Growbots vs Outreach: Which One Actually Fits Your Team?

Your VP of Sales just asked you to "evaluate Outreach." You've got five SDRs, a HubSpot instance held together with duct tape, and no dedicated data provider. You start Googling and somehow end up comparing Growbots vs Outreach - two tools that share a category on G2 but solve fundamentally different problems.

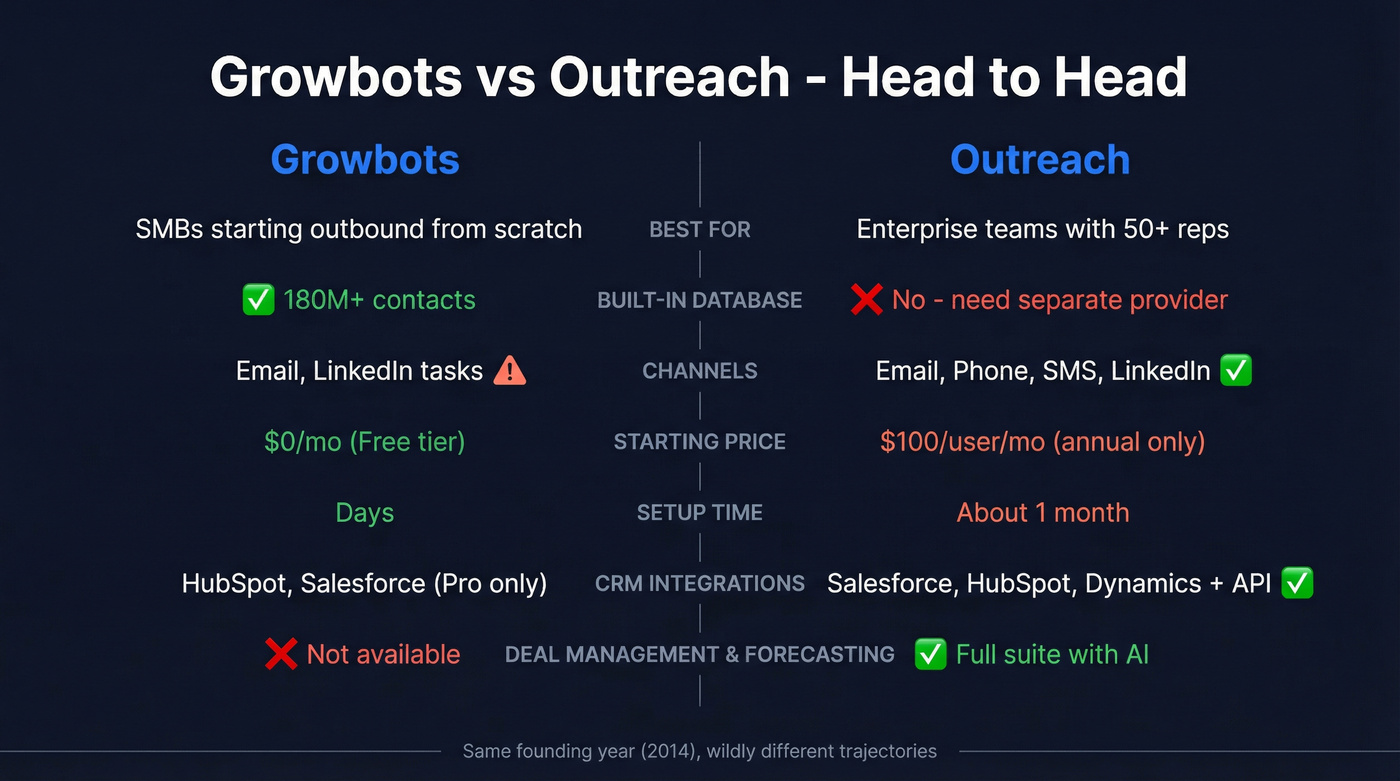

Here's the thing: Outreach is a full-cycle revenue platform built for enterprise sales orgs running Salesforce. Growbots is a top-of-funnel prospecting tool with a built-in contact database. Comparing them is like comparing a Swiss Army knife to a fishing rod - they overlap on "email sequences" and diverge on everything else.

