How to Run a Competitor Buy-Back Campaign (Step-by-Step)

Most "Closed-Lost to Competitor X" deals don't stay lost. They quietly renew, expand seats, and turn into the kind of account your team swears was "never a fit" until you see the renewal number.

This playbook is for a competitor buy-back campaign: re-entering accounts you lost to a competitor, timed around renewal and switching pressure, with an offer that removes migration risk.

Look, if your ACV is tiny and switching is easy, skip this. You'll spend more on incentives and rep time than you'll ever earn back.

What you need (quick version)

Print this and build the program around it - not around "a clever sequence."

A clean source list

- CRM filter: Closed-Lost + competitor involved (loss reason + call notes)

- Export to CSV

- Suppress: current customers, open opps, do-not-contact/unsubscribed, duplicates

Three levers that actually move results

- Timing: target 0-120 days pre-renewal (or 9-14 months post-adoption if you don't have dates)

- Risk-removal offer: migration + parallel run + buyout cap beats "20% off"

- Multi-threading: champion + economic buyer + IT/security + ops/admin (one-thread = ghosted)

Signals to prioritize

- Renewal window

- Switching intent (for example: "[Competitor] alternatives")

- Adoption friction (low rollout, admin pain, internal complaints)

Deliverability minimums

- SPF + DKIM + DMARC aligned

- Dedicated sending subdomain for outbound

- List-Unsubscribe headers / one-click unsubscribe where applicable

- Bounce <2% and complaint rate kept near zero

- Verify emails before you send; don't "test" deliverability on real prospects

A weekly cadence

- Refresh list + re-score + route hot accounts

- Log "why we lost again" like it's product feedback (because it is)

Competitor buy-back campaign: what it is (and isn't)

A buy-back motion targets accounts that match your ICP and are currently running a competitor - especially accounts you already sold into and lost. The point isn't to "check in." It's to show up when the account is forced to reconsider: renewal, expansion, leadership change, or visible adoption pain.

Definition (competitor buy-back campaign) A targeted outbound + ABM program aimed at accounts you previously lost (or repeatedly lose) to a named competitor, timed around renewal and switching signals, with an offer designed to remove migration risk.

Why buy-back is narrower (and more winnable) than broad displacement

Broad competitive displacement starts with "who uses Competitor X?" and then tries to create a reason to switch. Buy-back starts with your own loss history, which gives you three unfair advantages:

- You already know the buying group shape (or at least the first champion).

- You know the real objection (price, security, missing feature, "too complex," procurement timing).

- You can time the re-entry based on contract cycles and internal triggers.

That's why buy-back is one of the few outbound motions that still feels relevant instead of random.

What it isn't

Not a win-back/reactivation campaign. Win-back is for churned customers or dormant users. Triggers are usage drop, cancellation, inactivity, or support issues. Buy-back is for accounts that chose someone else - often never became your customer.

Not a generic "switch to us" blast. If your message is basically "Competitor X is bad," you'll get ignored, and you'll create legal/compliance risk. The best outreach reads like a practical re-evaluation: timeline, migration plan, and a commercial bridge that makes switching safe.

Where your buy-back list actually comes from (3 concrete sources)

You don't need a fancy data stack to start. You need a defensible list.

- Closed-Lost with competitor tagged (loss reason field + call notes tags)

- "No decision" deals where the competitor later won (common in enterprise: your deal dies, then procurement picks a default vendor)

- Lookalikes of your closed-lost set (only after you prove messaging + offer on the core list)

I've seen teams start with lookalikes because it feels bigger, then spend a quarter arguing about whether the program works because the list is mush.

When this works best (and when it backfires)

Run it when:

- You lose to the same 1-3 competitors repeatedly and you can say exactly why.

- You have a real switching wedge (time-to-value, support, UX simplicity, compliance posture, measurable outcomes).

- You can identify renewal timing - or at least approximate adoption timing.

- You can multi-thread. If you can't reach more than one stakeholder, you're not running buy-back. You're sending hope emails.

Skip it when:

- Your only angle is price. Discounts don't win displacement; they just teach procurement that you fold.

- Your onboarding is fragile. If switching to you feels risky, no buyout cap saves you.

- Your data is messy. I've watched teams burn a sending domain in two weeks because they rushed a stale list into sequences.

