The Best Lead Tracking CRMs in 2026: Honest Reviews, Real Pricing, Clear Recommendations

A RevOps lead I know ran a 3-tool CRM bake-off last quarter. The "best" platform created 4,000 duplicate contacts in Salesforce in five days. The cheapest one had better lead-to-close rates because reps actually used it. That's the dirty secret of every lead tracking CRM: the tool your team adopts beats the tool with the longest feature list every single time.

The average CRM returns $8.71 for every $1 invested. But 32% of SMEs are still tracking sales leads in spreadsheets, and half of micro-businesses don't use a CRM at all. That's not a technology problem. It's a "every CRM guide ranks the same five tools without telling you which one actually fits" problem.

I've tested or evaluated every tool on this list. You'll get real 2026 pricing - not "contact sales" - honest opinions on where each tool breaks down, and a decision framework that matches your team size and budget to the right pick.

Our Picks (TL;DR)

- Best overall ecosystem: HubSpot Free, then upgrade to Pipedrive if you outgrow it. HubSpot's free tier gets you started; Pipedrive ($14/seat/mo) is the better paid experience for most small teams.

- Best for call-heavy outbound: Close CRM ($35/seat/mo). Built-in Power Dialer and Predictive Dialer. No Twilio duct tape required.

- Best budget AI scoring: Freshsales ($39/user/mo for Freddy AI). Cheapest real AI lead scoring on the market.

- Best for CRM data quality: Prospeo - the data layer that makes every CRM on this list work. 98% email accuracy, 50+ data points per enriched contact. Starts free.

- Best ultra-simple: Less Annoying CRM ($15/mo, done). One price, all features, setup in an hour.

What Is Lead Tracking (and Why Your Spreadsheet Won't Cut It)?

What lead tracking actually means

Lead tracking is monitoring every interaction with a prospect - from first website visit through closed deal - in one centralized system. It's the difference between "I think we talked to that VP last month" and knowing exactly which emails they opened, which pages they visited, and that they're 72 hours overdue for a follow-up.

