Navattic vs Reprise (2026): Which Interactive Demo Platform Fits Your GTM?

Most Navattic vs Reprise comparisons start with a feature checklist and end with the wrong answer.

The real choice is demo architecture: capture, overlay, or replica. That one decision decides how long implementation takes, who owns the demo library, how "real" the product feels, and whether RevOps can turn engagement into pipeline without creating a brittle mess of one-off workflows.

I've watched teams buy the "most powerful" platform and ship nothing for a quarter because they chose a replica-first approach with zero dev bandwidth. I've also watched teams ship beautiful capture demos that convert on the website, then hit a wall in late-stage deals because they can't represent backend-driven states, permissions, or data models without rebuilding half the thing.

Pick the architecture first.

Then pick the vendor.

30-second verdict: choose Navattic, choose Reprise, or skip both

Choose Navattic if...

- You want fast time-to-value for website demos, pre-call "show me your use case" flows, and post-call leave-behinds.

- Your builders sit in marketing/PMM + enablement, not a dev-heavy presales org.

- You want a GTM-friendly admin experience. On G2, Navattic leads on key subratings: Quality of Support 9.7 vs 8.8, Ease of Admin 9.3 vs 8.4, Ease of Use 9.0 vs 8.0.

- You prefer clear pricing anchors you can budget from: Navattic's G2 pricing page shows Free, $40, $500, $1,000 plan price points.

Choose Reprise if...

- You need multiple demo modes (Replay + Reveal + Replicate) because your use cases span "website tour" through "near-sandbox realism."

- You've got real technical capacity for higher-fidelity builds, especially Replicate.

- You want enterprise security packaging that's easy for procurement: SOC 2 Type II + ISO/IEC 27001:2022, with SSO and RBAC included in every package.

Skip both if...

- Your demos get engagement, but pipeline doesn't move because you can't identify the buyer and reach them within hours.

In that case, the demo tool isn't the bottleneck. Identity, verified contacts, and routing speed are.

That's where Prospeo fits naturally: it's "The B2B data platform built for accuracy," and it's built for the moment someone engages - enrich the record, attach verified email/mobile, and get the right rep in front of the buyer while intent is still hot.

Navattic vs Reprise: side-by-side comparison (2026)

Mobile-tight, procurement-friendly, and based on how these tools behave in real GTM teams.

