Dialpad vs MightyCall (2026): Which Business Phone System Fits You?

Switching phone systems feels simple right up until you port your main number and something breaks: routing goes weird, the greeting plays twice, voicemail-to-email stops, and your CEO's cell rings at 2 a.m. because "after-hours rules" didn't copy over the way you thought they would.

Dialpad and MightyCall can both get you calling fast. The gap shows up after week two: porting edge cases, A2P 10DLC timelines, "unlimited" policies, and whether your bill matches what you thought you bought.

Here's the angle: judge these two on rollout risk, texting compliance, and policy predictability, not on a feature checklist.

30-second verdict

Pick Dialpad if...

- You want a modern UCaaS stack (calling + meetings + messaging) with strong AI features and admin controls.

- You care about enterprise-grade security (SOC 2 Type 2, ISO suite, HIPAA-ready + BAA) and you're standardizing across teams.

- You're fine paying for a broader platform, not just a basic phone system.

- You want a longer trial: 14 days (Dialpad Connect).

Pick MightyCall if...

- You're an SMB that wants a simpler phone system and you're willing to manage usage policies like a utility bill.

- You want dialer modes gated by plan and you're willing to pay for them: Preview/Progressive in Power; Predictive in Enterprise.

- You value support ratings and a more SMB-focused product footprint.

- You're okay with a shorter trial: 7 days / 100 minutes.

Skip both if...

- Your biggest issue is bad lists (wrong numbers + stale emails). A new dialer won't fix that - start with data quality.

Two hard disqualifiers:

- Don't buy MightyCall if toll-free inbound is your primary channel and you can't monitor usage/refills weekly.

- Don't buy Dialpad if you only need a single line and you'll never use meetings/messaging. Platform overhead isn't worth it.

Hot take: if your average deal size is small and you're not running a real outbound program, Dialpad's overkill. It's excellent. It's also bigger than most small teams need.

Quick cue: if your rollout risk is "compliance + security," lean Dialpad. If your risk is "fair-use surprises + A2P support," be extra cautious with MightyCall.

Dialpad vs MightyCall: comparison table (features that decide the purchase)

Both tools cover the basics: local numbers, call routing, business hours, voicemail, and mobile/desktop apps. The decision usually comes down to (1) whether you want a full comms suite, (2) how serious your outbound motion is, and (3) how much policy risk you're willing to accept.

| Category | Dialpad | MightyCall | Best for / Winner |

|---|---|---|---|

| Product shape | UCaaS + AI | SMB VoIP | Dialpad |

| Trial | 14 days | 7 days/100 min | Dialpad |

| Dialer modes | Suite-led | Plan-gated | MightyCall |

| Predictive dialer | Higher tiers | Enterprise only | MightyCall |

| Toll-free cost model | Metered ($/min) | Fair-use + refills | Dialpad |

| A2P/texting runway | More time to test | Tight window | Dialpad |

| E911 constraints | More flexible | Notable limits | Dialpad |

| Enterprise admin/SSO | Stronger | Lighter | Dialpad |

Takeaways that actually matter:

- Dialpad's a platform purchase. If you'll use meetings/messaging and want consistent admin controls, it's the cleaner long-term bet.

- MightyCall's a phone-system purchase. It's attractive when you want straightforward calling and you're okay managing "fair use" like a budget line item.

- Outbound teams should treat texting/A2P as a first-class requirement, not a checkbox. That's where timelines slip - use an outbound campaigns checklist, not a vibe check.

- "Unlimited" is a pricing policy, not physics. Model toll-free minutes (Dialpad) or fair-use behavior (MightyCall) before you port numbers.

Pricing in 2026 (plans, minimum seats, and real TCO)

