HubSpot vs SugarCRM: An Independent, Data-Driven Comparison for 2026

Every page-1 result for HubSpot vs SugarCRM is published by someone with skin in the game. SugarCRM's own blog holds two spots. HubSpot partners fill three more. Forecastio sneaks in a comparison that conveniently promotes its own forecasting tool. Nobody on page one is neutral.

That's what you're dealing with - every "objective comparison" is quietly steering you toward a vendor relationship. We're not going to pretend we don't have a product (we do - more on that later), but we're going to give you the pricing data, analyst rankings, and user complaints that vendor-published comparisons leave out. Then you can decide.

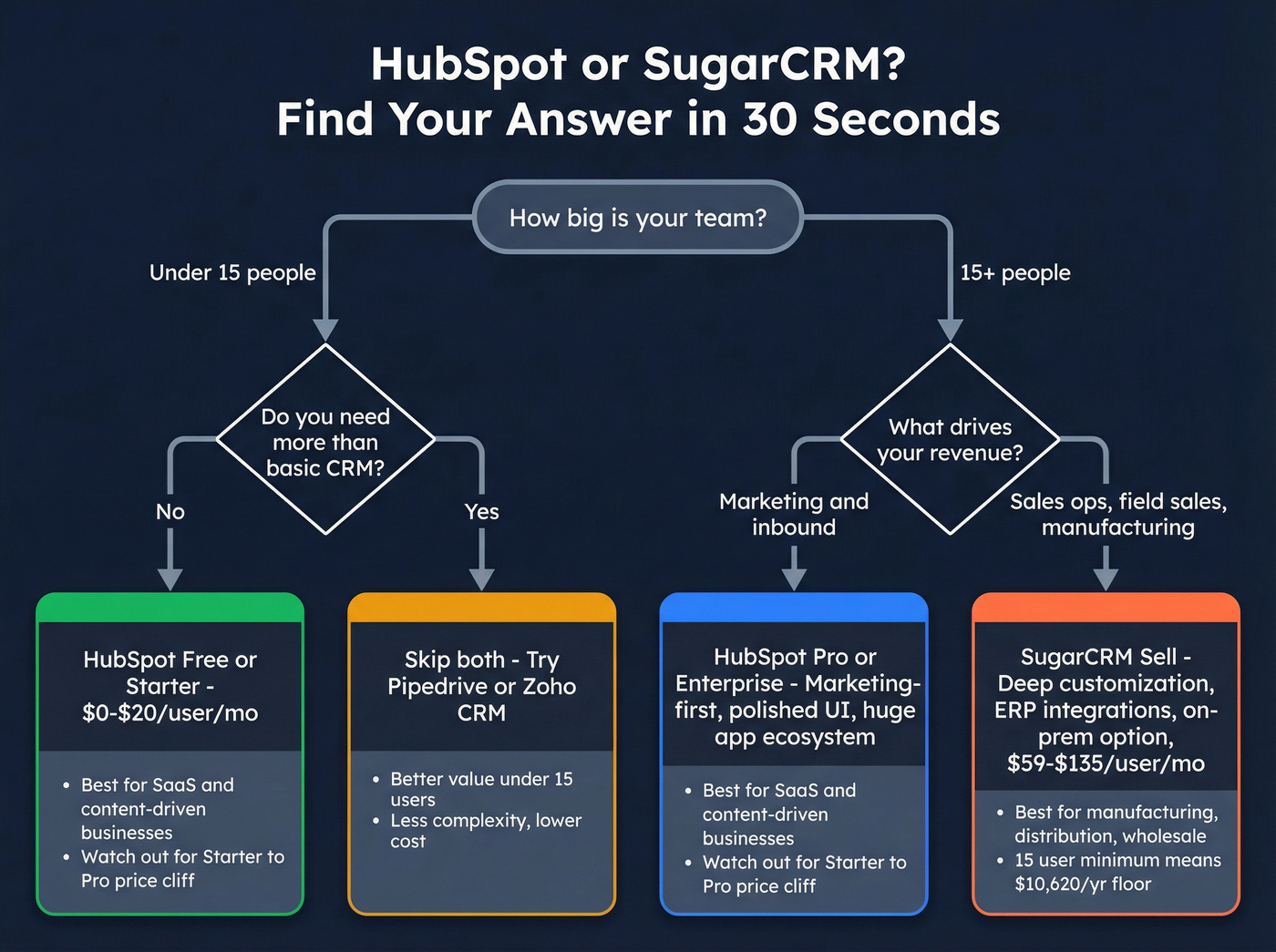

30-Second Verdict

Choose HubSpot if you're a marketing-led SMB under 50 employees that values ease of use, a massive integration ecosystem, and a free entry point - and you're prepared for costs to escalate sharply once you outgrow Starter.

