12 Best Amplemarket Alternatives in 2026 for Teams That Want Better Data for Less

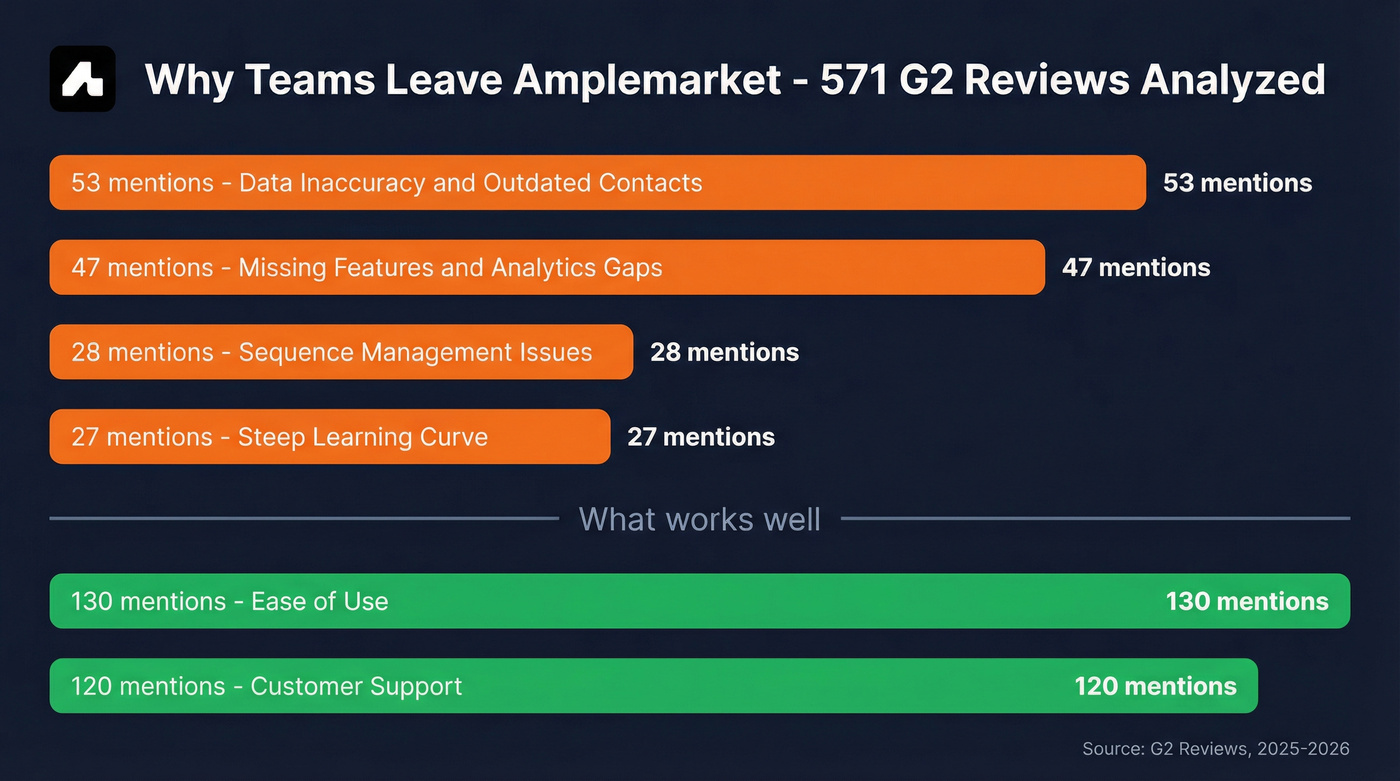

You're searching for Amplemarket alternatives because something isn't working. Maybe it's the renewal invoice - at least $7,200 a year, $600+/month minimum, annual lock-in, no monthly option. Maybe it's the bounce rates your SDRs keep flagging. Across 571 G2 reviews, 53 separate mentions call out data inaccuracy as a core problem. When your data layer is unreliable, everything built on top of it - sequences, AI agents, intent signals - falls apart.

Six of the top 10 Google results for this query are vendor self-promotion pages. This one isn't. We tested these tools, compared real pricing, and have actual opinions about which ones deserve your budget.

