Airscale Pricing in 2026: Every Plan, Every Cost, Every Comparison

You just opened the Airscale pricing page and saw four tiers with credit numbers that don't mean much without context. How many emails is 4,000 credits? How many phone numbers? And is $49/month actually cheap, or does it just look cheap until you run out of credits in week two?

Let's break down every number so you can make a real decision.

Airscale Plans at a Glance

| Plan | Monthly Price | Credits/Mo | Per-Credit Cost |

|---|---|---|---|

| Starter | $49 | 4,000 | $0.01225 |

| Pro | $99 | 12,000 | $0.00825 |

| Growth | $189 | 25,000+ | $0.00756 |

| Scale | Custom | Custom | Best rates |

Most teams should start with Starter at $49/mo. It includes every feature Airscale offers - waterfall enrichment, Airsearch AI agent, CRM sync, API access, unlimited users - and 4,000 credits is enough to enrich roughly 530 verified emails or 200 phone numbers per month. No feature gating between tiers. The only variable as you move up is credit volume and per-credit cost.

That "no feature gating" detail matters more than it sounds. Clay locks CRM integrations behind its $720/mo Pro plan. Apollo charges per user. Airscale gives you everything on day one.

Full Airscale Pricing Breakdown

Every Airscale plan runs on credits. You spend credits when you enrich a contact, find a phone number, run an AI research query, or pull company data. The key detail: you only burn credits when valid data is found. If an email lookup returns nothing? No charge.

| Plan | Monthly | Credits | Per-Credit | Per-Unit Costs |

|---|---|---|---|---|

| Starter | $49 | 4,000 | $0.01225 | ~$0.0075/email, ~$0.20/phone |

| Pro | $99 | 12,000 | $0.00825 | ~$0.0075/email, ~$0.20/phone |

| Growth | $189 | 25,000+ | $0.00756 | ~$0.0075/email, ~$0.20/phone |

| Scale | Custom | Custom | Best | $0.008/email, $0.15/phone |

All plans include unlimited users, credit rollover, 30+ data providers, Airsearch AI agent, CRM exports, email sequencer integrations, Slack support, and API access. You can optionally bring your own API keys for additional providers, but it isn't required - Airscale's 30+ built-in providers handle most use cases.

Per-unit costs stay roughly fixed across Starter through Growth, with Scale getting the best per-action rates.

Monthly vs. Annual Billing

Airscale offers roughly a 17% discount on annual billing - effectively two months free:

| Plan | Monthly Billing | Annual (Per Month) | Annual Savings |

|---|---|---|---|

| Starter | $49/mo | ~$41/mo | ~$98/yr |

| Pro | $99/mo | ~$82.50/mo | ~$198/yr |

| Growth | $189/mo | ~$157.50/mo | ~$378/yr |

Airscale is a French-founded company, so annual pricing on some aggregators appears in euros. The dollar equivalents above are approximate.

Start monthly. Airscale offers a 14-day free trial, and credits roll over, so there's no urgency to lock in annual until you've validated the data quality for your specific ICP.

What Each Enrichment Actually Costs

Here's what 4,000 credits (Starter plan) actually buys:

| Enrichment Type | Approx. Cost | Credits Used | Monthly Volume |

|---|---|---|---|

| Verified email | $0.0075 | ~0.6 | ~530 emails |

| Valid phone | $0.20 | ~16-24 | ~170-200 phones |

| Mixed (70/30) | - | - | ~370 emails + 50 phones |

What Can You Do With Airscale Credits?

Airscale's enrichment library covers 20+ actions across four categories:

Contact Data: Verified professional email (waterfall across 15+ providers), phone number (waterfall across 10+ providers), email verification via BounceBan and Debounce, profile and company URL discovery.

Company Data: Domain discovery, Crunchbase funding data, Similarweb traffic, company technologies, open jobs, company insights (headcount growth, median tenure, department breakdown).

AI-Powered: Airsearch AI agent (visits webpages and extracts custom data points), AI custom prompt with dynamic data, job title standardization, B2B/B2C inference, SaaS inference.

