Seismic vs Showpad (2026): The Practical Buyer's Guide

The Seismic vs Showpad decision gets real the first time a rep can't find the right deck in their first five tries. At that point, your "enablement platform" turns into shelfware with a login screen.

This matchup isn't about feature count. It's about week-one search, packaging gotchas, and whether you've got the people (and patience) to run the system.

What this comparison is really about in 2026

Most comparison pages drown you in checklists. That's not where implementations succeed or fail.

In 2026, three things decide the winner:

- Packaging reality (especially Showpad): Showpad's eOS tiers and add-ons make it easy to demo one thing and buy another. Teams get excited about AI Search, manager hubs, or structured learning, then find out it's gated behind a higher tier or an add-on.

- Implementation prerequisites (both): These platforms don't "fix adoption." Adoption comes from a clean taxonomy, a permissions model that matches your org, and Salesforce wiring that works on day one. If you don't staff governance, you'll ship a content dump with a search bar.

- Consolidation risk: You're buying a roadmap, not just today's UI. Mergers and product rationalization can change which modules get love, which integrations get rebuilt, and what "the platform" means 12 months from now.

Enablement platforms don't fail because they're missing a button. They fail because search disappoints in week one, content migration drags for months, and nobody owns the operating system after launch.

We'll show you exactly what to test in a pilot, and what to demand on the order form.

30-second verdict (and who should skip both)

Pick Showpad if:

- You want a faster rollout and a clean seller experience.

- You're disciplined about mapping requirements to eOS tiers + add-ons before procurement locks the paperwork.

- Your org prefers "simple first, scale later," and you're fine adding complexity over time.

Pick Seismic if:

- Governance and scale are the whole point (permissions, metadata, compliance, complex org structures).

- You can staff enablement ops and accept a longer ramp. G2's benchmark is ~4 months for Seismic Content implementation vs ~3 months for Showpad eOS.

- You want a broader enablement suite (content + learning + programs + AI) and you're willing to pay for that breadth.

Here's the thing: if your average deal size is in the low five figures and your sales cycle is short, you probably don't need Seismic-level governance. You need a tight "day-one library," ruthless content cleanup, and a tool your reps will actually use without a training campaign.

Skip both if your real bottleneck is getting meetings, not running content. Enablement improves what happens after you have a conversation; data quality decides whether you get the conversation.

In our experience, teams that fix contact data first see enablement tools perform better because reps aren't wasting half their week chasing dead emails and wrong numbers. Tools like Prospeo (the B2B data platform built for accuracy) sit upstream of Seismic/Showpad and keep your sequences from rotting before they even start.

Seismic vs Showpad at a glance (features, pricing, time-to-value)