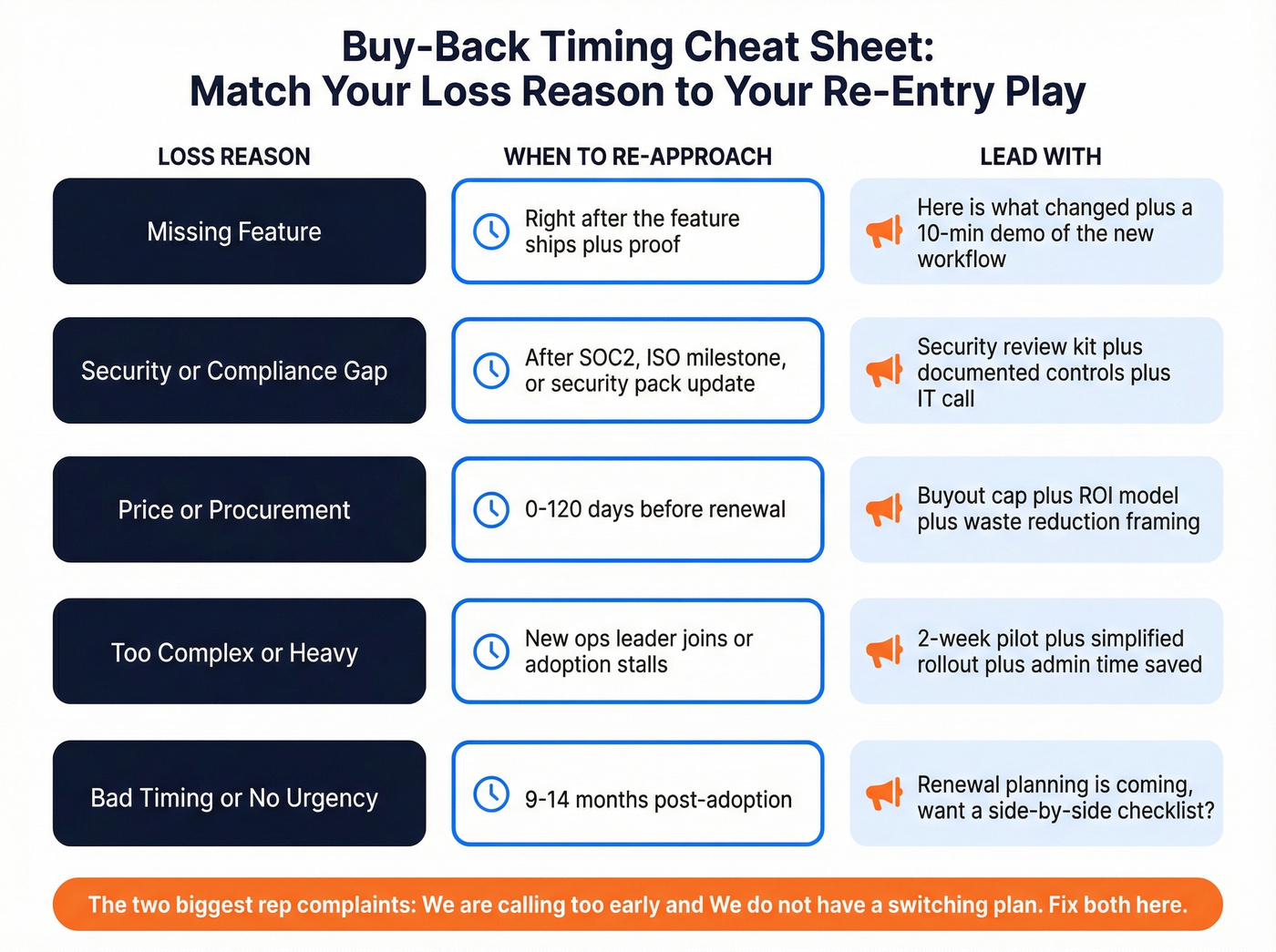

Timing by loss reason (this is the part most playbooks miss)

Use your loss reason to decide when and how you re-approach:

| Why you lost last time | When to re-approach | What to lead with |

|---|---|---|

| Missing feature | Immediately after the feature ships + proof | "Here's what changed + a 10-minute demo of the new workflow" |

| Security/compliance gap | After SOC2/ISO milestone or security pack update | "Security review kit + documented controls + IT call" |

| Price / procurement | 0-120 days pre-renewal | Buyout cap + ROI model + "waste reduction" framing |

| "Too complex / heavy" | When a new ops leader joins or adoption stalls | 2-week pilot + simplified rollout plan + admin time saved |

| Bad timing / no urgency | 9-14 months post-adoption | "Renewal planning is coming - want a side-by-side checklist?" |

Reps complain about two things: "We're calling too early" and "We don't have a switching plan." They're right.

