Lookalike Audience B2B Prospecting: What Actually Works in 2026

You built a 1% lookalike on Meta from your best customers, set a $15K monthly budget, and watched the leads roll in. Except they weren't leads - they were marketing students, freelancers browsing from coffee shops, and bots that somehow passed Meta's fraud filters. You burned 40-60% of that budget on people who'll never buy enterprise software. The Reddit threads tell the same story: niche down to your actual ICP in a single region, and your audience shrinks so small you barely get impressions. Go broad, and you're lighting money on fire.

Here's the thing: lookalike audience B2B prospecting still works. But the playbook has fundamentally shifted. Ad-platform lookalikes are mostly broken for B2B. Data-platform lookalikes - tools that analyze your CRM data directly - are where the real results live. And the biggest gap in the whole workflow isn't finding similar companies. It's turning that company list into verified contacts you can actually reach.

The Short Version

Ad-platform lookalikes (Meta, Google) are largely broken for B2B. LinkedIn is the only ad platform where they still work. Data-platform lookalikes - tools that analyze firmographic and technographic signals from your CRM - are the modern approach.

Start with 50+ best-fit accounts as seed data, not your entire customer list. Model on closed-won deals with the shortest sales cycles and highest lifetime value. Your whole CRM includes bad-fit customers who churned. Don't let the algorithm learn from them.

What Is a Lookalike Audience in B2B?

A lookalike audience starts with a seed - a list of your best customers - and uses algorithms to find more companies (or people) that share the same characteristics. In consumer advertising, platforms like Meta match demographics: age, location, interests, purchase behavior. Feed in 1,000 customers, get back 100,000 people who look like them.

B2B lookalikes work differently. Instead of demographic matching, you're matching on firmographic signals (industry, revenue, headcount), technographic signals (what tools they use), intent signals (what they're researching), and behavioral patterns (hiring trends, funding rounds, website content themes).

The distinction matters because consumer lookalikes optimize for volume. B2B lookalikes optimize for precision. You're not trying to reach 100,000 people who vaguely resemble your customers. You're trying to find 500 companies that match your best accounts on the signals that actually predict a deal.

The data backs this up: Facebook B2B case studies show lookalike campaigns yielding a 46% conversion lift versus generic targeting, and Forrester's research found companies that prioritize well-defined, high-value audiences see 2-3x higher conversion rates compared to broad campaigns. That's the promise when you do it right. The problem is that most teams are still using consumer-grade workflows.

