How to Segment Your Email List in 2026 (Full Guide)

Your open rates dropped below 15% last quarter. You blamed the subject lines, swapped the send time, maybe even redesigned the template. Nothing moved. Here's what actually happened: you sent the same email to everyone, and most of them didn't care.

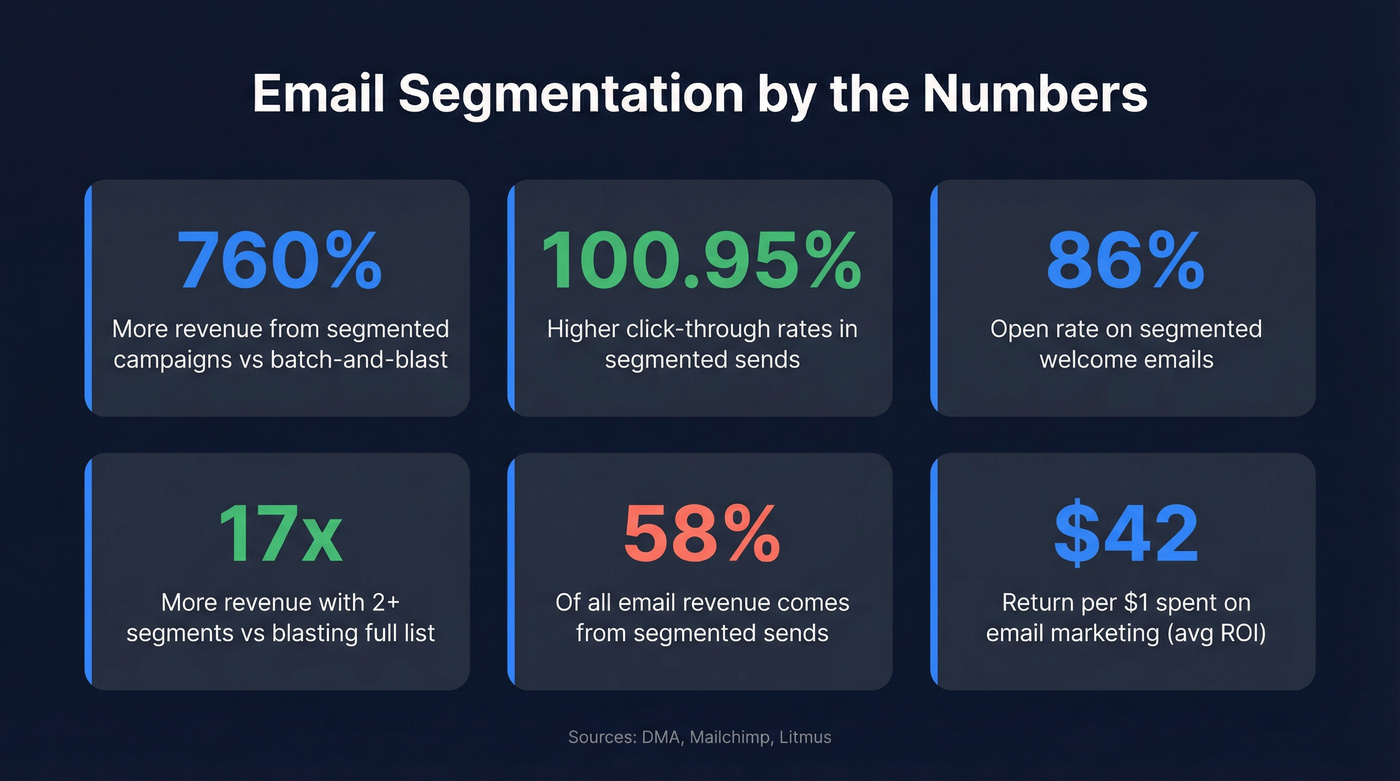

Segmented campaigns drive 760% more revenue than batch-and-blast sends, per the Data & Marketing Association. Targeted campaigns hit 3-5x higher conversion rates than generic mass emails. Yet only 60% of ecommerce businesses bother personalizing emails based on customer activity. That gap - between "we should segment" and "we actually do it well" - is where the money lives.

Here's my hot take: most teams don't have a segmentation problem. They have a data quality problem dressed up as a segmentation problem. If 15% of your emails bounce, your engagement data is garbage, your segments are built on lies, and your sender reputation is tanking. Clean your list first, then segment. That order is non-negotiable.

What You Need (Quick Version)

If you've got under 1,000 subscribers, start with two segments: customers vs. non-customers. That's it. Don't overthink it.

At 1,000+, add engagement-based segmentation - active vs. cold. This single layer will improve your deliverability overnight.

