Qualification Call Best Practices (2026): A Measurable 30-Minute Playbook

$15k in pipeline can die on a "quick 15-minute chat" that ends with "send me something." That's not a qualification call. That's a polite time sink.

Treat qualification like a decision meeting: either you earn a next step with a date, or you disqualify fast and move on. This playbook's built for reps who want cleaner pipelines, fewer zombie deals, and calls that actually go somewhere.

Here's the hook: you'll leave with a 30-minute agenda, a "pick 12" question set, coaching numbers, and a scorecard you can paste into your CRM today.

What a qualification call is (and what it isn't)

A qualification call is a short, structured conversation to answer one question: is there a real path to a next step that's worth your time?

Not "do they like us." Not "can I pitch." And definitely not "can I keep this lead warm forever."

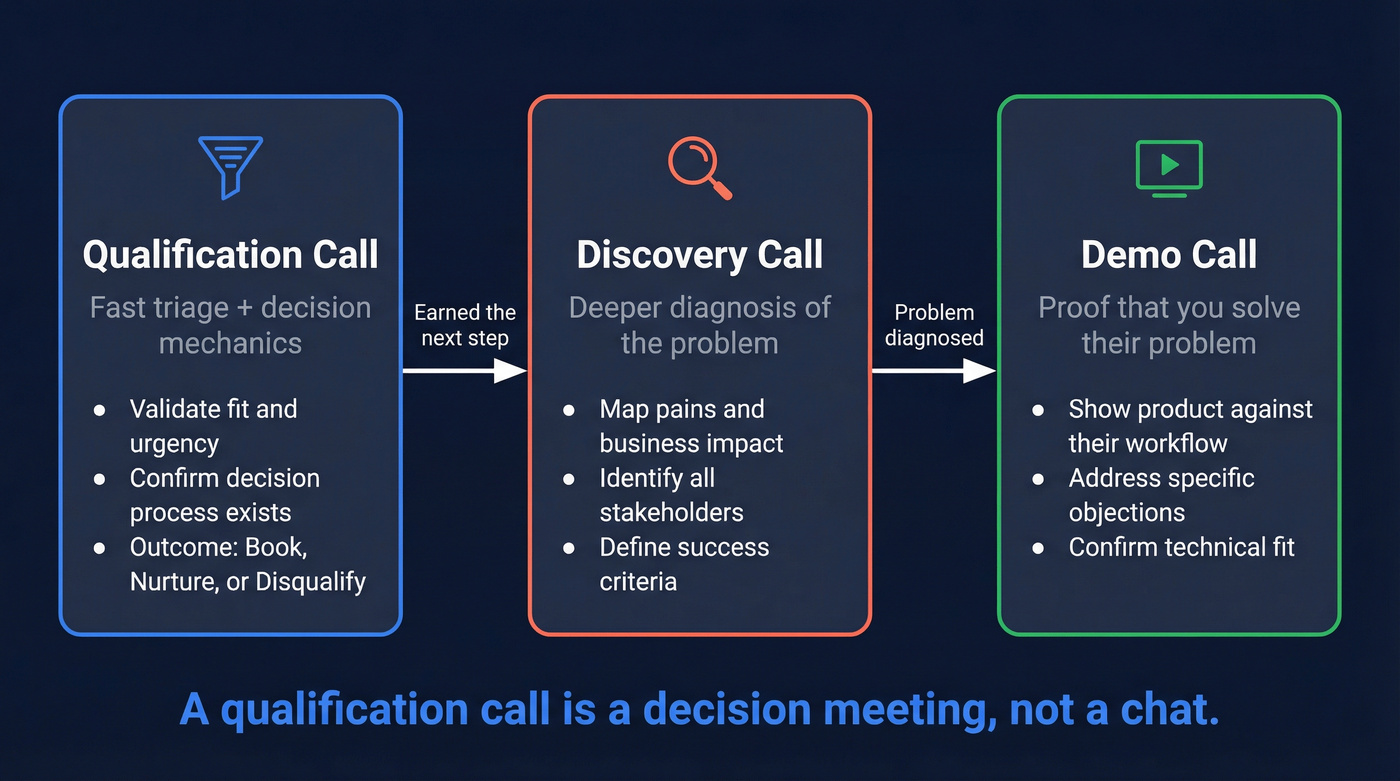

Here's the separation that keeps teams sane:

- Qualification call: fast triage + decision mechanics. You validate fit, urgency, and process enough to justify a deeper meeting.

- Discovery call: deeper diagnosis. You map pains, impacts, stakeholders, and success criteria.

- Demo: proof. You show how the product solves the specific problem you already diagnosed.

My POV (and yes, it fixes most teams): a qualification call is a decision meeting, not a chat. The decision is "book the next step" vs "nurture" vs "disqualify," and you should say that out loud early.

What you need (quick version): agenda, benchmarks, scorecard

Implement these three things this week and your calls will stop drifting.

1) A 30-minute agenda + opener that ends in a decision

- Frame the call as: confirm fit + agree next step.

- Ask "what would make this a win?" so you're not guessing what "good" means.

- If you can't get to a next step with owners and dates, it isn't qualified.