The right choice depends entirely on what you're missing today. And for a lot of teams, the answer is neither.

30-Second Verdict

- Pick Outreach if you're an enterprise team with 50+ reps, Salesforce is your CRM, and you need deal management, forecasting, and conversation intelligence alongside sequencing. Budget $15-25K/year.

- Pick Growbots if you're an SMB starting outbound from scratch, you don't have a contact database, and you want prospecting + sending in one box. Watch credit costs - they escalate fast.

- Skip both if you're a mid-market team that needs accurate contact data and a reliable sending tool. A dedicated data layer paired with Instantly or Lemlist costs less and performs better than either all-in-one platform.

Growbots vs Outreach at a Glance

| Outreach | Growbots | Edge | |

|---|---|---|---|

| G2 Rating | 4.3/5 (3,528 reviews) | 4.5/5 (140 reviews) | Growbots (higher rating, far fewer reviews) |

| Pricing | ~$100-160+/user/mo | Free-$29+/mo + credits (scales to $700+) | Growbots (at entry level) |

| Built-in Database | No | 180M+ contacts | Growbots |

| Channels | Email, phone, SMS, LinkedIn | Email, LinkedIn tasks | Outreach |

| CRM Integrations | Salesforce, HubSpot, Dynamics | HubSpot, Salesforce (Pro only) | Outreach |

| API Support | Yes | No | Outreach |

| Contract Terms | Annual, paid upfront | Monthly or annual | Growbots |

| Avg. Implementation | ~1 month | Days | Growbots |

| Employees | 680 | 55 | Outreach (stability signal) |

| Customers | 6,000+ | 450 | Outreach |

| Founded | 2014 | 2014 | Tie |

The numbers tell the story. Outreach is a 680-person company with 6,000+ customers and enterprise-grade complexity. Growbots is a 55-person bootstrapped shop with 450 customers and a scrappier approach. Same founding year, wildly different trajectories.

What Each Tool Actually Does

Growbots - Prospecting + Outreach in One Box

Growbots bundles a 180M+ contact database with email sequencing, warmup (Warmbots), and basic multichannel capabilities. The pitch is simple: find prospects, build sequences, and send - all without leaving the platform.

The AI template generator saves time on first drafts, though you'll want to edit the output before hitting send. Warmbots helps with deliverability out of the gate. For an SMB team without a separate data provider, the all-in-one approach eliminates vendor juggling.

Where it works:

- Quick setup - you can be sending within days

- Built-in database means no separate data subscription

- Solid customer support (the #1 praise on G2)

- Free tier lets you test before committing

Where it doesn't:

- Deliverability is the #1 complaint on G2 - emails hitting spam tanks your response rates (see Email Deliverability 2026)

- Credit system is use-it-or-lose-it monthly, and costs escalate fast

- Multiple AI features (Similar Companies Recommender, AI Prospecting, AI Email Personalizer, AI Responder) are still listed as "coming soon"

- CRM integrations locked behind the Pro tier

- No API support, conversation intelligence, deal management, or forecasting

Outreach - The Full-Cycle Revenue Platform

Outreach isn't just a sequencing tool. It's a platform with six modules: Engage (sequences), Call (dialer + AI summaries), Meet (transcription + coaching), Deal (pipeline visibility), Forecast (scenario planning), and Amplify (AI agents). Kaia, their conversation intelligence engine, listens to calls and surfaces buying intent in real time. Their mutual action plans increase win rates by 26%, and sellers close over 2 million opportunities every month through the platform.

Recent 2026 updates added Smart Account Assist (analyzes 80 recent conversations + 500 emails per account), Smart Email Assist (drafts responses based on CRM data), personalized AI voicemails, a mobile app with calendar and forecast submission, and intelligent inbound call routing.

