ListKit Pricing (2026): What It Costs, How Credits Work, and the Gotchas

The headline price isn't the real price. Credit burn is.

With ListKit pricing, it can look like $83/month... until you realize your "2,000 credits" can translate to roughly 285-1,000 exports depending on whether you add mobile (+5 credits) and extra enrichment (+1 each).

I've seen teams approve the plan based on the card price, then wonder why they only got a few hundred usable contacts out of a month. The tool didn't "overcharge" them; they just exported a fat template.

Hot take: if your outbound volume isn't steady week to week, annual credit plans are a trap. You don't "save 15%" if you donate unused credits back to the vendor every month.

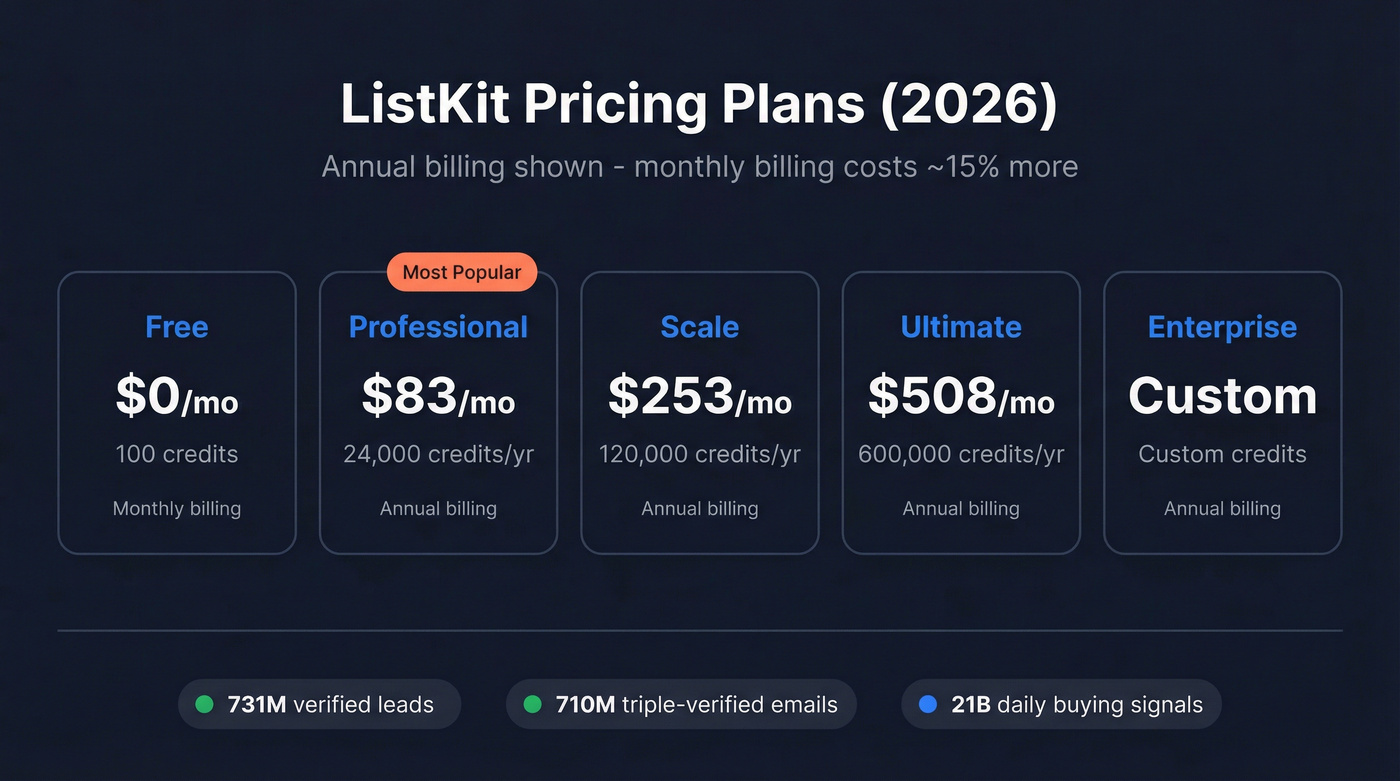

ListKit pricing in 2026 (plans + what's actually shown)

As of 2026-02-17, ListKit's pricing page pushes yearly billing ("Save 15%"), while the same page's calculator nudges you toward a monthly plan recommendation. That split presentation is the root of most ListKit pricing confusion you'll see in reviews and community threads.

ListKit also markets its scale and verification on the pricing page: 731M verified leads, 21B daily buying signals, 710M triple-verified email contacts, and 5M emails verified monthly.

