LeadLoft pricing (2026): what you'll actually pay each month

LeadLoft pricing looks simple until you add extra seats, start pulling phone numbers, and your card gets hit with a $50 credit top-off you forgot you enabled. The real cost is always subscription + seats + credits, and once you do that math, you'll know fast whether it's a fit.

Here's the thing: most "LeadLoft cost" posts stop at the $99 headline and call it a day. That's not budgeting. That's wishful thinking.

LeadLoft pricing snapshot (quick version)

Use this as your back-of-the-napkin calculator.

Checklist (the only numbers that matter):

- Unlimited: $99/mo (includes 1 user)

- Unlimited add'l users: $99/mo per user

- Scale AI: $400/mo (includes 1 user)

- Scale AI add'l users: $149/mo per user

- Data credits: $0.10 per credit

- Auto top-off: $50 (500 credits) when your balance drops below 50 credits

- Credits are opt-in (no opt-in = no credit charges)

Mini table (monthly, before credits):

| Plan | Base (1 user) | Add'l user | Best for |

|---|---|---|---|

| Unlimited | $99 | $99 | 1-3 reps, light phones |

| Scale AI | $400 | $149 | 3+ reps using AI workflows weekly |

If you want to double-check the seat math, LeadLoft's pricing page and Help Center line up on the core plan and seat numbers ($99/$400 and the add-on seat pricing), even though the pricing page also shows an extra $1,500 figure on the Scale AI card that isn't explained.

LeadLoft plans and per-user pricing (Unlimited vs Scale AI vs Managed Service)

LeadLoft has two self-serve software plans plus a done-for-you Managed Service.

Here's the clean comparison (monthly list pricing):

| Plan | Base (1 user) | Add'l user | Annual deal |

|---|---|---|---|

| Unlimited | $99/mo | $99/mo | Annual: 2 months free |

| Scale AI | $400/mo | $149/mo | Annual: 2 months free |

| Managed Service | ~$3k-$10k+/mo | N/A | Custom |

Two practical notes:

Annual billing is real savings. "2 months free" means you pay for 10 months and get 12.

Managed Service is a separate purchase. It's not a "bigger plan" - it's LeadLoft running outbound for you.

