Prospecting Tools Comparison (2026): Which Stack Actually Works?

You can spend $15,000 a year on a database and still fail to get a working phone number for the VP of Sales at a Series B company. Then your sequences bounce at 6%, your domain reputation tanks, and everyone blames the sequencer.

This prospecting tools comparison is about outcomes, not feature grids. Reachability, time-to-list, and whether costs stay sane once you scale.

Most "best tools" posts fall apart because they compare checkboxes instead of results.

Our picks (TL;DR): the 3 tools to trial first

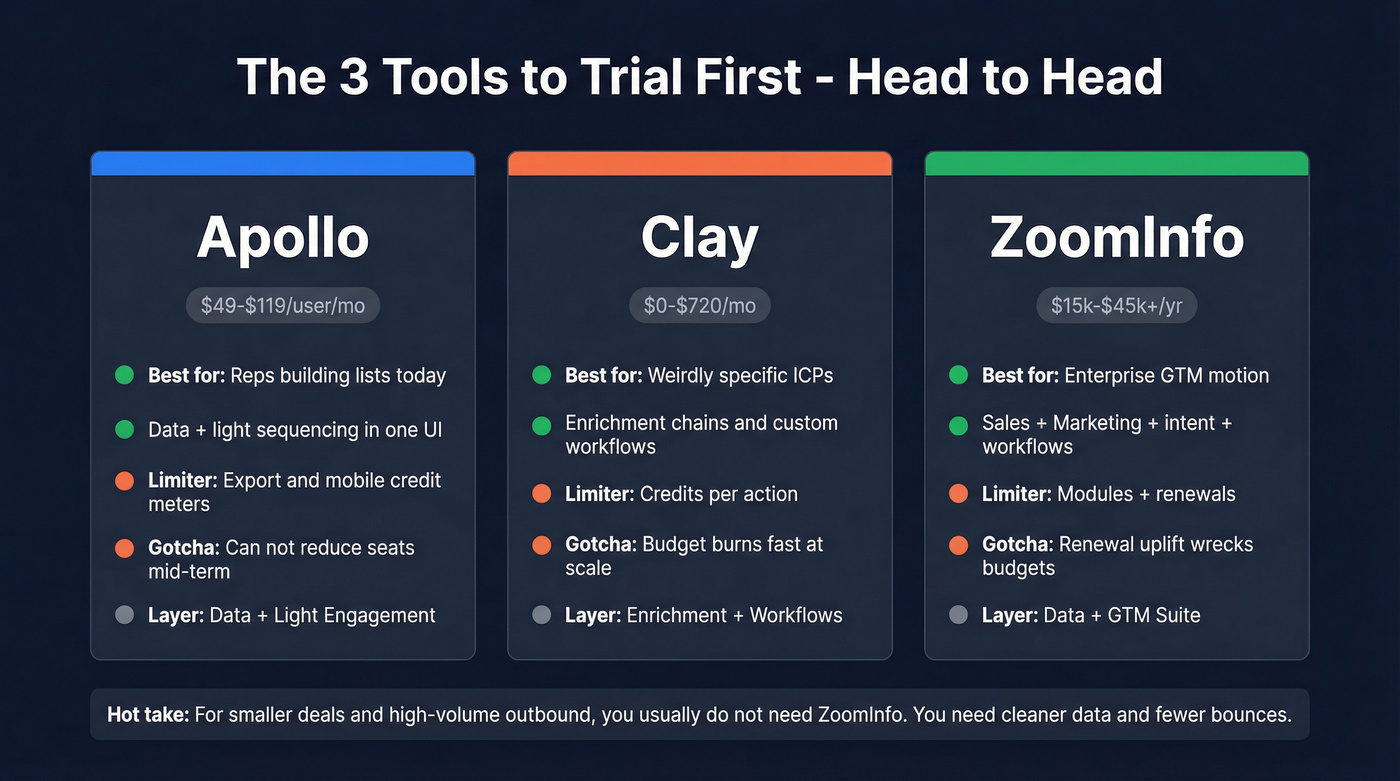

If I had to pick three tools to trial first: Apollo, Clay, and ZoomInfo.

That combo maps cleanly to the only outcomes that matter: reachable contacts, hours saved building lists, and clean records pushed into your CRM/sequencer.

- Apollo - Use this if you need reps producing lists today and you want a simple "data + light engagement" starting point. Skip it if you can't tolerate data variance or you hate export/mobile credit meters.

- Clay - Use this if your ICP's weirdly specific and you need enrichment chains, routing logic, and custom fields. Skip it if you don't have an operator who enjoys building workflows.

- ZoomInfo - Use this if you're truly running an enterprise GTM motion (Sales + Marketing + intent + workflows). Skip it if you only need emails and direct dials.

Hot take: for smaller deal sizes and high-volume outbound, you usually don't need ZoomInfo-level packaging. You need cleaner data, fewer bounces, and a stack your team actually uses.

Prospecting tools comparison table (pricing + what actually limits you)

Here's the table I wish every vendor put on their homepage: not "features," but what limits you when you scale (credits, caps, modules, renewals). If you're doing a prospecting tools comparison for budget planning, this is the part that prevents month-3 surprises.

Normalization note: engagement tools are usually per-seat/month, data suites are often annual contracts, and workflow tools are credit-based.