Your buy-back campaign dies the moment a stale email bounces and tanks your domain. Prospeo enriches your Closed-Lost CSV with 50+ data points per contact at a 92% match rate - verified emails, direct dials, job changes, and fresh titles. All refreshed every 7 days, not 6 weeks.

Stop burning sending domains on dead data. Enrich your competitor-installed list first.

The 5-step competitor buy-back campaign workflow (RevOps-first)

Step 1 - Build the competitor-installed list (Closed-Lost -> CSV -> clean)

Start with Closed-Lost deals where a competitor was involved, then export.

Pull this from your CRM:

- Stage: Closed-Lost

- Competitor name (standardized field if you have it; otherwise loss reason + notes)

- Date range: last 12-24 months

- Export fields: company, domain, primary contact, role, last activity date, competitor, estimated contract start (if known)

Clean it like a program (not an SDR side quest):

- De-dupe by domain + company name

- Suppress current customers, open opps, do-not-contact/unsubscribed

- Normalize competitor names (this saves you later when you score and route)

Then sanity-check "competitor installed" using what you already have: call context, internal notes, technographics, job posts, and web signals. You're trying to answer one question: is the competitor actually in the building?

Here's a real scenario I've seen: an AE marks "Lost to Competitor" because the champion went dark, but six months later the account actually bought a different vendor through procurement. If you don't validate install, you end up running a buy-back campaign against the wrong product and wondering why every reply sounds confused.

Step 2 - Prioritize by renewal window + intent + adoption signals

If you do nothing else, do this step well. Timing is the difference between "not interested" and "perfect timing," and it's also the difference between a clean domain reputation and a trashed one because you're hammering stale contacts at scale.

Renewal timing (practical heuristics):

- If you have contract dates: prioritize 0-120 days pre-renewal

- If you don't: prioritize accounts that adopted 9-14 months ago (annual renewals are common)

- Add adoption proxies:

- "first seen" dates from technographics

- job posts asking for competitor experience

- leadership change in the owning function (new leader = re-evaluation)

Intent overlay (what you actually want):

- "[Competitor] alternatives" and "[Competitor] pricing" searches

- category pain intent ("reduce bounce rate," "admin overhead," "workflow automation," etc.)