Data Cleaning: Company name normalization, website content scraping via ZenRows.

The Airsearch agent is the standout. It's an AI researcher that visits a company's website and pulls whatever custom data you define - pricing model, tech stack mentions, hiring signals, whatever your ICP scoring needs.

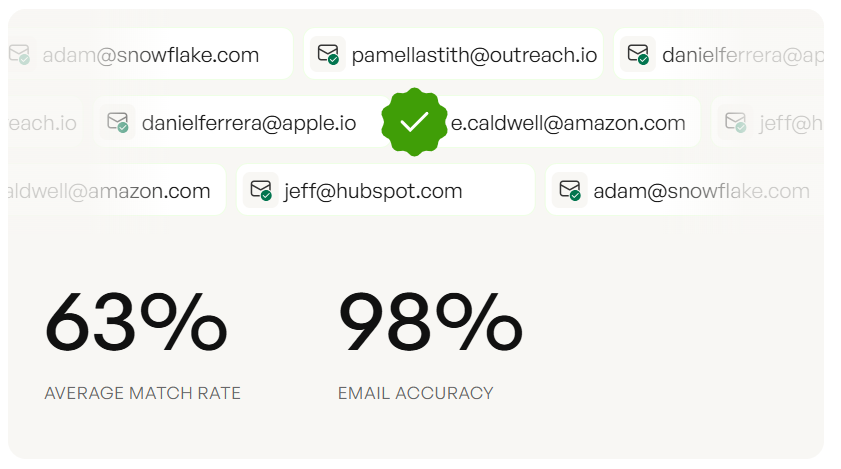

Airscale charges ~$0.0075/email and $0.20/phone. Prospeo delivers 98% accurate emails at $0.01 each - with 125M+ verified mobile numbers and a 30% pickup rate. No API keys to bring, no feature gating, and data refreshed every 7 days instead of sitting stale for weeks.

Stop comparing credit tiers. Start reaching real buyers.

How Far Do Your Credits Actually Go?

Credit counts are meaningless without context. Here's how three common use cases map to Airscale's tiers:

The Solopreneur (500 emails/week) You're running cold outreach solo, targeting ~2,000 contacts per month. You need verified emails for most, phone numbers for maybe 50 high-value prospects.

- Credits consumed: ~1,200 (emails) + ~1,000 (phones) = ~2,200

- Recommended: Starter ($49/mo) - 4,000 credits gives you headroom

The 5-Person SDR Team (2,000 emails/week) Your team's burning through lists. You need ~8,000 email enrichments and ~200 phone numbers monthly.

- Credits consumed: ~4,800 + ~4,000 = ~8,800

- Recommended: Pro ($99/mo) - 12,000 credits covers it with buffer

The Growth Team (5,000+ enrichments/week) Multi-channel outbound at scale - emails, phones, company research, AI-powered ICP scoring.

- Credits consumed: 15,000-25,000+

- Recommended: Growth ($189/mo) - scalable up to 150,000 credits

What the workflow actually looks like: Upload 500 contacts, run email waterfall, Airscale cascades through 15+ providers, 490 found, 10 missed - you burn credits only on the 490 valid results, total cost: ~$3.68. The 10 misses cost you nothing.

Here's the thing: because Airscale doesn't charge per user, that 5-person SDR team pays $99 total - not $99 per seat. That single detail changes the math dramatically compared to per-user tools.

Airscale vs. the Competition - Real Cost Comparisons

A $49/mo tool that gives you 4,000 credits with no hidden costs is fundamentally different from a $134/mo tool that requires separate API subscriptions and locks CRM integrations behind a $720/mo tier. Total cost of ownership is what matters, not sticker price.

