White Label Outreach Platform: Best Tools, Pricing & Fit (2026)

Most "white label outreach platform" tools aren't actually white-label. They're a logo swap, a shared inbox, and a prayer your clients never click "Help" and see the vendor's name.

We've tested this stuff in real agency setups, and the pattern's always the same: the sequencer isn't what breaks you. Ops does. Provisioning, permissions, reporting, billing, and the boring deliverability guardrails you only notice after a client domain gets cooked.

Here's the shortlist worth your time if you need multi-client control, deliverability stability, and reseller economics that don't fall apart the moment you add your fifth client. If you want a broader landscape first, start with our guide to cold email outreach tools.

Our picks (TL;DR): the 4 tools to shortlist

If you only trial four tools, make it these:

- Saleshandy: best "agency-ready" option (unlimited clients, clear tiering, white-label included at $199/mo). (See also: Saleshandy pricing.)

- Smartlead: best for deliverability testing + scale (white-label lives in SmartDelivery Pro/Export).

- Prospeo: best data + verification layer to keep every client's sending deliverability-safe (pair it with Saleshandy or Smartlead for sequencing). If bounces are your pain, compare options in our email verifier websites roundup.

- Manyreach: best pay-as-you-go model when client volume's lumpy and you want credits instead of subscriptions.

