LeadLeaper Pricing in 2026: What You Actually Get for $49-$69/Month

You land on LeadLeaper's pricing page and see four tiers: Free, Basic, Professional, Enterprise. Clean layout. Reasonable numbers. Then you look closer at the Basic plan and notice it says "Email Credits" - with no number next to it. Same for Professional. You search for LeadLeaper pricing hoping for clarity, and you find five different prices from five different years. $29, $39, $49, $90, $125 - all supposedly for the same tool.

Here's what's actually going on, and whether it's worth your money.

The Short Version

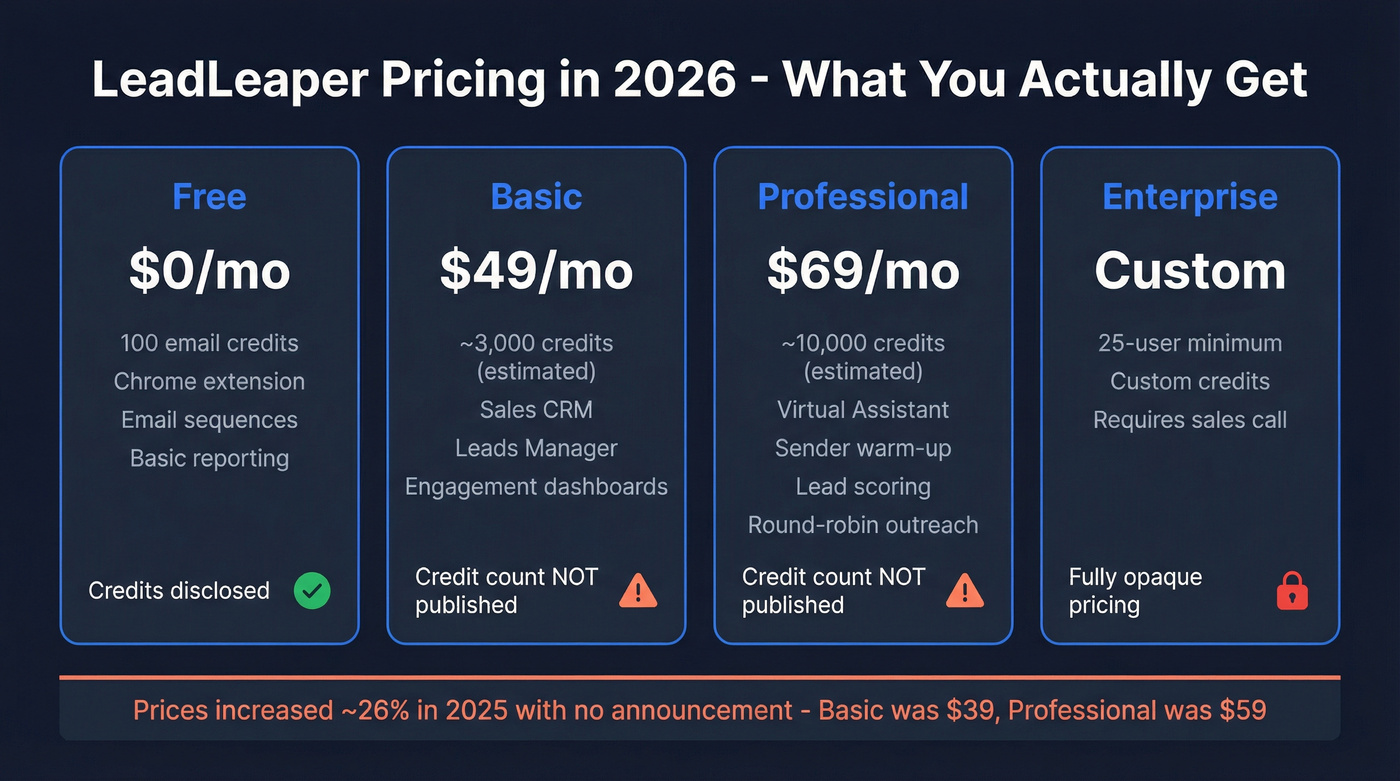

LeadLeaper runs four tiers: Free ($0), Basic ($49/mo), Professional ($69/mo), and Enterprise (custom). The biggest problem isn't the price - it's that paid plans don't disclose how many email credits you actually get. Based on the best available data, Basic includes roughly 3,000 credits and Professional roughly 10,000. Prices went up about 26% in 2025 with no announcement.

