Your Broken Sales Funnel: Here's Exactly Where the Leak Is - and How to Fix It

The VP of Sales just pulled you into a room. Pipeline is down 30% quarter-over-quarter, and nobody can explain why. Marketing says leads are up. Sales says leads are garbage. RevOps is staring at a dashboard that shows 10,000 website visitors last month turned into exactly four customers.

Four.

That's not a pipeline problem. That's a broken sales funnel with holes in it.

68% of companies haven't even measured their funnel. Only about 25-30% have a formally documented funnel process at all. They're flying blind, pouring budget into the top while revenue leaks out the middle and bottom. If you're reading this, you're already ahead of most - but only if you do something with what follows.

What You Need (Quick Version)

If you're short on time, here's the playbook:

- Use the industry benchmark tables below to identify which funnel stage is underperforming. You can't fix what you haven't measured against a standard.

- Apply the revenue-per-point formula to prioritize which leak to fix first. Not the biggest leak - the most expensive one.

- Before optimizing anything, check your data. 70% of CRM data is outdated, and bad contact data is the invisible funnel killer most guides ignore entirely.

Now let's break each of those down.

What a Broken Sales Funnel Actually Looks Like

Most people think of a failing funnel as "not enough leads." That's rarely the real problem. The real problem is compounding drop-off - small conversion gaps at each stage that multiply into catastrophic losses at the bottom.

Here's a real waterfall, based on VWO's funnel analysis:

- 10,000 website visitors

- 500 leads (5% conversion)

- 150 MQLs (30% of leads)

- 30 SQLs (20% of MQLs)

- 18 opportunities (60% of SQLs)

- 4 closed customers (22% of opportunities)

That's a 0.04% visitor-to-customer rate. Looks terrible. But here's what makes it interesting - and actionable.

Watch what happens when you improve just one stage by 5 points. If you bump MQL-to-SQL from 20% to 25%, your 150 MQLs now produce 37.5 SQLs instead of 30. That flows down to 37.5 x 60% = 22.5 opportunities, then 22.5 x 22% = roughly 5 customers. One stage, 5 points, 25% more revenue.

Now imagine you'd spent that same effort optimizing visitor-to-lead from 5% to 10%. You'd double your leads to 1,000, which flows to 300 MQLs, 60 SQLs, 36 opportunities, and 8 customers. Both are 5-point lifts, but the relative impact depends entirely on where in the funnel you apply them. Same absolute improvement, completely different ROI.

This is why "fix the funnel" advice that doesn't include math is useless.

The median overall funnel conversion across industries sits around 6.6%, with 10%+ considered excellent. But 96% of visitors aren't ready to purchase on their first visit. Your funnel isn't just a filter - it's a nurturing machine. And most nurturing machines are running on fumes.

Is the Sales Funnel Even the Right Model Anymore?

