Overloop AI Pricing in 2026: What It Actually Costs (And What the Credit System Hides)

You're Googling "overloop ai pricing" and getting three different numbers. One site says $69/month. Another says $299. A third lists $399. The CFO wants a straight answer, and you can't give one because the internet can't agree on what this tool costs.

Here's the definitive breakdown - current pricing, the credit math nobody explains upfront, and how Overloop stacks up against the alternatives you're probably also evaluating.

Quick Answer: What Overloop AI Costs Right Now

| Plan | Monthly Price | Credits/User/Mo | Email Accounts | Campaigns |

|---|---|---|---|---|

| Starter | $69/user | 250 | 1 | 3 |

| Growth | $99/user | 500 | 3 | 10 |

| Enterprise | ~$149-199/user | 1,000 | Unlimited | Unlimited |

All plans include the 450M+ database, AI campaigns, email warmup, multichannel (email + LinkedIn), open/click/reply/bounce tracking, CASA Tier 2 certification, and GDPR compliance. There's a 14-day free trial with no credit card required.

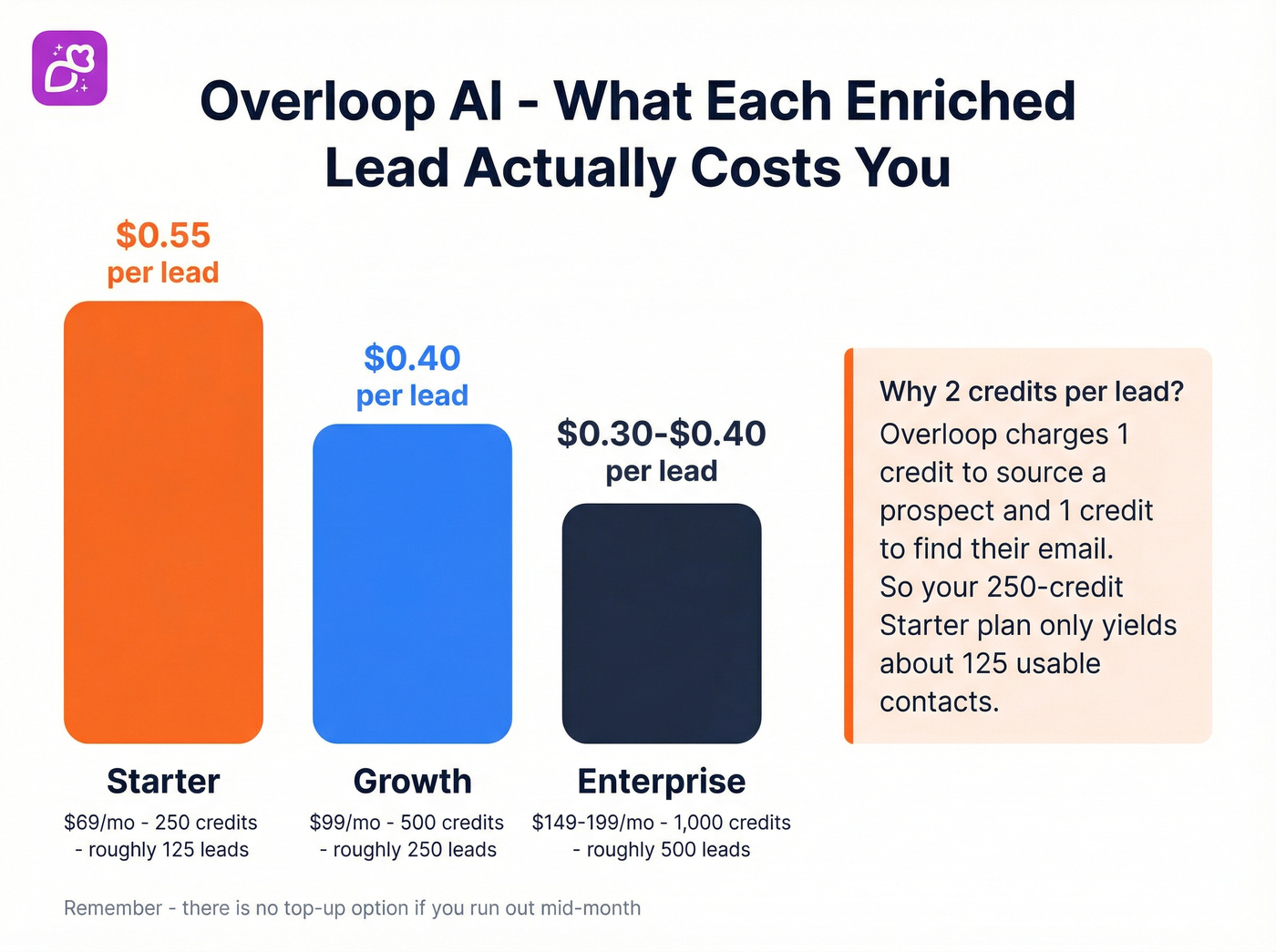

The one-line verdict: Solid UX for small teams, but the credit system costs more than it looks. Two credits per enriched prospect means your 250-credit Starter plan yields roughly 125 usable leads. That's $0.55 per enriched contact before you've sent a single email.

Overloop AI Plans: The Full Breakdown

Starter Plan ($69/user/month)

The Starter tier is Overloop's entry point, clearly designed for a solo SDR testing the waters. You get 250 credits per month, one email account, and a cap of three active campaigns.

Integrations are basic - Slack, Zapier, and the Chrome Extension. You're on a shared IP for email sending, which means your deliverability is partially at the mercy of other users on that same IP. Onboarding is self-serve, and support is chat-only.