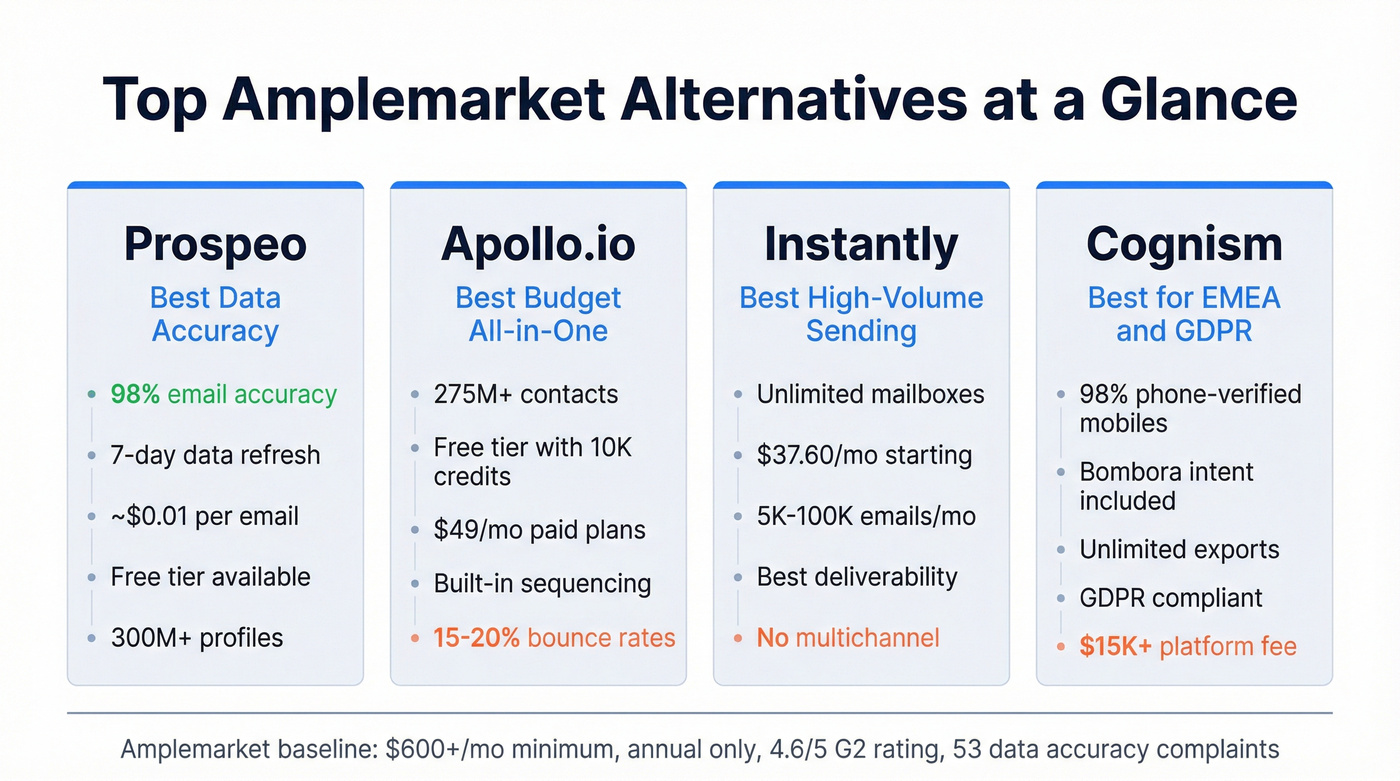

Our Picks (TL;DR)

| If you need... | Pick this | Why |

|---|---|---|

| Best data accuracy | Prospeo | 98% email accuracy, 7-day refresh, ~$0.01/email |

| Budget all-in-one | Apollo.io | Free tier + $49/mo paid, 275M+ contacts |

| High-volume cold email | Instantly | Unlimited mailboxes from $37.60/mo |

| EMEA/GDPR compliance | Cognism | Phone-verified mobiles, Bombora intent |

Why People Switch from Amplemarket

Amplemarket isn't a bad product. It carries a 4.6/5 on G2 across 571 reviews, with 130 positive mentions for ease of use and 120 for customer support. The Duo Copilot AI agent helps some teams surface buying signals they'd otherwise miss, and the LinkedIn capture feature - exporting engaged users from posts, events, and groups - is a genuine differentiator. Gartner named them a Cool Vendor in Generative AI for Sales. Amplemarket claims 60-70% open rates and 15%+ reply rates for some customers.