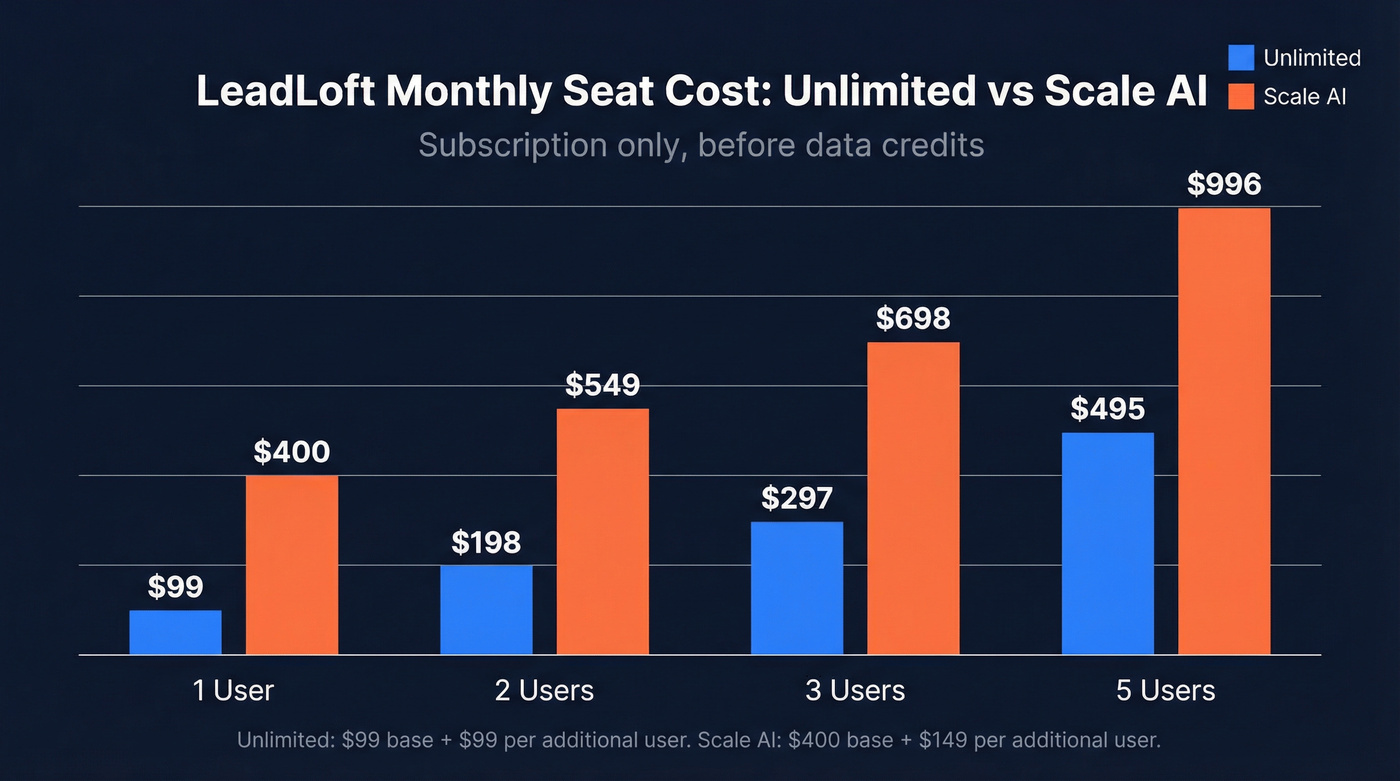

LeadLoft pricing scenarios (1, 2, 3, 5 users)

This is where the "$99/mo" headline either holds up or falls apart.

Seat math only (no credits yet):

| Users | Unlimited | Scale AI |

|---|---|---|

| 1 | $99 | $400 |

| 2 | $198 | $549 |

| 3 | $297 | $698 |

| 5 | $495 | $996 |

In our experience, Unlimited is only "cheap" for a solo user. The moment you hit 3-5 seats, it's a normal SaaS bill - before variable credits.

Use/skip notes by scenario

1 user

- Use Unlimited if you're a founder or solo SDR and want one workspace without a big commitment.

- Skip Scale AI unless you'll use the AI features every week. Otherwise you're paying for features you won't touch.

2 users

- Unlimited still makes sense for prospecting + light outreach.

- Scale AI only makes sense if you're actually building repeatable AI-assisted workflows (not just "trying AI").

3 users

- Unlimited is now a mid-tier SaaS line item. If you're also buying credits, budget for it like a real tool.

- Scale AI is a real investment. If you don't have a defined workflow (lists -> playbooks -> inbox -> pipeline), it'll feel expensive fast.

5 users

- Unlimited at $495/mo is fine if it replaces multiple tools. If it doesn't, you'll resent it.

- Scale AI at about $1k/mo is "team tool" territory. If adoption's sloppy, you're buying shelfware.

LeadLoft pricing for data credits: $0.10/credit explained

LeadLoft's subscription gets you access to the platform. Data actions can consume credits, and credits cost real money.

Here's the cheat sheet:

- You start with 100 free data credits

- Credits cost $0.10 per credit

- Common actions:

- BounceShield: 1 credit = $0.10

- Enrich AI: 1 credit = $0.10

- Phone Finder: 5 credits = $0.50 per phone number

- Email Finder doesn't consume credits on Unlimited/Scale AI

Quick examples (so you can budget without guessing):

- Verify 1,000 emails with BounceShield: 1,000 credits = $100

- Enrich 2,000 contacts: 2,000 credits = $200

- Pull 500 phone numbers: 500 x $0.50 = $250 (2,500 credits)

One budgeting reality check: LeadLoft has published a ~60% phone coverage result in testing, so plan for the fact that not every lookup returns a number, even if you're building a phone-heavy workflow.

What typically burns credits (and what barely moves the needle)

Credits don't "mysteriously disappear." They get burned by a few predictable behaviors.

Email verification at scale is a steady burn. If your process is "verify every new contact before sending," you'll spend consistently; it's usually worth it for deliverability, but it becomes a monthly line item quickly.

Enrichment on every import is the silent burn. Enriching entire account lists feels harmless because it's one click, and it's also the easiest way to rack up 5,000 credits without noticing.