Choose SugarCRM if you're a sales-led mid-market team with 15+ users in manufacturing, distribution, or wholesale that needs deep customization, ERP integration, and on-prem deployment - and you can absorb the $10,620/year minimum.

Skip both if your team is under 15 people but needs more than HubSpot Starter offers. Look at Pipedrive or Zoho CRM instead.

Two Different CRM Philosophies

These aren't two versions of the same product. They're built on fundamentally different assumptions about how companies sell.

HubSpot was founded in 2006 around the inbound methodology - attract leads with content, nurture them with marketing automation, hand them to sales when they're warm. It serves 228,000+ customers and has evolved into a full customer platform, but its DNA is marketing-first. The CRM exists to serve the marketing engine.

SugarCRM was founded in 2004 as an open-source CRM. Its roots are in sales operations - pipeline management, account tracking, deal forecasting. It serves teams in 120+ countries with a heavy concentration in manufacturing, distribution, and wholesale. The marketing tools exist to support the sales motion, not the other way around.

Analyst rankings reflect this split. In the Nucleus Research 2025 SFA Value Matrix, SugarCRM earned Leader status for the fifth consecutive year, alongside Salesforce, Microsoft, Zoho, and Creatio. HubSpot was classified as an Accelerator - delivering value through ease of use and fast deployment rather than depth and customization.

Analyst Cameron Marsh put it directly: Sugar Sell places a stronger emphasis on industries such as manufacturing, distribution, and wholesale. That's not a limitation. It's a deliberate focus. If you're in those verticals, SugarCRM speaks your language. If you're a SaaS company running inbound, HubSpot does.