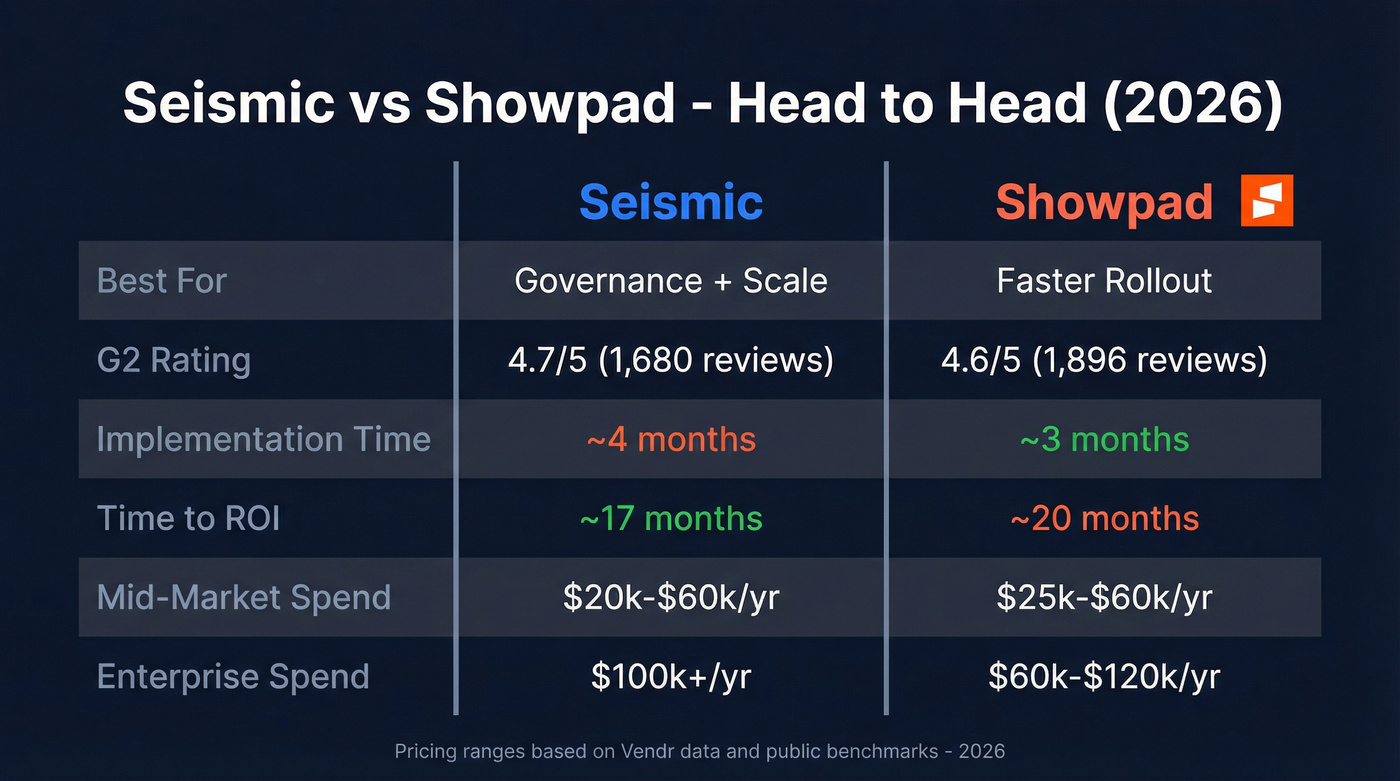

Both are top-tier enablement platforms with strong review volume (ratings/review counts as of our latest check in 2026):

- Seismic Content: 4.7/5 (1,680 reviews)

- Showpad eOS: 4.6/5 (1,896 reviews)

The differences that matter show up in time-to-value, how much governance you need, and what you actually get for the tier you buy.