Where it wins:

- Deepest sequencing and deal management in the category

- Forecasting and conversation intelligence give managers real visibility

- Enterprise-grade Salesforce workflows no other tool matches

Where it falls short:

- No built-in prospect database - you need a separate data provider, adding $50-150/user/month

- $100/user/month starting price with mandatory annual contracts

- $1-8K implementation fee on top

- Reps still spend up to 2 hours/day on administrative tasks even with automated sequences

- Learning curve is steep - G2 users cite it 25 times as a top complaint

- HubSpot integration gets frequent complaints (18 mentions of integration issues on G2)

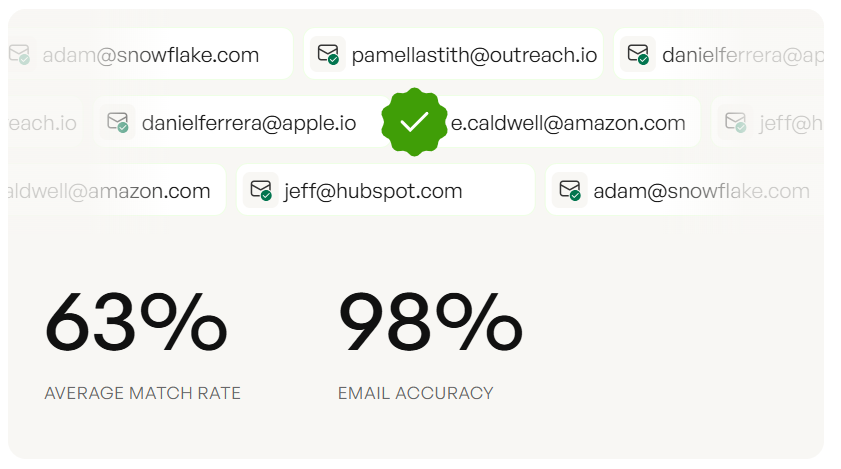

Growbots caps your credits monthly. Outreach doesn't include data at all. Prospeo gives you 300M+ profiles with 98% email accuracy at $0.01/email - refreshed every 7 days, not 6 weeks. Pair it with Instantly or Lemlist and you have a better stack than either all-in-one for a fraction of the cost.

Stop overpaying for bundled data that bounces. Start with accuracy.

Pricing Breakdown - What You'll Actually Pay

Growbots Pricing

Growbots' pricing page shows four tiers:

- Free: $0/mo - 3 campaigns, 20 emails/day, Warmbots warmup included

- All-In-One Starter: $29/mo - 100 emails/day, A/B testing, Zapier, deliverability monitoring

- All-In-One Pro: ~$49-79/mo - CRM integrations, 500 emails/day, AI template generator, priority support

