Field Sales vs Inside Sales: The Distinction Is Dying - Here's What Actually Matters

A sales rep on r/sales held three different titles - Inside Sales, Sales Engineer, Account Manager - and his day-to-day never changed once. Same calls. Same CRM. Same quota. The only thing that shifted was the org chart after each private equity restructuring. He eventually dropped "Outside" from his business cards and went with "Sales Representative." His employer? A billion-dollar company.

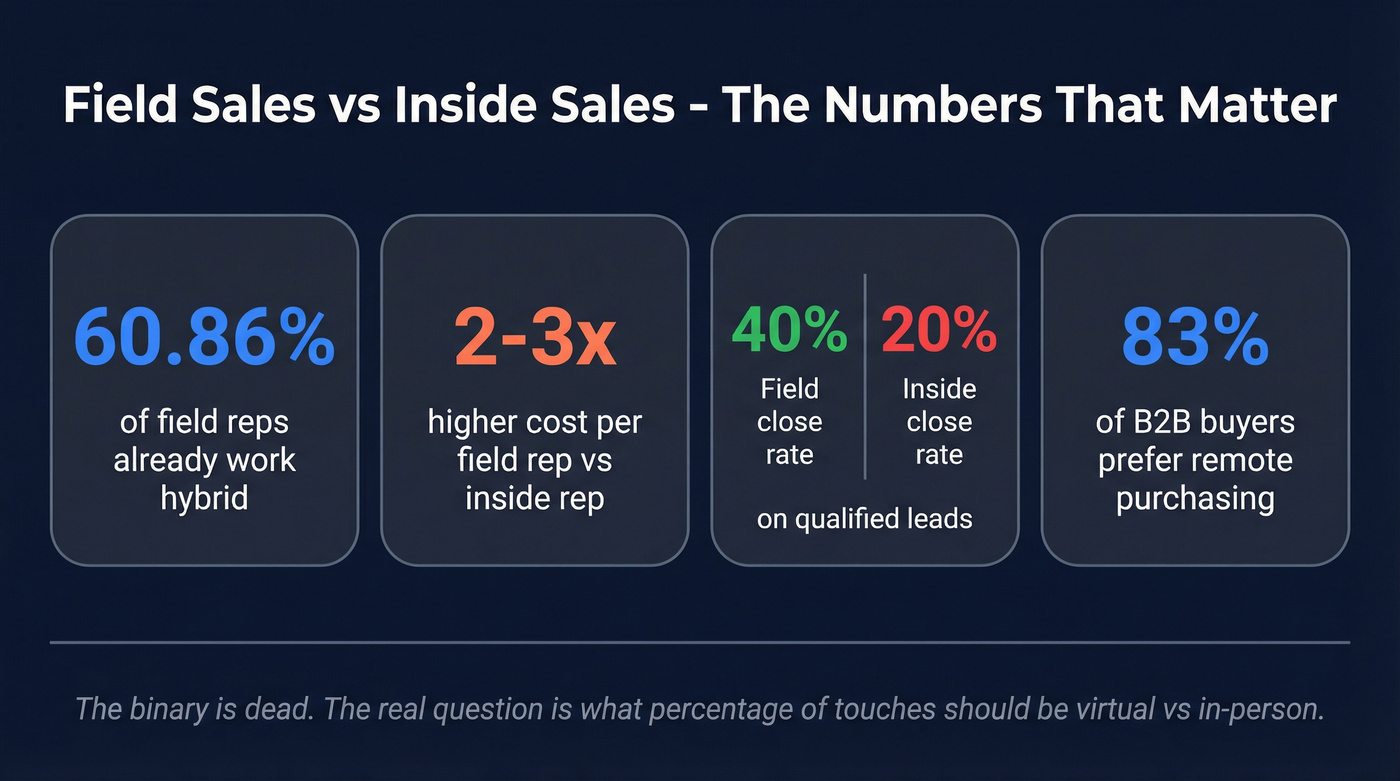

That story isn't an outlier. When you compare field sales vs inside sales today, the lines barely exist. A survey of 649 field sales professionals found that 60.86% already conduct at least a quarter of their sales activity virtually. The inside-versus-field binary isn't blurring - it's already blurred.

The question isn't which model to pick. It's how to build the right blend for your buyers, your deal size, and your market.

