Unify Pricing (2026): Which "Unify" and What You'll Actually Pay

$1,740/month billed annually in one spot. $1,000/month in another. Then you notice credits, seats, senders, "active plays," and managed mailboxes all have their own meters. That's how unify pricing turns into a budgeting headache.

Here's the thing: UnifyGTM isn't "just another outbound tool." It's an operating layer, and the bill behaves like one.

Hot take: if your outbound motion is still "list -> sequence -> pray," UnifyGTM's overkill. You'll pay platform money for orchestration you won't operationalize.

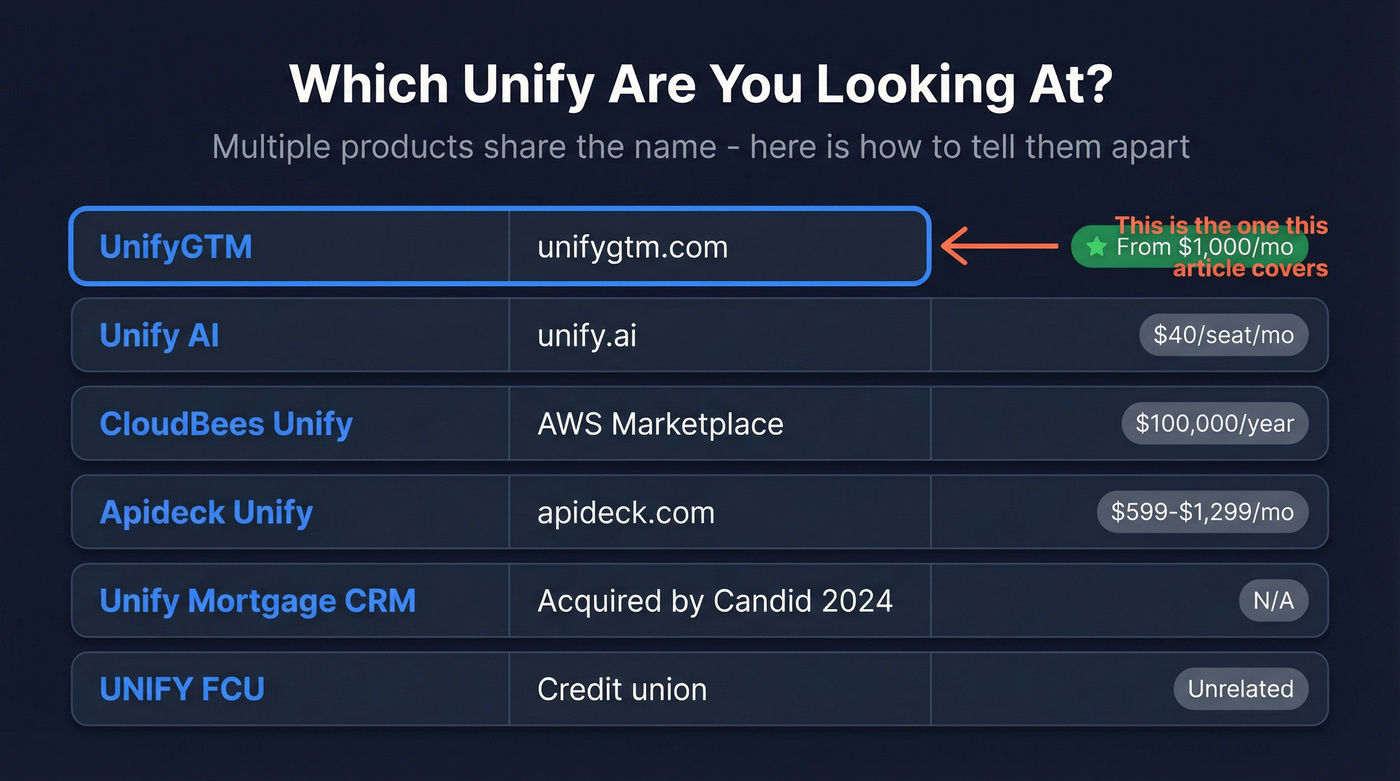

Which "Unify" pricing do you mean?

Before you build a spreadsheet, make sure you're looking at the right company. "Unify" is a SERP trap: multiple unrelated products share the name, and Google blends them together.