Plan table (yearly-billed effective monthly)

| Plan | Price (yr eff/mo) | Credits | Billing |

|---|---|---|---|

| Free | $0 | 100 | Monthly |

| Professional | $83 | 24,000/yr | Annual |

| Scale | $253 | 120,000/yr | Annual |

| Ultimate | $508 | 600,000/yr | Annual |

| Enterprise | Custom (often $1,500-$6,000+/mo) | Custom | Annual |

Sanity check on the annual math:

- Professional: $83/mo x 12 = ~$996/year for 24,000 credits

- Scale: $253/mo x 12 = ~$3,036/year for 120,000 credits

- Ultimate: $508/mo x 12 = ~$6,096/year for 600,000 credits

What "unlimited users" actually means (and what it doesn't)

ListKit's paid plans include unlimited users, which is genuinely useful if you've got SDRs, RevOps, and leadership all poking around the same account. In practice, it means:

- you're not paying per seat,

- everyone shares one org-wide credit pool, and

- your real limit is exports/enrichment, not logins.

Here's the catch: the whole team can burn the same credits faster. If you don't set a default export template, someone will export "everything" and torch a week's worth of credits in an afternoon.

If you’re building processes around SDR output and guardrails, it’s worth aligning this with your broader outbound sales teams operating model.

Why some pages show different tiers (credits changed)

If you've seen older posts with "better" credit amounts, you're not imagining it. In a March 2024 community update, ListKit said the price per credit was cut in half (credits became ~50% cheaper). That's why affiliate pages and old screenshots often disagree with what you see today.

Rule of thumb: trust the current pricing page and the current credit documentation, not a random "updated 2024" blog post.

Phone-only plans + coaching (what's real vs what's noise)

A few third-party pages mention phone-number-only plans and 1:1 cold email coaching bundled into certain tiers.

Here's how I'd treat that in 2026:

- Phone-only plans: they aren't clearly shown on the current pricing page, so assume they're negotiated, historical, or packaged differently now. If phone-only matters, ask support for the current offer in writing.

- 1:1 coaching: if your plan includes it, price it separately in your head. Coaching can be worth more than the data for a small team, but it doesn't fix messy unit economics.

If phone coverage is a decision driver, compare against a dedicated B2B phone number workflow before you commit.

Why you see $83/month and $97/month (the monthly vs annual mismatch)

ListKit shows an annual-effective monthly price on the plan cards, but the calculator shows an actual month-to-month plan.

On the same pricing page, the calculator example reads: "Recommended Plan Pro $97/month - 2,000 credits & up to 2,000 search results included." That $97 is the month-to-month price. The $83 is what you get when you commit annually (15% savings).

Mini truth table:

| What you're looking at | Number | What it means |

|---|---|---|

| Plan card (Yearly) | $83/mo | Paid annually |

| Calculator (Monthly) | $97/mo | Paid monthly |

| Monthly credits | 2,000 | Pro monthly |

| Annual credits | 24,000 | Pro annual |

My recommendation: treat $97/mo as the real "try it" price. Only take $83/mo if you already know your team will export every week, because the discount doesn't matter if you don't use the credits.

ListKit charges 5 credits per mobile and stacks fees per field. Prospeo gives you 98% accurate emails at $0.01 each, 125M+ verified mobiles, and no field-by-field credit drain. Same data depth, 90% less cost.

Stop doing credit math. Start building pipeline.

Free plan vs 7-day trial (and how to avoid surprise charges)

ListKit offers a Free plan. Separately, ListKit's Terms of Service on listkit.run describe trial mechanics that can include billing info and auto-renewal unless canceled.

UpLead also reports a "7-day trial with 50 leads." Check the exact trial offer and limits inside your account before you enter a card.

Free plan: what you can test with 100 credits

With 100 credits, you can answer the only questions that matter:

- Can you find your ICP fast with the search workflow?

- Do the filters match reality (not just your fantasy TAM)?

- Do exports land cleanly in your CRM/sequencer?

Don't try to run outbound on 100 credits. Use it to measure credits per exported lead with your real export template.

If you need a broader benchmark set, cross-check with other lead database free trial options.

Trial: the day-1 move that saves you headaches

Per the listkit.run ToS, trials can roll into paid billing unless you cancel. So do this on day 1:

- set a calendar reminder for 24 hours before the trial ends,

- find the cancellation path in the dashboard and screenshot it,

- export a small batch first (25-50 leads) and calculate credits/lead before you scale,

- don't buy top-ups during the trial unless you're already committed.

Billing drama is the dumbest way to lose a week of pipeline-building time.