Phone Finder is the spiky burn. The per-unit cost is reasonable, but teams tend to run phone lookups in bulk (director+ across a whole territory), which creates big credit months.

If you want predictable spend, keep it simple: verify the contacts you'll actually message this week and reserve phone lookups for high-intent accounts.

LeadLoft's credit math adds up fast - $0.10 per verify, $0.50 per phone, plus $50 auto top-offs. Prospeo delivers 98% accurate emails at ~$0.01 each, 125M+ verified mobiles, and zero surprise charges. No auto top-offs. No opt-in traps. Just transparent credit-based pricing.

Stop budgeting around surprise charges. Pay $0.01 per email instead.

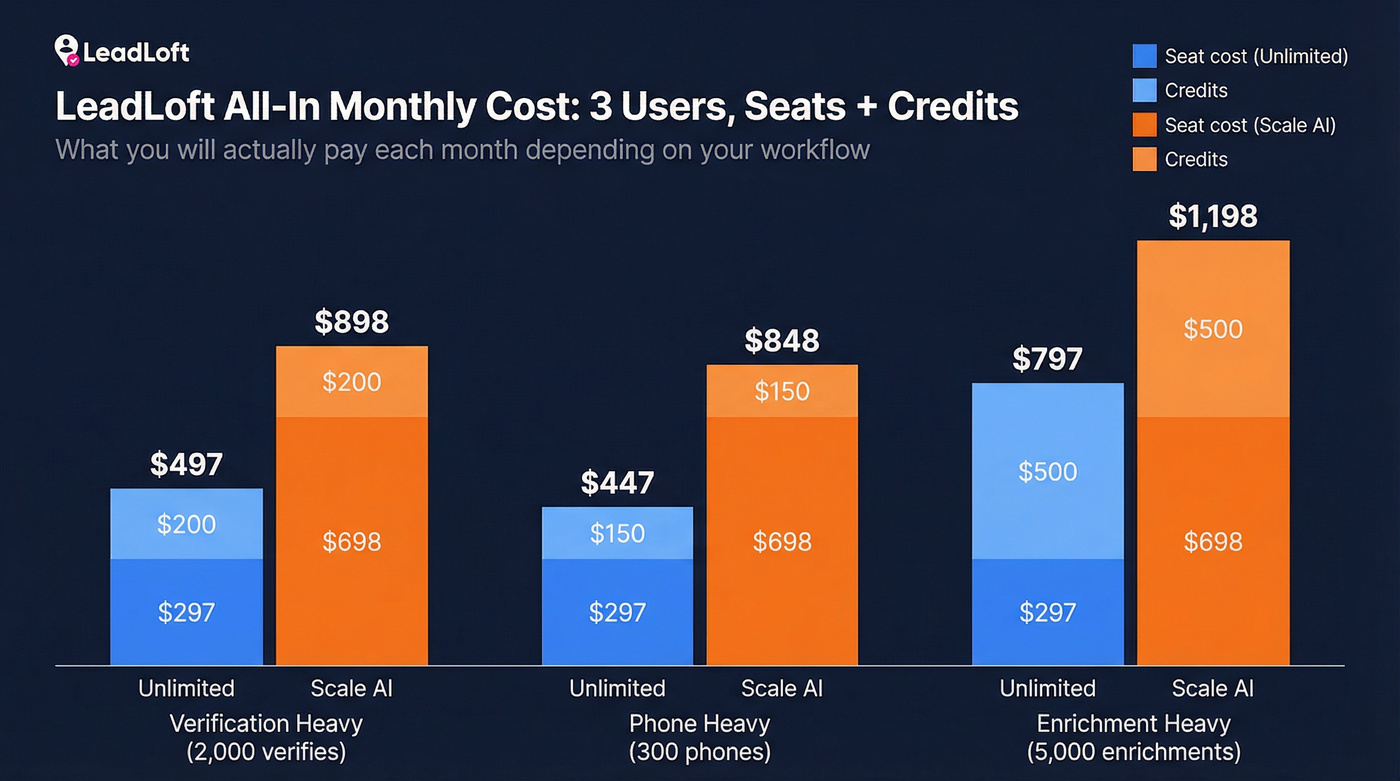

Typical "all-in" monthly totals (seats + credits)

Most pricing articles stop at seat math. That's useless.