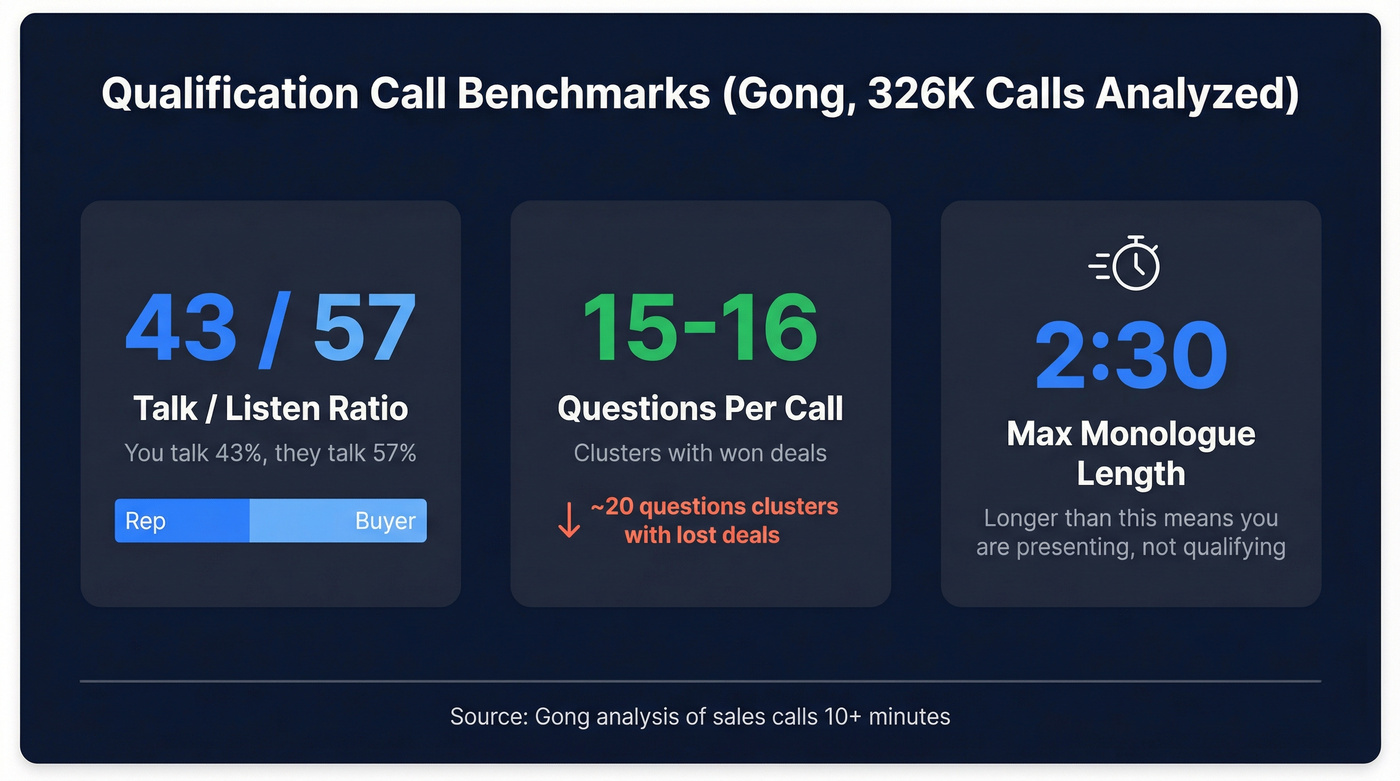

2) Benchmarks to coach to (Gong standards) Gong's analysis of 326K sales calls (10+ minutes) gives you targets that are easy to coach:

- 43% talk / 57% listen is the ratio to aim at.

- 15-16 questions clusters with won deals; ~20 clusters with lost deals.

- <= 2:30 longest monologue (longer than that = you're presenting, not qualifying).

3) A 0-100 scorecard with routing bands Stop vibes-based qualification. Use a simple banding system:

- 80-100 = book the next step (calendar invite sent on the call)

- 50-79 = nurture (clear gap + defined re-entry trigger)

- 0-49 = disqualify (with reason code)

If you can't reliably reach the other stakeholders, qualification stalls. Verified contact data (for example, Prospeo's 98% email accuracy) helps you multi-thread without playing email roulette.

Qualification call best practices: The 30-minute agenda (copy/paste) + exact opener

The best qualification calls feel calm and inevitable.

That's not charisma. It's structure.

Timeboxes come from Storylane. The opener and agenda language come from YourSalesTutor. Use both and you'll stop ending calls with "I'll follow up."