Table 1 - the 5 things that matter

| Tool | Layer | Best for (specific) | Key limiter | Entry price / unit |

|---|---|---|---|---|

| Prospeo | Data + verify | Lowest-bounce lists fast (verified email + mobile) | Credits (clear meter) | $0 + ~$0.01/verified email |

| Apollo | Data + light eng | Reps building lists today + basic sequencing | Exports + mobiles + seat lock | $49-$119/user/mo |

| Clay | Enrich + workflows | "Impossible" ICP lists via enrichment chains | Credits per action | $0-$720/mo |

| ZoomInfo | Data + GTM suite | Enterprise depth + intent + workflows | Modules + renewals | $15k-$45k+/yr |

| Outreach | Engagement | Enterprise sequences + governance + coaching | Modules + usage | ~$100-$160/user/mo |

| Salesloft | Engagement | Cadences + coaching with manager visibility | Caps + add-ons | ~$125-$150/user/mo |

| HubSpot Sales Hub | CRM-native engagement | CRM-native prospecting + reporting consistency | Seats + tiers | $15/seat/mo (Starter) -> packaged tiers |

| Cognism | Data + phones | EMEA coverage + verified mobile focus | Exports + intent topic cap | ~$1k-$3k/mo |

| LeadIQ | Capture + sync | Capture -> enrich -> push cleanly to CRM | Phone credits | $0 / $200/mo |

| Amplemarket | Signals -> send | Signals + personalization in one workflow | Seats + volume | ~$50-$170/user/mo (annualized) |

| Lusha | Data utility | Quick lookups for emails/phones mid-research | Credits | ~$30-$70/user/mo |

| Instantly | Sending | Cold email sending at scale (mailbox mgmt) | Mailboxes | ~$37-$97/mo |

| Lemlist | Sending | Personalization-first outbound for SMB | Seats + add-ons | ~$55-$79/user/mo (annual) |

| Waalaxy | Social automation | Social workflows for agencies | Invites + 1 acct/license | EUR 0-EUR 69/user/mo |

| Dripify | Social automation | Simple social sequences for solo users | Seats | ~$59-$79/user/mo |

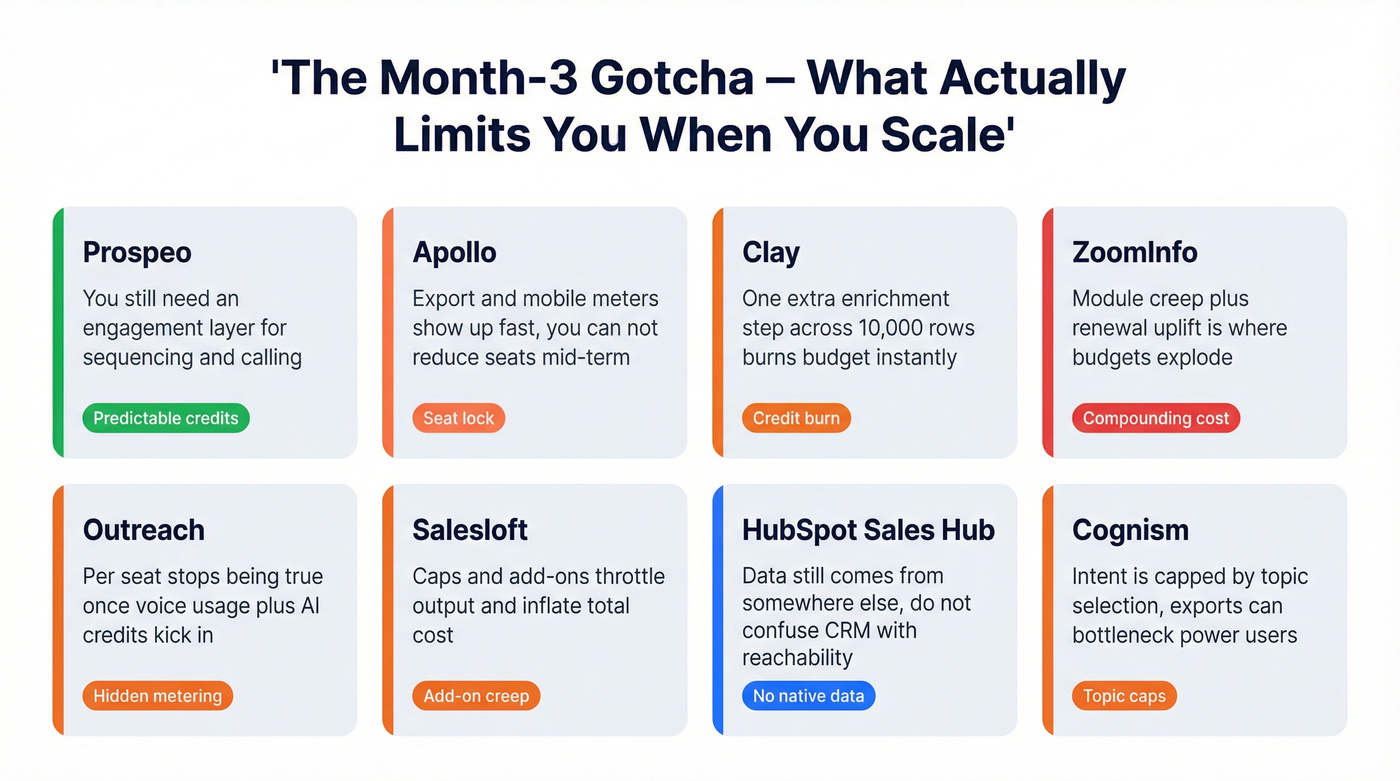

Table 2 - the "gotcha" you feel at month 3

- Prospeo: You still need an engagement layer (Outreach/Salesloft/HubSpot) for sequencing and calling.