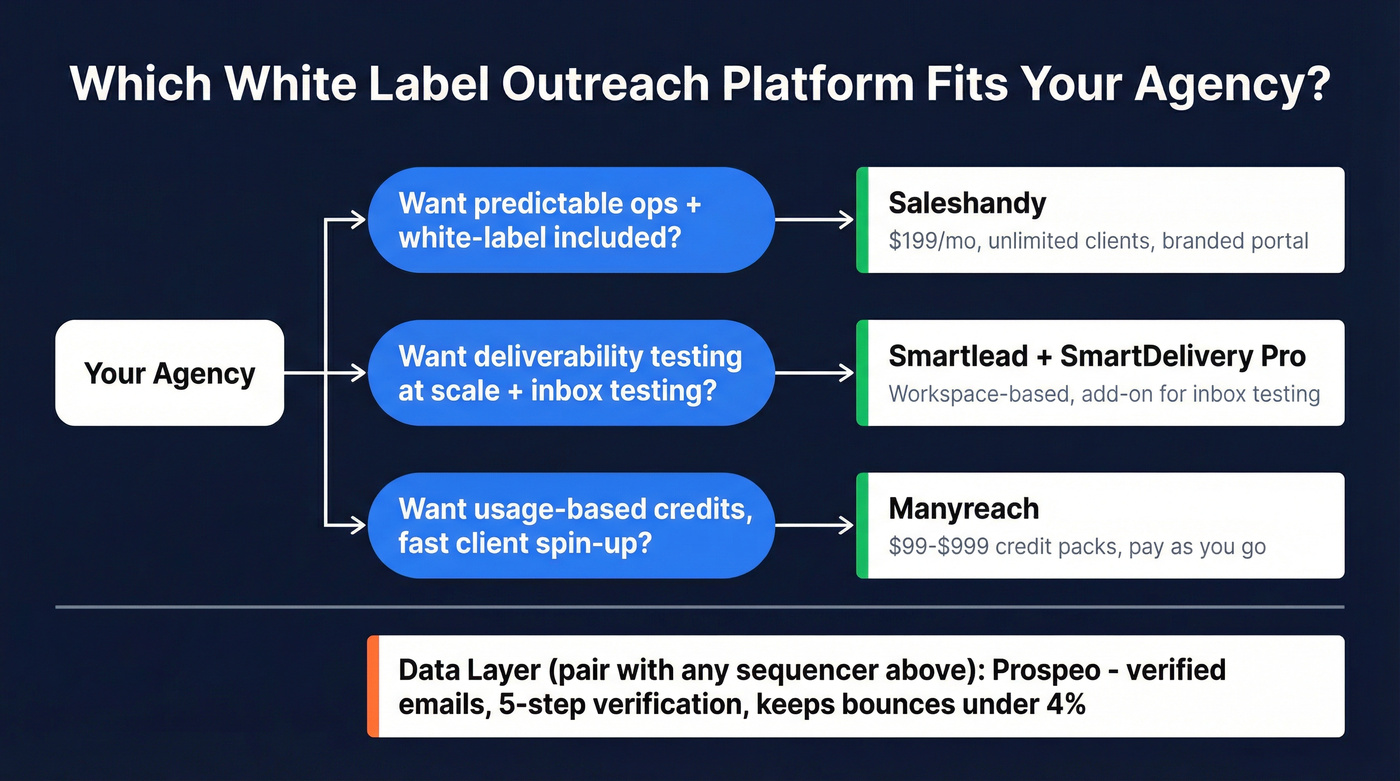

Mini decision tree (three lines, no fluff):

- Want predictable agency ops + white-label included? -> Saleshandy

- Want deliverability experiments at scale + inbox testing? -> Smartlead + SmartDelivery Pro

- Want usage-based credits and fast client spin-up? -> Manyreach

What "white label" means here (and what it doesn't)

A white label outreach platform is software you can sell as your platform across multiple clients without branding leaks, without mixing client data, and without rebuilding half the product in spreadsheets. For most agencies, that means a white label email platform: multi-tenant, client-safe, and reportable. For the underlying mechanics, see our breakdown of sales engagement platform alternatives.

That's the standard.

Most tools miss it because search results lump three different things under "white label":

White-label outreach software (out of the box) You log in, create a client workspace/sub-account, connect mailboxes, run sequences, and export branded reports. No dev team. This is what most agencies want.

API-embedded white-label (dev-heavy) You get APIs and webhooks and build your own portal/UI. That's a product build, not a tool choice.

White-label outreach services (managed service) A vendor runs campaigns for you and you resell the service. That's a fulfillment decision, not a platform decision.

Here's the thing: the #1 "white label outreach" result in a lot of niches is a managed service with a guarantee ("we'll book meetings," "we won't contact your clients," etc.). Sometimes that's the right buy.

Buy a managed white-label outreach service when:

- you don't have an ops lead who can own deliverability, inbox provisioning, and QA

- you want a guarantee more than you want process control

- you're fine trading margin for speed

Skip it when:

- you want a repeatable outbound machine you control

- you want to keep your playbooks, data, and deliverability learnings in-house

- you care about long-term retention (clients stick to your system, not a vendor's black box)