For a solo founder or SDR running a few targeted campaigns per month, this works. But three campaigns is a hard ceiling. If you're testing multiple ICPs or running A/B variants, you'll hit that wall fast.

Growth Plan ($99/user/month)

This is where most small teams land. You get 500 credits (so ~250 enriched prospects), three email accounts per user, and up to 10 active campaigns. The jump from 3 to 10 campaigns is significant - it's the difference between "testing outbound" and "running outbound."

The Growth plan unlocks HubSpot and Pipedrive integrations plus REST API access. If your CRM is either of those, this is effectively the minimum viable plan.

Enterprise Plan (Custom, Est. $149-199/user/month)

Enterprise bumps you to 1,000 credits per user, unlimited email accounts, unlimited campaigns, and Salesforce integration. You also get a dedicated IP (critical for deliverability at scale), a dedicated CSM, 1:1 onboarding, and priority support.

Overloop doesn't publish Enterprise pricing. Based on the credit scaling pattern and the added infrastructure - a dedicated IP alone has real cost - expect $149-199/user/month. You'll need to talk to their sales team.

Here's the thing: the Enterprise plan is the only tier that makes sense for teams of 5+. At the Growth level, five SDRs cost $495/month for 2,500 total credits - roughly 1,250 enriched prospects. That's 250 leads per rep per month. For many outbound motions, that's not enough.

How Overloop AI Credits Actually Work

This is where the sticker price gets misleading. The credit system is the real pricing mechanism, and it deserves a close look.