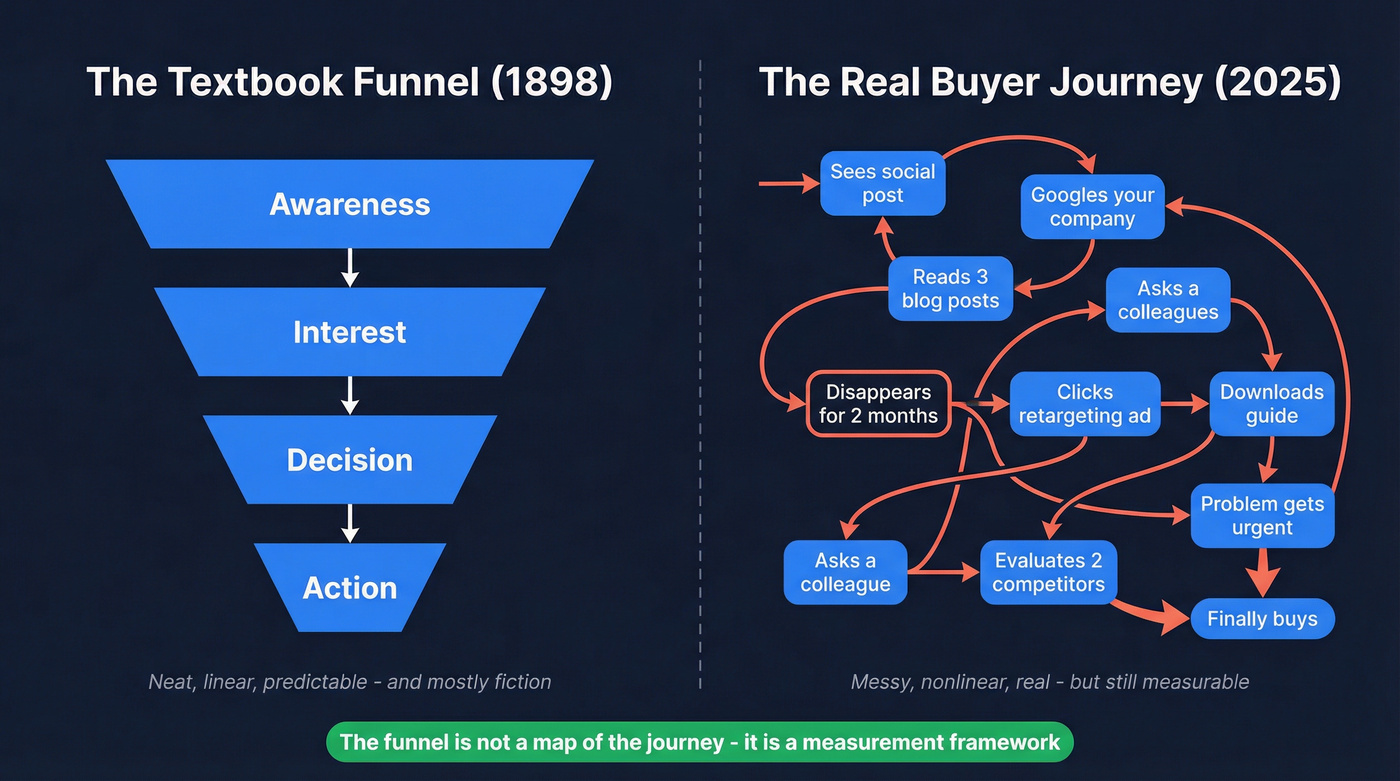

The funnel model is over 125 years old). It assumes a neat, linear progression: awareness, interest, decision, action. Buyers don't work that way anymore, and everyone knows it.

The reality is what researchers call the "messy middle." Buyers revisit earlier stages when new stakeholders appear. They compare competitors repeatedly. They pause for budget cycles, internal alignment, or just because someone went on vacation. A lead can look sales-ready today and return to early-stage research tomorrow. People glance at their phones roughly 150 times per day - a user can go from zero awareness to paying customer in seconds, or they can loop through your content for six months before raising a hand.

Here's what a modern buyer journey actually looks like: discover your brand on social, search your company on Google, read three blog posts over two months, disappear completely, return via a retargeting ad, download a guide, ask a colleague what they think, evaluate two competitors, come back when the problem becomes urgent enough to act.

I call it a pinball machine.

But here's my take: the funnel model still works for diagnosis, even if the journey isn't linear. You still need to know your conversion rates between stages. You still need to identify where the biggest drop-offs are. The funnel isn't a map of the buyer's journey - it's a measurement framework. And as a measurement framework, it's still the best tool we've got.

The practitioner insight that keeps surfacing in B2B communities nails it: "Your funnel isn't broken at the top - it's broken in the middle." The middle is where leads stall, where nurturing dies, and where 60% of potential revenue goes to rot.

You just saw how a 5-point lift at one stage can mean 25% more revenue. But none of that math works if 70% of your CRM data is stale. Prospeo refreshes 300M+ profiles every 7 days - not every 6 weeks - so your reps reach real buyers, not dead ends.

Stop optimizing a funnel built on bad data. Fix the foundation first.

Sales Funnel Benchmarks by Industry

You can't diagnose a leaking funnel without knowing what "healthy" looks like. These benchmarks come from FirstPageSage's multi-year analysis across hundreds of companies.

| Industry | Lead-to-MQL | MQL-to-SQL | SQL-to-Opp | SQL-to-Won |

|---|---|---|---|---|

| B2B SaaS | 39% | 38% | 42% | 37% |

| eCommerce | 23% | 58% | 66% | 60% |

| Financial Services | 29% | 38% | 49% | 53% |

| Healthcare | 24% | 38% | 51% | 51% |

| Higher Ed | 45% | 38% | 42% | 37% |

| IT & Managed Services | 19% | 38% | 49% | 53% |

Notice something? Lead-to-MQL is the lowest conversion stage in most industries. That's where the biggest volume leak happens. But it's not always where the biggest revenue leak is - more on that in the One-Leak Method section.

