Price Increase Email Best Practices (2026): A Complete Playbook

Most price increase emails fail for three boring reasons: they surprise people, they confuse people, or they make it weirdly hard to do the obvious thing (downgrade, switch billing, or cancel).

Your customers usually aren't rage-quitting over an extra $10-20/month. They churn because they feel blindsided or trapped.

Here's the angle that works in 2026: treat this like a billing notice, not a campaign. Keep it crisp, show the math immediately, and give people a clean set of options.

The minimum viable checklist (don't overthink it)

- Put the math up front: old price -> new price + effective date (line 1-2)

- State scope: who's impacted (plan/billing cycle) + who isn't

- Use a defensible notice window: default 60 days; 30 days minimum

- Offer a fair choice set: annual lock, downgrade path, transition credit, or classic opt-out (if bundling)

- Make cancellation easy: same channel as signup; no hoops

- Run deliverability like revenue: monitored sender, separate transactional subdomain, SPF/DKIM/DMARC

- Segment the send: legacy vs current, monthly vs annual, discounted vs full price, high-risk accounts (account segmentation)

- Staff the first 48 hours: fast replies, escalation rules, save offers pre-approved

One email isn't a rollout.

Why price increase emails backfire (and how to stop it)

Backlash usually isn't about the dollars. It's about the story customers tell themselves: "They're squeezing me because they can."

I've seen teams do a perfectly reasonable increase and still get torched because the email read like marketing copy, the effective date was buried, and the only "option" was "pay more."

Look, people don't want a brand narrative. They want a receipt-style notice with choices.

Common failure patterns show up everywhere:

- Sticker shock: Rackspace customers saw mailbox pricing jump from $1.20 to $6 per mailbox (about 400%) and the reaction was immediate.

- "Again?" fatigue: QuickBooks threads read like a loop; customers stop debating your roadmap and start shopping alternatives when increases feel constant.

- Forced bundles: Office 365 users called out a move from EUR69.99/year to EUR99.99/year (about 42%) tied to AI bundling. The thing that calms people down is simple: a classic option that doesn't force the bundle.

Two lines you'll see in your inbox if you mess this up:

- "I didn't even see the email - then I got charged."

- "If it's so great, why can't I opt out?"

What not to do:

- Don't bury the math.

- Don't pretend it's "exciting innovation" if it's a pricing move.

- Don't force bundles without an opt-out.

- Don't treat one email as the whole plan.

Price increase email best practices you can't skip

You're not writing marketing copy. You're sending a billing notice that has to survive legal scrutiny, inbox filters, and an annoyed customer reading on mobile in 12 seconds.

1) Put old -> new price + effective date in the first two lines

Example: "Your Pro plan changes from $49/mo to $59/mo on April 1, 2026."

If that line isn't visible without scrolling on mobile, rewrite it.

2) Say who it applies to (and who it doesn't)

Example: "Applies to Pro monthly. Annual plans renew at current pricing until renewal."

3) Separate "what changes" from "what stays the same"

Example: "Features and limits stay the same. Only the rate changes."

4) Give a one-sentence reason (no corporate poetry)

Good: "We expanded support coverage and infrastructure."

Bad: "To continue delivering world-class innovation..."

5) One clear action path + one human fallback

Example: "Manage plan: /billing" + "Reply to this email with questions."

6) Offer a fair choice set

Annual lock, downgrade path, transition credit, classic opt-out (for bundles). If you don't offer choices, you're basically asking for angry replies.

7) Use a real deadline that matches billing reality

Example: "To avoid the new price, cancel by March 25, 2026."

8) Make cancellation as easy as signup

If signup was self-serve online, cancellation can't require a phone call. This is where companies get themselves into trouble, and it's also where customers decide you're not trustworthy.

9) Route high-value accounts like you mean it

Named sender, escalation path, and procurement-friendly paperwork. A generic "Billing Team" inbox with a 72-hour SLA is how you turn a calm account into a churn story.

Clarity beats persuasion.

Billing math clarity (proration + invoice transparency)

If you want fewer angry tickets, show the billing math before the charge happens. Not after.

Include:

- Next charge date: "Your next charge at the new rate is May 3, 2026."

- Proration rule (one line): "If you change plans mid-cycle, we prorate the difference on your next invoice."