Two Types of B2B Lookalikes: Ad-Platform vs Data-Platform

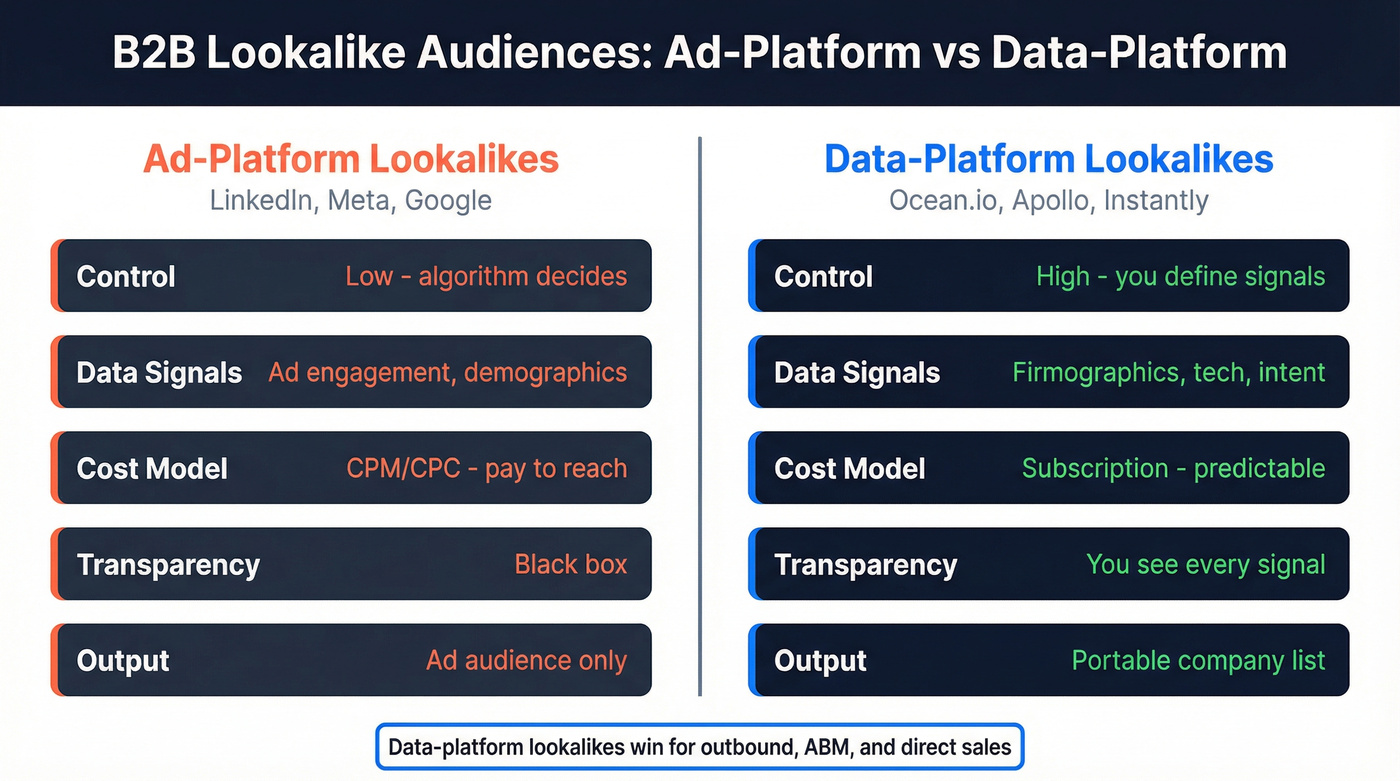

Not all lookalikes are created equal. The market has split into two distinct approaches, and understanding the difference will save you months of wasted budget.

| Dimension | Ad-Platform | Data-Platform | Winner |

|---|---|---|---|

| Examples | LinkedIn, Meta, Google | Ocean.io, Apollo, Instantly | - |

| Control | Low - algorithm decides | High - you define signals | Data-Platform |

| Data signals | Ad engagement, demographics | Firmographics, tech, intent | Data-Platform |

| Cost model | CPM/CPC (pay to reach) | Subscription (pay for data) | Data-Platform (predictable) |

| Best for | Awareness, retargeting | Outbound, ABM, direct sales | Depends on goal |

Ad-platform lookalikes rely on the platform's own algorithm, trained primarily on ad engagement data. You upload a customer list, the platform finds users who behave similarly on that platform. The problem? "Behaves similarly on LinkedIn" and "is likely to buy your software" are very different things.

Data-platform lookalikes analyze your CRM data directly. They look at the actual firmographic, technographic, and intent signals that correlate with your closed-won deals - then find companies that match those patterns in their database. You get a list of companies, not an ad audience. That list is portable: you can activate it across LinkedIn ads, email sequences, direct mail, or any other channel.

This shift from ad-platform to data-platform lookalikes is the single biggest change in B2B prospecting over the past two years.

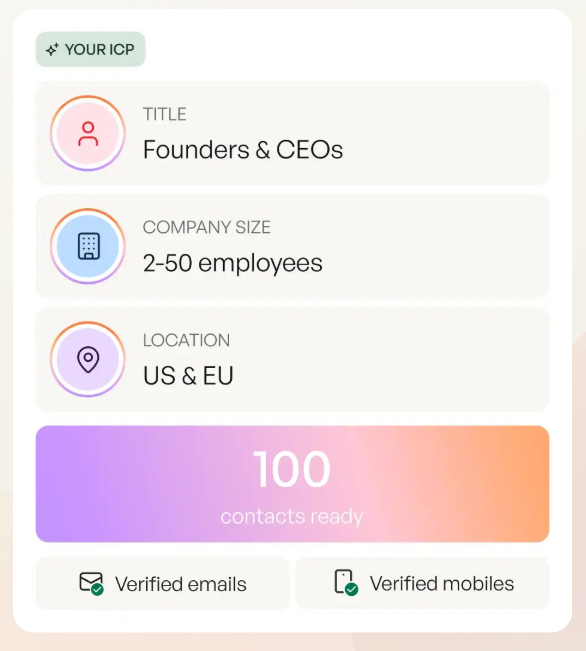

Lookalike tools find similar companies. Prospeo turns those companies into verified contacts you can actually reach. With 300M+ profiles, 30+ filters including intent data and technographics, and 98% email accuracy - you go from a lookalike list to booked meetings without burning your domain.