- visits to your comparison, pricing, and security pages

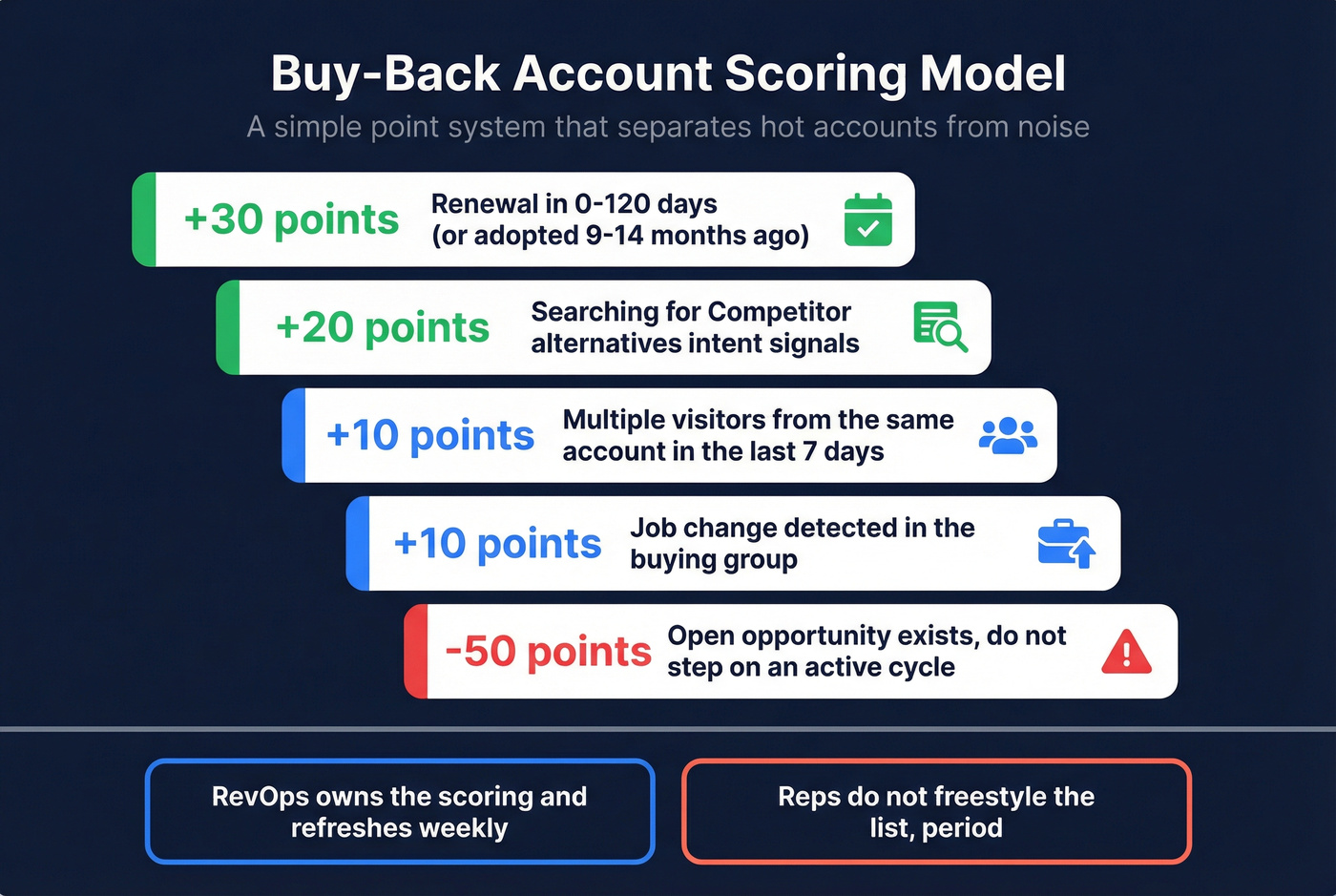

A simple scoring model that works:

- +30: renewal in 0-120 days (or adopted 9-14 months ago)

- +20: "[Competitor] alternatives" intent

- +10: multiple visitors from the same account in 7 days

- +10: job change in buying group

- -50: open opp exists (don't step on an active cycle)

The operational rule I enforce: reps don't get to freestyle the list. RevOps owns the scoring, refreshes weekly, and pushes the right tier into the right motion.

If you're turning a Closed-Lost CSV into a deliverable list, Prospeo is the cleanest way we've used to do it without torching your domain reputation. It's "The B2B data platform built for accuracy" with 300M+ professional profiles, 143M+ verified emails at 98% email accuracy, and 125M+ verified mobile numbers with a 30% pickup rate, plus 83% enrichment match rate and a 7-day data refresh cycle (industry average: 6 weeks). That combination matters in buy-back because stale contacts aren't just wasted touches - they create bounces, bounces create deliverability problems, and deliverability problems kill every outbound motion you run.