At 5,000+, layer in purchase history, lifecycle stage, and behavioral data. This is where RFM scoring and conditional flows start paying for themselves.

The single biggest mistake? Segmenting a dirty list. Verify your contacts first, then segment. Tools to start with: MailerLite if you're a beginner, Klaviyo if you're in ecommerce, ActiveCampaign if you're B2B.

What Email Segmentation Actually Is (And Isn't)

Segmentation determines WHO receives a message. Personalization determines WHAT they see inside it. These aren't the same thing, and conflating them is how teams waste months building dynamic content blocks for audiences that were wrong to begin with.

Segment first - engaged customers vs. new leads, enterprise vs. SMB, buyers vs. browsers. Then personalize within each segment using dynamic content, product recommendations, and name tokens. The order matters.

One more distinction worth making: this guide covers both marketing email (newsletters, promotions, lifecycle flows) and outbound/cold email (B2B prospecting). The techniques overlap more than you'd think, but the data sources and compliance rules diverge. I'll call out when something applies to one context and not the other.

Why Segmentation Works - The Numbers

Segmentation isn't a "nice to have" optimization. It's the single highest-leverage change most email programs can make.

Mailchimp's data shows segmented campaigns get 14.31% higher open rates and 100.95% higher click-through rates than unsegmented ones. That's not a marginal improvement - it's doubling your clicks. Automated segmented emails drive 320% more revenue than non-segmented automated sends. Merchants running just two or more segments earn 17x more revenue than those blasting their entire list. And 58% of all email revenue comes from segmented sends, meaning the majority of your email program's value is locked behind segmentation you aren't doing.

The downstream effects compound. Segmented welcome emails hit an 86% open rate. Unsubscribe rates drop 40% when people receive relevant content instead of noise. The overall ROI of email marketing sits at $42 per $1 spent on average - and it climbs even higher with proper segmentation.

EasyJet proved this at scale: their personalized, segmented email campaign hit a 7.5% booking rate, making it 14x more effective than standard promotional campaigns. Amazon's AI-driven recommendation emails - essentially hyper-segmented product suggestions - drove a 25% increase in email-driven revenue. These aren't theoretical projections. They're results from millions of sends.

The question isn't whether segmentation works. It's why you're still sending the same email to everyone.

You just read it: segmenting a dirty list is the #1 mistake. Prospeo's 5-step verification delivers 98% email accuracy - so your engagement data is real, your segments are honest, and your sender reputation stays intact.

Stop building segments on bounced emails. Verify first.

