B2B SaaS Lead Generation in 2026: A Measurable Pipeline Playbook

B2B SaaS lead generation isn't "more leads" anymore. It's predictable conversations with the right accounts, at a cost your unit economics can survive.

Hot take: if your ACV's under $10k, you don't need a fancy "full-funnel engine." You need one clean conversion path and one reliable way to start conversations. Then you scale.

Most teams don't fail because they picked the wrong channel. They fail because they never define what a lead is, they never fix the MQL-to-SQL leak, and they keep feeding sales a queue full of junk.

What you need (quick version)

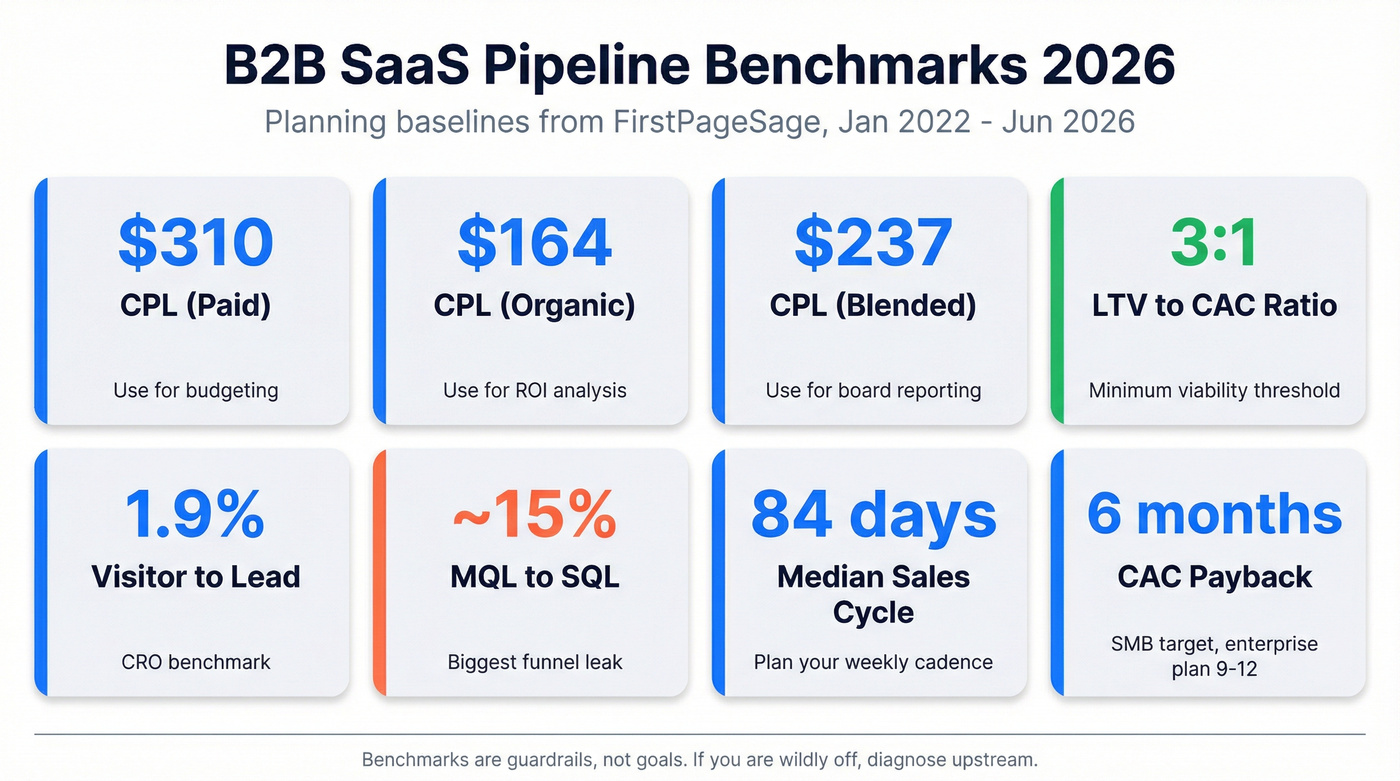

Baseline targets (so you don't argue feelings):

- CPL baseline: $310 paid / $164 organic / $237 blended

- Biggest funnel bottleneck: MQL→SQL ~15%

- Outbound deliverability guardrails: bounces <2%, spam complaints <0.3%

Do this first (Week 1-2):

- Pick one ICP you can describe in one sentence + one disqualifier.

- Define MQL as high-intent (demo/pricing/contact intent), not "downloaded an ebook."

- Set a single "lead" definition: a direct connection with an interested prospect (email/phone/intro).

- Instrument the funnel in your CRM (HubSpot or Salesforce): Lead → MQL → SQL → Opp → Closed.

Then this (Week 3-12):

- Pick 2 channels max and run them weekly (one compounding, one capture).

- Fix list quality before scaling outbound: verify + enrich contacts so bounces stay under 2%.