Feature-by-Feature Breakdown

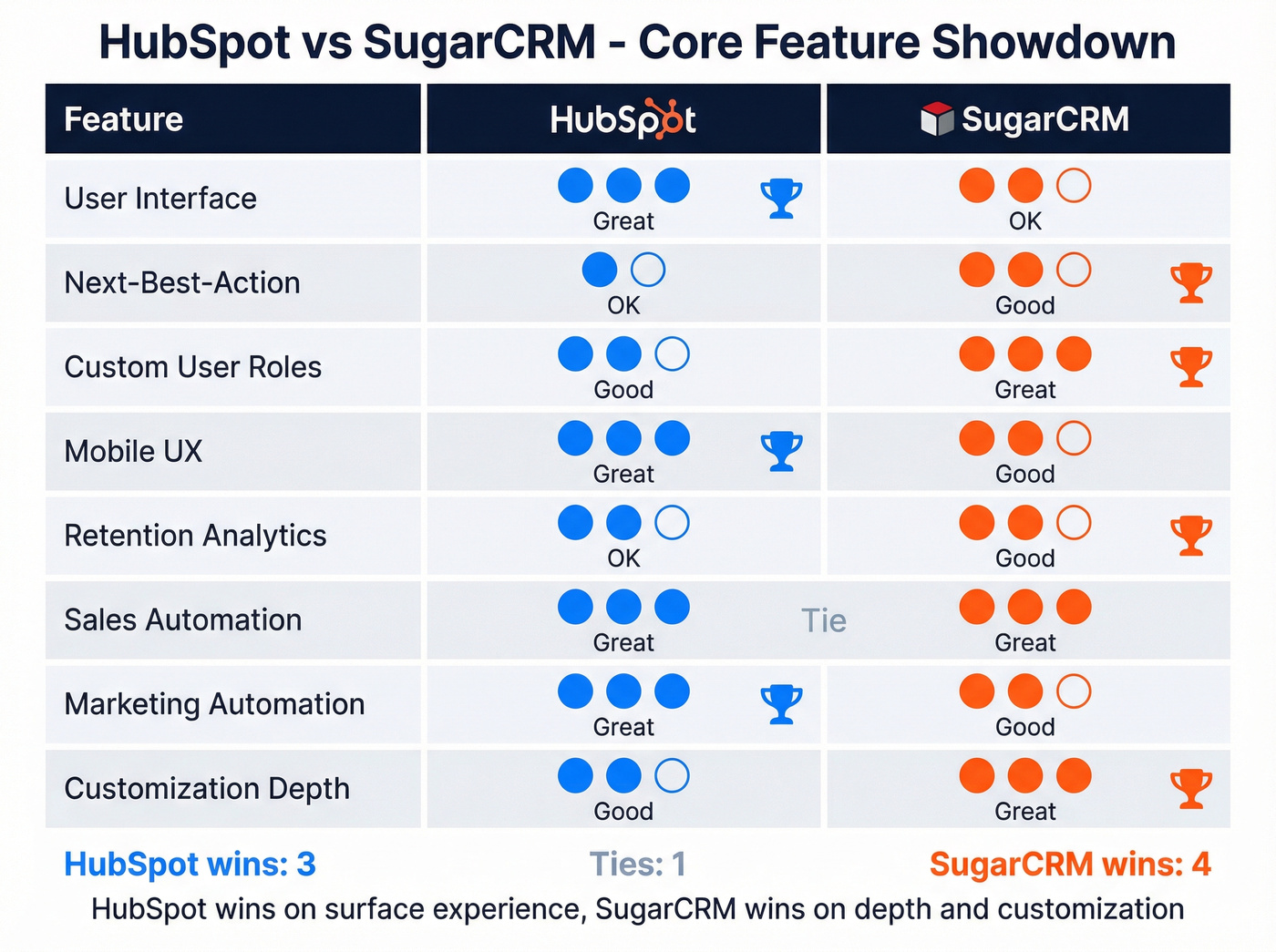

Core CRM Features

The Taloflow platform runs structured evaluations across CRM capabilities. Here's how the two stack up on the features that actually matter day-to-day:

| Feature | HubSpot | SugarCRM | Winner |

|---|---|---|---|

| User Interface | Great | OK | HubSpot |

| Next-Best-Action | OK | Good | SugarCRM |

| Custom User Roles | Good | Great | SugarCRM |

| Mobile UX | Great | Good | HubSpot |

| Retention Analytics | OK | Good | SugarCRM |

| Sales Automation | Great | Great | Tie |

| Marketing Automation | Great | Good | HubSpot |

| Customization Depth | Good | Great | SugarCRM |

The pattern is clear. HubSpot wins on surface-level experience - the UI is polished, mobile works beautifully, and onboarding is fast. SugarCRM wins on depth - customizable roles, next-best-action recommendations, and retention analytics that reflect its focus on complex B2B sales cycles.

Here's the thing: "Great" UI and "OK" customization is fine when you're a 20-person marketing team. It's a problem when you're a 200-person manufacturing operation with a 14-step approval workflow and three ERP systems that all need to talk to each other in real time.

SugarCRM's September 2025 release also added multi-stop route planning for field sales reps - a feature HubSpot doesn't offer and one that matters if your team is visiting manufacturing sites or distribution centers.