What You Need to Know (Quick Version)

- The binary is dead. 60.86% of field reps work hybrid. Pure inside or pure field is increasingly rare outside a few industries.

- Field reps earn more - and cost more. ~$87K base vs. ~$59K for inside reps. But field reps cost companies 2-3x more when you add travel, mileage, and variable expenses.

- Conversion rates favor field. Volume favors inside. Outside reps convert qualified leads at 40% vs. 20% for inside reps. But inside reps contact 12x more prospects daily (60 vs. 5).

- Buyers have already decided. 83% of B2B decision-makers prefer to research and purchase remotely. Only 20% want in-person back as the primary channel.

- The real question: What percentage of your sales touches should be virtual vs. in-person, given your average deal size and buyer expectations?

If your average deal is under $50K and your buyers prefer async demos, don't build a field team. If you're selling $500K+ industrial equipment that requires site assessments, don't try to close it over Zoom. Everything in between? That's where the hybrid model lives - and it's where most of you are.

Inside Sales vs Field Sales - Definitions (Keep It Short)

Salesforce frames it simply: inside sales means shorter cycles and higher transaction volumes. Field sales means longer cycles and fewer, higher-value deals. Inside is efficiency-driven. Field is relationship-driven.

The HBR version is more nuanced. Andris Zoltners, Prabhakant Sinha, and Sally Lorimer - the ZS Associates founders - wrote that technology was already blurring the line between field and inside sales well before the pandemic. Their thesis: the traditional model where field reps did the heavy lifting in person while inside reps handled simpler products and smaller customers was breaking down. COVID didn't create this trend. It accelerated it by five years.

Here's the thing: inside sales reps prospect via CRM, qualify leads, run product demos over video, and close deals with e-signature tools. Field reps travel to client meetings, work trade shows, build relationships over dinners, and negotiate face-to-face. But in 2026, most "field" reps do 25-50% of that work virtually anyway. The definitions are useful for understanding the spectrum. They're less useful for building an actual sales org.

The Buyer Already Decided for You

You can debate the merits of digital selling versus in-person all day. Your buyers already made the call.

83% of B2B decision-makers prefer to research and purchase remotely. McKinsey found that 44% would actually pay more for a digital or remote sales experience. Only 20% of buyers want to return to in-person as the primary channel.

That's not a temporary COVID hangover. That's a structural shift in how B2B purchasing works.

HubSpot's data reinforces this from the buyer's side: 96% of prospects research companies before engaging with a sales rep, and 71% prefer to do their own research rather than talk to a rep at all. Your buyers are showing up to calls already knowing your pricing, your competitors, and your G2 reviews. The "trusted advisor who shows up with a briefcase" model still works for certain deals - but the buyer has to want that interaction, and most don't.

Gong reports that 81% of revenue leaders say deals are more complex than ever. More stakeholders. More procurement hoops. More security reviews. That complexity doesn't mean you need more in-person meetings - it means you need more touchpoints, period. Virtual touchpoints scale. In-person ones don't.

The companies closing $500K+ software implementations entirely via virtual sales processes aren't outliers anymore. B2B marketplaces are winning accounts through shared dashboards and async collateral rather than steak dinners. The buyer's preference for digital isn't about laziness - it's about efficiency. They've got 6 vendors to evaluate and a day job to do. They don't want to block 90 minutes for a lunch meeting when a 30-minute Zoom covers the same ground.

If you're building a pure field sales team in 2026 without strong evidence that your specific buyers demand in-person, you're spending 2-3x more per rep to serve a preference that doesn't exist for most B2B segments.

Inside reps contact 60 prospects a day. Field reps visit 5. Either way, bad contact data kills the math. Prospeo delivers 98% email accuracy and 125M+ verified mobile numbers with a 30% pickup rate - so every touch counts, whether it's a cold call from HQ or a follow-up after a site visit.

Stop wasting your reps' selling time on bounced emails and dead numbers.