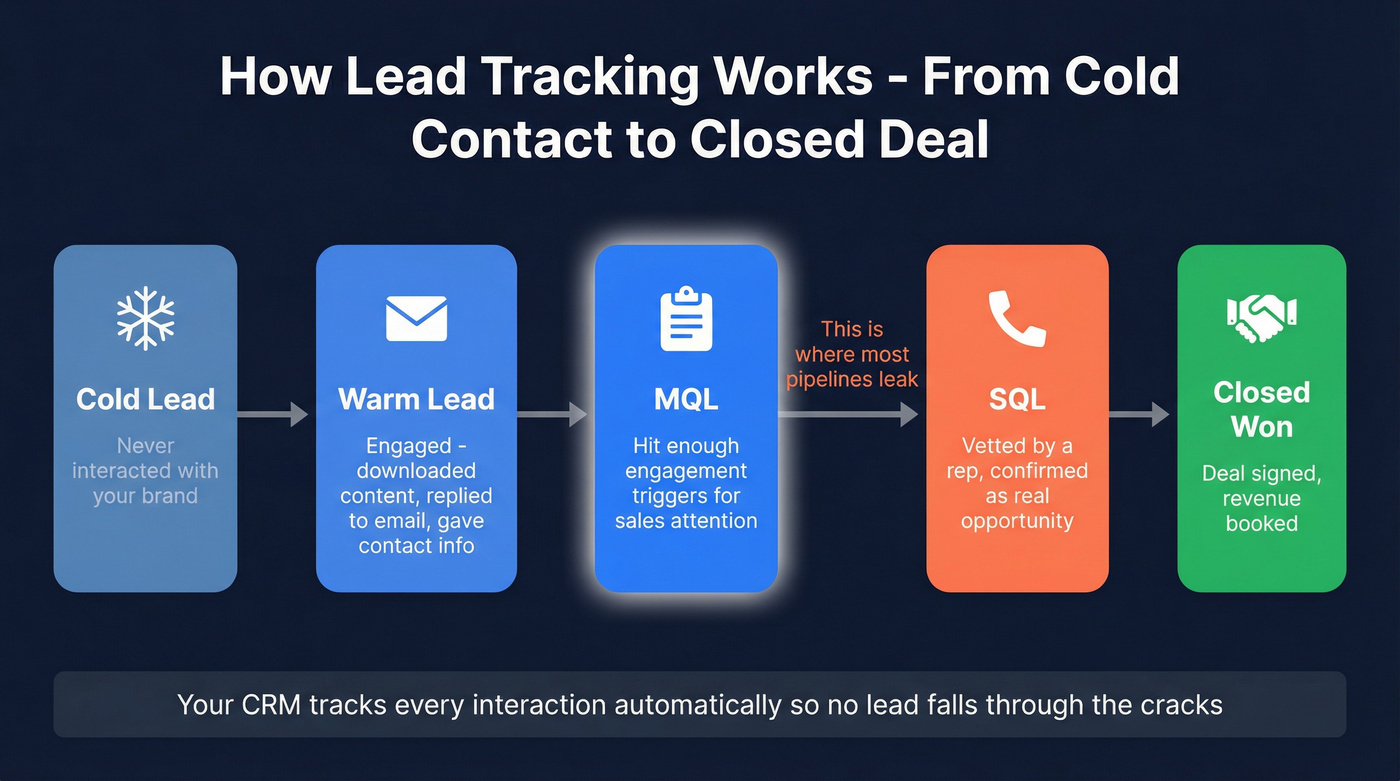

The framework is straightforward. Leads move through temperature stages: cold (never interacted with your brand), warm (they've engaged - downloaded content, replied to an email, given you contact info), and hot (bottom of funnel, ready for a proposal). Your CRM's job is to track that progression automatically.

There's also the MQL vs. SQL distinction that trips up most teams. A Marketing Qualified Lead has hit enough engagement triggers (form fills, content downloads, email opens) to warrant sales attention. A Sales Qualified Lead has been vetted by a rep and confirmed as a real opportunity. The gap between those two definitions is where most pipelines leak - and it's exactly what a sales lead management system is designed to close.

The spreadsheet breaking point

Every team starts with a spreadsheet. For your first 20-30 leads, it works fine. But spreadsheets can't send follow-up reminders. They can't score leads. They can't tell you that a prospect opened your email three times yesterday at 11 PM.

The breaking point hits fast. Responding to a lead within the first minute increases conversions by 391%. After 30 days without contact, 90% of leads go inactive. A spreadsheet can't enforce speed-to-lead - a CRM can (see speed-to-lead metrics).

I've seen teams lose deals simply because two reps were working the same account from different tabs of the same Google Sheet. Once things start growing, spreadsheets don't just slow you down - they completely fall apart.

Every CRM on this list has the same weakness: garbage data in, garbage pipeline out. Prospeo enriches your HubSpot or Salesforce contacts with 50+ verified data points at 98% email accuracy - on a 7-day refresh cycle, not the 6-week industry average.

Stop blaming your CRM when the real problem is your data.

The 10 Best Lead Tracking CRMs in 2026

HubSpot CRM - Best All-in-One Ecosystem

Why it wins: HubSpot's free CRM is the most feature-rich zero-cost option available. You get contact management, deal tracking, email templates, and a basic pipeline - enough to run a small sales operation without spending a dollar. The ecosystem is the real draw: marketing, sales, service, and ops hubs all share the same database. When your marketing team tags a lead as MQL, your sales rep sees it instantly - a real-time sync that most competitors can't match without third-party middleware.

Key tradeoff: HubSpot's free tier is a gateway drug. The moment you need automation, lead scoring, or more than basic reporting, you're looking at Sales Hub Professional at $100/seat/month. A 5-seat Sales Hub Pro contract runs $6,000/year minimum - and that's before the mandatory $1,500 onboarding fee. Most mid-sized businesses spend $10,000-$50,000 annually on HubSpot subscriptions alone.

The #1 complaint on Reddit? Free plan limitations that force upgrades. It's a legitimate frustration - the free CRM is genuinely useful, but the jump from free to paid is steep. One underrated feature worth noting: HubSpot's lead source reporting lets you trace exactly which channel - organic, paid, referral, direct - generated each contact, so you can tie pipeline revenue back to specific campaigns.

Pricing: Free CRM, then Starter at $20/seat/mo, Professional at $100/seat/mo, Enterprise at $150/seat/mo. All plans require annual commitment. G2 rating: ~4.4/5.

Use this if you want one platform for marketing + sales. Skip this if you're a 3-person team that just needs pipeline tracking - you'll overpay.