- Concierge: ~$500-2,000+/mo - fully managed outbound service across three tiers

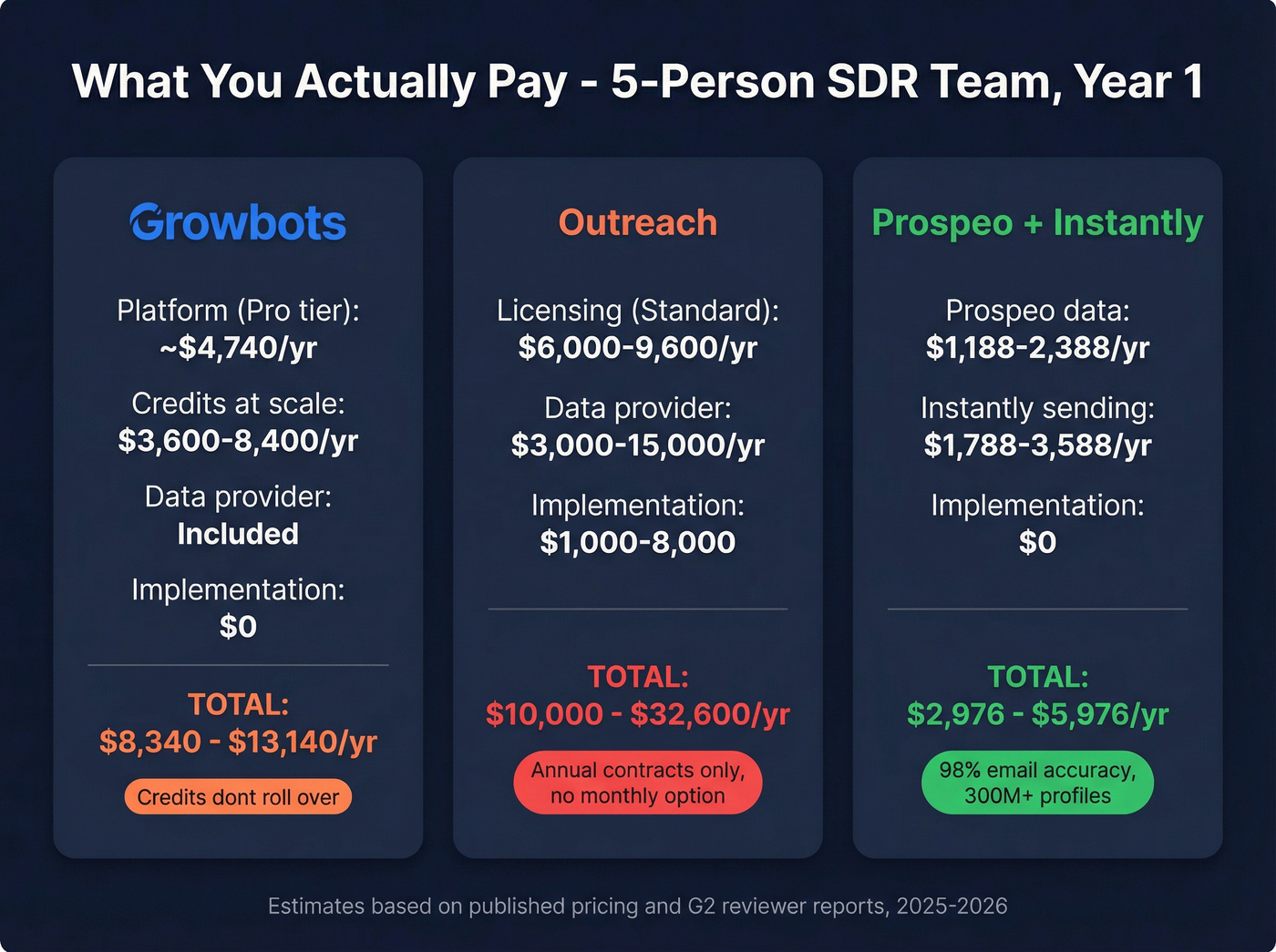

The catch is the credit system. Each new prospect from the database costs credits, and credits don't roll over. One reviewer put it bluntly: they were paying "$700+ a month" at scale and planned to switch to Instantly to "add as many emails as we want without paying $700+ a month."

Save 14% with annual billing, but the credit math still adds up fast.

Outreach Pricing

Outreach doesn't publish pricing in 2026, which is frustrating for a tool that's been around for over a decade. Here's what the market confirms:

- Standard: $100/user/month

- Professional: ~$120-140/user/month (adds AI deal scoring, content cards, improved forecasting)

- Enterprise: $160+/user/month (custom governance, HIPAA compliance)

- Implementation fee: $1,000-8,000 one-time

Annual contracts only. No monthly billing option.