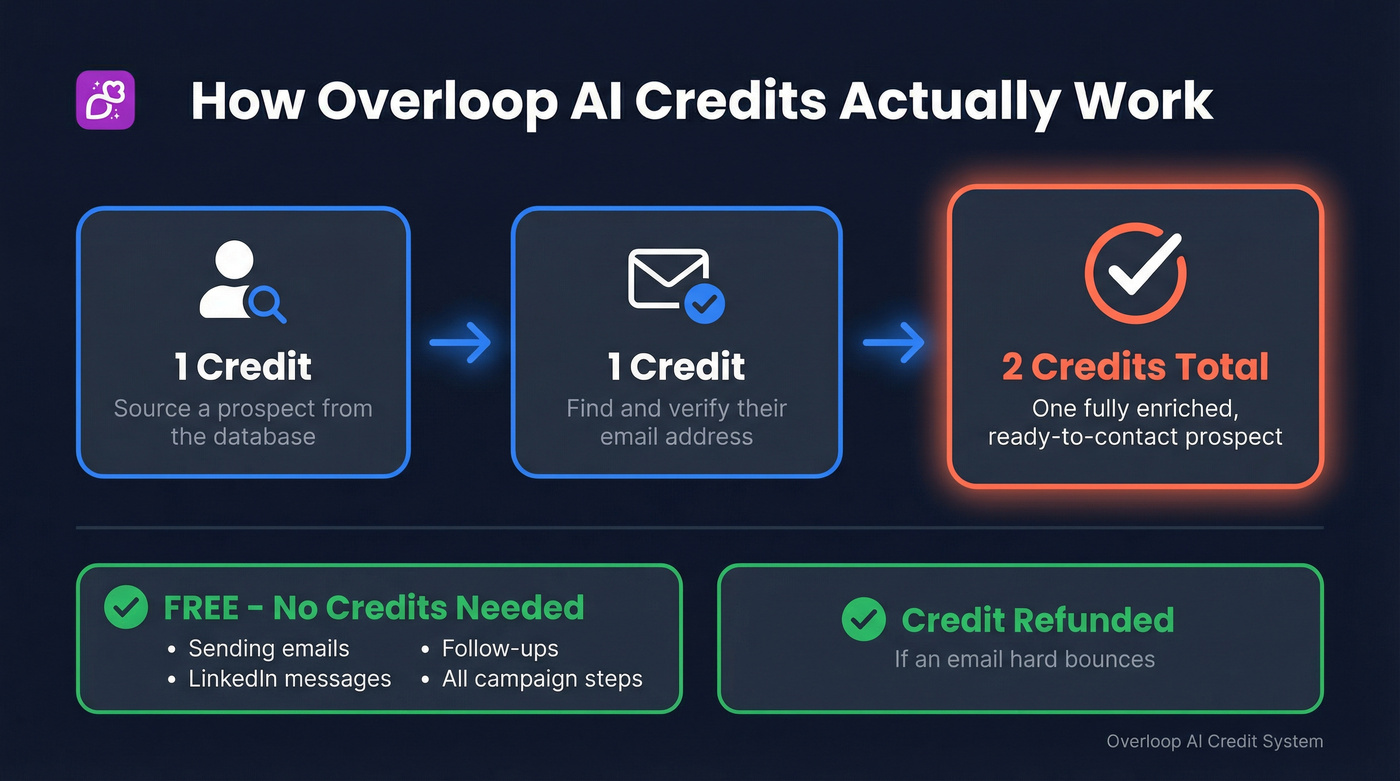

What Costs Credits (And What Doesn't)

- 1 credit = source a prospect from the database

- 1 credit = find/verify their email address

- 2 credits total = one fully enriched prospect (sourced + email found)

- 0 credits = sending emails, LinkedIn messages, follow-ups, and all campaign steps

- Credit refunded if an email hard bounces

Campaign execution being free is a real plus. But the sourcing cost is where the math gets uncomfortable - especially if you're doing email lookup and verification at scale.

The Real Cost Per Lead at Each Tier

Let's do the math that the pricing page doesn't show you:

| Plan | Credits | Enriched Prospects | Cost/Lead |

|---|---|---|---|

| Starter | 250 | ~125 | $0.55 |

| Growth | 500 | ~250 | $0.40 |

| Enterprise | 1,000 | ~500 | ~$0.30-0.40 |

What Happens When You Run Out

This is the part that frustrates teams the most.

When your credits hit zero mid-month, prospect sourcing stops completely. Email finding stops completely. Your campaigns keep running for existing contacts, but you can't add anyone new. Your options? Wait for your billing cycle to reset, upgrade your plan, or renew early. That's it.

Credit packs are listed as "coming soon" in Overloop's help center, but they don't exist yet. No overage option. No top-up button. We've seen SDRs frozen for 10-12 days mid-month because they burned through credits in the first three weeks. The system just stops.