- Use tools like Prospeo, "The B2B data platform built for accuracy," to verify and enrich before you scale outbound volume so your sequences stay deliverable as you ramp.

Lead gen vs demand gen (and what "a lead" is in 2026)

Demand gen creates awareness and preference. Lead gen creates a measurable next step you can route, work, and convert.

In 2026, the cleanest way to stop internal debates is to separate:

- Demand signals: impressions, clicks, time on page, webinar attendance, product usage.

- Leads: a direct connection with an interested prospect you can follow up with.

That lead definition matters because it forces discipline. The definition I use (and the one FirstPageSage popularized) is simple: a lead is a direct connection with a prospect interested in purchasing (email, phone, or an intro). That's not "they saw an ad," and it's not "they downloaded a PDF."

If your "lead" can't be contacted, routed, and worked inside 24-48 hours, it's not a lead.

It's a metric.

Benchmarks for B2B SaaS pipeline: what "good" costs and converts

Benchmarks aren't goals. They're guardrails. If you're wildly off, something upstream's broken: targeting, offer, data quality, conversion path, or sales follow-up.

These CPL benchmarks come from FirstPageSage's dataset collected Jan 2022-Jun 2026 (updated May 8, 2026). They define CPL as gross marketing cost per lead - not cost per click, and not cost per MQL.

Table A - Planning baselines (use these to budget and diagnose)

| Metric | Baseline | Use it for |

|---|---|---|

| CPL (Paid) | $310 | Budget |

| CPL (Organic) | $164 | ROI |

| CPL (Blended) | $237 | Board |

| CAC (Organic) | $205 | Mix |

| CAC (Inorganic) | $341 | Discipline |

| CAC (Combined) | $239 | Planning |

| LTV:CAC | 3:1 | Viability |

| CAC payback | 6 months | Cash |

| Visitor→Lead | 1.9% | CRO |

| Lead→Customer | 1.5-2.5% | Reality |

| MQL→SQL | ~15% | Leak |

How to use this table without lying to yourself

- Don't compare your "lead" to their "lead" unless the definition matches. If you count webinar registrants and ebook downloads as leads, your CPL will look "great" and your pipeline will look terrible.

- Pick the benchmark that matches your motion. A PLG funnel can tolerate higher top-of-funnel CPL if activation's strong; a sales-led motion can't.

- Use benchmarks as a trigger, not a verdict. If you're off, diagnose (offer, targeting, conversion path, follow-up). Don't just turn the budget up.

Table B - Sales execution targets (use these to run the week)

| Metric | Target | Use it for |

|---|---|---|

| MQL speed-to-lead | <5 minutes (in-hours) | SLA |

| SQL→Opp | 25-30% | Discovery |

| Win rate | 20-30% | Forecast |

| Sales cycle (median) | ~84 days | Cadence |

Direct stance on payback (no hand-waving):

- If you're SMB/self-serve, a 6-month payback's achievable and worth pushing for.

- If you sell into procurement-heavy mid-market/enterprise, plan 9-12 months and stop pretending your funnel should behave like a $99/mo product.

What to do when you're off benchmark

- Paid CPL is high: tighten keywords and audiences, improve landing page intent match, and stop sending "pricing" clicks to generic pages.

- Visitor→Lead is low (<1%): fix the page before you buy more traffic. More traffic just makes the problem louder.

- Lead→Customer is low (<1.5%): you don't have a lead gen problem - you've got a qualification, routing, or sales process problem.

- MQL→SQL is low (<15%): your MQL definition's inflated, your speed-to-lead is slow, or your data's messy enough that sales doesn't trust the queue.

FirstPageSage publishes the underlying CPL table in their "average cost per lead by industry" report. For CAC context, HubSpot's CPL/CAC benchmark summary (updated Feb 28, 2026) is still a useful sanity check: https://blog.hubspot.com/marketing/2022-cpl-and-cac-benchmarks

That MQL→SQL leak sitting at 15%? Stale contacts and bad emails are the silent killer. Prospeo's 7-day data refresh and 98% email accuracy keep bounces under 2% so sales actually trusts the queue marketing hands them.

Stop rewriting sequences when the real problem is your data.