- Apollo: Export/mobile meters show up fast; you can't reduce seats mid-term.

- Clay: One extra enrichment step across 10,000 rows burns budget instantly.

- ZoomInfo: Module creep + renewal uplift is where budgets explode.

- Outreach: "Per seat" stops being true once voice usage + AI credits kick in.

- Salesloft: Caps and add-ons throttle output and inflate TCO.

- HubSpot Sales Hub: Data still comes from somewhere else; don't confuse CRM with reachability.

- Cognism: Intent is capped by topic selection; exports can bottleneck power users.

- LeadIQ: Phone-heavy motions get expensive (phones cost 10 credits).

- Amplemarket: Powerful, but overpriced if you only need list building.

- Lusha: Coverage swings by region/industry; don't assume US-depth everywhere.

- Instantly: Great sending; it won't fix bad lists.

- Lemlist: Add-ons creep as you scale; watch the "small team" plan assumptions.

- Waalaxy: Extension + account licensing creates IT/security friction.

- Dripify: Fine for small teams; don't roll it out org-wide without a pilot.

A few budget truths that matter:

- ZoomInfo isn't "expensive," it's compounding. Renewal uplifts plus re-quotes when you change seats/modules are where budgets get wrecked.

- Apollo's sticker price is fair. The pain is exports + mobiles + seat lock.

- Clay's cheap until it isn't. Credit burn's the whole game.

- Engagement tools hide cost in "usage." Voice and AI are increasingly metered.

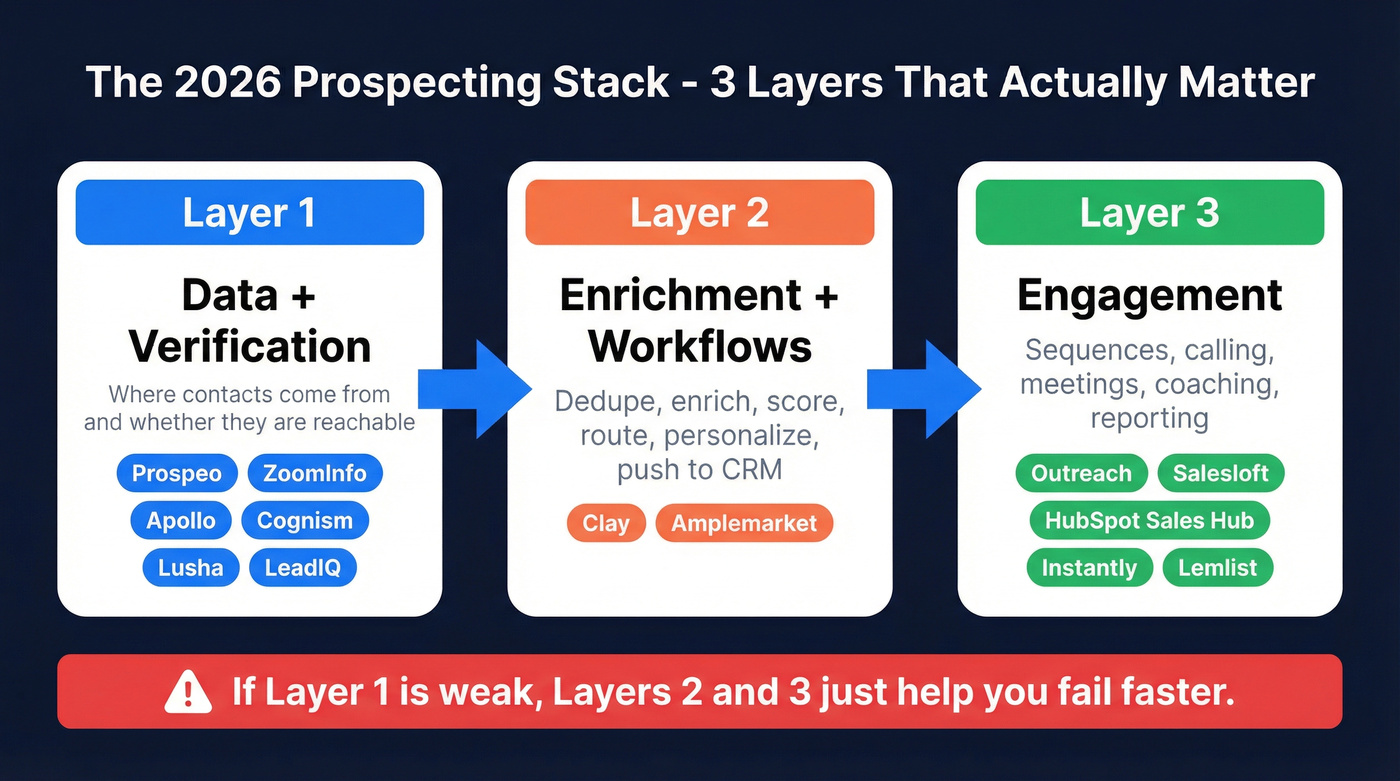

What counts as a "prospecting tool" in 2026 (and what doesn't)

In 2026, "prospecting tool" is a junk-drawer label. There are thousands of sales tech products, and tool overlap plus data silos are what teams complain about most once they pass the "two SDRs and a spreadsheet" stage.

The clean way to think about it is a 3-layer stack:

Data + verification Where contacts come from - and where you decide if they're reachable. This layer lives or dies on freshness + verification.

Enrichment + workflows Where "a list" becomes "a usable list": dedupe, enrich, score, route, personalize, and push cleanly into your CRM/sequencer. Clay's the best-known example.

