SDR Job Meaning (2026): What You Actually Do and How You're Measured

Searching "sdr job meaning" usually means you've read five job posts and they all sound like: "make 100 touches/day, be resilient, and somehow create pipeline." That's not a job description. It's a stress test.

Here's the real translation: an SDR gets paid to turn attention into conversations, and conversations into qualified meetings. Everything else is just the mechanics.

I've been on teams where SDRs were treated like a dial counter, and I've seen teams where SDRs were treated like the start of the revenue engine. Same title. Completely different job.

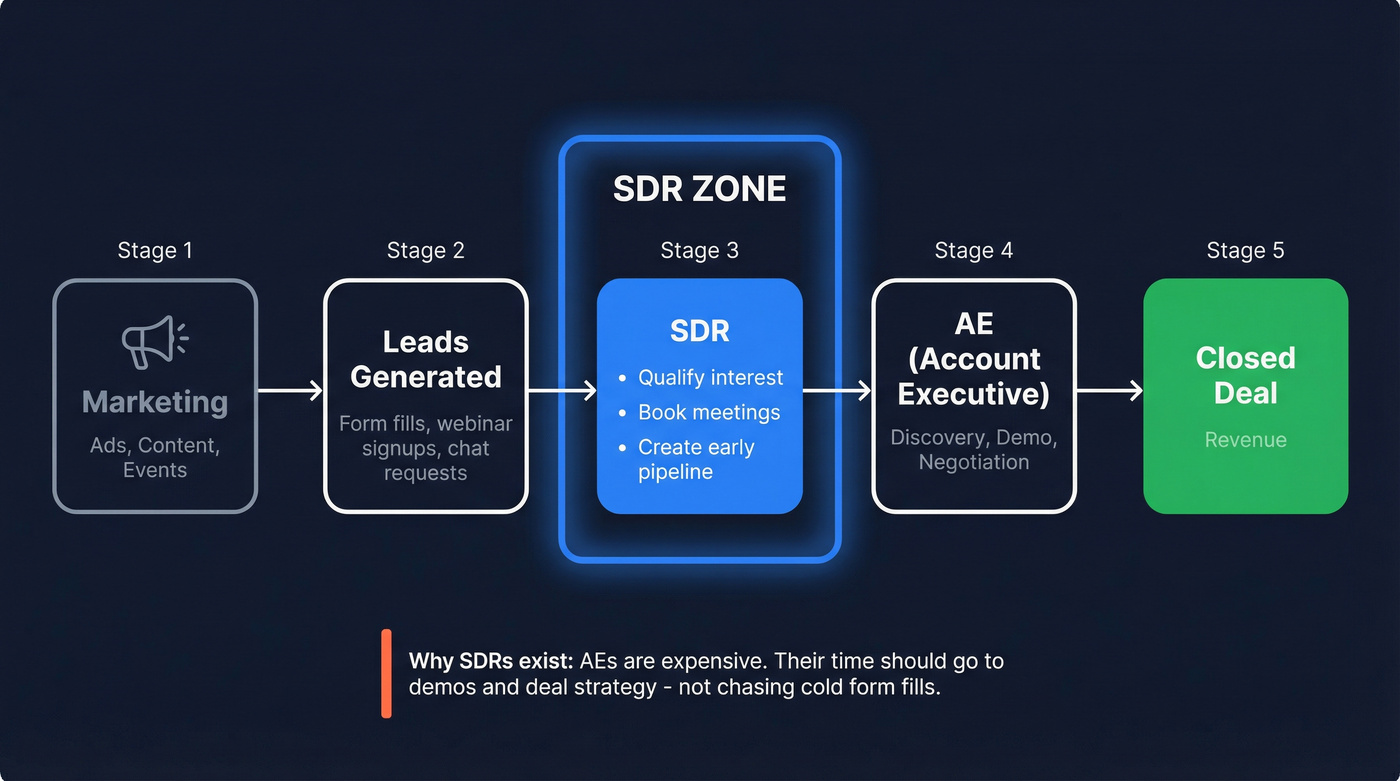

If you only read one section, read this. SDR = Sales Development Representative. You work the top of the funnel: qualify interest, book meetings, and create early-stage pipeline. You sit between marketing demand (and/or outbound lists) and the AE who runs discovery, demos, and closes. Your day is fast follow-up, qualification calls, routing, light research, writing/emailing, calling, and relentless CRM updates. You're measured on meetings booked/held, SQLs, and pipeline created - with activity targets as guardrails. US pay reality: total comp commonly lands in the $83K-$128K range (with a median around $102K); OTE's usually tied to meetings and/or opportunity creation. Ramp reality: average ramp's ~3.1 months. Average tenure's ~1.8 years, and churn's a real factor in many SDR orgs. Interview questions that matter: "What's quota?" "What % hits it?" "How's lead quality?" "What's speed-to-lead?" "How many AEs per SDR?" "What tools + data do I get?"