Those numbers depend on the data being accurate in the first place.

Data accuracy is the biggest pain point. Across those 571 reviews, 53 mentions call out inaccurate or outdated contact data. One user reported bounce rates hitting 65%. That's not a data platform problem - that's a domain reputation killer. When more than half your emails bounce, you're actively damaging your sender infrastructure.

Missing features frustrate power users. 47 G2 mentions flag gaps like conditional sequence steps and advanced analytics filters. Another 28 cite sequence management issues - email organization, lead routing complications, the kind of workflow friction that compounds across a team of 10+ reps over months.

The pricing model creates lock-in. $600+/month minimum, annual contracts only, no monthly option. For a 2-person SDR team at a Series A company, that's a significant line item for a tool where the data layer isn't reliable enough.

One Reddit user described the appeal well: "The data, signals, and engagement all sit in one place, so we stopped stitching tools together." That's the dream. But when the data layer underneath is shaky, the whole stack wobbles. And the learning curve - flagged in 27 G2 mentions - doesn't help.

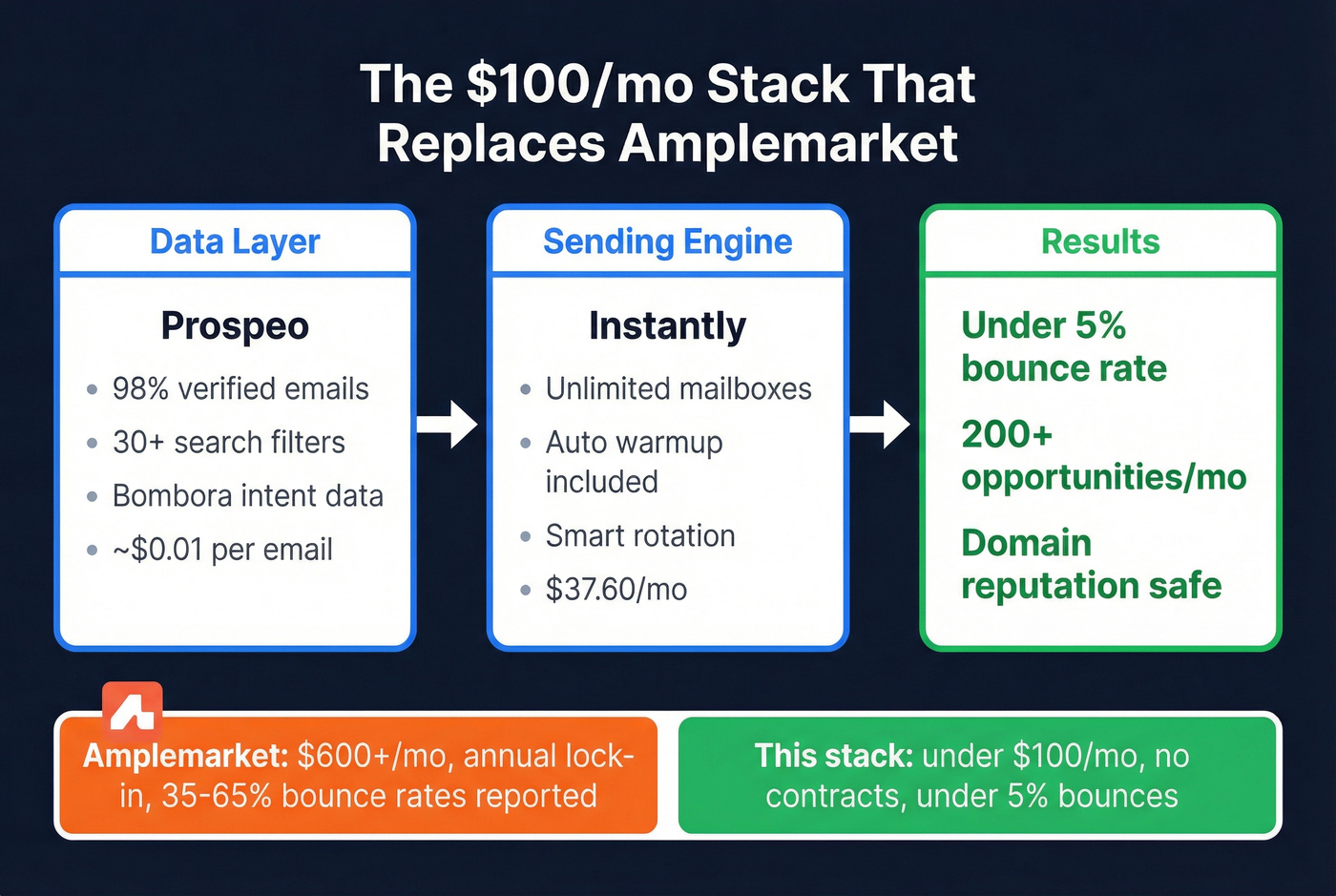

So the question isn't whether Amplemarket works. It does, for some teams. The question is whether you're getting $7,200+/year of value - or whether you'd get better results spending less on tools that do their specific jobs better.

Here's the thing: if your average deal size is under $15k and your team is under 10 reps, you almost certainly don't need Amplemarket. The all-in-one premium only pays off when you have dedicated RevOps to configure it and enough volume to justify the AI features. Everyone else is overpaying for a data layer that underdelivers.

53 G2 reviews flag Amplemarket's data accuracy issues. Prospeo delivers 98% verified emails refreshed every 7 days - not every 6 weeks. Snyk's 50 AEs dropped bounce rates from 35% to under 5% and generated 200+ new opportunities per month.

Replace your shaky data layer with one that actually works.

The Best Amplemarket Alternatives in 2026

Prospeo - Best for Data Accuracy and Self-Serve Prospecting

Use this if: Your bounce rates are killing your domain reputation and you need verified data you can trust.

Skip this if: You need built-in sequencing - pair Prospeo with Instantly or Lemlist for that.