Stop paying ad platforms to guess. Start reaching buyers directly.

Ad-Platform Lookalikes: What Still Works (and What Doesn't)

LinkedIn - The Only Ad Platform That Still Works for B2B

LinkedIn is the exception. With 1B+ members and 67M decision-makers - four out of five members drive business decisions - it's the only ad platform where professional data is accurate enough for B2B lookalikes to deliver.

The numbers tell the story. LinkedIn's MQL-to-SQL conversion rate runs 14-18%, roughly double Google's 7-12%. SQL-to-opportunity rates hit 50-60% versus Google's 36-42%. And LinkedIn-sourced deals close at $75K-$250K, compared to $40K-$120K from Google. You're paying more per click ($5.58 average CPC versus Google's $2.69 - and SaaS-specific campaigns can run $10-15 per click), but the downstream quality justifies it.

LinkedIn's Predictive Audiences use AI-driven modeling to enhance targeting beyond basic lookalikes. The minimum audience size is 300 members, but optimal performance starts at 50,000+. If your audience is under 50K, layer in additional targeting (seniority, company size, industry) to give the algorithm enough room to optimize.

HockeyStack analyzed $28M in LinkedIn ad spend across 70+ B2B SaaS companies and found a 6.01x pipeline ROI in Q3 - the strongest quarter. Thought Leader Ads specifically delivered 1.7x higher CTR and 62% lower CPC compared to standard Sponsored Content.

LinkedIn should get 25-35% of your B2B PPC budget. That's not a suggestion - it's what the data says works.

Meta - Why B2B Lookalikes Are Broken Here

Meta can't distinguish between a CMO buying marketing software and a marketing student writing a thesis about marketing software. After iOS 14 gutted tracking, Meta's algorithm lost the signal quality it needed for precise B2B targeting. Interest targeting is effectively dead - you're burning 40-60% of budget on students, bots, and retired accounts.

Advantage+ campaigns are now the primary growth engine for 65% of U.S. advertisers across all categories, but they're optimized for e-commerce conversions, not B2B pipeline.

The one viable B2B play on Meta: Search-to-Social retargeting. Capture high-intent Google Search traffic, then retarget those visitors on Meta where CPMs are 80% cheaper than LinkedIn. That's it. Allocate 5-10% of your B2B budget to Meta, max, and only for retargeting.

Google - Similar Audiences Are Gone

Google deprecated Similar Audiences between May and August 2023. If you're reading older content that recommends Google lookalikes, it's outdated.

The replacements - Optimized Targeting and Audience Expansion - don't offer the same precision. Optimized Targeting uses ML to find new users based on real-time behavior, which sounds good until you realize it's optimizing for clicks, not B2B buying intent.

One critical warning: don't enable Optimized Targeting on remarketing campaigns. It targets new users, which defeats the entire purpose of remarketing. We've seen teams accidentally flip this on and wonder why their remarketing CPAs doubled overnight.

Data-Platform Lookalikes: The Modern Playbook

The modern playbook skips ad platforms entirely for the discovery phase. Instead, you use data platforms that analyze your CRM directly and find matching companies across their database. Some platforms now accept natural-language prompts - "find companies that look like our top 10 customers" - and translate that into multi-signal queries automatically.