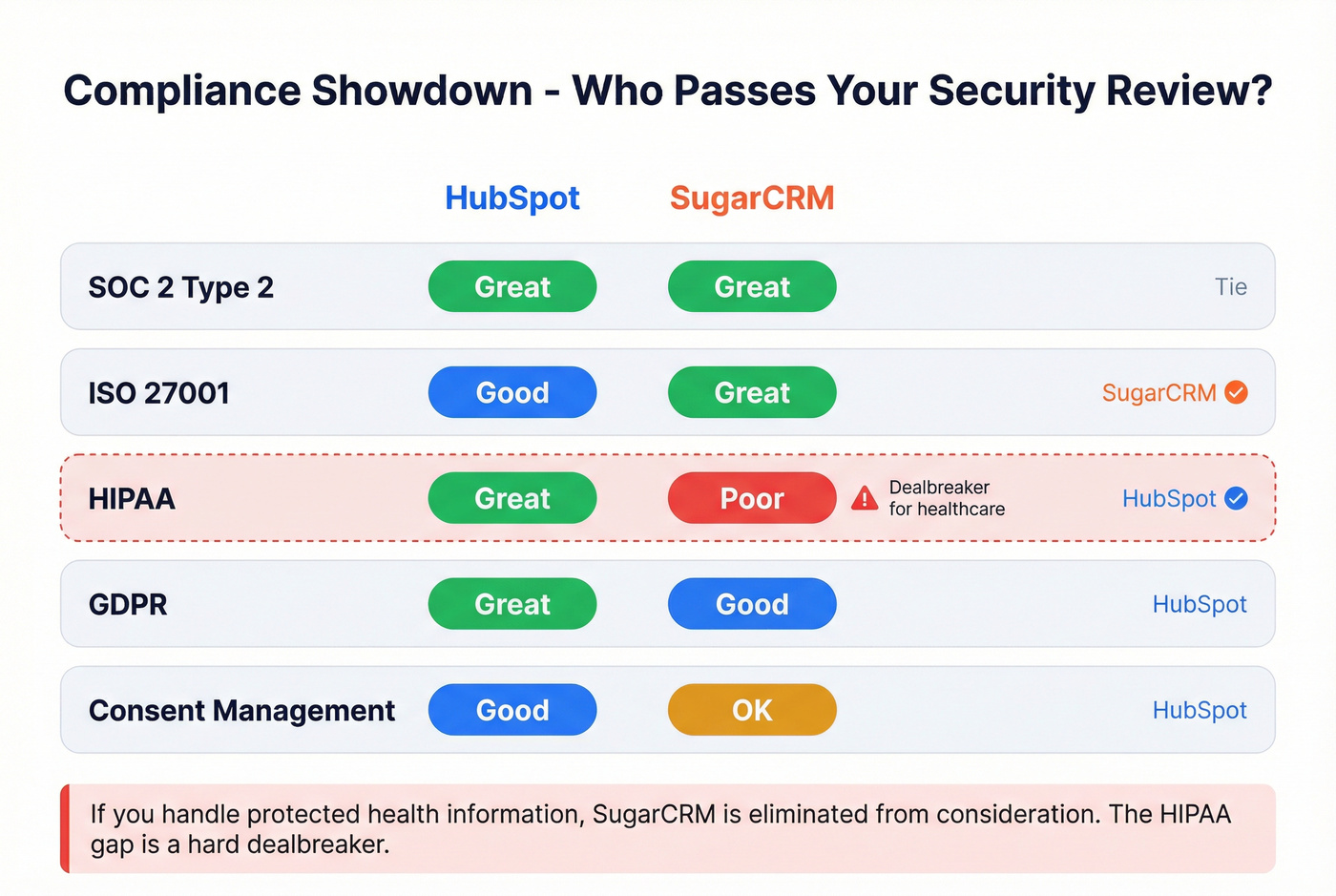

Compliance and Security

This is where the comparison gets interesting for regulated industries.

| Standard | HubSpot | SugarCRM | Winner |

|---|---|---|---|

| SOC 2 Type 2 | Great | Great | Tie |

| ISO 27001 | Good | Great | SugarCRM |

| HIPAA | Great | Poor | HubSpot |

| GDPR | Great | Good | HubSpot |

| Consent Mgmt | Good | OK | HubSpot |

Both platforms handle SOC 2 well. SugarCRM edges ahead on ISO 27001 - meaningful if you're selling into enterprises that require it in vendor assessments.

The HIPAA gap is the headline. SugarCRM rates "Poor" on HIPAA compliance, which is a dealbreaker for healthcare-adjacent teams. If you're a medical device manufacturer, a health tech company, or anyone handling protected health information, this single rating eliminates SugarCRM from consideration. Full stop.

For finance-specific compliance (SOX, PCI-DSS), neither platform offers out-of-the-box support - you'll need third-party tools regardless.

HubSpot killed free company enrichment. SugarCRM hides AI enrichment behind asterisked add-ons. Prospeo enriches your CRM contacts with 50+ data points at a 92% match rate - for $0.01 per email. Native HubSpot and Salesforce integrations included.

Stop paying your CRM vendor extra for data that should already be there.

AI Capabilities - Breeze vs SugarPredict

Both platforms are racing to add AI features. Neither is where they need to be yet, but they're taking different approaches.

HubSpot's Breeze AI includes agents for prospecting, customer service, and content creation, plus Breeze Intelligence for data enrichment. The catch: Breeze Intelligence starts at $45/month for 5,000 credits, and as of March 2025, HubSpot stopped automatically enriching new company records with free data. Everything consolidated into paid HubSpot Credits. That's a meaningful cost increase for teams that relied on the free enrichment.

SugarCRM's AI took a different path. The September 2025 release (v25.2) introduced "Needed Follow-ups" - surfacing meetings and calls that need attention - and "Engaged Contacts," which prioritizes contacts based on communication frequency. Role-based access controls let admins decide which teams see AI dashlets. Sugar's Sankey diagrams showing where deals drop off and which marketing channels perform best are genuinely useful for pipeline diagnostics. SugarPredict 2.0 can autonomously enrich contact records from social and public data sources.

The asterisk - literally. On SugarCRM's pricing page, generative AI, sentiment analysis, intelligent lead prioritization, and revenue intelligence are all marked with asterisks as add-ons. They aren't included in the base Sell Standard price. You'll pay extra. SugarCRM doesn't publish add-on pricing publicly. Expect to negotiate, but budget an additional 20-30% on top of your base per-seat cost.