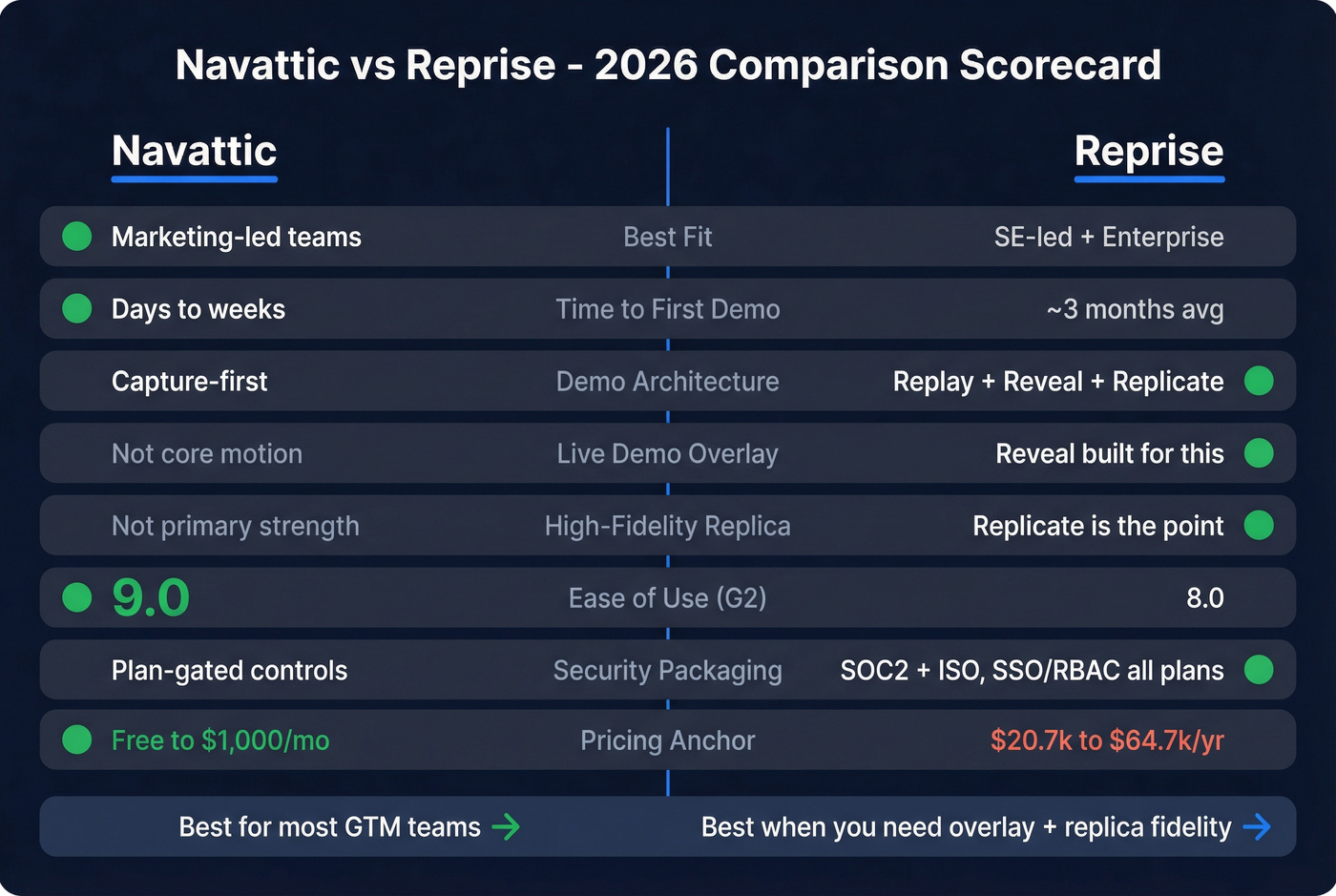

| Category | Navattic | Reprise | Winner |

|---|---|---|---|

| Best fit | Marketing-led demo program | SE-led + enterprise demo program | Navattic (most teams) |

| Demo architecture | Capture-first guided demos | Replay + Reveal + Replicate | Reprise (flexibility) |

| Time to implement | Fast if capture-first (team-driven) | 3 mo avg (G2) | Navattic |

| Who builds it | PMM/enablement-friendly | Best with technical SE/dev help | Navattic |

| Live overlay (sales) | Not the core motion | Reveal is built for this | Reprise |

| High-fidelity replica | Not the primary strength | Replicate is the point | Reprise |

| Analytics depth | Strong GTM iteration + testing | Some reviews call out analytics gaps | Navattic |

| Integrations (native) | Salesforce + HubSpot + Marketo + webhooks | Connectors (Salesforce/HubSpot/Marketo/Google Analytics) + Okta connector | Tie (different style) |

| Integrations (API) | Webhooks + ecosystem | Data API to pull data into a warehouse/lake | Reprise |

| Offline support | Enterprise: PWA offline player | Not a core focus | Navattic |

| Security packaging | Strong, but key controls can be plan-gated | SOC2+ISO; SSO/RBAC all packages | Reprise |

| Auditability | Ent: WorkOS audit logs + CSV | Enterprise-grade controls | Navattic (audit logs clarity) |

| Pricing anchor | Free-$1k (G2) | $20.7k-$64.7k/yr (Vendr) | Navattic |

My blunt take: Reprise is the better platform when you truly need overlay + replica. Navattic is the better buy for the average GTM team that wants demos live this month and maintained by non-engineers.

The real decision: what "demo type" are you buying?