Prospeo solves exactly the problem Amplemarket users complain about most: data accuracy. 300M+ professional profiles, 143M+ verified emails at 98% accuracy, 125M+ verified mobile numbers with a 30% pickup rate. Every record refreshes on a 7-day cycle - the industry average is six weeks. The proprietary email-finding infrastructure doesn't rely on third-party providers, which is why the accuracy numbers hold up at scale.

The case study that sealed it for us: Snyk's 50-person AE team was running 35-40% bounce rates before switching. After moving to Prospeo, bounces dropped under 5%. AE-sourced pipeline jumped 180%, generating 200+ new opportunities per month.

Search runs 30+ filters including Bombora intent data across 15,000 topics, technographics, job changes, headcount growth, and funding signals. The Chrome extension has 40K+ users for prospecting directly from company websites and professional profiles.

Pricing starts at roughly $0.01 per email. Free tier gives you 75 verified emails and 100 Chrome extension credits per month. No contract, no sales call. Compare that to Amplemarket's $600+/month floor.

You're paying Amplemarket $600+/month for data that bounces. Prospeo costs ~$0.01/email, requires no annual contract, and runs 30+ filters including Bombora intent data across 15,000 topics. Same signals, verified data, 90% less spend.

Stop overpaying for emails that never land.

Apollo.io - Best Budget All-in-One Platform

Use this if: You want the closest thing to Amplemarket's all-in-one approach without the $600/month price tag.

Skip this if: You're selling into enterprise accounts where mobile number accuracy matters.

Apollo is the obvious starting point for most teams switching from Amplemarket on a budget. The free tier alone - 10,000 email credits, 5 mobile credits, 250 emails/day - is more generous than what most tools charge $50/month for. Paid plans start at $49/user/month (annual) for Basic, $79 for Professional, $119 for Organization.

The database covers 275M+ contacts across 73M+ companies. For a 5-person SDR team on Professional, you're looking at roughly $7,140/year with typical credit overages - less than Amplemarket's annual cost for a single user.

The tradeoff: Apollo's data quality isn't in the same league as dedicated data platforms. Bounce rates run 15-20% on some segments. Mobile numbers are unreliable for mid-market and enterprise contacts. And the "credit anxiety" problem is real - SDRs start rationing credits mid-month, which kills prospecting momentum.

Amplemarket's own comparison argues that Apollo's AI features require manual prompt building and segmentation, while Duo Copilot automates the workflow end-to-end. That's a fair point. Apollo gives you more control but demands more setup.