- Invoice line item example: "Plan price adjustment (May 3-Jun 2): +$10.00"

- Downgrade timing: "Downgrades before April 1 apply immediately; your April invoice reflects the lower tier."

That one paragraph saves your support team from a week of "explain the invoice" tickets, and it lowers chargeback risk because customers can see the math before money moves.

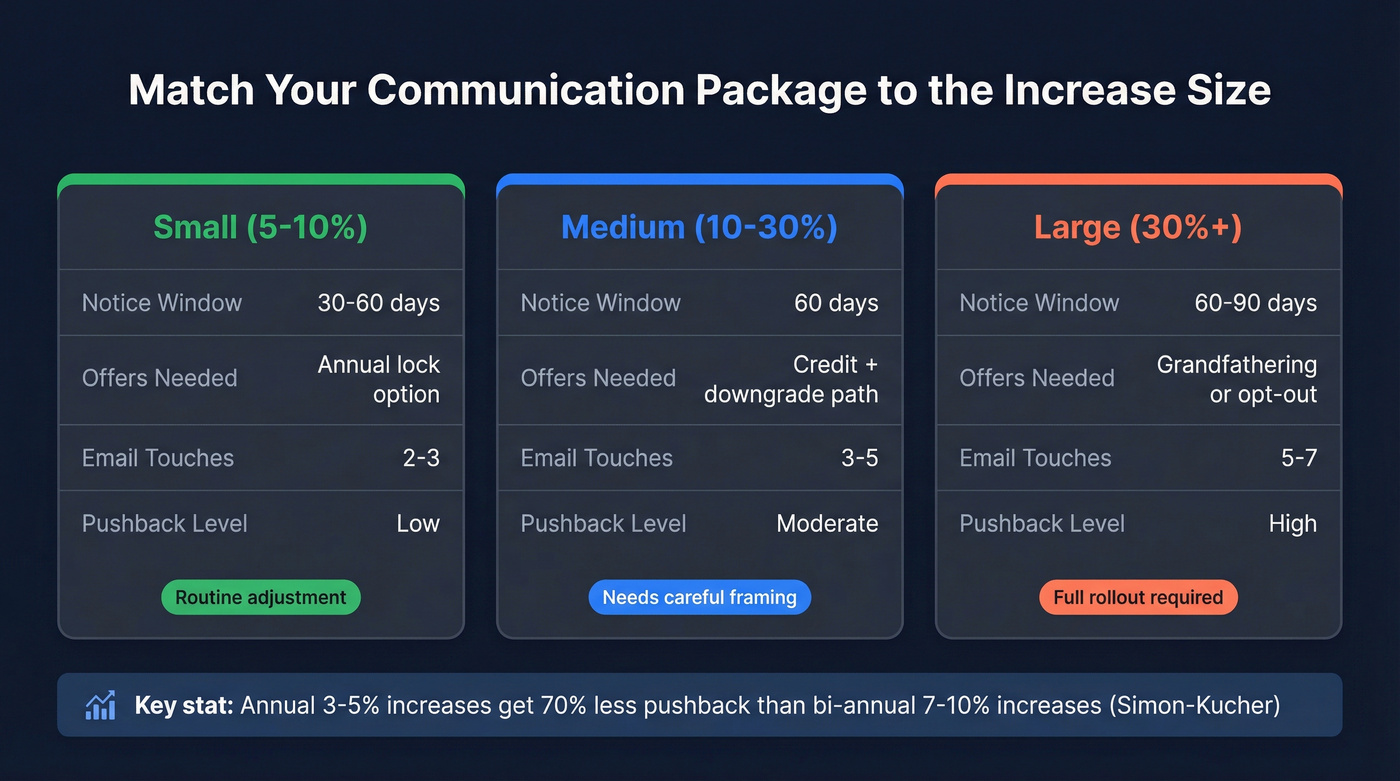

Decide your communication package by increase size

Treating a 6% adjustment like a 45% hike creates panic. Treating a 45% hike like a routine update creates a revolt.