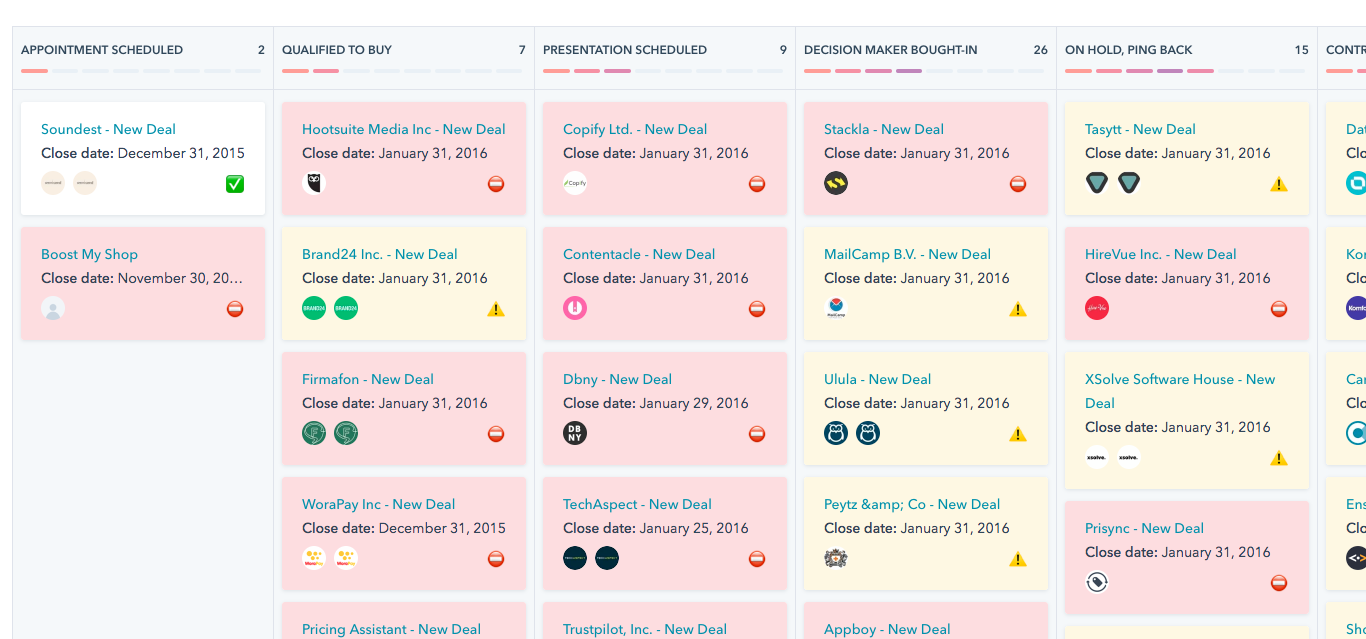

Pipedrive - Best Visual Pipeline Management

Pipedrive does one thing exceptionally well: it makes your pipeline visual and intuitive. The drag-and-drop board isn't just pretty - it changes how reps think about deals. Instead of scrolling through a contact list, you're physically moving cards across stages. It sounds trivial. It's not. Reps who can see their pipeline actually work it.

The AI-powered reports are solid, and the 500+ integrations mean you can bolt on almost anything. Lead scoring requires the Premium plan ($59/seat/mo), which is worth it if you're running 100+ active deals. For teams that want scoring without building custom workflows, Pipedrive's native scoring on Premium is plug-and-play (more on AI lead scoring vs traditional lead scoring).

Pricing: Lite at $14/seat/mo, Growth at $39/seat/mo, Premium at $59/seat/mo, Ultimate at $79/seat/mo (all billed annually). No free plan - 14-day trial only. Capterra: 4.5/5.

Use this if your team is visual, you want a clean interface, and you're running 2-50 reps who need to manage deals without drowning in features.

Skip this if you need built-in calling or heavy marketing automation. Pipedrive is a sales tool, not a GTM suite. You'll need add-ons (LeadBooster from $32.50/mo, Campaigns from $13.33/mo) to fill those gaps.