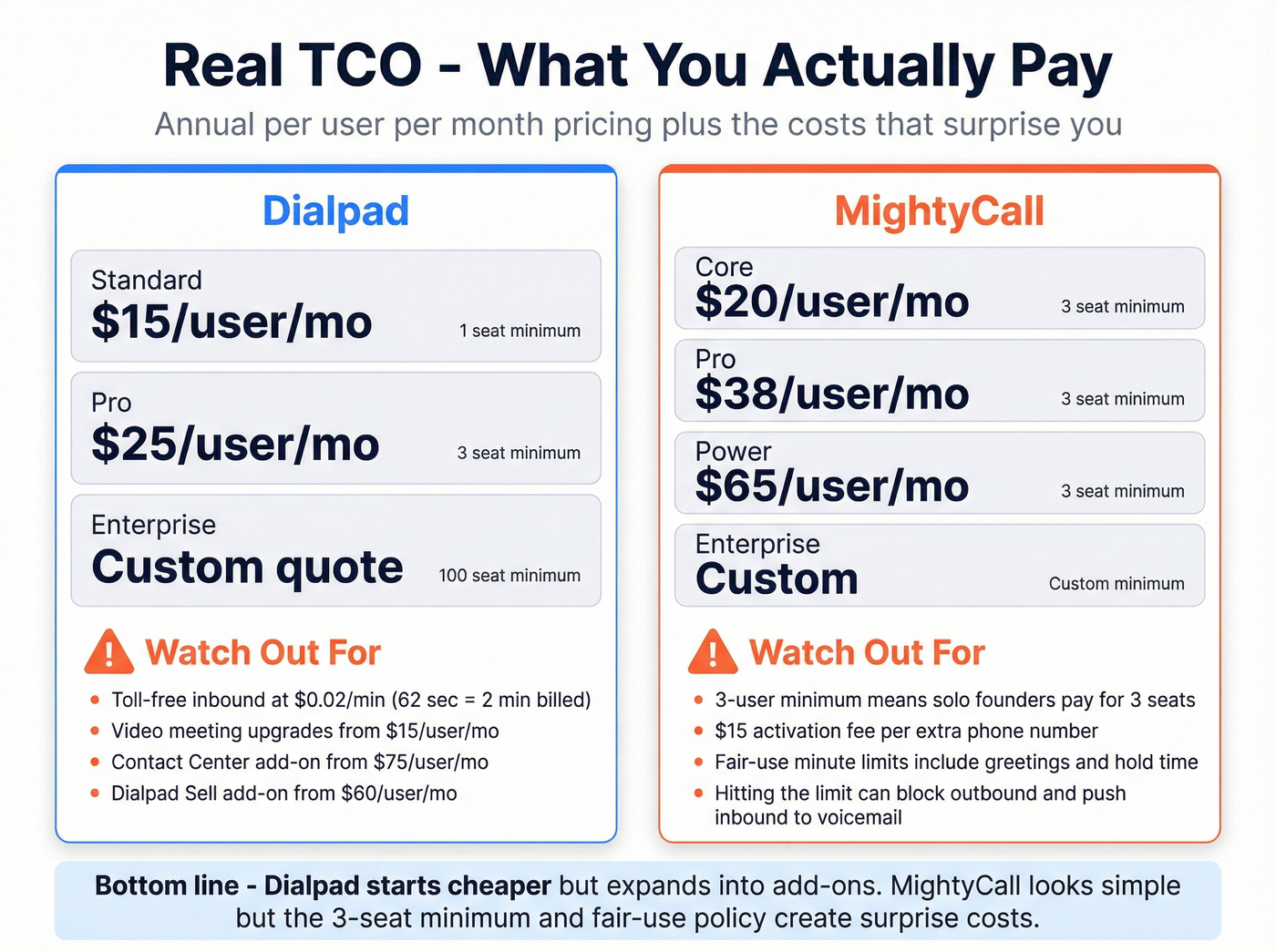

Dialpad's cheaper than MightyCall at the entry annual tier ($15 vs $20), but it's easy to expand into add-ons. MightyCall looks simple, but the 3-user minimum and usage policy can create surprise costs if you're inbound-heavy.

| Vendor | Plan | Annual (per user/mo) | Monthly (per user/mo) | Minimum seats |

|---|---|---|---|---|

| Dialpad | Standard | $15 | $27 | 1 |

| Dialpad | Pro | $25 | $35 | 3 |

| Dialpad | Enterprise | Custom | Quote-based | 100 |

| MightyCall | Core | $20 | Not public | 3 |

| MightyCall | Pro | $38 | Not public | 3 |

| MightyCall | Power | $65 | Not public | 3 |

| MightyCall | Enterprise | Custom | Custom | Custom |

What you actually pay (the part that changes the decision)

Dialpad: add-ons can dwarf the base plan. Dialpad's annual sticker price is real, but procurement should model the common expansions. Typical anchors look like:

- Larger video meetings (up to 1500 participants): from $15/user/month

- Longer meeting durations (over 45 minutes): from $15/user/month

- Contact Center: starting at $75/user/month

- Dialpad Sell (sales features): starting at $60/user/month

In our experience, teams get burned when Dialpad starts as "just phones" and quietly turns into a UCaaS consolidation project with add-ons nobody budgeted for. If you're buying Dialpad, decide up front whether you're standardizing on the suite. If you are, commit and negotiate. If you aren't, keep the deployment tight.