The sticker price is misleading because Outreach doesn't include data. Here's the TCO math for a 5-person SDR team:

- Outreach licensing: ~$6,000-9,600/year (Standard to Professional)

- Data provider: $3,000-15,000/year

- Implementation: $1,000-8,000 one-time

- First-year total: $10,000-32,000+

What Real Users Say

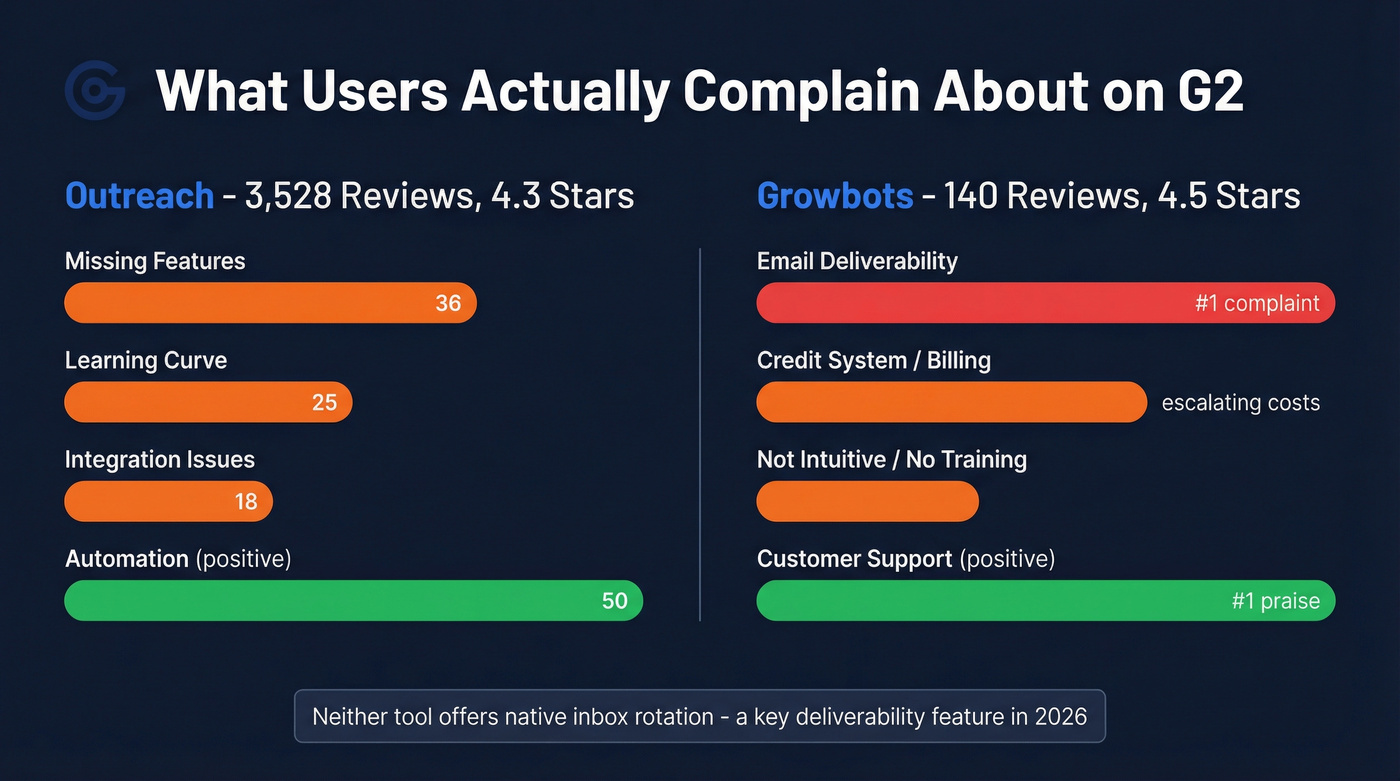

Complexity and Bloat

The #1 complaint about Outreach on G2? Missing features - 36 mentions. Sounds counterintuitive for a platform with six modules, but the pattern is clear: teams buy Outreach for sequencing and then discover the other modules don't quite work as advertised, or they're paying for capabilities they never activate.