SDR job meaning in plain English

SDR stands for Sales Development Representative.

In plain English, an SDR's job is to create qualified sales conversations. If you're wondering what an SDR job is, it isn't closing deals and it isn't running marketing campaigns - it's being the bridge between interest and a real sales process.

Companies hire SDRs because pipeline's fragile. If AEs have to prospect and run deals, they do both worse.

Operationally, the role is simple: you own the top-of-funnel scoreboard.

That scoreboard usually looks like:

- Meetings booked (and held)

- SQLs (Sales Qualified Leads)

- Pipeline created (opportunities opened that have a real chance)

Everything you do - calls, emails, follow-ups, routing, research - only matters if it moves those numbers.

Titles are messy (especially at startups), but the core meaning doesn't change: you're paid to manufacture "next steps" with the right accounts.

Where SDR fits in the sales funnel (and why companies hire them)

SDRs sit at the top of the revenue funnel, right where leads are either:

- captured and qualified quickly

- ignored until they go cold

- worked sloppily and handed to AEs as garbage

The business reason companies hire SDRs is simple: specialization increases throughput. AEs are expensive, and their time should go to discovery, demos, and deal strategy - not chasing form fills or guessing email formats.

Here's the thing: leadership isn't romantic about SDR work. They're doing math.

A realistic year-1 cost for 1 SDR + 1 AE often lands around $175K-$200K all-in once you count salary, benefits, tooling, and management time, while outbound agencies commonly charge $6,000-$10,000/month to set meetings and you still need internal people to qualify, close, and keep the relationship moving.

Outbound infrastructure costs (directional, but real): a 2026 cost breakdown shared by a B2B SaaS operator estimated inboxes at ~$3.50/inbox/month, domains at ~$12/domain/year, and sending volume examples like 1,000 emails/day ≈ $1,175/month and 2,500/day ≈ $1,940/month after initial domain setup.

Hidden costs leadership forgets:

- Data/enrichment: often $1,000+/month once you're serious about outbound (see data quality basics)

- Management time: 5-10 hours/week for coaching, QA, routing rules, and firefighting

- Ramp time: typically 3-5 months before output stabilizes (compare to a real sales onboarding plan)

- Annual churn: ~40% in many SDR orgs (hiring + onboarding becomes a permanent tax)

That's why SDR teams exist: they're a controllable pipeline engine with measurable inputs and outputs.

Bad data is the #1 silent killer of SDR performance. When 35%+ of your emails bounce, ramp takes longer, quota feels impossible, and AEs lose trust. Prospeo delivers 98% email accuracy with a 7-day refresh cycle - so every dial and every send actually reaches a real buyer.

Stop grinding against dead leads. Start every sequence with verified contacts.