Two quick rules that save time:

- If the site isn't

unifygtm.com, you're probably not looking at the outbound platform with credits, plays, and managed mailboxes. - If you're seeing an assistant/dev-tool vibe and seat-based AI plans, that's

unify.ai, not UnifyGTM.

Use this checklist to get to the right pricing page fast:

- UnifyGTM (GTM "system of action" with intent + plays + sequencing + agents) -> go straight to unifygtm.com/pricing or jump to [Unify pricing at a glance](#unify-pricing-at-a-glance-unifygtm-plans - why-numbers-conflict)

- Unify AI (assistant platform) -> unify.ai/pricing (Pro is $40/seat/month)

- CloudBees Unify (DevOps) -> quote-based; free up to 5 users; its AWS Marketplace listing shows a $100,000 per 12 months line item for a 12-month contract

- Apideck Unify (unified APIs) -> apideck.com/pricing ($599/month Launch, $1,299/month Scale)

- Unify mortgage CRM (different company) -> acquired by Candid in 2024; not the GTM tool

- UNIFY FCU rates (credit union rates) -> unrelated

If you meant UnifyGTM, the rest of this article is about the stuff that actually hits your budget: credits + users + email sending users + managed Gmail mailboxes + active plays.

Unify pricing at a glance (UnifyGTM plans + why numbers conflict)

UnifyGTM's pricing looks public, but it isn't clean. The same pricing page shows multiple packaging blocks that don't reconcile neatly, which is exactly why finance teams get stuck.

The two anchors you'll see most often:

- $1,740/month billed annually (Growth, "credits issued annually")

- $1,000/month (Growth, monthly block with a smaller monthly credit allotment)

You may also see $1,460/month in a "recommended" or calculator-style area. You're not imagining it; Unify's presenting multiple offers/SKUs on one page.

One sentence of advice from someone who's been on the receiving end of this: if the pricing page makes you squint, assume procurement's going to ask for three rounds of clarification.

Definitions that change your quote (don't skip this)

These terms are where pricing gets misunderstood:

- Users = platform access (who can log in and work in Unify)

- Email sending users = users who can actually send sequences (G2 labels these sequencing users)

- Active Plays = how many plays/workflows can run concurrently (the $1,000/month block includes 2 Active Plays)

- Managed Gmail mailboxes = Unify-provisioned inboxes with warmup/rotation/bounce checks (not just "extra inboxes," but part of deliverability infrastructure)

What the first-party annual table shows (the cleanest snapshot)

The annual view is the most explicit about inclusions:

| Plan (annual view) | Price | Credits | Users included | Managed Gmail mailboxes included |

|---|---|---|---|---|

| Growth | $1,740/mo (billed annually) | 50,000/year (issued annually) | 1 | 8 |

| Pro | Custom | 200,000/year (issued annually) | 2 | 20 |

| Enterprise | Custom | 600,000/year (issued annually) | 5 | 40 |

Why mailbox counts differ across pages (and why you should care)

You'll see mailbox counts that don't match across Unify's page vs third-party listings. That's normal for a fast-moving product: packaging changes, "managed mailbox" definitions shift, and some pages lag behind.

Treat third-party numbers as directional, then lock the exact inclusions (users, sending users, plays, mailboxes, credits, rollover/expiration) into the order form.

One comparison, because it frames expectations: ZoomInfo's pain is usually the contract size; UnifyGTM's pain is metering complexity layered on top of a meaningful platform minimum.

Unify charges 2 credits per email, 4 per phone, and layers on seats, senders, and mailbox fees. Prospeo gives you 98% accurate emails at $0.01 each and verified mobiles with a 30% pickup rate - no metering complexity, no hidden add-on schedules.

Skip the credit burn math. Pay one price per verified contact.