Apollo is a great prospecting engine with a good-enough data layer. If you need enterprise-grade accuracy, look elsewhere. (If you want a deeper dive, start with Apollo accuracy.)

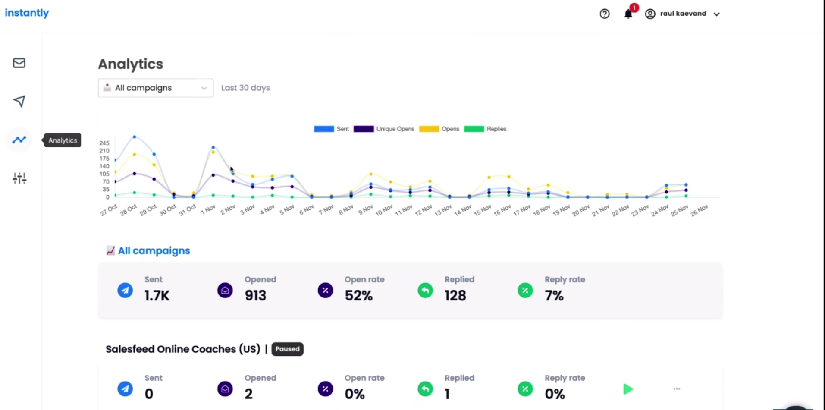

Instantly - Best for High-Volume Cold Email

Instantly nails one thing better than almost anyone: getting emails delivered at scale. If you already have a data source and just need a sending engine, stop reading and go sign up.

The Growth plan at $37.60/month (annual) gives you unlimited email accounts, unlimited warmup, and 5,000 emails/month. Hypergrowth at $77.60/month bumps that to 100,000 emails/month with 25,000 contacts. Their SuperSearch lead database is a separate product starting at $47/month for 1,500-2,000 credits across 450M+ B2B leads - decent for top-of-funnel, but verify that data before sending.

Where Instantly falls short compared to Amplemarket: no multichannel sequences, no intent signals, no AI copilot. It does one thing well and doesn't pretend otherwise. I respect that.

The winning stack for most teams leaving Amplemarket: Instantly for sending + a dedicated data source for verified contacts. That combination runs under $100/month and typically outperforms Amplemarket's built-in sending on deliverability. (If you're comparing senders, see Instantly vs Lemlist.)

