trigger-based outbound

- Escalation rule: job change, leadership change, renewal timing signal, or intent spike -> move to moderate/high

Here's the thing: most teams fail here because they treat every account like high intent. That's how you burn domains, annoy champions, and make procurement defensive before you've earned a meeting.

Competitive takeout targeting & list-building (installed base -> buying group -> clean reach)

This is where takeout lives or dies. If your list's wrong, everything downstream is theater.

Step-by-step targeting checklist

- Start with competitor customer evidence (installed base). Logos, case studies, partner directories, job posts mentioning the tool, "we use X" language on careers pages, and tech-detect signals.

- Enrich with firmographics. Industry, headcount, revenue band, region, growth signals, funding - whatever defines your ICP.

- Score accounts. Keep it simple: 1-5 on ICP fit + 1-5 on switching likelihood. Multiply them.

- Map the buying group. Champion, economic buyer, technical owner, procurement/finance, power-user lead (minimum).

- Layer renewal timing. If the competitor's been in place around a year in annual-contract categories, outreach starts landing.

- Overlay intent topics that match your wedge (security, compliance, pipeline, data quality - whatever you actually fix).

- Verify contactability before sequences launch. Bad data doesn't just waste touches; it hurts deliverability.

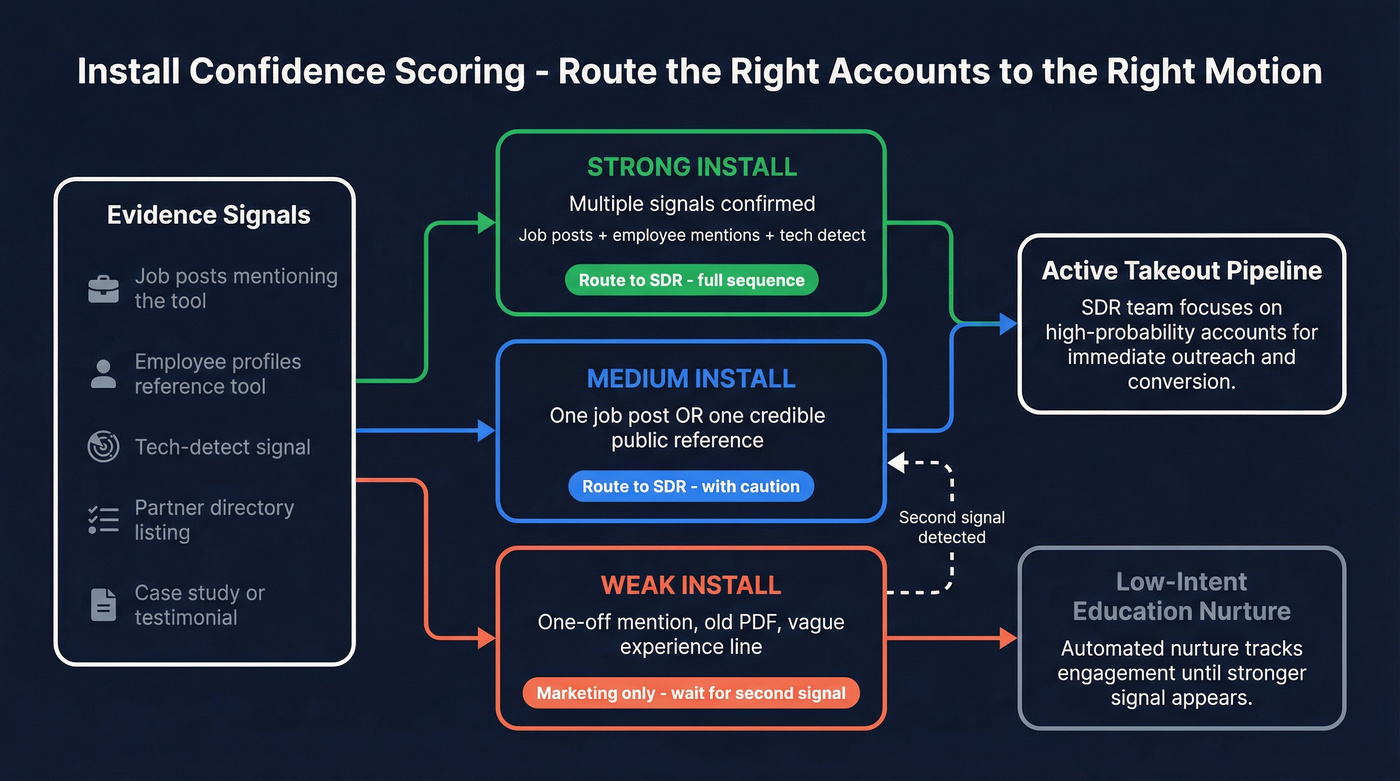

Install confidence scoring (avoid false positives)

Don't treat "one random mention" as an install. Score install evidence like this:

- Strong install (SDR eligible): job posts + multiple employees reference the tool + tech-detect signal and/or partner directory listing

- Medium install (SDR eligible with caution): one job post or one credible public reference (case study/testimonial)

- Weak install (marketing-only): one-off mention, old PDF, vague "experience with X" line

Routing rule: only Strong + Medium go to SDR. Weak installs go into low-intent education until you get a second signal.