Here are blended totals with common credit patterns so you can budget like an adult, including the kind of month where you run a big enrichment job, pull a few hundred phone numbers, and still do basic verification so deliverability doesn't fall apart.

Assumptions (monthly):

- Verification-heavy: 2,000 BounceShield credits = $200

- Phone-heavy: 300 phones x $0.50 = $150

- Enrichment-heavy: 5,000 Enrich AI credits = $500

| Scenario (monthly) | Credits cost | 3-user Unlimited ($297) | 3-user Scale AI ($698) |

|---|---|---|---|

| Verification-heavy | $200 | $497 | $898 |

| Phone-heavy | $150 | $447 | $848 |

| Enrichment-heavy | $500 | $797 | $1,198 |

My recommendation: if your average deal size is in the low four figures and you're enrichment-heavy, be ruthless about tools that add variable spend. Variable costs punish teams that don't have tight targeting, and I've seen "we'll just enrich everything" turn into a recurring $500-$1,000/month habit that nobody owns.

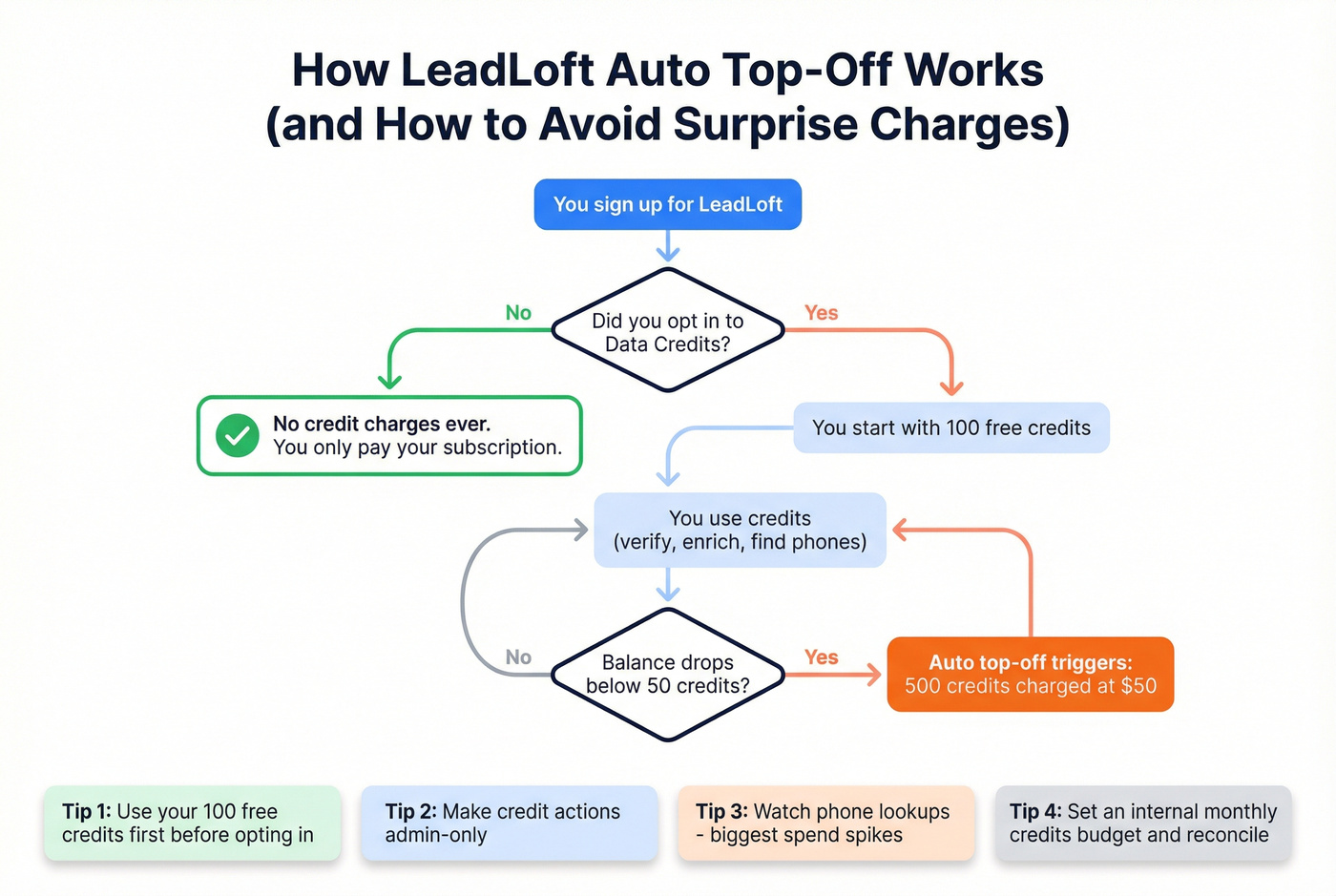

The only "hidden fee" to understand: opt-in + $50 auto top-off

LeadLoft's credit system isn't shady, but it'll surprise you if you don't set it up intentionally.

Read this twice.

You must opt in to use Data Credits.

If you never opt in, you won't be charged for credits.

If you do opt in, LeadLoft auto top-offs 500 credits ($50) whenever your balance drops below 50 credits.

How to avoid surprise charges

- Make credit-consuming actions admin-only until you trust the workflow.

- Watch phone-finding workflows. That's where spend spikes.

- Use the 100 free credits first, then opt in once you've proven ROI.

- Set a simple internal rule like "credits budget = $150/mo" and reconcile monthly.

I've watched teams treat credits like pennies and then act shocked when finance asks about "random $50 charges." It's not the $0.10 that gets you - it's the automation.

Why Google shows conflicting LeadLoft pricing (and what's outdated)

If you searched leadloft pricing, you probably saw numbers that don't match each other. That's not you - it's the internet.

Some third-party directories have stale plan details, like ultra-low "starter" pricing or "two users included." That conflicts with LeadLoft's current model where plans include 1 user and extra seats are paid.