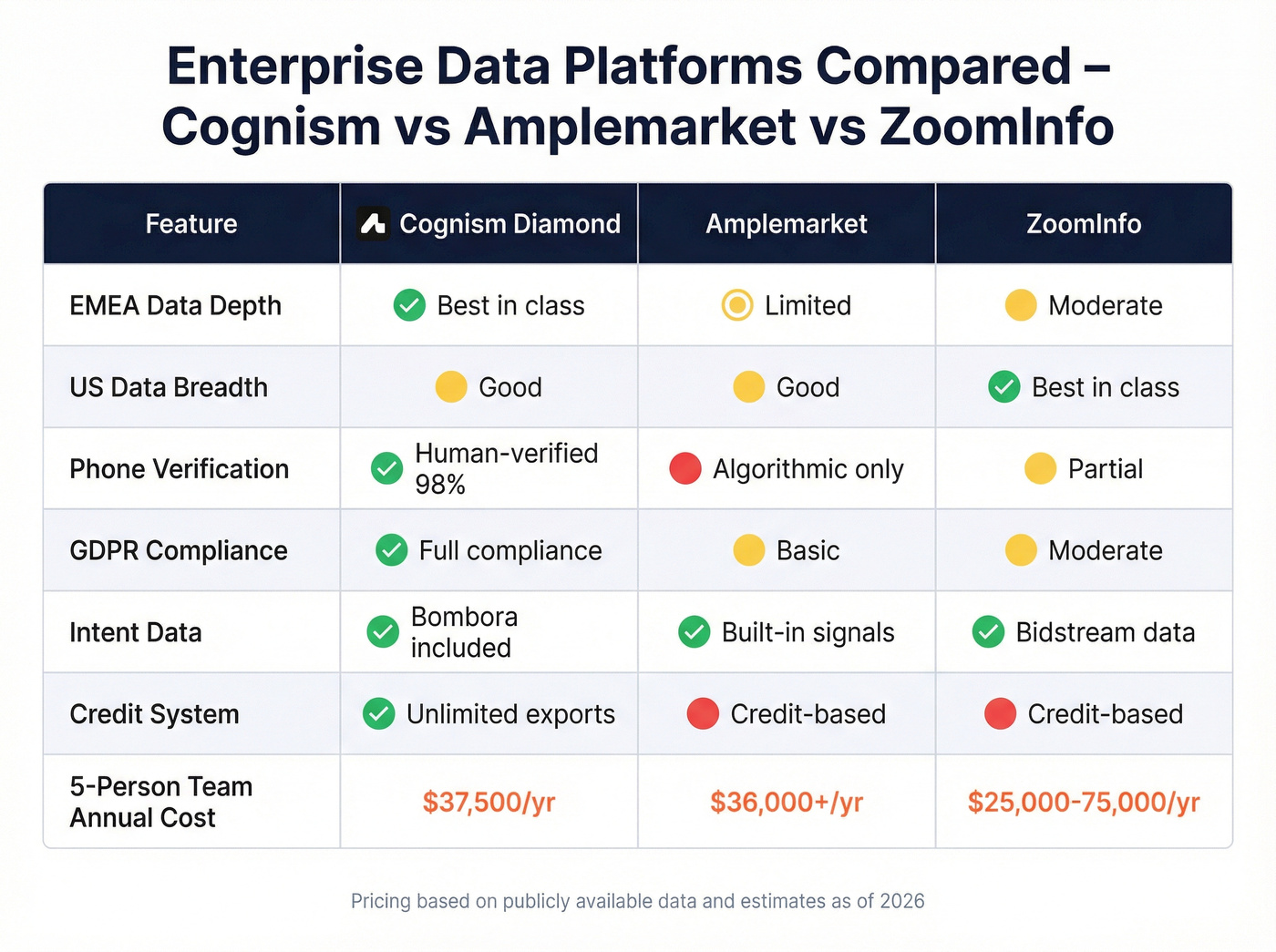

Cognism - Best for EMEA and GDPR Compliance

The pricing reality check: Cognism is not cheap. Platinum runs $15,000 platform fee plus $1,500/user/year (25M contacts). Diamond jumps to $25,000 platform plus $2,500/user/year (50M contacts). For a 5-person team on Diamond, you're looking at $37,500/year.

That's more than Amplemarket.

So why is it here? Because Cognism's Diamond plan offers phone-verified mobile numbers at 98% accuracy - humans actually call the numbers to verify them. That's a fundamentally different level of data quality than algorithmic verification. Bombora intent data comes included, and they run an unlimited views/exports model under fair use. No credit system, which is refreshing.

Cognism beats ZoomInfo on EMEA data depth and GDPR compliance. ZoomInfo still wins on US database breadth. Cognism beats Amplemarket on data accuracy, period.

Pro tip: negotiate end-of-quarter. Cognism reps have been known to offer up to 29% discounts when they're pushing to hit numbers.

Reply.io - The Closest Multichannel Match to Amplemarket

If you bought Amplemarket specifically for Duo Copilot, Reply.io is the first place to look. The Jason AI SDR starting at $500/month runs fully autonomous 24/7 outreach with real-time contact search - the most direct competitor to Duo Copilot on the market.

Beyond the AI agent, Reply.io competes with Amplemarket on scope. Email Volume starts at $49/month. Multichannel runs $89/user/month with email, calls, SMS, and WhatsApp. Monthly billing available - no annual lock-in required. The database covers 1B+ B2B contacts, though depth and accuracy vary by region. Pair with a verification layer for best results.

Lemlist - Best for SME Simplicity

| Pros | Cons |

|---|---|

| Free plan available (rare) | Reps click through steps manually - no full automation |

| 450M+ contacts, 80%+ verified | Creative features less useful for high-volume teams |

| Visual personalization templates | Database accuracy below dedicated providers |

| Lemwarm included (10K+ user network) | Limited enterprise features |

Paid tiers run $55-$79/month. The visual personalization - custom images, dynamic landing pages, personalized video thumbnails - is Lemlist's secret weapon. It's the kind of creative outreach that actually gets replies in crowded inboxes. For small teams that want dead-simple cold email without enterprise complexity, Lemlist delivers.

Clay - The Data Enrichment Engine (Not a Standalone Replacement)

Don't buy Clay thinking it replaces Amplemarket. It doesn't send emails. It doesn't have a dialer. It's a data enrichment engine, full stop - and it's the best one available.