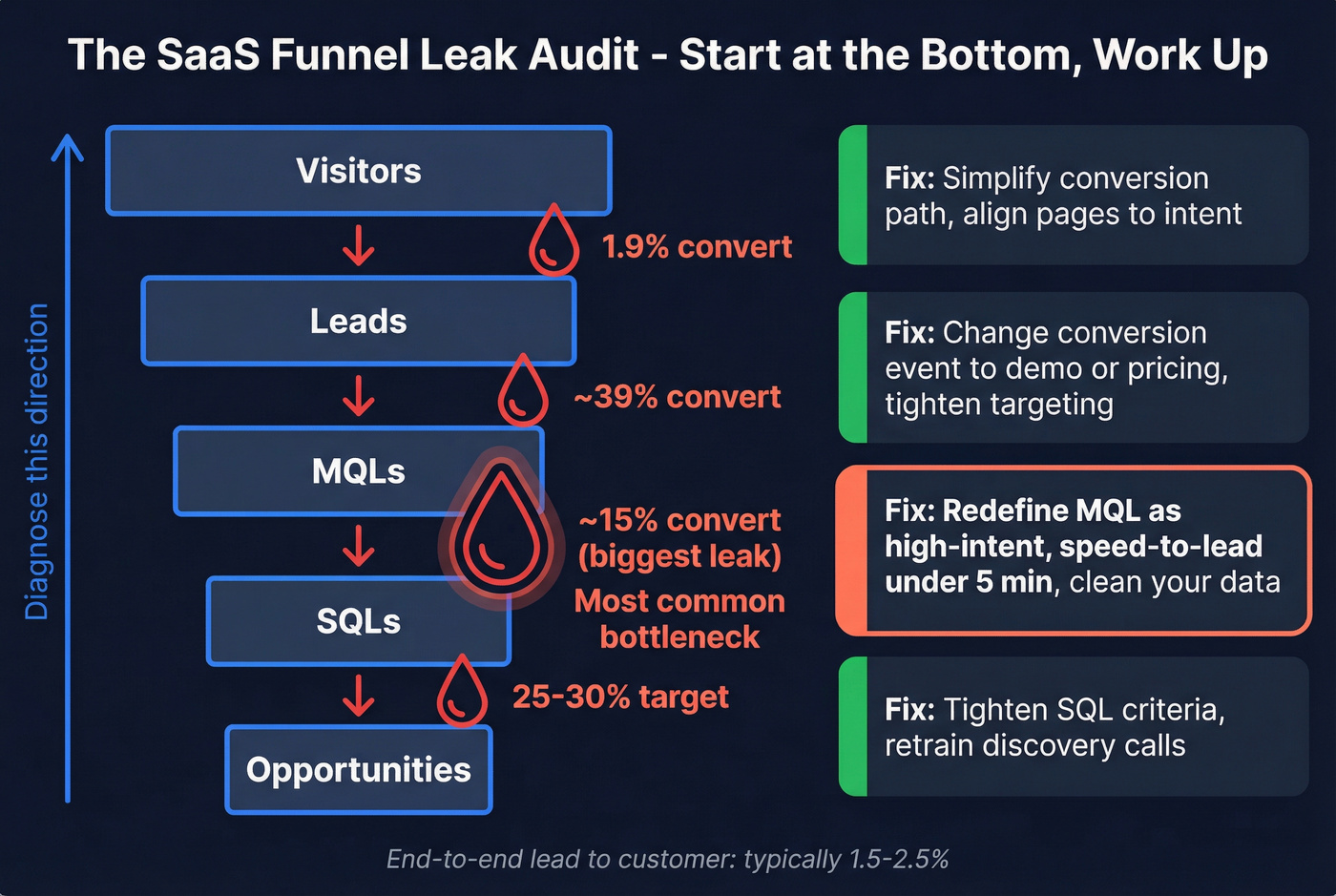

The SaaS funnel leak audit (where lead gen actually breaks)

Most teams spend 80% of their time at the top of the funnel because it's the easiest place to create activity.

The money's made by fixing leaks.

The leak audit (diagnostic)

Start at the bottom and work up:

1) If SQL→Opp is low (target 25-30%)

- Your SQL definition's too loose, or discovery's weak.

- Fix: tighten SQL criteria (problem + authority + urgency), retrain discovery, improve routing.

2) If MQL→SQL is low (baseline ~15%)

- This is the most common bottleneck.

- Fix: redefine MQL as high-intent, improve speed-to-lead, and stop feeding sales junk.

3) If Lead→MQL is low (baseline ~39%)

- Your leads aren't actually leads. They're students, competitors, bad-fit, or "content tourists."

- Fix: change the conversion event (demo/pricing/contact), add qualification, tighten targeting.

4) If Visitor→Lead is low (baseline 1.9%)

- Your site's not converting, or you're driving the wrong traffic.

- Fix: simplify the path to conversion, align pages to intent, improve proof and CTA.

Decision tree (what to do next)

- Visitor→Lead <1%? Fix landing pages + intent alignment before buying more traffic.

- Sanity check: end-to-end lead→customer is typically 1.5-2.5% - if you're below that, stop buying more top-of-funnel.

- Lead→Customer <1.5%? Fix qualification + sales process before you chase volume.

- MQL→SQL stuck around 10-15%? Treat it like a systems issue: definition, routing, speed, and data quality.

Bad data quietly destroys MQL→SQL. I've watched teams rewrite sequences for months when the real issue was simple: the list was stale, bounces crept up, inbox placement slid, and sales stopped trusting anything marketing handed them.

Look, that's a brutal way to waste a quarter.