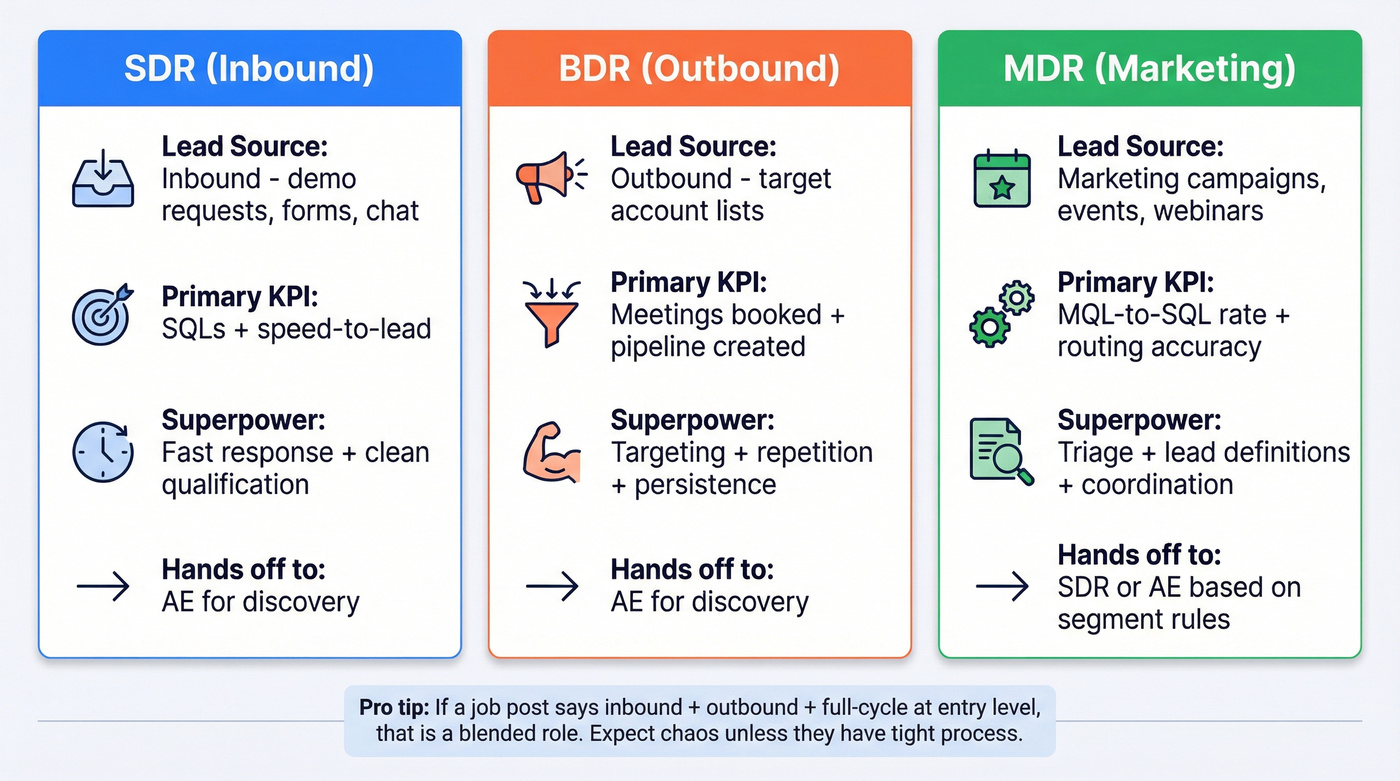

SDR vs BDR vs MDR: what's the difference?

Most confusion comes from companies using "SDR" as a generic label for "junior sales person who does outreach."

Here's the clean baseline (and the one that matches how funnels actually behave):

- SDR = inbound qualification

- BDR = outbound prospecting

- MDR = marketing-sourced lead follow-up and routing (common in some orgs)

Why it matters: inbound and outbound are different sports.

Inbound wins on speed-to-lead and tight qualification. If you respond late, you lose the deal before it starts. Outbound wins on targeting, list quality, and repetition. If you target poorly, you can "work hard" all month and create nothing.

When companies mash inbound and outbound into one blended role, performance usually drops in both motions: inbound follow-up slows down, and outbound turns into spray-and-pray.

Responsibilities by role (what you'll actually be doing)

SDR (inbound) responsibilities

- Work demo requests, contact forms, webinar signups, chat leads

- Call fast, qualify fast, route cleanly

- Disqualify quickly (bad fit's still a win if you do it early)

- Keep lead statuses and next steps spotless in the CRM

BDR (outbound) responsibilities

- Build/execute sequences into target accounts

- Research accounts and pick angles that match the ICP

- Handle objections and "not now" follow-up loops

- Create opportunities by earning a meeting with the right stakeholder

MDR responsibilities

- Triage marketing leads (especially high volume)

- Enforce lead definitions (MQL, SQL) so the funnel doesn't rot

- Coordinate with marketing on what converts and what wastes time

- Route leads to the right SDR/AE based on territory/segment rules

Quick taxonomy table (use this to decode job posts)

| Role | Lead source | Primary KPI | Handoff |

|---|---|---|---|

| SDR | Inbound | SQLs + speed-to-lead | AE for discovery |

| BDR | Outbound | Meetings + pipeline created | AE for discovery |

| MDR | Marketing | MQL-to-SQL rate + routing accuracy | SDR/AE split |

| "Blended SDR" | Both | Meetings + activities | AE (often messy) |

How to spot which one you're applying for (60-second checklist)

- If the post says "respond within SLA," "work the queue," "route to AEs" --> it's inbound SDR.

- If it says "build lists," "target accounts," "cold outbound" --> it's BDR/outbound SDR.

- If it says "events/webinars," "MQL follow-up," "lead management" --> it's MDR.

- If it says "inbound + outbound + full-cycle" at entry level --> it's a blended role. That can be fine at a startup, but expect chaos unless they've got tight process.

Hot take: if your average deal size is a few thousand per year, you probably don't need fancy title taxonomy at all. You need fast follow-up, clean qualification, and a simple handoff.