The Numbers That Actually Drive the Decision

Here's the comparison stripped down to the metrics that matter:

| Metric | Inside Sales | Field Sales |

|---|---|---|

| Daily contacts | ~60 prospects | ~5 prospects |

| Conversion rate | 20% | 40% |

| Time selling | ~30% of day | ~34% of day* |

| Base salary | ~$59K | ~$87K |

| Total comp (OTE) | $71K-$130K | $110K-$265K |

| Cost to company | $60K-$80K/yr | $120K-$190K/yr |

| Sales cycle | 14-60 days | 3-9 months |

| Avg deal size | $5K-$25K | $25K-$500K+ |

| Best industries | SaaS, tech, SMB | Manufacturing, medical, enterprise |

The "time selling" numbers come from RepMove's cross-model survey (30.44% inside, 33.54% outside). A separate field-specific survey found field reps spend 55% of their day on "selling activity" - but that definition includes travel to meetings, so the numbers aren't directly comparable. The gap is smaller than most people think.

The conversion rate gap is the stat everyone fixates on - 40% vs. 20%. It's real. When a field rep sits across from a decision-maker, reads body language, and handles objections in real time, they close at double the rate of an inside rep working the same qualified lead.

But that number is misleading without context.

An inside rep touching 60 prospects a day at a 20% conversion rate generates far more total pipeline than a field rep visiting 5 accounts at 40%. The math isn't close for deals under $25K. It only flips when deal sizes get large enough that the higher conversion rate on fewer opportunities outweighs the volume advantage.

The cost gap is where CFOs start paying attention. An inside rep costs $60K-$80K per year fully loaded. A field rep adds $20K-$40K in variable expenses on top of that - mileage at the IRS rate of $0.67/mile (a rep driving 150 miles a day burns $100+ in vehicle costs alone), hotels, meals, and entertainment. Inside sales costs 40-60% less per rep. For a 10-person team, that's the difference between a $750K annual cost and a $1.5M+ one.