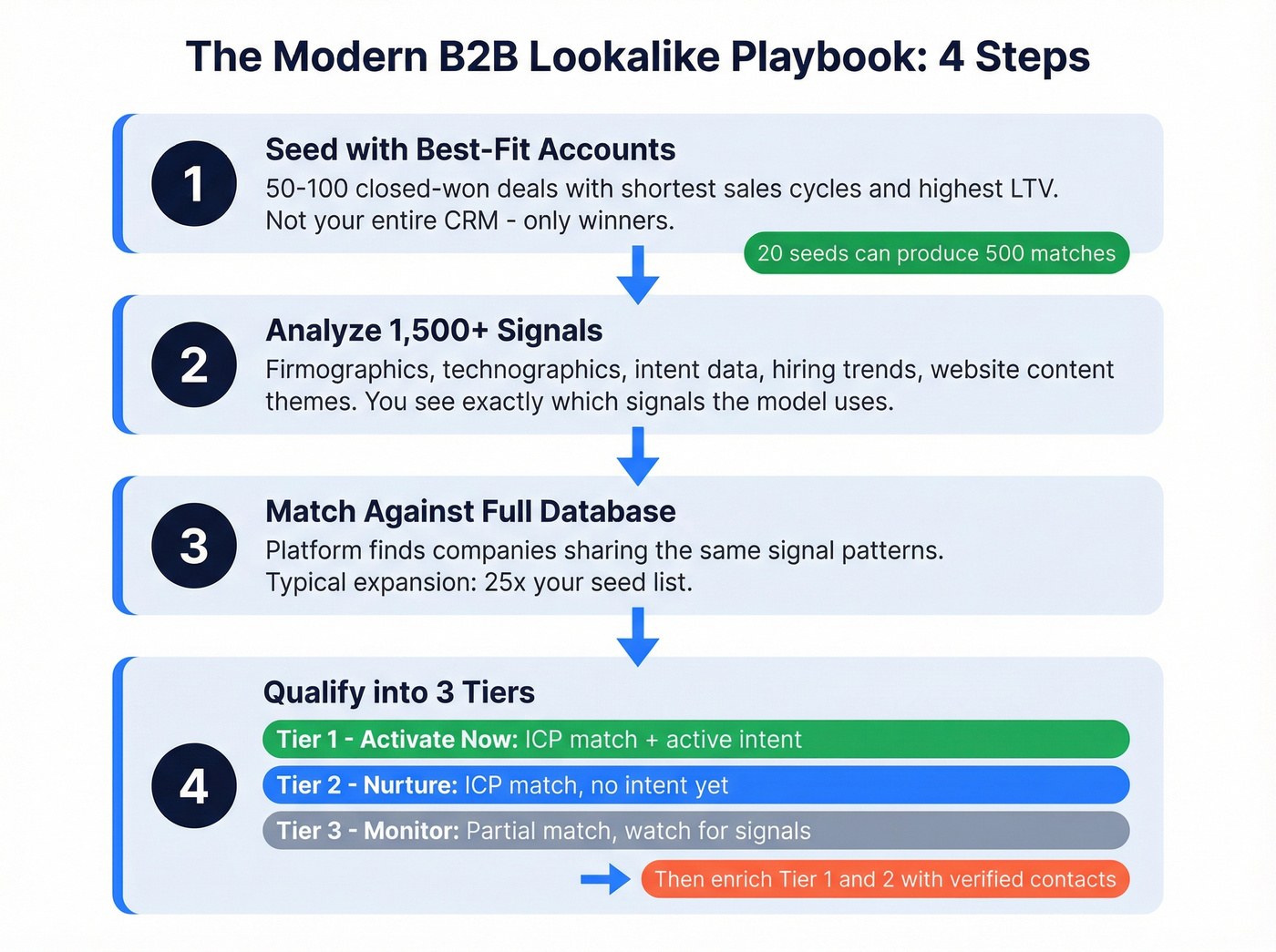

Here's the four-step framework:

Step 1: Seed with your best-fit accounts. Pull 50-100 accounts from your CRM - but not your entire customer list. Use closed-won deals with the shortest sales cycles, highest lifetime value, and expansion revenue. One documented case: a cybersecurity company used just 20 seed accounts - $250K+ deals, closed in under 12 months, attended a webinar, tech stack included CrowdStrike and Okta. That specificity matters.

Step 2: Analyze the signals that matter. Modern platforms compare 1,500+ signals across firmographics (industry, revenue, headcount), technographics (tools they use, tech migrations), intent (what they're researching), hiring trends (new roles posted), and even website content themes. This is where data-platform lookalikes crush ad-platform lookalikes - you see exactly which signals the model is using.

Step 3: Match against the full database. The platform identifies companies that share the same signal patterns as your seed list. That cybersecurity example? Twenty seed accounts produced 500 lookalike companies - a 25x expansion of the target list.

Step 4: Qualify and prioritize. Not every match is ready to buy. Use a three-tier system:

- Tier 1 (Activate now): Strong ICP match + active intent signals (researching your category, hiring for relevant roles, recent funding). These get immediate multi-threaded outreach.