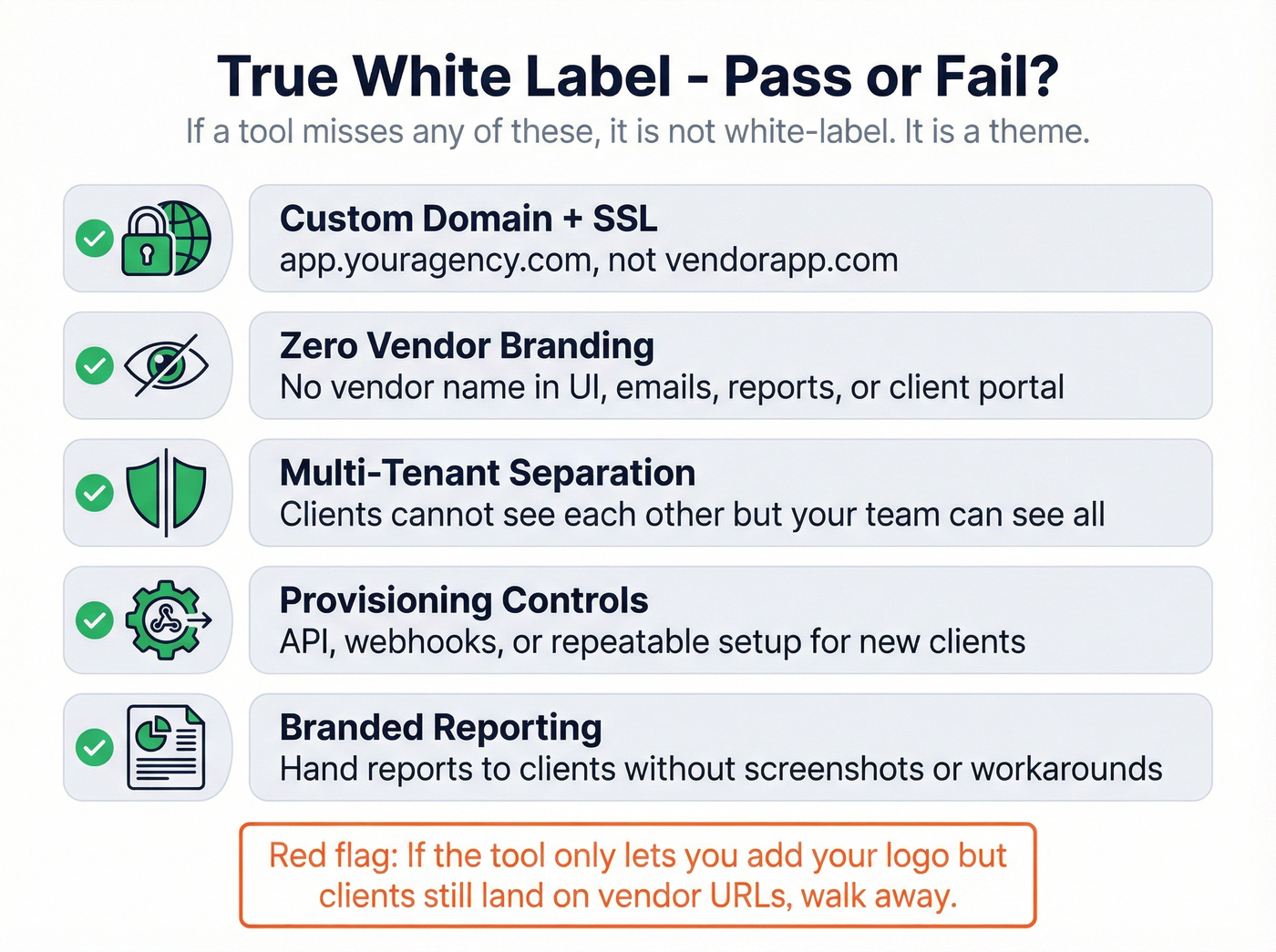

A "true white label" pass/fail checklist

- Custom domain + SSL (app.youragency.com, not vendorapp.com)

- No vendor branding in UI, emails, reports, and client portal

- Multi-tenant separation (clients can't see each other; your team can)

- Provisioning controls (API/webhooks or repeatable setup)

- Branded reporting you can hand to clients without screenshots

If a tool only offers "add your logo" but still sends clients to vendor URLs, it's not white-label. It's a theme.

White-label sequencers don't cook client domains - bad data does. Prospeo's 5-step email verification keeps bounce rates under 4%, with a 7-day refresh cycle so your agency never sends to stale contacts. Stack Optimize built a $1M agency on Prospeo data with zero domain flags across all clients.

Stop letting bad data burn your clients' domains. Verify before you send.