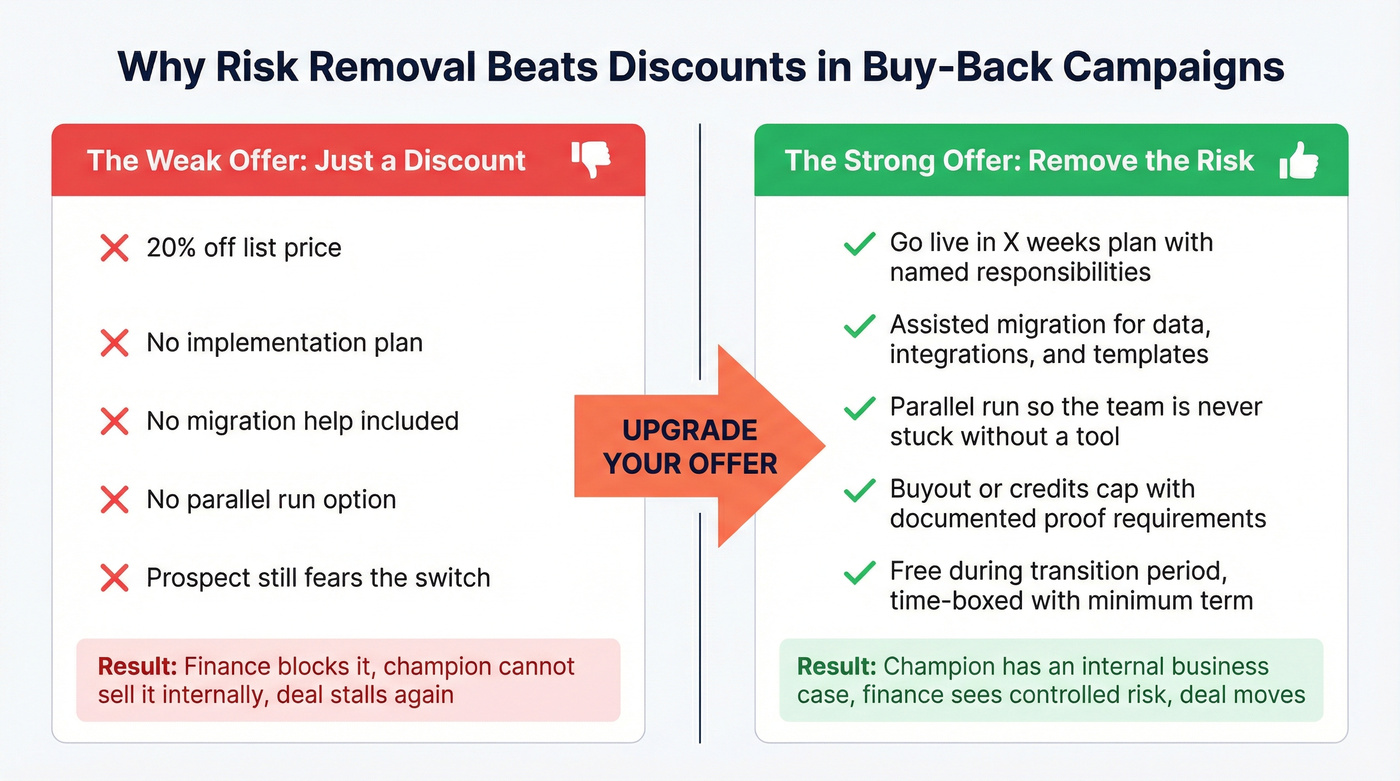

Step 3 - Design the switch offer (risk removal > discount)

Your offer isn't "20% off." Your offer is "switching won't hurt."

A good buy-back offer has three parts:

- a clear implementation plan,

- migration help,

- a commercial bridge that makes finance stop blocking the change.

What reduces switching fear:

- Implementation timeline with responsibilities

- Assisted migration (data + integrations + templates)

- Parallel run (use both tools during transition)

- Buyout/credits cap with proof requirements

- Success criteria (what "go live" means)

Offer components I recommend (because they're hard to ignore):

- "Go live in X weeks" plan with dates

- Free during transition (time-boxed)

- Migration services included

- Buyout structure with cap + proof

- Minimum term so you're not buying churn

One strong opinion: if you can't articulate the parallel-run plan in two sentences, your offer isn't ready. Prospects don't fear your product; they fear the week their team can't do their job because a migration went sideways.

Step 4 - Execute across channels (email + phone + ads + ABM content)

Email alone isn't ABM. It's just email.

A recent ABM benchmark summary put email (92%) and in-person events (72%) among the most-used ABM channels. The point isn't "do more channels." It's coordinate touches across the buying group so the champion isn't carrying your whole case on their back.

Channel mix that works in practice:

- Email: renewal-timed, switching-focused, short

- Phone: permission-based calls to confirm timing + owner + pain

- Ads: retargeting to keep your narrative present (switch kit, comparison page, case study)

- One ABM asset built for switching (not awareness)

- switch plan one-pager

- migration checklist

- security + compliance pack

- ROI model vs status quo

Multi-stakeholder mapping (don't overthink it):

- Champion/user: daily workflow pain

- Economic buyer: ROI + contract waste

- IT/security: access, controls, vendor risk

- Ops/admin: rollout, training, governance

A tactic that still works: search professional profiles for competitor keywords to find power users. You want the people who touch the tool, not just the person who signed the order form.