Head-to-head snapshot

| Category | Seismic | Showpad |

|---|---|---|

| Best for | Governance + scale | Faster rollout |

| G2 rating | 4.7/5 (1,680) | 4.6/5 (1,896) |

| Impl. benchmark | 4 months | 3 months |

| ROI benchmark | ~17 months | 20 months |

| Pricing | $20k-$120k+/yr | $12.6k-$121k/yr |

| Mid-market spend | $20k-$60k/yr | ~$25k-$60k/yr |

| Enterprise spend | $100k+/yr | $60k-$120k/yr |

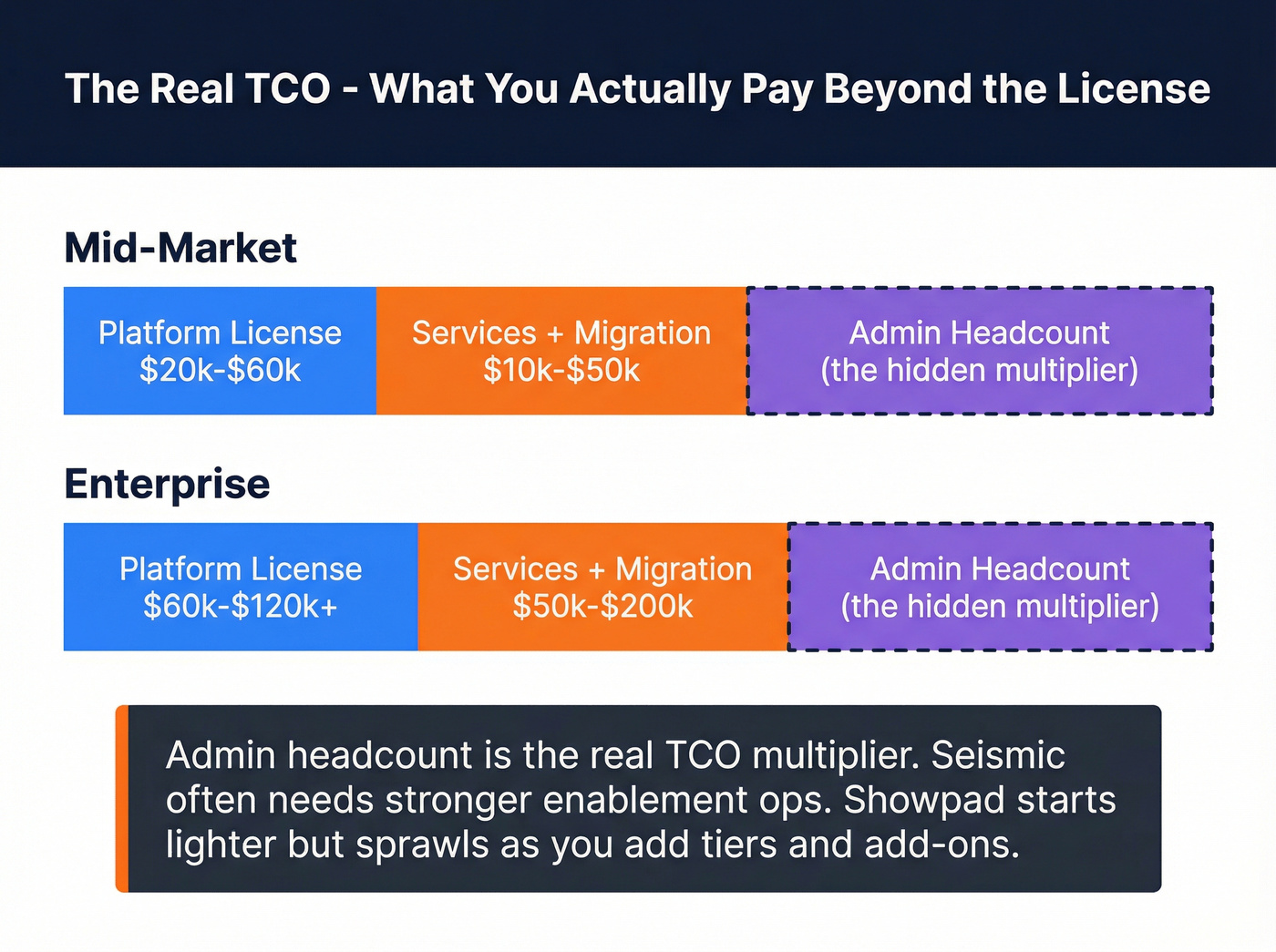

What these numbers actually mean (and what drives TCO)

Showpad pricing is easier to benchmark because Vendr publishes real contract outcomes: median $32,497/yr with a $12,648-$121,024 range. That spread usually comes down to seat counts, packaging, and add-ons.

Seismic pricing behaves like enterprise software: $20k-$120k+/yr is the common band, with mid-market often $20k-$60k and enterprise $100k+ once you include the modules you'll actually use.

Services are the silent budget line. Both tools routinely add $10k-$50k in mid-market services and $50k-$200k in enterprise services for migration, taxonomy, SSO, Salesforce logging, and rollout support.

Admin headcount is the real TCO multiplier, and this is where buyers get burned: Seismic often needs a stronger enablement ops function (metadata, governance, programs) to hit its stride, while Showpad can start lighter but tends to sprawl into more moving parts as you add tiers, add-ons, and manager workflows.

If you want a quick third-party feature-grid sanity check, Capterra's Seismic vs Showpad comparison is fine: https://www.capterra.com/compare/140225-152887/Seismic-vs-Showpad. Just don't let a grid replace a workflow pilot.

Market footprint (directional)

Technographics aren't perfect, but they're useful for a gut check. In 6sense's dataset (based on detection signals), Seismic appears on more sites than Showpad, which suggests a larger detected footprint in their Sales Enablement category. Treat that as a trend signal, not a market share report.

Seismic and Showpad optimize what happens after the meeting. But if your reps waste half their week on bounced emails and wrong numbers, no enablement platform will save your pipeline. Prospeo delivers 98% email accuracy and 125M+ verified mobiles so your sequences actually reach real buyers.

Fix the data upstream and watch your enablement tools finally perform.

Core workflow head-to-head: where each platform actually wins

Seismic and Showpad overlap on paper. In real deployments, they win in different moments: governance, search, learning, buyer engagement, and analytics.

Content governance & compliance

Winner: Seismic (if governance is non-negotiable). Seismic Content is built for heavy metadata, permissions, versioning, and "who can use what, where" controls. If you're regulated, global, or politically complex, Seismic's complexity is protection.

Winner: Showpad (if you need usable fast). Showpad can govern content, but it feels more approachable when you don't want to run a mini library-science program just to ship content.