Real talk: neither platform's AI is a reason to choose it over the other yet. Both are useful but incremental. Pick your CRM based on workflow fit and pricing, not AI features that'll look completely different in 12 months.

Pricing Compared - What You'll Actually Pay in 2026

HubSpot Pricing Tiers

| Product | Tier | Price | Included |

|---|---|---|---|

| Sales Hub | Free | $0 | 1M contacts, basic pipeline |

| Sales Hub | Starter | $20/user/mo | Email tracking, meetings, quotes |

| Sales Hub | Pro | $100/seat/mo | Workflows, sequences, forecasting |

| Sales Hub | Enterprise | $150/seat/mo | Custom objects, ABM, predictive lead scoring |

| Marketing Hub | Starter | $20/mo | 1 seat, 1K contacts |

| Marketing Hub | Pro | $890/mo | 3 seats, 2K contacts |

| Marketing Hub | Enterprise | $3,600/mo | 5 seats, 10K contacts |

| Platform Bundle | Pro | $1,170/mo | 5 core seats, all Pro Hubs |

| Platform Bundle | Enterprise | $4,300/mo | 7 core seats, all Ent Hubs |

The free tier is genuinely useful for getting started. But 61% of free users upgrade within 3-4 months - HubSpot knows exactly what it's doing with that funnel.

SugarCRM Pricing Tiers

| Product | Tier | Price | Min. Commitment |

|---|---|---|---|

| Sugar Sell | Standard | $59/user/mo | 15 users ($10,620/yr) |

| Sugar Sell | Advanced | $85/user/mo | 15 users ($15,300/yr) |

| Sugar Sell | Premier | $135/user/mo | 15 users ($24,300/yr) |

| Sugar Market | - | $1,000/mo | 10K contacts |

| Sugar Serve | - | $80/user/mo | No minimum |

| Sugar Enterprise | On-Prem | $85/user/mo | No minimum |

The 15-user minimum on all Sell tiers is the defining constraint. If you have 8 salespeople, you're paying for 15. That $10,620/year floor is real money for a feature you're only half-using.

The Advanced tier's "Most Popular" label is doing heavy lifting. Generative AI, sentiment analysis, intelligent lead prioritization, and revenue intelligence are all add-ons - not included in the $85/user/mo price.

What You'll Actually Pay - Total Cost of Ownership

List prices are fiction. Here's what companies actually pay.

Tropic analyzed $15B+ in processed software spend and found most companies pay 30-35% below HubSpot's list prices. Small businesses with 10-50 employees typically land at ~$620-$670/mo for Marketing Hub Pro. Mid-market teams negotiate down to ~$760-$820/mo. That's meaningful savings, but you have to know to ask.

Then there's onboarding. HubSpot charges $1,500-$12,000 depending on the tier, with Advanced onboarding running ~$7,000 over 90 days and Enterprise ~$10,000 over 120 days. These can sometimes be discounted up to 50%, but they aren't optional on higher tiers.

The real pain point is the Starter-to-Pro cliff. One Reddit user on r/hubspot described being quoted $17,500/year for Pro after paying $250/year on Starter - calling it "a pricing strategy severely disconnected from small-business realities." Another startup founder on r/sales shared that at $10K MRR, HubSpot would cost ~$2K/month to use all features: "I feel really nickel and dimed." A startup on r/startups reported needing five separate packages for basic tasks - Sales Professional for CRM, Prospecting for leads, Operations Hub for de-duplicating, Marketing for newsletters, plus upgrades to remove branding.

That's not a platform. That's a tax code.

One analysis found 74% of small businesses switch away from HubSpot within their first year due to rising costs or complexity. That number came from a competing CRM vendor, so take it with a grain of salt - but it tracks with the Reddit complaints. HubSpot also applies a ~5% annual renewal uplift. Year one pricing is your best pricing.

SugarCRM's TCO has different traps. Implementation runs 4-8 weeks versus HubSpot's 1-4 weeks, and you'll likely need developer resources for customization. The 15-user minimum means you can't start small and grow. But once you're past that floor, per-seat costs are predictable and don't escalate the way HubSpot's do.