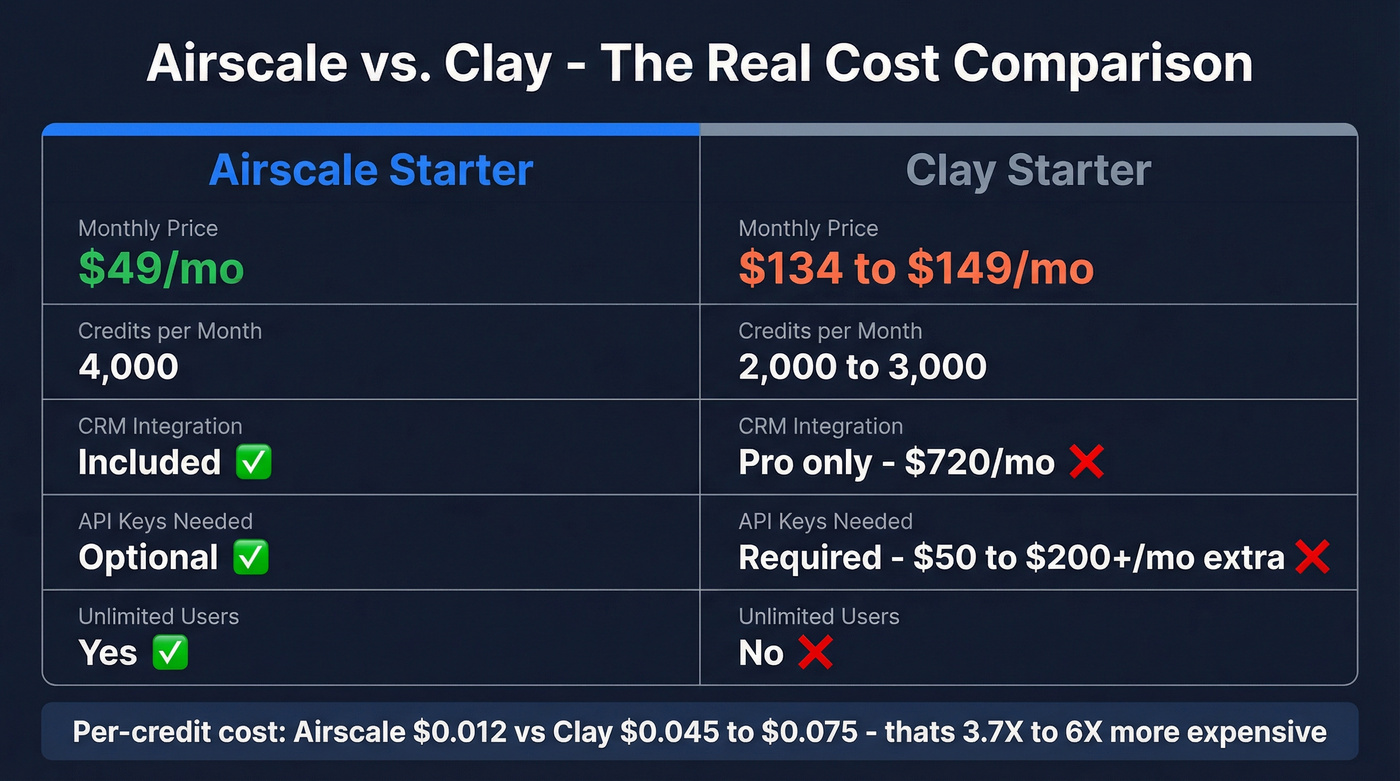

Airscale vs. Clay

This is the comparison everyone's making. Here's the reality:

| Factor | Airscale Starter | Clay Starter |

|---|---|---|

| Monthly price | $49 | $134 (annual) / $149 (monthly) |

| Credits/month | 4,000 | 2,000-3,000 |

| CRM integration | Included | Pro only ($720/mo) |

| API keys needed | Optional | Required ($50-200+/mo extra) |

| Unlimited users | Yes | No |

The sticker price gap is already 3X. But the real gap is wider.

Clay's credit system requires you to bring your own API subscriptions for most enrichment providers - an additional $50-200+/month that doesn't show up on Clay's pricing page. Want to push enriched data to your CRM? That's locked behind Clay Pro at $720/month. Clay's learning curve is itself a cost: 28% of surveyed users cite it as a top complaint, and practitioners report burning $500-800+ in their first weeks just learning the platform. Even Clay's 14-day trial comes with only 1,000 credits and excludes phone enrichments.