Deliverability minimums for buy-back outbound (don't skip)

Buy-back lists are often stale. Stale lists create bounces. Bounces wreck deliverability. And once your domain reputation's cooked, every other outbound motion suffers.

Minimum bar:

- SPF, DKIM, DMARC aligned (no "p=none forever" laziness)

- Dedicated outbound sending subdomain

- List-Unsubscribe headers / one-click unsubscribe where applicable

- Warm up new sending domains; don't start at full volume

- Bounce rate under 2% (if you're above that, stop and fix the list)

- Monitor complaint rate and blocklist signals weekly

Deliverability isn't "email ops." It's revenue ops. (If you need the full mechanics, start with an email verification workflow and a real email deliverability checklist.)

Step 5 - Route, follow up, and keep the program running

Buy-back fails when it's treated like a one-off campaign. It's a weekly program.

Weekly operating cadence:

- Refresh the list (new closed-lost, intent spikes, job changes)

- Re-score tiers (high/moderate/low)

- Route hot accounts to AEs with context (competitor, renewal window, pain hypothesis)

- QA deliverability (bounces, complaints, domain health)

- Review outcomes (meetings, pipeline, wins, and "why we lost again")

We don't ship buy-back lists to reps without weekly refresh + suppression. Ever.

Routing rules that prevent chaos:

- High intent -> AE + SDR paired, 24-hour SLA, 3-day blitz

- Moderate intent -> SDR owns, AE pulled in after engagement

- Low intent -> marketing nurture + quarterly SDR touch

In practice, the SDR role here looks like account activation: confirm the renewal month, map stakeholders, and create a clean handoff when the account shows real switching intent.

Offer mechanics that actually get switches (with a terms template)

Below is the commercial structure that makes finance say "fine."

Buy-back offer menu

| Offer type | Best for | What you promise | Proof required | Common gotchas |

|---|---|---|---|---|

| Early switch credits | Mid-market SaaS | Credits cover ETFs | Invoice/ETFs | Credits expire |

| Buyout cash cap | Enterprise | Reimburse up to cap | Contract + bill | Slow approvals |

| Free transition period | Complex rollout | Free for 30-90 days | Project plan | Scope creep |

| Migration services | Data-heavy tools | Assisted migration | Data access | Hidden effort |

| Implementation SLA | Ops-heavy | Live in 4-8 weeks | Mutual plan | Blame games |

| Price lock | Volatile pricing | Hold rate 12-24 mo | Signed order | Margin risk |

Common buyout structure (usable template)

Guardrails that keep margin intact:

- Cap: reimburse up to $5k-$50k depending on segment

- Proof: invoice/contract showing remaining term + ETFs

- Payout method: service credits (preferred) or netted against invoices

- Minimum term: 12-24 months (or annual prepay)

- Clawback: churn inside 6-12 months converts credits to payable balance

- Scope: ETFs only (not "soft regret costs")

- Timing: credits applied after go-live or after first invoice's paid

If you're tempted to just discount: don't. Discounts are easy to match. A switching plan is hard to match, and it's the part that makes the buyer feel safe enough to take the meeting in the first place.

Messaging that converts: sequences, call opener, and objection handling

They already chose someone else. Your job is to create a safe moment to reconsider.

Email pattern 1: renewal ending this quarter

Subject: Quick question before your [Competitor] renewal

Hi {{FirstName}} - reaching out because {{Company}} has been running [Competitor], and this is usually the quarter teams start renewal planning.

When companies scale, we see one of two issues: admin overhead that drags adoption, or gaps that show up once the rollout hits more teams.

If your renewal's in the next 3-4 months, open to a 15-minute compare? I'll bring a switch plan and a parallel-run timeline so there's no downtime.

-- {{YourName}}

Email pattern 2: low adoption / overwhelming UX

Subject: Is [Competitor] getting used... or just paid for?

Hi {{FirstName}} - quick one. A common pattern: [Competitor] gets bought with big expectations, then adoption stalls because the workflow's heavier than expected.