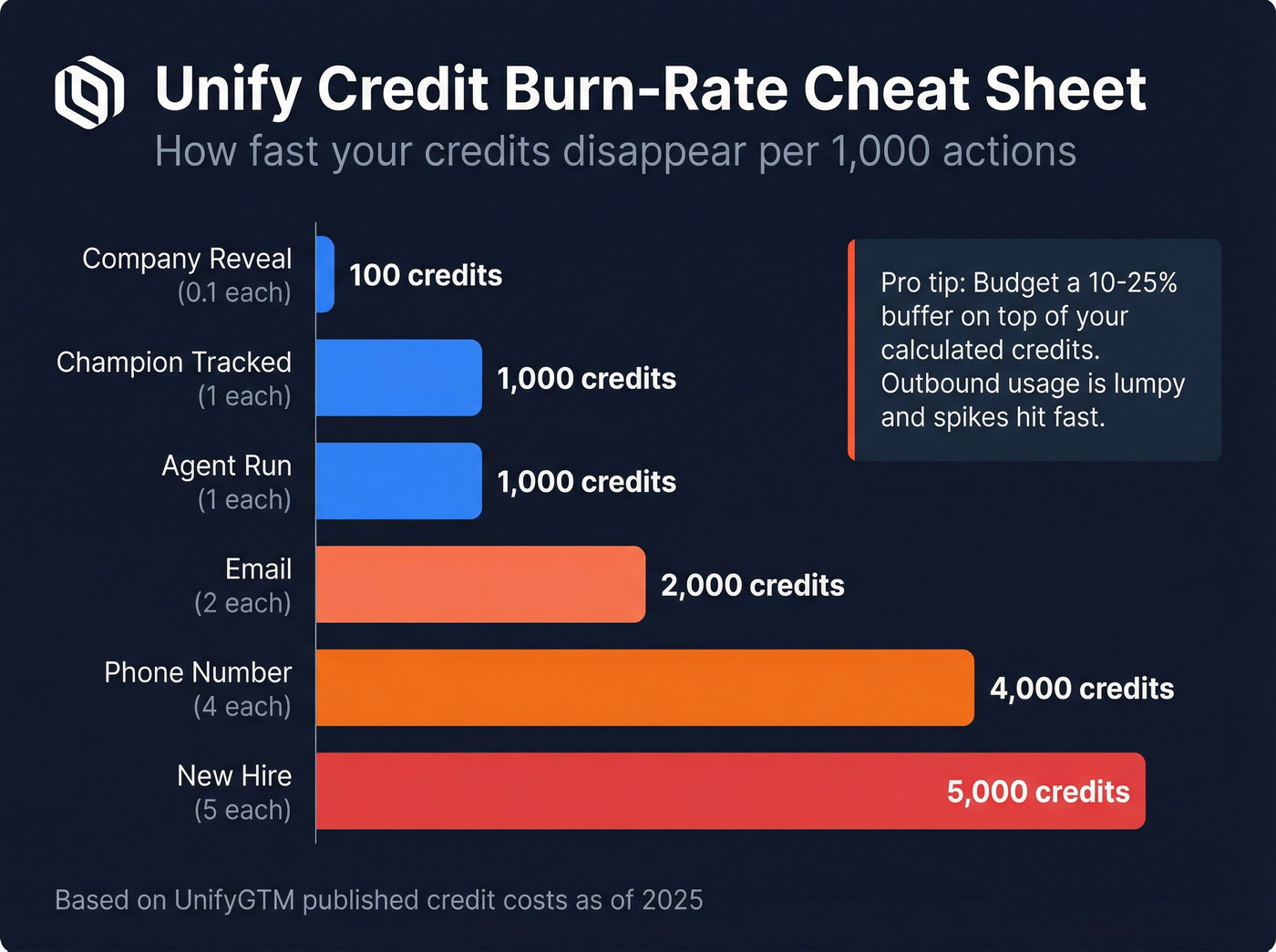

How Unify credits work (unit costs + burn-rate cheat sheet)

Unify credits are the gas tank. Every time you reveal a company, pull contact data, track a champion, or run an agent, you burn credits.

These unit costs are the ones that matter for budgeting:

| Action | Credits per action | 1,000 actions cost |

|---|---|---|

| Company reveal | 0.1 | 100 credits |

| 2 | 2,000 credits | |

| Phone number | 4 | 4,000 credits |

| Champion tracked | 1 | 1,000 credits |

| New hire | 5 | 5,000 credits |

| Agent run | 1 | 1,000 credits |

How I've modeled it in RevOps sheets (and how you avoid surprise top-ups):

- Start with monthly activity targets (reveals, emails, phones, agent runs).