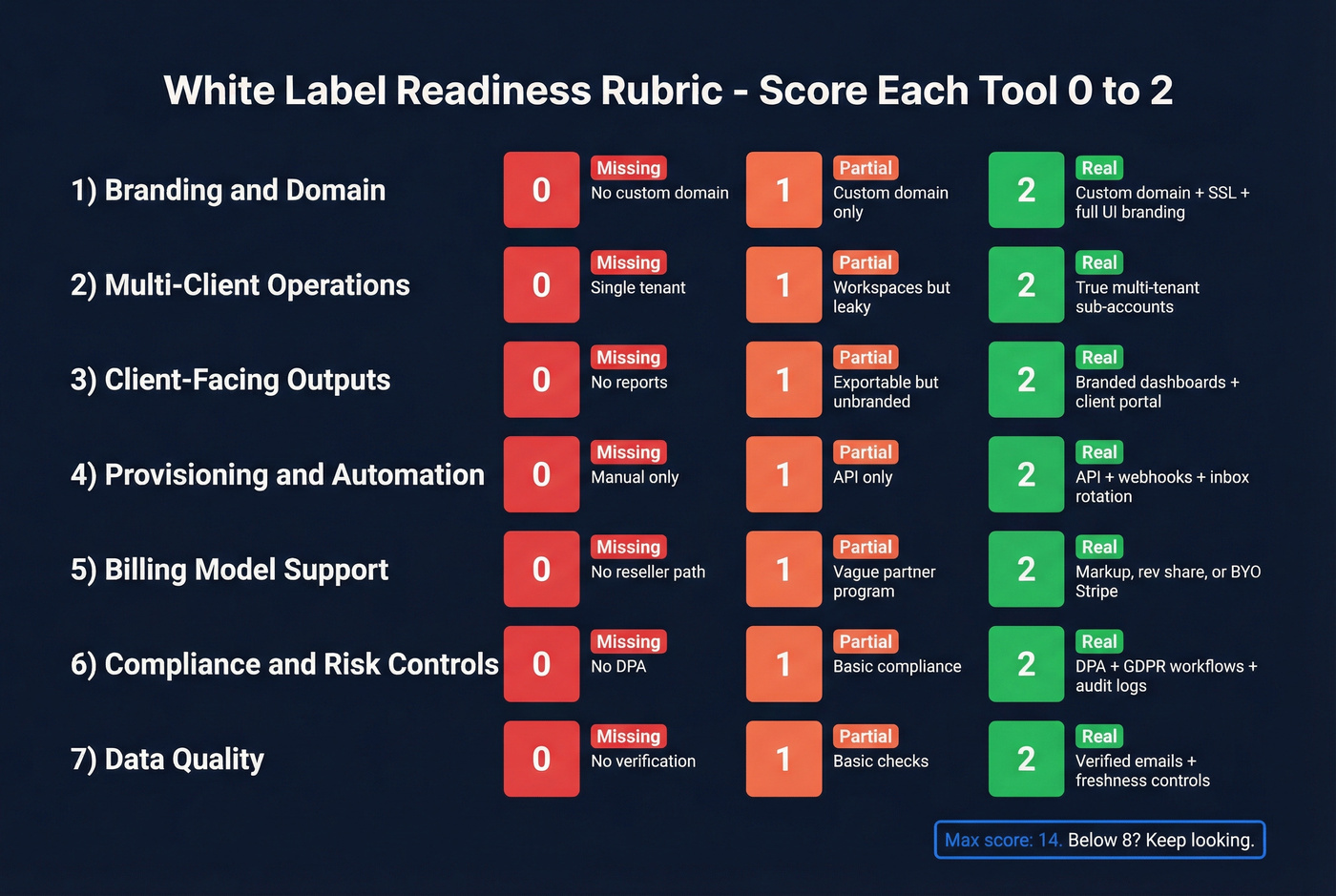

The non-negotiables in a white-label outreach platform (rubric)

Agencies don't fail at white-label outreach because they picked the "wrong sequencer." They fail because the tool can't support multi-client reality: provisioning, permissions, reporting, compliance, and billing.

I once watched a team spend six weeks rebuilding a "client portal" in Notion + Looker Studio because the vendor's "white-label" feature was basically a favicon change and a PDF export that still linked back to the vendor's login page. The client noticed on day one. That renewal was dead on arrival.

Score each platform 0-2 per criterion (0 = missing, 1 = partial, 2 = real). Total it and move on.