The tradeoff is simple: Seismic charges an enterprise complexity tax (time + process + ownership). If you don't need that, you'll feel it every week.

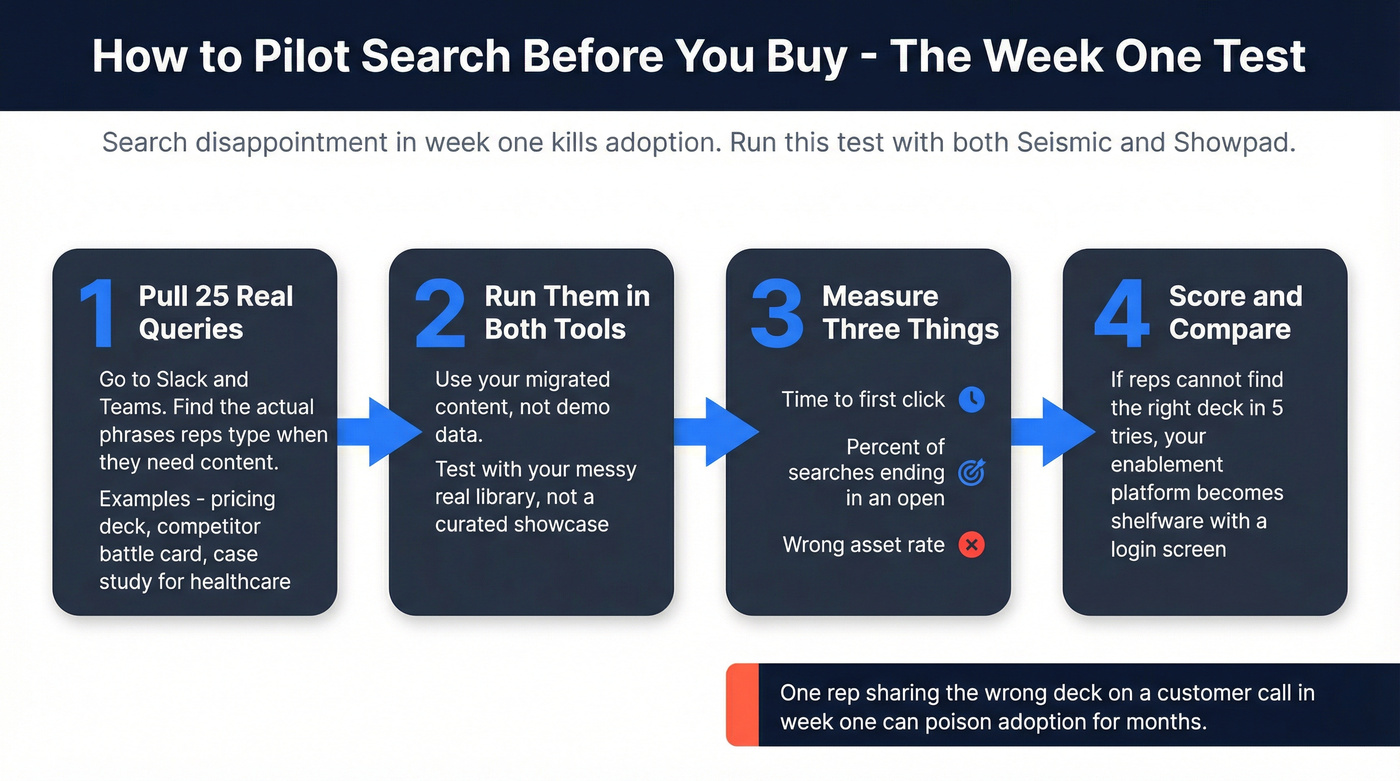

Search & findability (adoption make-or-break)

Both tools get heat for search because enablement search is hard: synonyms, duplicates, outdated decks, and reps typing "pricing deck" expecting one perfect answer.

Pilot it like you mean it:

- Pull 25 real seller queries from Slack/Teams.

- Run them in both tools with your migrated content.

- Measure: time-to-first-click, % of searches that end in an open, and "wrong asset" rate.

I've watched a rollout go sideways because a rep shared the wrong deck on a customer call in week one, then told the whole team "search is trash" before enablement even had time to tune metadata. That one moment can poison adoption for months.

Winner: Seismic (when taxonomy is tight). With disciplined metadata, Seismic can get brutally relevant.