Close CRM - Best for Call-Heavy Outbound Teams

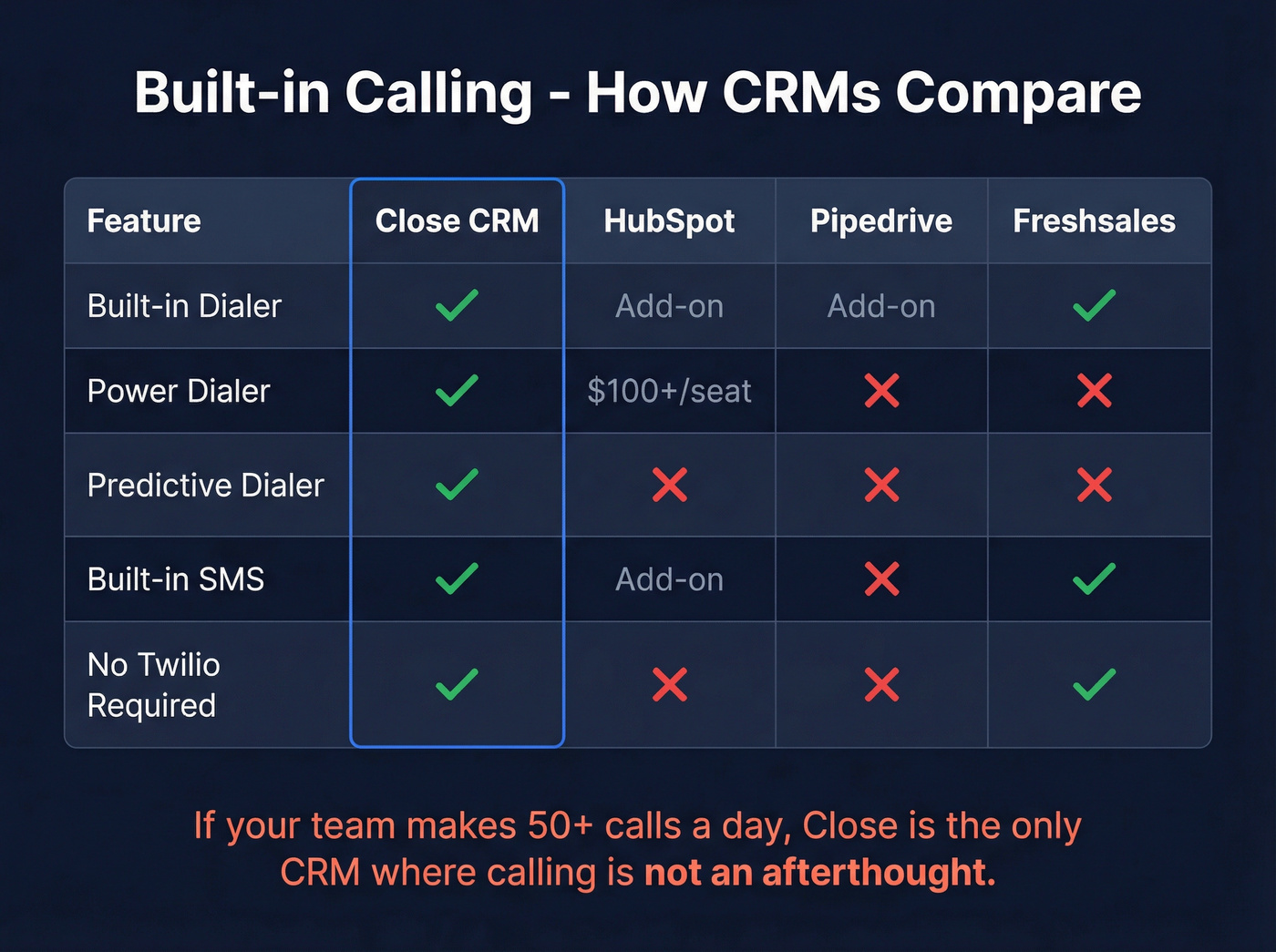

I watched a 6-person SDR team switch from HubSpot + a separate dialer to Close CRM. Their daily call volume went up 40% in the first week - not because they were working harder, but because they stopped toggling between tabs. Close has a built-in Power Dialer and Predictive Dialer baked into the product. No Twilio integration. No third-party calling app. You click a lead, you call them.

Built-in email, SMS, and calling on every plan (usage-based calling costs apply) means your entire outbound workflow lives in one window. The Growth plan ($99/seat/mo) adds automated workflows and an AI Email Assistant. The Scale plan ($139/seat/mo) unlocks the Predictive Dialer and role-based access.

Here's what most guides miss: Close is the only CRM on this list where calling isn't an afterthought or an add-on. If your team makes 50+ calls a day, nothing else comes close. For high-velocity sales environments, it's the clear winner (and if you're comparing dialer types, see power dialer vs predictive dialer).

Pricing: Solo at $9/seat/mo (1 user only), Essentials at $35/seat/mo, Growth at $99/seat/mo, Scale at $139/seat/mo. No free plan. 14-day trial. Call Assistant add-on: $50/mo + $0.02/minute. G2: ~4.7/5.

Skip this if you're a marketing-led team that rarely picks up the phone. Close is built for dialers, not nurturers.