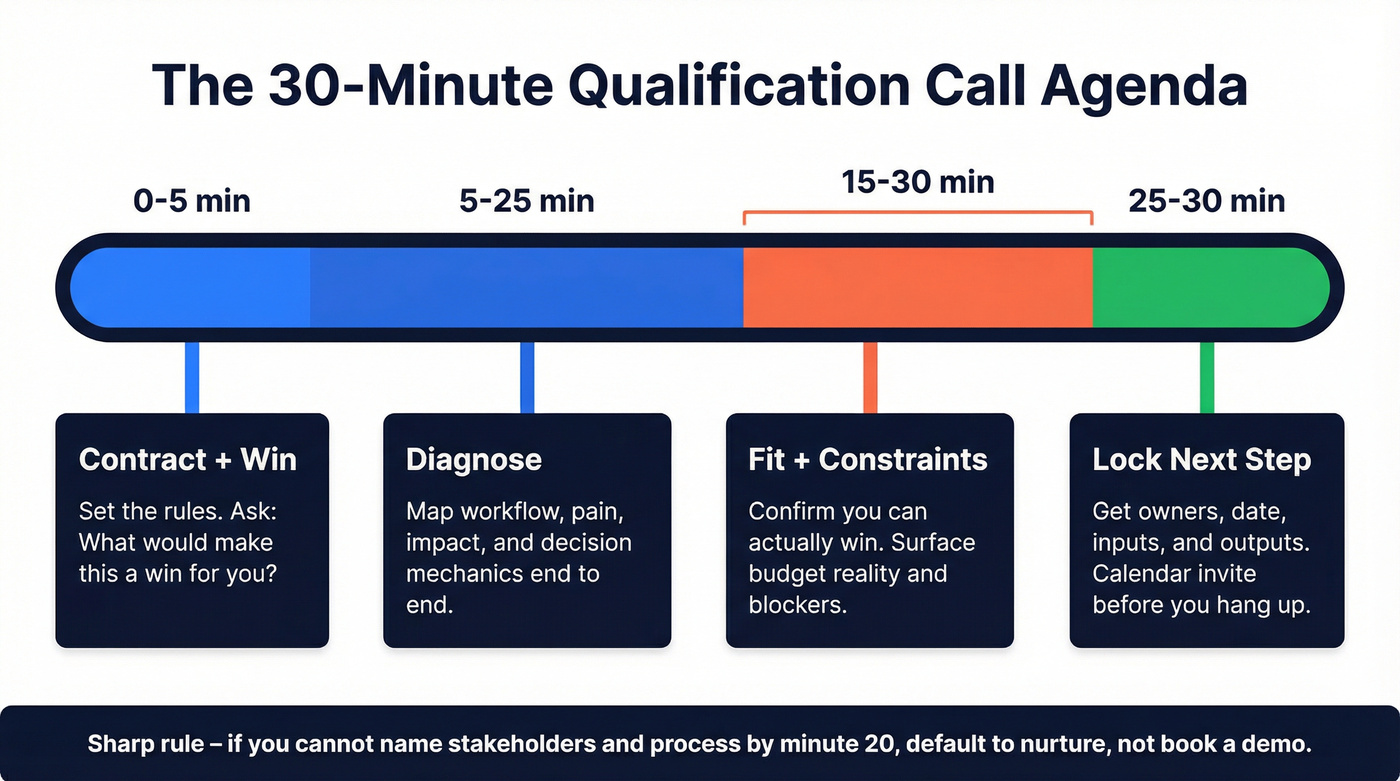

The Storylane timeboxes (exact structure)

- 5 minutes: set the contract + define "win"

- 15-20 minutes: diagnose (workflow, pain, impact, decision mechanics)

- 10-15 minutes: map fit + confirm constraints (including budget reality)

- 5-10 minutes: recap + lock the next step (owners, date, inputs/outputs)

Here's the agenda you can paste into your call prep doc.

| Block | Minutes | Your job | Exact line |

|---|---|---|---|

| Contract + win | 5 | Set the rules of the call | "Plan: confirm goals + current situation, confirm requirements/constraints, then decide the next step. Still good on 30 minutes?" |

| Diagnose | 15-20 | Get to specific pain + process | "Walk me through how this works today, end to end." |

| Fit + constraints | 10-15 | Confirm you can win (or exit) | "Based on what you said, here's where we help - and here's what I need to confirm so I don't waste your time." |

| Next step | 5-10 | Get a dated decision | "If this is worth pursuing, let's lock the next step right now: who needs to be there, and what time works?" |

Sharp rule (use it): if you can't name stakeholders and process by minute 20, default to nurture, not "book a demo." Demos don't create urgency; decision mechanics do.

Opener script (word-for-word)

Use this verbatim until it's muscle memory:

"Thanks for making time. Plan for today: (1) goals + current situation, (2) requirements and constraints, (3) confirm fit and agree the next step. Still good on 30 minutes?"

Then immediately:

"By the end of this call, what would make this a win for you?"

This works because it sets a contract and forces the buyer to define success before you start guessing.

What this sounds like (mini-transcript: setting the contract)

Rep: "If we're aligned, we'll book the next step before we hang up. If we're not, we'll call it and I'll point you to the right resource. Fair?" Buyer: "Yep."

That one line prevents a ton of "circle back next quarter" purgatory.

Diagnose prompts (keep it diagnostic)

Your job in the 15-20 minute block is diagnosis, not persuasion. You're trying to learn whether there's a real problem, a real process, and a real next step.

Use prompts that force specificity:

- "What triggered you to take this call right now?"

- "Walk me through the workflow end-to-end."

- "Where does it break most often?"

- "What happens if nothing changes in the next 90 days?"

- "Who feels the pain the most - and who owns fixing it?"

If they ask for pricing early, don't dodge. Park it with a reason:

"Happy to talk pricing. First I want to confirm scope and what 'success' looks like so I don't give you a useless number."

Recap + propose ONE next step

The recap is where you earn the right to move the deal forward.

"Let me recap in three bullets to make sure I've got it..."

Then propose one next step. Not three options. Not "what do you want to do?" You're the guide.

Examples of next steps that actually qualify:

- "A 45-minute working session with you + whoever owns X to map success criteria and confirm the decision process."

- "A tailored demo focused on your workflow, plus a pilot plan with pass/fail metrics."

- "A technical validation call if security/integrations are gating."

Lock next steps (owners, dates, inputs/outputs)

This is where most reps get polite and lose control. Use a close that's operational, not salesy:

"If we're aligned this is worth pursuing, let's lock next steps. Who needs to be there, and what's a good time?"

Confirm four things before you hang up:

- Owner (who schedules / who attends)

- Date/time

- Inputs (what you need from them)

- Outputs (what they'll get)

What this sounds like (mini-transcript: locking next steps)

Buyer: "Just send me something." Rep: "I will - but if I send generic info, it won't help. The useful next step is 20 minutes with you and whoever owns X. Can we grab Tuesday at 2 or Wednesday at 11?" Buyer: "Wednesday at 11."