Monetizely, citing Simon-Kucher, found a clear pattern: annual 3-5% increases get 70% less pushback than bi-annual 7-10% increases.

| Increase size | Notice window | Offers needed | Cadence |

|---|---|---|---|

| Small (5-10%) | 30-60 days | Annual option | 2-3 touches |

| Medium (10-30%) | 60 days | Credit + downgrade path | 3-5 touches |

| Large (30%+) | 60-90 days | Grandfathering or opt-out | 5-7 touches |

Operator ranges (these swing with list health and how transactional your billing stream is):

- Billing notice open rate target: 55-75%

- Reply rate expectation: 1-5% (higher usually means confusion or anger)

Your price increase email is useless if it bounces. Bad contact data means customers get blindsided by a charge they never saw coming - and you eat the churn. Prospeo's 98% verified email accuracy and 7-day refresh cycle ensure your billing notices reach the right inbox, every time.

Stop losing customers to emails that never arrived.

Notice periods and sequencing (one email isn't a rollout)

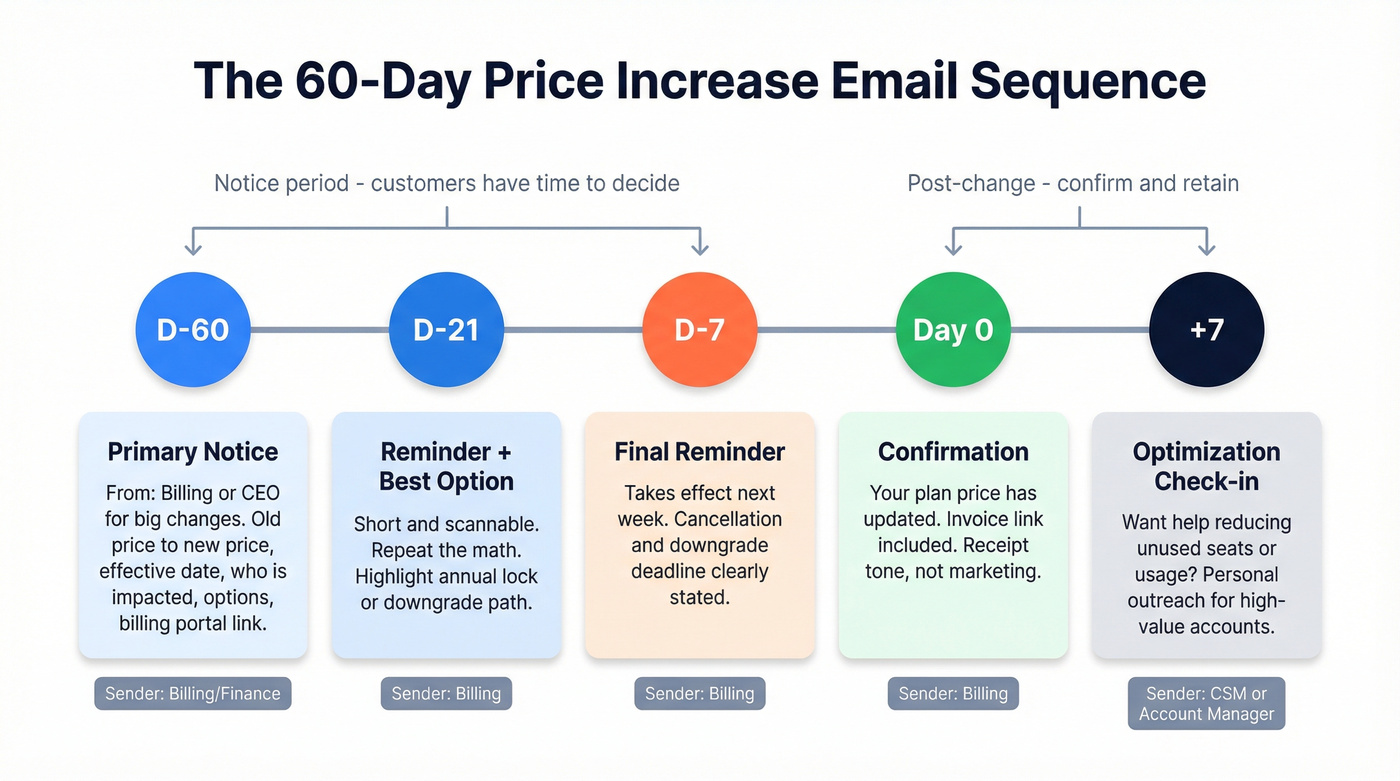

Default to 60-day notice. It's the cleanest operationally and the easiest to defend later if someone complains. 30 days is the minimum that doesn't feel like a gotcha.