MightyCall: the minimum seat count is the first hidden cost. The 3-user minimum means "one number for the founder" is automatically a multi-seat purchase. Extra phone numbers also carry a $15 one-time activation fee, which adds up fast if you're spinning up campaign numbers.

Trials:

- Dialpad: 14-day free trial

- MightyCall: 7 days + 100 minutes

That MightyCall window is short. If texting matters, it's often not long enough to run an end-to-end A2P test, hit a snag, and still have time to fix it before the trial ends.

Hidden costs & gotchas (where budgets and rollouts break)

Phone systems don't fail because someone picked the "wrong" IVR. They fail because the billing model and policies weren't modeled before porting.

Dialpad gotchas (metered toll-free + credit-based usage)

Gotcha --> Toll-free inbound isn't included. Impact --> If you run inbound support or marketing on a toll-free line, you'll pay $0.02/min for inbound toll-free calls. It's billed per minute, so 62 seconds = 2 minutes ($0.04). Avoid it --> Estimate toll-free minutes before you port. Example: 20,000 inbound toll-free minutes/month = about $400/month in metering.

Gotcha --> Credits apply to specific usage categories (and they add up quietly). Impact --> Credit-based charges commonly show up in categories like international calling, toll-free usage, messaging (SMS/MMS), faxes, and AI agent conversation (depending on setup and destinations). Auto-recharge can trigger when your balance drops below $5, so you can see frequent small top-ups if nobody's watching. Avoid it --> Assign an owner, set internal alerts, and reconcile usage weekly for the first month, then monthly once it's stable.

Gotcha --> Fraud controls can block certain destinations. Impact --> Dialpad can disable high-cost jurisdictions by default. That's good security, but it can break international calling workflows until enabled. Avoid it --> If you sell globally, test your top 10 destination countries during the trial.