Calendar invite sent. Deal stays alive.

A practical add-on I like from Storylane: send a short interactive demo 2-3 business days before the call so the buyer shows up with context. Use it to shorten your "what we do" section, not to replace discovery. Storylane's discovery agenda template is a solid reference: https://www.storylane.io/blog/discovery-call-agenda

Choose the right qualification framework (and where each breaks)

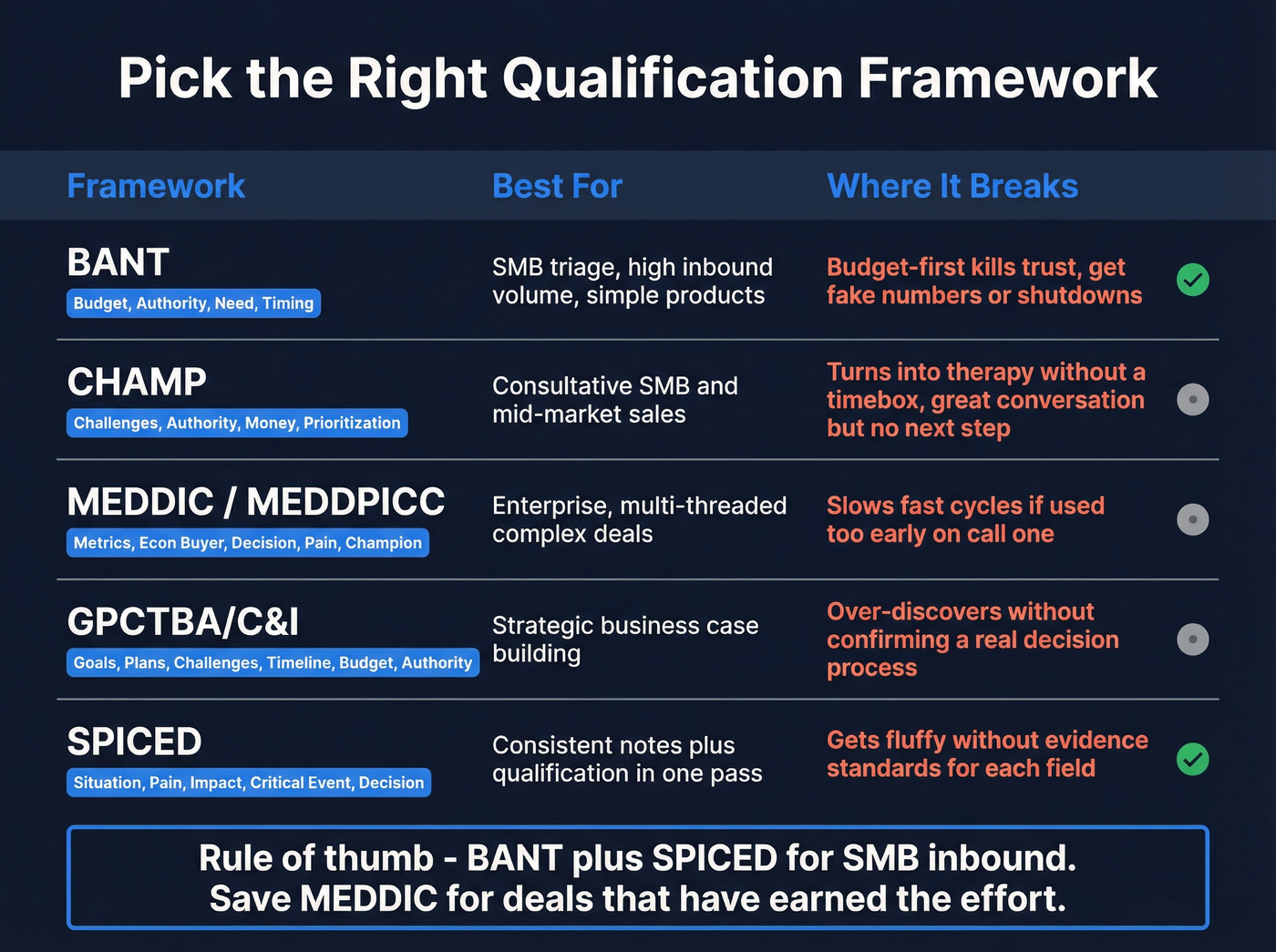

Frameworks are useful until they turn into interrogation scripts. The failure mode's predictable: reps ask a checklist, the buyer feels processed, and nobody learns how a decision actually gets made.

Spotio's guidance is a clean rule of thumb: use BANT for SMB triage and MEDDIC/MEDDPICC for enterprise control. The mistake is mixing them - running MEDDIC on call one for a fast cycle, or running BANT on a complex buying committee and pretending you "qualified" it.

My stance: for SMB inbound SDR teams, start with BANT + SPICED notes. Skip MEDDIC on call one. Save heavyweight frameworks for deals that have earned the effort.

Quick comparison (pick one, don't mash them together)

| Framework | Best for | Where it breaks |

|---|---|---|

| BANT | SMB triage, high inbound volume | Budget-first kills trust |

| CHAMP | Consultative SMB/mid-market | Drifts without a decision push |

| MEDDIC/MEDDPICC | Enterprise, multi-threaded deals | Slows fast cycles if used too early |

| GPCTBA/C&I | Strategic business cases | Over-discovers without confirming process |

| SPICED | Consistent notes + qualification | Becomes fluffy without evidence standards |

BANT (fast triage)

BANT (Budget, Authority, Need, Timing) has been used since the 1950s and it's still the fastest way to sort real opportunities from tire-kickers.