Winner: Showpad (for faster baseline). It's often easier to get to "good enough search" quickly, especially if your library is smaller and cleaner.

Learning/coaching

Winner: Seismic (if learning is a serious program). Seismic Learning (Lessonly) benchmarks around ~2 months to implement and works well for structured onboarding, certifications, and repeatable programs.

Winner: Showpad (if you want learning inside the hub). Showpad's structured learning is tied to packaging (notably eOS Advanced). It's a smoother experience if you want coaching and content in one place without running a separate learning project.

Buyer engagement / digital sales rooms / MAPs (and immersive content)

Winner: Showpad (if buyer experience is the strategy). Showpad's buyer engagement story is straightforward, especially with Collaborate+ (buyer uploads + Mutual Action Plans in the new packaging world).

Winner: Seismic (if you want buyer rooms plus broader programs). Seismic has buyer engagement and digital sales room capabilities, plus broader platform pieces like Programs and a larger ecosystem.

Deal rooms don't win deals because you turned them on. They win because your team runs a consistent mutual plan, champions share it, and content is mapped to stages.

Immersive/interactive content (test this if you're field-heavy): If you sell manufacturing, med device, construction, or anything that benefits from 3D/360/VR-style demos, treat this as a first-class evaluation item. In pilots, test load times on real field connections, offline behavior on tablets, sharing friction (how many clicks to get a buyer in), and whether analytics show meaningful interaction instead of just "opened."

Analytics & attribution (what's realistic)

Both platforms can show content usage, engagement, and influence. Neither will settle attribution arguments by itself.

What you can trust:

- "This deck was used in 38 opportunities."

- "These reps use the library weekly; these reps never do."

- "This content correlates with higher win rates."

What leaders ask for and won't get cleanly: "This one asset caused $4.2M in ARR."

Winner: Seismic (if you invest in governance). It tends to go deeper when metadata and programs are real.

Winner: Showpad (for manager usability). It's often easier for frontline managers to use week to week, assuming you're on the tier that includes the manager hub.