One Reddit user switching away captured it perfectly: "Outreach has gotten way too heavy for us. Tons of features we don't use, a lot of manual steps, feels built for mass activity instead of targeted outreach."

Another testing the AI beta: "Took around 5 meetings to get set up and running. Still early but so far it doesn't feel like the juice is worth the squeeze."

Deliverability and Data Quality

On the Growbots side, deliverability is the #1 complaint. One G2 reviewer praised the partnership approach and account management but noted "the only challenge we faced was with email deliverability, which impacted the volume of warm responses."

Neither tool offers native inbox rotation - a deliverability feature that tools like Instantly handle automatically. If you're sending at volume, this gap matters (more on this in our email pacing and sending limits playbook).

Cost Escalation

Independent reviews paint a harsher picture of Growbots' billing model. Users describe the platform as "not very intuitive" with "no training video series." The billing model draws particular frustration: "You get charged every time you add a new email, so it's not very scalable."

What Actually Works

- Outreach: Automation is the standout - 50 G2 mentions. When it works at scale for large BDR teams running Salesforce, it works well. The analytics and reporting give managers real visibility.

- Growbots: Customer support consistently gets top marks. The team is responsive and takes a partnership approach. For SMBs, that personal touch matters.

I've seen this pattern repeatedly: teams choose Outreach for the brand name, then realize they're paying enterprise prices for features their 10-person team doesn't need. And teams choose Growbots for the convenience of built-in data, then hit a wall when deliverability tanks their campaigns.

Company Health - Can You Bet Your Pipeline on Them?