- Tier 2 (Nurture): Strong ICP match but no intent signals. Add to LinkedIn ad audiences and low-touch email sequences. They'll move to Tier 1 when timing aligns.

- Tier 3 (Monitor): Partial ICP match + some intent. Worth watching, not worth spending outbound resources on yet.

Then enrich Tier 1 and Tier 2 accounts with verified contacts.

One stat that should keep you honest: about 70% of CRM data becomes outdated within a year. If you built your model six months ago and haven't refreshed it, you're working with stale inputs. Refresh quarterly, minimum.

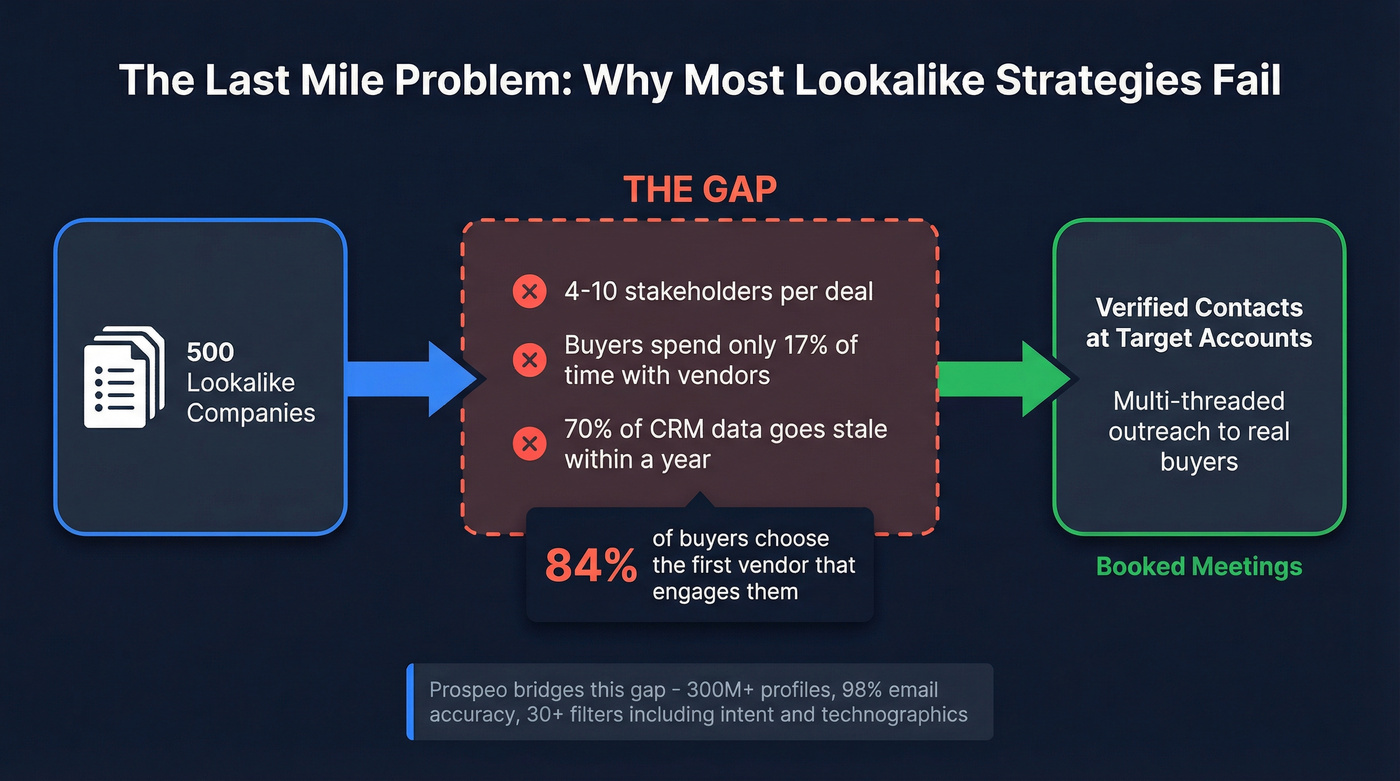

The Last Mile: From Lookalike Companies to Verified Contacts

Here's where most lookalike strategies fall apart.

You've got a beautiful list of 500 companies that match your best customers. Now what? Every lookalike tool gives you company names. None of them book meetings. B2B buying decisions involve 4-10 stakeholders, and Gartner found buyers spend only 17% of their buying time with all suppliers combined. If you're not the first to reach them with relevant outreach, you won't get a second chance - 84% of buyers go with the first vendor that engages them.