Freshsales - Best Affordable AI Lead Scoring

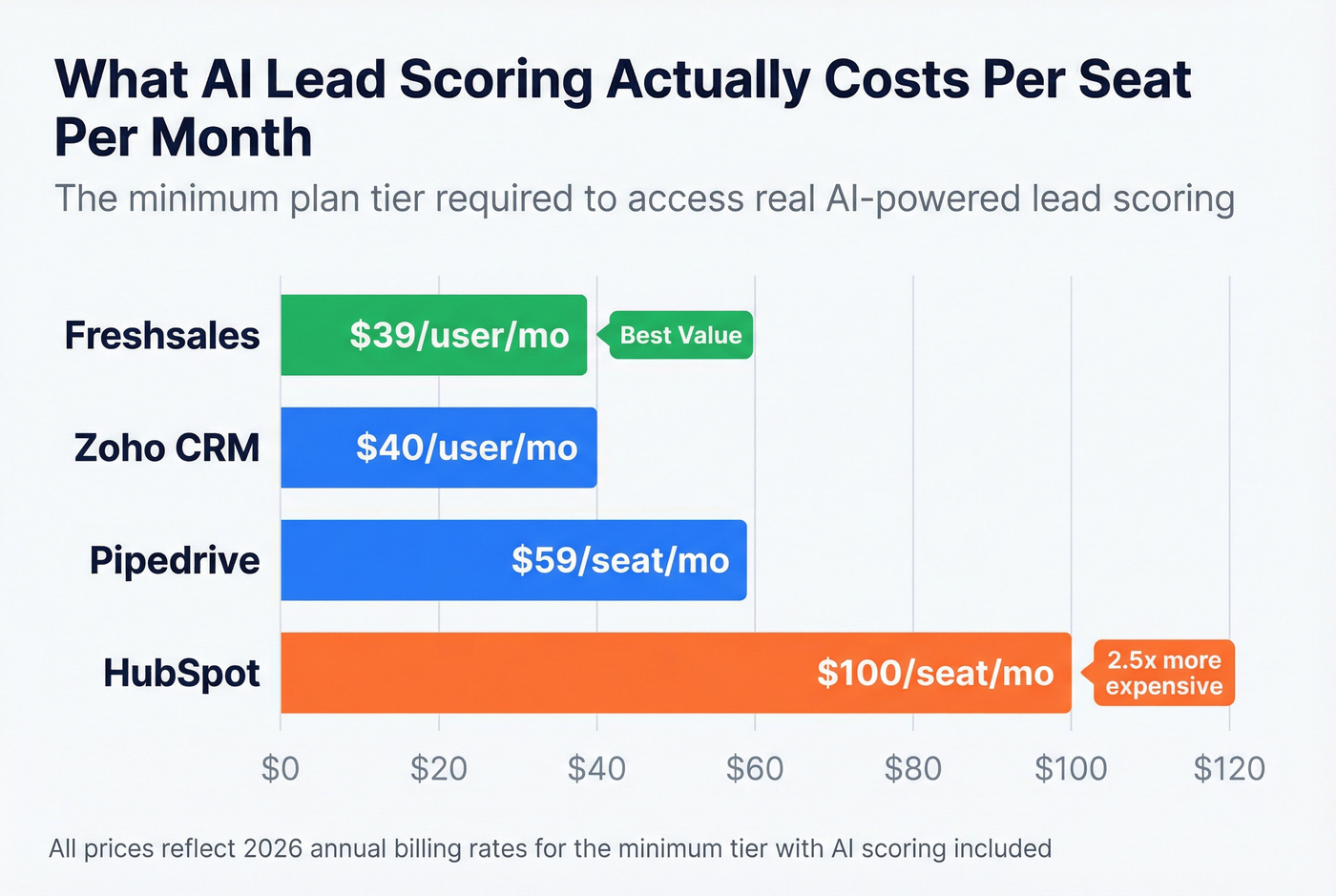

Freshsales punches above its weight class. Freddy AI - their lead scoring engine - is available at $39/user/month on the Pro plan. That's the cheapest real AI scoring on the market. HubSpot charges $100/seat/mo for comparable functionality. Zoho gates Zia AI behind their $40/user/mo Enterprise tier.

Pros:

- Freddy AI contact scoring at $39/user/mo (Pro) - genuinely useful, not just a marketing checkbox

- Free plan for up to 3 users with Kanban views, email templates, built-in phone and chat

- Growth plan at $9/user/mo is absurdly cheap for what you get

- Capterra: 4.5/5 across 620 reviews, with 79% from small businesses

- 21-day free trial (longest on this list)

Cons:

- Enterprise features (custom modules, forecasting insights) jump to $59/user/mo

- The free plan caps at 3 users - fine for a startup, limiting for a growing team

- Less ecosystem depth than HubSpot - you won't get marketing hub, service hub, etc.