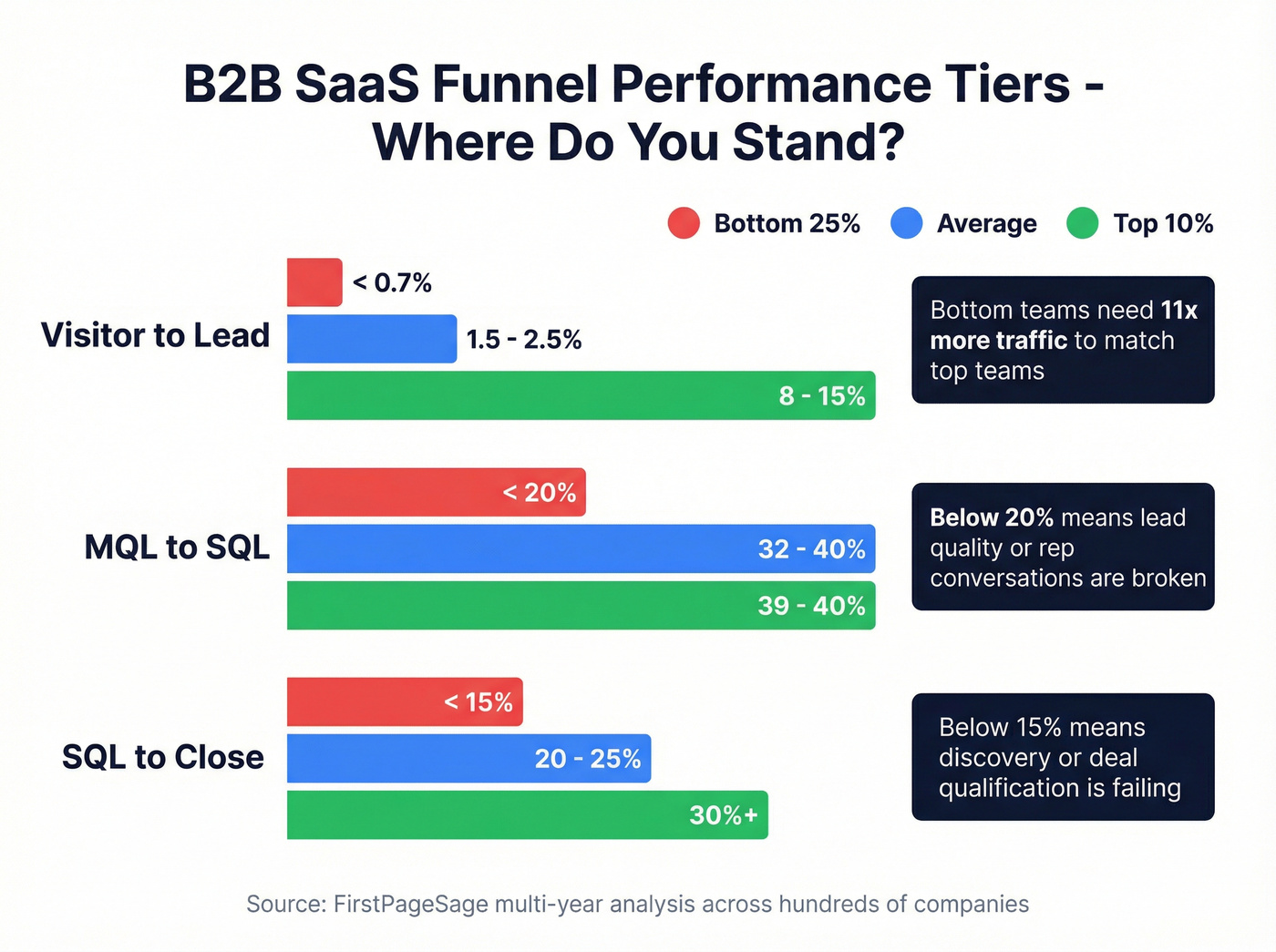

Now here's the performance tier breakdown for B2B SaaS specifically:

| Metric | Bottom 25% | Average | Top 10% | What This Means |

|---|---|---|---|---|

| Visitor-to-Lead | <0.7% | 1.5-2.5% | 8-15% | Bottom-quartile teams need 11x more traffic than top-decile to match pipeline |

| MQL-to-SQL | <20% | 32-40% | 39-40% | Below 20% = lead quality or rep conversations are broken |

| SQL-to-Close | <15% | 20-25% | 30%+ | Below 15% = discovery process or deal qualification failing |