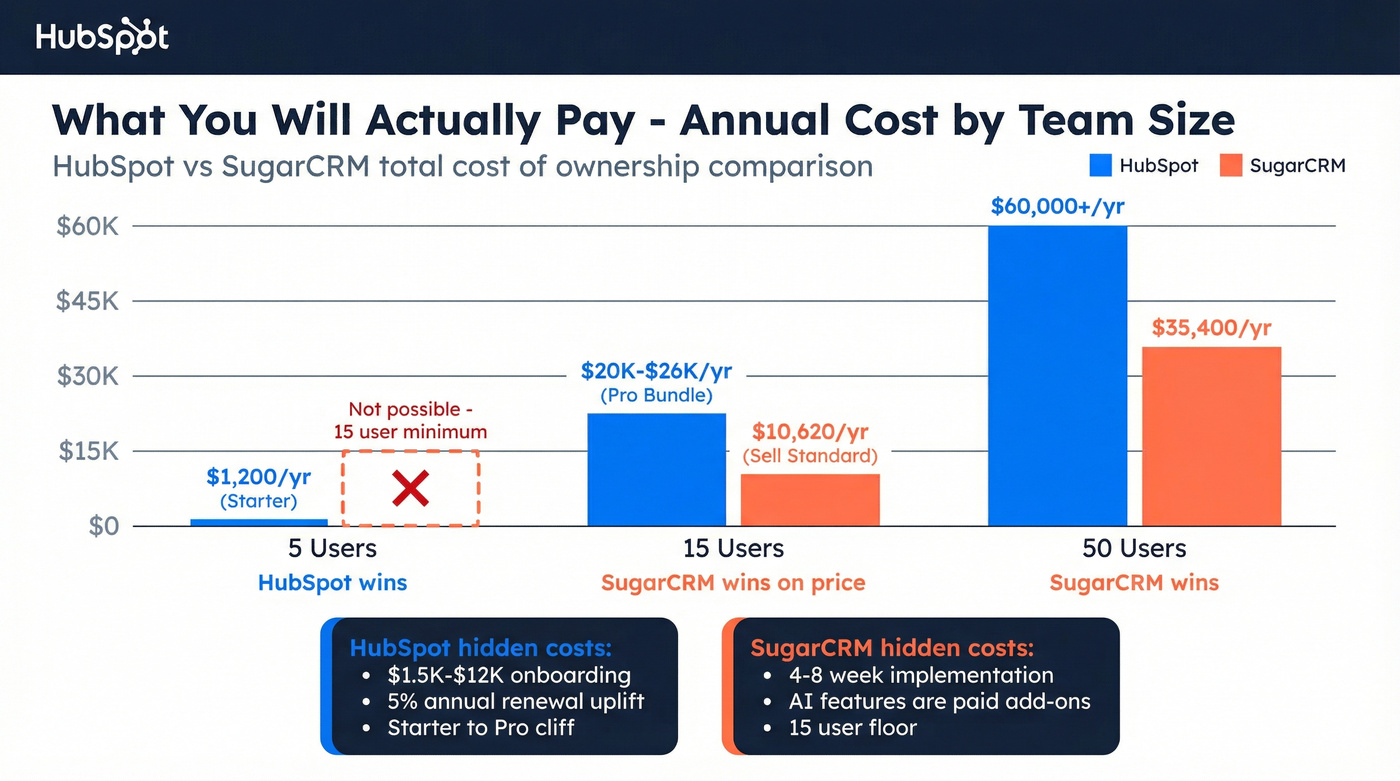

Pricing by Team Size - Who's Actually Cheaper?

| Scenario | HubSpot | SugarCRM | Winner |

|---|---|---|---|

| 5 users | ~$1,200/yr (Starter) | Impossible (15-user min) | HubSpot |

| 15 users | ~$20,000-$26,000/yr (Pro Bundle + extra seats) | $10,620/yr (Sell Std) | SugarCRM on price; HubSpot if you need marketing tools |

| 50 users | ~$60,000/yr (Sales Pro) | $35,400/yr (Sell Std) | SugarCRM |

At 15 users, SugarCRM's base price is substantially lower. HubSpot's $1,170/mo Pro Platform Bundle covers only 5 core seats; additional seats at $50-$100/mo each bring the 15-user total to ~$20,000-$26,000/yr depending on seat type. If you need both sales and marketing, HubSpot covers more ground - but you're paying for it.

The crossover point is roughly 20-25 users. Below that, HubSpot's flexibility wins. Above that, SugarCRM's flat per-seat pricing becomes increasingly attractive - especially if you don't need HubSpot's marketing automation.

Ease of Use, Integrations, and Onboarding

Ease of Use and Onboarding

HubSpot is the easier CRM. That's not opinion - it's consensus across every analyst, review platform, and user forum we've checked.

Taloflow rates HubSpot's UX as "Great" versus SugarCRM's "OK." TechRadar spent 40 hours inside SugarCRM and concluded the UI "feels outdated compared to modern CRM systems," though they noted it's "highly customizable" once you learn the layout. One G2 reviewer put it plainly: SugarCRM's "setup can be time-consuming without guidance."