Real talk: if you need AI lead scoring and you're not ready to pay HubSpot prices, Freshsales is the obvious answer.

Prospeo - Best for CRM Data Quality

Every CRM on this list has the same Achilles' heel: garbage in, garbage out. You can have the best pipeline visualization, the smartest AI scoring, and the slickest automation - and it all falls apart when 35% of your emails bounce and half your phone numbers are disconnected.

Prospeo isn't a CRM. It's the data quality layer that makes your CRM actually work. The platform covers 300M+ professional profiles with 143M+ verified emails and 125M+ verified mobile numbers - all refreshed on a 7-day cycle (the industry average is six weeks). Email accuracy sits at 98%, and that number holds up in practice: Snyk's team saw bounce rates drop from 35-40% to under 5% after switching, generating 200+ new opportunities per month.

Native integrations with HubSpot and Salesforce mean enrichment happens inside your existing workflow. Upload a CSV or connect your CRM, and Prospeo returns 50+ data points per contact at roughly $0.01 per email. The 30+ search filters - buyer intent, technographics, job changes, headcount growth, funding - let you build targeted lists before they ever hit your pipeline (compare categories in lead enrichment tools).

The free tier gives you 75 verified emails per month. No credit card, no contracts.

Zoho CRM - Best Customization-to-Price Ratio

Why it wins: Zoho CRM is the Swiss Army knife of CRMs. The customization depth at $14/user/mo (Standard) is unmatched - custom modules, workflows, cadences, sales forecasting, and Canvas (their drag-and-drop UI builder). If you need a CRM that bends to your process instead of forcing you into a template, Zoho is the answer. It also supports lead-to-account matching natively, so you can automatically associate incoming leads with existing company records - a feature most competitors gate behind enterprise tiers.

Key tradeoff: The learning curve is real. Zoho's ease-of-use scores consistently trail competitors (4.2 on Capterra vs. 4.4 for Freshsales and Pipedrive). Reddit users call out "too much manual data entry" and a steep onboarding curve. Zia AI (lead scoring, predictions, anomaly detection) requires the Enterprise plan at $40/user/mo.

Pricing: Free (3 users), Standard $14/user/mo, Professional $23/user/mo, Enterprise $40/user/mo, Ultimate $52/user/mo. 30-day trial. Capterra: 4.3/5 across nearly 7,000 reviews.

Less Annoying CRM - Best for Simplicity

Less Annoying CRM lives up to its name. $15/user/month. One tier. All features included. Unlimited contacts, unlimited pipelines, free US-based phone and email support. Average setup time: about one hour. PCMag gave it an Editors' Choice award (4.0/5) and called it "Best for Budget-Conscious Start-Ups."

It's self-funded (no VC), which means they're not racing to upsell you into an enterprise tier that doesn't exist. The trade-off? No AI features, no lead scoring, no native mobile app (mobile-responsive web version only, with a native app in beta).

Use this if you're a team of 1-5 who wants CRM basics without complexity. Skip this if you need lead scoring, AI, or deep automation - you'll outgrow it fast.

Bigin by Zoho - Best Ultra-Budget Option

PCMag named Bigin "Best Overall" for small business CRM (4.0/5 Editors' Choice). It's Zoho's simpler sibling - designed specifically for businesses moving from spreadsheets to a proper sales pipeline workflow.

Pros:

- Express plan at $7/user/mo gets you 3 pipelines, 50K records, email + WhatsApp integration, and 30 automations

- Free tier for a single user with built-in phone

- Social media lead ads integration (Facebook, Instagram, TikTok)

Cons:

- No AI features at any tier

- Caps out at 5 pipelines on Premier ($12/user/mo)

- You'll eventually outgrow it and need to migrate to full Zoho CRM

For teams spending less than $20/user/month, Bigin is the best value on the market.

Salesforce - Best for Enterprise Teams

Look, if you're reading a "best lead tracking CRM" article, Salesforce probably isn't for you. It's the enterprise standard for a reason - the customization, AppExchange ecosystem, and reporting depth are unmatched. But a Pro Suite license runs $100/user/month (annual contract required), and implementation costs $5K-$20K+ in consulting fees alone.

Salesforce now offers a Free Suite (max 2 users) and a Starter Suite at $25/user/month, which are genuinely useful for tiny teams willing to grow into the platform. But the complexity tax is real. Most small teams that start with Salesforce end up using 15% of its features and resenting the other 85%.

Skip this if you have fewer than 50 reps. Use this if you need enterprise-grade reporting, territory management, and a platform that'll scale to 500+ users.