If that's happening at {{Company}}, I can map a simpler rollout to your current process so it's apples-to-apples.

Worth a quick walkthrough next week?

-- {{YourName}}

Call opener (permission-based)

"Hey {{FirstName}}, it's {{Name}}. Quick one - are you the right person to ask about {{category}} tooling, or is that owned by someone else?"

(If yes)

"Got it. We usually talk to teams on [Competitor] when renewal's coming up or adoption's been bumpy. Is either true for you this quarter?"

Objection: "We already have a solution in place."

Agree, then anchor on timing.

"Totally. I'm not calling to rip-and-replace something that's working. This is only worth it if renewal's close or there's friction - adoption, reporting, support, whatever. If neither's true, I'll back off."

Then ask:

"Is your renewal in the next 3-4 months, or later in the year?"

Sequence skeleton (7 touches / 14 days)

- Day 1: Email (renewal-timed)

- Day 2: Call + voicemail

- Day 4: Email (switch plan + migration timeline)

- Day 6: Call (confirm owner + renewal month)

- Day 8: Email (case study: "switched from X")

- Day 11: Social touch (optional; keep it human)

- Day 14: Breakup email ("close the loop" + ask for renewal month)

Measurement: targets, attribution, and incrementality

If you don't measure incrementality, buy-back turns into story-time: "we think it helped."

KPI checklist (track weekly)

List health

- Verified email rate

- Bounce rate (keep it under ~2%)

- Duplicate rate

- Suppression compliance (customers/open opps excluded)

Engagement

- Reply rate (positive + neutral)

- Connect rate on calls

- Stakeholder coverage (contacts per account touched)

Conversion

- Meeting rate (booked meetings / accounts touched)

- SQL rate

- Pipeline created + velocity

Outcome

- Win rate on targeted accounts

- Sales cycle vs baseline

- Gross margin impact (buyout credits used)

One benchmark worth stealing: in a Prospeo customer example (Meritt), bounce rate went from 35% to under 4% after verification.

Targets (directional, but useful)

- 1-3% meeting rate on highly-qualified competitor-installed lists, with the highest rates near renewal windows.

- First Page Sage pegs B2B SaaS average website conversion at 1.1% - so don't expect your "[Competitor] alternative" page to do miracles without serious intent and proof.

- 6sense's ABM guide highlights outcomes like 5x pipeline velocity and 35% win rates on targeted accounts once list quality and timing are dialed.

Proving incrementality (simple and defensible)

- Hold out 10-20% of your competitor-installed list for 30-60 days

- Compare meeting rate, pipeline created, and win rate vs holdout

- Tag contacts + opportunities with a campaign ID

- Capture "why we lost again" in a structured field (timing, feature gap, switching risk, champion left)

If you can't show lift vs holdout, you don't have a program. You've got activity.

Multi-threading a buy-back account means finding the new champion, the economic buyer, and the IT lead - not just the contact who ghosted you 14 months ago. Prospeo's 300M+ profiles and 30+ filters (including job changes and department headcount) let you map the entire buying group in minutes at $0.01 per email.

One thread equals ghosted. Build the full buying group before you re-enter.

Legal + compliance guardrails for competitor buy-back campaigns

You can name competitors. You just can't be sloppy.

The FTC's comparative advertising policy encourages comparisons that are truthful and non-deceptive, and it expects the basis of comparison to be clear. FTC advertising guidance is also blunt about substantiation: you need evidence before the ad runs, implied claims count, and "money-back guarantees" don't replace proof.

Trademark basics matter too: nominative fair use generally allows using a competitor's mark to identify them if you use only what's necessary, don't imply endorsement, and don't alter the mark.

The compliance workflow (what keeps you safe in the real world)

This is what I'd implement before you run competitor pages, ads, or "vs" decks at scale:

1) Build a substantiation file per claim

- Claim statement (exact wording)

- Evidence (docs, tickets, customer data, third-party reports)

- Date captured + owner

- Where it appears (landing page URL, ad ID, deck version)

2) Define legal review triggers (non-negotiable)

Require review for:

- Security claims ("more secure," "insecure," "breach risk," etc.)

- "Best/#1/most/fastest" claims

- Pricing comparisons and savings claims

- Any use of competitor logos, screenshots, or UI references

- Regulated-industry claims (HIPAA, FINRA, etc.)