If transparent pricing and email accuracy matter more to you than a Chrome extension workflow, Apollo gives you 10,000 free email credits - more than LeadLeaper's entire paid Basic plan. For most teams doing serious outbound, the combination of opaque pricing, below-average accuracy, and a stealth price hike makes it hard to justify.

LeadLeaper Pricing Plans in 2026

Here's what the pricing page actually shows - and what it doesn't:

| Plan | Monthly Price | Credits | Key Features |

|---|---|---|---|

| Free | $0 | 100 emails | Finder, exports, sequences |

| Basic | $49 | ~3,000 (est.) | CRM, leads manager, dashboards |

| Professional | $69 | ~10,000 (est.) | Virtual assistant, warm-up, scoring |

| Enterprise | Custom | Custom | 25-user minimum |

The "est." next to those credit numbers matters. LeadLeaper doesn't publish them.

Free Plan ($0/month)

You get 100 email credits per month, the email finder Chrome extension, unlimited exports, email sequences, templates, basic reporting, and open tracking. Sounds decent on paper.

In practice, with LeadLeaper's roughly 51% email find rate (more on that later), you're looking at about 50-70 usable verified emails per month. Most teams burn through the free tier in a day or two. One analysis found email deliverability jumps from ~68% to 92% on paid plans, so the free tier is really just a test drive with the parking brake on.

Basic Plan ($49/month)

This is where the opacity starts. The pricing page lists "Email Credits" as a feature - no number. Based on Woodpecker's March 2025 review, when this plan was $39/month, it included approximately 3,000 email credits. At the current $49 price, credit quantities are likely the same or slightly higher.

You get the Sales CRM, Leads Manager, unlimited email sequences, engagement dashboards, and email open and link tracking. Annual discounts are "available upon request" - which means they don't want you comparing them to competitors who publish their annual rates.

Professional Plan ($69/month)

Again, no credit quantity disclosed. The same March 2025 data pegged this at roughly 10,000 credits when the plan was $59/month.

Professional adds a meaningful feature jump over Basic:

- Virtual Assistant for automated lead discovery

- Team features with round-robin outreach

- Reply tracking and unlimited sender accounts

- Sender warm-up and behavioral lead scoring

- Custom tracking domains and CRM auto-sync

The question is whether the ~$0.007/credit math works for you once you factor in the find rate.

Enterprise Plan (Custom)

Twenty-five user minimum, custom credit allocation, requires a sales call. If you're evaluating LeadLeaper for a team of 25+, you're probably looking at the wrong tool category entirely.

What LeadLeaper's Pricing Page Doesn't Tell You

Credit Quantities Are Hidden by Design

This isn't an oversight. The pricing page deliberately lists "Email Credits" as a feature on Basic and Professional without specifying how many you get. Every other tool in this space - Apollo, Hunter, Snov.io, Lusha - publishes credit counts on their pricing pages. LeadLeaper is the exception, and in our experience, undisclosed credit counts always mean the vendor is planning to change them.

Prices Went Up ~26% With No Announcement

Between March and late 2025, LeadLeaper raised Basic from $39 to $49/month and Professional from $59 to $69/month. Free plan credits got cut in half - from 200 to 100. There was no blog post, no email to customers, no changelog entry. The old prices just disappeared.

A $10/month increase on a $39 plan is a 26% price hike. That's not a rounding adjustment.

Doing it silently erodes trust - especially when you're already not disclosing credit quantities.