- Convert each to credits using the table.

- Add a 10-25% buffer because usage spikes (new campaigns, new territories, new reps).

- Then pick the SKU: annual credits issued annually vs a monthly credit block.

A quick scenario I've seen in the wild: a team planned for "2,000 emails/month" and forgot they were also pulling mobiles for the same accounts, then turned on agent runs for research. The credit burn doubled in two weeks, and suddenly the "cheap" plan wasn't cheap anymore.

Example: enrich 2,000 emails/month -> 4,000 credits/month just for emails. Add 500 mobiles/month -> 2,000 more credits. You're at 6,000 credits/month before reveals, champions, new hires, or agents.

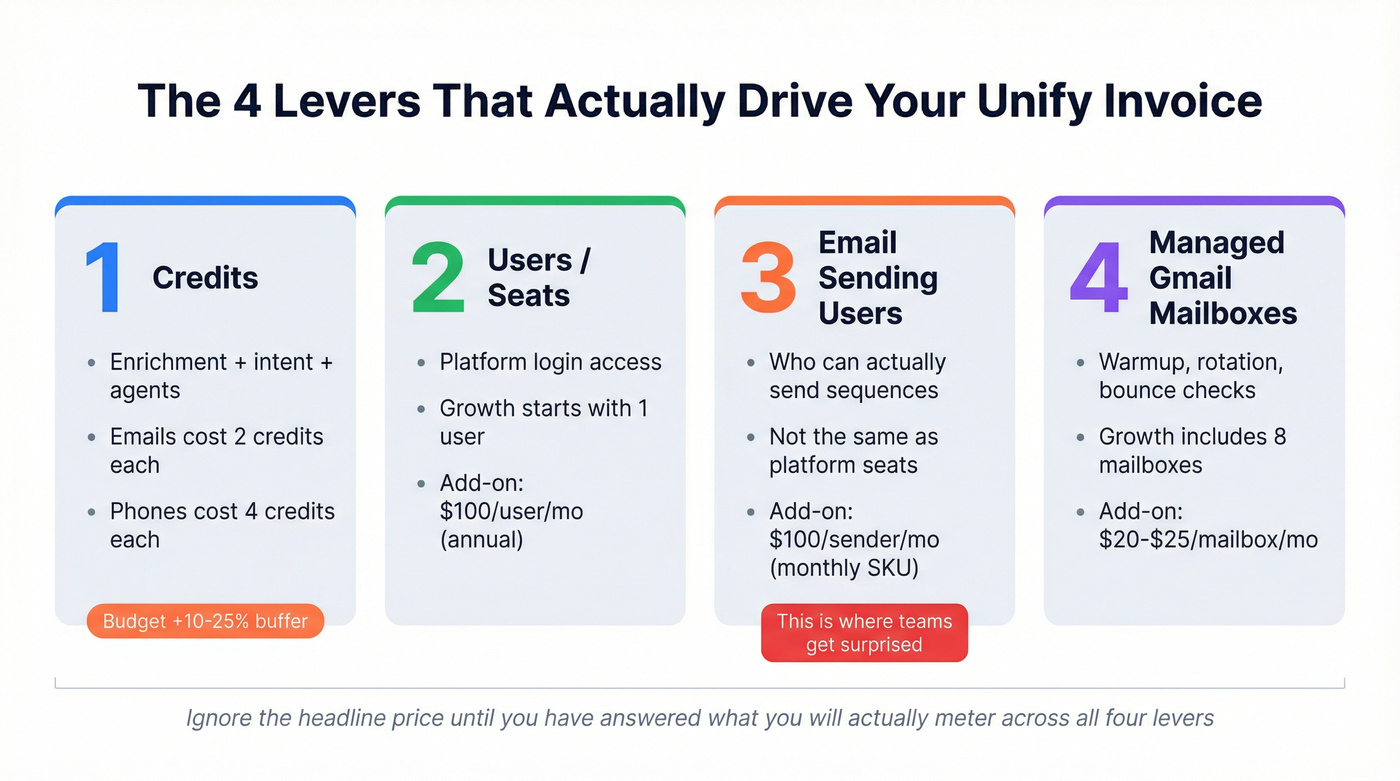

The real cost drivers (credits vs users vs senders vs managed mailboxes)

If you're budgeting UnifyGTM, ignore the headline monthly price until you've answered one question: what will you actually meter? The invoice is driven by four levers.

