Saleshandy Pricing in 2026: What You'll Actually Pay (Not Just the Headline Price)

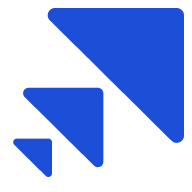

$25/month looks clean on a pricing page. Then you discover Lead Finder is a separate subscription, your one-time verification credits vanish in a week, and email infrastructure costs $4/month per account on top of everything else. By the time you've built a functional cold email setup, you're spending $130-$200/month - not $25.

This breakdown covers every layer of Saleshandy pricing: the plans, the add-ons, the hidden fees, and the math nobody else does for you. We've stacked these numbers against Instantly, Smartlead, Lemlist, and Woodpecker so you can see what you're actually comparing.

Here's the thing: Saleshandy is genuinely one of the best values in cold email outreach - especially for agencies. But only if you budget for the real number, not the headline number.

The Cheat Sheet

- Four outreach plans: Starter ($25/mo), Pro ($69/mo), Scale ($139/mo), Scale Plus ($209/mo) - all annual billing

- Lead Finder is separate. Starts at $29/mo for 500 credits. Budget for it - you'll need it

- Realistic monthly spend for a scaling team: $130-$200/mo, not $25/mo

- Free trial: 7 days, no credit card, capped at 100 emails and 2,000 prospects

- Best value for: Agencies (unlimited clients on every plan, whitelabel on Scale+)

- Best beginner alternative: Instantly - simpler UI, faster setup

Saleshandy holds a 4.6/5 on G2 across 770+ reviews. 87% of those reviewers are from companies with 50 or fewer employees. This is an SMB tool that punches above its weight - if you understand the full cost structure.

Saleshandy Cold Emailing Plans - Full Breakdown

Every outreach plan includes unlimited email accounts, unlimited clients, and unlimited team members (except Starter, which limits team access). That's the headline differentiator - and it's real. No per-seat charges.

Here's the current pricing, verified from Saleshandy's official pricing page:

| Plan | Annual | Monthly | Emails/Mo | Active Prospects | Accounts/Sequence |

|---|---|---|---|---|---|

| Starter | $25/mo | $36/mo | 6,000 | 2,000 | 10 |

| Pro | $69/mo | $99/mo | 150,000 | 30,000 | 100 |

| Scale | $139/mo | $199/mo | 240,000 | 60,000 | 1,000 |

| Scale Plus | $209/mo | $299/mo | 300,000 | 100,000 | 1,000+ |

Annual billing saves real money: $132/year on Starter, $360/year on Pro, $720/year on Scale, and $1,080/year on Scale Plus.

If you're cross-referencing review sites, their pricing data is often outdated (showing $74 for Pro, $149 for Scale, $219 for Scale Plus from late 2024). The numbers above are current.

Every plan includes one-time credits for Lead Finder, AI, and email verification. These aren't monthly - they're a one-time welcome bonus that depletes fast. More on that in the hidden costs section.

Outreach Starter ($25/mo) - Who It's For

Solo founders testing cold email for the first time. You get 2,000 active prospects, 6,000 emails/month, and 10 email accounts per sequence. That's enough to run a basic campaign to a small list.

The catch: no CRM integrations (Salesforce, HubSpot, Pipedrive, Zoho), no API access, no subsequences, and limited team functionality. You also get just 50 Lead Finder credits (one-time) and 1,000 verification credits (one-time). Those 50 Lead Finder credits? Gone in your first prospecting session.

If you're just validating whether cold email works for your business, Starter is fine. If you already know it works and need to scale, skip straight to Pro.

Outreach Pro ($69/mo) - The Sweet Spot

This is where most teams land, and for good reason. 30,000 active prospects, 150,000 emails/month, 100 email accounts per sequence, CRM integrations (Salesforce, HubSpot, Pipedrive, Zoho), API access, MCP access, webhooks, and subsequence logic.

Pro also unlocks unlimited team members - a massive differentiator when competitors like Lemlist charge per seat. For a 5-person SDR team, that's the difference between $69/mo total and $375/mo on Lemlist.