Implementation timelines reflect this gap. HubSpot Starter and Pro deployments typically take 1-4 weeks. SugarCRM implementations run 4-8 weeks, and that's with dedicated resources. If you're a lean team without a CRM admin, SugarCRM's learning curve is a real cost - measured in lost productivity, not just dollars.

One HubSpot Community user who migrated from Sugar described building reports in Sugar as "very frustrating" compared to HubSpot. Reporting is one of those features that seems minor until you're the one building pipeline reviews at 6 PM on a Thursday.

Integrations and Ecosystem

Use HubSpot if you need breadth. The HubSpot App Marketplace offers 1,800+ integrations with one-click installs for most popular tools. Slack, Zoom, Salesforce, Shopify, Stripe - it's all there, and it mostly just works.

Use SugarCRM if you need depth. SugarCRM's roughly 200-300 pre-built integrations are a fraction of HubSpot's count, but its open API architecture enables deep ERP integration with SAP, Oracle, and NetSuite. For manufacturing and distribution teams, that ERP connection is worth more than 1,500 marketing app integrations they'll never use.

Skip SugarCRM if you're worried about long-term ecosystem health. A developer with 5+ years of SugarCRM experience noted on r/CRM: "I seldom hear anyone talking about it these days. Not many jobs ask for it either." A shrinking developer community means fewer custom integrations, slower community support, and higher costs when you need specialized help.

Both CRMs benefit from third-party data enrichment to keep contact records accurate. Prospeo integrates natively with HubSpot and connects to any CRM - including SugarCRM - via API, keeping the contact data flowing into your pipeline verified on a 7-day refresh cycle. If you're evaluating vendors, it's also worth pressure-testing your broader B2B sales stack so CRM + data + outreach work as one system.

What Real Users and Analysts Say

Analyst Positioning

The Nucleus Research 2025 SFA Value Matrix tells a clear story: SugarCRM is a Leader (fifth consecutive year), and HubSpot is an Accelerator. Leaders excel at customization, scalability, and industry-specific features. Accelerators deliver value through ease of use and fast deployment.

Neither classification is inherently better. If you need a CRM that molds to your business process, SugarCRM's Leader status is earned. If you need a CRM that gets reps productive in two weeks, HubSpot's Accelerator positioning is the point.

On Gartner Peer Insights, HubSpot holds a 4.4/5 rating across 2,174 reviews. SugarCRM sits at 4.0/5 across 1,182 reviews on G2. The review volume gap matters - HubSpot's larger user base generates more signal, making its rating more statistically reliable.

Real User Complaints - Both Sides

I've seen teams commit to a CRM based on a demo and regret it within 90 days. The complaints are where you learn what the demos don't show.

HubSpot's biggest complaints:

"Deliberate paywall friction" designed to push upgrades - that's a direct quote from r/hubspot. The Starter-to-Pro jump isn't a pricing tier; it's a trap door. One user described needing five separate packages just to run basic operations. Support is another sore spot. On lower-tier plans, you're directed to forums and chatbots. One user said: "HubSpot has Zero Support unless you Pay $500 a month." That came from a competitor's blog, so factor in the bias - but the underlying complaint about tiered support access echoes across Reddit.

SugarCRM's biggest complaints:

"Interface feels a bit outdated" is the most common G2 critique. A HubSpot Community user who migrated from Sugar said building lists was "very frustrating." And the r/CRM developer's observation - "I seldom hear anyone talking about it these days" - reflects a real perception problem in the market.

The praise is real too. A G2 reviewer said of SugarCRM: "I love how customizable Sugar Serve is. You can do almost anything with it." The results speak: Creative Foam reported a 44% increase in annual sales after implementing Sugar Sell, Essendant added $3.8M in revenue in just two months, and FSIoffice saw a 40% boost in sales efficiency.

For HubSpot, a G2 reviewer praised the ability to "architect your business exactly as it appears in the real world... without months of custom dev work." When HubSpot fits, it fits fast.

Migration - Switching Between the Two

Here's a data point that says more than any feature comparison: every documented migration story we've found goes Sugar to HubSpot. Not the reverse.

The most detailed case is TransTrack Solutions, a transportation tech company that migrated 7,980 records - 3,422 companies, 4,239 contacts, 319 deals - from SugarCRM to HubSpot in 60 days. Their GM said: "The new HubSpot system is much better integrated than our prior CRM." The reason for switching: data was a mess in Sugar, the sales process was too manual, and the team couldn't adapt their pipeline within Sugar's customization parameters.