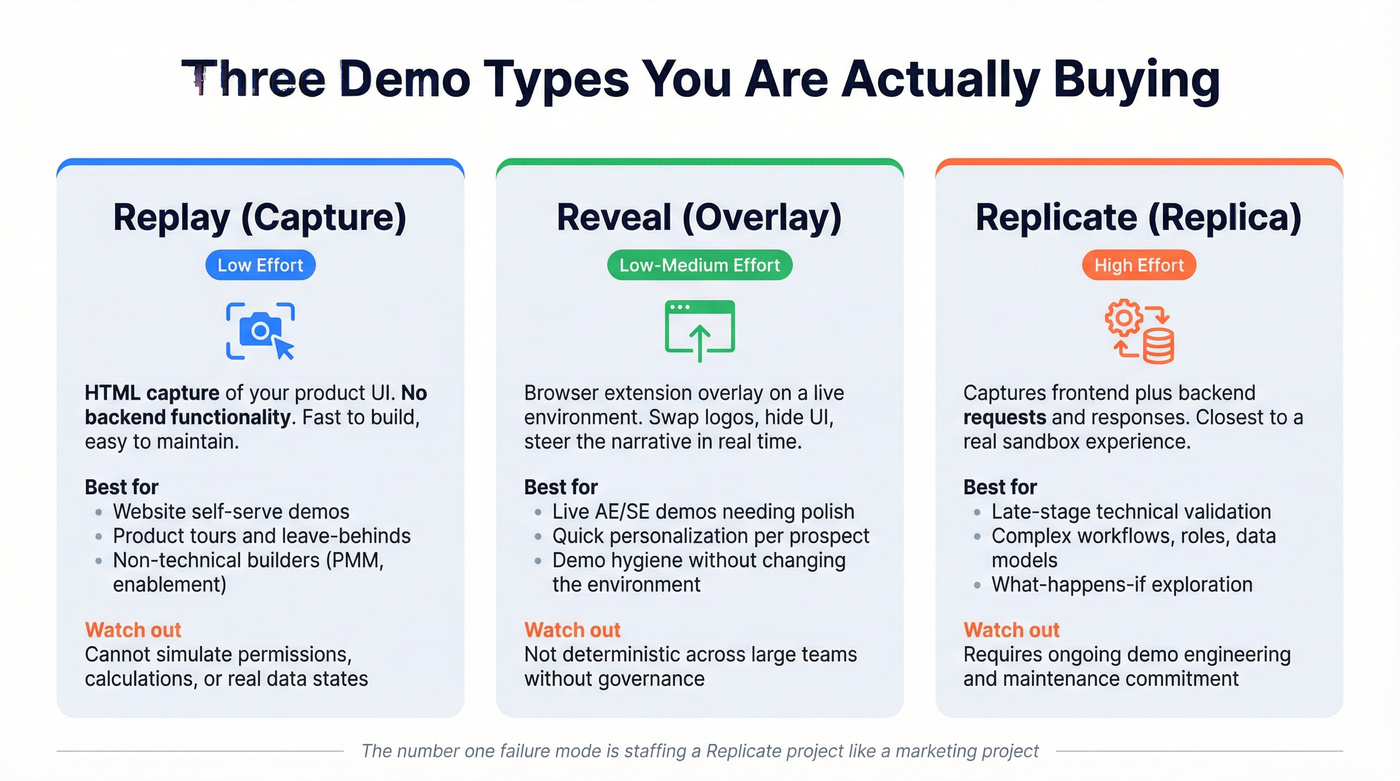

"Interactive demo" is three different products.

Reprise names the categories clearly, and it's the right mental model even if you end up buying Navattic.

Replay (capture): fast, scalable, and limited by backend reality

What it is: HTML capture of the web document (HTML/CSS) at capture time, without capturing functionality driven by web-app code.

Use it when

- You need website self-serve demos, product tours, leave-behinds, guided flows.

- You want non-technical builders producing variants by persona/industry.

- You care more about shipping than simulating every edge case.

Avoid it when

- Buyers must test permissions, calculations, complex filters, or "real data" states.

- Your sales cycle includes technical validation inside the demo itself.

Reveal (overlay): the fastest way to personalize live demos

What it is: An extension-based overlay on top of an existing environment for quick live-demo customization (hide UI, swap logos/copy, steer the narrative).

Use it when

- AEs/SEs run live demos and need consistent "demo hygiene" without changing the underlying environment.

- Personalization is mostly presentation control: "make it look like their world."

Avoid it when

- You need deterministic click paths across a large team without strict governance.

- You're trying to overlay your way into backend realism.