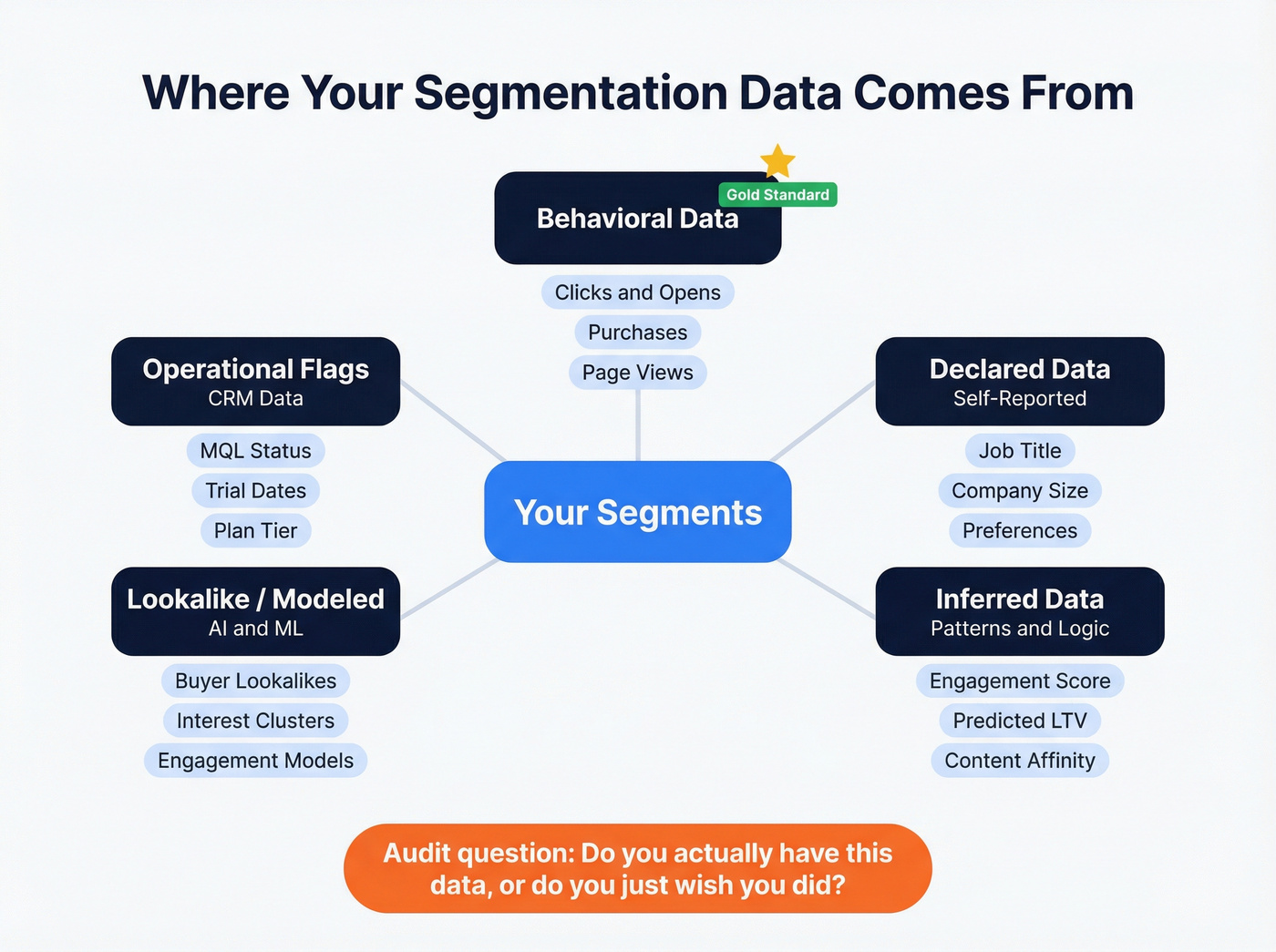

Where Your Segmentation Data Actually Comes From

Before you build a single segment, audit what data you actually have. Not what you wish you had - what's sitting in your ESP and CRM right now.

Behavioral Data (The Gold Standard)

Opens, clicks, purchases, webinar attendance, pricing page views, cart abandonment, login activity. This is what people do, not what they say. It's the most reliable signal you've got.

Declared Data (Self-Reported)

Job title, company size, location, content preferences, frequency preferences. This is what people tell you directly through forms, quizzes, and preference centers.

The catch: 27% of users abandon forms because they're too long. Progressive profiling fixes this - ask one or two questions per interaction instead of a 12-field form upfront. Post-signup surveys hit 50%+ completion rates vs. 5-15% for email surveys sent later.

Inferred Data (Patterns and Logic)

Engagement status, loyalty tier, predicted LTV, content affinity. You're deriving this from behavioral data using rules or scoring models.

Lookalike/Modeled Data (AI/ML)

Shared characteristics with top buyers, modeled interest in new products, engagement clustering. This is where AI segmentation lives, and 64% of marketers now use AI somewhere in their segmentation workflow.

Operational/Internal Flags

MQLs, trial dates, subscription renewal dates, product plan tier, event attendance. This data lives in your CRM, not your ESP - and most teams forget to sync it.

Here's the audit question that separates good segmentation from performative segmentation: instead of saying "we should segment by industry," say "we're asking for industry at opt-in, but 48% of the list left it blank. Can we add it to the preference center?" Map what you have, identify the gaps, then fill them with progressive profiling and zero-party data collection - quizzes, surveys, and preference centers that let subscribers tell you what they want.