Marketplaces like Capterra also tend to show simplified metadata (for example, "$100") and can lag behind reality.

Rule of thumb: trust LeadLoft's pricing page and Help Center first, then use third-party pages only as a historical hint.

Why you're seeing "$1,500" and "$400/mo" for Scale AI

LeadLoft shows $400/mo for Scale AI, but you may also see $1,500 on the same card. The pricing page doesn't explain what that $1,500 represents.

In practice, numbers like $1,500 are usually one of two things: a setup/onboarding fee, or a minimum commitment (like a minimum prepay). Assume you'll pay $400/mo, and treat the $1,500 as an additional charge until it's spelled out in the agreement, because the only number that matters is the one that ends up on the invoice.

Ask this before you buy:

"What exactly is the $1,500 - one-time setup, minimum term/prepay, or something else - and where is it stated in the agreement?"

Money-back guarantee: 5 days vs 7 days (site inconsistency)

LeadLoft's site has shown inconsistent guarantee copy (a 7-day money-back window for Starter plans in one spot, and a 5-day money-back guarantee in another). It's not a dealbreaker, but it's the kind of detail that matters when you're buying a tool that can trigger variable credit charges.

What to do:

- Screenshot the guarantee language you see at checkout.

- Ask support to confirm in writing which window applies to your plan (and whether it's limited to "starter"/self-serve plans).

- If you're paying annually, confirm whether the guarantee applies to annual prepay or only monthly.

This takes five minutes and saves you a painful back-and-forth later.

Annual vs monthly billing math (2 months free)

LeadLoft's annual discount is simple: 2 months free.

Effective monthly rate:

monthly price x (10/12) = monthly price x 0.833

Examples (single seat):

- Unlimited: $99/mo -> annual effective $82.50/mo

- Scale AI: $400/mo -> annual effective $333.33/mo

My rule: go annual only after you've proven two things: adoption (people actually use it) and deliverability (your workflow isn't wrecking inbox placement).

Managed Service pricing (what you get + what it likely costs)

LeadLoft doesn't publish Managed Service pricing; you'll need a call.

Managed Service is LeadLoft saying: "We'll do the outbound work, not just give you software."