Compensation Deep-Dive

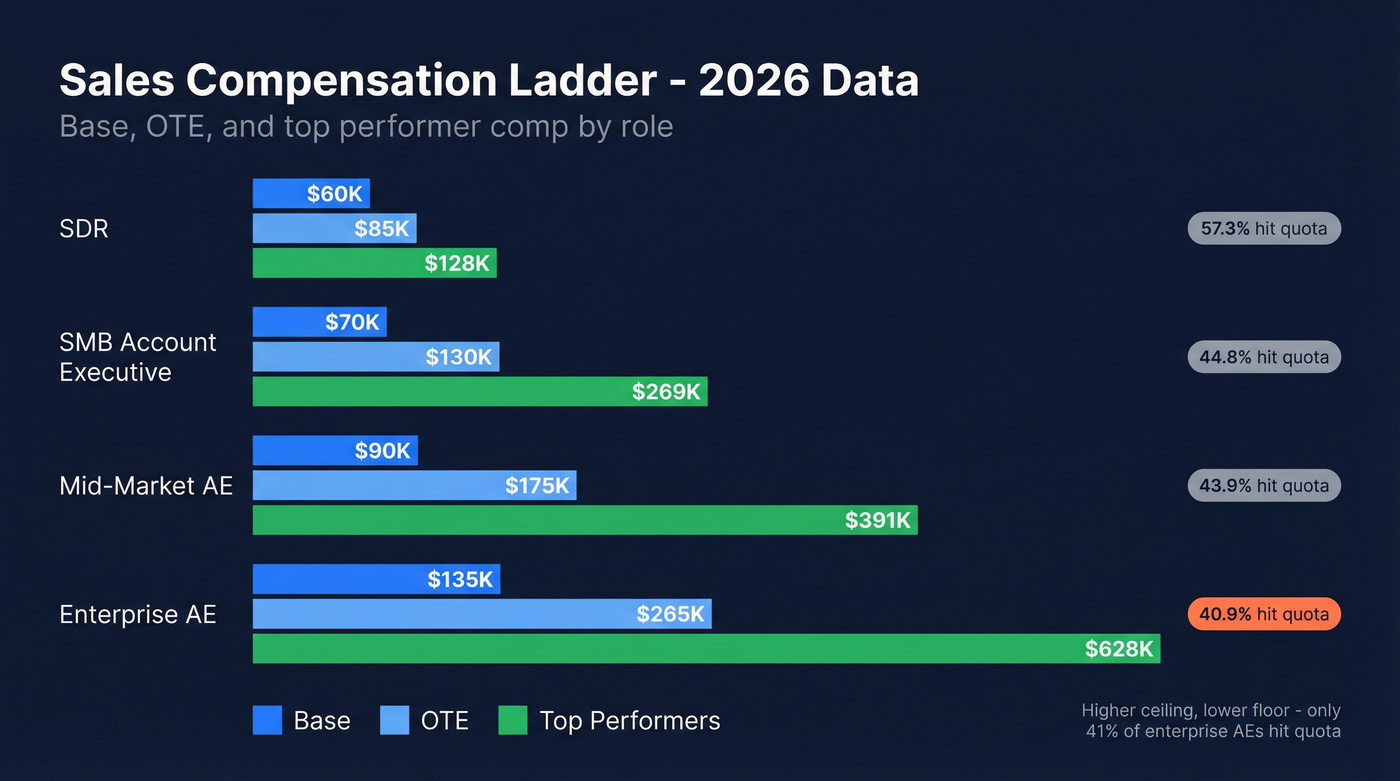

Salary is the question everyone asks first, so let's lay it out. RepVue's early 2026 data across thousands of sales professionals:

| Role | Base | OTE | Top Performers | Quota Attainment |

|---|---|---|---|---|

| Sales Development Rep | $60K | $85K | $128K | 57.3% |

| SMB Account Executive | $70K | $130K | $269K | 44.8% |

| Mid-Market AE | $90K | $175K | $391K | 43.9% |

| Enterprise AE | $135K | $265K | $628K | 40.9% |

SDRs map roughly to inside sales entry level. Enterprise AEs map to enterprise sales at the top end. The gap between $85K OTE and $265K OTE is massive - but so is the gap in quota attainment. Only 40.9% of enterprise AEs hit quota, compared to 57.3% of SDRs. Higher ceiling, lower floor.

Glassdoor puts the median total comp for outside sales reps at $137K per year. Indeed's base salary data shows inside reps at ~$59K and outside reps at ~$87K, while other sources peg the inside sales floor closer to $44K depending on market and company size. Commissions widen the gap further: inside reps average ~$12K-$13K in commissions while outside reps pull ~$22.5K.

Geography matters too. Outside sales reps in New Jersey average $69K base, and companies like United Rentals pay up to $179K for top performers. Experience moves the needle more than education: junior reps earn ~$48K, mid-level hits ~$62K, and senior reps reach ~$99K base. A bachelor's degree bumps average comp from $52K to $67K, and a master's pushes to $74K - but neither credential matters as much as your track record of closing.

Here's what the salary comparison misses: cost to company. We've seen teams where the field cost-per-rep was 2.8x the inside cost, but revenue-per-rep was only 1.6x higher. That's a negative ROI on the field model for that specific deal size and market. The math has to work at your deal size, not in the abstract.