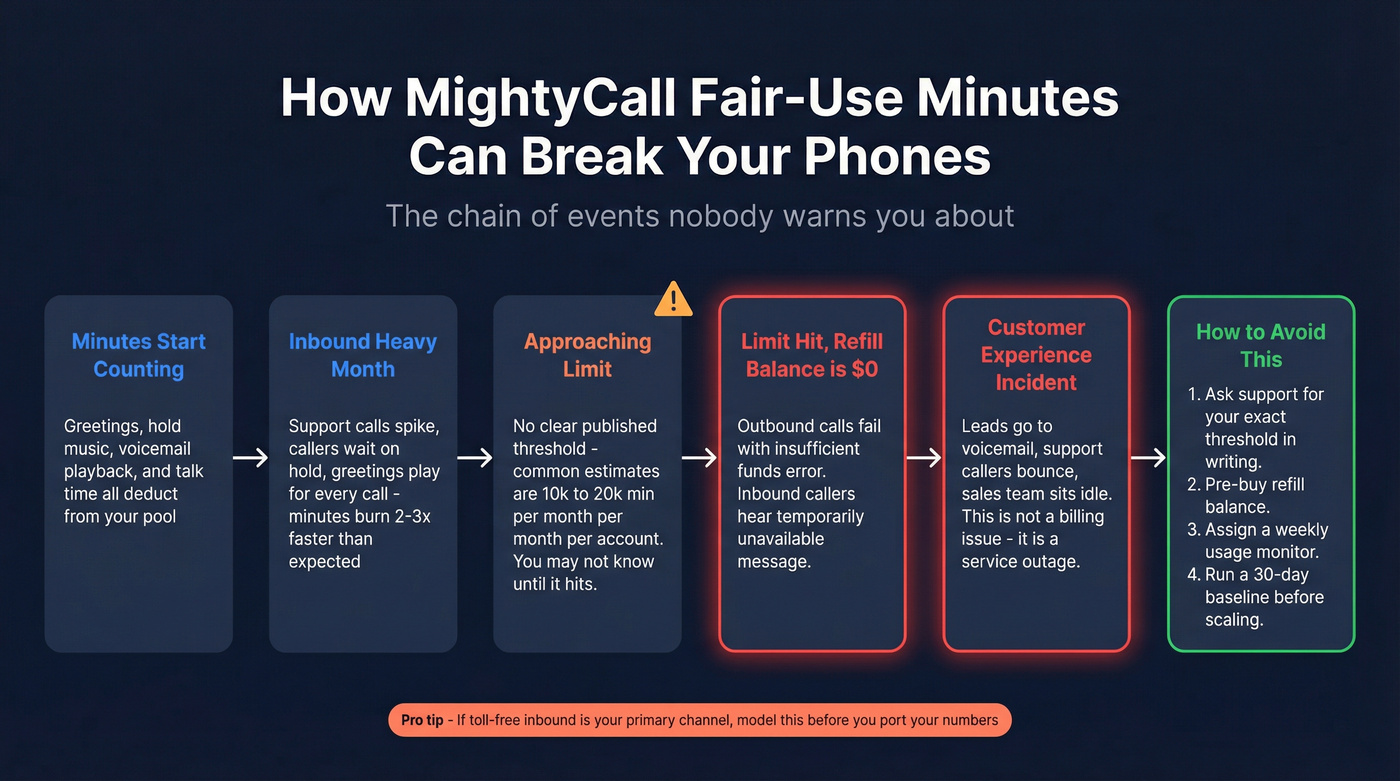

MightyCall gotchas (fair-use enforcement that can interrupt service)

Here's the thing: MightyCall's "unlimited" is the kind of unlimited that still needs a spreadsheet.

Gotcha --> "Unlimited" minutes include more than talk time. Impact --> Minutes can be deducted when callers listen to greetings, on-hold messages, and voicemail, not just agent talk time. Inbound-heavy teams burn minutes faster than they expect. Avoid it --> Keep greetings concise, reduce hold time, and track minutes early.

Gotcha --> Hitting the limit can break outbound and degrade inbound. Impact --> When you hit the monthly limit and your refill balance is $0, outbound can fail with "insufficient funds," and inbound callers can get pushed to voicemail with "temporarily unavailable." That's a customer experience incident, not a billing detail. Avoid it --> Pre-buy refills and assign an owner to monitor usage weekly.

Gotcha --> The threshold isn't published where buyers model budgets. Impact --> You can't forecast cleanly from the plan page. A common pattern for pooled fair-use thresholds is somewhere around 10k-20k minutes/month per account, but the real number depends on greetings/holds and call patterns. Avoid it --> Ask support for your account's threshold in writing, then run a 30-day baseline before you scale.

One more opinionated note: if your business lives on toll-free inbound (support, reservations, lead gen), I'd rather pay Dialpad's metered toll-free than play "did we hit the limit?" roulette.

You're comparing dialers, but your real rollout risk is data quality. Stale numbers and wrong emails waste more budget than any per-minute metering gotcha. Prospeo delivers 125M+ verified mobile numbers with a 30% pickup rate - so when your new phone system goes live, reps actually connect.

Stop dialing dead numbers. Start with verified contacts at $0.01 each.