A credit system without a top-up option is a tax on teams with variable prospecting volume. Some months you need 400 leads. Some months you need 100. Overloop forces you to size for the peak or accept downtime.

Overloop charges $0.40-$0.55 per enriched contact and freezes your prospecting when credits run out. Prospeo delivers 98% accurate emails at $0.01 each - 40x cheaper - with no hard caps that stop your team mid-month.

Stop paying 55 cents for what costs a penny.

Annual Pricing, Free Trial, and Money-Back Guarantee

Estimated Annual Pricing

Overloop doesn't publish annual pricing on their website - no toggle, no comparison table. That's unusual for SaaS and frankly annoying when you're trying to build a business case.

Based on industry-standard SaaS discounts (15-25%) and Overloop's older pricing structure, expect roughly a 20% annual discount:

- Starter: ~$55/user/month (billed annually)

- Growth: ~$79/user/month (billed annually)

- Enterprise: negotiate directly

The big annual advantage isn't the discount - it's the credit rollover. Monthly plans lose unused credits every billing cycle. Annual plans deliver all 12 months of credits upfront, and they roll over within the year. If you have a slow Q1 and a heavy Q3, annual billing gives you that flexibility.

14-Day Free Trial

Yes, it exists. No credit card required. You can sign up directly at overloop.com/pricing.

Some third-party reviews incorrectly claim there's no free trial. That's wrong - it's right on the website.

30-Day Money-Back Guarantee

Available on annual plans for the first user. Standard SaaS safety net. Nothing unusual here, but worth knowing if you're committing to an annual contract.