Use this sequencing, and be intentional about the sender:

D-60: Primary notice (from Billing/Finance; CEO if it's a large hike or packaging change) Old -> new price, effective date, who's impacted, options, billing portal link

D-21: Reminder + best "keep cost flat" option (from Billing) Short, scannable, repeats the math and highlights annual lock or downgrade

D-7: Final reminder (from Billing) "Takes effect next week" + cancellation/downgrade deadline

Day-of: Confirmation (from Billing, receipt tone) "Your plan price has updated" + invoice link

+7: Optimization check-in (from CSM/AM for high-value accounts) "Want help reducing unused seats/usage?"

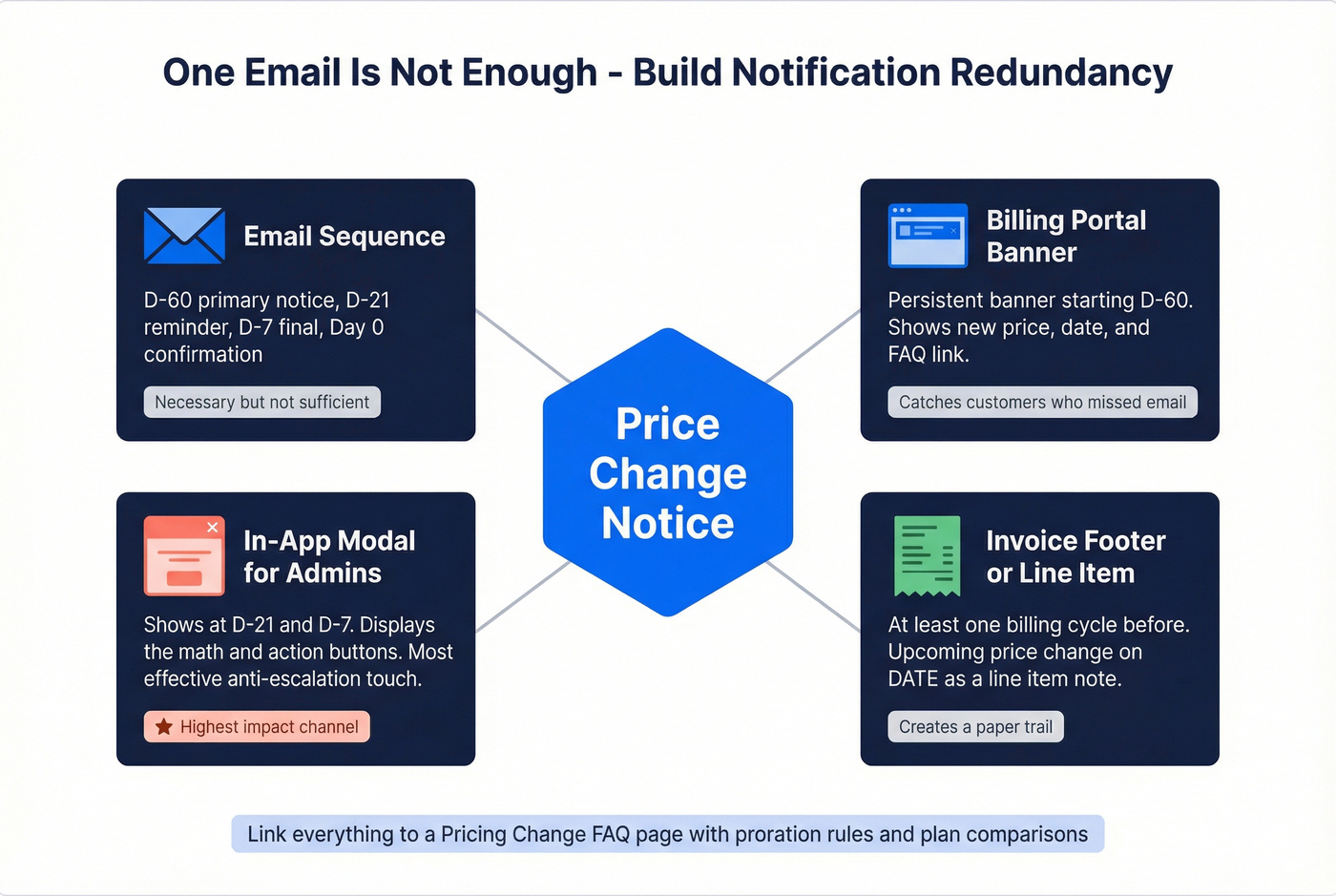

Redundancy: mirror the notice in-app and on invoices

Email is necessary. It's not sufficient.