Outbound fit: dialers + texting/A2P readiness

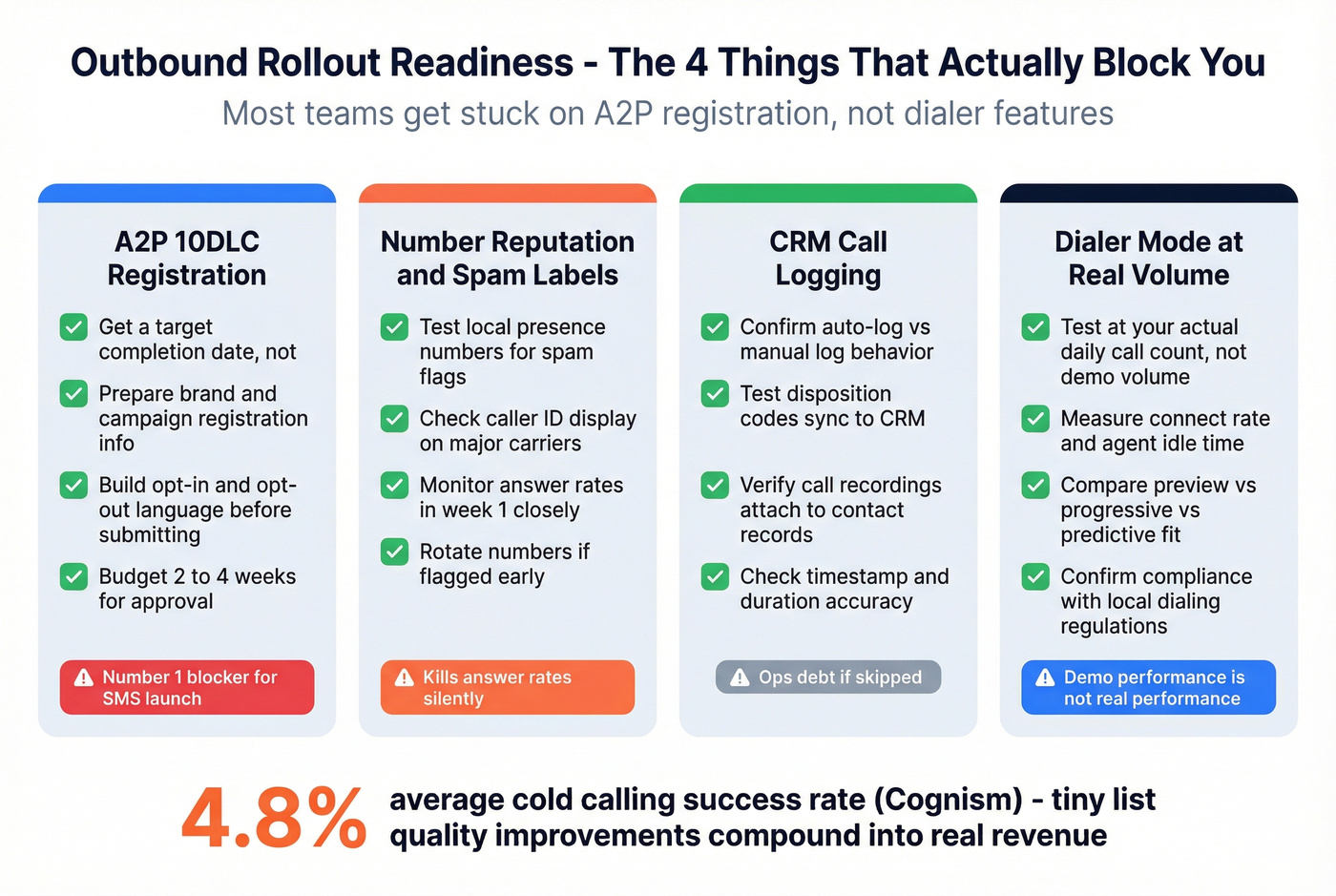

If outbound's a core motion, don't get hypnotized by "dialer modes" on a feature grid. Your bottlenecks are usually (1) A2P 10DLC registration, (2) deliverability/compliance, and (3) list quality.

One-sentence reality check: speeding up bad dials just burns reps faster - fix your answer rate inputs first.

Dialer modes (what you're really buying)

- MightyCall is explicit: Preview/Progressive in Power; Predictive in Enterprise.

- Dialpad supports outbound workflows, but it's suite-first. If your whole world is high-volume cold calling, you'll feel that.

Texting/A2P 10DLC (where timelines slip)

A2P is the rollout blocker nobody budgets time for.

I've seen a team promise "SMS next week," then spend three weeks stuck in registration back-and-forth, while reps kept blasting from personal phones and the ops lead tried to retroactively clean up consent and opt-out language. That mess is avoidable, but only if you treat A2P like a project: owner, timeline, and a real test plan.

Cut the fluff and test these:

- A2P registration start-to-finish timeline (get a target date, not vibes)

- Local presence + number reputation (spam labeling)

- Call logging into your CRM (auto vs manual) - use a cold calling CRM integration checklist.

- Dialer mode behavior at your real call volume (not demo volume)

One number worth keeping in mind: cold calling success rates average ~4.8% (as cited by MightyCall via Cognism). That's why list quality matters so much; tiny improvements compound.