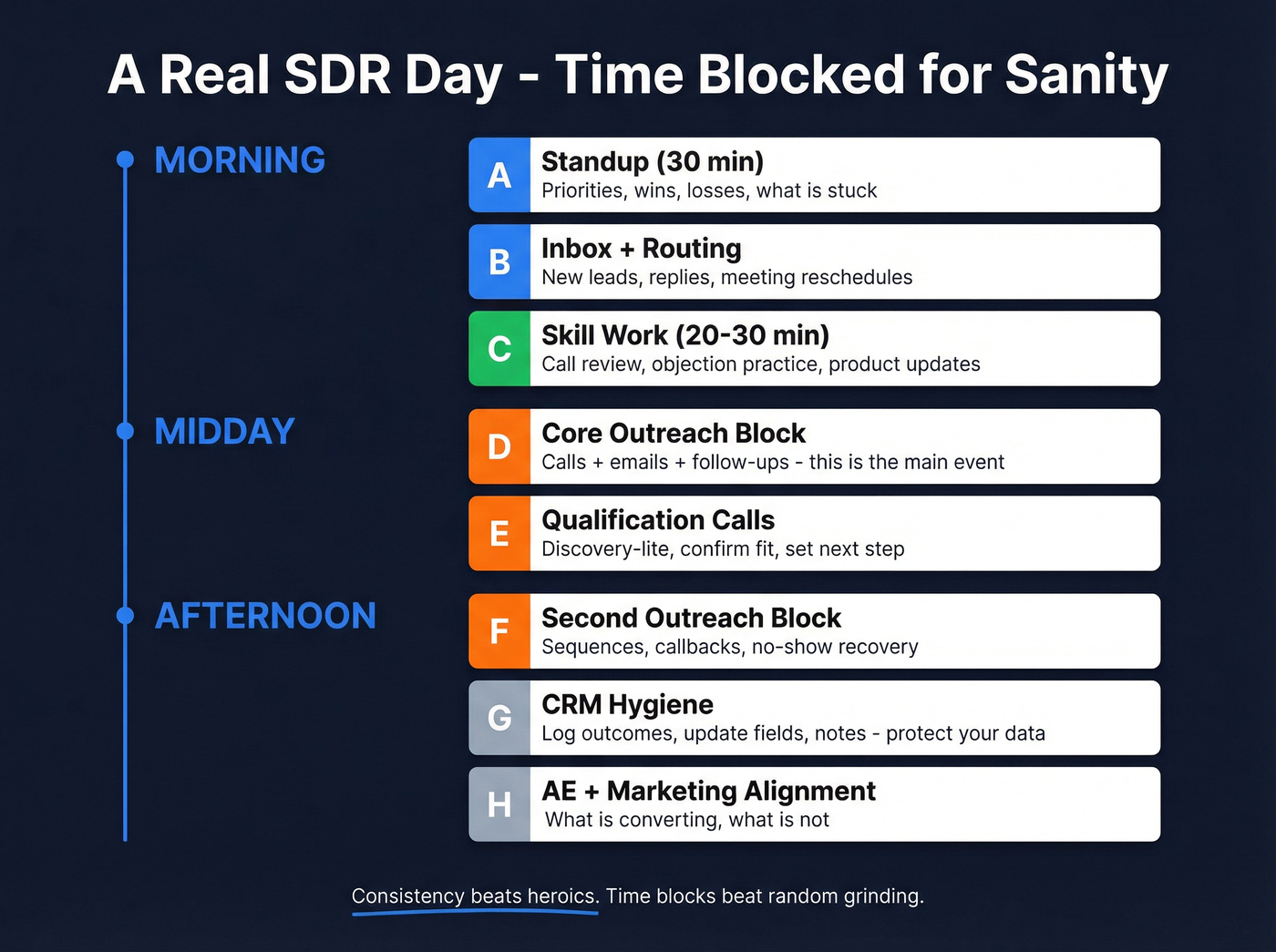

What an SDR does all day (inbound vs outbound)

A good SDR day isn't "grind all day." It's time blocks.

Consistency beats heroics.

Day-in-the-life template (common blocks)

Morning

- Standup (~30 min): priorities, wins/losses, what's stuck

- Inbox + routing: new leads, replies, meeting reschedules

- Skill work (20-30 min): call review, objection practice, product update (use a cold call coaching scorecard)

Midday

- Core outreach block: calls + emails + follow-ups

- Qualification calls: discovery-lite, confirm fit, set next step (see qualification call best practices)

Afternoon

- Second outreach block: sequences, callbacks, no-show recovery

- CRM hygiene: log outcomes, update fields, next steps, notes (protect CRM data clean habits)

- AE/marketing alignment: what's converting, what's not

Two real variants: inbound SDR vs outbound SDR

Inbound SDR (speed-to-lead heavy)

- You live in the queue: demo requests, contact forms, webinar signups

- Your superpower's fast response + clean qualification

- You spend more time on calls and routing, less on list building

Outbound SDR (sequencing heavy)

- You live in sequences: targeted accounts, persona messaging, follow-up loops

- Your superpower's targeting + repetition + data hygiene

- You spend more time researching accounts and writing tight first lines (use a pre call research checklist)

SDR checklist (what "good" looks like)

- Respond to inbound within SLA (minutes, not hours)

- Keep sequences clean (no dead accounts, no bounced emails)

- Log every outcome in CRM the same day

- Track conversion rates weekly (not just activity counts)

- Bring patterns to your manager: "This persona converts," "This industry doesn't," "This message gets replies"

Scenario you'll recognize: it's Thursday, your activity's high, your calendar's empty, and your manager says "just add more dials." If the list is stale and half the numbers are wrong, you can dial until your voice gives out and still lose.