Annual Pricing Is a Black Box

The pricing page says annual and team discounts are "available upon request." No percentage, no estimated savings, no comparison to monthly. Based on industry norms (competitors offer 20-30% annual discounts), expect roughly 15-20% off - putting Basic at approximately $39-42/month and Professional at $55-59/month when billed annually. But you won't know until you ask.

No API Access

LeadLeaper doesn't offer an API. If you're running enrichment workflows through Clay, Zapier, or any programmatic pipeline, LeadLeaper can't plug in. That's a dealbreaker for any team beyond the "manually browse profiles" stage.

The G2 Profile Has Been Inactive for Over a Year

LeadLeaper's G2 profile is marked inactive - no one has managed it since October 2024. For a tool that claims 100,000+ customers, that's a red flag. It suggests either a very small team or a product that's coasting in maintenance mode.

LeadLeaper's 51% find rate means half your credits are wasted. Prospeo's proprietary email infrastructure delivers 98% accuracy with transparent pricing - no hidden credit counts, no stealth price hikes. At ~$0.01 per verified email, you get 3x more usable contacts for less money.

Stop paying double for emails that don't exist.

Why Google Shows Different LeadLeaper Prices

If you've been searching for current costs, you've probably seen wildly different numbers. Here's why.

G2's pricing page shows plan names that don't exist anymore: Prospector ($90/mo), ProspectorPlus ($110/mo), ProspectorPro ($125/mo). These are legacy tiers from an earlier version of the product, complete with features like ZoomInfo integration and Data.com integration that aren't on the current site. That data was last updated October 2024 and the profile's been inactive since.

Capterra still shows a starting price of $39/month - the pre-increase number. Salesforge's directory lists $29/user/month and $99/user/month, which appears to be very outdated data from an even earlier pricing structure.

The current plans are Free, Basic ($49), Professional ($69), and Enterprise (custom). Everything else you find online is stale.