10 Email Segmentation Strategies That Drive Revenue

1. Engagement-Based Segmentation

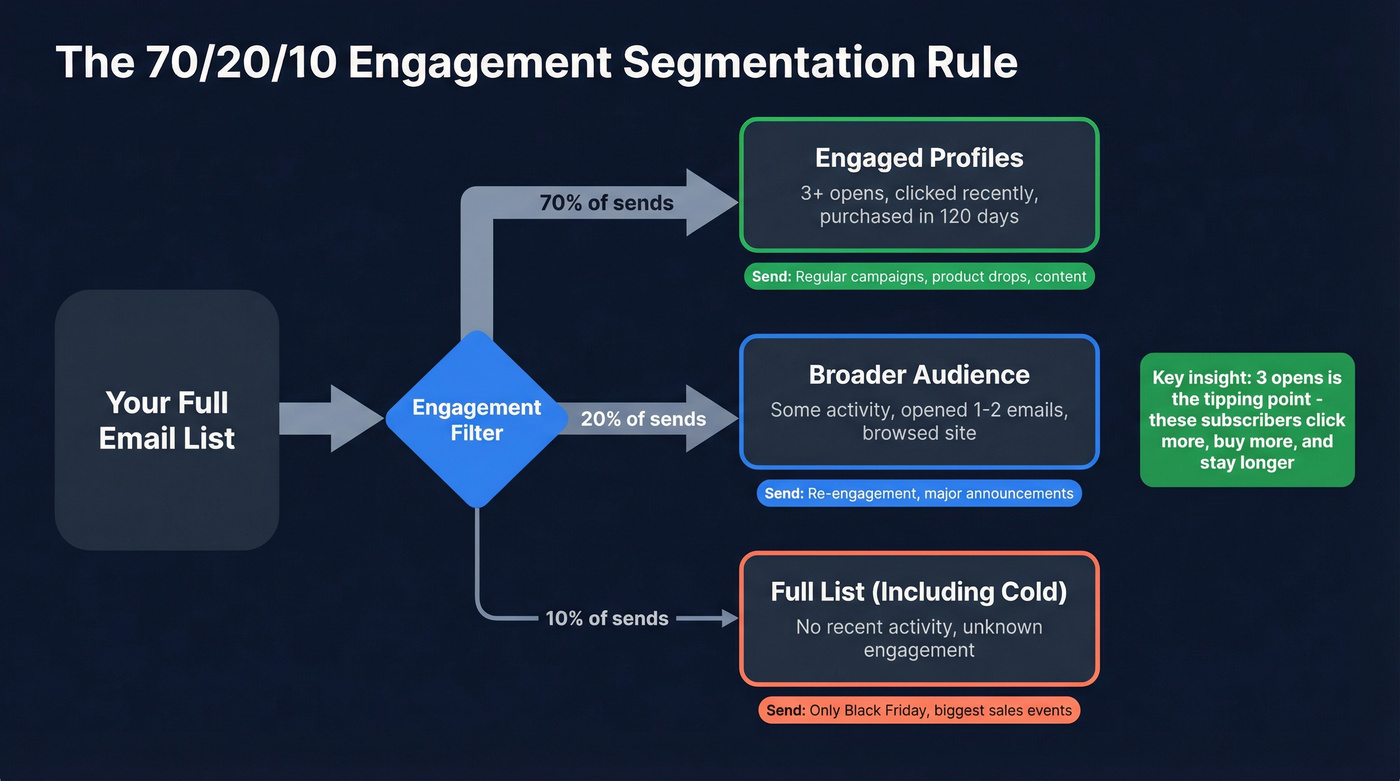

Huda Beauty was struggling with deliverability. Their list had grown, but engagement was declining - too many inactive subscribers dragging down sender reputation. The fix was deceptively simple: they scrubbed inactive contacts and implemented an engagement track strategy. Only subscribers who'd engaged within the last 120 days received regular campaigns. Less engaged subscribers only heard from the brand during major sales like Black Friday/Cyber Monday.

The result: 2x+ year-over-year growth in Klaviyo-attributed revenue and 50%+ year-over-year growth in placed order rate from email campaigns.

The takeaway isn't "suppress your list." It's Klaviyo's 70/20/10 rule: send 70% of campaigns to your engaged profiles, 20% to a broader audience, and 10% to the full list. This protects deliverability while still giving dormant subscribers a chance to re-engage during your biggest moments.

One practitioner insight worth stealing: 3 opens is the tipping point. Subscribers who've opened at least 3 emails behave fundamentally differently from those who've opened 1 or 2. They click more, they buy more, and they stay subscribed longer. Use that as your threshold for "engaged" rather than a simple "opened in the last 90 days" filter.

2. Purchase History and RFM Scoring

RFM stands for Recency, Frequency, and Monetary value. You score each customer 1-5 on all three dimensions, then group them into actionable segments.

| Segment | R-F-M Score | Campaign Idea |

|---|---|---|

| Champions | 5-5-5 | Exclusive early access |

| Loyalists | 4-5-4 | Premium product drops |

| Big Spenders | 3-2-5 | Subscription offers |

| Promising | 5-3-3 | Nurture sequences |

| At-Risk | 1-2-2 | Win-back + discount |

| Low-Value | 1-1-1 | Sunset sequence or suppress |

Champions get handwritten notes in their orders. At-Risk customers get limited-period discounts to pull them back. High-frequency buyers get subscription pushes. Low-Value contacts either get a final re-engagement attempt or get suppressed - keeping them on your list hurts deliverability without adding revenue.

RFM works best when your average purchase frequency exceeds 1.5 orders per customer, returning customers generate over 40% of revenue, you've got 30,000+ total customers, and at least six months of historical data. Below those thresholds, simpler engagement-based segmentation gives you more bang for the effort.