Clay waterfall-enriches contacts across 100+ data providers, finding the best data point from multiple sources rather than relying on a single database. Free tier available, Starter at $134/month, Explorer at $314/month, Pro at $720/month. All plans include unlimited users - pricing is credit-based, not per-seat. (If you’re building a stack, this pairs well with a waterfall approach.)

The Reddit consensus is clear: Clay is best-in-class for list quality, but it's one piece of a stack, not the whole stack.

Outreach.io - Enterprise Engagement Platform

Outreach runs ~$100/user/month with annual commitment. For a 5-person team, that's $6,000/year minimum - and you still need to add a data provider on top. No built-in prospect finder, significant learning curve, and the UI complexity is a common complaint.

Enterprise teams with dedicated RevOps love it. Everyone else finds it overkill.

Salesloft - Enterprise Engagement with Dialer Add-On

Salesloft runs ~$1,000/user/year with a 3-seat minimum ($3,000/year floor). The frustrating part: the dialer is an add-on at $200/user/year - it's not included in any plan. No free trial either. Like Outreach, it's a pure engagement platform with no data layer. You're paying for workflow orchestration, not contacts.

Lusha - Budget-Friendly Data Provider

Lusha offers a free tier (40-70 credits/month), Pro at $29.90/user/month, Premium at $69.90/user/month. The credit system burns fast for serious outbound - 1 credit per email, 5-10 per phone number. A team doing 500 lookups/month will blow through Pro credits in days.

Good for occasional lookups, not for pipeline-scale prospecting.

LeadIQ - Prospecting-Focused Chrome Extension

LeadIQ's free tier gives you 50 credits/month. Pro runs $200/month for a credits-based model where phone numbers cost 10 credits each. It's built specifically for prospecting workflows that feed into Outreach or Salesloft - a data capture tool, not a full platform. Solid for reps who live in their browser, but not an Amplemarket replacement.

Salesforge - Budget Cold Email + AI SDR

Salesforge starts at $48/month with a deliverability-first approach. Their Agent Frank AI SDR runs $499/quarter - one of the cheapest autonomous AI agents on the market. Limited brand recognition compared to the bigger players, but the price-to-feature ratio is compelling for bootstrapped teams testing AI-driven outbound.

How These Tools Compare on Price

This is the table nobody else publishes with real numbers. Amplemarket sits at the top as your baseline. ZoomInfo is included as a reference point - it's the enterprise pricing anchor that puts everything else in perspective.

| Tool | Starting Price | Free Tier | Database | Best For |

|---|---|---|---|---|

| ZoomInfo | $14,995/yr | No | 321M+ | Enterprise data (reference) |

| Amplemarket | $600+/mo (annual) | 14-day trial | 200M+ | All-in-one AI |

| Apollo.io | $49/user/mo | Yes, optional annual | 275M+ | Budget all-in-one |

| Instantly | $37.60/mo | No, optional annual | 450M+ | High-volume email |

| Cognism | ~$16,500/yr | 25 leads | 25-50M | EMEA compliance |

| Reply.io | $49/mo | No, monthly OK | 1B+ | Multichannel + AI |

| Lemlist | $55/mo | Yes, monthly OK | 450M+ | SME simplicity |

| Clay | $134/mo | Yes, monthly OK | 100+ sources | Data enrichment |

| Outreach.io | ~$100/user/mo | No | None | Enterprise engagement |

| Salesloft | ~$83/user/mo | No | None | Enterprise engagement |

| Lusha | $29.90/user/mo | Yes, monthly OK | 100M+ | Quick lookups |

| LeadIQ | $200/mo | Yes, monthly OK | N/A | Chrome prospecting |

| Salesforge | $48/mo | No, monthly OK | N/A | Budget cold email |

A few things jump out. Amplemarket's $600+/month floor is the second-highest starting price in this entire list - only ZoomInfo costs more. The engagement-only platforms (Outreach, Salesloft) don't include data, so their real cost is higher than it looks. And the gap between ZoomInfo at $14,995/year and tools like Apollo at $588/year tells you how much the market has shifted.

All-in-One vs. Best-of-Breed - Which Approach Is Right?