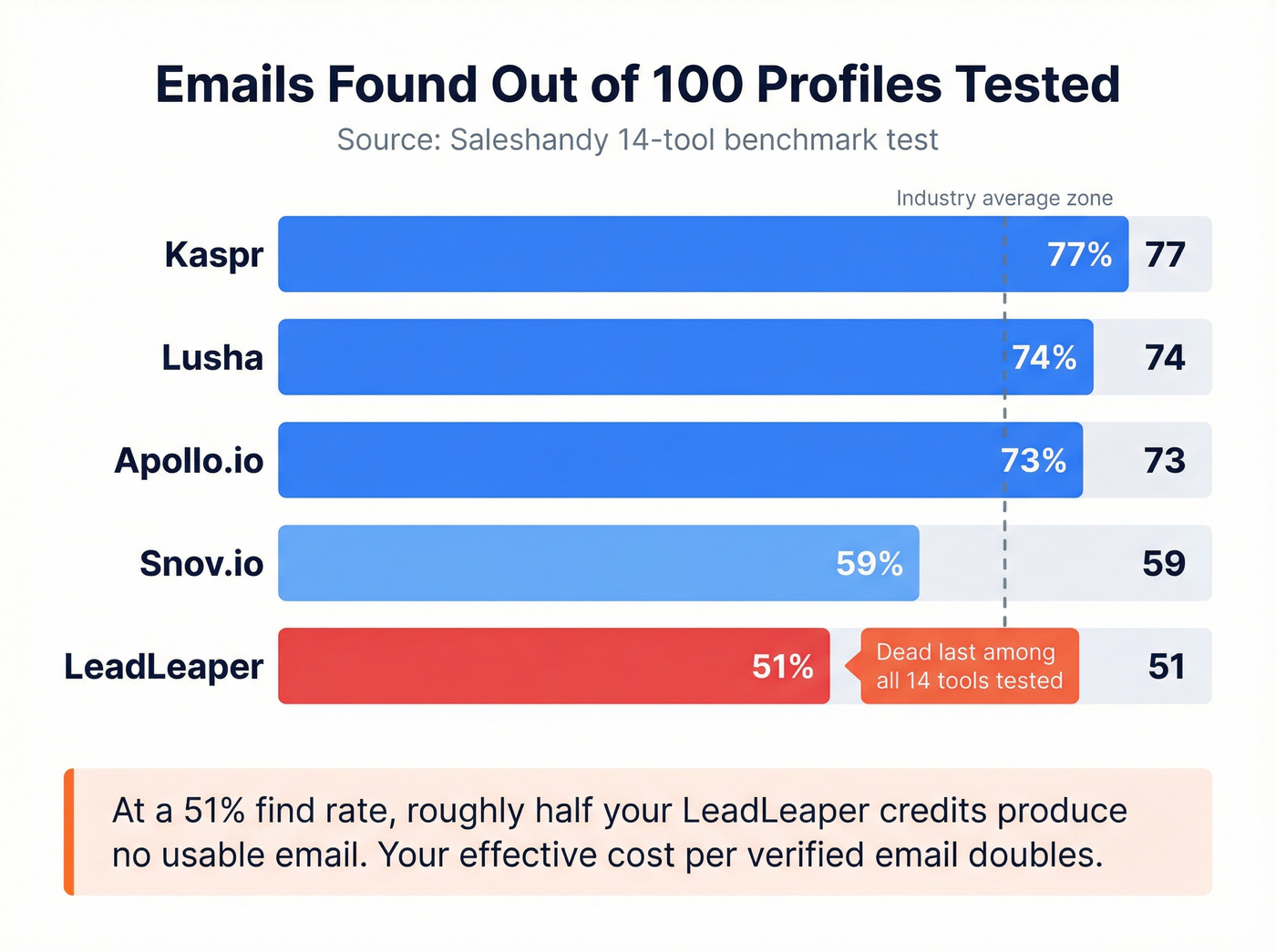

The Hidden Cost: Email Accuracy

Look - the sticker price of a data tool is meaningless without knowing how many of those credits actually produce usable results.

Saleshandy ran a test across 14 email finder tools, checking how many valid emails each could find from 100 professional profiles. (Saleshandy's own product ranked first at 95/100, so take the absolute numbers with context - but the relative rankings are useful.)

LeadLeaper found 51 out of 100. Dead last among all 14 tools tested.

| Tool | Emails Found (out of 100) |

|---|---|

| Kaspr | 77 |

| Lusha | 74 |

| Apollo.io | 73 |

| Snov.io | 59 |

| LeadLeaper | 51 |

That 51% find rate fundamentally changes the cost math. At $49/month for an estimated 3,000 credits, you're not getting 3,000 emails. You're getting roughly 1,530 usable verified emails. That puts your effective cost at about $0.032 per verified email - double the raw per-credit cost of ~$0.016.

At $49/month for ~3,000 credits, LeadLeaper is mid-range on price but bottom-tier on accuracy. That's a bad combination.

And here's what frustrates me about this: if you're running cold email sequences, every bounced email hurts your sender reputation. A 49% miss rate isn't just wasted credits - it's actively damaging your deliverability. I've seen teams torch a perfectly good domain in two weeks because their data provider was feeding them coin-flip emails.

If your average deal size sits below $15k, you can't afford a 49% miss rate on your email data. The sender reputation damage alone will cost you more than the subscription savings. Pay more per credit for data that actually works, or use a free tier with better accuracy - either path beats the current value equation.

How LeadLeaper Compares on Price

Plan-Level Comparison

| Tool | Plan | Monthly | Annual/mo | Credits |

|---|---|---|---|---|

| LeadLeaper | Basic | $49 | ~$39-42 (est.) | ~3,000 (est.) |

| LeadLeaper | Professional | $69 | ~$55-59 (est.) | ~10,000 (est.) |

| Apollo | Free | $0 | $0 | 10,000 emails |

| Apollo | Basic | $59 ($49 ann.) | $49 | Unlimited email |

| Hunter | Starter | $49 | $34 | 2,000 |

| Snov.io | Starter | $39 | $29.25 | 1,000 |

| Lusha | Pro | $29.90 | ~$22.45 | 250 |

Apollo's free tier alone gives you more email credits than LeadLeaper's paid Basic plan. Let that sink in.