What moves your invoice (budget these first)

- Credits: enrichment + intent + agent activity. Plan for +10-25% top-ups because outbound's lumpy.

- Users/seats: who needs platform access.

- Email sending users: who can send sequences (this is where teams get surprised).

- Managed Gmail mailboxes: included bundles can be generous at first, then mailbox add-ons become the quiet tax of scaling.

This is the part that annoys people: you can "have seats" and still not be able to send from those seats without paying again.

What to treat as secondary (until procurement asks)

- Onboarding/support language: assume it's included unless your order form adds services. In practice, services land around $0-$5,000 for many mid-market setups, and more when enterprise security/process is heavy.

Add-on schedules (they differ by SKU)

Unify shows different add-on rates depending on which block you're buying:

- Annual table add-ons: $100/user/month (additional users) and $25/mailbox/month (additional managed mailboxes)

- Monthly block add-ons: $40/platform seat, $100/email sender, $20/mailbox

And one budgeting posture that'll save you from a nasty Q4: Unify doesn't publish rollover/expiration rules publicly, so budget as if credits don't roll over unless your order form says they do.

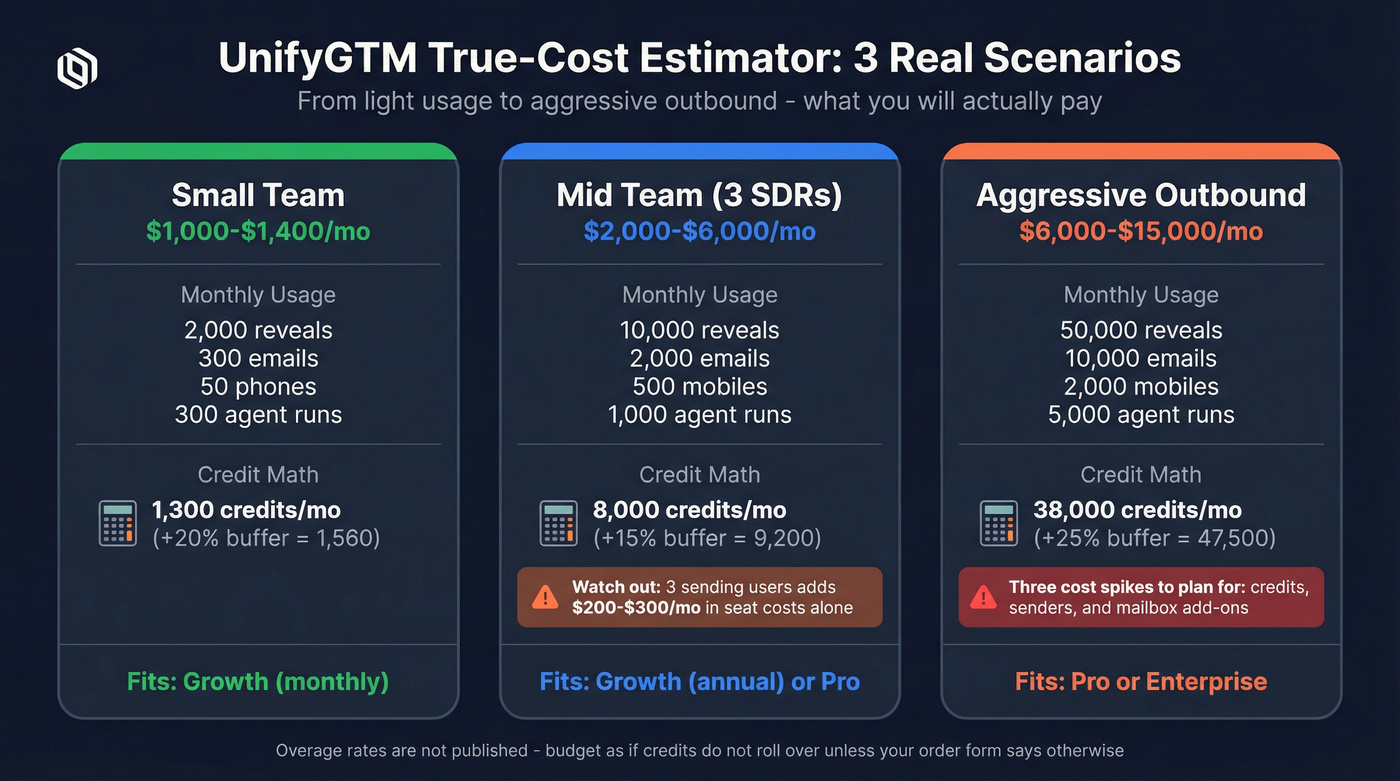

Unify pricing estimator: 3 true-cost scenarios

This estimator won't match Unify's internal quote tool perfectly (because overage pricing isn't posted), but it'll get you to a defensible budget range.

The only overage assumption that's worth using

Anchor it to the $1,000/month Growth block: $1,000 includes 2,500 credits, which implies $0.40 per included credit if you (incorrectly) treat the whole platform fee as "credit spend." You shouldn't, because that fee also buys plays, users, mailboxes, and the operating layer.

That's why I budget top-ups in a tighter, realistic band: $0.02-$0.04 per credit unless your order form says otherwise. In most credit systems, top-ups are cheaper than the smallest "all-in" bundle but not as cheap as enterprise volume, and the exact number depends on how Unify writes your overage schedule.

Estimator table (inputs -> credits -> plan fit)

| Scenario | Monthly usage inputs | Credit calc | Likely fit | Est. monthly range |