The best teams assume some customers won't see the email (spam, forwarding, old admin address) and build redundancy.

Mirror the notice in:

- Billing portal banner (starting D-60): "Price changes to $X on DATE" + link to FAQ

- In-app modal for admins (D-21 and D-7): show the math and the action buttons

- Invoice footer / line-item note (at least one billing cycle before): "Upcoming price change on DATE"

- Pricing-change FAQ page linked everywhere (email, app, invoices) with proration rules and plan comparisons

In our experience, the single most effective "anti-escalation" touch is an in-app banner about a week before the first invoice at the new rate. It doesn't need to be fancy; it just needs to exist.

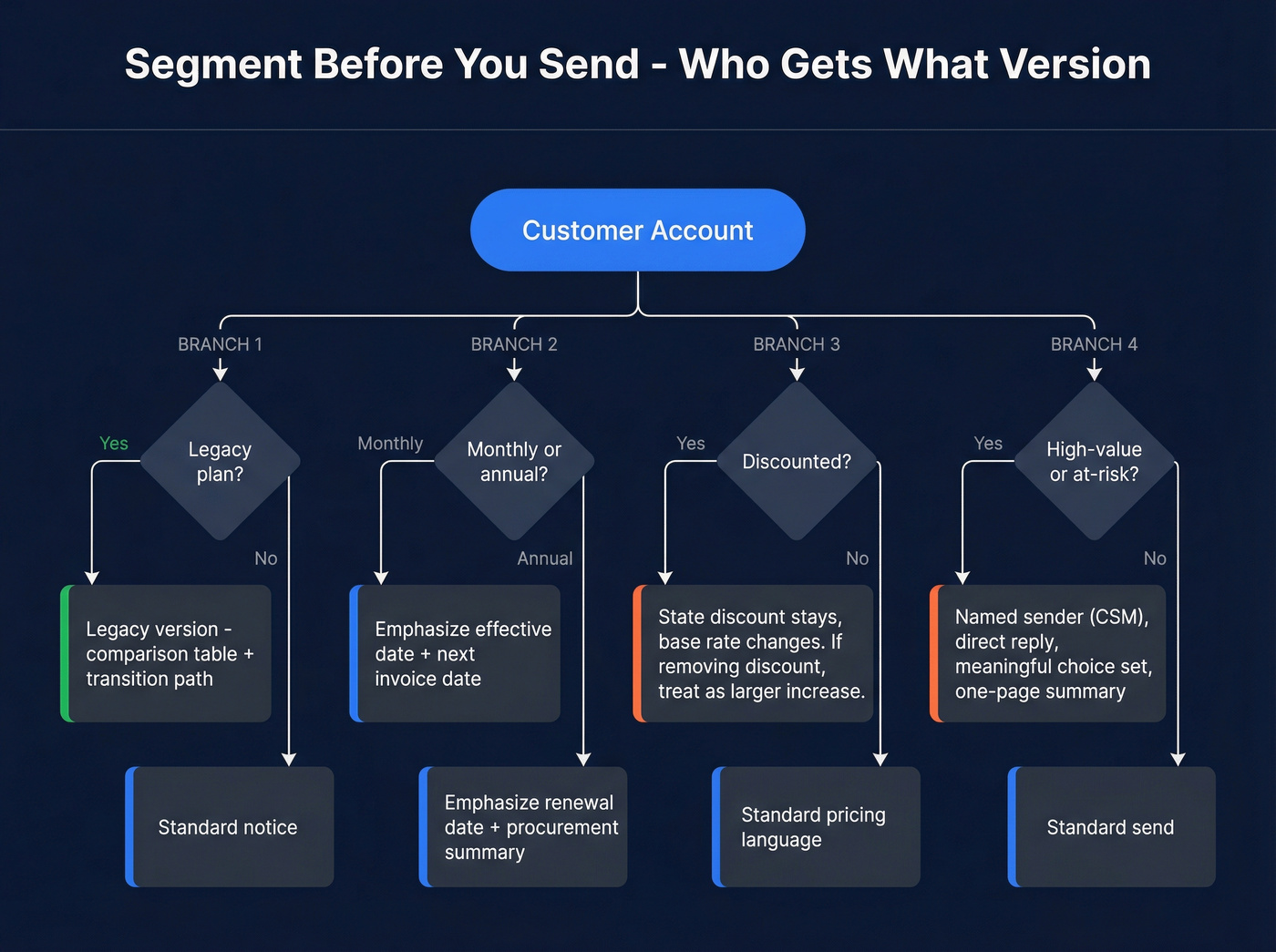

Segment before you send (who gets what version)

Segmentation is the difference between a professional rollout and an unsegmented blast that creates chaos.