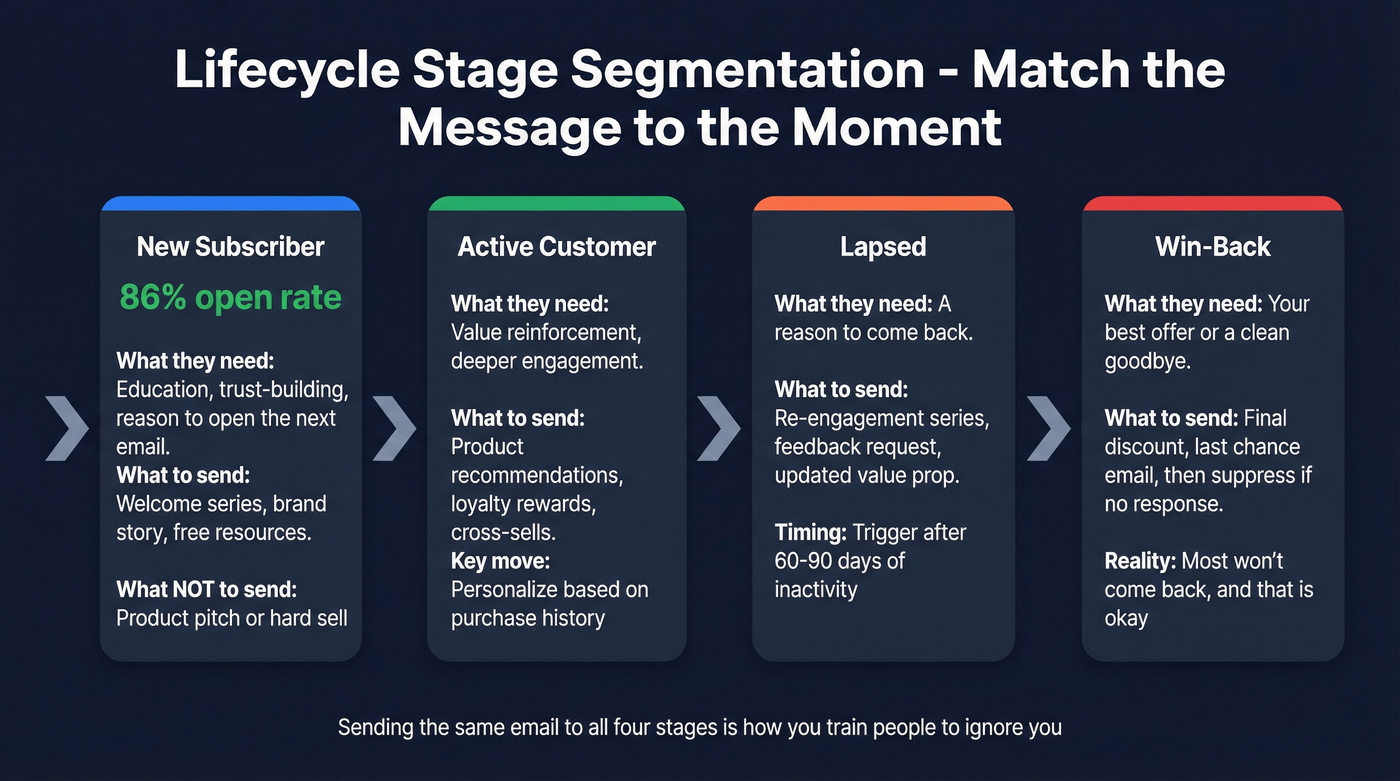

3. Lifecycle Stage

New subscriber, active customer, lapsed, win-back. Every contact is somewhere on this pipeline, and the message that works at each stage is completely different.

Segmented welcome emails hit an 86% open rate - the highest of any automated flow. That's your best shot at making a first impression. A new subscriber who just downloaded a guide doesn't need a product pitch. They need education, trust-building, and a reason to open your next email.

Active customers need product recommendations and loyalty rewards. Lapsed customers need re-engagement. Win-back targets need your best offer. Sending the same email to all four is how you train people to ignore you.

4. Demographic Segmentation

Demographics are the most basic segmentation layer, and they still work. Demographic-based segmentation improves open rates by up to 25% and click-through rates by 15%.

Age, gender, job title, income level - these are blunt instruments, but they're better than nothing. A 22-year-old college student and a 45-year-old executive don't respond to the same subject line. Use demographics as your foundation, then layer behavioral data on top.

5. Behavioral (Website and Email Activity)

Use this if: You sell consumable products, have browse abandonment triggers set up, or can track website activity alongside email engagement.

Graza, the olive oil brand, nails this. First-time olive oil purchasers get a follow-up timed to when they'd realistically need a refill. It's not a generic "buy again" email - it's a consumable product timing play that feels helpful instead of pushy.

Browse abandonment is the other big win here. Someone who viewed your pricing page three times this week but didn't convert is a fundamentally different prospect than someone who opened one newsletter. Treat them differently. Browse abandonment emails recover 3-10% of lost sessions on average - small percentage, big revenue at scale.