Where BANT breaks: when reps lead with budget like it's a customs checkpoint. Ask "what's your budget?" before you've earned trust and you'll get a fake number or a shutdown.

Use BANT when:

- You've got high inbound volume

- You sell a simpler product with a clear price band

- You need a fast "yes/no" on next step

CHAMP (challenge-first)

CHAMP flips the order: start with Challenges, then Authority, Money, Prioritization.

Where it breaks: CHAMP turns into "therapy" if you don't timebox and drive to a decision. Great conversation, no next step.

MEDDIC / MEDDPICC (enterprise control)

MEDDIC is the heavyweight: Metrics, Economic Buyer, Decision Criteria, Decision Process, Identify Pain, Champion. MEDDPICC adds Paper Process + Competition, which is exactly what kills deals late.

Operational rule (steal this): don't invest (SE time, custom demo, security review) until you have evidence for Metrics + Economic Buyer + Pain + Champion. If those four aren't real, you're decorating a deal that won't close, and everyone on the team will feel it two months from now.

GPCTBA/C&I (goal planning)

GPCTBA/C&I is strong when the buyer's strategic and you're mapping a business case: Goals, Plans, Challenges, Timeline, Budget, Authority + Consequences/Implications.

Where it breaks: it invites over-discovery. You'll learn a lot and still not know if there's a real decision process.

SPICED (notes + qualification in one)

SPICED (Situation, Pain, Impact, Critical Event, Decision) is my favorite for teams that want consistency without turning reps into robots.

Where it breaks: if you don't enforce evidence standards, reps write SPICED notes that sound good and mean nothing.

You just locked a next step with the champion - now you need to multi-thread to the economic buyer. Prospeo gives you 98% accurate emails and 125M+ verified mobile numbers so you reach every stakeholder without bouncing.

Stop letting qualified deals stall because you can't reach the decision-maker.

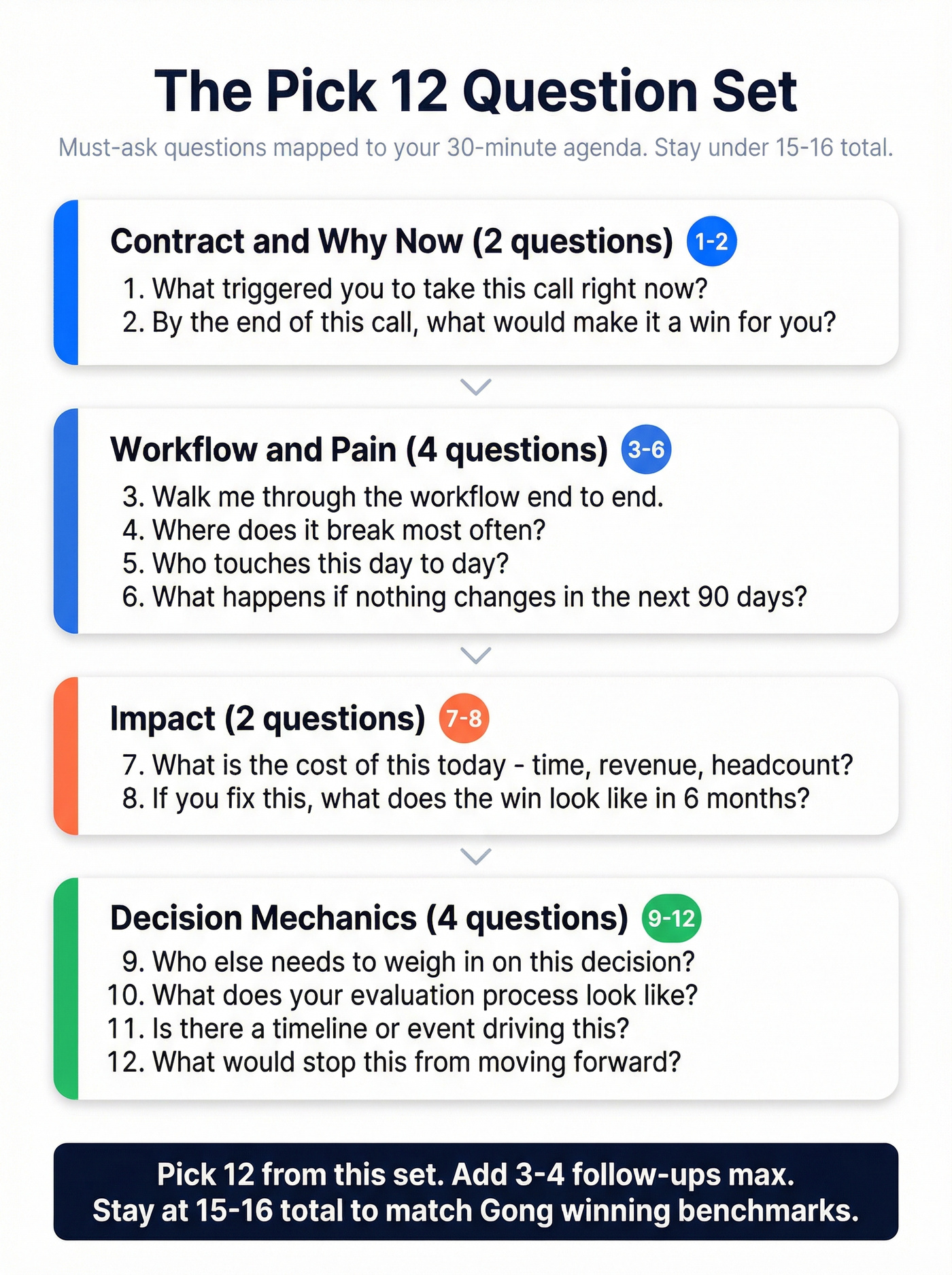

The question bank that gets to a decision fast (with a "Pick 12" set)

You don't need "better questions." You need fewer questions that force decisions.