Use this decision tree:

Legacy plan?

- Yes -> legacy-specific version with a simple comparison table + transition path

- No -> standard notice

Monthly or annual?

- Monthly -> emphasize effective date + next invoice date

- Annual -> emphasize renewal date + procurement-friendly summary

Discounted?

- Yes -> say it plainly: "Your discount remains; the base rate changes."

- Removing discounts = treat as a larger increase

High-value / at-risk?

- Yes -> named sender (CSM/AM), direct reply path, and a meaningful choice set

Enterprise buying behavior? Many IT teams reserve budget for vendor increases, but they need clean paperwork. Give them a one-page summary, a quote on request, and an annual option.

Grandfathering and transition offers that feel fair

Grandfathering is one of the strongest trust levers you have: existing customers keep old pricing (or old plan terms) while new customers get the new deal.

A founder-level approach I respect: Everhour's policy was basically "we always grandfathered." Customers could stay on their plan indefinitely, and if they canceled and came back later, they'd join the new plans. That posture builds goodwill you can spend later.

Gainsight and Monetizely have shared benchmarks showing well-executed grandfathering can preserve 85-90% of existing revenue. That's the goal: modernize pricing without detonating retention.

Offers that work:

- Indefinite grandfathering (maximum trust, maximum plan complexity)

- Time-bound grandfathering (12-24 months) (less plan sprawl, but requires a second migration later)

- Transition credit (feels fair; keep it tightly scoped)

- Real choices (downgrade path + annual lock)

If you're bundling something controversial (AI is the current champion), a classic opt-out is the cleanest pressure-release valve.

Skip indefinite grandfathering if your plans are already a mess and your team can't support the edge cases. You'll just create a second problem that shows up every time someone upgrades, downgrades, adds seats, or asks for a refund.

Copy/paste templates (with filled-in examples)

If you only change one thing: make these scannable in under 10 seconds.

Template 1: SaaS monthly plan increase (short version)

Subject: Price update: Pro goes to $59/mo on Apr 1, 2026

Hi {{FirstName}}, Your Pro plan changes from $49/mo to $59/mo on April 1, 2026.

Manage your plan: {{ManagePlanLink}} Switch to annual to lock pricing for 12 months: {{AnnualLink}}

Cancel: {{CancelLink}} Questions? Reply to this email.

- {{SenderName}}, Billing

Template 1B: SaaS monthly plan increase (expanded version)

Subject: Price update: Pro plan goes to $59/mo on Apr 1, 2026

Hi {{FirstName}}, Your Pro plan price will change from $49/month to $59/month starting April 1, 2026. Your features and limits stay the same.

Why the change: we expanded support coverage and increased infrastructure capacity to keep performance consistent as usage grows.

Options:

- Annual billing (lock pricing for 12 months): {{AnnualLink}}

- Review or downgrade: {{ManagePlanLink}}

- Cancel: {{CancelLink}}

Questions? Reply to this email.

Thanks, {{SenderName}} Billing Team, {{Company}}

Template 2: Services/agency retainer increase (scope/value framing)

Subject: Retainer update effective May 1, 2026

Hi {{FirstName}}, Starting May 1, 2026, our monthly retainer changes from $4,000 to $4,600 (+$600). Core scope stays the same: {{ScopeSummary}}.

Two paths:

- Keep scope at $4,600/mo starting May 1

- Keep $4,000/mo by removing {{ScopeReduction}} (we'll confirm the revised SLA in writing)

If you want to talk it through: {{CalendarLink}}.

Thanks, {{SenderName}}

Template 3: Enterprise renewal notice (procurement-friendly)

Subject: Renewal pricing notice for {{Product}} - effective {{RenewalDate}}

Hi {{FirstName}}, For your renewal on {{RenewalDate}}, the annual subscription for {{Product}} changes from $48,000/year to $54,000/year.