You get 100 one-time Lead Finder credits, 200 AI credits, and 5,000 verification credits. The verification credits sound generous until you realize you're managing 30,000 prospects - they'll last maybe a month or two of active importing.

Outreach Scale ($139/mo) - Built for Agencies

Scale adds whitelabel capabilities, SSO, unlimited teams, and 1,000 email accounts per sequence.

If you're running cold email for multiple clients, this is the plan. The unlimited clients feature is Saleshandy's killer advantage for agencies. Smartlead charges $29/month per additional client. Instantly charges per user for team access. Saleshandy? Zero extra. Ten clients, twenty clients - same price.

You get 100 Lead Finder credits, 500 AI credits, 10,000 one-time verification credits, and 2 Inbox Placement Tests per month.

Outreach Scale Plus ($209/mo) - Enterprise Volume

100,000 active prospects, 300,000 emails/month, a dedicated success manager, and customized warm-up where Saleshandy's team configures schedules tailored to your domain reputation and sending patterns rather than using the default automated settings.

This plan scales up to 500,000 prospects and 1.5 million emails/month with custom pricing - Saleshandy publishes tiers at $249, $299, $349, $399, and $449/month (annual) for progressively higher limits. If you need that kind of volume, you're negotiating custom terms anyway.

Scale Plus is where Saleshandy competes with enterprise-grade platforms. The dedicated success manager alone is worth the jump from Scale if you're sending 200K+ emails/month and need someone watching your deliverability.

Saleshandy's Lead Finder costs $29-$1,999/mo on top of your outreach plan. Prospeo gives you 300M+ profiles with 98% verified emails, 125M+ mobile numbers, and 30+ search filters - all in one platform starting at $0.01 per email. No separate subscriptions. No hidden add-ons.

Stop paying twice for prospecting and outreach data.

Lead Finder Pricing - The Subscription Nobody Tells You About

Here's where the cost structure gets frustrating. Lead Finder - the built-in B2B database with 700M+ contacts and 60M+ companies - is a completely separate subscription. It's not included in your outreach plan. Those one-time credits you got? They're a teaser.

The fact that this is buried as a separate product, rather than bundled into outreach plans, is the #1 thing I'd change about the pricing model. Every buyer I've talked to discovers this after they've already committed to an outreach plan.

Here are the Lead Finder tiers:

| Lead Finder Plan | Annual | Monthly | Credits/Mo |

|---|---|---|---|

| Starter | $29/mo | $35/mo | 500 |

| Pro | $59/mo | $69/mo | 1,000 |

| Scale | $99/mo | $119/mo | 2,500 |

| Scale Plus 5K | $199/mo | $239/mo | 5,000 |

| Scale Plus 10K | $399/mo | $479/mo | 10,000 |

| Scale Plus 30K | $999/mo | $1,119/mo | 30,000 |

| Scale Plus 70K | $1,999/mo | $2,399/mo | 70,000 |

Unused credits carry forward to the next billing cycle, which is a nice touch. Credits reveal both email addresses and phone numbers.

Let's do the math that matters: Outreach Starter ($25/mo) + Lead Starter ($29/mo) = $54/mo minimum for a functional setup with prospecting. That's the real starting price - not $25.

For a growing team on Outreach Pro + Lead Pro, you're at $128/mo. Add email infrastructure for 10 accounts and you're pushing $173/mo. That's the number to budget for.