A HubSpot Community user who completed the same migration described it as a "manual export/import type of situation" and said: "I'm not looking back!" Budget 4-8 weeks and plan for significant data cleanup. The technical process is straightforward; retraining your team and rebuilding workflows takes longer. If you want a step-by-step, use this import leads playbook as your checklist.

The one-directional migration pattern is itself a signal. It doesn't mean SugarCRM is bad - it means HubSpot's gravitational pull in the SMB and mid-market is strong enough that teams are willing to absorb the switching cost. Whether that pull is product quality or marketing momentum is a fair debate.

Who Should Choose What - And When Neither Fits

Choose HubSpot If...

- You're a marketing-led SMB under 50 employees

- Ease of use and fast onboarding matter more than deep customization

- Your tech stack needs broad integrations (1,800+ in the marketplace)

- You're okay with costs escalating as you scale past Starter

- You need HIPAA compliance

- You want a free entry point to evaluate before committing budget

- Your sales process is relatively standard - not heavily customized

Choose SugarCRM If...

- You're a sales-led mid-market team with 15+ users

- You're in manufacturing, distribution, or wholesale

- You need deep ERP integration (SAP, Oracle, NetSuite) and on-prem deployment

- You prioritize customization over out-of-the-box simplicity

- ISO 27001 compliance matters for your vendor assessments

- You want predictable per-seat pricing without the Starter-to-Pro cliff

- You have technical resources to manage implementation and customization

When Neither CRM Is the Right Fit

If you're a team under 15 people who's outgrown HubSpot Starter but can't justify SugarCRM's 15-user minimum, you're in no-man's land. Pipedrive offers solid pipeline management starting at ~$15/user/mo with no minimums - it's the pragmatic choice for small sales teams. Zoho CRM, a fellow Nucleus Research Leader alongside SugarCRM, starts at ~$14/user/mo and covers both sales and marketing without the sticker shock.

But here's what nobody in the CRM comparison space talks about: your CRM is only as good as the data inside it. You can spend $10K-$50K/year on either platform and still watch your sequences bounce at 25%+ because the emails and phone numbers you imported are stale. If you're seeing that, start with data quality basics, then add a steady B2B contact data decay refresh workflow.

Prospeo solves the data layer. With 98% email accuracy, 143M+ verified emails, and a 7-day data refresh cycle, it ensures the contacts in your CRM actually connect. It integrates natively with HubSpot and connects to any CRM via API. Starts free, scales at ~$0.01/email, no contracts. Whichever CRM wins your evaluation, clean data is what makes it pay off. If you need the underlying process, follow a simple How to keep CRM data clean framework and verify before every import with an email verifier website.

Neither HubSpot nor SugarCRM solves your biggest pipeline problem: bad contact data. Prospeo's 7-day refresh cycle and 98% email accuracy mean your reps actually reach decision-makers - whether you're running inbound or outbound.

Your CRM is a database. Make sure the data in it is real.

FAQ

Can I migrate from SugarCRM to HubSpot (or vice versa)?

Yes - TransTrack Solutions migrated 7,980 records from SugarCRM to HubSpot in 60 days via manual export/import. Every documented migration goes Sugar to HubSpot. Budget 4-8 weeks and plan for data cleanup. The technical process is straightforward; retraining your team on new workflows takes longer.

Is SugarCRM cheaper than HubSpot for mid-market teams?

For 50+ users, SugarCRM's $59/user/mo significantly undercuts HubSpot Sales Pro at $100/seat/mo - saving roughly $24,600/year. For teams under 15, HubSpot wins by default since SugarCRM's 15-user minimum makes it inaccessible. Factor in HubSpot's $1,500-$12,000 onboarding fees when comparing total cost.

Does HubSpot's free CRM have enough features to replace SugarCRM?

For basic contact management and a single pipeline, yes. But the free tier lacks sales automation, custom reporting, and sequences - features SugarCRM includes at its base tier. 61% of free users upgrade within 3-4 months, so compare HubSpot Sales Pro ($100/seat/mo) against Sugar Sell Standard ($59/user/mo) for realistic planning.

How do I keep CRM data accurate after choosing a platform?

Neither CRM verifies contact data - they store what you give them. Use a dedicated enrichment tool like Prospeo (98% email accuracy, 7-day refresh cycle) to verify emails and phone numbers before importing. Data decays at roughly 30% per year, so ongoing enrichment prevents the bounce-rate creep that degrades CRM ROI.