Replicate (replica/sandbox): closest to "real," with real upkeep

What it is: Captures the web document plus requests/responses between web app code and backend to preserve more realistic behavior. It often needs setup for auth checks and sometimes uses code snippets.

Use it when

- Late-stage deals demand "what happens if...?" exploration.

- Your product value is in workflows, roles, data models, and state changes.

Avoid it when

- You can't commit to maintenance. This becomes demo engineering, not asset creation.

Navattic or Reprise - either way, demo engagement without buyer identity is a dead end. Prospeo enriches anonymous demo viewers into actionable contacts with 98% verified emails and 125M+ direct dials, so your reps reach engaged buyers while intent is still hot.

Turn demo engagement into pipeline before your competitor's SDR even wakes up.

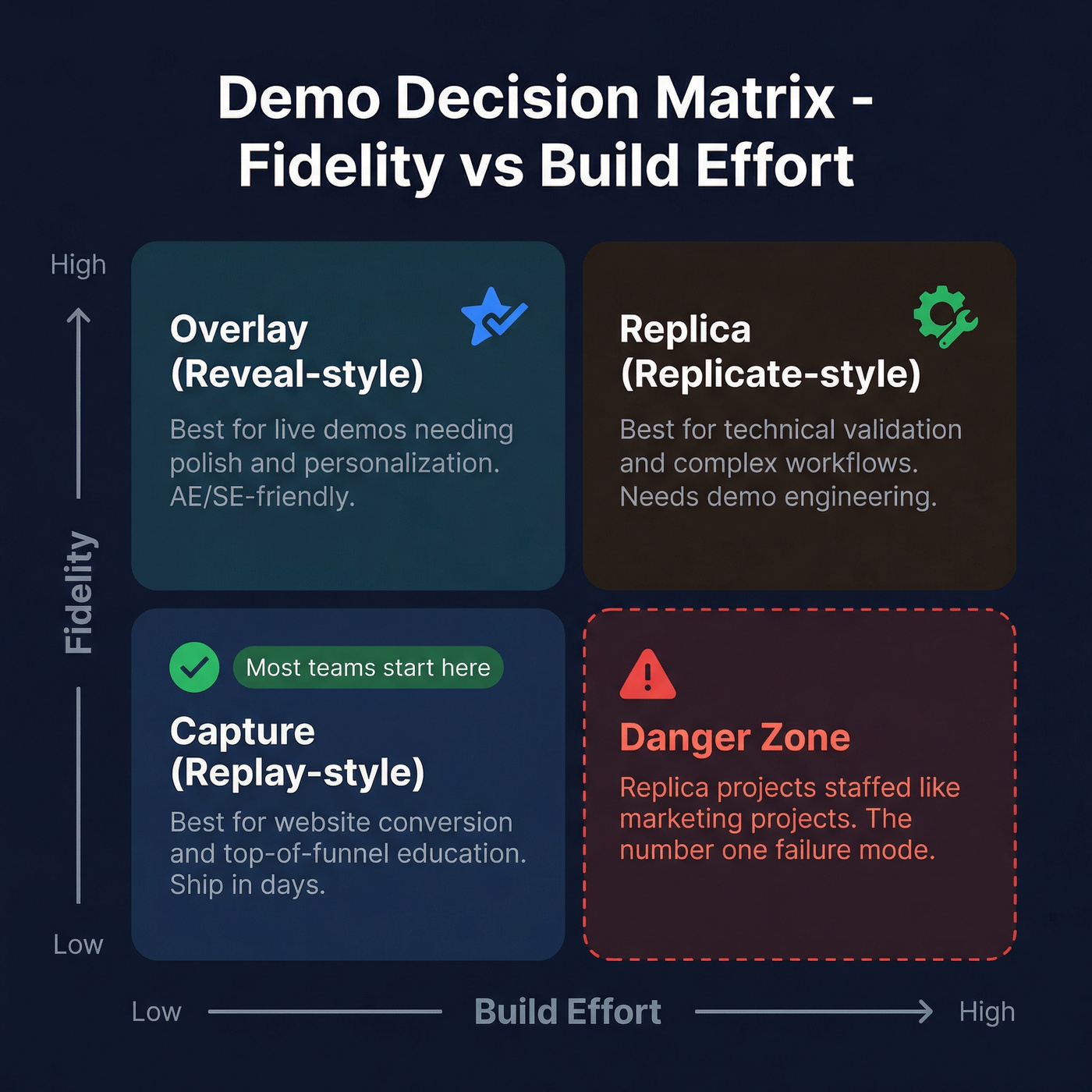

A simple decision matrix (2x2): fidelity vs build effort

If you want a fast gut-check, use this grid:

- Low effort / Low fidelity: Capture demos (Replay-style). Best for website conversion and top-of-funnel education.