Salesflare - Best for Automated Data Entry

Salesflare ($49/user/mo on Pro, annual) automatically pulls contact data from emails, calendars, and social profiles to minimize manual entry. G2 composite score of ~4.8/5. Strong for small B2B teams who hate data entry, but the niche audience and higher price point limit its appeal. I haven't tested it deeply enough to recommend it confidently, but it's on my radar (related: manual data entry problems).

ActiveCampaign - Best for Email-First Teams

ActiveCampaign is a marketing automation platform that bolted on a CRM - not the other way around. The CRM (called "Enhanced CRM") requires a base marketing plan ($59/mo for Plus) plus the Pipelines add-on ($68/mo). That's $127/month minimum before you've added a single user. The 950+ automation recipes are genuinely impressive, but if you need a CRM first and email marketing second, you're paying for the wrong thing in the wrong order.

Lead Tracking CRM Pricing Comparison (2026)

Pricing is the #1 thing teams want to compare, and most guides make you click through to ten different websites. Here's everything in one table:

| Tool | Free Plan | Starting Price | AI/Lead Scoring | Best For |

|---|---|---|---|---|

| HubSpot CRM | Yes (limited) | $20/seat/mo | Pro ($100/seat) | All-in-one ecosystem |

| Pipedrive | No | $14/seat/mo | Premium ($59/seat) | Visual pipeline |

| Close CRM | No | $9/seat/mo* | Growth ($99/seat) | Call-heavy outbound |

| Freshsales | Yes (3 users) | $9/user/mo | Pro ($39/user) | Budget AI scoring |

| Prospeo | Yes (75 emails) | ~$0.01/email | N/A (data layer) | CRM data quality |

| Zoho CRM | Yes (3 users) | $14/user/mo | Enterprise ($40/user) | Customization depth |

| Less Annoying | No | $15/user/mo | None | Simplicity |

| Bigin by Zoho | Yes (1 user) | $7/user/mo | None | Ultra-budget |

| Salesforce | Yes (2 users) | $25/user/mo | Pro Suite ($100/user) | Enterprise scale |

| Salesflare | No | $49/user/mo | Included | Auto data entry |

| ActiveCampaign | No | $127/mo** | Included w/ CRM | Email-first teams |

*Close Solo plan limited to 1 user, 10K leads. **ActiveCampaign CRM requires Plus plan ($59) + Pipelines add-on ($68).

A few footnotes that matter: HubSpot charges a mandatory $1,500 onboarding fee for Professional and Enterprise tiers. Salesforce Pro Suite requires an annual contract - no monthly option. ActiveCampaign's pricing is a two-cost structure (marketing plan + CRM add-on) that catches people off guard.

The frustrating pattern across this market? AI lead scoring is gated behind mid-to-upper tiers at almost every vendor. Freshsales at $39/user/mo is the cheapest path to real AI scoring. Everyone else wants $59-$100+/user.

Five Lead Tracking Mistakes That Kill Your Pipeline

Skipping lead qualification

67% of sales are lost due to poor lead qualification. That's not a rounding error - it's the majority of your pipeline leaking because reps chase leads that were never going to close. Even a basic CRM with hot/warm/cold tags fixes this. Without it, your team treats every inbound form fill like a qualified opportunity, and your close rate suffers (use a formal lead qualification process).

Responding too slowly

Responding to a lead within the first minute increases conversions by 391%. Within the first minute. Not the first hour. Not the first day.

After 30 days without contact, 90% of leads go inactive. And 30% of prospects go to a competitor if you don't respond quickly. Your CRM should be sending instant notifications and auto-assigning leads the moment they come in. If you're relying on a rep to check their inbox, you've already lost.

Neglecting lead nurturing

Nurtured leads create 20% more sales opportunities and spend 47% more than non-nurtured leads. Yet most teams treat nurturing as "send a follow-up email when I remember." A CRM with automated sequences (Pipedrive Growth, Close Essentials, Freshsales Pro) turns nurturing from a hope into a system (see lead nurturing emails).

Marketing-sales misalignment

This is the #1 systemic failure in lead management: marketing and sales have different definitions of "qualified." Marketing sends over an MQL that downloaded a whitepaper. Sales looks at it and says "this person has no budget and no authority." The lead falls into a black hole.

Fix this by agreeing on MQL and SQL definitions inside your CRM. Document the criteria. Build them into your lead scoring rules. If marketing and sales can't agree on what "qualified" means, no CRM in the world will save your pipeline.

Filling your CRM with bad data

Bad data costs businesses an average of $12.9 million per year. That stat sounds inflated until you calculate the cost of bounced emails tanking your domain reputation, reps wasting hours calling disconnected numbers, and duplicate records creating confusion across your pipeline.