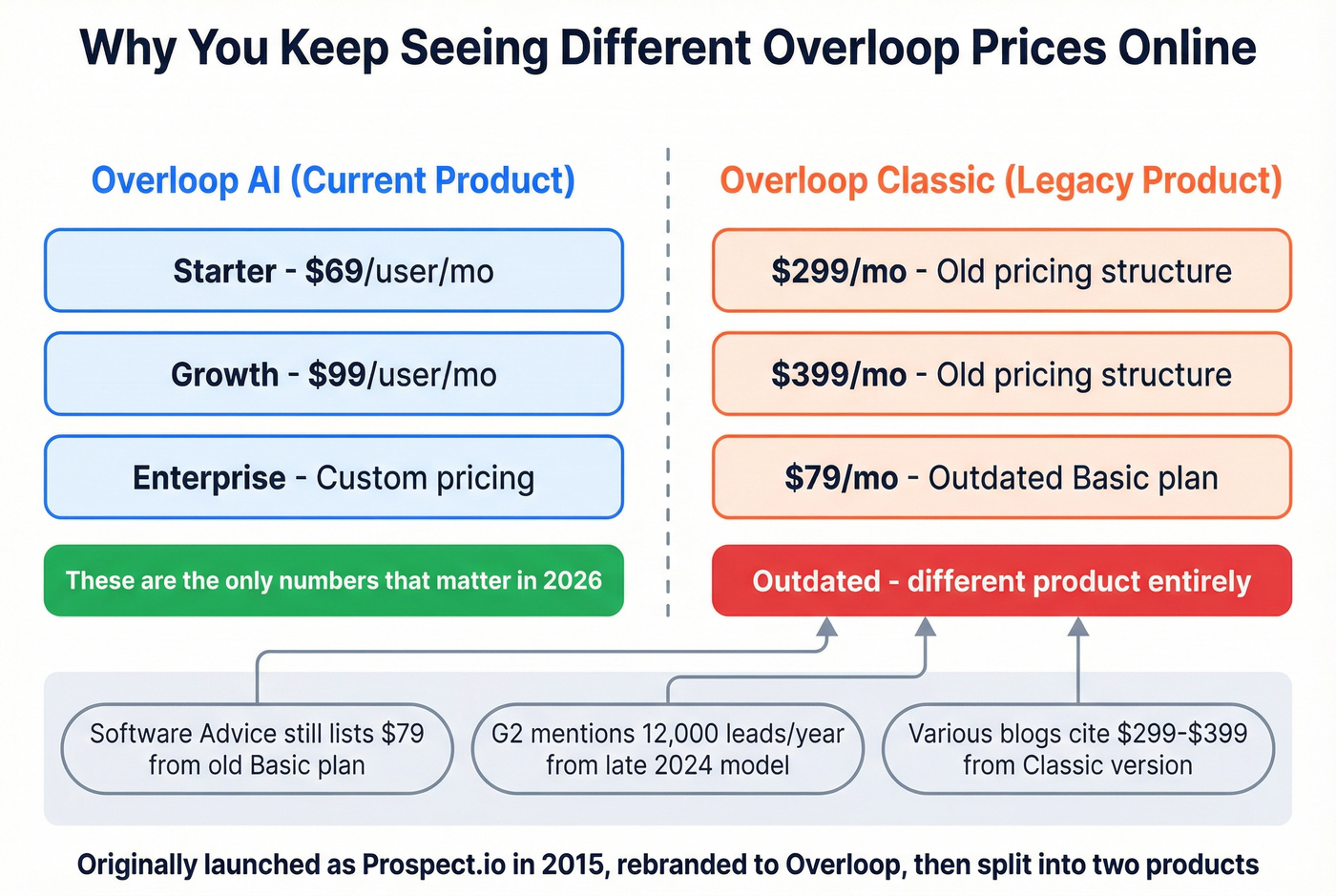

Why You See Different Prices Online

If you've been researching Overloop's cost, you've probably seen $69, $79, $99, $299, and $399 - all for what seems like the same product. Here's why.

There are two separate products: Overloop AI and Overloop Classic. They're listed as distinct items in the site navigation. Overloop AI is the current AI-powered prospecting platform at $69/$99/custom. Overloop Classic is the legacy CRM/outreach tool, originally launched as Prospect.io back in 2015.

The $299-$399 figures floating around reference the older product version - a different pricing structure for a different product entirely. Software Advice still lists $79 as the starting price, which references an outdated "Basic" plan. G2's pricing page mentions "12,000 leads per year" - that's from late 2024 and references the old model.

Bottom line: if you're evaluating Overloop today, the only numbers that matter are $69 (Starter), $99 (Growth), and custom (Enterprise).

Overloop also has minimal Reddit presence compared to Apollo and Lemlist, which dominate r/coldemail discussions. That means less community validation and fewer real-world pricing anecdotes to cross-reference - another reason the conflicting numbers persist.

If you want a bigger list of comparable tools, see our breakdown of Overloop alternatives.