Hidden Costs and Add-Ons

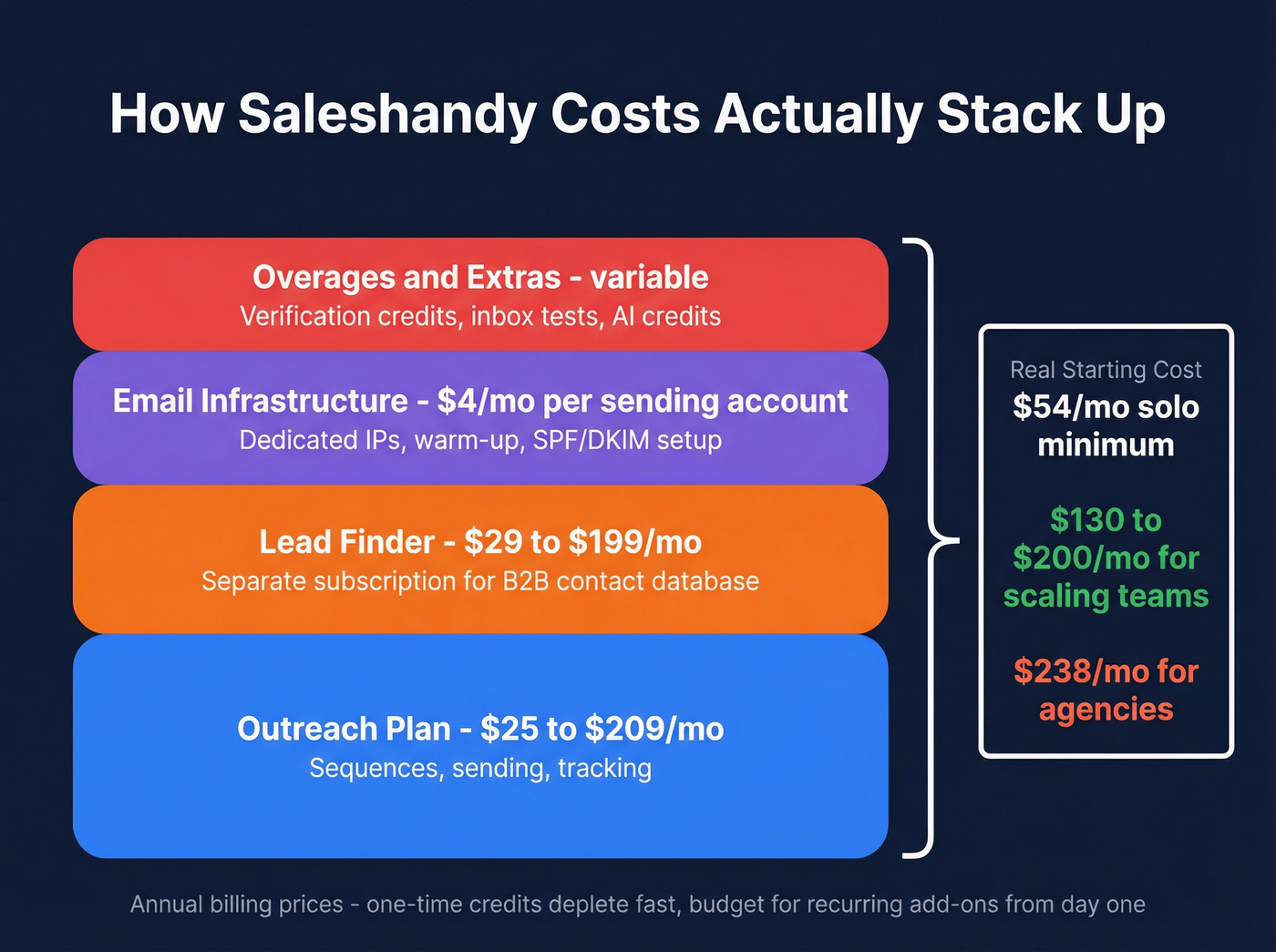

The pricing page shows clean plan prices. The blog breakdown reveals the rest. Here's what matters and what you can skip.

Use These Add-Ons

Email Infrastructure ($4/mo per account + $14/yr per domain). Saleshandy sets up dedicated US IP addresses, automatic warm-up, and pre-configured SPF/DKIM/DMARC. If you're running 10 sending accounts, that's $40/month plus ~$5/month amortized for domains. Worth it if you don't want to manage infrastructure yourself. (If you want the mechanics, see SPF/DKIM/DMARC.)