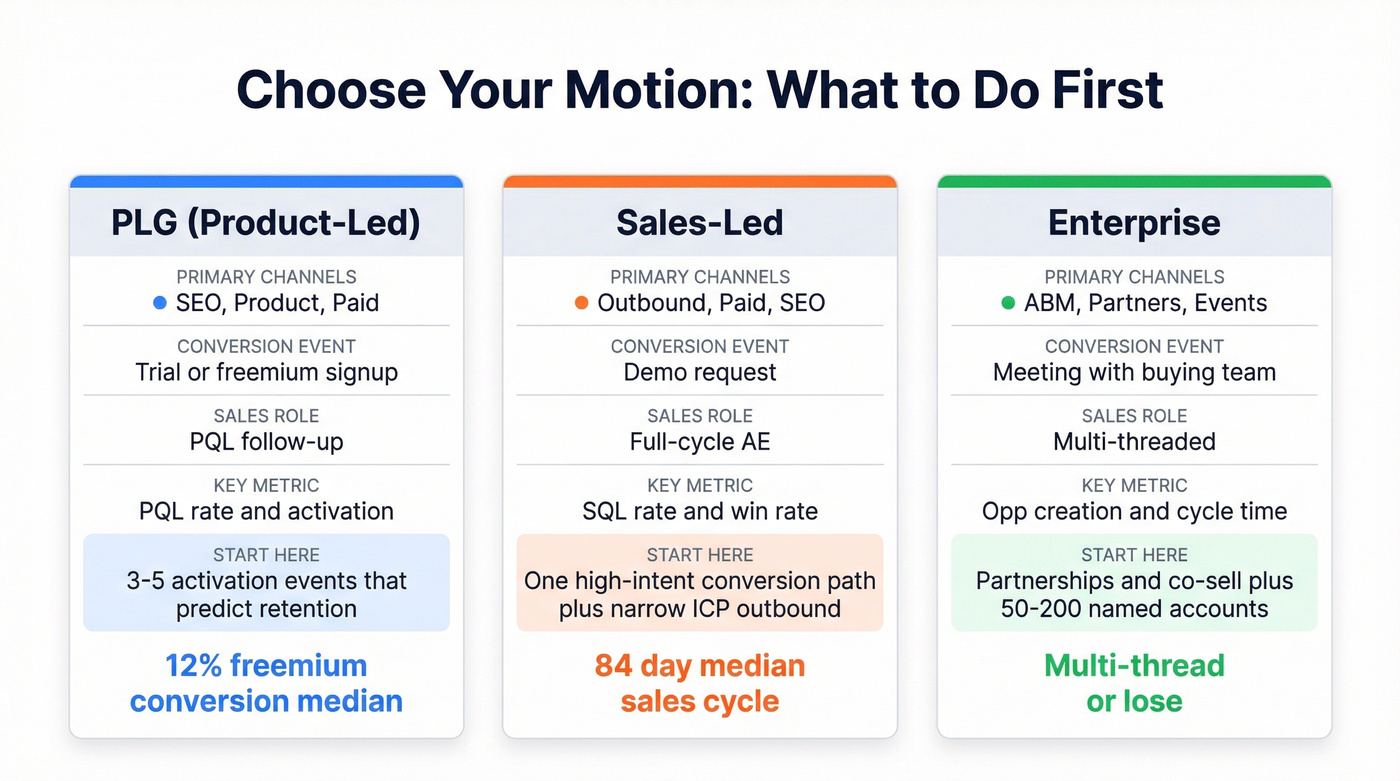

Choose your motion: PLG vs sales-led vs enterprise (what to do first)

You can't run the same playbook for a PLG product and an enterprise platform with security reviews. You'll create noise and call it "pipeline."

PLG is mainstream: 58% of B2B SaaS companies report a PLG motion. But PLG doesn't mean "no sales." It means product usage becomes the primary lead engine, and sales engages on signals.

Motion comparison table (what to prioritize)

| Motion | Primary channels | Conversion event | Sales role | KPIs that matter |

|---|---|---|---|---|

| PLG | SEO, product, paid | Trial/freemium use | PQL follow-up | PQL rate, activation |

| Sales-led | Outbound, paid, SEO | Demo request | Full-cycle | SQL rate, win rate |

| Enterprise | ABM, partners, events | Meeting w/ buying team | Multi-thread | Opp creation, cycle |

Start-here playbooks

If you're PLG (trial or freemium):

- Freemium visitor conversion median: 12%

- Free-to-paid averages ~9%

- PQL adoption is only ~25%, but PQLs convert 3x better

Start with:

- 3-5 activation events that correlate with retention.

- A PQL definition sales can action (not "logged in twice").

- Lifecycle emails + in-app prompts before you scale paid.

If you're sales-led (demo-driven):

Start with:

- One high-intent conversion path (demo/pricing/contact).

- Outbound to a narrow ICP with a tight offer.

- Paid search for bottom-funnel keywords you can actually afford.

If you're enterprise (security + procurement reality):

Start with:

- Partnerships and co-sell motions (fastest warm path).

- Webinars and "trust content" (risk frameworks, implementation plans).

- ABM-lite: 50-200 named accounts, multi-threaded outreach.