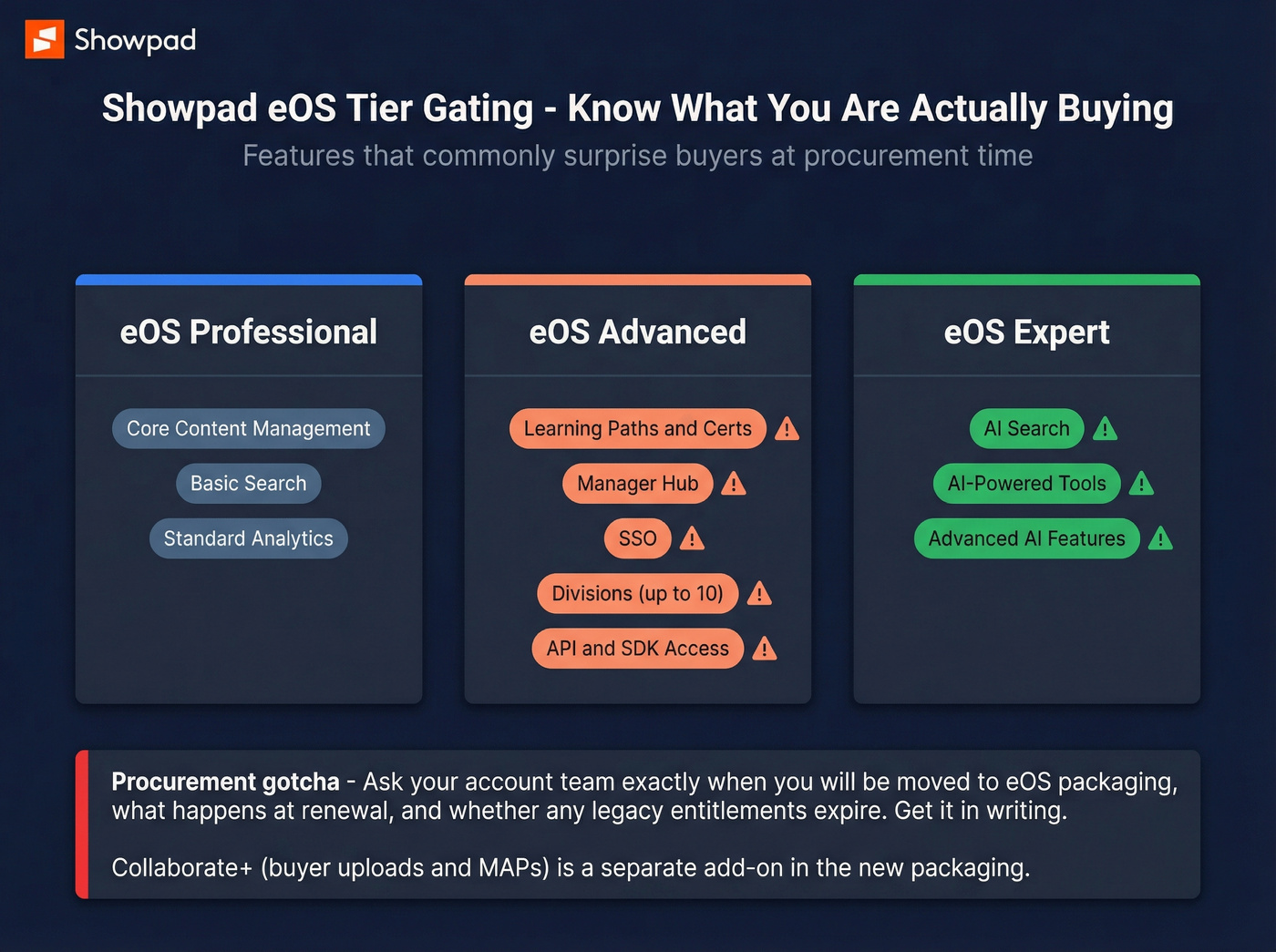

What you actually buy with Showpad in 2026 (tiers, gates, add-ons)

Showpad's packaging transition is the single biggest gotcha in this comparison. It's not a trap. It's just easy to buy the wrong thing.

Showpad documents the transition here: https://help.showpad.com/hc/en-us/articles/23319038354066-Preparing-for-Pricing-and-Packaging-changes

Legacy -> eOS mapping (the part buyers miss)

If you're coming from legacy packages, the practical question is: what do you map into now? Per Showpad's packaging guidance, legacy packages map into multiple possible eOS tiers depending on what you had before:

- Content Essential -> eOS Professional / eOS Advanced

- Content Plus -> eOS Professional / eOS Advanced

- Content Ultimate -> eOS Professional / eOS Advanced / eOS Expert

- Content Ultimate with Coach Plus -> eOS Professional / eOS Advanced / eOS Expert

- Buyer collaboration capabilities can sit behind Collaborate+ depending on what you need

Procurement gotcha: ask your account team when you'll be moved onto eOS packaging, what happens at renewal, and whether any legacy entitlements expire. Get it in writing.

The tier gating that bites buyers

| Requirement | Where it lives in 2026 | Buyer risk |

|---|---|---|

| Learning paths/certs | eOS Advanced | Under-buy tier |

| Manager hub | eOS Advanced | Miss coaching ops |

| SSO | eOS Advanced | Security blocker |

| Divisions (<=10) | eOS Advanced | Org complexity |

| API/SDK access | eOS Advanced | Integration limits |

| AI Search + AI tools | eOS Expert-only | Surprise upsell |

| Buyer uploads + MAPs | Collaborate+ add-on | Deal room gap |

Three packaging realities that matter:

eOS Advanced is where the "enterprise plumbing" starts (SSO, divisions, API/SDK) plus Structured Learning & Growth and the manager hub.

Advanced AI tools are eOS Expert-only (AI Search, Page Builder, Message Composer, CRM recommendations, FAQs).

Buyer uploads + MAPs live in Collaborate+.

Don't ask "Do you have X?" Ask: "Which tier includes X, and what's the SKU name on the order form?" That one question prevents the most common Showpad buying mistake.

Implementation & admin reality (Salesforce gotchas + rollout checklist)

Enablement platforms don't implement like a typical SaaS tool. You're migrating content, changing seller behavior, and wiring into Salesforce, all at once.

Benchmarks:

- Showpad eOS: ~3 months to implement (G2)

- Seismic Content: ~4 months to implement (G2)

Calendar time isn't the real risk. Dependencies are.