What competitors claim (and what to do with it)

You'll see loud marketing from both sides. Translate it into buyer-proof tests.

Dialpad's AI + Google Cloud story: Dialpad emphasizes its Google Cloud architecture, frequent releases, and AI features trained on billions of minutes. What to do: run a real pilot on your actual network and devices. Test call quality at peak hours, then score AI summaries/coaching against 20-30 real calls. If the AI's wrong, it's noise, not value.

MightyCall's redundancy story: MightyCall positions its infrastructure around redundancy and high uptime (~99.99%). What to do: ask for evidence: status history, incident write-ups, and the exact SLA language (uptime definition, exclusions, service credits).

"Dialpad Salesforce dialer is $110/user/mo" claim: you'll see this number thrown around in comparisons. What to do: treat it as a quote item. Salesforce-related bundles and dialer packaging vary by edition, contract, and add-ons. Get a written quote for your exact seat mix.

Integrations & workflows (where "it integrates" still fails in production)

Most teams over-index on "how many integrations" and under-index on "does it log the right activity without breaking." Native beats Zapier when you need reliability and auditability.

Dialpad fits better when you need standardized logging and admin across multiple teams (sales + support + ops) and you don't want every department inventing its own workflow. MightyCall works well for simpler SMB stacks, but you still need to validate CRM association rules because "it logged the call" isn't the same as "it logged to the right record."

The three workflows to validate before you sign

- CRM logging (calls, recordings, dispositions)

- Ticketing (support queues, call notes, callbacks)

- Slack (missed call alerts, voicemail notifications, escalations)

The questions that prevent most integration pain

- Does it log to the right contact and account/company every time?

- Does it attach recordings + transcripts (not just a timestamp)?

- Does it respect record ownership (rep vs shared inbox vs queue)?

- Can you control what gets logged (to avoid CRM spam)?

I've watched teams spend weeks "integrating" only to realize calls log, but attach to the wrong record half the time, which is worse than not logging at all because it poisons reporting and coaching.

Security, compliance & E911 checklist (remote-team dealbreakers)

A phone system touches PII, call recordings, and sometimes payment flows. Treat it like infrastructure.

Security & compliance checklist

Dialpad security posture (stronger disclosure and cert coverage):

- ISO 27001:2022 / 27017 / 27018

- SOC 2 Type 2

- HIPAA-ready + BAA

- Encryption: TLS/SRTP/AES-256

- 90-day key rotation

- Data stored in the US on GCP

- Transient data retained <=72 hours

MightyCall security posture (solid basics, fewer formal cert disclosures):

- Infrastructure on AWS

- TLS v1.2+

- Payments via Recurly with PCI-DSS Level 1

- STIR/SHAKEN

Telemarketing / outbound compliance features (separate from security):

- DNC integration (operational compliance, not "security")

E911: the stuff that bites remote teams

MightyCall's E911 limits are operational constraints:

- Only one 911 location at a time

- US/Canada only

- Mobile app can't call 911 over Wi-Fi (it routes through the cellular provider)

That last bullet's a big deal for remote teams in patchy coverage areas.

Test emergency calling behavior and write down a backup plan.

Mini scorecard (my take):

- Dialpad wins for regulated industries and security questionnaires.

- MightyCall's fine for many SMBs, but you'll do more policy homework yourself, especially around E911 and fair use.

Reliability & support (status-page transparency vs SLA reality)

Dialpad publishes detailed uptime by component. On its status page, the last 365 days show Calling 99.989% (with similar numbers for Meetings, Messaging, and Contact Center).

The catch: the status page says those uptime percentages are global and not part of any terms of service. Status uptime isn't a contractual SLA.

MightyCall also has a status page, which is good. If you need credits, escalation paths, or response-time commitments, ask for the SLA in writing before you port numbers.

One-sentence rule: if it isn't in the contract, it doesn't exist.

What users say (G2 + Software Advice, quantified)

Reviews won't tell you which tool's "best." They will tell you where pain clusters.

| Metric | Dialpad | MightyCall |

|---|---|---|

| G2 rating | 4.4/5 | 4.4/5 |

| G2 reviews | 4,059 | 321 |

| G2 Support | 8.5 | 9.4 |

| G2 Setup | 9.0 | 8.7 |

| SMB skew (G2) | 57.9% | 91.9% |

| Software Advice | 4.2 | 3.8 |

One excerpt that matches the theme (Software Advice, Dialpad):

"Billing was confusing and support wasn't helpful when we tried to resolve it."