How ListKit pricing really works: credits, fields, and unit economics

ListKit pricing only makes sense once you internalize two things:

- there are two credit types, and

- your export cost is field-based, not "per lead."

That's why "2,000 credits" can feel like a lot or like nothing, depending on whether you're exporting mobiles and enrichment.

If you want a framework for comparing vendors on credit math, see our breakdown of global database pricing.

Universal vs Verification credits (when each applies)

- Universal Credits power B2B Search, intent data, and enrichment.

- Verification Credits are for verifying external lists inside the Email Verification Tool.

The operational rule: if you're exporting from ListKit, you're typically using Triple Verification during export rather than verifying the same emails again afterward.

One detail that matters for list-cleaning math: 1 email verified = 1 Verification Credit. If you're cleaning a 10,000-row CSV, that's 10,000 Verification Credits - simple, predictable, and separate from your export/enrichment budget.

Intent data refreshes every 24 hours, and it uses the same Universal credit structure as search. Translation: intent isn't "free." It's another way to spend Universal credits. (Related: intent signals.)

Credit cost cheat sheet (field-by-field)

Universal credits

- Business email: 1

- Business email + triple verified add-on: +1 (so 2 total for triple-verified business email)

- Personal email: 2

- Personal email + triple verified add-on: +1

- Mobile phone number: 5

- Many enrichment fields: +1 each

- Basic identity fields (name, title, company, domain, industry, location, employee count): free

This is where teams get burned: an export template that grabs "nice-to-have" fields by default quietly turns into 8-10 credits per lead.

Real talk: if you don't lock the template, your unit economics aren't "unknown." They're guaranteed to get worse over time.

If you’re pressure-testing data quality, build a small QA loop like our preview contacts before export checklist.

Top-ups (and the cleanest way to price any export)

ListKit sells top-ups in-app:

- 1,000 Universal credits = $10

- 10,000 Verification credits = $15

That implies a simple marginal cost:

- Universal credit ~= $0.01

- Verification credit ~= $0.0015

Even if you never buy top-ups, this is still the cleanest way to estimate unit economics because it prices the fields, not the marketing headline, and it lets you model what happens when a rep insists on adding mobile plus two enrichments "because it might be useful later."

Real cost per exported lead (scenarios + dollars, not just credits)

ListKit's docs give a baseline example: business email (1) + triple verify (+1) + Company LinkedIn URL (+1) = 3 credits per lead.

Below are practical bundles using the Pro monthly example of 2,000 credits.

Scenario table (credits -> exports -> marginal $/lead)

| Export bundle | Credits/lead | Exports per 2,000 credits | Marginal $/lead (at $0.01/credit) |

|---|---|---|---|

| Business email only | 1 | 2,000 | $0.01 |

| Email + triple verify | 2 | 1,000 | $0.02 |

| Email + triple + 1 enrichment | 3 | 666 | $0.03 |

| Email + triple + mobile | 7 | 285 | $0.07 |

| Email + triple + mobile + 2 enrich | 9 | 222 | $0.09 |

Two important interpretations:

- Marginal cost (table above) is what each lead costs in credits.

- Effective subscription cost per export is what your CFO cares about.

If you’re modeling pipeline impact, you may also want a quick pipeline generation calculator to connect exports → meetings → revenue.

Worked example: monthly vs annual effective cost per export

Assume you're on Pro monthly at $97/mo with 2,000 credits.

If you export email + triple (2 credits/lead):

- exports/month ~= 1,000

- effective subscription cost/export ~= $97 / 1,000 = $0.097/export

If you export email + triple + mobile (7 credits/lead):

- exports/month ~= 285

- effective subscription cost/export ~= $97 / 285 = $0.34/export

Now compare annual Pro (effective $83/mo, paid upfront):

- email + triple: $83 / 1,000 = $0.083/export

- email + triple + mobile: $83 / 285 = $0.29/export

Annual is cheaper only if you actually use the credits. If you miss months, your effective cost per export spikes fast because unused credits expire.