Which Model Fits Your Business

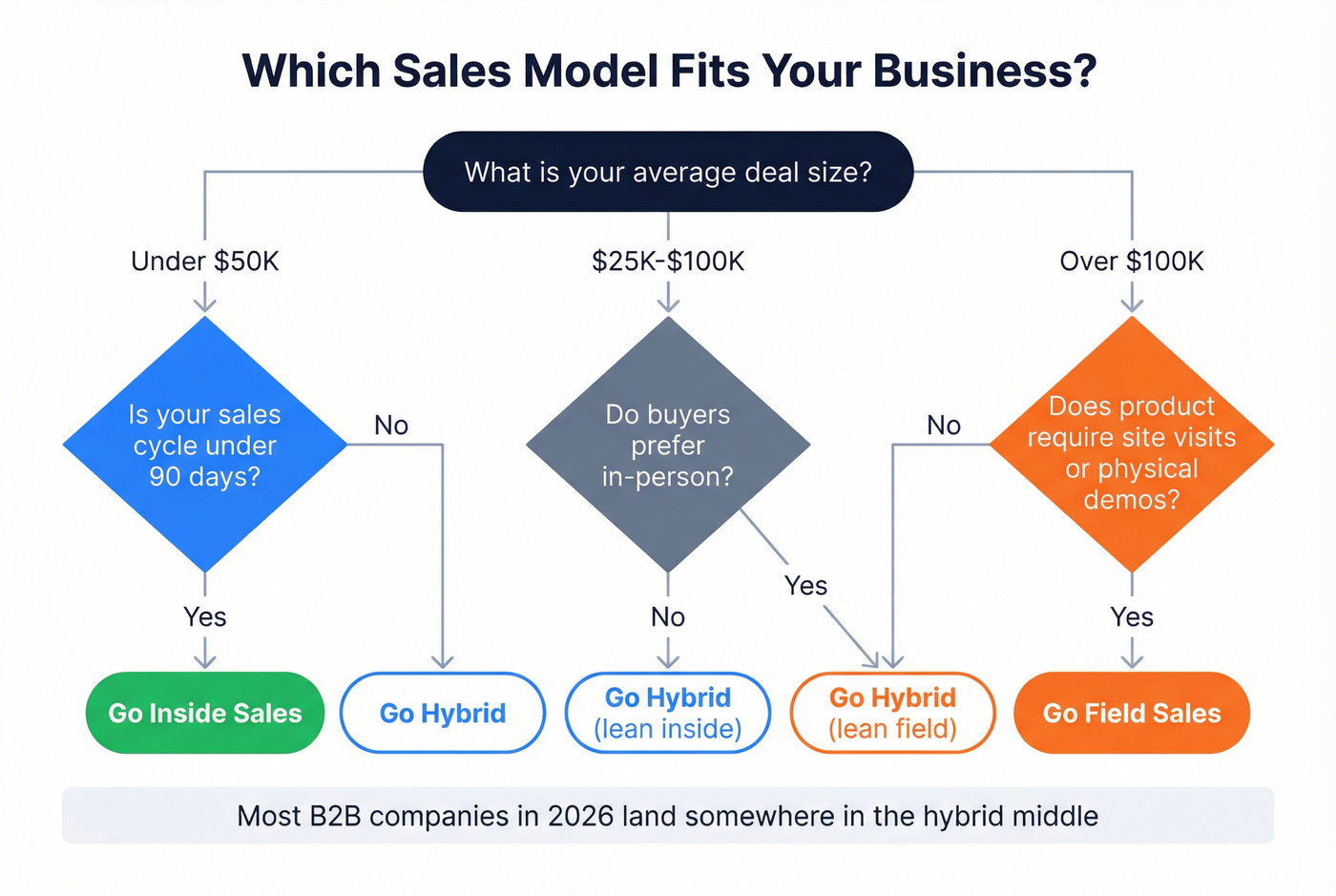

Stop thinking about this as a philosophical choice. It's a math problem with three variables: deal size, industry, and buyer preference.

| Signal | Go Inside | Go Field | Go Hybrid |

|---|---|---|---|

| Avg deal size | Under $50K | Over $100K | $25K-$100K |

| Sales cycle | Under 90 days | 3+ months | 60-180 days |

| Product complexity | Standardized | Requires demos/site visits | Moderate |

| Buyer preference | Digital-first | In-person relationship | Mixed |

| Target market | SMB/mid-market | Enterprise | Multiple segments |

Industries where field sales still dominates: manufacturing, medical devices, industrial equipment, construction. These involve physical products, site assessments, and procurement processes that reward face-to-face relationships. If you're selling MRI machines, you're not closing that over Zoom.

Industries where inside sales wins: SaaS, technology vendors, digital services, SMB-focused businesses. Standardized products with clear value propositions and sales cycles under 90 days.

Product maturity also matters. Early-stage products in discovery or introduction phases often benefit from field sales to build market awareness and gather direct feedback. Mature products with established value propositions shift toward inside sales for efficiency. If your product is new enough that buyers need to see it, touch it, or have their objections handled in person, field makes sense - temporarily.

The Zippia workforce data reflects the broader split: 53.7% of US sales reps work inside sales, 46.3% outside. But that 46.3% is shrinking, and the hybrid middle is growing.

Here's the scenario I keep seeing: a VP of Sales at a Series B company with a $35K average deal and buyers who prefer async demos decides to hire three field reps because "enterprise is the growth play." Six months later, the field reps are doing 80% of their work virtually anyway, the travel budget is bleeding, and the conversion rate advantage hasn't materialized because the deals aren't complex enough to require in-person. They would've been better off hiring five inside reps and sending them on-site for the 2-3 deals per quarter that actually warranted it.

Most companies under $20M ARR don't need a dedicated field sales team. They need inside reps who are willing to get on a plane when the deal is worth it. The "field sales" line item on your P&L should be a travel budget, not a headcount category.