Pre-signature readiness checklist

Before you sign, lock these down:

Ownership

- Named enablement ops owner (not "whoever has time")

- Named Salesforce admin owner

- Named security/IT reviewer

Taxonomy

- Draft metadata model (industries, personas, stages, regions)

- Permission model (publish/approve/archive)

- Versioning rules (what happens when marketing updates a deck)

Migration scope

- Asset count you'll migrate (and what you'll delete)

- "Day one library" (the 20% that drives 80% of usage)

- Cleanup accountability

Adoption plan

- Pilot group (10-20 reps + 2 managers)

- Success metrics (search success rate, weekly active usage, content shared per opp)

- Feedback loop (office hours + content request intake)

Real talk: if you can't name an owner for taxonomy and governance, pause the deal. Buying the tool doesn't create the operating model.

Salesforce integration prerequisites (Showpad)

Showpad's Salesforce activity logging has real prerequisites that derail timelines when discovered late. The official doc is here: https://help.showpad.com/hc/en-us/articles/20873986096786-Integrate-Showpad-activities-in-Salesforce

Two practical notes before the checklist:

- Activity logging is available on eOS Professional, eOS Advanced, eOS Expert (and legacy Showpad Content Ultimate).

- Don't let "we integrate with Salesforce" end the conversation. Activity logging is where the sharp edges are.

Key prerequisites and setup items:

- Salesforce Enterprise or Unlimited

- Salesforce admin privileges

- Add a CORS allowed origin:

https://*.showpad.biz - Users need Salesforce API access

- Permissions to create/edit/view Tasks

- Access to relevant objects (Account/Opportunity/Lead/Contact)

- If you log to custom objects, you need "Allow Activities" + "Allow Search" on that object

Seismic implementation risk pattern

Seismic's risk isn't usually "can't integrate." It's operational complexity.

Seismic wins when someone treats metadata, governance, and programs like a product. When that owner doesn't exist, Seismic becomes a powerful system that reps experience as "too many clicks," and then the org starts routing around it in Slack.

The review themes match the field reality: steep learning curve, navigation friction, and search frustration when taxonomy is loose.

Failure mode callout (read this before you sign)

"We lost a year of implementation time... We had to pay 2 years of license fees for nothing."

That scenario isn't rare enough. And it's infuriating, because it's preventable.

Prevent it by making "done" measurable:

- Put migration scope in writing (asset count + acceptance criteria).

- Put a search success metric in the pilot (example: 80% of test queries return the right asset in <30 seconds).

- Tie renewal expansion to adoption metrics, not promises.

Pricing & total cost of ownership (what to budget, what to negotiate)

Neither vendor makes pricing simple. You need benchmarks and a negotiation plan.

Budget benchmarks (licenses + services)

| Cost item | Seismic | Showpad |

|---|---|---|

| Typical annual | $20k-$120k+/yr | $12.6k-$121k/yr |

| Mid-market | $20k-$60k/yr | ~$32.5k/yr median |

| Per-user signal | ~$30-$60/user | Usually bundled |

| Contract term | Annual typical | Standard 1-year billed annually; monthly sometimes available on request (usually worse economics) |

| Discount signal | Often lower unless multi-year/volume | ~15% average discount |

| Services (MM) | $10k-$50k | $10k-$50k |

| Services (Ent) | $50k-$200k | $50k-$200k |

Showpad pricing benchmarks come from Vendr: median $32,497/yr with a $12,648-$121,024 range. Seismic commonly lands $20k-$120k+/yr, with a per-user benchmark around $30-$60/user depending on edition and volume.

What to negotiate (so you don't get taxed later)

- Tier clarity (Showpad): list the exact tier + add-ons (like Collaborate+) on the order form. No "we'll enable it later."

- Services scope: define what's included (migration, taxonomy workshops, Salesforce logging, SSO).

- Renewal protections: cap uplift (or tie uplift to seat growth).

- Pilot-to-production path: lock expansion pricing for 12-18 months.

- Implementation guardrails: include success criteria for pilot and go-live (search success + adoption targets).

For procurement sanity checks on Showpad numbers, Vendr's marketplace page is the cleanest public benchmark: https://www.vendr.com/marketplace/showpad

What users complain about (and how to de-risk in a pilot)

You don't need perfect software. You need predictable failure modes, and a pilot that exposes them early.

Showpad: common complaints (and what to test)

Common review themes:

- Search relevance

- Reporting limits (especially around learning)

- Admin heaviness at scale

- Mobile/offline reliability

A representative field-team sentiment you see in reviews is blunt: "mobile app is not as reliable... especially offline."

Pilot tests that de-risk this:

- Run the 25-query search test with real content.

- Have one non-admin user upload/tag content and time it.

- Test mobile/offline in the exact environments your field team works in (airports, hospitals, basements).