Inbox Placement Test ($34/mo). Seed list of 50 email accounts across ESPs, spam score analysis, domain reputation reports. If you're sending 50K+ emails/month, this pays for itself by catching deliverability issues before they tank your campaigns. If you’re new to seed lists, start with what a seed list is.

Skip These (Usually)

AI Credits add-on. The one-time credits included with your plan are enough for most teams. The AI Sequence Copilot is useful but not essential - you can write sequences manually.

Extra email verification credits ($60 per 30,000). Saleshandy's built-in verification has documented issues with catch-all domains. Reddit users report bounces from emails that passed Saleshandy's verification. Paying more for the same flawed verification doesn't solve the root issue. Run your lists through a dedicated verification tool like Prospeo before importing - 98% accuracy with catch-all handling at ~$0.01/email catches what Saleshandy's built-in verification misses. (Related: how to verify an email address and the best email verifier websites.)

Billing Overages: The Cost Nobody Mentions

If you exceed your active prospect limit mid-cycle, Saleshandy doesn't cut you off - it charges overages on your next billing cycle. This is easy to miss, especially on Starter where the 2,000 prospect cap is tight. Monitor your usage dashboard weekly, or you'll get a surprise invoice.

One-Time Credits: The Depletion Problem

Those "included" credits on your outreach plan? They're one-time, not monthly. Here's how fast they disappear:

- 50 Lead Finder credits (Starter): Gone in your first prospecting session

- 1,000 verification credits (Starter): Gone within a week if you're importing lists at any real volume

- 5,000 verification credits (Pro): Lasts maybe 1-2 months of active prospecting against 30,000 prospects

This isn't a feature - it's a trial. Budget for the Lead Finder subscription and external verification from day one. If you need a repeatable process, use an email verification list SOP.

Your real Saleshandy spend hits $130-$200/mo before you even count email infrastructure. Prospeo delivers verified contact data refreshed every 7 days - not the 6-week industry average - with native integrations to Instantly, Smartlead, and Lemlist built in.

Get enterprise-grade B2B data without enterprise-grade invoices.