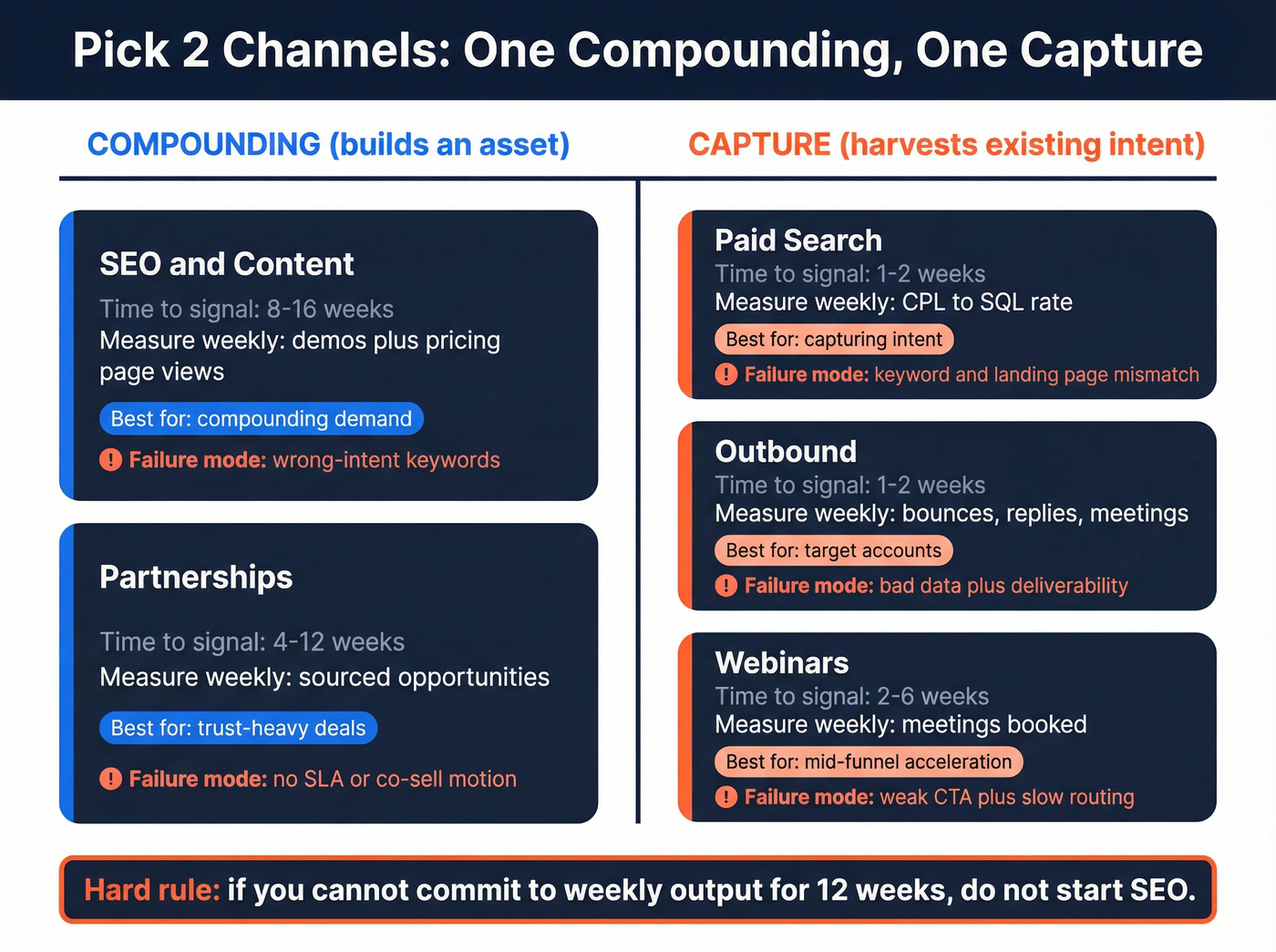

B2B SaaS lead generation channel playbooks (pick 2, run weekly)

Pick two channels: one compounding (builds an asset) and one capture (harvests existing intent). If you try to run five channels at once, you'll do all of them badly.

Digital Bloom's funnel-by-channel view is the right mental model: PPC can drive volume but often converts worse at the top (they show 0.7% visitor→lead for PPC vs 2.1% for SEO, and webinars around 2.2%). They also peg the median sales cycle at 84 days, which is why weekly cadence matters - you're stacking weeks to create pipeline months later, not chasing daily dopamine.

Channel selection table (use this to choose fast)

| Channel | Best for | Time to signal | Typical failure mode | What to measure weekly |

|---|---|---|---|---|

| SEO/content | Compounding demand | 8-16 weeks | wrong intent keywords | demos + pricing views |

| Paid search | Capture intent | 1-2 weeks | keyword/LP mismatch | CPL → SQL rate |

| Outbound | Target accounts | 1-2 weeks | deliverability + bad data | bounces, replies, meetings |

| Webinars | Mid-funnel accel | 2-6 weeks | weak CTA + slow routing | meetings booked |

| Partnerships | Trust-heavy deals | 4-12 weeks | no SLA / no co-sell motion | sourced opps |

Hard call: if you can't commit to weekly output for 12 weeks, don't start SEO. You'll ship half-assets, never refresh them, and then complain SEO "doesn't work."