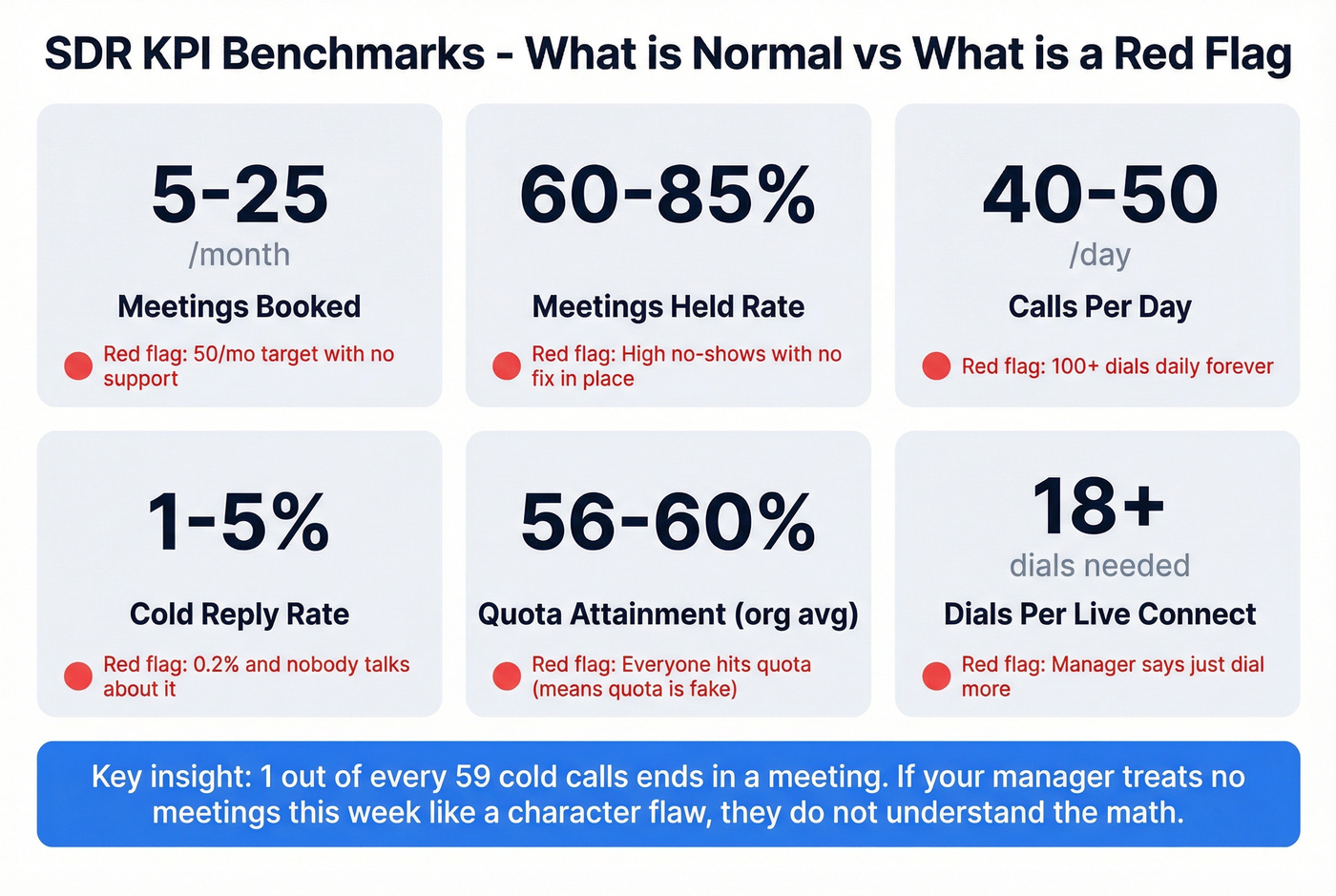

SDR job meaning in numbers: KPIs + benchmark ranges

Benchmarks vary by ICP and channel. Use these as ranges, not commandments.