A survey of 500+ GTM professionals found that 42% cited pricing and credit burn as their top complaint about Clay. One respondent put it well: "Credits per month, cost per credit, credits per $100 - all these numbers are worthless without knowing the actual value of a credit." Another was more blunt: "Clay's great on features, but when cost per credit is 6X higher than a solid alternative, the math speaks for itself."

That 6X claim checks out. Airscale Starter: 4,000 credits for $49 ($0.01225/credit). Clay Starter: 2,000-3,000 credits for $134-149 ($0.045-0.075/credit). That's a 3.7-6X difference on credits alone - widening further when you factor in Clay's hidden API costs. In an independent review of 10 Clay alternatives, Airscale was ranked the "best overall value" option, and 30% of Clay users actively seeking cheaper alternatives named Airscale specifically.

Clay is a powerful platform. If you need complex multi-step workflows with custom logic, it's hard to beat. But if you're paying for enrichment and the enrichment is what matters, Airscale delivers more data per dollar. Period.

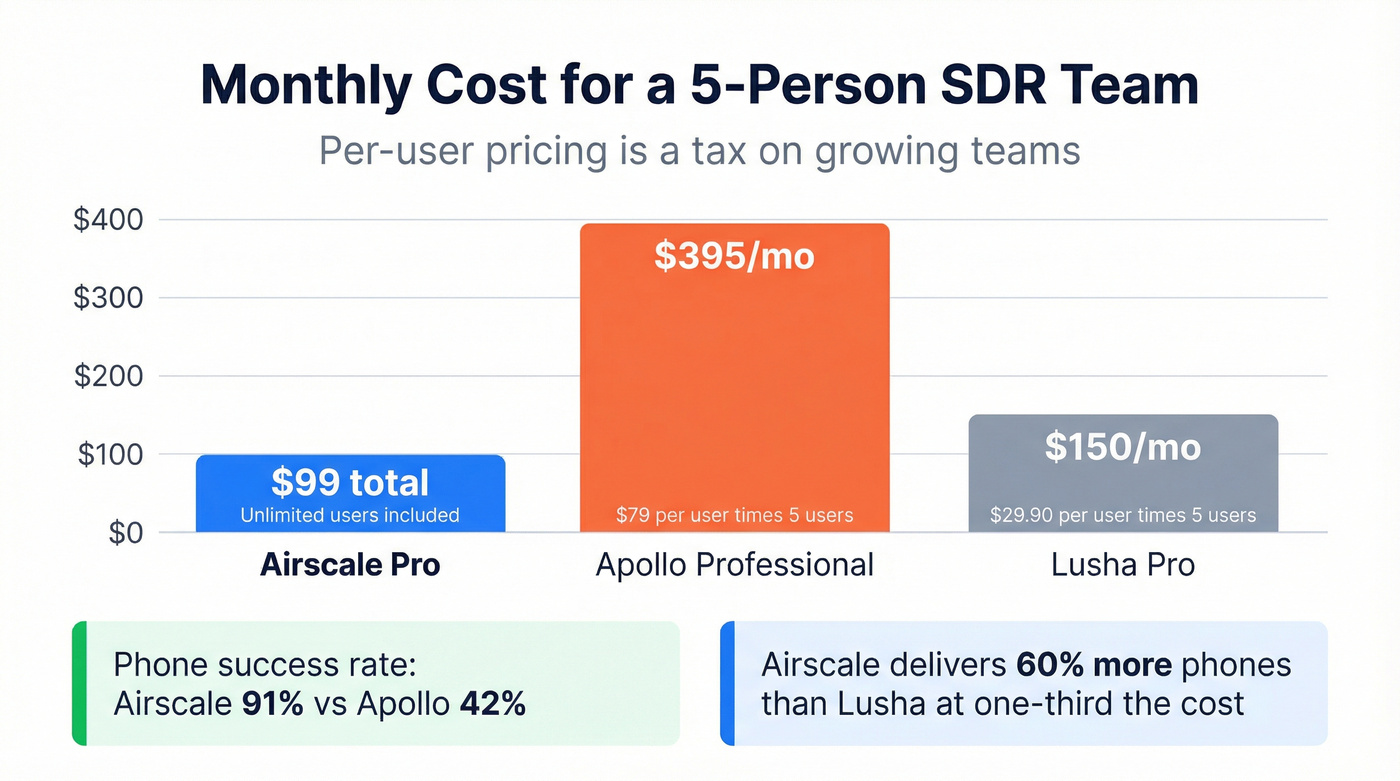

Airscale vs. Apollo

Use Airscale if: you have a team of 3+ people and care about phone number accuracy.

Skip Airscale for Apollo if: you want an all-in-one platform with built-in sequencing and a massive free tier for email-only prospecting.

Apollo's per-user pricing is the killer. A 5-person team on Apollo Professional runs ~$395/month ($79/user on annual billing). That same team on Airscale Starter? $49 total. Unlimited users.

Data quality diverges sharply on phones. An independent test by Derrick App found Airscale hitting a 91% phone success rate versus Apollo's 42% on the same set of hard-to-reach profiles. Apollo's email bounce rates also run 15-20% on some segments per G2 reviewers. Airscale's waterfall approach - cascading through multiple providers and only charging for valid results - structurally avoids this problem.

Apollo's free tier (10,000 email credits/month) is genuinely generous for solo operators. But the moment you add seats or need reliable phone numbers, the economics flip hard.

Airscale vs. Lusha

The credit math here is brutal for Lusha.