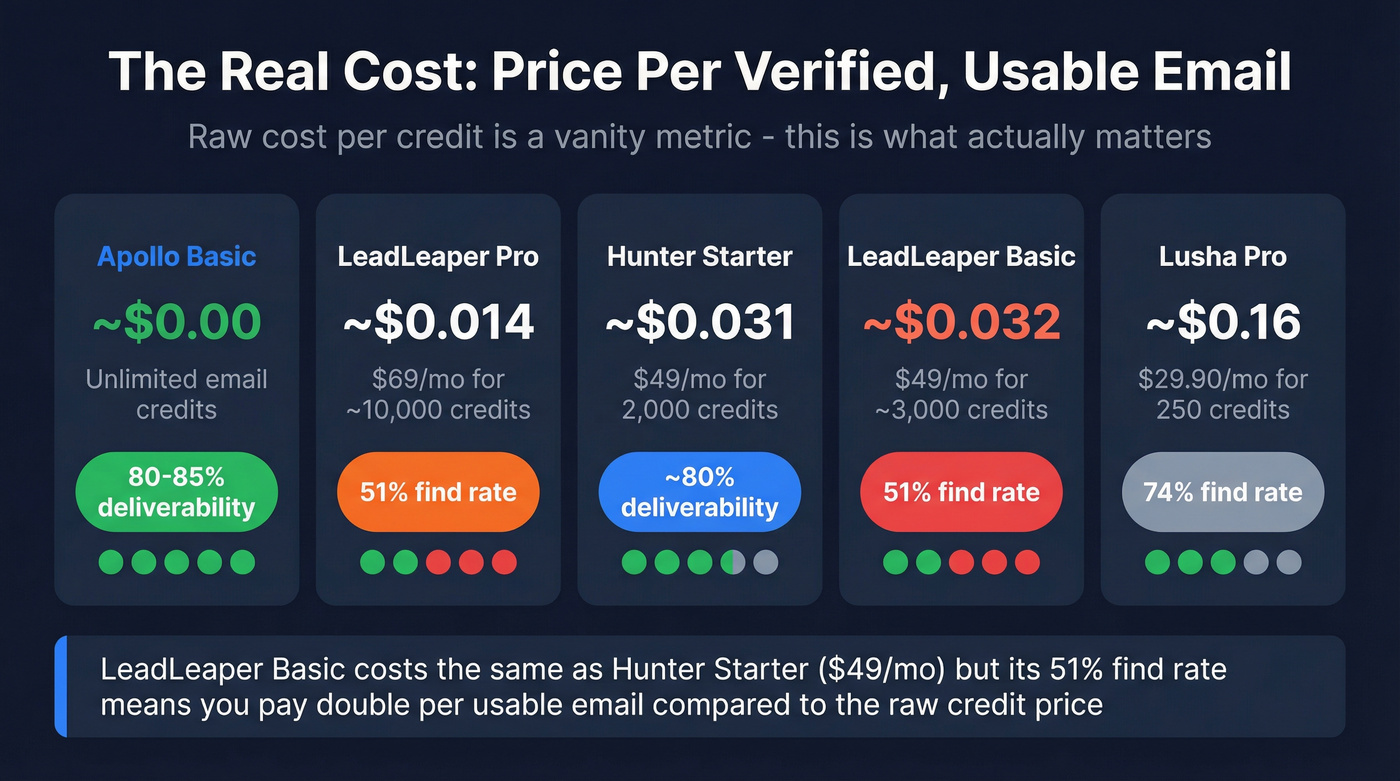

Per-Credit and Accuracy-Adjusted Cost

This is the table that actually matters. Raw cost per credit is a vanity metric - what you care about is cost per verified, usable email.