The gap between bottom 25% and top 10% is massive. A bottom-quartile team converting visitors to leads at 0.7% needs 11x more traffic than a top-decile team at 8% to generate the same pipeline. That's not a marginal difference - that's a completely different business model.

A few things these numbers don't tell you:

Time-to-convert matters as much as conversion rate. Enterprise B2B software deals take around 120 days from opportunity to close. SMB deals take 30-45 days. If you're benchmarking against the wrong segment, you'll misdiagnose urgency. (If you need a tighter model, see SaaS sales cycle benchmarks.)

Lead source quality varies wildly. Website leads convert to MQL at 31.3%, referrals at 24.7%, webinars at 17.8%. A "broken" funnel might just be a funnel fed by the wrong channel mix.

A 2% visitor-to-lead rate is terrible for mid-market SaaS and perfectly fine for enterprise software selling six-figure deals. Context is everything. We've seen teams benchmark against the wrong segment and waste entire quarters chasing the wrong problem.

7 Signs Your Sales Funnel Is Not Converting

These aren't vague warning signs. Each one ties to a specific, measurable threshold.

1. Lead qualification is a coin flip. Lead qualification is broken in 70% of SaaS companies. If marketing and sales can't agree on what an MQL is - or worse, if the criteria are so vague that "downloaded a whitepaper" counts - you don't have a funnel. You have a conveyor belt dumping unqualified names on your sales team. (Use a real lead qualification framework and lock it into your lead qualification process.)

2. Speed-to-lead is measured in days, not minutes. The average SaaS lead gets cold-called three days after downloading a resource. That's a death sentence. Companies that reach out within 5 minutes are 21x more likely to qualify the lead than those who wait 30 minutes. Handoff timing kills 40% of deals. (More benchmarks in average lead response time.)

3. Nobody owns the middle. Marketing owns the top. Sales owns the bottom. The middle - where leads get nurtured from MQL to SQL - belongs to nobody. 60% of potential revenue dies in this gap. If you can't name the person responsible for middle-of-funnel conversion, that's your answer.

4. Last-touch attribution is starving your top-of-funnel. When you give all credit to the demo request or the sales call, you defund the awareness programs that filled the funnel in the first place. It's a slow death spiral that takes 2-3 quarters to notice.

5. You haven't A/B tested anything in 6 months. Only 44% of companies use A/B testing at all. If you're making funnel decisions based on gut feel instead of data, you're guessing. And guessing at scale is expensive. (If you want a repeatable system, use this A/B testing framework.)

6. Your copy reads like it was approved by a committee. As one B2B consultant who's audited 100+ funnels put it: "Committee copy - bland, soulless writing that seven stakeholders watered down until it could apply to literally any company - is a conversion killer." If your landing page could swap in a competitor's logo and still make sense, your messaging is broken.

7. Your funnel is built around your org chart, not the buyer's journey. Marketing counts leads. Sales handles conversations. Operations gets pulled in at the last minute. Everyone measures different things. When pipeline stages don't match how buyers actually make decisions, you get false confidence in forecasting and real losses in revenue. ScoliClinic learned this the hard way - after rebuilding their entire digital journey around how patients actually seek care instead of how their departments were organized, contact form submissions increased 650% year-over-year.