SDR performance should be measured on outcomes. In real life, most teams measure a mix of outcomes and activity guardrails because outcomes lag.

KPI benchmarks table (what's normal vs what's a red flag)

| KPI | Typical range | Depends on | Red flags |

|---|---|---|---|

| Meetings booked | 5-25 / month | ICP + channel | "50/mo" with no support |

| Meetings held | 60-85% of booked | reminders + fit | high no-show, no fix |

| Dials per live connect | 18+ | data + timing | "Just dial more" |

| Calls/day | 40-50 | motion + list | 100+ daily forever |

| Emails/day | 10-40 | personalization | 200/day + "quality" |

| Total activities/day | 80-100 | tooling + rules | activity-only culture |

| Reply rate (cold) | 1-5% | offer + list | 0.2% and ignored |

| Quota attainment | 56-60% | org maturity | "Everyone hits quota" |

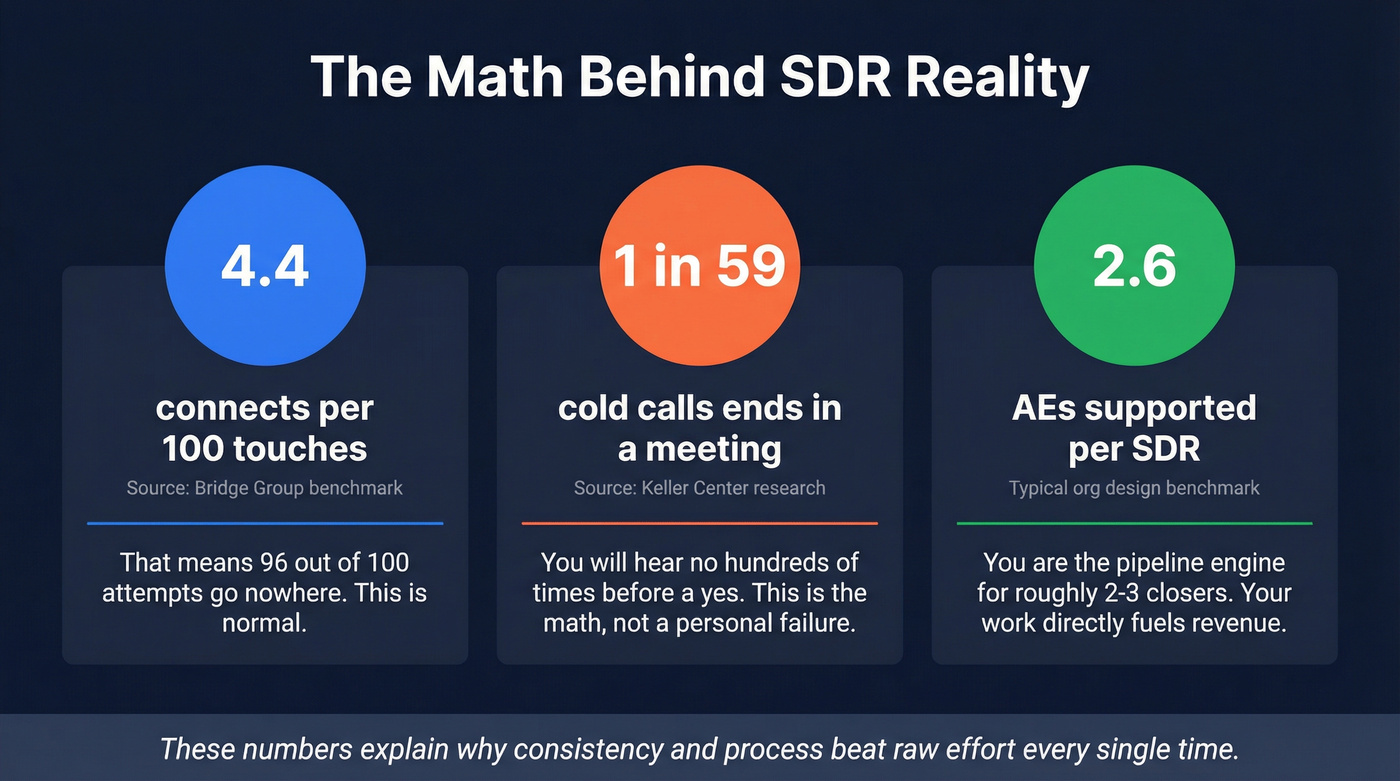

Connect math that normalizes the pain

These numbers explain why the job feels brutal even when you're doing it right:

- Bridge Group benchmark: ~4.4 connects per 100 touches.

- Keller Center research: ~1 of 59 calls ends in a meeting.

- Typical org design benchmark: ~2.6 AEs per 1 SDR.