Procurement summary:

- Term: 12 months

- Billing: annual upfront (net {{NetTerms}})

- Scope: {{Seats}} seats, {{KeyModules}}

- Non-renewal deadline: {{NonRenewalDeadline}}

- Billing details: {{BillingPortalLink}}

If you need a one-page quote or vendor form, reply here - we'll turn it around within 1 business day.

Regards, {{SenderName}} Account Management, {{Company}}

Template 4: Forced bundling/AI add-on with classic opt-out

Subject: Plan update: {{PlanName}} now includes AI - opt out available

Hi {{FirstName}}, On June 1, 2026, your {{PlanName}} price changes from EUR69.99/year to EUR99.99/year and includes {{AIFeatureName}}.

You'll be moved to {{PlanName}} with AI unless you switch to {{ClassicPlanName}} by {{Deadline}}. Switch to {{ClassicPlanName}} (no AI) at EUR69.99/year: {{ClassicPlanLink}}

Manage your plan: {{ManagePlanLink}} Questions? Reply to this email and we'll help you choose.

Thanks, {{SenderName}}

Objection-handling scripts (email replies + calls)

"You didn't give enough notice."

You're right to flag timing. The new price takes effect on {{EffectiveDate}}, and your current rate stays in place until then. If you need more runway, we can offer {{Option}} for {{Duration}}.

"We can't afford this."

Totally fair. The fastest fixes are (1) annual billing to reduce monthly impact, or (2) moving to {{LowerTier}} at ${{LowerPrice}} which still covers {{CoreNeed}}. Tell me what you use most ({{FeatureA}}/{{FeatureB}}) and I'll recommend the cheapest fit.

"Competitor X is cheaper."

They might be. Send their plan link + your seat count/usage and I'll reply with a side-by-side within 1 business day, including the lowest-cost way to match your current outcomes.

"Why am I paying for AI/features I didn't ask for?"

Valid concern. Switch to {{ClassicPlan}} (no AI) here: {{Link}} by {{Deadline}} to keep pricing at {{ClassicPrice}}. If you want AI later, you can add it as an optional upgrade.

Compliance checklist (US-focused, 2026 reality)

This is an operational compliance checklist, not legal advice. Confirm requirements with counsel for your jurisdictions. The goal is simple: clear disclosure, proper notice timing, and easy cancellation.

Enforcement's active. Subscription and auto-renewal practices have triggered major actions, including a $7.5M HelloFresh settlement, New York AG actions involving health club membership practices (including Equinox), and FTC action involving gym cancellation/negative option conduct (including LA Fitness). The common thread is boring: unclear terms, hard-to-cancel flows, and customers saying they weren't properly informed.

The practical standard to run in 2026 (even with federal uncertainty)

Dentons noted the FTC Negative Option Rule was vacated on July 8, 2025, leaving a state-law patchwork and an aggressive enforcement posture.

Operational baseline in 2026:

- Disclose old price, new price, effective date, and next charge date clearly

- Send change notices within required windows where applicable

- Make cancellation as easy as signup, every time

Checklist

Put material terms in the notice

- Old price, new price, effective date

- Billing frequency + next charge date

- How to cancel (same channel as signup)

Make cancellation as easy as signup

- If signup was online, cancellation can't require a phone call

- Don't force a live agent if enrollment didn't require one

Send within required windows where applicable

- California (CARL): for covered California auto-renewal contracts, CARL generally requires certain change notices 7-30 days before the change takes effect, depending on the scenario. Applicability depends on contract type and how the subscription was entered or amended.

- New York: for certain subscriptions (including 1-year+ terms), renewal reminders are commonly cited as 15-45 days; for material changes, provide notice at least 5 business days in the same manner as the original transaction.

Keep records

- Retain consent and notice logs (data quality)

Don't misrepresent

- No "same price" language if it's not

- Don't bury the increase behind "feature updates"

Mini-table for ops alignment (not universal legal advice):

| Jurisdiction | Timing window (commonly referenced) | What to include |

|---|---|---|

| CA (CARL, covered cases) | 7-30 days | change details + cancel method |

| NY (certain 1-year+ subs) | 15-45 days | renewal reminder |

| NY (material change) | >=5 business days | change notice in same manner |

Deliverability for billing notices (so nobody can say "I never saw this")

A price increase email that goes to spam manufactures "you didn't tell me" escalations.