Speed matters. If your lookalike list sits in a spreadsheet for two weeks while you manually hunt for contact info, you've already lost. This is especially true for teams running cold email off modeled account lists, where deliverability depends entirely on data freshness and accuracy.

The fix is multi-threading: map 3-5 contacts per account across the buying committee. If you're selling to the VP of Sales, you also need the CRO, the RevOps lead, and the SDR manager. One thread gets ignored. Five threads create internal pressure.

And your audience needs to be portable - activating across LinkedIn ads, email sequences, and direct mail simultaneously. A company list that only works in one channel is a company list that underperforms.

Your data-platform lookalike gave you 500 target accounts. Now what? Prospeo enriches that list with verified emails, direct dials, and 50+ data points per contact - 92% match rate, refreshed every 7 days. Layer in buyer intent across 15,000 topics to prioritize who's actually in-market.

Turn lookalike accounts into pipeline for $0.01 per verified email.

Best Tools for B2B Lookalike Prospecting

| Tool | Best For | Starting Price | Key Strength | Verification |

|---|---|---|---|---|

| Prospeo | Verified contacts + enrichment | Free / ~$39/mo | 98% email accuracy + 7-day refresh | Best-in-class |

| Ocean.io | Company discovery | $59/mo | Native AI lookalike | Basic |

| Apollo.io | All-in-one | Free / $49/mo | Lookalike + sequencing | Built-in |

| Instantly | Budget outreach | $37/mo | Vector AI matching | Waterfall |

| Clay | Enrichment workflows | $149/mo | Custom AI workflows | Multi-source |

| 6sense | Enterprise ABM | ~$30K+/yr | Predictive intent | Limited |

| Demandbase | Enterprise ABM | ~$30K+/yr | Buying-group AI | Limited |

| Clearout | Budget verification | ~$20-50/mo | 99% accuracy claimed | Core product |

Prospeo - Best for Verified Contacts (and the Fastest Last Mile)

If your workflow breaks at "cool list of companies, now find the people," this is the fix. 300M+ professional profiles, 143M+ verified emails, 125M+ verified mobile numbers, and 98% email accuracy on a 7-day refresh cycle.

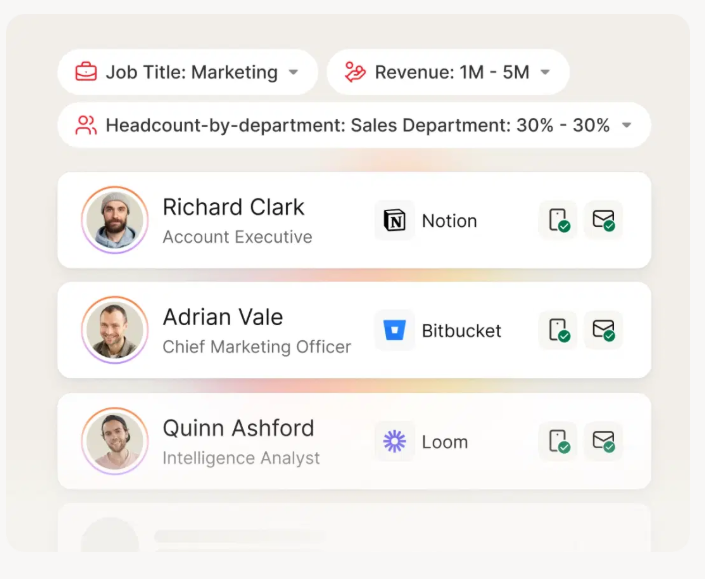

It's also built for actually operationalizing the list: 30+ search filters (including buyer intent, technographics, job change, headcount growth, department headcount, funding, revenue), CSV + CRM enrichment (83% enrichment match rate, 50+ data points per contact), and API access (92% API match rate). The free tier includes 75 emails + 100 Chrome extension credits/month, and it's self-serve with transparent pricing - no contracts, cancel anytime.

If you've been burned by bounces, Prospeo's 5-step verification includes catch-all handling, spam-trap removal, and honeypot filtering - the stuff that protects your domain reputation when you scale outbound. Real numbers from customers: Snyk cut bounce rates from 35-40% to under 5% and generated 200+ new opportunities per month across 50 AEs.