The One-Leak Method - Fix the Right Thing First

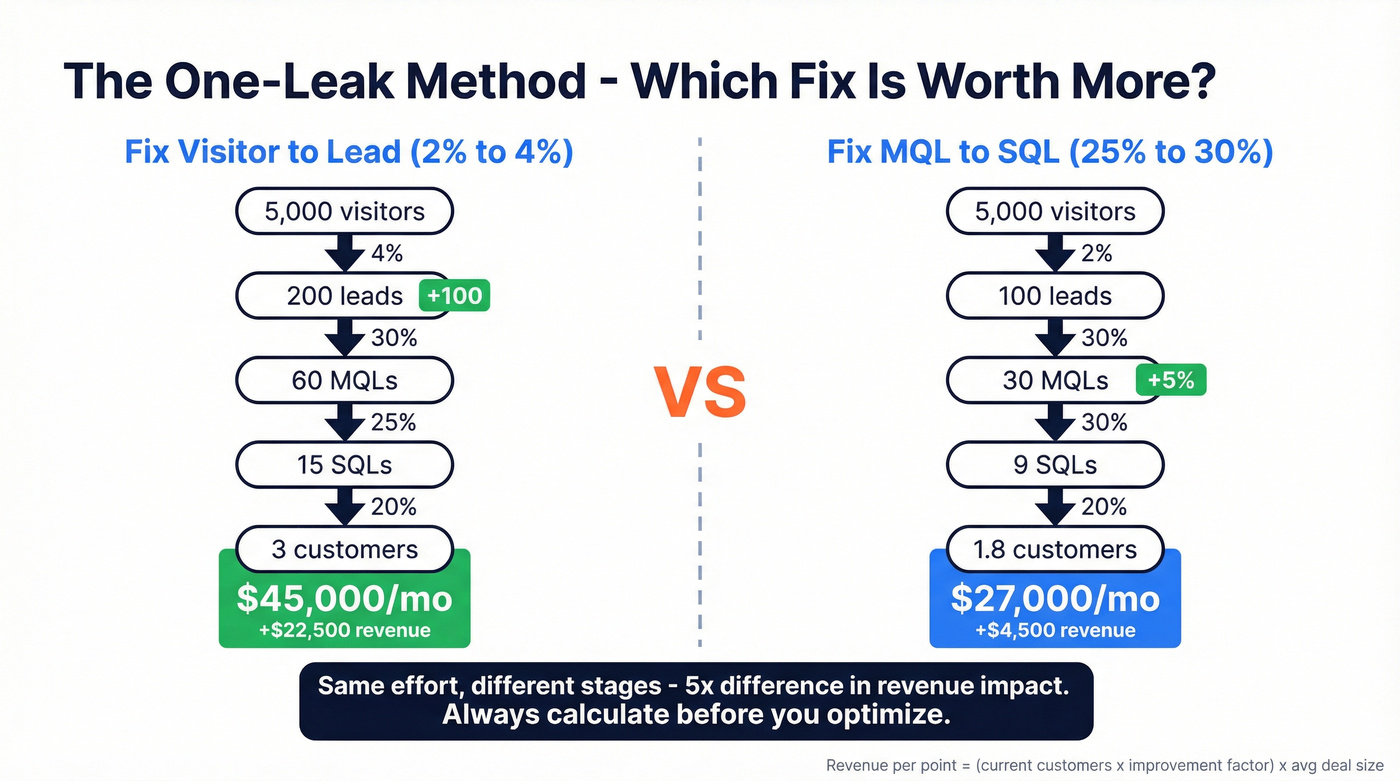

I've seen smart operators spend months optimizing a funnel stage worth $3,000/month per point while completely ignoring one worth $50,000. The problem isn't effort - it's prioritization.

Most funnel audits produce 47-slide decks and zero revenue lift. A buffet of 15 recommendations paralyzes action. Companies implement two of them half-heartedly over six months and wonder why nothing changed.

Here's a better approach: find one leak, fix it, measure, then move to the next.

The revenue-per-point formula makes this simple. For each funnel stage, calculate:

Additional monthly revenue = (current customers x improvement factor) x average deal size

Where improvement factor = (new rate / old rate) - 1.

Worked example: Say you have 5,000 visitors/month, a 2% visitor-to-lead rate, 30% lead-to-MQL, 25% MQL-to-SQL, 20% SQL-to-close, and a $15,000 average deal.

Current state: 5,000 x 2% = 100 leads, then 30 MQLs, then 7.5 SQLs, then 1.5 customers = $22,500/month.

- Improving visitor-to-lead from 2% to 4% (2 points): 5,000 x 4% = 200 leads, flowing to 60 MQLs, 15 SQLs, 3 customers = $45,000/month. Delta: +$22,500/month.