Also: you can't say "cap yourself at 15-16 questions" and then ask 30. So here's the practical way to run this.

The "Pick 12" core questions (must-ask)

These map cleanly to the 30-minute agenda and keep you under control.

Contract / why now (2)

- "What triggered you to take this call right now?"

- "By the end of this call, what would make it a win for you?"

Workflow + pain (4) 3) "Walk me through the workflow end-to-end." 4) "Where does it break most often?" 5) "Who touches this day-to-day?" 6) "What happens if nothing changes in the next 90 days?"

Impact (2) 7) "What's the cost of this today - time, money, or risk?" 8) "How often does this happen per week or month?"

Decision mechanics (3) 9) "How do you typically evaluate something like this?" 10) "Who besides you will have strong opinions about this?" 11) "What are the decision criteria that matter most?"

Next step (1) 12) "If we agree this is worth pursuing, can we lock the next step on the calendar before we hang up?"

The "Pick 3" optional questions (choose based on motion)

Pick three. No more.

If budget is usually the blocker

- "Is there budget allocated, or would this come from another line item?"

- "What's a no-go price range so we don't waste time?"

If security/integrations are usually the blocker

- "What systems does this need to integrate with on day one?"

- "What's your security review process and typical timeline?"

If you're displacing an incumbent

- "If you choose a vendor, what would you replace?"

- "What would make you stick with the current approach?"

What this sounds like (mini-transcript: budget without being weird)

Buyer: "Just give me pricing." Rep: "I can. First: are you replacing something you already pay for, or is this net-new budget?" Buyer: "Replacing." Rep: "Great - what are you spending today between tools and people to make this work?"

Now pricing is anchored to reality, not vibes.

Full question bank (grouped, for reps who want options)

If you want more prompts, use these, but stick to the Pick 12 + Pick 3 rule.

Situation & current workflow

- "What tools are involved today?"

- "Where does it break most often?"

- "Who owns the process vs who suffers the pain?"

Pain & impact

- "Who's complaining the loudest?"

- "If you fixed this, what would improve - revenue, cost, cycle time, churn?"

Decision mechanics

- "What's the approval path - and where do deals usually get stuck?"

- "If we nailed the solution, what would still stop this from happening?"

Budget & build-vs-buy

- "If you didn't buy, would you build, hire, or live with it?"

- "What's the ROI bar you'd need to clear?"

Timing & critical event

- "What's the ideal go-live date?"

- "When do you need to make a decision by?"

Competition & displacement

- "What other options are you considering?"

- "Have you tried a tool or internal approach before - what happened?"

Benchmarks to coach to: talk/listen, questions, monologues

Most teams coach calls with vague advice ("be curious," "build rapport"). That produces inconsistent calls and bloated pipelines.

Coach to numbers instead.

Gong's patterns across 326K sales calls (10+ minutes) are simple benchmarks to enforce:

- Talk/listen target: 43% rep talk / 57% buyer talk

- Question count: 15-16 questions clusters with won deals; ~20 clusters with lost deals

- Longest monologue: keep it <= 2:30

The three numbers that matter (and the "so what")

- 43/57 talk ratio: if you're above 50% talk, you're probably pitching.

- <= 2:30 monologue: if you can't explain something in 2:30, you don't understand it well enough yet.

- 15-16 questions: when reps drift to ~20, it's usually because they're avoiding the moment where they propose a next step.

Here's the thing: the goal isn't to "sound consultative." It's to get the buyer talking about their process and constraints so you can either move forward cleanly or get out of the way.

Manager coaching cadence (simple, repeatable)

If you manage reps, here's the cadence that actually changes behavior:

- Weekly: pick one metric per rep (talk ratio or monologue length or question count).

- Twice weekly: scorecard QA on 3 random calls (check evidence, not "style").

- Monthly: pipeline hygiene review by reason code (if "no access to stakeholders" is high, your qualification's single-threaded).

Hot take: most "coaching" is just managers reacting to bad outcomes. Coaching is moving one measurable behavior at a time until the outcomes follow.

The pass/fail qualification scorecard (0-100) + decision outcomes

If you want consistent qualification, you need a scorecard that's:

- short (5-7 criteria)

- evidence-based (notes must prove points)

- decays over time (stale leads shouldn't look "hot" forever)

monday.com's lead scoring mechanics translate cleanly to qualification calls: use 5-7 criteria, set a threshold (often 50-75/100), and apply 25% monthly decay without activity.

Score (behavior) vs grade (fit)

Salesforce Trailhead's model is a clean way to avoid mixing signals: keep score for behavior/engagement and grade for fit.

Operationally:

- Grade (fit): do they match your ICP and use case?

- Score (behavior): are they acting like a buyer who'll follow through?

Behavior score examples (steal these point values)

Use these as a starting point and tune them to your motion:

| Behavior signal | Points |

|---|---|

| Visited pricing page | +10 |

| Requested a demo / booked time | +5 |

| Replied to an email (non-OOTO) | +5 |

| Added a stakeholder to the next meeting | +10 |

| No-showed a scheduled call | -15 |

| Visited careers/jobs page | -10 |

Routing impact (be decisive):

- If fit's strong but behavior's weak, nurture with a trigger date.