Lusha Pro costs $29.90/user/month for 250 credits. A phone reveal costs 10 credits - that's 25 phone numbers per month, per user. A 5-person team pays ~$150/month for 125 total phone numbers. Airscale Starter at $49/month (unlimited users) delivers roughly 200 phone numbers. That's 60% more phones at one-third the cost.

Scale it up: a 10-person team on Lusha Pro runs $299/month for 250 phones total. Airscale Pro at $99/month delivers 500+. The per-user model is a tax on growing teams.

Airscale vs. Enterprise Tools (ZoomInfo, Cognism)

ZoomInfo Professional starts at ~$14,995/year for 5,000 annual bulk credits - $3.00 per contact. Cognism Platinum runs a $15,000+ access fee plus $1,500/user/year.

Airscale delivers verified emails at $0.0075 each and phone numbers at $0.20. Even at the most generous interpretation of ZoomInfo's credit economics, Airscale is 10-15X cheaper per contact.

Real talk: unless you're a 200+ person sales org that needs ZoomInfo's intent data modules, conversation intelligence, and workflow automation baked into one platform, you're overpaying by 10-50X on the data enrichment piece alone. ZoomInfo and Cognism are GTM platforms. Airscale is a data enrichment engine. Know which one you actually need.

Master Pricing Comparison Table

| Tool | Starting Price | Credits/Mo | Per Email | Per Phone | Feature Gating | Unlimited Users |

|---|---|---|---|---|---|---|

| Airscale | $49/mo | 4,000 | $0.0075 | $0.20 | No | Yes |

| Prospeo | Free / ~$39/mo | 75 free | ~$0.01 | 10 credits | No | Yes |

| Clay | $134/mo (annual) | 2,000 | ~$0.05+ | ~$0.50+ | Yes (CRM at $720) | No |

| Apollo | $59/user/mo | Included on paid | Included | ~$0.50+ | Yes (per tier) | No |

| Lusha | $29.90/user/mo | 250 | $0.12 | $1.20 | Yes (per tier) | No |

| ZoomInfo | ~$14,995/yr | 5,000/yr | ~$3.00 | Included | Yes (heavy) | No |

| Cognism | ~$15,000+/yr | Unrestricted | N/A | N/A | Yes (per tier) | No |

The Feature Gating column tells the real story. Airscale and Prospeo are the only tools here that give you every feature on every plan - no artificial walls between you and the data you're paying for.

Is Airscale Worth the Price? Data Quality Benchmarks

Price means nothing if the data bounces.