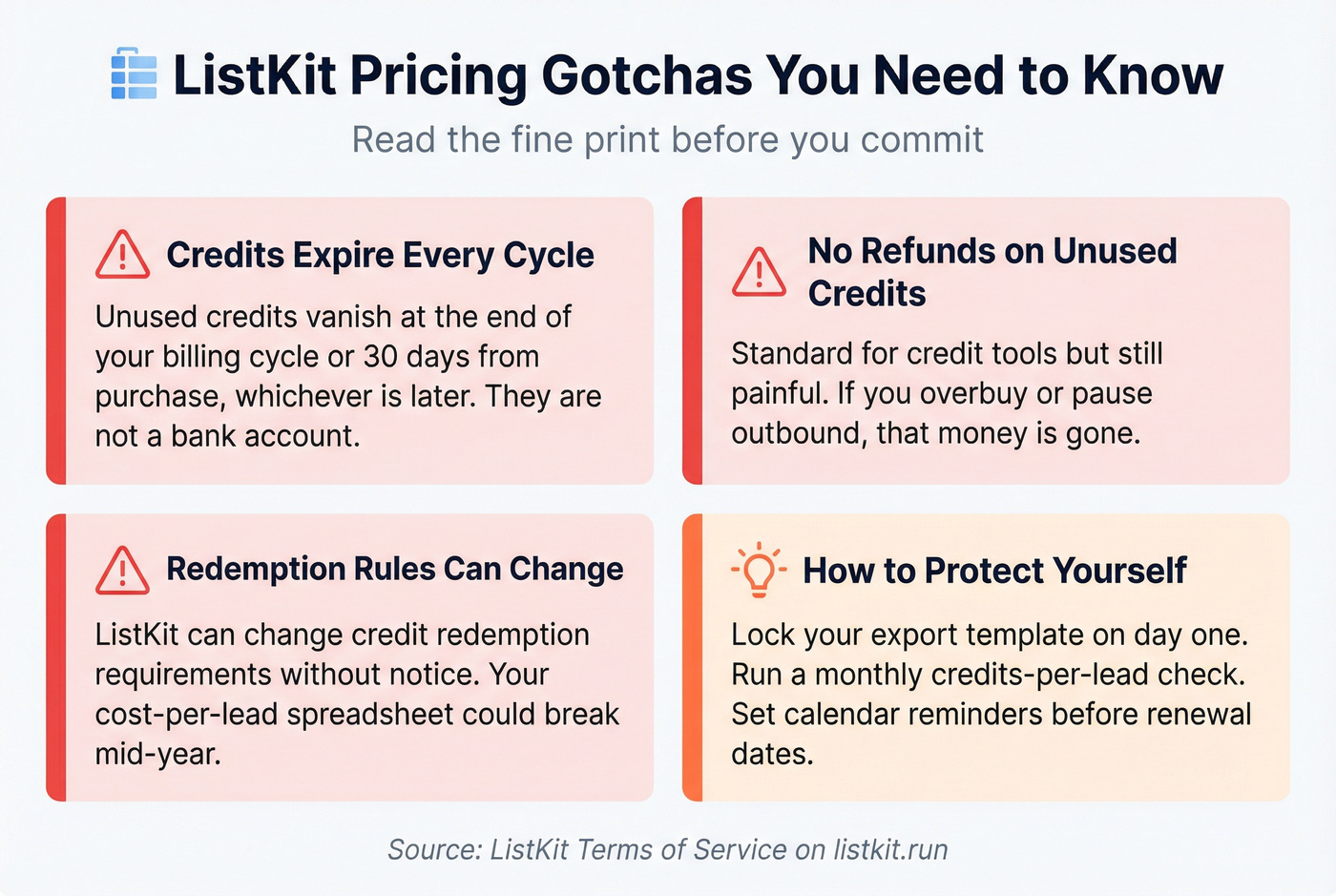

Pricing gotchas (from Terms): expiry, refunds, plan changes

If you only read the pricing page, you'll miss the stuff that creates buyer's remorse.

- Credits expire at the end of your billing cycle or 30 days from purchase (whichever is later). Credits aren't a bank account. They're time-boxed.

- Unused credits are forfeited when they expire. If you pause outbound for hiring, events, launches, or seasonality, you'll feel this immediately.

- No refunds for unused credits. Standard for credit-based tools, still painful when you overbuy.

- Credit redemption requirements can change without notice. This clause can break your spreadsheet mid-year.

Mitigation that actually works: lock an export template, run a monthly "credits/lead" check, and keep a screenshot of the current credit table from the docs for internal budgeting. If the table changes, you'll catch it before your team does a 5,000-lead export and then asks why the credit pool evaporated.

And yes, I'm opinionated here: any pricing model where the vendor can change the "exchange rate" mid-contract is annoying. You can live with it, but you can't ignore it.

If your main risk is bounces and reputation damage, pair this with an email verification list SOP.

Is ListKit worth it in 2026? (who it's for vs who should avoid it)

As displayed on 2026-02-17, ListKit's ratings are strong: G2: 4.8/5 (385 reviews) and Trustpilot: 4.3/5 (215 reviews).