Outreach

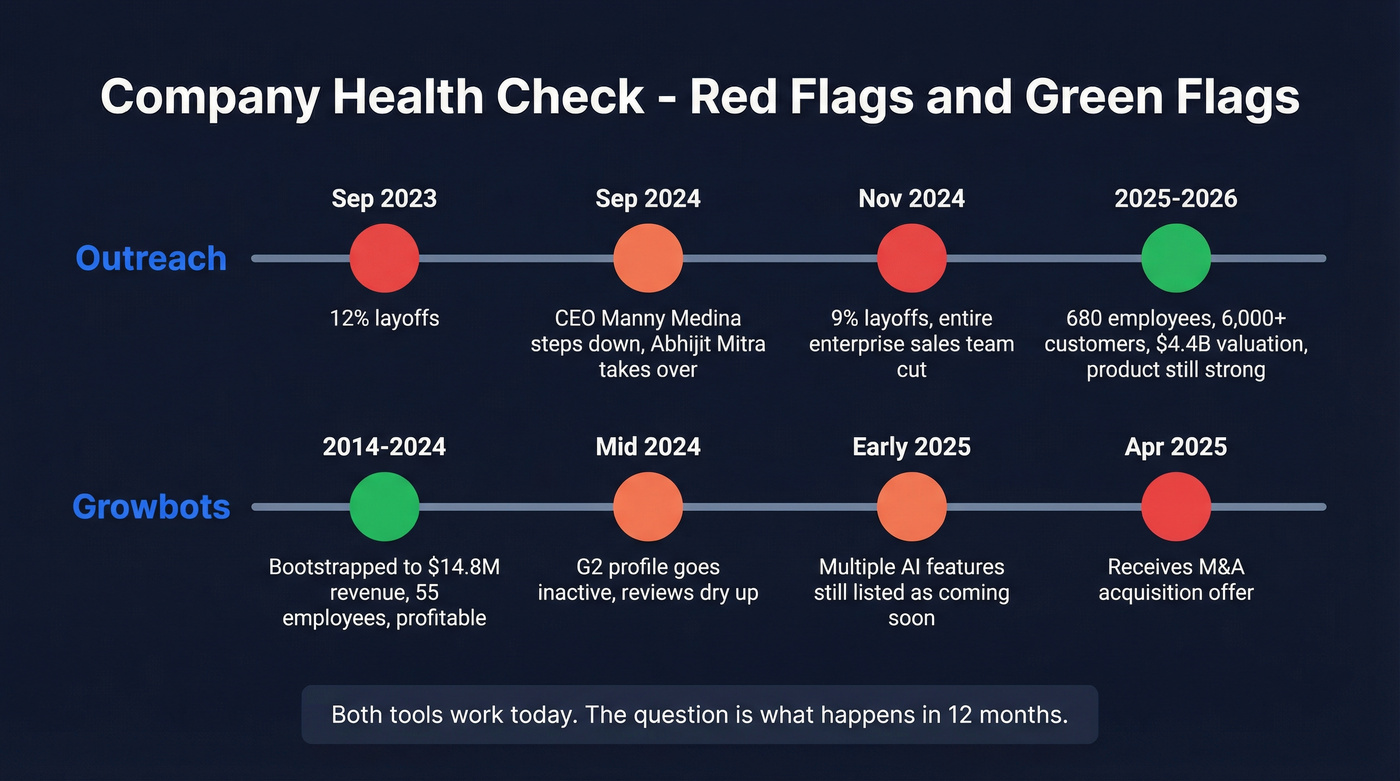

Outreach has raised nearly $500M at a $4.4B valuation. They've got 6,000+ customers including Zoom, Twilio, and McKesson. They're not going anywhere.

But the turbulence matters. In November 2024, Outreach laid off 9% of staff - 65+ employees, including the entire enterprise sales team. That followed a 12% cut in September 2023. Co-founder and CEO Manny Medina stepped down in September 2024, replaced by Abhijit Mitra.

Two rounds of layoffs, a CEO change, and the enterprise team gutted - all within 14 months. The product still works. The company still has 680 employees. But if you're signing an annual contract (which is your only option), you're betting on stability during a transition period.

Growbots

Growbots is the opposite story. Fully bootstrapped, $14.8M in revenue, 55 employees, 450 customers. That's a profitable, lean operation - impressive for a company with zero external funding.

But the signals are mixed. Their G2 profile has been inactive for over a year - nobody's managing it, and new reviews have dried up. Multiple AI features remain "coming soon" with no ship dates. And in April 2025, Growbots received an M&A offer.

Inactive marketing presence, stalled product roadmap, acquisition interest. The core product works today. Whether it'll be the same product in 12 months is a genuine question. If you're evaluating Growbots, ask directly about the roadmap and ownership plans.

The Data Quality Problem Neither Tool Solves

Here's what neither tool's marketing page tells you: your outbound results are only as good as your data.

Outreach has no built-in database at all. Growbots has 180M contacts, but deliverability being the #1 G2 complaint points to data quality issues underneath. A 15% bounce rate doesn't just waste credits - it damages your domain reputation and tanks deliverability for every future campaign (see what is domain reputation).

Real talk: if your average deal size is under $15K, you almost certainly don't need either of these platforms. Separate your data layer from your sending layer, optimize each independently, and you'll outperform teams spending 5x more on all-in-one tools.

Who Should Choose What - The Final Call

Enterprise teams (50+ reps, Salesforce, deal management needs): Outreach is the right call. Budget $15-25K/year, expect a one-month implementation, and pair it with a strong data provider (see our guide to the best B2B data providers). The sequencing, forecasting, and conversation intelligence justify the price at scale.

SMBs starting outbound from scratch without a contact list: Growbots gets you moving fast. The built-in database and simple setup mean you can be sending within days. But monitor your credit costs monthly, have a deliverability backup plan, and keep an eye on the company's direction.

Mid-market teams that need accurate data + simple sending: Skip both. Use a dedicated data platform like Prospeo for verified contacts - 300M+ profiles, 98% email accuracy, 30+ search filters including buyer intent and technographics - and pair it with Instantly or Lemlist for sending. You'll get better data accuracy, lower total cost, and more control over each layer of your stack (start with our B2B sales stack blueprint).