|---|---|---|---|---|

| Small team | 2k reveals, 300 emails, 50 phones, 300 agent runs | 200 + 600 + 200 + 300 = 1,300 | Growth (monthly) | $1.0k-$1.4k |

| Mid team (3 SDRs) | 10k reveals, 2k emails, 500 mobiles, 1k agent runs | 1,000 + 4,000 + 2,000 + 1,000 = 8,000 | Growth (annual) or Pro | $2.0k-$6.0k |

| Aggressive outbound | 50k reveals, 10k emails, 2k mobiles, 5k agent runs | 5,000 + 20,000 + 8,000 + 5,000 = 38,000 | Pro / Enterprise | $6.0k-$15k |

Now the worked examples, with the gotchas that show up in approvals.

Scenario 1: Small team (light usage, minimal orchestration)

You're basically using Unify as a light signal + enrichment layer with a couple workflows.

Monthly inputs

- 2,000 company reveals

- 300 emails

- 50 phone numbers

- 300 agent runs

Credits: 1,300/month. Add 20% buffer -> ~1,560.

What to watch

- Need 2 sending users? Add $100/month (monthly SKU).

- Need more than 5 managed mailboxes? Add $20/mailbox/month.

True-cost range: $1,000-$1,400/month.

Scenario 2: Mid team (3 SDRs) - what breaks first

This is the most common setup: a small SDR pod running intent-triggered plays and enriching contacts as they go.

And here's what breaks first: it's usually sending users or credits, not "platform seats."

Monthly inputs

- 10,000 reveals

- 2,000 emails

- 500 mobiles

- 1,000 agent runs

Credits math (with buffer)

- Reveals: 10,000 x 0.1 = 1,000

- Emails: 2,000 x 2 = 4,000

- Mobiles: 500 x 4 = 2,000

- Agent runs: 1,000 x 1 = 1,000 Total = 8,000 credits/month. Add 15% buffer if you're scaling plays -> ~9,200.

Where the budget surprise happens

- On the monthly block, you can have multiple platform users, but you'll pay $100 per email sending user/month as soon as more reps need to sequence.

- On the annual Growth SKU, you start with 1 user, so a 3-SDR pod immediately adds $200/month in users (2 extra x $100).

True-cost range: $2,000-$6,000/month, driven by (1) how many people must send, and (2) how expensive your top-up credits are.

Scenario 3: Aggressive outbound - cost spike checklist

If you're scaling outbound hard, don't model this as "a tool." Model it like infrastructure with three predictable spikes.

Monthly inputs

- 50,000 reveals

- 10,000 emails

- 2,000 mobiles

- 5,000 agent runs

Credits: 38,000/month. Add 25% buffer -> ~47,500.