SEO & content (12-month compounding channel)

SEO's still the best "asset" channel in SaaS because it compounds.

Across 500+ SaaS companies, average organic traffic growth runs +24% YoY. Position 1 still pulls about 27.6% CTR, which is why ranking #1 for a money keyword can change your quarter.

Two 2026 realities teams hate hearing:

- It takes 6-12 months to reach stable rankings.

- AI Overviews compress clicks on a chunk of informational queries. If your content doesn't create a reason to click (proof, screenshots, pricing context, a strong POV), you'll "rank" and still lose traffic.

What works in practice:

- Build a "money page" cluster: 1 core landing page + 6-12 supporting pages that answer buyer questions.

- Refresh your top pages every 6-12 months (new screenshots, new benchmarks, new objections).

- Treat "demo request" and "pricing view" as the conversion events, not newsletter signups.

Tooling (keep it simple): Ahrefs or Semrush for keyword research and content gap analysis. Ahrefs starts at $129/month; Semrush plans are commonly in the ~$140-$250/month range for small teams, and go up from there.

Paid search (capture intent without burning CAC)

Paid search is where you buy existing intent. It's also where you can light money on fire with the wrong keyword set.

WordStream's cross-industry benchmark puts average Google Ads CTR at 6.66%. Use it as an "is my account broken?" check, not a promise.

Planning ranges I use for B2B SaaS non-brand search:

- Conversion rate (click→lead): 2-5%

- CPL: $150-$400 depending on category competitiveness and landing page quality

Rules that keep CAC sane:

- Separate brand, competitor, and non-brand intent campaigns. Don't blend them.

- Start with bottom-funnel intent: "pricing," "alternatives," "comparison," "software," "platform," "vendor."

- Build landing pages that match the keyword's job-to-be-done (don't send "pricing" clicks to a generic homepage).

Budget signal: most teams need $3k-$10k/mo to get signal without waiting forever.

Paid social (don't buy noise - buy defined intent)

Paid social is where B2B teams accidentally buy "engagement" instead of pipeline.

HockeyStack's dataset across 70+ B2B SaaS companies (with $28M spend) shows CTR around 0.82-0.96% and CPC around $10.48-$15.72. If you're seeing 0.2% CTR and $30 CPC, your targeting or creative's off.

The bigger point is their conversion standard: count high-intent actions - demo requests, pricing intent, contact intent - whether that happens on-site or via a form. Don't count generic gated content as MQLs.

Hard call: if your MQL definition includes ebooks, you don't have MQLs. You've got subscribers. Treat them like a nurture list, not a sales queue.

Budget signal: plan $5k-$20k/mo to learn anything. Below that, you're mostly buying anecdotes.

Webinars & virtual events (mid-funnel accelerator)

Webinars work when you treat them like a pipeline event, not a content project.

ON24 benchmarks:

- 57% registration→attendance

- 51 minutes average engagement

- 216 average attendees

- 3x increase in meeting bookings during webinars

Goldcast's benchmark report covers 19,531 webinars across 418 brands. Webinars aren't dead. The winners just route faster and repurpose harder.

Use-case format (when webinars are worth it)

- Run webinars if you sell something that needs trust + education (security, data, finance, infra, compliance).

- Skip webinars if your team can't commit to same-day routing. A webinar lead that sits for a week is a wasted event.

What works:

- Pick one painful topic ("how this fails," "implementation timeline," "ROI math") and invite a credible partner or customer.

- Offer a clear next step: "book a working session," not "contact sales."

- Route attendees by intent: asked a question, clicked CTA, stayed 40+ minutes.

Tooling: ON24 is typically enterprise-priced. Zoom Webinars is typically a lower-cost option with pricing that scales by capacity and add-ons.

Partnerships (especially for regulated/enterprise)

If you're in regulated categories (fintech, security, healthcare IT), partnerships are often the fastest path to warm pipeline because trust's the bottleneck.

Start small:

- 5 target partners with overlapping ICP.

- One co-marketed webinar or checklist.

- A simple referral SLA (what qualifies, how you route, how you follow up).

Budget signal: partnerships cost time more than cash. Expect $0-$5k/mo in hard costs early, plus someone owning it.

Two underrated channels that beat "more content"

1) Dark social & DMs (operationalized, not vibes) People buy after private conversations: communities, group chats, DMs, forwarded links. You can't attribute it cleanly, but you can run it like a system:

- Put one forwardable asset behind every campaign (a checklist, teardown, ROI calculator).

- Add a "How did you hear about us?" field with pre-filled options (community, friend, Slack group, DM).

- Route replies like leads: if they ask a question or request a template, that's a lead - work it inside 24-48 hours.