Before you import a single contact, verify it. Teams switching from unverified data sources to tools like Prospeo see bounce rates drop from 35%+ to under 5%. At roughly $0.01 per email, verification costs less than a single bounced sequence (use a repeatable email verification list workflow).

That 4,000-duplicate nightmare? It starts with bad contact data. Prospeo's 5-step verification and automatic deduplication feed your lead tracking CRM clean, current records - 143M+ verified emails at $0.01 each. No contracts. No sales calls.

Clean data turns any CRM into a pipeline machine. Start free.

How to Choose the Right Sales Lead Tracking System

Stop picking CRMs based on feature lists. Pick based on your team size and budget:

| Team Size | Free / <$15/user | $15-$40/user | $40-$100/user | $100+/user |

|---|---|---|---|---|

| Solo | Bigin Free or HubSpot Free | Less Annoying ($15) | Freshsales Pro ($39) | Overkill - don't |

| 2-10 reps | Freshsales Free | Pipedrive Lite ($14) | Close Essentials ($35) | HubSpot Pro ($100) |

| 11-50 reps | HubSpot Free (limited) | Zoho Standard ($14) | Close Growth ($99) | Salesforce Pro ($100) |

| 50+ reps | Not realistic | Zoho Professional ($23) | Salesforce Starter ($25) | Salesforce/HubSpot Enterprise |

A few context benchmarks from First Page Sage's B2B SaaS funnel data: CRM companies see a 2% visitor-to-lead rate, 36% lead-to-MQL, and 42% MQL-to-SQL. If your numbers are significantly below these, the problem isn't your CRM - it's your qualification criteria or your content.

One more data point that should influence your decision: companies using mobile CRM are 150% more likely to exceed sales goals. If your reps are in the field, prioritize tools with strong mobile apps (HubSpot, Pipedrive, Freshsales). Less Annoying CRM's mobile app is still in beta - a real limitation for field teams.

The decision framework is simple: start with the cheapest tool that covers your must-haves. You can always upgrade. You can't always get back the six months you spent implementing a platform that was three tiers above what you needed (and if you’re doing migrations, follow a clean import leads SOP).

What Good Lead Tracking Looks Like (Benchmarks)

You can't improve what you don't measure. Here are the funnel conversion benchmarks for CRM companies specifically:

| Funnel Stage | Benchmark |

|---|---|

| Visitor to Lead | 2.0% |

| Lead to MQL | 36% |

| MQL to SQL | 42% |

| SQL to Opportunity | 48% |

| Opportunity to Close | 38% |

The hardest step? MQL to SQL. It's where marketing-sales misalignment kills deals and where lead scoring earns its keep.

Beyond the funnel, here's what CRM adoption does to your broader metrics:

- Sales revenue: up 29%

- Sales productivity: up 34%

- Forecast accuracy: up 42%

- Customer retention: up 27%

These aren't aspirational numbers - they're averages across CRM implementations. The ROI case for a lead tracking CRM isn't theoretical. It's $8.71 back for every $1 you invest. The only question is which tool gets you there without overspending.

FAQ

What is a lead tracking CRM?

A lead tracking CRM is software that monitors every prospect interaction - from first touch through closed deal - in one centralized system, replacing spreadsheets with automated pipeline management, follow-up reminders, and lead scoring. Most modern options start free or under $15/user/month.

What's the best free CRM for tracking sales leads?

HubSpot Free is the most feature-rich free option, but it limits contacts and gates automation behind paid tiers starting at $20/seat/month. Freshsales Free and Bigin Free are strong alternatives for teams of 1-3 people.

How much does a lead tracking CRM cost?

Prices range from $0 (free tiers) to $150+/user/month for enterprise plans like HubSpot Enterprise or Salesforce. Most small teams spend $14-$39/user/month on tools like Pipedrive, Freshsales, or Close CRM. Budget options like Less Annoying CRM ($15/user) and Bigin ($7/user) keep costs under $20.

Do I need lead scoring in my CRM?

Lead scoring matters once you have more leads than your team can manually prioritize - typically 100+ active prospects. Freshsales offers AI scoring at $39/user/month, the cheapest real option available. Focus on consistent follow-up first, then layer in scoring as volume grows and reps can't eyeball priority anymore.

How do I keep my CRM data clean?

Verify contact data before importing it - bad emails and disconnected numbers waste rep time and damage sender reputation. Schedule quarterly audits to catch natural data decay (people change jobs, companies merge, emails go stale), and use a verification tool to catch problems before they enter your pipeline.