Published deliverables include output ranges (estimates) like:

- 600-1000 qualified leads

- optimized messaging + ongoing optimization

- 30-60 meetings per quarter

- "average 30+ booked meetings per quarter"

In the managed outbound world, that usually lands in a retainer band of $3,000-$10,000+/mo, depending on how narrow your ICP is, whether you're selling into regulated industries, how much personalization you expect, and whether they're doing list building, enrichment, copy, and inbox management.

Decision rubric:

- Buy Managed Service if you're founder-led, time-starved, and you'll happily trade margin for speed.

- Don't buy it if you already have SDR capacity and mainly need better data + a tighter outreach system. You'll pay premium labor rates for work your team can do.

Limits and caps: outreach safety numbers LeadLoft references

LeadLoft publishes outreach safety guidance (think: "don't get restricted"), and I respect that. These are guidelines from LeadLoft's limits guidance, not plan-enforced quotas.

The guidance centers on:

- Connection requests: 100-200/week is the platform allowance, but staying under 80/week is recommended if you don't have Sales Navigator

- Messaging: 100/week (free accounts) / 150/week (paid accounts) for new outreach

- Follow-ups: LeadLoft suggests you can go higher (200-300/week), but keep new outreach within safer ranges

- Acceptance-rate risk: if your acceptance rate drops below 30%, restrictions get more likely

Checklist to keep risk low:

- Keep volume boring and consistent (spikes trigger problems).

- Don't automate to irrelevant personas just because you can.

- Treat 30% acceptance as your minimum bar. If you're below it, fix targeting and messaging before scaling.

Is LeadLoft worth it in 2026? (who should buy, who should pass)

LeadLoft's pitch is "prospecting to closing in one place," and for small teams that can be genuinely nice.

User sentiment (small sample, but still useful): on G2, LeadLoft is rated 4.9/5 from 16 reviews. One reviewer highlights ease-of-use ("easy to navigate and set up") while the most repeated drawback is basic: no mobile app. "Expensive" also shows up as a con tag, which tracks once you do seat math plus credits.

Who should buy

- Solo operators and small pods that want one workspace for prospecting + outreach + pipeline.

- Teams that will use the AI features weekly (otherwise Scale AI is overkill).

- Anyone comfortable with credits as a variable cost and disciplined enough to control who spends them.

Who should pass (and what I'd do instead)

If you mainly need verified emails and mobile numbers with predictable self-serve pricing, skip the seat-plus-credits math entirely and use a dedicated data platform.

Prospeo is the B2B data platform built for accuracy. It gives you 300M+ professional profiles, 143M+ verified emails, and 125M+ verified mobile numbers, used by 15,000+ companies and 40,000+ Chrome extension users, with 98% verified email accuracy and a 7-day data refresh cycle (the industry average is about 6 weeks). Real talk: if your biggest pain is "our lists are stale and deliverability's getting cooked," I'd rather fix the data layer first than pay for a bigger engagement suite and hope it magically makes bad targeting work.

We've seen teams do this in the real world: they keep their engagement tool for sequencing, but they source and verify contacts in Prospeo so they're not paying for junk records or guessing whether an address is safe to send.

At 3 users with phone-heavy workflows, LeadLoft runs $848-$898/mo - and that's before enrichment. Prospeo gives you 300M+ profiles, 30+ search filters, intent data, and a 7-day data refresh cycle. Enrichment returns 50+ data points at a 92% match rate.

Get enterprise-grade data without enterprise-grade invoices.

Before you buy LeadLoft, do these three checks:

- Seat reality check: how many users will you actually have in 90 days?

- Credits reality check: are you verification-heavy, enrichment-heavy, or phone-heavy (and who controls spend)?

- Scale AI clarity check: what does the $1,500 mean in your agreement: setup fee or minimum commitment?

Summary: LeadLoft pricing comes down to seats + credits

If you're trying to budget LeadLoft pricing without getting surprised, ignore the headline monthly number and model it like this: base plan + paid seats + the specific credit actions you'll run every week. Do that once (with realistic phone and enrichment volume), and you'll know whether Unlimited stays lean or whether Scale AI and credits push you into "team tool" spend.

Outbound links used: LeadLoft pricing page, LeadLoft cost help doc, LeadLoft data credits cost article, LeadLoft reviews on G2