Synthesis:

- Dialpad's review volume is the signal. More deployments means more edge cases, and more billing/support stories. The recurring negative theme is billing disputes and slower accountability when something goes sideways.

- MightyCall's support score is meaningfully higher on G2 (9.4 vs 8.5). That tracks with its SMB footprint: smaller teams reward fast, human support.

- Both tools get tagged with call/connection issues. That's normal in VoIP. Your network and device environment are part of the product whether vendors like it or not.

Alternatives (when you should switch lanes)

Sometimes the right move isn't "Dialpad or MightyCall," but "neither."

OpenPhone (best for fast SMB texting + lightweight workflows)

If your priority is texting-first outreach and you want a modern, lightweight experience without buying a full UCaaS platform, OpenPhone's a clean lane change. It's popular with small teams that want to move quickly on messaging, shared inbox workflows, and simple automations without enterprise overhead. Rough price signal (2026): typically $15-$35/user/month depending on tier and add-ons.

Nextiva (best for feature-heavy SMB value)

If you want a more traditional "business phone system" with lots of included features and you're shopping value, Nextiva's the alternative buyers pick when they want the most features for the money and a familiar UCaaS footprint. It's also a common choice when you want calling plus a broader set of business comms features, but you don't care as much about AI depth. Rough price signal (2026): commonly $20-$45/user/month on annual plans; higher tiers and contact-center features push above that.

If neither wins: add a data layer to either system (Prospeo)

Look, if your reps are dialing junk, no dialer mode is going to save you.

Prospeo is the publisher's product, and it's the B2B data platform built for accuracy. It's the fastest way to raise connect rates without changing your phone system: 300M+ professional profiles, 143M+ verified emails with 98% email accuracy, and 125M+ verified mobile numbers with a 30% pickup rate, refreshed every 7 days (industry average: 6 weeks). Pull verified contacts, then feed them into Dialpad or MightyCall so reps spend time talking to real prospects instead of arguing with voicemail. If you need direct dials specifically, use this B2B phone number workflow.

Skip this if your pipeline is 100% inbound and you're not doing any outbound at all. Otherwise, it's the highest-ROI "phone system upgrade" you'll make this quarter.

Neither Dialpad nor MightyCall will save an outbound campaign built on bad lists. Prospeo's 7-day data refresh cycle means your contacts are current - not 6 weeks stale like most providers. 300M+ profiles, 98% email accuracy, and direct dials that actually ring.

Fix the data first. The dialer choice gets easy after that.

FAQ

Is Dialpad or MightyCall better for outbound dialing teams?

MightyCall's usually better for small outbound teams that need specific dialer modes, because Preview/Progressive is in Power and Predictive is in Enterprise. Dialpad's usually better when outbound is one motion inside a broader comms suite and you want AI plus stronger admin controls across teams.

What's the biggest "unlimited calling" catch with each tool?

Dialpad's biggest catch is metered toll-free inbound at $0.02/min billed per minute (so 62 seconds bills as 2 minutes). MightyCall's biggest catch is fair-use enforcement where minutes can include greetings/on-hold/voicemail, and hitting limits can block outbound and push inbound callers to voicemail unless refills are available.

How should remote teams evaluate E911 before switching?

Test E911 on at least 2 device types (desktop + mobile) and document who updates locations and how often. MightyCall supports E911 only in the US/Canada, allows one 911 location at a time, and its mobile app can't call 911 over Wi-Fi, so you need a written backup plan.

What's a good free way to improve connect rates before buying a new phone system?

Use Prospeo's free tier (75 emails + 100 Chrome extension credits/month) to verify emails and find direct dials before you change anything else.

Summary: what decides dialpad vs mightycall

Dialpad vs MightyCall comes down to your risk tolerance.

Dialpad's the safer bet for security/compliance and platform standardization, but you need to model add-ons and toll-free metering. MightyCall's attractive for SMB simplicity, but you must respect fair-use behavior and the short trial window. Porting's the point of no return, so model the policy costs first, then sign.