Data inputs that actually matter

| Input | What it tells you | Where used |

|---|---|---|

| Competitor install | "They're a takeout" | Targeting |

| Install confidence | False-positive risk | Routing |

| Install age | Renewal window | Timing |

| Intent topics | Active pain | Messaging |

| Buying group roles | Who to reach | Sequencing |

| Email/phone validity | Can you reach them | Deliverability |

What buyers actually say in takeouts (the lines you'll hear all week)

Use these as your objection-handling starting point - because this is how it comes out of their mouths:

- "We can't survive another implementation."

- "Procurement won't let us switch mid-term."

- "We like the tool; we hate the process around it."

- "We're not unhappy enough to change."

- "We already negotiated hard - switching makes us look indecisive."

- "If you can't migrate our data cleanly, this is dead on arrival."

- "We'll talk at renewal. Not before."

Your job's to answer those fears with a plan, not a pitch.

How teams build and verify the list (the clean way)

A real scenario: an SDR team pulls a "competitor users" list, launches a 7-touch sequence, and by day three the bounce rate's ugly. Now the domain's warming backwards, replies drop, and the AE says "these accounts are trash." The accounts weren't trash. The list was.

If you want takeout to work, you need fresh, verified reach into the buying group, especially because renewal windows are unforgiving.

Prospeo gives you 300M+ professional profiles, 143M+ verified emails, and 125M+ verified mobile numbers, with 98% verified email accuracy and a 7-day data refresh cycle (the industry average is 6 weeks). It also returns an 83% enrichment match rate with 50+ data points per contact and a 92% API match rate, which matters when you're trying to cover 4-6 roles per account without turning list-building into a full-time job.

Now, what the workflow looks like in practice:

- Filter to your ICP (industry, headcount, region, revenue band).

- Add technographic filters and growth signals to tighten the list.

- Toggle Verified only so you're not exporting dead addresses.

- Select the intent topic(s) that match your wedge and sort by strongest signals.

- Check the "last refreshed" / verification state before export.

- Export to CSV or push into your CRM/outbound tool via integrations.

Takeout operating cadence (bi-weekly) that keeps the program sharp

Most takeout programs don't fail because the copy's bad. They fail because nobody owns the loop: signals change, objections evolve, offers drift, and Sales stops trusting the list.

Run this cadence and you'll keep momentum.

Bi-weekly 30-minute takeout standup (cross-functional)

Attendees: Marketing, Sales (SDR + AE leader), RevOps, CS/Implementation, Pricing/Finance (Product optional)

Agenda (tight, every time)

- Signal review (5 min): new install evidence, intent spikes, renewal timing updates

- Target list changes (5 min): add/remove accounts; adjust install confidence

- Objections (8 min): top 3 loss reasons + what to change this sprint

- Offer performance (5 min): which lever's winning (credits, price lock, phased rollout)

- Enablement gaps (7 min): battlecard updates, proof asset needs, migration FAQ updates

Monthly exec review (30 minutes)

- Takeout cohort win rate vs baseline

- Sales cycle (median) and discount rate

- Competitive presence rate and where you're losing

- Onboarding capacity and time-to-first-value for takeout wins

Post-mortem questions (use on every closed-won and meaningful loss)

- What was the real trigger: renewal, leadership change, adoption failure, budget reset?

- Which switching risk mattered most (data, downtime, security, training, procurement)?

- What proof actually moved the deal (case study, benchmark, reference call)?

- What did implementation effort look like (hours, tickets, surprises)?

- What would we change before running this exact takeout again?

The execution kit (copy/paste assets)

You don't need more theory.

You need assets your team can ship this week.

Battlecard template (one page, no fluff)

Header

- Competitor:

- Segment:

- Primary wedge (why switch):

Competitor claims (what buyers repeat)

- Claim #1:

- Claim #2:

- Claim #3:

Landmines (where we lose)

- Pricing objection:

- Migration fear:

- Feature gap perception:

Proof (what we can show)

- Customer story (same segment):

- Metric proof (before/after):

- Third-party validation (reviews/benchmarks):

Switching risks (say them out loud)

- Data migration:

- Training/change management:

- Downtime/security review:

Risk reversal (how we remove fear)

- Migration plan + timeline:

- Dedicated support/office hours:

- Price lock / opt-out clause (if applicable):

Talk tracks (verbatim lines)

- "If you're renewing in the next 90 days, the safest path is..."