- If behavior's strong but fit's weak, disqualify fast (don't let excitement override reality).

- If both are strong, book and move.

Evidence required (what must be in notes)

Rule: no evidence, no points. Evidence can be a quote, a metric, a named stakeholder, a date, or a documented process step.

Bands + routing rules (book/nurture/disqualify)

Use these bands:

- 80-100 (Book): schedule next step live, create opportunity (or convert to SQL)

- 50-79 (Nurture): no opp; add to sequence; set a re-qual date and trigger

- 0-49 (Disqualify): close out with reason code; don't let it rot in pipeline

Here's a practical scorecard you can implement in one afternoon.

| Criteria | Points | Pass/Fail | Evidence to capture |

|---|---|---|---|

| ICP fit (industry/use) | 0-20 | Pass >= 12 | Use case + why now |

| Pain severity | 0-15 | Pass >= 8 | "What breaks" quote |

| Impact quantified | 0-15 | Pass >= 8 | $/hrs/risk metric |

| Critical event | 0-10 | Pass >= 5 | Date + consequence |

| Process mapped | 0-15 | Pass >= 8 | Steps + timeline |

| Stakeholders named | 0-10 | Pass >= 5 | Names/roles list |

| Next step agreed | 0-15 | Pass >= 10 | Invite + agenda |

Reason codes (protect pipeline hygiene)

- No pain / low priority

- No critical event

- No access to stakeholders

- No budget path

- Wrong segment / wrong use case

- Build vs buy (building)

- Timing (revisit in X)

We've run scoring rollouts where pipeline dropped 20-30% in a week and leadership panicked.

Two weeks later, win rates improved because reps stopped spending time on "maybe" deals. That's the whole point.

One-page qualification sheet (copy/paste, printable)

Print this. Put it next to your monitor. Use it as your call note template.

Qualification Call One-Pager (30 minutes) Goal: Decide: Book next step / Nurture / Disqualify

1) Contract (first 60 seconds)

- Agenda: goals/current -> requirements/constraints -> decide next step

- Win question: "What would make this a win?"

2) Six categories (ask, then capture evidence)

- Trigger: Why now? What changed?

- Workflow: How does it work today, end-to-end?

- Pain: What's broken? Who feels it?

- Impact: Cost in time/$/risk; frequency

- Decision: stakeholders, criteria, process steps, timeline

- Constraints: budget reality, security/integrations, resourcing

3) Required evidence fields (no blanks)

- Use case (one sentence)

- Impact metric (one number)

- Critical event date (or "none")

- Stakeholders list (names/roles)

- Decision process (steps + owner)

- Next step (meeting title + date/time)

4) Score + route

- 80-100: Book (invite sent on call)

- 50-79: Nurture (re-entry trigger + date)

- 0-49: Disqualify (reason code)

5) Reason code (mandatory)

- Timing / No pain / No critical event / No stakeholders / No budget path / Wrong segment / Build internally / Lost to X

Common qualification call mistakes (and the fix)

These anti-patterns show up across GTM teams because they're comfortable, not because they work.

- Pitching in minute 3

Fix: earn the right to pitch by getting one quantified impact metric first.

- Mistaking politeness for intent

Fix: intent is a dated next step with other stakeholders, not "sounds good."

- Checklist interrogation

Fix: ask fewer questions, then summarize and propose a next step by minute 25.

- No ICP spine

Fix: decide your non-negotiables (segment, use case, minimum pain) and disqualify fast.

- No disqualification culture

Fix: if the buyer won't agree to a dated next step, it isn't qualified - close it out or nurture with a trigger. Keeping it "open" is how pipelines rot.

- Single-threading

Fix: map stakeholders on the call and make "add one stakeholder" part of the next step definition.

Objections & stalls on qualification calls (diagnose, don't debate)

Objections on qualification calls are usually uncertainty or lack of urgency wearing a polite mask. Treat each as a diagnostic branch, not a debate.

Decision-tree playbook

If it's price:

Diagnostic question: "When you say expensive, what are you comparing it to?"

Then: anchor to impact you quantified. If you didn't quantify impact, you can't win a price objection.

If it's timing:

Diagnostic question: "What would need to be true for it to be the right time?"

Then: identify the missing trigger and set a re-entry date.

If it's trust:

Diagnostic question: "What part feels riskiest about moving forward?"

Then: propose a risk-reducing next step (reference call, pilot with pass/fail, security review).

If it's fit:

Diagnostic question: "What requirement are you not confident we can meet?"

Then: either confirm fit with proof or disqualify quickly.

"Send me info" (customize -> book)

"Send me info" is usually a stall. Use this pattern: agree, customize, then book.

Permission-based script:

"Totally - happy to send something. To make it relevant, can I ask one quick question: what are you hoping to solve this quarter?"

Then:

"Based on that, the most useful thing is a 20-minute working session so I can tailor it. Want to grab time now?"

What this sounds like (mini-transcript: stakeholder mapping)

Rep: "Who besides you will have strong opinions about this?" Buyer: "My VP and security." Rep: "Perfect - then the next step isn't a demo. It's a working session with your VP plus a security Q&A. Can we invite both now?"

That's qualification. Everything else is theater.

Post-call operating system: prep -> notes -> score -> route -> follow-up (SOP)

A qualification call isn't done when the call ends. It's done when the record's clean enough that someone else can run the next step without re-asking basic questions.