Translation: if your manager treats "no meetings this week" like a character flaw, they don't understand the math of the role.

What to optimize (and what to ignore)

Optimize these (they compound):

- Connect rate (list quality + call timing)

- Meeting show rate (reminders + qualification)

- Lead-to-SQL conversion (fit + talk track)

- Pipeline per meeting (quality of handoff; see pipeline quality)

Treat these as guardrails, not goals:

- raw activity counts

- emails sent

- dials made

Activity targets often turn into activity theater: everyone looks busy, nobody knows if the motion works.

The data quality lever (where most SDRs get screwed)

If your contact data's stale, your KPIs get harder overnight: bad emails inflate your "emails/day" with bounces, wrong numbers turn "18 dials per live connect" into 30+, missing mobiles kill connect rates, and junk titles wreck qualification rates.

We've tested a lot of data workflows, and the simplest fix is boring: verify before you sequence, every time (see how to verify an email address).

Prospeo, "The B2B data platform built for accuracy," is one of the cleanest ways to do that at SDR speed: 300M+ professional profiles, 143M+ verified emails, 125M+ verified mobile numbers, 98% email accuracy, and a 7-day data refresh cycle (while many providers refresh on a ~6-week cycle). That combo directly reduces bounces and wasted dials, which is the fastest way to make your day feel less like punishment and more like a system you can actually win.

Tools SDRs use daily (quick stack)

- CRM: Salesforce, HubSpot

- Sequencing / sales engagement: Outreach, Salesloft

- Calling: dialer + call recording (often bundled with coaching; see outbound calling software)

- Enrichment + verification: a data platform + verification layer (don't run outbound on stale records) (compare email verifier websites)

Skip the "10 tools for SDRs" rabbit hole if you're new. Get the basics working first: clean data, a dialer that doesn't fight you, and a CRM setup that doesn't punish you for logging notes.

Inbound SDR meaning: speed-to-lead + MQL-to-SQL conversion

Inbound SDR work's less about "hunting" and more about not wasting demand.

Your job is to catch intent while it's hot, qualify fast, and route cleanly. If you're slow, the prospect books with a competitor or goes back to doing literally anything else.

Directional benchmarks to anchor on:

- Average MQL-to-SQL conversion: 18-22%

- Top teams: 25-35%

Speed-to-lead is the lever. Contacting high-intent leads within the first hour can dramatically improve outcomes; in practice, the teams that win treat speed like a product feature, with routing rules, calendar links, and call blocks designed so a rep can respond fast without dropping everything else (see speed to lead metrics).

A simple SLA that works:

- Demo requests: first touch in <5 minutes

- Webinar/event leads: first touch in <15 minutes

- All other inbound: same-day, with a clear next step or disqualify

Quick hits that actually move inbound results:

- Call first, email second (for demo requests)

- Confirm ICP in 60 seconds (don't "discovery call" a bad fit)

- Set a clear next step on every call (calendar invite or disqualify)

- Track reasons for disqualification and feed them back to marketing weekly

SDR salary meaning (base vs OTE) + how comp plans actually work

"SDR salary" is really two numbers: base and OTE (on-target earnings). OTE's what you make if you hit quota - and most teams set quotas that a meaningful chunk of reps miss.

OTE's only real if most reps hit quota.

Glassdoor's US median total pay for SDRs is $102K (last updated Apr 10, 2026), with a common range of $83K-$128K. Base often shows up around $53K-$71K, with $30K-$57K as additional pay.

RepVue's US benchmarks (Feb 2026) put median base at $60K and median OTE at $85K, with 55.4% of SDRs attaining quota.

Salary benchmarks table (what to anchor on)

| Source | Base | OTE/Total | Quota attainment note |

|---|---|---|---|

| Glassdoor (US) | $53-71K | $83-128K | "Total pay" range |

| RepVue (US) | $60K | $85K OTE | 55.4% hit quota |

Links if you want to sanity-check:

How comp plans actually work (and why OTE can mislead)

A common structure is a 62/38 base/variable split. Variable pay's usually tied to:

- meetings held (not just booked)

- opportunities created (or accepted by AE)

- sometimes activity volume as a floor

- accelerators after 100% of quota (that's where top reps make real money)

Where OTE goes to die:

- You get paid on "meetings booked," but AEs reject them with no written criteria.

- You get paid on "pipeline created," but AEs control opportunity creation.

- You're promised inbound volume, but you're really doing outbound with weak data.

The best comp plans pay you on outcomes you control, and they define acceptance criteria in writing.

Ramp, tenure, and the reality check (plus how to pick a good SDR job)

Bridge Group benchmarks (shared via Reply) put average SDR ramp at 3.1 months, and average tenure at 1.8 years.