- "Most teams switch when..."

- "The reason this won't be disruptive is..."

Competitive traps to avoid

- Don't insult their current choice

- Don't promise "easy migration" without a plan

- Don't argue features; argue outcomes

- Don't let competitor mud slinging sales creep into your talk track - buyers read it as insecurity

Sequence 1: Renewal-window email (2 steps + proof attach)

Email 1 - subject: {{Competitor}} renewal timing

Hi {{FirstName}} - quick question: are you planning to renew {{Competitor}} this cycle, or evaluating alternatives?

Many switches happen when coverage gaps show up or adoption never matches the business case. If you're even slightly in that zone, I can send two things:

- a 1-page outcome comparison for {{Segment}} teams, and

- a 30-day migration plan (phased, low-risk).

Worth a 12-minute call next week?

Email 2 (3-4 days later) If you're staying put, totally fair. If renewal's coming up, this is the only moment you get leverage.

Want the renewal pack (migration checklist + negotiation points) or should I close the loop?

Sequence 2: Intent-based email (2 steps)

Email 1 - subject: {{Topic}} at {{Company}}

Hey {{FirstName}} - when teams dig into {{Topic}}, it's usually because they're trying to fix {{pain}} without ripping everything out.

If you're on {{Competitor}} today, the clean path is phased: keep what's working, swap the piece that's breaking, and migrate in steps. Want the phased plan?

Email 2 (2-3 days later)

Two buckets I see:

- optimize what you have (if adoption's strong), or

- switch at renewal with migration support and a price lock.

Which bucket are you in?

Call opener (30 seconds)

"Hey {{Name}}, it's {{Rep}}. I'll be direct - this is a competitive takeout call. We're reaching out to teams using {{Competitor}} who are within ~90-180 days of renewal or seeing {{pain}}. Is that even remotely true, or should I disappear?"

If they say "we already have a solution," follow with:

"Totally. The only reason to talk is if renewal's coming up or adoption hasn't matched the business case. Which is closer to reality?"

Landing page outline (takeout-specific)

- Headline: "A safer switch from {{Competitor}}--live in 30 days"

- Subhead: outcome + segment specificity

- Proof strip: 3 logos + 2 metrics + 1 quote

- The wedge: 3 bullets on outcomes you win

- Migration plan: phases, timeline, who's involved

- Risk reversal: price lock, migration credits, support model

- FAQ: security, downtime, data migration, contract timing

- CTA: "Get the renewal pack" (not "Book a demo")

Building an installed-base list with intent tiers, firmographics, and buying-group mapping requires fresh data. Prospeo refreshes every 7 days - not 6 weeks - and gives you 30+ filters including buyer intent across 15,000 topics, technographics, and job change signals to time your takeout perfectly around renewal windows.

Route competitor accounts by real intent signals, not guesswork.

Offers that win takeouts (without destroying unit economics)

Takeout offers work when they reduce switching friction, not when they bribe the buyer.

A common operator range is ~10-30% year-one concessions for competitive takeouts, depending on segment and deal size. Use it as a lever, not a personality.

Offer menu (mix and match)

- Migration credits: $2,000-$15,000 equivalent value (services, onboarding, implementation hours)

- Price lock: cap year-two uplift so Finance can sign without renewal fear

- Termination-fee assist (capped): offset early exit costs with proof of fee

- Phased rollout: start with one team/region, expand after proof

- Executive sponsor + success plan: boring, but it closes deals

Never lead with discount; lead with the migration plan. Discounts are easy to copy. A credible switching plan isn't.

Incentives (SPIFFs) that drive behavior without gaming

SPIFFs work when they're simple, time-bound, and hard to game.

SPIFF design checklist

- Timeframe: 30-60 days max

- Eligibility: which roles qualify (SDR, AE, SE)

- Caps: per rep and total program cap

- Payout timing: within 30 days

- Exclusions: house accounts, inbound, existing opps, channel-sourced

- Definition clarity: what counts as "competitive" and how it's verified

- Quality gates: right persona + right stage

Payout norms (practical ranges)

| SPIFF type | Trigger | Payout range | Anti-gaming rule |

|---|---|---|---|

| Meeting SPIFF | Qualified meeting | $100-$500 | Must be ICP + role |

| Opp SPIFF | Stage created | $200-$800 | No dup opps |

| Closed-won | Competitive win | $500-$2,500 | Must displace X |

| Team kicker | Team target hit | $1k-$5k | Shared quota gate |

Measurement, benchmarks, and the dashboard spec

If you can't measure takeout as a cohort, you'll end up arguing feelings in QBRs.