2) Feature request → lead capture loop (product-led without pretending) Your roadmap's a lead engine if you stop treating feature requests as support tickets.

- Add a "request a feature" form that asks: company size, use case, timeline, and "happy to talk?"

- Tag requests by segment and trigger a follow-up when you ship (or when you need design partners).

- Count a lead only when there's a direct conversation (email/phone/meeting), not when someone clicks "submit."

Outbound for B2B SaaS lead generation in 2026 (checklist + sequencing)

Outbound still works. Bad outbound doesn't.

Here's the concrete observation that ends the debate: in our tests, campaigns that kept bounces under 2% consistently beat "better copy" campaigns running 4-6% bounces - reply rates were higher, and domain health stayed stable.

Hard call: if your bounce rate's >2%, stop outbound immediately. Fix the list and infrastructure first. Copy changes are wasted.

Outbound pre-flight checklist (non-negotiables)

Deliverability guardrails

- Bounces: <2%

- Spam complaints: <0.3%

- Authenticate domains: SPF/DKIM/DMARC

- Ramp volume gradually (don't 10x overnight)

Performance targets

- Good reply rate: 5-10%

- Follow-ups add 40-50% more replies

- Email length: 50-125 words (best band is often 50-75)

Sequence structure (simple and effective)

- Day 1: Email 1 (problem + relevance + ask)

- Day 3: Follow-up (new angle, same ask)

- Day 7: Follow-up (proof point + soft CTA)

- Day 12: Breakup (permission + next step)

Execution tools: Lemlist or Instantly are solid for sequencing. Typical pricing is ~$50-$150/user/mo depending on features and volume.

Domain setup + ramp checklist (the part nobody wants to do)

If you skip this, you'll spend the next month diagnosing ghosts.

- Use a dedicated outbound domain (or subdomain) and keep it consistent.

- Set SPF/DKIM/DMARC on day one.

- Warm volume like a grown-up: start low, increase weekly, and keep daily sends stable.

- Keep your first two weeks boring: tight ICP, short copy, clean lists. You're training reputation.

List hygiene SOP (weekly, not "when it breaks")

This is the operating system behind outbound. Run it every week.

Weekly cadence

- Pull new prospects (only from your current ICP + triggers).

- Verify emails before any send.

- Enrich + normalize key fields (company, title, domain, region, employee count).

- Dedupe across CRM + sequencer + spreadsheets.

- Suppress risky contacts and anyone who opted out.

- Export to sequencer with consistent naming + campaign tags.

- Post-send cleanup: add bounces/complaints/unsubs to suppression lists.

Dedupe rules (simple and strict)

- Primary key: email (if present).

- Secondary key: domain + full name.

- If two records conflict, keep the one with the most recent verification/enrichment timestamp.

Suppression lists you need

- Unsubscribes (global).

- Hard bounces (global).

- Spam complaints (global).

- Existing customers + open opportunities (global).

- Role-based addresses (info@, support@) unless your product truly sells there.

Catch-all handling

- Treat catch-all domains as higher risk.

- Only send to catch-all addresses if they pass verification and you've got a strong trigger.

- Keep catch-all volume low until you see stable inbox placement.

The one outbound step teams skip: verify + enrich before you send

If you want bounces under 2%, you can't "hope" your list is clean.

Prospeo's built for this exact workflow: 300M+ professional profiles, 143M+ verified emails, and 125M+ verified mobile numbers, with 98% verified email accuracy and a 7-day refresh cycle (the industry average is about 6 weeks). That combo matters because deliverability problems usually aren't dramatic - they're slow and quiet - and once your domains are cooked, you're stuck digging out for weeks while pipeline dries up.

If you want a concrete scenario: an SDR team pulls 5,000 contacts for a new segment, loads them into a sequencer, and starts sending the next morning. Week one looks "fine" until bounces hit 3-4%, replies drop, and suddenly every meeting's coming from the one rep who cherry-picks accounts manually. The fix isn't a new opener. It's verifying and enriching before the first send, deduping against the CRM, and refreshing the segment weekly so you're not emailing yesterday's org chart.

The triage order when replies drop (don't touch copy first)

When reply rates dip, the internet tells you to rewrite your opener.

Don't.

Use this order:

- Wait 72 hours before changing copy (you need enough sends to judge).

- Check inbox placement first (not opens).

- If bounce rate is 2-3%, fix the list before anything else.

- If you increased volume recently, roll it back.

- Break out performance by mailbox/provider instead of averaging everything together.

If reply rate's under 1%, it's infrastructure and deliverability. If positive replies are under 5%, it's offer and positioning.

Copy + personalization that moves replies (after the basics are clean)

Benchmarks that hold up:

- Personalized emails get 2x replies (GMass)

- 50-75 words tends to perform best (BuiltForB2B shows 50-75 words at 12% response vs 200+ words at 2%)

A template that's hard to mess up (keep it under 125 words):

Subject: quick question about {{trigger}}

Hey {{first}}, saw {{signal}} at {{company}}.