Seismic: common complaints (and what to test)

Common review themes:

- Search frustration when taxonomy isn't tight

- Steep learning curve

- Navigation friction

And the quote that should scare any buyer into doing a real pilot:

"We lost a year of implementation time... We had to pay 2 years of license fees for nothing."

Pilot tests that de-risk this:

- Give 10 reps a scavenger hunt: "Find the deck, the one-pager, and the case study for X persona." Measure time and frustration.

- Validate governance workflows: who approves, who archives, how versioning works.

- Stress-test permissions across regions/roles.

Don't choose based on AI demos. In pilots, search + governance + admin capacity decide outcomes.

2026 buying risk: consolidation, roadmap uncertainty, and what to demand in writing

Consolidation is the backdrop you can't ignore in 2026. Forrester frames the market around consolidation dynamics, including Showpad's acquisition of Bigtincan and the announced intent for Seismic and Highspot to combine: https://www.forrester.com/blogs/as-rep-vendors-consolidate-buyers-face-clearer-choices-and-new-risks/

What that means for buyers:

- Features you love can get deprioritized.

- Integrations can change.

- "Platform" can mean "we're merging products" for 12-18 months.

Demand commitments in writing:

- Roadmap commitments for the modules you're buying (buyer rooms, AI search, learning).

- Support SLAs and named escalation paths for the first 90 days post-go-live.

- Data portability language (export content metadata, engagement data, learning records).

- No forced migration surprises during your contract term (or services credits if it happens).

If you're buying enablement in 2026, treat it like a strategic system, not a nice-to-have.

If neither Seismic nor Showpad fits: the best alternatives (Tier 2 + Tier 3)

Sometimes the right answer is "neither."

Tier 2: two smart pivots

- Highspot: Pick Highspot if you want an enterprise-grade revenue enablement platform but prefer a different UX and coaching approach than Seismic. It's a credible same-weight-class alternative when Seismic feels too heavy or Showpad's packaging gates too much of what you need.

- Dock: Pick Dock if your motion lives and dies on buyer coordination: multi-threaded committees, mutual plans, and keeping next steps visible. Dock is buyer-room-first and lighter weight, and it's a great fit when you want deal rooms without buying a full REP stack.

Tier 3: also consider (by primary use case)

- Allego / Mindtickle / SalesHood: Strong picks when learning, coaching, and readiness are the center of your enablement strategy and content is secondary.

- Bigtincan: Worth a look for field enablement and asset-heavy orgs (showrooms, distributors, on-the-go teams) where offline and rich media matter more than deep governance.

FAQ

Is Seismic better than Showpad for enterprise content governance?

Seismic is usually better for enterprise governance because it supports deeper metadata, permissions, versioning, and compliance workflows across complex orgs. If you've got multiple regions, strict approval rules, or regulated content, plan for a heavier admin model, but you'll get stronger control.

What Showpad eOS tier includes AI features like AI Search?

In 2026, Showpad's advanced AI tools sit in eOS Expert, including AI Search, Page Builder, Message Composer, CRM recommendations, and FAQs. If AI-assisted workflows are a must-have, require the exact tier and SKU names on the order form before signing.

How long does implementation usually take for these platforms?

A realistic benchmark is ~3 months for Showpad eOS and ~4 months for Seismic Content, based on G2 time-to-implement data. Add 2-6 weeks if Salesforce/security reviews drag, content cleanup is messy, or governance decisions don't have a single owner.

What's a good free alternative for fixing low connect rates before enablement?

Prospeo is a strong free starting point because its free tier includes 75 emails plus 100 Chrome extension credits per month, with 98% verified email accuracy and a 7-day refresh. If outbound's bouncing or reps can't reach buyers, fix contact data first, then optimize content workflows.

Summary: choosing the winner for your team

If you're deciding Seismic vs Showpad in 2026, don't let a demo pick for you. Run a pilot that proves week-one search, confirm packaging in writing (especially tiers and add-ons), and be honest about admin capacity.

Choose Showpad for faster rollout and a cleaner seller experience. Choose Seismic when governance and scale are the whole point, and you're staffed to run it.

You're about to spend $30K-$120K/yr on enablement. Don't let bad contact data starve it. Teams using Prospeo book 26% more meetings than ZoomInfo users - at roughly $0.01 per verified email. Your content only works if someone's there to read it.

Get meetings first. Enable them second. Start with accurate data.