The sentiment pattern is consistent:

- people love speed and workflow when it fits,

- people get angry when billing/cancellation friction shows up.

A few representative snippets you'll see in the wild:

- Trustpilot-style praise: "Great data and easy to use... lists are quick to build."

- Trustpilot-style complaint: "Hard to cancel / charged after trying it."

- Reddit-style skepticism: "Credits disappear fast once you add phones."

Worth it if...

- You export consistently every week, so expiry doesn't matter.

- You value triple verification baked into export.

- You actually use intent signals and you're fine paying Universal credits for them.

- You have a multi-user team and want one shared workspace without per-seat pricing.

I've run bake-offs where the "best" tool wasn't the biggest database; it was the one the team could operate without constant credit anxiety, and the one where a new SDR couldn't accidentally blow up the budget with one careless export.

Skip it if...

- Your outbound volume's inconsistent (expiring credits will irritate you).

- You want simple unit economics like "$X per verified email" with no field math.

- You're sensitive to cancellation friction and don't want to babysit renewals.

If that's you, don't force it. Pick a model that matches how you actually work.

Alternatives if ListKit pricing/credits aren't a fit (quick comparison)

If ListKit's credit math or expiry rules don't match your workflow, you've got options. The fastest sanity-check is comparing pricing clarity and what you're paying for.

Comparison table (ListKit vs Prospeo vs UpLead vs Apollo vs ZoomInfo)

| Tool | Typical price (2026 market range) | Best for | Gotcha / scope note |

|---|---|---|---|

| Prospeo | Free + ~$39-$199/mo | Accuracy + freshness with self-serve pricing | Credit-based; pay per data type |

| ListKit | $97/mo monthly or $83/mo (annual eff.) | AI list building | Credits expire |

| UpLead | ~$99-$249/mo | Straightforward exports | Smaller dataset than full suites |

| Apollo | ~$59-$119/user/mo | SMB outbound all-in-one | Per-seat costs add up |

| ZoomInfo | ~$15k-$60k/yr | Enterprise GTM | Modules + seats compound |

If you’re shopping broadly, our roundups of best B2B data providers and prospecting tools comparison can help narrow the shortlist.

Prospeo (Tier 1 alternative, if you want clearer economics)

If expiring credits or unpredictable field-based burn is a deal-breaker, Prospeo is the best alternative for email accuracy, data freshness, and self-serve B2B data. It's "The B2B data platform built for accuracy" with 300M+ professional profiles, 143M+ verified emails, and 125M+ verified mobile numbers, refreshed on a 7-day cycle (industry average: 6 weeks).

The quality stats are blunt: 98% verified email accuracy and a 30% mobile pickup rate. For RevOps, the workflow side matters too: enrichment returns 50+ data points per contact, with an 83% enrichment match rate and a 92% API match rate, so you're not stuck paying for a tool that can't match your CRM rows back to real people.

If you want the full credit breakdown, see Prospeo pricing.

Tier 2 blurbs (quick, opinionated)

UpLead: pick this when you want straightforward buying and clean exports without turning prospecting into a tooling project. It's not the deepest dataset, but it's easy to run.

Apollo (Apollo.io): the default choice for SMB teams that want prospecting plus sequencing in one place. It's fast to roll out. The catch is per-seat pricing; what looks cheap for 2 reps gets expensive at 10.

Tier 3 mentions (for completeness)

ZoomInfo: still the best all-in-one enterprise suite when you actually use the modules (intent, enrichment, workflows) across a big org. If reps only use the search bar, it's a very expensive search bar.

Lusha: lightweight contact lookup. Typical entry pricing lands around $30-$60/mo (annual-effective), but you'll hit limits quickly at real outbound volume.

Hunter: best for email finding/verification workflows, not a full sales intelligence platform. Typical pricing is ~$49-$199/mo depending on volume.

Snov.io: budget-friendly outbound toolkit with email finding plus outreach features. Typical pricing is ~$39-$199/mo depending on seats and sending needs.

While ListKit refreshes intent data on universal credits, Prospeo refreshes all 300M+ profiles every 7 days - not every 6 weeks. You get Bombora intent across 15,000 topics, 30+ search filters, and transparent per-credit pricing with no annual traps.

Get fresher data, simpler pricing, and 100 free credits today.

If you need mobiles, assume 7-9 credits per lead in ListKit and budget from there. And if you can't reliably export weekly, don't buy annual; pay monthly until your outbound cadence is real.

Summary: ListKit pricing is only "cheap" when your export template is lean and your cadence is consistent. Once you add mobiles and enrichment (and you miss a month), the real cost per lead climbs fast.