That tenure number tells you something uncomfortable: lots of SDR roles are designed as a churn machine. If you're interviewing, you're not just picking a job. You're picking a system.

A practical 90-day ramp plan (what good onboarding looks like)

Days 1-30: learn + shadow

- product + ICP + competitors

- shadow top reps' calls

- build your talk track and objection handling

- start with low-risk follow-ups and warm leads

Days 31-60: controlled volume

- run full sequences with manager feedback

- daily call reviews (even 15 minutes)

- tighten qualification: what's an SQL here, really?

Days 61-90: quota runway

- own a segment or territory

- hit consistent activity floors

- focus on conversion rates, not just volume

- build AE trust with clean notes and honest qualification

Cold calling timing (small edge, real edge)

Revenue.io's benchmark: calling 8-11am prospect local time lifts connects by ~15%, and 3-6pm is also strong (with 4-5pm often peaking). Protect those call blocks like they're meetings.

Reality check: stress is normal, chaos isn't

One line you'll see over and over in SDR burnout threads is basically: "I feel sick before call blocks." That's not rare. The job can be mentally loud.

What isn't normal is:

- being punished for missing activity while your lists bounce

- being told to "grind harder" with no messaging help

- constant tool changes and no clear ICP

- "book meetings at any cost" culture that burns AE trust

Interview filter checklist (steal these questions)

Ask these and listen for specifics:

- Quota + attainment: "What's monthly quota, and what % of the team hit it last quarter?"

- Definition of success: "Do AEs have to accept meetings? What's the acceptance criteria?"

- Lead sources: "How much is inbound vs outbound? Who owns list building?"

- Data + tools: "What data provider do you use, and do we verify emails/mobiles before sequencing?" If they don't verify contacts (for example, with Prospeo), you'll waste dials and burn domains.

- Coaching cadence: "How often do we do call reviews?"

- Promotion path: "What does promotion look like in 12-18 months?" (see go-to-market roles)

- Anti-activity theater question: "Which metrics are leading indicators vs vanity activity here, and which ones determine comp?"

Career path (what happens after SDR)

The classic path is SDR --> AE, and a common promotion window is 12-18 months with sustained performance (think ~90%+ quota for two straight quarters).

AE isn't the only good exit. Strong SDRs also move into:

- Customer Success (relationship + process)

- Demand Gen / Marketing (messaging + channels)

- RevOps (systems + data + process)

Quick wrap (my take)

If the org measures outcomes, supports data quality, and protects call blocks, SDR's a great launchpad.

If it's activity-only with bad lists, skip. You'll work twice as hard for half the results, and they'll still tell you it's a "mindset" problem.

To put the sdr job meaning in one line: you're the person who turns interest (or a cold list) into qualified meetings and early pipeline, and you're judged on whether those meetings actually turn into revenue.

FAQ about SDR jobs

What does SDR stand for in sales?

SDR stands for Sales Development Representative, a role focused on top-of-funnel work: qualifying leads, booking meetings, and creating early-stage pipeline for Account Executives. In most teams, success is measured by meetings held, SQLs, and pipeline created, with activity metrics used as guardrails.

What's the difference between an SDR and a BDR?

An SDR usually handles inbound qualification (demo requests, contact forms), while a BDR usually handles outbound prospecting into target accounts. If a company combines both, ask what gets priority, because slow inbound follow-up and spray-and-pray outbound are the most common failure modes.

What are typical SDR quotas and KPIs?

Most SDR quotas land around 5-25 meetings per month, with 60-85% of booked meetings holding when qualification's solid. Activity guardrails often look like 40-50 calls/day and 80-100 total activities/day, and a common benchmark is 18+ dials per live connect on decent data.

How much do SDRs make (base vs OTE) in 2026?

In the US, SDR total pay commonly falls in the $83K-$128K range, with a median around $102K (Glassdoor's figure is still widely referenced). RepVue's Feb 2026 benchmark shows $60K median base and $85K median OTE, with 55.4% of reps hitting quota.

What tools do SDRs use to find verified contact info (and avoid bounces)?

Most SDRs use a CRM (Salesforce/HubSpot), a sequencing tool (Outreach/Salesloft), and a verification layer to keep emails and mobiles clean. Prospeo's a strong self-serve option because it delivers 98% email accuracy, 125M+ verified mobile numbers, and a 7-day refresh, which directly reduces bounces and wasted dials.

The article mentions data and enrichment costs hitting $1,000+/month for serious outbound teams. Prospeo starts at $0.01/email with 125M+ verified mobiles and 30+ filters to build ICP-perfect lists - giving SDRs enterprise-grade data without the enterprise price tag.

Ramp faster with direct dials and emails that don't bounce.