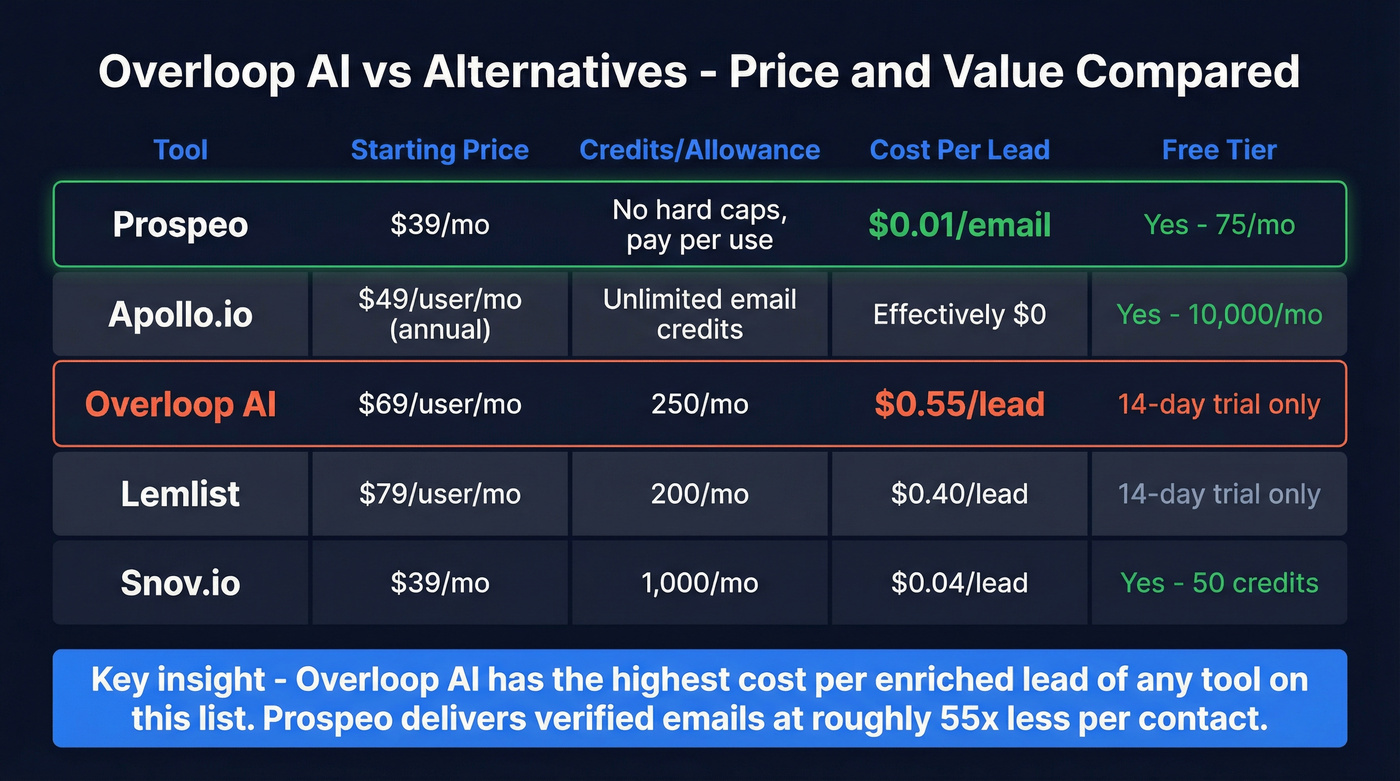

How Overloop AI Compares to Alternatives on Price

Here's where the credit math really starts to matter. Overloop isn't expensive in isolation - but compared to what else is available, the value equation gets complicated fast.

| Tool | Cheapest Paid (Monthly) | Credits/Allowance | Database | Free Tier |

|---|---|---|---|---|

| Prospeo | ~$39/mo | ~$0.01/email, no caps | 300M+ | Yes (75/mo) |

| Apollo.io | $49/user/mo (annual) | Unlimited email | 275M+ | Yes (10K/mo) |

| Overloop AI | $69/user/mo | 250/mo | 450M+ | 14-day trial |

| Lemlist | $79/user/mo ($63 annual) | 200/mo | 600M+ | 14-day trial |

| Snov.io | $39/mo ($29.25 annual) | 1,000/mo | 50M+ | Yes (50 credits) |

Prospeo - Best Value for Verified Contact Data

If your main frustration with Overloop is the credit bottleneck, Prospeo solves that problem directly. At roughly $0.01 per verified email with 98% accuracy, the cost-per-lead math isn't even close - it's roughly 55x cheaper than Overloop's Starter tier for email verification alone. The platform covers 300M+ professional profiles with a 7-day data refresh cycle (vs. the 4-6 week industry average), and the free tier includes 75 verified emails per month with no credit card required.

Prospeo isn't a direct Overloop replacement - it doesn't include campaign automation or LinkedIn sequencing. But if you pair it with a sending tool like Instantly or Smartlead, you get verified data at a fraction of the cost and campaign execution without credit walls. For teams whose real bottleneck is contact data quality rather than campaign orchestration, that combination is significantly cheaper and more flexible.

If you're comparing data vendors specifically, you can also review our round-up of the best B2B data providers.

Apollo.io - The Volume Play

Apollo's free plan gives you 10,000 email credits per month. Ten thousand. Overloop's Starter gives you 250.