- Low effort / Higher perceived fidelity: Overlays (Reveal-style). Best for live demos that need polish and personalization.

- High effort / High fidelity: Replicas (Replicate-style). Best for technical validation and complex workflows.

- High effort / Low payoff: Replica projects staffed like marketing projects. This is the #1 failure mode.

We've implemented capture-style demos with marketing teams and replica-style demos with SE-led teams; the resourcing mismatch is what kills adoption, not the software itself, and it shows up as "we'll get to it after this launch" until the quarter ends and nothing's actually live.

Implementation reality: time-to-first-demo, ownership, maintenance

Reprise's advantage (multi-mode architecture) is exactly why rollouts take longer. G2 lists Reprise's average time to implement as 3 months, which tracks when you're building a demo program with governance, environments, and ongoing upkeep across multiple teams.

Navattic ships faster when you keep the scope capture-first. I've seen teams publish a first Navattic demo in days to a couple weeks when the goal is a guided website flow and the builders sit in PMM/enablement.

Here's the thing: the tool doesn't "own" your demo program. Someone does. If you can't name the owner, you're about to buy shelfware.

Sample rollout plan (what good implementation looks like)

Week 1-2: Foundation

- Pick 1-2 core flows (not 12).

- Define the CTA: "Book a demo," "Start trial," or "Talk to sales."

- Decide gating: ungated -> soft gate -> hard gate.

Week 3-4: Program

- Build a demo library with naming conventions and owners.

- Add routing rules (alerts, tasks, sequences).

- Establish a monthly maintenance cadence tied to product releases.

Month 2-3 (Reprise-heavy builds): Fidelity

- Add overlay personalization for live demos (Reveal).

- Build one high-fidelity replica for late-stage deals (Replicate).

- Document "what breaks when the UI changes" and who fixes it.

What a great website demo looks like (patterns that convert)

- Persona routing in the first 10 seconds: "I'm in Sales / RevOps / IT" -> different paths, not just different copy.

- One primary CTA, always visible: sticky "Book time" or "Get pricing," not a scavenger hunt.

- Gate at the moment of value: don't gate the first screen; gate after the "aha" step (for example, after they complete a workflow or hit a key dashboard).

- Calendar embed after intent: embed scheduling only after they finish the path or click a high-intent step, otherwise you're asking for a meeting before you've earned it.

Integrations & RevOps: where demo data turns into pipeline (or dies)

Demo platforms don't fail because they can't build a demo. They fail because engagement data never becomes an action.

Quick integration map (compressed)

| Destination | Navattic | Reprise |

|---|---|---|

| Salesforce | Leads/Contacts/Accounts engagement sync | Connector + custom via API |

| HubSpot | Contacts/Companies engagement sync | Connector + custom via API |

| Marketo | Program-level sync | Connector |

| Warehouse | Via webhooks/Segment-style patterns | Data API lane (pull into a warehouse/lake) |

| Identity/SSO | Plan-based | SSO included in every package; Okta connector available |

Navattic is straightforward when you want engagement attached to CRM objects quickly. Reprise is strong when RevOps already runs a warehouse-first event pipeline and wants full control downstream.