"Find rate" measures how often a tool returns any email at all. "Verification accuracy" measures how often the emails it does find are actually valid. LeadLeaper's problem is the first metric - it simply can't find emails for half the profiles you search.

| Tool | Plan | $/Month | Cost/Credit | Adj. $/Email | Metric |

|---|---|---|---|---|---|

| LeadLeaper | Basic | $49 | ~$0.016 | ~$0.032 | 51% find rate |

| LeadLeaper | Pro | $69 | ~$0.007 | ~$0.014 | 51% find rate |

| Apollo | Basic | $49 | $0.00 | ~$0.00 | 80-85% deliverability |

| Hunter | Starter | $49 | $0.025 | ~$0.031 | ~80% est. deliverability |

| Snov.io | Starter | $39 | $0.039 | ~$0.049 | ~80% est. deliverability |

| Lusha | Pro | $29.90 | $0.12 | ~$0.16 | ~74% find rate |

Apollo's unlimited email credits on the Basic plan make it the obvious winner on raw volume. The tradeoff is bounce rates - users report 15-20% bounces on some segments, which is better than LeadLeaper's 49% miss rate but not in the same league as 98% verification accuracy.

Hunter at $49/month for 2,000 credits costs more per credit than LeadLeaper, but Hunter publishes every number transparently and offers a clear 30% annual discount.

Annual Cost for a 5-Person Team

Here's where the numbers get real for anyone scaling beyond solo prospecting. Hunter and Snov.io offer unlimited team seats on a single subscription, while Apollo and LeadLeaper charge per user:

| Tool | Plan | Annual Cost | Notes |

|---|---|---|---|

| LeadLeaper | Basic (5 users, monthly) | ~$2,940 | $49 x 12 x 5 users |

| LeadLeaper | Professional (5 users, monthly) | ~$4,140 | $69 x 12 x 5 users |

| Apollo | Basic (5 users, annual) | $2,940 | $49 x 12 x 5 users |

| Hunter | Starter (annual) | $408 | $34 x 12, unlimited team members |

| Snov.io | Starter (annual) | $351 | $29.25 x 12, unlimited team seats |

LeadLeaper's Basic and Apollo's Basic land at the same annual cost for a 5-person team - but Apollo gives you unlimited email credits versus LeadLeaper's estimated 3,000 per seat. Hunter and Snov.io are dramatically cheaper since they don't charge per user, though you'd share a smaller credit pool across the team.

What Users Say About LeadLeaper's Value

LeadLeaper carries a 4.2/5 on Capterra (17 reviews) and a 4.5/5 on G2 (45 reviews). Decent scores on the surface. Dig into the sub-ratings and the picture gets murkier.

What users like:

- Ease of use scores high across the board (4.5/5 on Capterra)

- Quick email finding from profiles - "just works out of the box"

- No export credit charges (a genuine differentiator)

- Customer service rated 4.7/5 on Capterra

What users complain about:

- App freezes and glitches during heavy use

- LinkedIn suspension risk: "If we use this software for too many pages, then our LinkedIn account will be suspended for 1 day"

- Hidden credit quantities frustrate buyers trying to budget

- The built-in CRM is basic - "not a full-fledged CRM"

- Inconsistent data: "Sometimes it doesn't generate data"

The number that jumped out: Capterra's likelihood-to-recommend score is 5.9 out of 10. That's mediocre. Value for money sits at 4.3/5, which is fine but not compelling when Apollo scores 4.7/5 on G2 with over 9,000 reviews.

LeadLeaper isn't bad. It's just not competitive anymore. The tool was a solid value at $39/month with 3,000 credits. At $49/month with undisclosed credits and a 51% find rate, the value proposition has eroded significantly.