- Improving SQL-to-close from 20% to 25% (5 points): Same top, same middle, but 7.5 SQLs x 25% = 1.875 customers = $28,125/month. Delta: +$5,625/month.

A 2-point lift at the top is worth 4x more than a 5-point lift at the bottom in this scenario. In funnels with higher traffic volumes and lower top-of-funnel conversion, the disparity can easily reach 10x. Without this math, you'd probably focus on the bottom because the conversion rate "looks worse." (If you want to systematize this, use a pipeline generation calculator.)

Hot take: Most teams obsess over close rates because that's what the sales VP stares at in the Monday meeting. But the highest-ROI fix is almost always upstream. The One-Leak Method forces you to follow the money, not the org chart politics.

Stop running sprawling funnel audits. Find one leak, fix it, measure, then move to the next. That's the whole methodology.

How to Fix a Leaky Sales Funnel: Stage-by-Stage Diagnosis

Top of Funnel (Visitor to Lead)

Average conversion here runs 1.5-2.5%. Top 10% hit 8-15%. In our experience, teams below 1% almost always have a targeting problem, not a conversion problem. No amount of CTA optimization fixes a traffic-offer mismatch. (Start with website lead generation basics before you touch page tweaks.)

The single highest-impact fix: single-goal landing pages with one CTA. They convert at 13.5% versus 10.5% for multi-CTA pages. That's a 28% improvement from removing distractions.

Mobile load times under 3 seconds prevent roughly 20% conversion loss. Over 60% of traffic across B2B and B2C is mobile - if you're designing desktop-first, you're optimizing for the minority.

Keep your funnel to 3-4 steps max. Every additional step is a chance for the prospect to leave. The most effective funnels are shockingly simple but psychologically aligned with where the buyer is in their journey.

Red flag: your bounce rate is above 60% and time-on-page is under 30 seconds. That means your traffic and your offer are mismatched. Fix targeting first, then optimize the page.

Middle of Funnel (Lead to MQL to SQL)

This is where funnels go to die.

The MQL-to-SQL industry standard for B2B SaaS is 5-15%. If you're below 5%, your lead quality or your rep conversations are broken - possibly both.

The diagnostic red flag: prospects saying "I'm not sure why you're calling me" or "how did you get my details?" That's a qualification failure, not a sales failure.

SQL-to-SAL (Sales Accepted Lead) should run around 90%. If it's lower, the main issue is prospects not showing up for the second meeting. Root cause: BDRs compensated on securing SQLs, not actual meetings held. When the incentive is to book, not to qualify, you get ghost meetings. (Benchmarks and definitions: sales accepted lead rate.)

Most sales happen on the 5th-7th touchpoint. If your nurture sequences stop at three touches, you're quitting right before the payoff. Demo-to-opportunity conversion averages 60-80%, and elite teams exceed 90%.

My strongest recommendation for diagnosing middle-of-funnel problems: listen to actual sales calls. Not summaries. Not CRM notes. The actual recordings. You'll find the problem in the first five calls. (If you need tooling, start with sales call review software.)

Bottom of Funnel (SQL to Closed Won)

SAL-to-WIN industry standard is 33%. If you're below 20%, look for three things.

First, reps failing to uncover a "Critical Event" during discovery. Without a compelling reason to act now - a contract expiring, a board mandate, a competitor threat - deals stall indefinitely.

Second, reps who "show up and throw up" - showcasing features instead of solving problems. The gap between average and elite close rates almost always comes down to reps who listen versus reps who demo. If your win rate is below 20%, record five discovery calls and count how many minutes the rep talks versus the prospect. You'll have your answer. (This is classic feature dumping.)

Third, no clear next steps after meetings. Every meeting should end with one of three outcomes: yes, no, or explore further with defined actions. "Let's circle back" isn't a next step. It's a slow no.

And here's the fix most teams overlook entirely: ignoring existing customers. Return customers spend 67% more than new ones. Companies that excel at customer experience achieve revenue growth rates 5.1x higher than competitors. If your funnel ends at "closed won" and doesn't loop back into expansion and renewal, you're leaving the easiest revenue on the table.

One more thing: if your pipeline stages don't match the buyer's actual journey - if they're built around your internal process rather than how decisions get made - your forecasting is fiction and your reps are gaming stages instead of advancing deals. (If your team mixes these concepts, read sales pipeline vs sales funnel.)