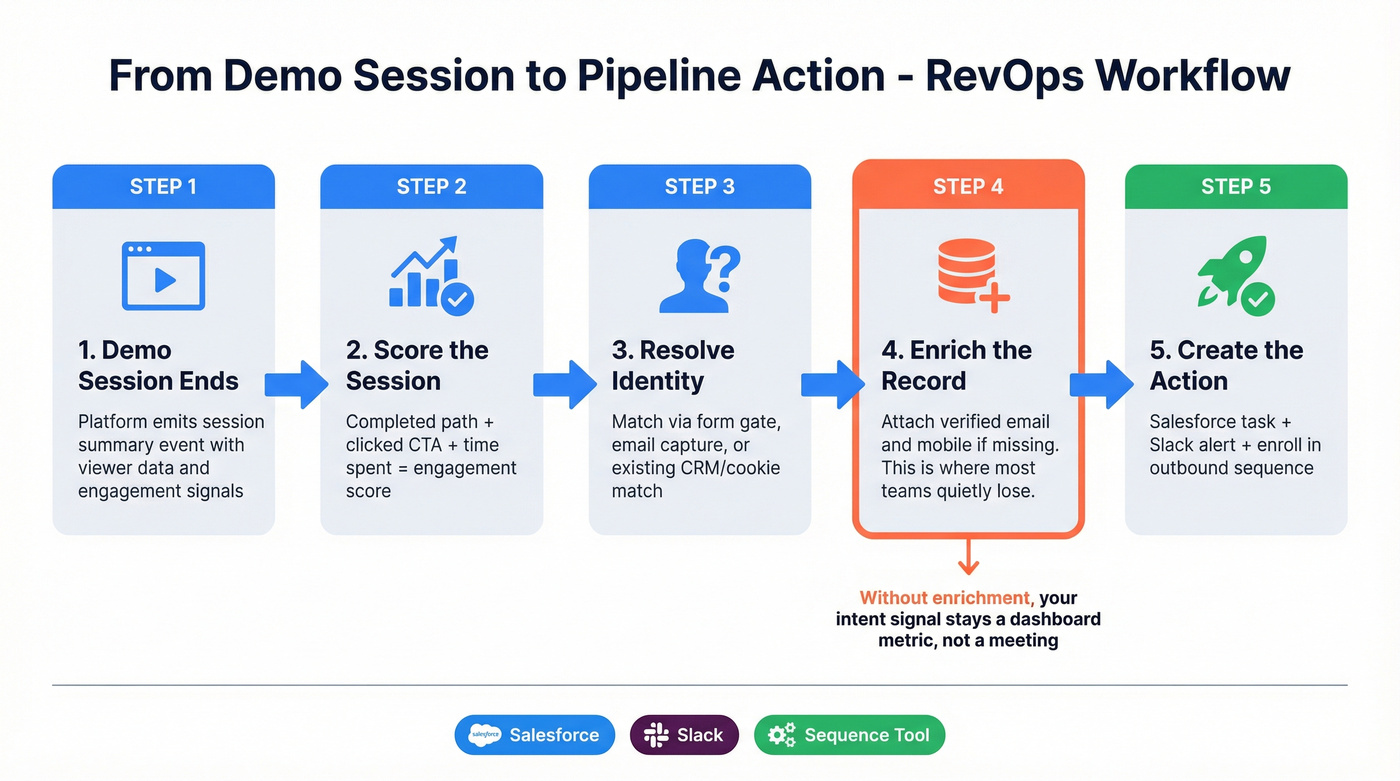

Concrete RevOps workflow example (session-close -> score -> enrich -> task)

A workflow that actually gets used looks like this:

- Demo session ends (platform emits a session summary event).

- Score the session (completed path + clicked CTA + time spent).

- Resolve identity (form gate, email capture, or existing cookie/CRM match).

- Enrich the record (attach verified email/mobile if missing).

- Create the action: Salesforce task + Slack alert + enroll in sequence.

Real talk: step 4 is where a lot of teams quietly lose. If you can't reliably attach a real person to the session, your "intent signal" stays a dashboard metric instead of becoming a meeting.

The webhook nuance that changes your RevOps plan

Navattic webhooks fire when a visitor session is marked closed, and the payload includes the session plus a list of recorded events. That's great for scoring after the session, not for streaming click-by-click automation.

Tiny pseudo-example (shape only):

{

"session": {

"id": "sess_123",

"closed_at": "2026-02-17T14:22:09Z",

"contact": { "email": null },

"company": { "domain": "example.com" }

},

"events": [

{ "type": "step_viewed", "step": "Dashboard" },

{ "type": "cta_clicked", "cta": "Book a demo" }

]

}

If you want fast outreach, design for session summary scoring and trigger actions immediately on close. It's cleaner, more reliable, and easier to debug at 4:30pm on a Friday.