Who LeadLeaper Is (and Isn't) For

Consider LeadLeaper if:

- You need a simple Chrome extension email finder and nothing else

- Your prospecting volume stays under 200 contacts/month

- You want basic email sequences built into the same tool

- You're already using it and the price increase doesn't break your workflow

Skip LeadLeaper if:

- You need more than ~3,000 emails/month without jumping to $69+

- Email accuracy is critical to your deliverability (51% find rate is rough)

- You want transparent pricing with disclosed credit quantities

- You need API access for enrichment workflows

- You're scaling a team - Apollo and Prospeo both offer better team economics and higher data quality at comparable or lower price points

Better Alternatives Worth Evaluating

Prospeo - Best for Email Accuracy and Transparent Pricing

If you've been burned by bad data - bounced emails, flagged domains, wasted sequences - this is where you end up. 98% email accuracy from a proprietary email-finding infrastructure, 300M+ professional profiles, and a 7-day data refresh cycle. Every plan shows exactly what you get: credit counts, features, price. No "available upon request" games.

Free tier gives you 75 verified emails plus 100 Chrome extension credits monthly. Paid plans run about $0.01 per email. For teams where deliverability matters more than feature count, it's the clear pick - and at roughly the same monthly cost as LeadLeaper's Basic plan, you're getting verified contacts instead of coin-flip find rates. We've seen teams using Prospeo cut their bounce rates from 30%+ down to under 4%, which is the kind of difference that compounds across every campaign you send.

If you want a fuller shortlist beyond this post, start with these email lookup tools and this comparison of B2B data providers.

Apollo.io - Best Free Tier and All-in-One Platform

Apollo's free plan gives you 10,000 email credits per month. That alone dwarfs LeadLeaper's entire paid Basic offering. The Basic plan at $59/month (or $49/user annually) unlocks unlimited email credits, 75 mobile credits, and 1,000 export credits.

It's a full sales engagement platform - sequences, dialer, CRM, the works. If you're evaluating Apollo specifically, see our breakdown of Apollo.io accuracy and the practical setup guide to Apollo cold email workflows.

Hunter.io - Simplest Email Finder with Full Transparency

Hunter is for the person who wants to type in a domain, get a list of emails, and move on. No CRM, no sequences, no AI assistant - just email finding done cleanly.

Hunter's Starter plan runs $49/month for 2,000 credits - or $34/month billed annually, with the 30% discount clearly displayed on the pricing page. Six million users trust it. Fewer credits per dollar than Apollo, and users report higher bounce rates than specialized verification tools. But if you value simplicity and pricing transparency above all else, Hunter delivers.

If deliverability is the priority, pair any finder with a dedicated workflow to verify an email address and follow a strict email verification list SOP before sending.

LeadLeaper has no API, no published credit counts, and a 26% price hike they never told you about. Prospeo gives you 300M+ profiles, 30+ search filters, native CRM integrations, and a full API - all with a 7-day data refresh cycle and zero guesswork on pricing.

Transparent pricing, verified data, no surprises - see for yourself.

FAQ

How many credits do you get on LeadLeaper's Basic plan?

LeadLeaper doesn't disclose credit quantities on its pricing page. Based on a March 2025 third-party review (when Basic was $39/month), the plan included approximately 3,000 email credits per month. At the current $49 price point, credit quantities are likely similar, but LeadLeaper hasn't confirmed this directly.

Did LeadLeaper raise its prices recently?

The last confirmed increase happened between March and late 2025: Basic jumped from $39 to $49/month and Professional from $59 to $69/month - roughly 26% across the board. Free plan credits were halved from 200 to 100. No official announcement accompanied any of these changes.

Is LeadLeaper's free plan enough for real prospecting?

Not really. At 100 credits per month with a ~51% find rate, expect roughly 50 usable verified emails. That's enough to test the tool but not enough to sustain any real outbound campaign. Prospeo's free tier offers 75 verified emails plus 100 Chrome extension credits at 98% accuracy - more usable contacts from fewer credits.

What's a more cost-effective alternative to LeadLeaper?

Apollo.io offers 10,000 free email credits monthly, dwarfing LeadLeaper's paid Basic plan. For accuracy-first teams, Prospeo delivers 98% verified emails at ~$0.01 each with transparent credit counts on every plan - no hidden quantities, no "contact us" gates.