In our experience evaluating dozens of engagement platforms, the real question when comparing Growbots vs Outreach isn't which one wins - it's whether you need either one.

Best Alternatives if Neither Fits

Apollo.io - The Middle Ground

Apollo combines a 275M+ contact database with built-in sequencing, a dialer, and deal management - splitting the difference between Growbots' data-first approach and Outreach's engagement depth. The free plan is genuinely useful for testing. Paid plans run $49-149/user/month. Where Apollo wins over Outreach: you don't need a separate data provider. Where Outreach still wins: deeper forecasting, conversation intelligence, and enterprise-grade Salesforce workflows. For mid-market teams with 10-50 reps, Apollo is the obvious starting point. Amplemarket also gets cited on Reddit as a strong Outreach replacement for teams wanting AI-native workflows (see Amplemarket alternatives).

Instantly.ai - Skip This Section if You Already Have Data

Instantly is the go-to for teams that care about deliverability above all else. Unlimited sending accounts starting around $30/month - no per-email charges. Native inbox rotation protects your domain reputation automatically, something neither Growbots nor Outreach offers.

Users switching from Growbots specifically cite predictable costs regardless of volume as the reason. Pair it with a verified data source and you've got a lean, high-performing outbound stack for under $200/month (use this email verification list SOP before you upload).

Lemlist - For Creative Outbound

| Lemlist | Instantly | |

|---|---|---|

| Best for | Personalization-heavy campaigns | High-volume deliverability |

| Starting price | $59/mo | ~$30/mo |

| Standout feature | Custom images, landing pages, liquid syntax | Unlimited sending accounts, inbox rotation |

| Weakness | Higher price for basic sending | No built-in personalization tools |

Lemlist is built for teams where personalization drives replies - custom images, landing pages, and liquid syntax variables that go beyond basic merge fields. Good for creative outbound plays, less ideal for pure volume (see our Instantly vs Lemlist breakdown).

That $10K-32K first-year Outreach bill? Or Growbots at $700+/month with expiring credits? Prospeo's 143M+ verified emails and 125M+ mobile numbers integrate natively with HubSpot, Salesforce, Instantly, and Lemlist - no annual contracts, no implementation fees.

Build the outbound stack your VP actually wants. Data that connects.

FAQ

What's the main difference between Growbots and Outreach?

Growbots is a top-of-funnel prospecting tool with a built-in 180M+ contact database and email sequencing. Outreach is a full-cycle revenue platform with deal management, forecasting, and conversation intelligence - but zero built-in data. Growbots finds contacts and sends emails. Outreach manages your entire sales workflow after you've sourced contacts from a separate provider.

Is Growbots cheaper than Outreach?

At entry level, yes - Growbots starts at $29/mo versus Outreach's $100/user/month with mandatory annual contracts. But Growbots costs escalate with credits; users report paying $700+/month at scale. Outreach's total cost with a data provider can exceed $20K/year for a five-person team.

Does Outreach include a prospect database?

No. Outreach is a sales engagement platform only - sequencing, dialing, deal management, and forecasting. You need a separate data provider to fuel it with contacts. Prospeo at ~$39/mo or Apollo's free tier are cost-effective options; enterprise data providers add $3,000-15,000/year depending on team size.

Is Growbots still actively developed in 2026?

That's unclear. Multiple AI features remain "coming soon" with no announced ship dates, the G2 profile has been unmanaged for over a year, and Growbots received an M&A offer in April 2025. The core product works today, but the roadmap is uncertain - ask the team directly about ownership plans before committing.

What's a good alternative if neither Growbots nor Outreach fits?

For mid-market teams, pair a dedicated data platform with a sending tool like Instantly ($30/mo) or Lemlist ($59/mo). Total cost under $200/month with better data quality and native inbox rotation - capabilities neither Growbots nor Outreach offers out of the box.