Pre-call 3-minute prep (beats winging it)

Do this before every qualification call:

- Trigger: what happened (form fill, referral, webinar, outbound reply)?

- Role: are they a user, champion, or economic buyer?

- Tech stack: what do they run today (CRM, data tools, core systems)?

- Recent events: funding, hiring, product launch, reorg, compliance deadline

- Intent signals: pricing page views, demo page views, comparison pages, repeat visits, stakeholder forwarding (if you can see it)

Then set a hypothesis in one line: "I think they care most about X; I need to confirm Y to earn a next step."

SPICED notes template (copy/paste)

Paste this into your CRM note template:

- Situation: Current tools/process, who's using it, what triggered the call

- Pain: What's broken, where it fails, who's impacted

- Impact: Quantified cost (time/$/risk), what happens if unchanged

- Critical Event: Deadline, milestone, or forcing function + date

- Decision: Stakeholders, process steps, criteria, approval path, next meeting date

If any SPICED field's blank, your scorecard should reflect that. No free points.

Scoring + decay + SLA handoff

Immediately after the call (same day):

- Fill SPICED notes (5 minutes)

- Apply the 0-100 score (2 minutes)

- Route based on band (book/nurture/disqualify)

Decay rule (simple and brutal):

- If there's no new activity, reduce the score by 25% each month.

SLA handoff (if SDR -> AE):

- Booked next step must include: agenda, attendees, and the 3-bullet recap

- AE accepts/rejects within 24 hours (or it goes back to SDR)

WhatConverts reports phone leads are 10-15x more likely to convert than other lead types. That's exactly why your post-call workflow can't be optional: calls create momentum, and sloppy follow-up kills it.

Multi-threading is part of qualification now. If you've only got one contact, you're one org chart away from a dead deal. (If you need a tighter framework for stakeholder coverage, see multithreading in sales.)

In our experience, the fastest "unblock" here isn't another follow-up email. It's getting the right people into the invite, which is why teams keep a tool like Prospeo around: it's the B2B data platform built for accuracy, with 300M+ professional profiles, 143M+ verified emails, and 125M+ verified mobiles on a 7-day refresh cycle, so you aren't chasing someone who left the company six weeks ago. If you're building a workflow around that, start with B2B contact data decay and a simple data quality scorecard.

Reason codes to protect pipeline hygiene

Reason codes aren't bureaucracy. They're how you learn.

Require one reason code any time a lead is nurtured or disqualified:

- Timing (revisit date required)

- No pain / low priority

- No access to stakeholders

- No budget path

- Wrong segment

- Build internally

- Competitive displacement (lost to X)

After 30 days, review reason code distribution. If "no access to stakeholders" is high, your calls aren't qualification calls. They're single-threaded chats.

Compliance checklist: recording consent + data hygiene (standard practice)

Don't get cute with compliance. Standard practice is simple: announce, confirm, store.

Use this checklist:

- Announce recording at the start: "I'm going to record so I can focus on the conversation - is that okay?"

- Get explicit consent (verbal yes) and note it in the call record.

- Default to explicit consent even if you operate in one-party consent regions; it's cleaner and builds trust.

- Store recordings securely with role-based access.

- Set retention rules (don't keep recordings forever "just because").

- Keep notes factual: stick to business context and decision process.

If your legal team's got a policy, follow it. Otherwise, explicit consent + secure retention is the operational baseline. (For outbound teams, align this with your GDPR for sales and marketing playbook.)

Skip this if...

If you're selling a $29/mo self-serve product with no onboarding and no human-led sales motion, don't force a "qualification call" just to feel enterprise.

Send the trial, instrument activation, and use lifecycle emails. You'll close more and annoy fewer people.

If you do nothing else this week...

- Paste the Storylane timeboxes into every invite and run the opener verbatim.

- Enforce one outcome: book / nurture with trigger date / disqualify with reason code.

- Coach one Gong metric per rep per week (talk ratio, monologue, or question count). For a fuller system, use a sales call checklist and standardize your lead qualification process.

FAQ

What's the difference between a qualification call and a discovery call?

A qualification call is a 20-30 minute decision meeting to confirm fit, urgency, and next-step mechanics; discovery is a deeper 45-60 minute diagnosis of pains, impacts, stakeholders, and success criteria. If you're building a full business case and mapping the entire problem, you're doing discovery, not triage.

How long should a qualification call be?

A qualification call should usually be 20-30 minutes, with at least 5 minutes reserved to recap and book a dated next step. If you can't map stakeholders and the decision process by minute 20, default to nurture instead of forcing a demo that won't convert.

How many questions should you ask on a qualification call?

Aim for 12-16 real questions, then stop and drive to a decision. Gong's benchmarks show won deals cluster around 15-16 questions, while lost deals drift toward ~20 because reps keep digging instead of proposing a concrete next step with owners and dates.

How do you qualify a buying committee when you only have one contact?

Make the next step contingent on adding 1-2 stakeholders (for example, VP + security) to the invite, and treat "names + roles" as a pass/fail requirement.

A practical mindset shift: the goal isn't just "a good conversation." It's qualifying leads on the first call by confirming fit, urgency, and decision mechanics well enough to earn a multi-threaded next step.

That's the whole game.

A clean pipeline starts before the call. Prospeo's 300M+ profiles with 30+ filters - buyer intent, job changes, headcount growth - let you qualify prospects before you even dial. At $0.01 per email, bad-fit calls stop eating your calendar.

Pre-qualify your pipeline with data that's refreshed every 7 days.