Skip this if: You don't have website tracking integrated with your ESP. Without that data pipeline, behavioral segmentation is just guessing.

6. Geographic and Timezone

The LA Raver Newsletter built $100K in revenue from just 16,000 subscribers - by going hyper-local. Location-based niche segmentation converts because relevance is highest when content matches someone's physical context.

For most brands, the geographic play is simpler: send-time optimization within regions. Klaviyo, Omnisend, and ActiveCampaign all offer AI send-time optimization that adapts to individual engagement patterns within each timezone. A subscriber in Tokyo shouldn't get your email at 3 AM because your marketing team is in New York.

7. Psychographic and Interest-Based

Andie Swim wanted to grow their email list, but they had a problem: subscribers were signing up without the brand learning anything useful about them. So they built a 12-question Fit Finder quiz integrated with Digioh and Klaviyo. Every quiz response auto-tagged the customer profile - one-piece vs. two-piece preferences, high-cut vs. low-cut, style preferences.

The quiz results flow sent personalized drips of swimsuit recommendations, style tips, and Fit Expert information. In eight months, that single flow generated $70K+ in revenue with a 70.9% year-over-year lift in flow click rates. Overall, Andie Swim saw 55% year-over-year growth in flow revenue.

The lesson: zero-party data - information customers proactively share - is the most valuable segmentation input you can collect. Quizzes, preference centers, and post-signup surveys turn anonymous subscribers into richly profiled contacts.

8. VIP and Customer Lifetime Value

Not all customers are equal. CLV-based segmentation lets you treat them accordingly:

- Top 5% (VIPs): Early access to new products, exclusive drops, handwritten thank-you notes. These people fund your business - act like it.

- Top 20% (Frequent buyers): Early access to sales, loyalty program perks, subscription offers.

- Middle 50%: Standard promotional cadence with personalized product recommendations.

- Unengaged VIPs: People who used to spend heavily but have gone quiet. They get deeper discounts and personal outreach.

Compass Coffee used a conditional split in their review flow: photo reviewers got a 15% discount, while non-photo reviewers got a thank-you plus a reminder. Result: 3.7x quarter-over-quarter jump in customer photos and a 70.5% jump in total reviews. Small segmentation tweak, outsized impact.

9. Acquisition Source

Use this if: You acquire subscribers from 3+ distinct channels (organic, paid, referral, events, cold outbound).

Skip this if: 90%+ of your list comes from a single source - there's nothing to segment.

Where someone came from tells you a lot about what they expect. Organic subscribers who found you through a blog post have different intent than paid ad leads who clicked a discount offer. Referral subscribers trust you more from day one than cold traffic. Each source deserves a different welcome sequence.

In the cold email world, this matters even more. We've seen teams consistently report that competitor follower scraping outperforms generic database pulls. The segment is tighter, the messaging is more specific, and the response rates reflect it.

10. Cart Value and Order Value Tiers

Tatcha sent emails to engaged subscribers plus less-engaged audiences who had previously purchased the featured product category. That targeting decision - layering engagement with purchase category - drove a 20% year-over-year increase in ecommerce revenue. During the promotion, 47% of all ecommerce revenue was attributed to email.

One smart play: only offer discounts in abandoned cart flows for high-value carts. A $30 cart doesn't need a 15% off nudge - a $300 cart does. Protecting margin on low-value carts while incentivizing high-value conversions is one of the easiest segmentation wins in ecommerce.

High-AOV customers don't need a 10% coupon - they need exclusivity. Low-AOV customers need a bundle offer or free shipping threshold to move up.

B2B vs. B2C - Different Segments, Different Rules

The strategies above apply broadly, but B2B and B2C diverge in important ways. B2B purchases are driven by logic, ROI, and long sales cycles. B2C purchases are driven by emotion, impulse, and immediate gratification.

| Dimension | B2B | B2C |

|---|---|---|

| Primary segments | Industry, company size, job title | Demographics, behavior, purchases |

| Decision drivers | ROI, compliance, team buy-in | Price, emotion, convenience |

| Nurture timeline | ~6 months | Hours to days |

| Core flows | Onboard, nurture, ABM, renew | Welcome, cart, post-purchase, re-engage |

| Re-engagement | Industry news, roundtable invites | "We miss you" + discounts |

| Data sources | CRM, forms, intent signals | Website behavior, purchases, quizzes |

B2B re-engagement looks nothing like B2C. You don't send a VP of Engineering a "we miss you" email with a 20% off coupon. You send them an industry report, a roundtable invitation, or a case study from their vertical. Account-based flows need role-specific content - the C-level executive cares about ROI and risk, while the end-user cares about implementation and daily workflow.