That gap is hard to ignore.

Apollo's Basic plan runs $49/user/month on annual billing with unlimited email credits, 75 mobile credits, and 1,000 export credits. The Professional plan at $79/user/month adds advanced filters, AI-assisted email writing, and dialer minutes. The database covers 275M+ contacts across 73M+ companies.

If you're a solo SDR testing outbound, start with Apollo's free tier before committing $69/month to Overloop. Where Overloop wins over Apollo: campaign UX and LinkedIn automation are more tightly integrated. Where Apollo wins: everywhere else on a cost-per-lead basis.

Lemlist - Skip This If You Don't Need Dynamic Personalization

Lemlist's Email Pro starts at $79/month ($63 annual) with 200 enrichment credits and 3 email senders. The Multichannel Expert tier at $109/month ($87 annual) adds LinkedIn automation and 400 credits.

Lemlist's database runs 600M+ leads - larger than Overloop's 450M+. The personalization engine is strong, with dynamic images and landing pages that Overloop doesn't match. But the credit system is similarly restrictive, and add-ons (phone numbers at 20 credits each, WhatsApp at $20/user/month) stack up fast.

Use Lemlist over Overloop if personalization depth matters more than campaign simplicity. Use Overloop over Lemlist if you want a cleaner UX and don't need dynamic image and landing page features.

For more on tools like these, see our list of cold email outreach tools.

Snov.io - Best Budget Alternative for Campaign Automation

| Snov.io | Overloop AI | |

|---|---|---|

| Starting price | $39/mo ($29.25 annual) | $69/user/mo |

| Credits | 1,000/mo | 250/mo |

| Team seats | Unlimited | 1 per license |

| Credit rollover | Yes, all plans | Annual plans only |

| LinkedIn automation | $69/mo add-on | Built in |

| Database size | 50M+ | 450M+ |

Read that again: unlimited team seats at $39/month. Overloop charges per user. For teams with variable prospecting volume - heavy one month, light the next - Snov.io's credit rollover alone makes it worth evaluating. The database is smaller at 50M+ company profiles, but the base economics are significantly better.

Other Options Worth Knowing

Instantly is the Reddit darling for cold email - focused on email sending and warmup at $30/month (Growth) to $77.60/month (Hypergrowth). It doesn't have a prospecting database, so you'd pair it with a data tool like Prospeo. If you already have lists, Instantly is cheaper than Overloop for pure sending.

La Growth Machine runs EUR50-150/month with no credit system and no campaign limits. It's European-focused (like Overloop), but the no-credit approach means you never hit a wall mid-month. Worth a look if the credit system is your main objection to Overloop.

If deliverability is the deciding factor, read our guide on dedicated IP vs shared IP.

Overloop's 250-credit Starter plan gives you ~125 usable leads. Prospeo's free tier includes 100 credits covering search, email finder, and Chrome extension - and paid plans unlock 300M+ profiles with 7-day data refresh, not stale records.

Get fresher data, more leads, and keep your budget intact.

What Users Actually Say About Overloop AI's Value

Overloop AI carries a 4.4/5 on G2 from 132 reviews. The sentiment splits cleanly between people who love the UX and people who hate the credit constraints.

What Users Love

Ease of use dominates - 44 G2 mentions, making it the most cited pro by a wide margin. Users describe it as intuitive, clean, and simple to get started with. In our experience testing the platform, the UX really is as clean as users describe. For a category full of clunky enterprise tools, that matters more than you'd think.

LinkedIn integration gets 17 mentions. The ability to run email + LinkedIn sequences from one platform without stitching together separate tools is a real differentiator. Users who tried HeyReach and Waalaxy before Overloop specifically called it a better "one stop shop for B2B outreach."

Easy CRM integration (15 mentions) and solid email automation features (16 mentions) round out the positives. The G2 data tells a clear story: people choose Overloop for simplicity, not power.