How to Prevent Sales Funnel Leakage With Better Data

Every funnel optimization guide talks about messaging, CTAs, and lead scoring. Almost none of them talk about the thing that silently kills all of it: bad data.

70% of CRM data is outdated, incomplete, or inaccurate. B2B contact data decays at 2.1% per month - that's 22.5% annually. Nearly a quarter of your database goes stale every year without you noticing. (More on the math in B2B contact data decay.)

The downstream impact is brutal. Sales reps lose 500 hours per year - 62 working days, roughly 25% of their selling capacity - validating and correcting contact information. That's not selling time. That's data janitor time. Poor data quality costs organizations an average of $12.9 million annually.

And the funnel impact? 23-30% of email addresses become outdated each year. 18% of phone numbers change. When your sequences are bouncing and your calls are going to disconnected numbers, it doesn't matter how good your messaging is. You're optimizing a funnel that's feeding on garbage. (If this is recurring, build a policy from how to keep CRM data clean.)

Providers with 97%+ data accuracy achieve 66% higher conversion rates. That's not a marginal improvement - that's the difference between a funnel that leaks and one that works.

The biggest funnel killer isn't bad strategy. It's bad data.

The proof: Snyk's 50-person AE team was running a 35-40% email bounce rate. After fixing their data source, bounce dropped below 5%, AE-sourced pipeline jumped 180%, and they generated 200+ new opportunities per month. Same reps, same messaging, same funnel - different data. If your funnel isn't converting and you haven't audited your contact database, start there.

Real-World Funnel Fixes (With Numbers)

Theory is nice. Results are better.

Financial Services Firm - 89% Sales Cycle Reduction

An established financial services firm was running an 18-24 month sales cycle with limited marketing, few inbound leads, and a sales team buried in manual tasks.

They implemented HubSpot with customized pipelines and deal stages, automated lead scoring, and a new trade show lead capture process. The first three trade shows produced 83 MQLs, 13 SQLs, and 1 closed-won opportunity. More importantly, the sales cycle dropped from 18-24 months to roughly 2 months - an 89% reduction. The fix wasn't magic. It was pipeline visibility, automated follow-up, and lead scoring that actually matched buyer behavior.

Amazon Seller - Conversion Doubled, Revenue +58%

An Amazon seller was stuck at a 2.1% conversion rate with high bounce rates and wasted ad spend. The diagnosis: low-quality product pages, insufficient reviews, no retargeting, and untargeted ad campaigns.

The fixes: SEO-focused copy, high-quality images, A+ Content, targeted ad campaigns, and retargeting sequences. Conversion doubled to 4.3%. Revenue jumped 58%. Bounce rates dropped 26%.

One stat that puts retargeting in perspective: Unilever's Robijn brand found that shoppers exposed to multiple ad types had a 4% purchase rate versus 0.04% for single ad type exposure. That's a 100x difference from simply showing up in more than one place.

The $50K/Month Ad Spend Fix

A company was spending $50K/month on ads driving traffic to a fundamentally flawed funnel. The traffic was fine. The offer was fine. The messaging had three psychological disconnects - it didn't match the emotional state of the prospect at each stage.

They fixed the three barriers in messaging. Conversion rate jumped by 4.7 percentage points. That translated to an extra $28,200/month in revenue from a few days of work. Not a redesign. Not a new tech stack. Just words on a page, aligned to how buyers actually think.

We've seen this pattern repeatedly: teams throw money at traffic when the real problem is a $500 messaging fix sitting right in front of them.

ScoliClinic - 650% Increase in Contact Form Submissions

ScoliClinic rebuilt their entire digital journey from scratch - mapping it to how patients actually research and choose care, rather than how the clinic's departments were structured. They overhauled landing pages, simplified the path from awareness to booking, and aligned messaging to each stage of the patient's decision process.

The result: contact form submissions increased 650% year-over-year. No new ad spend. No new channels. Just a funnel that finally matched how real humans make decisions.