Teams in {{peer group}} usually hit {{pain}} when {{context}}.

We help them {{outcome}} in {{timeframe}} without {{common risk}}.

Worth a 15-min working session next week to see if it's relevant?

Personalization doesn't mean "I saw you went to UCLA." It means "you're dealing with this situation right now."

Measurement that matters (stop reporting vanity leads)

If your dashboard's "leads, clicks, MQLs," you're going to optimize for garbage.

Your KPI stack should mirror the funnel and force quality.

KPI dashboard checklist (RevOps-friendly)

Acquisition

- Spend by channel

- CPL by channel (paid/organic/blended)

- Visitor→lead (site conversion)

Quality

- MQL rate (lead→MQL)

- MQL→SQL (target 15%)

- SQL→Opp (target 25-30%)

Revenue

- Win rate (target 20-30% overall)

- CAC and payback (plan 6 months SMB; 9-12 procurement-heavy)

- LTV:CAC (target 3:1)

Attribution

- Use position-based 40/40/20 (first touch / last touch / middle) so you don't over-credit retargeting.

Tooling price signals (so you can plan):

- HubSpot: Starter tiers are typically low hundreds/month; Pro is commonly $800+/mo once you add seats and automation.

- Salesforce: expect mid-to-high hundreds per user/month in real-world setups once you include add-ons and admin overhead.

The 90-day B2B SaaS lead gen plan (week-by-week cadence)

This is the cadence I'd run if I had to build pipeline fast without creating a mess.

Weeks 1-2: Foundation (definitions + instrumentation)

- Lock ICP + disqualifier.

- Define Lead, MQL, SQL, and (if PLG) PQL.

- Set benchmark targets: CPL ($310 paid / $164 organic / $237 blended), CAC ($239 combined), payback (6 months SMB; 9-12 enterprise).

- Build a simple funnel dashboard in HubSpot or Salesforce.

Weeks 3-4: Pick 2 channels + ship the first iteration

- Pick 2 channels:

- One compounding: SEO/content or partnerships

- One capture: paid search, outbound, or webinars

- Launch 2-3 landing pages tied to intent.

- If outbound's one of your two channels: verify and enrich your list before the first send, then refresh weekly so bounces stay <2%.

Weeks 5-8: Run weekly, fix leaks, don't channel-hop

- Weekly channel cadence (publish, launch, send, partner, webinar - whatever you chose).

- Weekly funnel review: where did conversion drop?

- Tighten MQL definition until MQL→SQL moves toward ~15%.

- If webinars are in your mix, use the baseline: 57% attendance and route high-intent attendees within 24 hours.

Weeks 9-12: Scale what's working (and only what's working)

- Increase spend/volume only on the channel that produces SQLs at acceptable CAC.

- Add one additional segment (not five).

- Standardize handoffs and SLAs (speed-to-lead, routing rules, follow-up).

I've watched teams hit a wall because they scaled outbound volume before they had list hygiene and routing nailed. Clean inputs create clean outputs, and the boring operational stuff is what keeps your "lead gen engine" from turning into a weekly fire drill.

You need bounces under 2% and spam complaints under 0.3% before you scale outbound. Prospeo enriches and verifies contacts across 300M+ profiles at $0.01/email - so your sequences stay deliverable as you ramp from Week 3 to Week 12.

Build the pipeline playbook on data that won't wreck your domain.

FAQ

What's a "good" CPL for B2B SaaS lead generation in 2026?

A good CPL baseline is $310 paid, $164 organic, and $237 blended, assuming a lead is a direct, contactable conversation and it converts downstream. If your CPL is lower but MQL→SQL is under ~15%, you're usually buying cheap noise or routing junk to sales.

What's the biggest bottleneck in the B2B SaaS funnel?

The biggest bottleneck is typically MQL→SQL at ~15%, because teams inflate MQLs and sales stops trusting the queue. Fix it by redefining MQLs as demo/pricing/contact intent, enforcing a <5-minute speed-to-lead SLA, and cleaning duplicates and bad-fit records before SDRs see them.

What bounce rate is too high for cold email?

Anything above 2% is too high and a deliverability red flag; 2-3% means pause scaling and fix list quality immediately. Keep spam complaints under 0.3%, roll back volume if you spiked sends, and verify addresses before launch so you don't burn domain reputation.

What's a good free alternative to ZoomInfo for outbound prospecting?

For most teams, Prospeo's the best free starting point because it includes 75 email credits + 100 extension credits/month, with 98% verified email accuracy and a 7-day data refresh (no contracts). Other common options are Apollo's free tier and Hunter's free plan, but freshness and verification depth vary.

Conclusion: build a system, not a pile of tactics

If you want B2B SaaS lead generation to feel predictable in 2026, stop chasing "more leads" and start running a measurable system: one clear lead definition, benchmark guardrails, two channels you can execute weekly, and ruthless leak-fixing (especially MQL→SQL and data hygiene).

Clean inputs, fast routing, and consistent cadence beat clever campaigns every time.