Skip the agonizing. If you're unsure, run both models in parallel for one quarter in a single segment. Compare CPA, conversion rate, and revenue per rep. Let the data decide.

The Hybrid Model Is Already the Default

Why Pure Models Are Dying

The survey of 649 field sales professionals tells the story in one number: 60.86% already conduct at least 25% of their sales activity virtually. The most common bracket - reported by more than a third of respondents - is 25-50% virtual. These aren't inside reps. These are people with "Field Sales" in their title who spend a quarter to half their time on video calls.

On the buyer side, 32.20% of reps say a quarter to half of their clients prefer a rep-free digital experience. Another 40% report client preference for even higher levels of digital autonomy. Your "field" reps are going hybrid whether you plan for it or not - because their buyers are demanding it.

The burnout numbers reinforce why pure field is unsustainable: 28.97% of field reps cite burnout as a core challenge. When nearly one in three reps is burning out and almost half the day disappears into admin, the pure field model has a structural efficiency problem that no amount of motivational sales kickoffs will fix.

How to Build a Hybrid Sales Team

- Audit what reps actually do. Strip out "inside" and "outside" labels. Map activities to reality, not titles.

- Default to virtual. Only go in-person when the deal stage, complexity, or buyer explicitly requires it.

- Deploy automation. Use sequencing tools for prospecting and qualification. Free up rep time for the high-value conversations - virtual or in-person.

- Measure outcomes, not labels. Track revenue per rep, conversion rate per channel, and cost per acquisition. Not "number of site visits."

The most common hybrid implementation: inside sales handles prospecting, nurturing, and pre-qualifying. Only the most promising opportunities get passed to field reps for high-stakes negotiations and closing. Both teams share data through the CRM. Inside reps run initial demos virtually; field reps step in when the deal size or complexity warrants face-to-face.

KPIs That Tell You If It's Working

Don't measure hybrid teams with pure-inside or pure-field metrics. Track these instead:

- Conversion rate per channel - Are in-person touches actually converting better than virtual for your specific deals?

- Average deal size - Is the field component pulling up deal values, or are reps traveling for deals they could close remotely?

- Cost per acquisition (CPA) - What's the fully loaded cost to close a deal through each channel?

- Customer lifetime value (CLV) - Do in-person-closed deals retain better?

- Rep productivity - Revenue per rep per quarter, not activity metrics.

If your in-person CPA is 3x your virtual CPA but CLV is only 1.2x higher, the math says go more virtual. Let the data decide, not tradition.

Building Your Prospect Pipeline - Either Way

Whether you're an inside rep dialing 60 prospects a day or a field rep driving to 5 meetings, your pipeline starts with data. Bad data kills both models equally - just in different ways.

For inside reps, bad data means bounced emails tanking your domain reputation and wasted dials to disconnected numbers. 48% of salespeople never make a single follow-up attempt. When 80% of sales take five or more follow-ups, bad contact data doesn't just waste one touch - it kills the entire sequence before it starts. A list with 30%+ bounce rates doesn't just underperform. It gets your sending domain blacklisted.

For field reps, bad data is even more expensive. Imagine driving 45 minutes to a meeting only to find out your contact left the company three months ago. That's not a wasted email - that's a wasted half-day plus $50 in mileage. Multiply that by twice a week and you're burning $5K+ per quarter on phantom meetings.

Tools like Prospeo solve this for both models - 98% email accuracy means inside reps aren't torching their domains on bad addresses, and a 7-day data refresh cycle (vs. the 6-week industry average) means field reps aren't driving to meetings with contacts who've already moved on.

The Tech Stack for Each Model

The tools you need depend on your model, but the overlap is bigger than most people think. Organizations running both selling motions under one roof often discover they can consolidate more than expected.

| Category | Inside Sales | Field Sales | Hybrid |

|---|---|---|---|

| CRM | Salesforce, HubSpot | Mobile CRM (Salesforce) | Same CRM, both models |

| Sequencing | Outreach, Salesloft | - | Outreach, Salesloft |

| Dialer | Orum, Nooks | - | Orum, Nooks |

| Route planning | - | Badger Maps, RepMove | Badger Maps |

| Conversation intel | Gong, Chorus | - | Gong, Chorus |

| Expense tracking | - | Expensify, SAP Concur | Expensify |

Inside sales tech stacks run $5K-$15K per rep annually - CRM seat, dialer, email sequencing, conversation intelligence. Field sales stacks cost $25K-$50K per rep when you add route optimization, mobile CRM, expense tracking, and the travel itself. The survey of 649 field reps found that 63% manage 5-10 tools, with the average field rep using 7-8 tools out of the 27 in a typical sales tech stack.