What Users Complain About

The credit system is the dominant complaint. Eight G2 reviews specifically cite "expensive" or "high initial costs." One user put it bluntly: "They should give more email credits. The email feature is a really important aspect of Overloop and the product would be a better value if they had more."

Other recurring complaints:

- European-timezone-only support - if you're a US team, don't expect real-time help during your workday

- Slow performance (6 mentions) - search and data handling lag

- Inaccurate open/click tracking - multiple users report inflated metrics

- Missing features (7 mentions) - no mobile app, no built-in CRM

- Limited customization (5 mentions) - list and sequence flexibility feels constrained

G2's pricing insights peg average implementation time at 2 months and ROI timeline at 4 months. That's not fast. For a tool positioned at SMBs, a 4-month path to ROI means you're paying $276-396 per user before you see returns.

Who Should (and Shouldn't) Use Overloop AI

Overloop AI Is a Good Fit If...

You're a solo SDR or a team of 1-3 who values clean UX over raw volume. You want email + LinkedIn in one tool without stitching together multiple platforms. Your monthly prospecting volume stays comfortably under 250-500 enriched leads. You're already in the HubSpot or Pipedrive ecosystem and want a native integration.

At 1-3 users, the cost is manageable:

- 1 SDR: $69-99/month

- 2 SDRs: $138-198/month

- 3 SDRs: $207-297/month

That's competitive with Lemlist and cheaper than most enterprise tools.

Look Elsewhere If...

You need more than 500 enriched prospects per month without jumping to Enterprise pricing. The Growth plan's 250-prospect ceiling is real, and there's no way to buy more credits mid-cycle.

Your prospecting volume is unpredictable. No credit packs, no overage option, no rollover on monthly plans. The system just stops.

You need phone or voice channels. Overloop is email + LinkedIn only. No dialer, no phone numbers, no SMS.

You're a team of 5+. Costs scale linearly with zero volume discounts:

- 5 SDRs: $345-495/month

- 10 SDRs: $690-990/month

At 10 seats on the Growth plan, you're paying nearly $12,000/year for 60,000 annual credits - 30,000 enriched prospects. Apollo's Professional plan at the same seat count costs roughly the same but includes unlimited email credits and a larger feature set.

You just need verified emails. If your bottleneck is contact data rather than campaign automation, a dedicated data platform or Apollo's free tier is dramatically cheaper. Don't pay $69/month for a campaign tool when your real problem is a $2.50/month data problem.

Real talk: the credit bottleneck is the real problem with Overloop, not the sticker price. $69-99/month is reasonable for an outreach tool. But 125-250 enriched prospects per month is not reasonable for a team trying to build pipeline. If you're closing deals under $15k, you almost certainly need more volume than the credit system allows - and you'll end up paying for a second data tool anyway. The price is fine. The capacity isn't.

Overloop AI Pricing FAQ

Does Overloop AI offer annual pricing?

Annual plans exist but pricing isn't published on the website. Expect roughly a 20% discount - around $55/user/month for Starter and $79 for Growth. The key advantage is that annual credits are delivered upfront and roll over within the 12-month period, unlike monthly plans where unused credits disappear each cycle.

Can I buy extra credits if I run out mid-month?

Not yet. Credit packs are listed as "coming soon" in Overloop's help center, but right now your only options are to wait for your billing cycle to reset, upgrade your plan, or renew early. There's no overage mechanism and no top-up button.

What's the difference between Overloop AI and Overloop Classic?

Two separate products. Overloop AI ($69-$99/user/month) is the current AI-powered prospecting and outreach platform. Overloop Classic is the legacy CRM/outreach tool formerly known as Prospect.io. The $299-$399 prices you see online reference the older product - not what you'd buy today.

What's a cheaper alternative for just finding verified emails?

How does Overloop AI's cost per lead compare to standalone tools?

At the Starter tier, a fully enriched prospect costs $0.55 (2 credits from a 250-credit pool at $69/month). Dedicated verification tools charge ~$0.01 per verified email - roughly 55x cheaper per contact. If you already have prospect lists and just need verified data, a standalone tool saves significantly.