Security & governance: procurement-grade checklist (with plan gates)

This section decides deals in regulated industries. Don't wait until legal's already annoyed.

SSO + SCIM (what to ask, specifically)

Reprise SSO specifics

- Supports SP-initiated SAML 2.0

- Required SAML attributes: email, first_name, last_name

- Setup requires Support enablement and IdP configuration details

Ask both vendors

- Do you support SCIM for automated provisioning/deprovisioning?

- Is SCIM included in the plan you're buying, or gated to Enterprise?

- Can you enforce SSO-only login and session timeouts?

CDN publishing (a detail procurement actually cares about)

Reprise publishes demos via a dedicated global CDN, which matters for performance, reliability, and security controls around content delivery, especially when demos are embedded on high-traffic pages and you need predictable load behavior.

Audit logs (Navattic's implementation is refreshingly concrete)

Navattic Audit Logs are Enterprise-only, and they're auditor-friendly:

- Access via Settings > Audit Logs

- Opens an Admin Portal powered by WorkOS

- Filter by Actor, Action, Date

- CSV export supported

Offline demos (events teams care; everyone else forgets until it hurts)

Navattic offline is a real differentiator for events:

- Enterprise-only

- Download demos and run via an Offline Player

- Can be installed as a PWA offline player for kiosks and unreliable Wi-Fi

If you don't do events, skip this whole feature and don't pay for it.

Data retention + deletion (don't skip this)

Ask both vendors:

- Event/session retention period (default + configurable)

- Deletion SLAs for end-user data

- Whether demo content and analytics are stored separately

- Export options if you churn (raw events vs aggregated reports)

Subprocessors transparency (year clarity)

Navattic publishes a subprocessor list; the page shows it was last updated Jul 24, 2026. That single page can save weeks of procurement back-and-forth.

For Reprise, ask for the subprocessor list, DPA, and retention/deletion policy during security review.

Mini checklist you can paste into a questionnaire:

| Control | Navattic | Reprise |

|---|---|---|

| SOC 2 | Ask in security pack | SOC 2 Type II |

| ISO 27001 | Ask in security pack | ISO/IEC 27001:2022 |

| SSO | Plan-based | All packages |

| RBAC | Plan-based | All packages |

| Audit logs | Enterprise (WorkOS + CSV) | Enterprise-grade |

| Offline mode | Enterprise (PWA player) | Not core focus |

| CDN publishing | Standard web delivery | Dedicated global CDN |

Pricing: what you'll actually pay in 2026 (and why)

These tools live in different pricing universes.

Budget anchors (quick)

- Navattic: G2 shows plan price points at Free, $40, $500, $1,000.

- Reprise: Quote-based. Vendr benchmarks show $20,700-$64,706/year, with a median $31,438/year.

Navattic: published tiers + the "real contract" sanity check

Navattic's G2 tiers map cleanly to how GTM teams buy:

- Starter (Free), Starter Plus ($40), Base ($500), Growth ($1,000), then Enterprise

Vendr also reports a Navattic median contract value of $8,000/year (directional). That lines up with what we see: teams outgrow the entry tiers once they add seats, advanced analytics, SSO, or enterprise governance, and the "cheap tool" becomes a real line item once it's mission-critical.

Reprise: what's included in the platform fee (packaging signal)

Reprise's pricing model is "annual platform fee + per-user licenses." The platform includes (as described on their pricing page):

- Full Application Cloning

- Unlimited Guided Demos

- Unlimited AI Data Injection

- Enterprise-Grade Security & Access

- Analytics

- Integrations

That packaging makes sense if you're building a serious demo program across teams and use cases, and you're willing to pay for breadth so you don't end up stitching together three tools and calling it a strategy.

What actually drives cost (the stuff that changes your quote)

- Number of builders (PMM-only vs every SE vs every AE)

- Number of products/environments

- Fidelity level (capture vs overlay vs replica)

- Security gates (SSO, RBAC, audit logs, offline)

- Services (implementation, program design, ongoing maintenance)

Hot take: for smaller deal sizes and a "show the workflow, book the call" motion, you don't need replica-level complexity. Ship a great capture demo, route the signal, and move on.