Your Funnel Fix Toolkit

You don't need a $50K tech stack to fix a funnel that's leaking revenue. Here's what actually works, organized by where to start:

Start here (free):

| Tool | What It Does | Price |

|---|---|---|

| GA4 | Funnel tracking, exit analysis | Free |

| Microsoft Clarity | Heatmaps, session recordings | Free |

| Hotjar | Heatmaps, micro-surveys | Free; from $39/mo |

Add when you're ready to scale:

| Tool | What It Does | Price |

|---|---|---|

| Amplitude | Behavioral analytics, cohort analysis | Free tier; from ~$1,000/mo |

| HubSpot | CRM, lead scoring, pipeline management | Free CRM; from $800/mo |

| Optimizely | A/B testing at scale | From ~$1,500/mo |

| Prospeo | Email/contact verification, CRM enrichment | Free tier; from ~$0.01/email |

Skip Optimizely until you've exhausted free tools. If you haven't set up GA4 funnel tracking yet, spending $1,500/month on A/B testing is putting the cart before the horse.

If I had to pick three tools to diagnose a broken funnel tomorrow: GA4, Microsoft Clarity, and Hotjar. That combination gives you quantitative funnel data, visual behavior data, and direct user feedback - all for free.

The Quarterly Funnel Audit Checklist

The best SaaS companies audit their funnel quarterly, not annually. Here's the repeatable cadence to prevent sales funnel leakage before it compounds:

- Pull conversion rates by stage from your CRM. Not vanity metrics - actual stage-to-stage conversion rates.

- Compare each stage to the industry benchmarks in the tables above. Flag any stage more than 10 points below your industry average.

- Run the revenue-per-point calculation on each flagged stage. Rank them by dollar impact, not percentage gap.

- Identify the single highest-value leak. Just one.

- Diagnose the root cause. Listen to sales calls. Check data quality. Review messaging. Talk to reps who are winning and reps who aren't.

- Implement one fix. Not three. Not five. One.

- Measure for 30-90 days. Most tactical fixes - messaging changes, CTA simplification, lead scoring adjustments - show measurable impact within this window.

- Repeat next quarter with the next highest-value leak.

A note on the "dark funnel": This checklist won't catch peer networks, communities, review sites, and word-of-mouth influence that never shows up in your attribution model. If your pipeline seems to appear from nowhere, that's not magic - it's untracked influence. Accept that 30-40% of your funnel's inputs are invisible, and optimize what you can measure.

Here's the thing: the temptation is always to boil the ocean. Resist it. One leak per quarter. Four fixes per year. That's how a broken sales funnel gets repaired in the real world.

Your MQL-to-SQL conversion is tanking because reps waste hours chasing outdated contacts. Prospeo delivers 98% verified emails and 125M+ direct dials - at $0.01 per email. Teams using Prospeo book 35% more meetings than Apollo users.

Plug the invisible leak in your funnel: bad contact data.

FAQ

How do I know which stage of my funnel is broken?

Pull your stage-by-stage conversion rates and compare them to the industry benchmarks in the tables above. The stage furthest below your industry average is your primary leak. Then run the revenue-per-point formula to confirm it's the most expensive leak - the biggest percentage gap isn't always the costliest one.

What's a good overall sales funnel conversion rate?

The median across industries is about 6.6%, with 10%+ considered excellent. "Good" depends on your industry and deal size - eCommerce averages 3.17% while B2B SaaS with strong product-market fit can exceed 10%. Use stage-by-stage benchmarks rather than a single overall number.

How long does it take to fix a broken sales funnel?

Most tactical fixes - messaging changes, CTA simplification, lead scoring adjustments - show measurable impact within 30-90 days. The financial services case study above cut an 18-24 month sales cycle to 2 months. The $50K/month ad spend fix took days. Start with the highest-value leak and measure from there.

How does bad contact data cause sales funnel leakage?

B2B contact data decays at 2.1% per month - 22.5% annually. Outdated CRM records mean emails bounce, calls hit dead numbers, and reps waste 500 hours per year on cleanup instead of selling. Snyk cut bounce rates from 35-40% to under 5% and grew pipeline 180% after switching to a provider with 98% email accuracy and weekly data refreshes.

What's the fastest way to fix a funnel that's not converting?

Use the One-Leak Method: run the revenue-per-point formula across every stage, identify the single most expensive leak, and fix that one thing first. One targeted improvement - whether it's data quality, messaging alignment, or lead scoring criteria - will move the needle faster than a sprawling audit that sits in a slide deck.