Engagement Where you run sequences/cadences, calling, meetings, coaching, and reporting. Outreach, Salesloft, and HubSpot Sales Hub live here.

What doesn't count (even if vendors want it to):

- CRMs aren't prospecting tools by themselves. They store records; they don't create reachability.

- Warmup/inbox rotation isn't prospecting. It's outbound infrastructure.

- "AI SDRs" aren't magic. They're automation layered on top of your data and sending. Bad data just scales mistakes.

If Layer 1 is weak, Layers 2 and 3 just help you fail faster.

This comparison proves Layer 1 decides everything. Prospeo delivers 98% email accuracy and 125M+ verified mobiles on a 7-day refresh cycle - so Layers 2 and 3 actually work. At ~$0.01/email, it's 90% cheaper than ZoomInfo.

Fix your data layer first. Everything else compounds from there.

Terminology crosswalk (so you compare like-for-like)

Different platforms use different words for the same object. Normalize terms first, or you'll pay twice for the same capability.

| Concept | HubSpot | Outreach | Salesloft | Salesforce |

|---|---|---|---|---|

| Person record | Lead | Prospect | Person | Lead |

| Sequence object | Sequence | Sequence | Cadence | Engagement |

| Task queue | Prospecting | Tasks | Tasks | Tasks |

| Account view | Company | Account | Account | Account |

| Activity logging | Timeline | Activity | Activity | Activity |

Practical takeaway: when someone says "we need a prospecting tool," force the answer: data, workflows, or engagement.

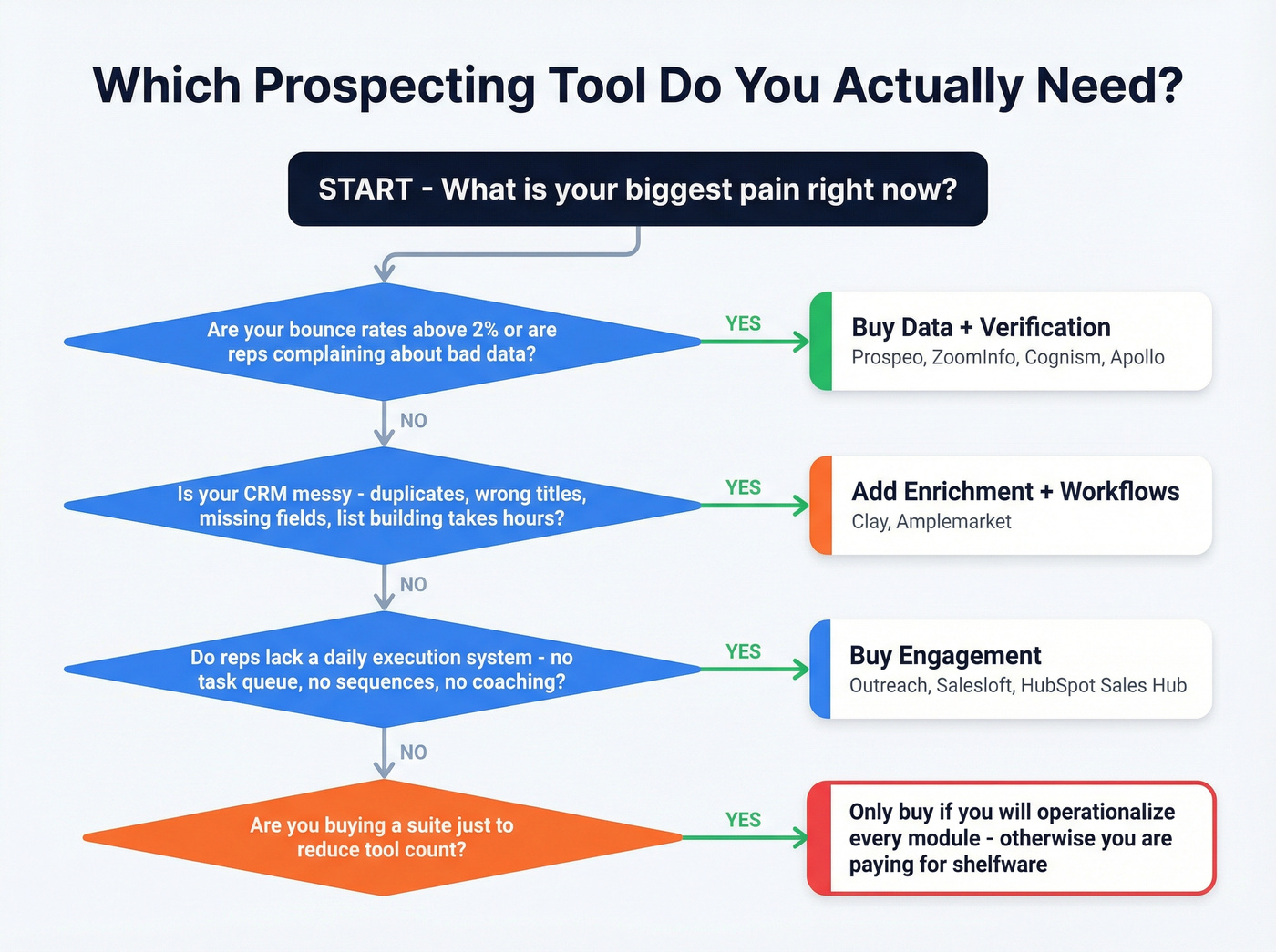

How to choose (a decision tree that prevents expensive mistakes)

Use this when you're stuck between "buy a suite" and "build a stack." It's especially useful if you're doing a sales prospecting tools comparison across multiple teams (SDR + RevOps + Marketing) and need a shared decision framework.