Ocean.io - Best for Dedicated Lookalike Company Discovery

Use this if: You need a purpose-built tool for finding companies that look like your best customers. Ocean.io's AI-powered lookalike filters are the core product, not an afterthought bolted onto a database.

Skip this if: You need verified contact data alongside company discovery. Ocean.io finds companies - it doesn't verify emails or direct dials at the level you need for outbound. You'll need a separate verification tool for the contact layer.

Pricing starts at $59/mo (Premium) with 21,600 annual credits, or $109/mo (Professional) for 43,200 credits. Credit consumption varies: 3 credits per verified email, 10 per phone number, 1 per company export. Integrations with HubSpot, Pipedrive, and Salesforce on the enterprise tier. GDPR compliant. The database is smaller than Apollo or ZoomInfo, but for pure lookalike company discovery, it's the most focused tool on the market.

Apollo.io - The Swiss Army Knife (With a Dull Blade or Two)

Apollo is the all-in-one play. Its 210M+ contact database, native lookalike features, and built-in sequencing mean you can go from seed list to outbound campaign without leaving the platform. Four ways to find lookalikes: from a single account page, via search filters (up to 5 seed companies), through the Chrome extension on corporate websites, or via automated Workflows that discover new similar companies weekly.

The free tier is genuinely useful for testing. Paid plans start at $49/user/mo. G2 rating: 4.7/5 from 8,900+ reviews - that's not hype, that's volume.

The tradeoff: Apollo's email accuracy doesn't match dedicated verification tools. In our experience, bounce rates run higher than what you'd get from a verification-first platform. If you're running high-volume outbound where deliverability is life or death, pair Apollo's discovery with a separate verification layer.

Instantly - Best Budget-Friendly Lookalike + Outreach

Instantly's SuperSearch covers 450M+ verified contacts and uses vector similarity, clustering, graph signals, and ensemble scoring to find lookalike companies. Surprisingly sophisticated for a tool that starts at $37/mo.

Credits only get charged for verified leads - a refreshing change from tools that burn credits on failed lookups. Growth plan at $37/mo, SuperSearch from $47/mo. G2 rating: 4.8/5.

The downside: Instantly is email-first. If you need phone numbers or deep CRM enrichment, you'll hit walls fast. And the outreach features, while solid, lack the sequencing depth of dedicated platforms like Outreach or Salesloft.

Clay - Best for Advanced Enrichment Workflows

Clay isn't a lookalike tool. It's a workflow engine that enables lookalike-style prospecting through AI research agents (Claygent), waterfall enrichment, and AI scoring. If you want to build a custom model that pulls from multiple data sources, scores accounts on your own criteria, and enriches with personalized research - Clay can do it.

The catch: the learning curve is steep. Reddit sentiment is consistent - "powerful and flexible" but the workflow handoff from discovery to CRM is clunky. One user described the Sales Nav to Clay to HubSpot pipeline as requiring manual CSV steps that ZoomInfo's Chrome extension handled in one click. Starts at $149/mo. Worth it for teams with a dedicated ops person. Frustrating for everyone else.

6sense and Demandbase - Enterprise ABM Plays

These are the heavy artillery. 6sense processes 1T+ buying signals daily through its Signalverse engine, predicting which accounts are in-market before they raise their hand. Demandbase takes a buying-group-first approach with a B2B-purpose DSP and AI-optimized bidding across the full committee.

Both run $30K-$100K+/year. Both require dedicated RevOps teams and months of implementation. And here's the frustrating reality: only 21% of marketing teams use intent data consistently. That means most companies buying these platforms aren't getting full value.

Real talk: if your average contract value is under $50K, you don't need 6sense or Demandbase. A ~$100/mo stack of Ocean.io plus a verification tool will get you 80% of the results at 0.3% of the cost. The enterprise ABM platforms are built for companies selling $200K+ deals into Fortune 2000 accounts. Everyone else is paying for capability they'll never use.

Clearout - Budget Email Verification

Clearout offers email verification (99% accuracy claimed) with 15+ search filters for basic prospecting. Chrome extension included. Credit-based pricing starts around $20-50/mo. Used by 80,000+ businesses. It's a solid budget option for verification, but the prospecting database is thin compared to dedicated platforms.