The strongest independent evidence comes from Derrick App's phone enrichment test. They ran 100 profiles through multiple tools - targeting hard-to-reach contacts in industrial and public administration sectors. Airscale hit a 91% phone number success rate, tying for second-best in the test. Apollo managed just 42% on the same profiles.

On the email side, waterfall enrichment benchmarks tell a clear story: single-source enrichment tools find emails for about 62% of contacts. Waterfall enrichment across 15+ providers (which is what Airscale does) pushes that to 98% found and 95% verified. That gap isn't marginal - it's the difference between a campaign that works and one that doesn't.

Airscale's "pay only for valid data" model is the structural advantage. When an email lookup fails across all providers in the waterfall, you don't burn a credit. When a phone number can't be verified, no charge. Your effective cost per usable contact is exactly what they quote - not inflated by failed lookups like tools that charge regardless of outcome.

One user from Viva reported her team "freed up 3-4 hours per person daily and increased lead volume by 275%" after switching to Airscale, with 90%+ data coverage across critical fields. That's the waterfall enrichment advantage - when one provider misses, the next one catches it.

A gap worth noting: Airscale doesn't have G2 reviews yet. Their profile is inactive with zero reviews, which is common for fast-growing startups that haven't invested in review generation. But the independent test data and user testimonials are strong enough to form a judgment. We've seen plenty of tools with 4.5-star G2 ratings that can't match these enrichment numbers.

Which Airscale Plan Should You Choose?

Starter ($49/mo) - Start here if:

- You're a solopreneur or small team testing the platform

- You need fewer than 4,000 enrichments/month

- You want to validate data quality for your specific ICP before scaling

- You're coming from a per-user tool and want to see the unlimited-seats difference

Pro ($99/mo) - Move up when:

- Your team runs 2,000+ enrichments weekly

- You have 3-5 SDRs actively prospecting

- You need the per-credit cost savings ($0.00825 vs $0.01225)

Growth ($189/mo) - Built for:

- Agencies managing multiple client campaigns

- Scaling SDR orgs with 10+ reps

- Teams running 25,000+ enrichments monthly (scales up to 150,000 credits)

Scale (Custom) - Talk to sales when:

- You need enterprise volume with the best per-unit rates ($0.008/email, $0.15/phone)

- You want custom integrations or dedicated support

Start with the 14-day free trial. Credits roll over, so there's zero risk in starting on Starter and upgrading once you've proven the data quality.

You're evaluating enrichment tools by credit math - but accuracy is what actually drives pipeline. Prospeo's 5-step verification and proprietary email infrastructure deliver 98% accuracy, and teams book 26% more meetings vs ZoomInfo. All with transparent pricing and zero contracts.

Credits mean nothing if half your emails bounce.

FAQ

Does Airscale have a free plan?

Airscale doesn't offer a permanent free plan, but it provides a 14-day free trial with no credit card required. That's enough time to test waterfall enrichment on your actual prospect lists and validate data quality before committing to the $49/mo Starter plan.

Do Airscale credits expire?

No - unused credits roll over to the next month on all plans. Many competitors either expire unused credits or cap rollover at 2X your monthly limit. Airscale's rollover policy means you won't lose credits during slow prospecting months.

Is Airscale really 6X cheaper than Clay?

Airscale Starter gives you 4,000 credits for $49 ($0.01225/credit) versus Clay Starter's 2,000-3,000 credits for $134-149 ($0.045-0.075/credit) - a 3.7-6X gap on credits alone. Add Clay's required API subscriptions ($50-200+/mo) and CRM access locked at $720/mo, and the 6X figure is conservative.

Does Airscale charge per user?

No. Every plan includes unlimited users - a 1-person team and a 20-person team pay the same subscription. This is the single biggest cost advantage over per-seat tools like Apollo ($79/user), Lusha ($29.90/user), and Cognism ($1,500/user/year).

What's a good free alternative for verified B2B emails?

Check a few B2B email lookup tools, or start with an email lookup workflow and add an email verifier to reduce bounces. If you need a broader stack, compare lead enrichment tools and review Prospeo pricing before committing.