Are bounces above 2% or are reps complaining about bad emails/phones? Start with Data + verification. Fix reachability before you buy anything else.

Is your CRM messy (duplicates, wrong titles, missing fields) or is list building taking hours? Add Enrichment + workflows. Your goal's "clean records pushed automatically," not more tabs.

Do reps need a daily execution system (tasks, sequences, calling, coaching)? Buy Engagement. If managers can't see activity and reps don't have a queue, you'll never scale.

Are you buying a suite because you want fewer tools? Only do it if you'll operationalize the modules. If you won't, you're paying for shelfware.

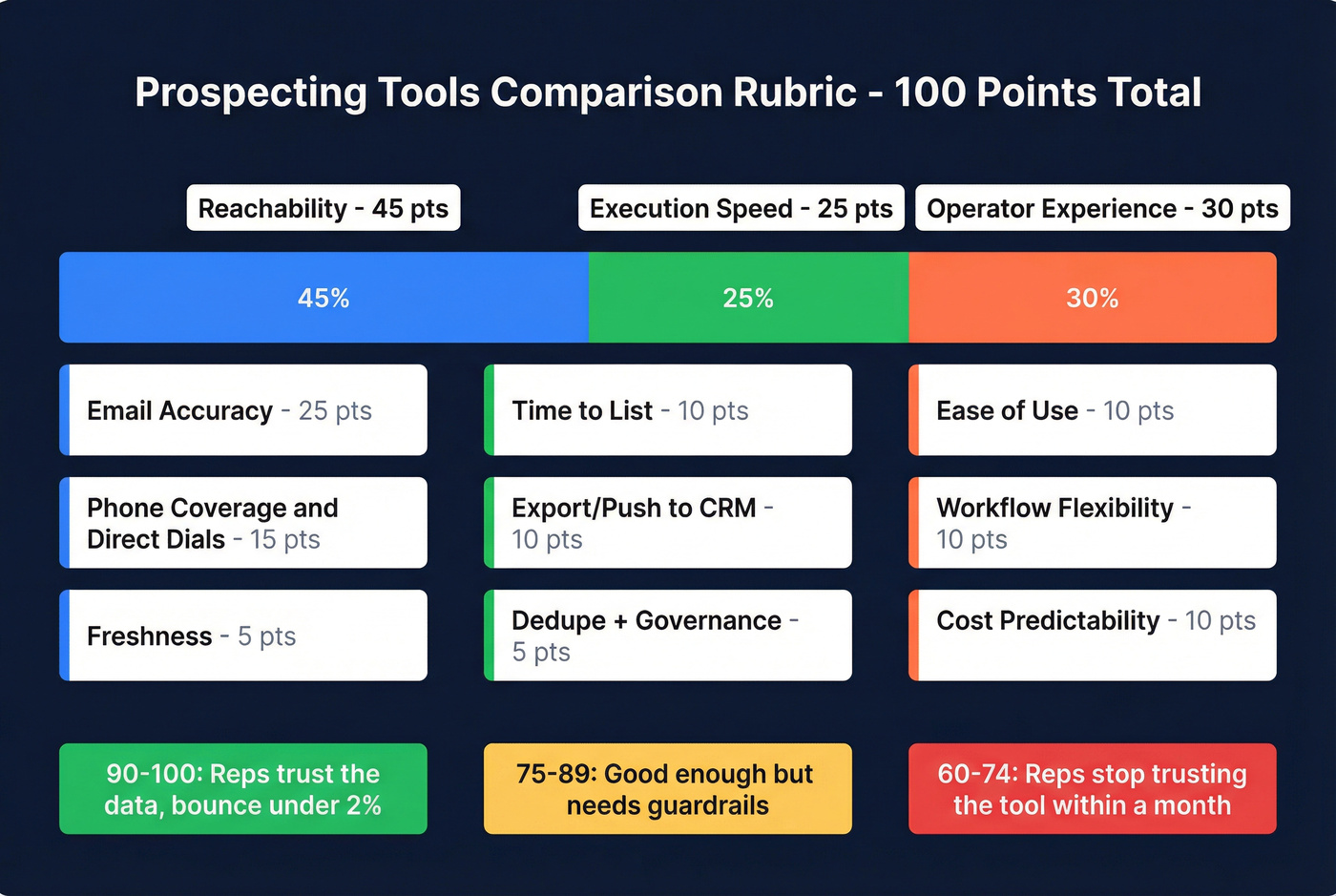

Prospecting tools comparison rubric (deliverability-first)

We use a simple bake-off task because feature grids lie.

Same task across tools: build a list of 100 SaaS VPs of Sales (USA) with verified emails + direct dials. Then score what actually affects pipeline.

Scoring weights (100 points total)

Reachability (45 points)

- Email accuracy (25)

- Phone coverage / direct dials (15)

- Freshness (5)

Execution speed (25 points)

- Time-to-list (10)

- Export/push to CRM or sequencer (10)

- Dedupe + governance controls (5)

Operator experience (30 points)

- Ease of use (10)

- Workflow flexibility (10)

- Cost predictability (10)

What the scores look like in real life

- 90-100/100: Reps trust the data, bounce rate stays under 2%, lists build fast, records land in CRM cleanly with minimal duplicates, and costs scale predictably.

- 75-89/100: Good enough to run outbound, but you'll need guardrails (verification, dedupe rules, export discipline).