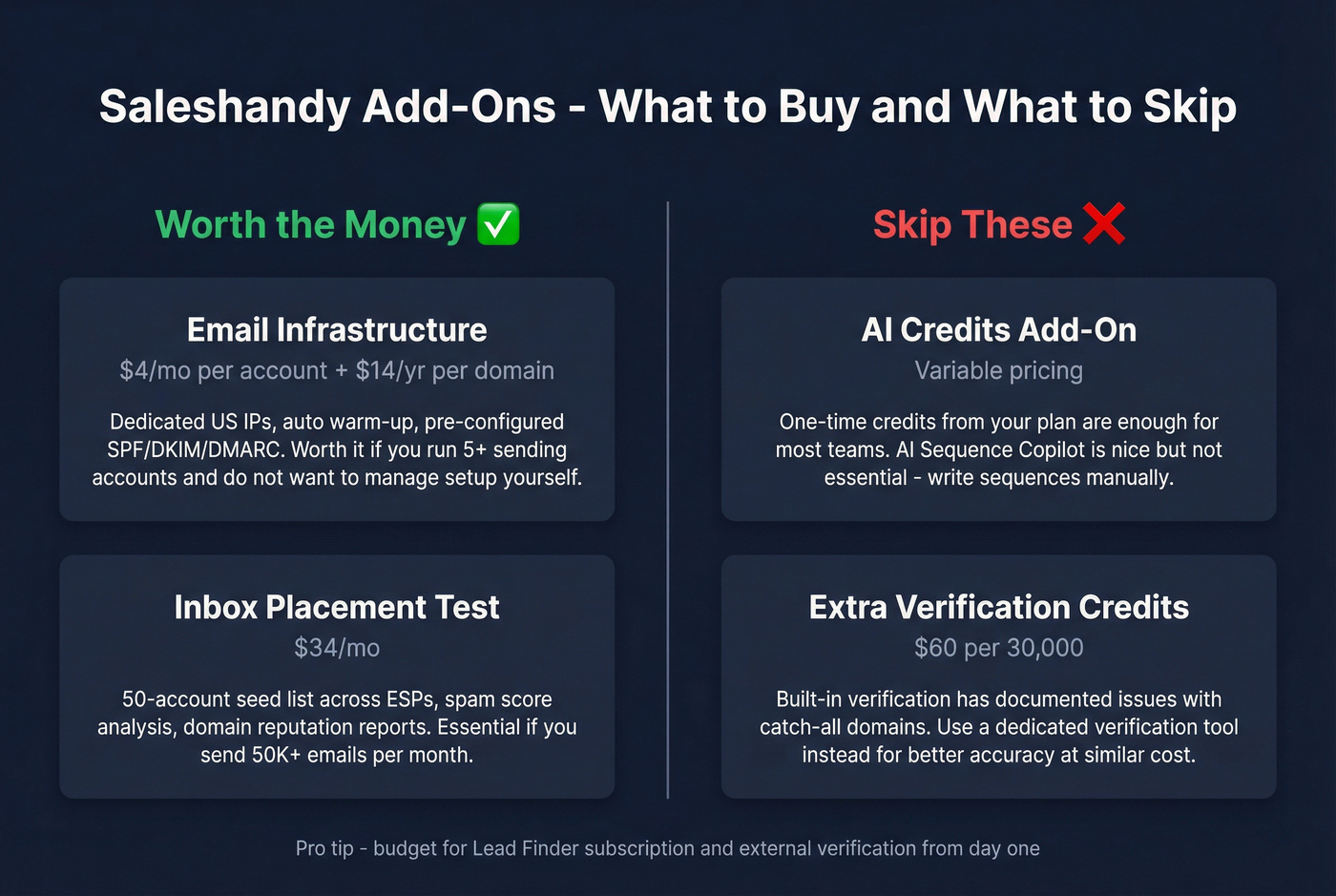

Total Cost of Ownership Scenarios

| Scenario | Outreach | Lead Finder | Infrastructure | Total/Mo |

|---|---|---|---|---|

| Solo founder | Starter $25 | Lead Starter $29 | - | $54 |

| 5-person SDR team | Pro $69 | Lead Pro $59 | 10 accounts ($45) | ~$173 |

| 10-client agency | Scale $139 | Lead Scale $99 | - | ~$238 |

These are annual billing prices. Monthly billing adds 30-43% on top.

Free Trial - What You Can and Can't Do

Saleshandy offers a 7-day free trial with no credit card required. Here's what's actually included:

Included:

- 100 emails total

- 2,000 prospect limit

- 50 email credits

- Basic sequence builder

- Sender rotation (capped at 50 emails/sequence)

- Unified Inbox (10 conversations, view only)

Not included:

- Team members

- API access

- A-Z testing

- Reply/forward in Unified Inbox

- Advanced warm-up settings

- CRM integrations

The verdict: enough to test the UI and sequence builder, not enough to run a real campaign. You'll know within 7 days whether the interface works for you. You won't know whether deliverability holds up at scale - that takes weeks.

How Saleshandy Stacks Up Against Competitors

Headline prices are meaningless in cold email tools. Every platform splits its product into separate subscriptions. Here's what you'll actually pay when you stack outreach + lead finding:

| Feature | Saleshandy | Instantly | Smartlead | Lemlist |

|---|---|---|---|---|

| Starting price | $25/mo | $37.6/mo | $32.5/mo | ~$75/mo/user |

| Contacts / Emails | 2K / 6K | 1K / 5K | 2K / 6K | Varies / 100/day |

| Lead finder | $29/mo+ (separate) | $42.3/mo+ (separate) | None built-in | Included (limited) |

| Stacked minimum | $54/mo | $79.9/mo | $32.5/mo + external | ~$75/mo |

| Per-seat charges | None | None (outreach) | None (Pro+) | Yes (~$75/user) |

| Agency pricing | Unlimited clients | Per-user | $29/client | Per-seat |

Woodpecker deserves a mention but doesn't belong in the main table. It starts at ~$29/month with a per-contacted-prospect pricing model - you pay based on how many prospects you actually email, not a flat seat fee. It's built for compliance-focused SMBs running smaller, more targeted campaigns (1,000-5,000 emails/month). No built-in lead database. Skip it if you're scaling past 10,000 emails/month or running agency operations - it's not built for that.