Cost spikes to plan for

- Credits spike: high-volume enrichment + agent runs will force top-ups unless you're in a higher tier.

- Sender spike: more reps sending means more $100/sender/month add-ons (monthly SKU).

- Mailbox spike: deliverability scaling means more managed mailboxes at $20-$25/mailbox/month depending on SKU.

True-cost range: $6,000-$15,000/month.

Sanity check: what does this look like annually?

A realistic planning band:

- Growth annual minimum: ~$20.9k/year before add-ons (because $1,740/month billed annually)

- Pro/Enterprise budgets: $25k-$100k+/year depending on users, mailboxes, and credit volume

If you got sticker shock, good. That means you're paying attention.

UnifyGTM's priced like an operating layer: intent + enrichment + orchestration + sequencing + deliverability. If you won't use the operating layer, don't buy the operating layer.

Before you budget for 50,000 annual credits that may not roll over, consider this: Prospeo delivers 143M+ verified emails refreshed every 7 days with transparent, self-serve pricing. No order-form gotchas, no sending-user surcharges, no three rounds of procurement clarification.

Get enterprise-grade data without enterprise-grade invoicing headaches.

What you're paying for with "managed mailboxes" (deliverability breakdown)

"Managed mailboxes" sounds like fluff until you've lived through a domain getting burned and your reply rates fall off a cliff.

Unify's managed deliverability bundle is basically: scale sending without trashing your primary domain. The components are the right ones, and if you're doing real volume, they matter more than people think.

- Mailbox warmup (up to 3 weeks / 21 days): ramps sending gradually so new inboxes don't look like spam cannons on day one.

- Bounce prevention: Unify blocks suspected bounces before sending and puts a number on it: prevents 75% of bounces before they're sent.

- Domain rotation: spreads sending across multiple healthy domains so no single domain/mailbox gets overloaded.

- Domain health reporting: visibility into bounce rates, engagement signals, and domain performance so you can intervene early.

- Fast setup: domain setup takes a couple minutes (updating DNS records); propagation can still take longer.

This is why mailbox add-ons matter: you're not just buying inboxes, you're buying a deliverability system.

Independent snapshot (G2) + what users like/dislike

On G2, Unify sits at 4.8/5 from 41 reviews, which is strong for a newer GTM platform. G2 also shows implementation in under 1 month and ROI in ~4 months, which fits a product built around plays and automation.

G2's pricing info was last updated Dec 15, 2026. Use that as directional context, not gospel: confirm the SKU and inclusions on the order form, because Unify's own pricing page shows multiple blocks.

What users like

- Ease of use and quick setup

- Automation + intent-driven workflows that get reps moving fast

What users dislike

- Occasional glitches

- Support responsiveness can lag

- Integration issues and a learning curve in real-world stacks

My take: Unify's awesome when it's aligned to a clean workflow and a disciplined outbound motion. It's miserable when you try to bolt it onto a messy CRM and expect magic.

If you want to sanity-check sentiment yourself: Unify reviews on G2.

Final recommendation (who UnifyGTM pricing makes sense for)

UnifyGTM pricing makes sense when you're buying a full outbound operating system: intent signals, enrichment, agent research, sequencing, and deliverability in one place.

Buy UnifyGTM if

- You run signal-based outbound (intent, champion tracking, job changes) and you'll actually automate plays end-to-end.

- You want managed deliverability baked in, not stitched together from five tools (see email deliverability).

- You can forecast usage well enough to live with a credit model.

Skip UnifyGTM if

- You mostly need contact data and verification. You'll pay platform money for features you won't use.

- Your team hates metered pricing and won't track volume.

Two non-negotiables before you sign:

- Confirm the exact SKU in writing (annual vs monthly block, and which add-on schedule applies).

- Lock definitions into the order form: users vs email sending users, active plays, managed mailboxes, credit rollover/expiration, and top-up pricing.

Tier-3 context so you don't overthink it: Clay's brilliant for custom enrichment workflows, but it's easy to turn it into a never-ending credit-and-API science project. Apollo's the obvious SMB starting point for basic prospecting (compare Apollo cold email). ZoomInfo's still the enterprise database beast with enterprise pricing (see ZoomInfo pricing). 6sense is ABM/intent-first, not a rep-first outbound OS.