- 60-74/100: You'll feel it within a month: reps stop trusting the tool, deliverability degrades, and RevOps spends time cleaning up instead of building pipeline.

Look, you can't coach your way out of bad data. Fix reachability first, then worry about fancy engagement features.

The tools (data, enrichment, engagement) - mini-reviews + pricing realities

Prospeo (Tier 1)

Best for: teams that want the best email accuracy, the freshest data, and self-serve pricing without contracts.

Here's the thing: most teams don't have an "Outreach problem" or a "Salesloft problem." They've got a reachability problem, and it shows up as bounces, spam placement, and reps quietly giving up on outbound because they don't trust the list.

Prospeo is "The B2B data platform built for accuracy." It gives you 300M+ professional profiles, 143M+ verified emails with 98% email accuracy, and 125M+ verified mobile numbers with a 30% pickup rate, all refreshed on a 7-day cycle (the industry norm's closer to six weeks). You also get 30+ search filters, 15,000 intent topics (powered by Bombora), and enrichment that returns 50+ data points per contact with a 92% API match rate.

We've seen the same pattern over and over: teams buy a big database, then spend months building rules to avoid sending to risky addresses. Starting with verification flips that. You protect deliverability first, then decide how fancy you want the rest of the stack to be.

Skip this if: you're shopping for a single UI that does sequencing, calling, coaching, and forecasting. Pair Prospeo with an engagement platform and call it a day.

Pricing: Free tier includes 75 emails + 100 extension credits/month. Paid usage stays simple: ~$0.01 per verified email and 10 credits per mobile. Links: pricing, B2B database, email finder, mobile finder, integrations.

Apollo (Tier 1)

Best for: SMB and mid-market teams that need reps producing lists immediately.

Why it wins: Apollo's the fastest path from "ICP idea" to "contacts in a sequence." Reps can self-serve, build lists quickly, and start working without a heavy RevOps build.

Implementation note: Apollo works best when you set rules early: who exports, how often, and what "verified" means in your org. Without that, you'll spray duplicates into your CRM and argue about attribution for months.

Watch-outs: Data quality swings by market and industry. The real cost meter is exports + mobiles, and the contract gotcha's simple: you can't reduce seats mid-term.

Pricing: Annual plans run $49-$119/user/month. Free plan includes 10,000 email credits/month, 5 mobile credits/month, and a 250 emails/day send limit. Overage credits often land around $0.03-$0.10/credit.

For a deeper dive on list quality and bounce outcomes, see Apollo.io accuracy.

Clay (Tier 1)

Best for: operators who need highly specific lists and custom enrichment logic.

Why it wins: Clay's the tool you buy when "filter by title + industry" isn't enough. It's how you build lists like: "VP Sales at SaaS companies hiring X role, using Y tech, with headcount growth, enriched with custom fields, routed to the right owner."

Watch-outs (budget guardrails that work):

- Put a hard credit budget on every run.

- Test on 200 rows before you run 20,000.

- Treat "one more enrichment step" like adding headcount: it has a real cost.

Pricing: $0 (1,200 credits/year), $134/mo (24K/year), $314/mo (120K/year), $720/mo (600K/year) billed yearly.

If you're comparing build-vs-buy, this pairs well with a lead enrichment tools breakdown.

ZoomInfo (Tier 1)

Best for: larger orgs that will actually use a GTM suite (Sales + Marketing + intent + workflows).

Why it wins: ZoomInfo still wins on breadth: contacts plus packaging for multi-team GTM motions. If you're running ABM, intent, and workflow automation across departments, it can be the "one contract" that supports the whole machine.

Contract checklist (read this before you sign):

- Lock renewal language; assume 10-20% uplift unless you negotiate it.

- Define what counts as a "module" and what triggers a re-quote.

- Ask how top-ups work and what happens when you exceed included credits.

- Make seat reductions possible at renewal (get it in writing).

Watch-outs: For SMB teams, it's overkill. The frustration isn't the base price - it's paying for modules you don't use and getting re-quoted when you try to right-size.

Pricing: Typical annual is $15k-$45k+/year. Most mid-market deployments land $25k-$40k/year, depending on seats and modules.

If you're sanity-checking reachability and decay, compare notes with Is ZoomInfo accurate? and ZoomInfo pricing.

Outreach (Tier 1)

Best for: serious outbound teams that need enterprise-grade sequencing, governance, and coaching.

Why it wins: Outreach is built for scale: sequences, templates, triggers, CRM sync (including custom objects), and the operational controls RevOps cares about. When it's implemented well, it becomes the system reps live in.

Packaging map (where the bill grows):

- Engage: core sequences + tasks

- Call: voice (often usage-based org-wide)

- Meet / Kaia: conversation intelligence

- Amplify: AI agents (credit-based consumption)

Watch-outs: Implementation and change management are the hidden cost. If you don't enforce standards (templates, steps, logging rules), you'll pay enterprise pricing for chaos.

Pricing: Estimate $100-$160/user/month depending on modules, plus voice usage and AI credits.

If you're weighing platforms, see sales engagement platform alternatives.

Cognism (Tier 2)

Best for: teams that care about EMEA coverage and phone verification.

Why it wins: Cognism's phone verification is genuinely useful when direct dials matter, and it's a strong alternative when you want a data product without a sprawling suite.

Watch-outs: Intent is capped in a way buyers miss: you pick 12 topics out of a much larger library. Export limits can also bottleneck power users.

Pricing: Quote-based; a realistic planning range is $1k-$3k/month for small teams depending on seats and export volume.