Deliverability checklist:

- Keep subject lines ~50 characters Example: "Price update effective Apr 1, 2026" (more ideas: reminder email subject lines)

- Don't send from noreply@ Replies reduce rage tickets and improve engagement signals.

- Separate transactional vs marketing reputation Use subdomains like billing.domain.com for notices and marketing.domain.com for promos (see: email sending infrastructure).

- Authenticate properly SPF, DKIM, DMARC aligned to the sending domain/subdomain (setup guide: SPF DKIM & DMARC).

- Keep it light Plain-text version, minimal images, one primary CTA link.

Post-send operations: the first 48 hours

Expect a 1-5% reply rate. On 20,000 customers, that's 200-1,000 conversations, and those conversations will cluster in the first day.

Here's a real scenario we've watched play out: you send the notice at 9am, support looks calm at noon, and then finance forwards a thread at 4pm from a customer whose admin inbox finally surfaced the email - except now they're angry because they already told their boss "the bill went up for no reason." If you don't have tags, macros, and escalation rules ready, your team starts improvising, and improvisation is how you end up offering three different "exceptions" to three different customers.

Runbook:

- Hour 0-2: tag inbound (timing, affordability, competitor, bundling, cancellation threat) and route high-value accounts to humans (playbook: strategic account)

- Hour 2-24: use pre-approved offers (annual lock, downgrade, transition credit, classic opt-out) with clear approval limits

- Hour 24-48: proactive outreach to high-value accounts showing risk signals (downgrade attempts, cancellation page visits, angry replies)

This is also where accurate contact data matters. If you're doing save outreach, bounces don't just waste time - they hurt sender reputation and slow down the one thing that actually works here: getting a real human on the other side to respond quickly.

Tools like Prospeo (the B2B data platform built for accuracy) are built for this moment: 98% verified email accuracy and a 7-day refresh cycle (vs the ~6-week industry average), so you reach the right stakeholders fast without burning your domain. If you're comparing vendors, start with an email lookup workflow and a strict email verification list SOP.

What customers evaluate when they threaten to leave:

- Total cost after add-ons (seats, usage, AI credits)

- Switching pain (migration, training, integrations)

- Support responsiveness

- Contract terms + cancellation friction

- "Classic" option availability (no forced bundle)

Segmenting by account value, plan type, and risk level is step one of any price increase rollout. Prospeo's 30+ search filters and CRM enrichment give you 50+ data points per contact - so you route high-value accounts to named senders and tailor every notice.

Enrich your customer list before you hit send.

Summary: the playbook that actually reduces churn

The best price increase email best practices are boring on purpose: put the math in the first two lines, give 60 days when you can (30 minimum), offer a real choice set, make cancellation painless, and run deliverability like it's revenue (including monitoring your domain reputation).

Then treat it like a rollout, not a one-off send.

FAQ

What's a reasonable notice period for a subscription price increase?

For most subscription businesses, 60 days is the safest default notice window, and 30 days is the minimum you should use for a meaningful change. If the increase is 30%+ or you're changing packaging, plan for 60-90 days plus reminders at D-21 and D-7.

What should the subject line say for a price increase email?

Use a direct subject line that includes "price update," the plan name, and the effective date in ~50 characters. Example: "Price update: Pro goes to $59/mo on Apr 1, 2026." Avoid hype and vague "important changes" phrasing.

Do I need to follow state auto-renewal laws for price changes?

Yes. Treat price changes as potentially material changes and follow the strictest notice and cancellation expectations that apply to your customers. As a baseline, disclose old/new price, effective date, next charge date, and a same-channel cancellation path; confirm CA/NY timing rules with counsel.

Should price increase notices be sent as transactional or marketing emails?

Send them as transactional/billing-critical emails with separate sending infrastructure from marketing. Use a billing subdomain, proper SPF/DKIM/DMARC alignment, and a reply-capable sender; then mirror the notice in-app and on invoices to cover spam filters and forwarded admin inboxes.

What's a good free tool for finding the right stakeholder email during save outreach?

If you need fast, low-bounce outreach after a pricing change, Prospeo's free tier includes 75 email credits plus 100 Chrome extension credits per month, with 98% verified email accuracy and a 7-day refresh cycle.