Saleshandy vs Instantly

This is the comparison everyone's making on Reddit, and the math favors Saleshandy - especially at scale.

At the entry level: Saleshandy Outreach Starter + Lead Starter = $54/mo. Instantly Outreach Growth + SuperSearch Growth = $79.9/mo. That's a $26/month gap for roughly comparable features, though Instantly's UI is cleaner and setup is faster.

At scale, the gap widens. Instantly's Outreach Hypergrowth ($77.6/mo) + SuperSearch Supersonic ($87.3/mo) = $164.9/mo for 25,000 contacts. Saleshandy's Outreach Pro gives you 30,000 active prospects for $69/mo plus Lead Pro at $59/mo = $128/mo.

Where Instantly wins: beginner experience. The UI is more intuitive, setup takes minutes, and the learning curve is almost flat. If you're a solopreneur who wants to hit volume fast without configuring subsequences and sender rotation rules, Instantly is the easier path.

Where Saleshandy wins: depth. Advanced deliverability tools (Inbox Radar, dedicated IPs), subsequence logic, multi-path flows, and team collaboration without per-seat fees. I've seen teams outgrow Instantly's simplicity within 3-6 months and migrate to Saleshandy for the control it offers over warm-up schedules, sending patterns, and reply handling - things that don't matter at 5,000 emails/month but matter a lot at 50,000. If you’re building for scale, follow a cold email outreach strategy instead of tool-hopping.

Deliverability data from a 5.2M email test across 300+ domains: Saleshandy hit a 96.2% inbox rate vs Instantly's 94.1%, with reply rates of 11.2% vs 10.8%. Directionally meaningful - Saleshandy has a slight edge on both metrics, though your results will depend on domain health and content quality.

Saleshandy vs Smartlead

Smartlead's Basic plan ($32.5/mo annual) matches Saleshandy Starter almost feature-for-feature: 2,000 active leads, 6,000 emails/month, unlimited email accounts. Two differences stand out: Smartlead has no built-in lead database, and its deliverability numbers from the same multi-million email test came in at ~92.3% inbox rate - solid, but below Saleshandy's 96.2%.

The agency math is where it gets ugly for Smartlead. Smartlead Pro ($78.3/mo) includes whitelabeling for 1 client. Each additional client costs $29/month. Ten clients = $78.3 + (9 x $29) = $339/mo. Saleshandy Scale with unlimited clients: $139/mo. That's $200/month in savings - $2,400/year.

My take: Skip Smartlead if you want an all-in-one platform with built-in prospecting. Choose Smartlead if you already have a lead source and want raw sending infrastructure at a lower entry price.

Saleshandy vs Lemlist

Lemlist starts at ~$75/month per user. That's per seat. For a 5-person SDR team, you're looking at ~$375/month just for outreach - versus $69/month on Saleshandy Pro with unlimited team members.

Lemlist's advantage is multichannel: email + LinkedIn + calls in one sequence. If multichannel is your strategy, Lemlist earns its premium. If you're running email-only outreach, the per-seat pricing is a tax you don't need to pay.

Lemlist offers a 14-day free trial (longer than Saleshandy's 7 days) and includes limited lead finding in its plans. But the per-user model makes it the most expensive option on this list for teams of any size.

Look - if your average deal size sits below $10K, you probably don't need Lemlist's multichannel premium. Email-only outreach through Saleshandy at one-fifth the team cost will generate enough pipeline to justify the simpler stack. Save the multichannel investment for when your deal sizes warrant the extra complexity.

How to Save on Saleshandy

Seven ways to cut your bill:

Go annual. Starter saves $132/year, Pro saves $360/year, Scale saves $720/year. This is the single biggest lever.