Salesloft (Tier 2)

Best for: teams that want cadences + coaching + analytics with strong manager visibility.

Why it wins: Salesloft's excellent for standardizing rep execution and giving managers clean visibility into activity and outcomes. It's a common choice when you want strong engagement without the same implementation overhead as Outreach.

Watch-outs: Caps and add-ons are where frustration builds. If your outbound motion's high-volume, throttles and feature gating will show up fast.

Pricing: Estimate $125-$150/user/month plus add-ons.

HubSpot Sales Hub (Tier 2)

Best for: teams that want CRM-native consolidation and cleaner reporting.

Why it wins: HubSpot's advantage is operational: fewer integrations, fewer sync failures, and a prospecting workspace that's easy to onboard. If you're governance-minded, CRM-native engagement keeps your data cleaner.

Watch-outs: HubSpot doesn't solve reachability by itself. You still need verified emails/mobiles upstream if you're doing real outbound.

Pricing: Starter starts at $15/seat/mo (Starter). Higher tiers are packaged (for example, Professional starts at $1,450/month for five seats), with calling minutes and AI credits as add-ons.

If you're trying to keep your system clean long-term, pair this with a keep CRM data clean workflow.

LeadIQ (Tier 2)

Best for: capturing leads from web sources and pushing clean records into CRM + sequencers.

Why it wins: LeadIQ nails "capture and sync." Reps stop babysitting CSVs, and RevOps gets fewer duplicates and cleaner mappings.

Watch-outs: Phone-heavy motions get expensive because phones cost 10 credits.

Pricing: Free includes 50 credits. Pro starts at $200/month. Credit math is explicit: email = 1, phone = 10, email+phone = 11, account enrichment = 3.

If you're budgeting, compare against LeadIQ pricing.

Amplemarket (Tier 2)

Best for: teams that want signals -> personalization -> send in one workflow.

Why it wins: Amplemarket's strongest when you want one place to decide who to contact, why now, and what to say - then launch outreach without stitching together five tools.

Watch-outs: It's overpriced if your only goal's list building and exporting contacts.

Pricing: Plan around ~$50-$170/user/month when annualized (often sold as ~$600-$2,000 per user/year depending on plan and volume).

If you're shopping around, see Amplemarket alternatives.

Lusha (Tier 3)

Best for: quick email/phone lookups during research. Pricing: ~$30-$70/user/month depending on credits.

Instantly (Tier 3)

Best for: cold email sending at scale (mailboxes + rotation). Pricing: $~$37-$97/mo.

Lemlist (Tier 3)

Best for: personalization-first outbound for SMB. Pricing: ~$55-$79/user/month on annual billing, plus add-ons.

Waalaxy (Tier 3)

Best for: agency-style social automation workflows. Pricing: EUR 0 / EUR 19 / EUR 49 / EUR 69 per user/month, plus EUR 20/month for Inbox add-on.

Dripify (Tier 3)

Best for: simple social sequences for solo users. Pricing: ~$59-$79/user/month.

ZoomInfo reality check: If you're buying ZoomInfo primarily for emails and direct dials, you're paying suite pricing for a Layer 1 problem. If you're buying it for ABM/intent/workflows across Sales + Marketing and you'll operationalize those modules, it earns its keep.

Credit economics & hidden limits (the real cost-to-scale)

This is where prospecting tools quietly wreck budgets.

Finance sees "$99/user/month" and assumes it's linear. It isn't. The real cost-to-scale is driven by credits, caps, and packaging mechanics, and those mechanics compound when you add phones, exports, enrichment runs, and "just one more module" that sounded small in the sales call but shows up as a new line item at renewal.

Patterns that repeat:

- Apollo: Base seats are fine, but exports + mobiles are the meter. Overage credits land around $0.03-$0.10/credit, and teams hit it faster than expected once they export at volume.

- LeadIQ: Pricing's honest, but phone math's brutal. Phone = 10 credits.

- Outreach: Voice and AI are usage-based; "per seat" is only the starting line.

- ZoomInfo: Top-ups + module creep, then renewals come back higher.

The mini math example (why $99/user becomes $30k/year)

Say you've got 6 reps.

- You buy a "$99/user/month" tool: ~$7,100/year.

- You add exports, mobiles, and enrichment runs.

- You add a second module (intent/workflows/AI).

- You can't reduce seats mid-term, so you carry unused seats.

Now you're at $20k-$30k/year without doing anything "wrong."

Real talk: credit systems that bill API calls the same as manual exports punish RevOps. You end up optimizing for billing mechanics instead of pipeline.

Deliverability checklist (so your "prospecting tool" doesn't burn your domain)

Deliverability isn't a nice-to-have anymore. It's the constraint.

Bad data -> bounces -> reputation damage -> worse inboxing -> lower reply rates -> reps send more -> you spiral.

Deliverability checklist (do this before scaling volume)

- Authenticate sending: SPF, DKIM, DMARC are non-negotiable.

- Enable one-click unsubscribe (List-Unsubscribe headers).

- Use a dedicated sending domain (separate from your primary domain).

- Warm up properly: start at 5-10 emails/day per mailbox and ramp over 4-6 weeks.

- Segment campaigns: don't mix high-risk cold with warm inbound follow-up.

- Verify emails before sending: bulk verification beats guessing formats.

- Classify bounces: track hard vs soft bounces; hard bounces are the real reputation killer.