Analytics & personalization: where each platform actually wins

This is where the "easy vs enterprise" stereotype breaks down.

Navattic: better for GTM iteration

Navattic shines when the goal is conversion and iteration:

- A/B testing for demo variants (message, CTA, flow)

- Strong library + governance for GTM teams shipping weekly

- Practical engagement signals that map cleanly into CRM objects for routing and follow-up

Common sentiment you'll hear from teams using it: non-technical builders can publish and maintain demos quickly, and the program doesn't collapse the moment one technical person goes on vacation.

Reprise: better for realism and sophisticated personalization

Reprise's standout is Data Studio: it injects synthetic/custom datasets into a live app or dedicated demo environment so charts and dashboards look like "their data," not lorem ipsum. For vertical demos, this is the difference between "cool tour" and "this was built for us."

Another pattern we've seen: teams love the power once they invest in it, but the learning curve is real beyond the basics, and larger, more complex demos can introduce performance and maintenance work you should plan for upfront.

Commissioned ROI data (useful, with the right skepticism)

A Forrester Consulting TEI study commissioned by Reprise (shared via PRNewswire) reports 323% ROI over three years for a composite customer, with $1.01M NPV, a 60% pipeline conversion improvement, and a 20% reduction in sales engineering involvement. Commissioned studies aren't gospel, but the mechanism is real: interactive demos pay off when they reduce SE load and increase conversion, not when they're treated like a fancy landing page.

Final recommendation: 4 scenarios that decide this fast

1) You need website self-serve demos live this quarter

Buy Navattic. It's built for shipping fast, iterating often, and letting marketing own the program without begging engineering.

2) You need live overlay customization for sales

Buy Reprise. If Reveal-style overlays are central to your sales motion, Reprise is the cleanest fit.

3) You need a true sandbox replica for late-stage deals

Buy Reprise, and staff it like an implementation because it is one. The 3-month benchmark is a feature, not a bug, when you're building high-fidelity evaluation experiences.

4) You sell at trade shows / events with bad Wi-Fi

Buy Navattic Enterprise for the PWA offline player workflow. Offline that isn't contractually guaranteed becomes a day-one disaster at the booth.

If neither fits, pick based on your motion (not the logo): Arcade for brand-forward micro-demos, Supademo for fast PLG tours, Consensus for SE-led demo rooms and buyer enablement.

You spent months picking the right demo platform. Don't lose pipeline because you can't identify who watched it. Prospeo's enrichment API returns 50+ data points per contact at 92% match rate - plug it into HubSpot or Salesforce and route demo-engaged leads to reps in minutes.

Stop debating demo tools. Start converting the buyers already watching.

FAQ

Is Navattic or Reprise better for website self-serve demos?

Navattic's usually the better pick for self-serve website demos because marketing teams can publish in days to a couple weeks, iterate with A/B tests, and keep ownership without heavy engineering. Reprise can do it too, but it's typically chosen when you also need overlay or replica builds.

How long does Reprise take to implement?

G2 lists Reprise at 3 months average to implement, which is realistic when you're rolling out governance plus higher-fidelity modes like overlay and replica. You can still ship simpler capture-style assets earlier, but the full program tends to take a quarter to stabilize.

Does Navattic support offline demos for events?

Yes. Navattic supports offline demos on the Enterprise plan via an Offline Player, including a PWA offline player option for kiosks and unreliable venue Wi-Fi. If events are a core channel, get offline access confirmed in the contract before you commit.

What should I pair with either tool to convert demo engagement into meetings?

If follow-up is the bottleneck, pair your demo platform with a verified enrichment layer. Prospeo's a strong fit here: 98% email accuracy, 125M+ verified mobile numbers with a 30% pickup rate, and a 7-day refresh cycle so you can enrich engaged accounts fast and route them to the right rep within hours.

Summary: the fastest way to decide

If you're stuck in Navattic vs Reprise mode, stop debating "features" and decide your demo architecture first: capture for speed, overlay for live personalization, replica for late-stage realism. Then match the vendor to your resourcing and governance reality.

And if engagement isn't turning into meetings, fix identity and routing with verified enrichment before you blame the demo platform.