For cold email specifically, the importance hierarchy is clear: deliverability, then list quality and segmentation, then relevance, then offer, then personalization. Personalization is the least important factor when everything upstream is dialed in.

And here's where B2B teams hit a wall that B2C teams don't: data decay. Job titles change, people switch companies, departments get restructured. If your "VP of Sales" segment is full of people who got promoted six months ago, your segmentation is fiction. Tools like Prospeo that refresh contact data on a 7-day cycle - returning 50+ data points per enrichment including verified emails, direct dials, and current job titles - keep your segments grounded in reality instead of last quarter's org chart.

The Data Quality Problem Nobody Talks About

Look: you can build the most sophisticated segmentation strategy in the world, and it won't matter if your data is garbage.

Email lists decay at 2-3% per month. That's 25-35% of your list going stale every year. People change jobs, abandon email addresses, get promoted, leave companies. The list you built six months ago isn't the list you have today.

Here's a scenario I've watched play out dozens of times: a marketing team spends three hours building a VIP segment. They craft the perfect email, nail the subject line, hit send. The campaign gets a 2% click rate - because half the emails bounced. Now their engagement metrics are skewed, their sender reputation took a hit, and the segment they thought was "VIPs" is actually "VIPs plus a bunch of dead addresses."

It gets worse. AI-generated spam is flooding inboxes in 2026, which means ISPs are tightening filters and relevance signals matter more than ever. A bounced email doesn't just waste a send - it actively damages your ability to reach the people who do want to hear from you.

Before you segment, make sure your data is worth segmenting. Upload a CSV, verify the addresses, push clean contacts back to your email platform. The whole process takes minutes, not days.

Running B2B outbound segments by job title, company size, or tech stack? Prospeo's 30+ search filters - including buyer intent, headcount growth, and technographics - let you build pre-segmented lists at $0.01/email with 98% accuracy.

Build segmented prospect lists in minutes, not hours.

Best Practices (And Five Mistakes That Kill Your Results)

Over-Segmenting

A segment of 37 people isn't a segment - it's a group chat. You can't A/B test it, you can't draw meaningful conclusions from the data, and the operational overhead of maintaining it isn't worth the marginal relevance gain. Aim for a minimum of 100-200 subscribers per segment. Below that, merge it with a related group.

Segmenting Without Purpose

If you can't explain what different content this segment receives, delete it. "We have a segment for people in the Pacific Northwest" is meaningless unless you're sending them region-specific offers or weather-triggered campaigns. Every segment needs a corresponding content strategy, or it's just a label collecting dust.

Never Excluding Contacts

This one drives me crazy. Emailing someone with an open support ticket about your new product launch is tone-deaf. Sending a promotional email to someone who just bought the same item at full price three days ago is worse. Exclusion logic is just as important as inclusion logic. Build suppression lists for recent purchasers, active support cases, and contacts in active sales conversations.

Skipping Waterfall Logic

If a subscriber qualifies for multiple segments, use waterfall logic - prioritize the most relevant segment and suppress the rest. Otherwise you're sending three emails in one day to the same person, and they'll unsubscribe from all of them. Rank your segments by priority (e.g., cart abandonment > promotional > newsletter) and let each contact flow into only the highest-priority match.

Ignoring the Buying Cycle

Sending a 25% off coupon on an item someone bought at full price three days ago isn't just wasteful - it actively erodes trust. That customer now feels like a sucker for paying full price. Post-purchase timing matters. Win-back timing matters. Promotional cadence relative to purchase history matters. Your segments need to account for where someone is in their buying cycle, not just who they are.

Best Tools for Email Segmentation in 2026 (With Actual Pricing)

Here's what you'll actually pay. I'm listing real prices because most of these companies make you sit through a demo to find out.

| Tool | Best For | Free Tier | Paid From | Key Strength |

|---|---|---|---|---|

| Klaviyo | Ecommerce/DTC | 250 contacts | ~$20/mo | AI segmentation + Shopify |

| ActiveCampaign | B2B + CRM | 14-day trial | ~$29/mo | Deep automations |

| Brevo | Budget teams | 300 emails/day | ~$25/mo | SMS + email + CRM |

| MailerLite | Beginners | 1,000 subs | $10/mo | Clean, no bloat |

| Omnisend | Multichannel ecom | 500 emails/mo | $16/mo | AI segment builder |

| Mailchimp | Small lists | 500 contacts | ~$13/mo | Easy drag-and-drop |

| HubSpot | Full-stack teams | Free CRM | ~$50/mo | Analytics + CRM |

| Campaign Monitor | Design-focused | None | $12/mo | Beautiful templates |

Klaviyo is the obvious choice for ecommerce. The Shopify integration is best-in-class, the AI segmentation and predictive features are genuinely useful, and the RFM scoring is built in. But it's overpriced if you're not running a Shopify or WooCommerce store. Outside ecommerce, you're paying a premium for features that don't apply to you.