3) Keep an audit trail

- Archive copies of landing pages and ads that ran (screenshots + HTML/PDF exports)

- Version your "vs" tables and battlecards

- Store approvals (who signed off, when, and what changed)

4) Train the field

- SDRs and AEs shouldn't freestyle competitor claims on recorded calls

- Give them approved phrases and a "don't go there" list (especially on security)

The fastest way to get a program shut down is letting reps improvise "they're insecure" or "they overcharge" with zero evidence.

Do / Don't checklist (practical)

Do:

- Compare specific attributes with a clear basis ("Implementation in 6 weeks vs 12 weeks" only if you can prove it)

- Use "vs" tables where each row's factual and backed by your substantiation file

- Keep logos/screenshots minimal and accurate

- Use neutral language: "differences," "tradeoffs," "switching plan"

Don't:

- Don't use "Best," "#1," "most accurate," or "cheapest" without substantiation

- Don't imply endorsement ("trusted by" misuse)

- Don't use altered competitor logos or confusing lookalikes

- Don't make security claims without current, defensible evidence

Safe phrasing examples (steal these)

- "Teams switch from [Competitor] when they need faster time-to-value."

- "Here's how our workflow differs from [Competitor] across onboarding, reporting, and admin."

- "If you're evaluating [Competitor] alternatives ahead of renewal, here's a side-by-side checklist."

Paid search reality (so you don't get surprised)

Competitor keyword bidding is common. Trademark restrictions typically apply to using the trademark in ad copy, and defending your own brand terms is non-negotiable.

Tools & data you need to run this (lightweight stack)

Keep the stack boring. The program's the advantage.

- CRM + governance: any major CRM works; the key is clean competitor fields + suppression + campaign tagging.

- Sequencing: sales engagement platforms typically run $100-$200/seat/month (SMB) and $150-$300/seat/month (enterprise tiers).

- Ads + retargeting: LinkedIn/Google retargeting budgets commonly start around $1,500-$10,000/month depending on audience size and ACV.

- Attribution + testing: basic multi-touch attribution ranges from $0-$50/user/month (lightweight) to $1,000-$5,000/month for dedicated platforms; holdout testing's free if you enforce it operationally.

If you run competitor keyword campaigns, assume you can bid, but keep trademarks out of ad copy unless legal signs off.

FAQ

What's the difference between a competitor buy-back campaign and a win-back campaign?

A competitor buy-back campaign targets accounts using a competitor (often from Closed-Lost history) and tries to win them at renewal or switching moments. A win-back campaign reactivates former customers or inactive users. Buy-back is competitive displacement with timing; win-back is lifecycle retention.

When should you run a competitor buy-back campaign after losing a deal?

The best windows are 0-120 days before renewal if you have contract timing, or 9-14 months after adoption as a proxy for annual terms. Reaching out right after they sign mostly produces "we already have a solution in place," so you burn touches without creating a real switching moment.

What should a contract buyout offer include (without killing margin)?

A solid buyout offer uses a cap (often $5k-$50k), requires proof (invoice/ETFs), pays as service credits when possible, and includes a 12-24 month minimum term plus a 6-12 month clawback. Pair it with a time-boxed migration plan so you're removing risk, not just cutting price.

Is it legal to name competitors in ads and landing pages?

Yes. Comparative advertising's allowed when it's truthful and non-deceptive and the basis of comparison is clear, and you need substantiation before claims run. For trademarks, stick to nominative fair use norms: use only what's necessary to identify the competitor and don't imply endorsement.

How do you build a clean competitor-installed contact list quickly (and keep bounce rates low)?

Export Closed-Lost + competitor from your CRM, de-dupe by domain, suppress customers/open opps/unsubscribes, then verify and enrich before sequencing. Keep bounce rate under ~2%; if you're above it, pause sending and fix the list before you damage domain reputation.

Summary: the program that wins renewals you "already lost"

A competitor buy-back campaign works because it's not random outbound - it's a renewal-timed re-entry into accounts you already understand, with an offer that removes switching risk. Build the list from Closed-Lost, prioritize by renewal + intent, multi-thread the buying group, and run it as a weekly RevOps program with strict deliverability and holdout testing.