Everyone wants one tool to rule them all. One login, one vendor, one invoice. Amplemarket sells this hard, and for teams with 10+ reps and a dedicated RevOps person, the consolidation argument has merit.

But here's what I've seen repeatedly: teams buy the all-in-one, use 40% of the features, and pay 100% of the price. The data layer is mediocre. The sending engine is fine but not best-in-class. The AI features are cool demos that don't move pipeline numbers.

Stack Example 1: The Budget Powerhouse A dedicated data source for verified contacts + Instantly (sending + warmup) + Clay (enrichment) = under $200/month for a single user. That's 67% cheaper than Amplemarket's starting price, with better data accuracy, better deliverability, and more flexible enrichment.

Stack Example 2: The Simple Upgrade Apollo.io (all-in-one prospecting) + a verification layer to clean the data before it hits your sequences = under $100/month per user. You get Apollo's workflow convenience with verified email accuracy. Best of both worlds.

80% of your outbound results come from data quality. The sending tool matters, the sequences matter, the copy matters - but none of it matters if the email bounces or the phone number is dead. That's why the best-of-breed approach usually wins: you pick the best data source, the best sending tool, and connect them. Total cost is lower. Results are better.

AI SDR Competitors to Duo Copilot

If you bought Amplemarket specifically for Duo Copilot, you're not alone. AI SDRs are the hottest category in sales tech right now. The economics are compelling: a human SDR costs $75,000-$100,000/year and generates 15-20 qualified opportunities per month. An AI SDR platform costs $500-$2,000/month and can produce 40-60 qualified opportunities per month.

Here's how the main AI SDR options stack up:

| AI SDR | Price | Approach |

|---|---|---|

| Duo Copilot (Amplemarket) | Included in $600+/mo | Signal-based, multichannel |

| Jason AI (Reply.io) | From $500/mo | Autonomous, real-time search |

| Agent Frank (Salesforge) | $499/quarter (~$166/mo) | Budget autonomous agent |

| 11x (Alice) | ~$2,000+/mo | Multi-channel; credibility concerns |

A word of caution on 11x: TechCrunch reported that the company made false customer claims. That gives me pause.

The caveat nobody in the AI SDR space wants to talk about: output quality depends entirely on input data quality. Feed an AI SDR garbage contacts and you'll get garbage results - just faster and at higher volume. Most vendors gloss over the 40-60 hours of data preparation before launch. That's where the real work happens.

Realistic ramp timeline: Month 1 produces 5-10 qualified opportunities as the system learns. Month 2 jumps to 20-30. Month 3 hits the 40-60 range. Teams with messy data take 6-9 months to see positive ROI instead of the promised 90 days. Clean data is the difference between a 3-month payback and a 9-month money pit.

FAQ

Is Amplemarket worth the price?

At 4.6/5 on G2 with 571 reviews, Amplemarket is a capable all-in-one platform with strong automation and helpful support. But at $600+/month with annual lock-in and 53 G2 mentions flagging data inaccuracy, most teams under 10 reps get better ROI from specialized tools. The value equation tips in Amplemarket's favor only when you're actually using the full suite.

What's the cheapest alternative to Amplemarket?

Apollo.io has the most generous free tier - 10,000 email credits and 5 mobile credits per month at $0. Instantly starts at $37.60/month for unlimited email accounts and warmup. Prospeo's free tier gives you 75 verified emails per month with no credit card required.

Which Amplemarket competitor has the best data accuracy?

Prospeo leads with 98% email accuracy and a 7-day data refresh cycle - the fastest in the industry. Cognism's Diamond plan offers 98% phone-verified mobile accuracy, particularly strong for EMEA. Apollo's accuracy drops to 80-85% on some segments, especially for mid-market and enterprise contacts.

Can I replace Amplemarket with a single tool?

Apollo.io and Reply.io come closest to matching Amplemarket's all-in-one scope. But most teams get better results with a 2-3 tool stack: one for data, one for sending (Instantly or Lemlist), and optionally one for enrichment (Clay). The stack approach costs less and performs better.

Do I need an annual contract for these alternatives?

Most offer monthly billing - Apollo, Instantly, Reply.io, Lemlist, and Prospeo all let you pay monthly with no long-term commitment. Cognism, Outreach, and Salesloft typically require annual contracts. Amplemarket is annual-only with no monthly option, which is increasingly unusual in this market.