ActiveCampaign is the B2B workhorse. Deep automations, behavioral targeting, built-in CRM. But the learning curve is brutal - expect to spend a week just understanding the automation builder. Pricing ramps fast as your contact count grows.

MailerLite is the #1 recommendation I give to founders who just need to start segmenting without overthinking it. Clean, cheap, no unnecessary bloat. The free tier covers 1,000 subscribers, and paid plans start at $10/mo.

Brevo is the budget play. Decent free tier at 300 emails per day, automations plus SMS plus a light CRM. For small teams trying to keep costs low while still doing real segmentation, it's hard to beat.

Omnisend deserves more attention than it gets. The AI segment builder lets you describe segments in natural language, and it layers shopping behavior with engagement data to find profitable micro-segments. At $16/mo for the standard plan, it's a cheaper Klaviyo alternative for ecommerce teams that don't need the full ecosystem.

Mailchimp is fine for tiny lists. The free tier covers 500 contacts, the drag-and-drop editor is easy, and it's the tool most people start with. But the free automations are very limited, and you'll outgrow it fast once you need real segmentation logic.

HubSpot is powerful if you're already in the HubSpot ecosystem. The free CRM foundation is genuinely useful. But full email marketing features get expensive quickly - expect $50/mo+ for anything beyond basics, and enterprise tiers run into the hundreds.

Campaign Monitor has beautiful templates and starts at just $12/mo, but its segmentation capabilities are limited compared to Klaviyo or ActiveCampaign. Best for design-focused teams with simpler needs.

Your First Two Weeks: A Concrete Plan

Days 1-3: Audit and Clean

Audit your current data. What fields do you actually have populated? What's blank? What's outdated? If you haven't verified your list recently, do that first - upload your CSV to a verification tool and remove invalid addresses. This takes 2-4 hours for most lists.

Set a SMART goal: "Increase click-through rate by 15% within 60 days by implementing engagement-based segmentation." Specific, measurable, and time-bound.

Days 4-7: Build Your First Two Segments

Start simple. If you've got under 5,000 contacts, build two segments: customers vs. non-customers. Then add engaged (opened or clicked in last 90 days) vs. cold. That's four segments total, and it's enough to meaningfully differentiate your messaging.

Days 8-14: Launch and Measure

Send your first segmented campaign. Track open rate, click rate, and conversion rate by segment. Compare to your unsegmented baseline. You'll need 1-2 weeks for behavioral data to accumulate before you can build more sophisticated segments.

Don't implement everything at once. I've seen teams try to launch 10 segments simultaneously and end up maintaining none of them. Focus on one strategy, prove it works, then add another.

None of this matters if your list is full of dead addresses. Clean first, segment second. That's the thread running through every strategy in this guide.

Compliance Essentials (Don't Skip This)

GDPR operates on opt-in consent. Pre-checked boxes don't qualify. Consent must be freely given, specific, informed, and unambiguous. Purpose limitation means you can't repurpose order confirmation data for unrelated promotions without separate consent.

The stakes are real: cumulative GDPR fines have reached EUR 5.88 billion across 2,245 enforcement actions. Even if you're US-based, if you've got EU subscribers, this applies to you.

FAQ

Is email segmentation worth it for lists under 1,000 subscribers?

Yes - start with two segments: customers and non-customers. At 1,000+, add engagement-based segmentation (active vs. cold). Two well-used segments outperform ten neglected ones every time. Don't overcomplicate it until your list and data justify the complexity.

What's the minimum segment size for meaningful results?

Aim for 100-200 subscribers per segment minimum. Below that, your sample is too small for reliable A/B testing or statistically meaningful open and click rate data. If a segment falls under 100, merge it with a related group until it hits critical mass.

How often should I update my segments?

Behavioral and engagement segments should update automatically via your ESP in real time. Review your full strategy quarterly. Verify contact data at least monthly, since lists decay 2-3% per month.

What's the difference between segmentation and personalization?

Segmentation determines WHO receives a message; personalization determines WHAT they see inside it. Segment your list first - engaged customers vs. new leads - then personalize within each group using dynamic content, name tokens, and product recommendations. Getting the order wrong wastes months on content nobody sees.

Which email segmentation strategies should I start with?

Start with engagement-based segmentation and lifecycle stage - these two deliver the highest ROI with the least setup. Once they're producing measurable results, layer in purchase history, RFM scoring, and behavioral website data. Prove each strategy works before adding the next one.