When Lookalike Audiences Don't Work

Lookalikes aren't magic. They fail in predictable ways, and knowing when not to use them saves more money than knowing when to use them.

Your TAM is under 5,000 companies. If your total addressable market fits in a spreadsheet, you don't need AI to find your audience - you need strategy. When you can identify 80-90% of your market by hand, lookalike algorithms can't outperform a focused, human-built target list. Build it manually. You'll know every account by name.

Your seed list is too small. Fewer than 50 accounts produces fuzzy, unreliable results. The algorithm doesn't have enough data points to distinguish signal from noise. I've seen teams try to build lookalikes from 15 accounts and wonder why the output looked nothing like their customers.

You're modeling off leads instead of customers. This is the most common mistake. Leads include people who downloaded a whitepaper and never responded to a single follow-up. Model on closed-won customers - specifically the ones with the shortest sales cycles and highest LTV. Those are the patterns worth replicating.

You're relying on a single data source. Firmographics alone won't cut it. Layer in technographics, intent signals, and hiring trends. A company that matches your ICP on industry and headcount but isn't actively researching your category is a cold account, not a hot prospect.

You're not refreshing. Only 5% of your market is ready to buy at any given time. The accounts that match today won't be the same accounts that match next quarter.

Best Practices for Lookalike Prospect Targeting

Seed with 50+ best-fit accounts, not your entire CRM. Your CRM includes churned customers, bad-fit deals, and accounts your sales team wishes they'd never closed. Filter ruthlessly.

Model on closed-won with shortest cycles and highest LTV. These are the deals you want to replicate. Expansion accounts - customers who upsold - are even better seed data.

Layer firmographic + technographic + intent signals. Industry and headcount alone produce generic lists. Add tech stack data, intent signals, and hiring patterns for precision.

Refresh quarterly. About 70% of CRM data goes stale within a year. Your ICP evolves as you close new deals. Rebuild the seed, re-run the model, re-verify contacts every quarter.

Verify every contact before outreach. A 23% bounce rate on your first sequence doesn't just waste emails - it damages your domain reputation. Verify with a tool that catches spam traps and honeypots, not just invalid MX records. This step is non-negotiable when you scale outbound.

Build portable audiences. Your list should activate across LinkedIn ads, email sequences, and direct mail simultaneously. A list locked inside one platform is a list that underperforms.

Allocate budget by platform performance. LinkedIn 25-35%, Google 35-45%, Bing 15-20%, Meta 5-10% - based on aggregate B2B PPC performance data across 10,000+ campaigns.

Track MQL-to-SQL, not just CPL. LinkedIn's $5.58 CPC looks expensive next to Google's $2.69. But LinkedIn's 14-18% MQL-to-SQL rate and $75K-$250K deal values make the math work. Cheap leads that don't convert are the most expensive leads you'll ever buy.

FAQ

How many seed accounts do I need for B2B lookalike modeling?

Minimum 50 accounts, ideally 100+. Use closed-won customers with the shortest sales cycles and highest lifetime value - not your entire CRM. Smaller seeds produce fuzzy, unreliable audiences that waste budget on poor-fit accounts.

Are Meta lookalike audiences still worth it for B2B?

Barely. iOS privacy changes degraded Meta's ability to distinguish professional roles from students and bots. Allocate no more than 5-10% of your B2B ad budget to Meta, and only for retargeting warm traffic from higher-intent channels - not cold lookalike campaigns.

What's a good free option for turning lookalike companies into verified contacts?

Prospeo's free tier includes 75 verified emails/month plus 100 Chrome extension credits, which is enough to validate a small batch of 25-50 accounts before you scale. For best results, export 3-5 contacts per account and verify everything to keep bounce rates under 5%.

How often should I refresh my B2B lookalike model?

Quarterly at minimum. About 70% of CRM data becomes outdated within a year, and your best-fit customer profile evolves as you close new deals. Refresh the seed list, re-run the model, and re-verify contact data each quarter to keep your targeting sharp.

The 2026 Playbook, Summarized

Lookalike audience B2B prospecting in 2026 isn't about building a 1% audience and praying. It's a repeatable system: seed with best-fit closed-won accounts, model on firmographic/technographic/intent signals, prioritize by readiness, and then move fast with verified contacts. If you can't turn matched companies into real decision-makers you can reach, the model doesn't matter.

The pipeline won't show up on its own.