Use the EOY50 coupon code. Active on Saleshandy's own coupon page - flat 50% off all annual outreach plans. Doesn't apply to email infrastructure plans. Third-party coupon sites list codes like SAVE10 and BFC50, though these are likely expired - stick with EOY50 from Saleshandy's own site.

Watch for Black Friday/Cyber Monday. Saleshandy historically runs 50-70% off promotions during the holiday season. If you can time your purchase, the savings are substantial.

Skip email infrastructure if you already have it. If you've already set up dedicated sending domains and accounts through Google Workspace or a similar provider, you don't need Saleshandy's $4/account/month add-on. (More on whether you need it: do you need a dedicated IP for email.)

Use external verification instead of buying Saleshandy credits. At $60 per 30,000 credits from Saleshandy versus ~$0.01/email through a dedicated verification tool with better accuracy, the math is straightforward.

Start with Lead Starter, not Lead Pro. 500 credits/month is enough for initial prospecting. Scale up once you've validated your ICP and messaging.

Don't overbuy on the outreach plan. If you're under 2,000 active prospects, Starter works. The jump to Pro only makes sense when you're consistently hitting the prospect or email cap.

Saleshandy's prices have actually dropped slightly over time. Review data showed Pro at $74/month in late 2024 versus $69/month now. The trend is in your favor.

Is Saleshandy Worth the Cost?

For agencies: Yes, unambiguously. Unlimited clients on every plan, whitelabel on Scale, and the lowest per-client cost of any major cold email platform. If you're running outreach for multiple clients, Saleshandy saves you thousands per year versus Smartlead or Instantly. Recruitment agencies, marketing firms, and lead gen shops all benefit from this model.

For growing SDR teams: The Pro plan at $69/mo is the sweet spot. Unlimited team members, CRM integrations, and enough volume for serious outbound. Pair it with Lead Pro ($59/mo) and you've got a complete stack for under $130/month.

For solo beginners who want simplicity: Honestly, Instantly is the better starting point. Cleaner UI, faster setup, less configuration. You can always migrate to Saleshandy when you outgrow it.

Real weaknesses worth knowing: Support runs on India timezone, which means US-based teams face delays on urgent issues. DKIM configuration bugs have been reported - emails flagging on Saleshandy that work fine on competitors. Verification quality has documented gaps with catch-all domains. And once you create an email account in the infrastructure add-on, you can't change the email address - you have to delete and recreate it. That's an operational headache if you're rotating sending accounts frequently.

Here's the bottom line: $25/month is honest but incomplete. Budget $130-$200/month for a real setup, verify your lists externally, and Saleshandy delivers strong value - especially if you're an agency or a team that needs unlimited seats without per-user pricing.

FAQ

Does Saleshandy have a free plan?

No. There's a 7-day free trial with no credit card required, limited to 100 emails, 2,000 prospects, and 50 email credits. Team members, API access, and A-Z testing aren't available during the trial.

What's the cheapest way to use Saleshandy?

Outreach Starter costs $25/month on annual billing, but most users also need Lead Finder at $29/month minimum - making the realistic starting cost $54/month. Apply the EOY50 coupon code for 50% off annual outreach plans to cut that further.

Is Saleshandy cheaper than Instantly?

For equivalent features, yes. Saleshandy Outreach Starter + Lead Starter = $54/mo versus Instantly Outreach Growth + SuperSearch Growth at $79.9/mo on annual billing. The gap widens at agency scale, where Saleshandy's unlimited clients save hundreds per month versus Instantly's per-user model.

Does Saleshandy offer coupon codes in 2026?

Yes. The code EOY50 gives 50% off annual outreach plans - listed on Saleshandy's own website. They also run Black Friday promotions with 50-70% discounts historically. The coupon doesn't apply to email infrastructure add-on plans.

How accurate is Saleshandy's email verification?

Users report mixed results, particularly with catch-all domains where emails pass verification but later bounce. For high-volume sending, run lists through a dedicated tool like Prospeo (98% accuracy with catch-all handling) before importing into Saleshandy to protect your sender reputation.