Monitoring that helps:

- Google Postmaster Tools (Gmail reputation + spam rate signals)

- Microsoft SNDS (Outlook/Hotmail reputation signals)

- Inbox placement testing with seed lists (not just "delivered")

Thresholds callout box (print this)

- Target spam complaints: <0.3%

- Target bounces: <2%

- Dedicated IP starts to matter around ~200,000+ emails (high volume)

DMARC example policy:

v=DMARC1; p=reject

I've watched teams blame their sequencer when the real issue was upstream: stale data and no verification. Your engagement tool can't "feature" its way out of a 5% bounce rate.

Best prospecting stacks by scenario (stop buying 15 tools)

You don't need 15 tools. You need a stack that matches your operating model.

Each recipe uses the same 3 layers: (1) Data + verification (2) Enrichment/workflows (3) Engagement. The optional "under-the-radar" layer is outbound infrastructure: inbox rotation, domain clustering, and verification.

SMB / founder-led outbound (speed + low overhead)

- Layer 1 (data + verification): a verified data source with transparent credits (optimize for bounce rate first).

- Layer 2 (workflows): light Clay usage only if you need enrichment chains; otherwise keep it simple with Zapier/Make.

- Layer 3 (engagement): Instantly or Lemlist for sending + personalization.

Optional under-the-radar: inbox rotation/domain clustering, plus a second verification pass for event/partner lists.

SDR team (repeatable process + governance)

- Layer 1: verified contacts + direct dials as a shared source of truth.

- Layer 2: Clay for enrichment, routing, dedupe rules, and "only push verified" guardrails into CRM.

- Layer 3: Outreach or Salesloft for sequences + calling + coaching.

Integrations that work in practice: verified data -> HubSpot/Salesforce, verified data -> Instantly/Lemlist, Clay -> CRM via native connectors or Zapier/Make.

RevOps / enterprise (control + scale + multi-team usage)

- Layer 1: API-first enrichment + strict verification to protect deliverability at scale.

- Layer 2: Clay (or internal workflows) for enrichment pipelines, dedupe, field mapping, and governance.

- Layer 3: Outreach for engagement, plus CRM-native reporting.

Optional under-the-radar: campaign separation (cold vs warm), mailbox rotation, and domain clustering.

30/60/90 rollout plan (so the stack actually sticks)

Days 1-30: stop the bleeding

- Verify and suppress risky addresses before sending.

- Clean duplicates and define field ownership (RevOps owns schema; SDR leadership owns list criteria).

- Set deliverability thresholds (pause rules when bounces/complaints spike).

Days 31-60: build repeatable list -> CRM flow

- Lock your ICP filters and naming conventions.

- Automate "only push verified" into CRM/sequencer.

- Create 2-3 standard plays (new funding, job change, headcount growth) and measure reply + meeting rates.

Days 61-90: scale volume without burning domains

- Add mailboxes gradually; keep segmentation strict.

- Add monitoring (Postmaster/SNDS + inbox placement tests).

- Review cost-to-meeting weekly (not cost-per-seat).

Micro case snippets (what "better data" changes)

I hate seeing teams "fix" this with more tools. The fix is usually boring: stop sending to risky addresses, tighten your list criteria, and make verification a hard gate before anything hits a sequencer.

- Deliverability rescue: Meritt cut bounce rate from 35% to under 4%, tripled pipeline from $100K to $300K/week, and pushed connect rate to 20-25%.

- AE time back + pipeline up: Snyk had 50 AEs prospecting 4-6 hours/week, cut bounce from 35-40% to under 5%, and increased AE-sourced pipeline 180% with 200+ new opportunities/month.

- Faster ramp + fewer fires: GreyScout cut bounce from 38% to under 4%, increased pipeline 140%, and cut rep ramp time from 8-10 weeks to 4 weeks.

Tired of month-3 surprises? Prospeo has no annual contracts, no module creep, no renewal uplifts. Just transparent credits, 300M+ profiles, and bounce rates under 4% - proven across 15,000+ companies.

Stop comparing tools and start comparing bounce rates.

FAQ

What's the difference between a data provider and a sales engagement platform?

A data provider supplies contact and company data (emails, mobile numbers, firmographics, and sometimes intent), while a sales engagement platform runs sequences/cadences, calling, tasks, and coaching. In practice, most teams pair one data source with one engagement tool to keep bounces under 2% and activity reporting consistent.

What bounce rate and complaint rate should cold email teams target in 2026?

Most outbound teams should target hard bounces under 2% and spam complaints under 0.3% to protect inbox placement. Start new mailboxes at 5-10 emails/day and ramp over 4-6 weeks, pausing sends when thresholds spike instead of powering through and burning the domain.

How do credit-based prospecting tools usually charge (exports vs mobiles vs enrichment)?

Most tools meter the expensive actions: exporting contacts, revealing mobile numbers, and running enrichment steps at scale. A common pattern is email being cheap while phones cost 10x (for example, 10 credits per mobile) and workflow chains multiply costs across every row, so a 10,000-row run can blow the budget fast.

Which tool's a good free option for verified emails without an annual contract?

Prospeo's a strong free option for verified emails because the free tier includes 75 emails plus 100 extension credits per month, and paid usage stays transparent at about $0.01 per verified email with no contract. If you're testing alternatives, compare on one metric first: can you keep bounces under 2% on real campaigns?

Summary: what to take from this prospecting tools comparison

If you only remember one thing from this prospecting tools comparison, make it this: optimize for reachability and cost-to-scale, not "most features." Start by fixing data quality (verification + freshness), add workflows only where they remove manual work, and then pick an engagement platform your reps'll actually live in without hidden usage meters wrecking your budget.