The hidden cost most teams miss: tool overlap. Field reps who spend 50%+ of their time selling virtually need the same sequencing and conversation intelligence tools as inside reps, plus their field-specific tools. Hybrid stacks can actually cost more than pure-play ones if you're not intentional about consolidation.

If you're building from scratch, start with a lean B2B sales stack and add field-specific tooling only when the travel ROI is obvious.

Career Path - How to Choose (and Switch)

The most common career path in sales still runs inside to field: start as an SDR or inside account executive, build your skills on high-volume prospecting and qualification, then move to field or enterprise roles when deal sizes justify the in-person investment.

But the title gatekeeping is real and infuriating.

That Reddit poster I mentioned earlier? His employer questioned his lack of "Outside Sales Experience" during the interview - despite extensive travel history, documented results, and references. His take: "They cared more about not seeing that damn title than they cared about the data, references, and travel schedule of my work."

If you're trying to make the switch, here's what actually moves the needle:

- Document your in-person activity. Even if your title says "Inside Sales," track every client visit, trade show, and on-site meeting. Build the evidence before you need it.

- Develop consultative selling skills. Field sales is less about volume and more about navigating complex buying committees. Practice multi-threading and executive-level conversations.

- Target hybrid roles first. A hybrid AE role is an easier jump than pure field, and most "field" roles are hybrid anyway.

Stop asking "inside or field?" Ask instead: "How many of my sales touches should be virtual vs. in-person for this deal size?" That reframe changes the career question from "what title do I want?" to "what selling skills do I need?" - and the answer is almost always "both."

The reps who'll command premium comp in 2026 and beyond aren't pure inside or pure field. They're the ones who can run a tight email sequence, hop on a video call to handle objections, and fly out for the final negotiation when the deal is worth it. That's the hybrid skill set, and it's where the $175K-$265K OTE roles live.

You're already paying $120K-$190K per field rep and $60K-$80K per inside rep. Don't let bad data eat into that investment. At $0.01 per verified email, Prospeo costs 90% less than ZoomInfo - and teams book 26% more meetings with fresher data refreshed every 7 days.

Cut your cost-per-contact without cutting your conversion rate.

FAQ

Is field sales dying?

No - but pure field sales is. 60.86% of field reps already work hybrid, conducting at least a quarter of their activity virtually. Industries like manufacturing and medical devices still need on-site presence, but even those reps do more remotely than five years ago. The role is evolving toward strategic in-person moments supported by virtual prospecting.

Do outside sales reps make more than inside sales reps?

Outside reps earn ~$87K base vs. ~$44K-$59K for inside reps, but they cost companies 2-3x more after travel, mileage ($0.67/mile), hotels, and meals. A field rep's fully loaded cost runs $120K-$190K/year vs. $60K-$80K for inside reps. Higher comp, higher cost - the ROI depends on your deal size.

What's the conversion rate difference between inside and outside sales?

Outside reps convert qualified leads at ~40% vs. ~20% for inside reps. Inside reps contact 12x more prospects daily (60 vs. 5), though. For deals under $25K, the volume advantage typically generates more total revenue. The field conversion premium only pays off on larger, complex deals.

How do I switch from inside sales to field sales?

Document every client visit and on-site meeting - even if your title says "Inside Sales" - then target hybrid AE roles as a stepping stone. The biggest barrier is title gatekeeping: employers fixate on seeing "Outside Sales" on your resume. Build a track record of consultative selling and multi-threading into buying committees before you make the jump.

What prospecting tools work for both inside and field sales teams?

Both need a CRM, a verified contact data platform, and a sequencing tool for follow-ups. Field reps add route optimization and expense tracking; inside reps add parallel dialers and conversation intelligence. Budget $5K-$15K/year for inside stacks and $25K-$50K for field.