Benchmarks to use as your baseline

Optifai's win-rate ranges by deal size are a solid sanity check (Optifai benchmark, N=939; Q1-Q3 2026):

- SMB: 28-35%

- Mid-market: 20-28%

- Upper mid-market: 15-22%

- Enterprise: 12-18%

Optifai also finds competitive presence correlates with 35% lower win rates. That's the whole reason takeout needs better timing and better proof than your normal motion.

For funnel health, Digital Bloom's benchmarks help you spot where takeout's breaking:

- MQL -> SQL: 15-21%

- Opp -> Close: 39% (SMB/MM) and 31% (ENT)

Dashboard spec (fields you actually need)

Build one dashboard with two cohorts: baseline vs takeout.

Cohort definition

- Takeout flag (yes/no)

- Competitor name (picklist)

- Competitor type (direct/indirect/status quo)

- Intent tier at creation (high/mod/low)

- Renewal window (T-180/T-90/T-30/unknown)

Funnel + efficiency

- Meetings set, SQLs, opps, closed-won

- Win rate by competitor + by segment

- Sales cycle length (median)

- ASP / ACV and discount rate

- Touches per opp (simple CAC proxy)

Debrief checklist (don't skip this)

- Top 3 win reasons / top 3 loss reasons

- Which asset was used in closed-won deals

- Implementation hours/tickets for takeout wins

- 30/60-day adoption flags for takeout cohort

Legal & compliance guardrails (competitor naming, PPC, and confusion risk)

I've watched teams create avoidable trademark risk with sloppy conquesting, and it's maddening because it's so preventable.

The test to keep in your head is simple: would a reasonable buyer be confused about affiliation, sponsorship, or "official" status?

The core legal idea (especially clear in Canadian case law) is confusion. Passing off generally comes down to goodwill, confusion, and damage. If your ads or pages make a reasonable person think you're the competitor (or affiliated), you're in the danger zone.

Do / don't checklist

Do

- Use competitor comparisons in a factual, non-deceptive way (feature tables, migration checklists, outcomes)

- Make your branding unmistakable on landing pages

- Keep conquesting ads focused on your value, not their name

- Expect higher CPC on competitor keywords and plan budgets accordingly

Don't

- Put competitor trademarks in meta tags (courts have called this "objectionable" in Pandi v. Fieldofwebs unless merely descriptive)

- Assume keyword bidding's always safe; it can still be passing off if confusion's likely (Vancouver Community College v. Vancouver Career College, 2017)

- Use competitor names in ad copy (this is where complaints and disapprovals happen)

- Use DKI on competitor campaigns (it can insert the trademark into ad text)

- Leave auto assets on in Google Ads for competitor campaigns

If you want the cleanest path, run competitor keyword campaigns that never use the competitor name in ad text, and push to a "switching plan" page that's clearly your brand.

FAQ: Competitive takeout

What's the difference between competitive takeout and competitive displacement?

Competitive takeout is the repeatable program (targeting, timing, messaging, offers, enablement, measurement) that creates competitor-switch opportunities at scale, while competitive displacement is the deal outcome where you replace a specific vendor in a specific account. In practice: takeout is the system; displacement is the win.

How early should you start outreach before a competitor renewal?

Start outreach 90-180 days before renewal so you can map 4-6 buying-group roles, get proof and migration assets in front of the champion, and influence the "Day 1 shortlist" before procurement defaults to a renewal. Under 60 days, you're usually negotiating, not shaping.

What are "switching-cost offers" in a takeout campaign?

Switching-cost offers are concessions that reduce disruption instead of just cutting price - migration credits ($2k-$15k), phased rollout, implementation support, and a year-two price lock. For most B2B teams, these beat a flat discount because they address the real blocker: fear of a messy changeover.

Can you bid on competitor keywords without using their name in ads?

Yes. Bidding's typically allowed, but you should avoid competitor names in ad copy to reduce confusion risk and trademark complaints. Keep DKI off, turn off auto assets, and expect CPCs to be meaningfully higher than non-competitive category terms.

How do you keep takeout lists accurate and avoid bounces?

Refresh installed-base signals and verify emails before every launch, ideally weekly, because bounce spikes can tank deliverability during the exact window you need credibility. Prospeo helps by providing 98% verified email accuracy, a 7-day refresh cycle, and real-time verification so you're not blasting dead addresses.

Your 30-day competitive takeout rollout (the recap)

- Day 1: baseline vs takeout dashboard + installed-base list (with install confidence) + switching-cost offer

- Day 7: battlecard + takeout landing page + routing live (high/mod/low) + sequences shipped

- Day 30: cohort readout + win/loss debrief + offer/asset iteration + next competitor queued