White-label readiness rubric (score 0-2 each)

Branding & domain

- Custom domain + SSL (2) / custom domain only (1) / none (0)

- Full UI branding (logo/colors) + no vendor mentions (2/1/0)

Multi-client operations

- True multi-tenant/sub-accounts (2) / workspaces but leaky (1) / single tenant (0)

- Roles/permissions + SSO for larger teams (2/1/0)

Client-facing outputs

- Branded reports/dashboards (2) / exportable but not branded (1) / none (0)

- Client portal or client dashboard access (2/1/0)

Provisioning & automation

- API + webhooks for provisioning and events (2) / API only (1) / none (0)

- Inbox rotation + warmup controls per client (2/1/0)

Billing model support (this is margin)

- Supports markup/rev share/BYO Stripe or clear reseller terms (2)

- "Partner program" but vague economics (1)

- No reseller path (0)

Compliance & risk controls (2026 reality)

- DPA available + GDPR-ready workflows + opt-out handling (2/1/0)

- Audit logs + role-based access + data export controls (2/1/0)

Data quality (yes, it's part of readiness)

- Verified emails + freshness controls to keep bounces low (2/1/0). If you need a concrete SOP, use our email verification list workflow.

White-label due diligence: questions to ask vendors before you sign

Use these in demos. If a rep can't answer cleanly, you're buying future pain.

Branding

- Can we use a custom domain with SSL? Who manages the certificate?

- Is vendor branding removed from login, app UI, reports, email footers, help center links, and system notifications?

Multi-tenant + permissions

- Are sub-accounts truly isolated (data, templates, inboxes, logs)?

- Can we restrict client users to their own workspace only?

- Do you support SSO/SAML? If yes, which plan?

Deliverability controls

- Can we set sending limits per inbox and per client? (Related: email pacing and sending limits.)

- Do you support inbox rotation rules per client?

- What happens when bounce rate spikes? Auto-pauses or alerts?

Reporting

- Can we export branded reports without screenshots?

- Do you provide client-facing dashboards? Can we hide internal notes and operational metrics?

Compliance

- Do you provide a DPA? Where's data hosted?

- Do you have audit logs and user activity history?

Economics

- Is there a reseller program? What's the rev share/markup policy?

- Any minimums, seat requirements, or add-ons required for white-label?

Comparison table (features + white-label + pricing)

The table below mixes "platforms" and "layers" on purpose. Agencies win when they build a stack that's easy to operate and hard to break: verified data -> deliverability controls -> sending -> reporting.

Pricing is from each vendor's public pricing pages where available (captured Feb 17, 2026). Infrastructure tools are rough ranges based on common small-agency volumes.

| Tool | White-label path | Multi-client | Pricing signal |

|---|---|---|---|

| Saleshandy | Outreach Scale tier | Unlimited clients | $36 / $99 / $199 (annual: $25 / $69 / $139) |

| Smartlead | SmartDelivery add-on | Workspaces | $39 / $94 / $174 / $379 + SmartDelivery $49 / $174 / $599 |

| Manyreach | Branding + custom domain | Client dashboard | Credits: $99-$999 packs |

| Salesforge | Reseller program | Sub-accounts | 20% rev share + markup |

| Meet Alfred | Team (5+ users) | Team settings | $79/user/mo (annual $39) |

| HRS Agency | Partner build | Unclear | $199 / $249 / $399/mo shown (credits model) |

| Outreach.io | Not agency-first | Enterprise orgs | Expect ~$1.5k-$4k+/mo+ on annual contracts |

| BigMailer | ESP-style white-label | Accounts | $12.5/mo per 5,000 contacts; example $400 for 200,000 contacts |

| Brevo | Partner routes | Accounts | $9-$669/mo (plan pricing; add-ons can increase total) |

| Mailgun / Mailjet | API email infra | Dev-built | Mailgun $15-$1,250/mo; Mailjet $17-$470/mo |

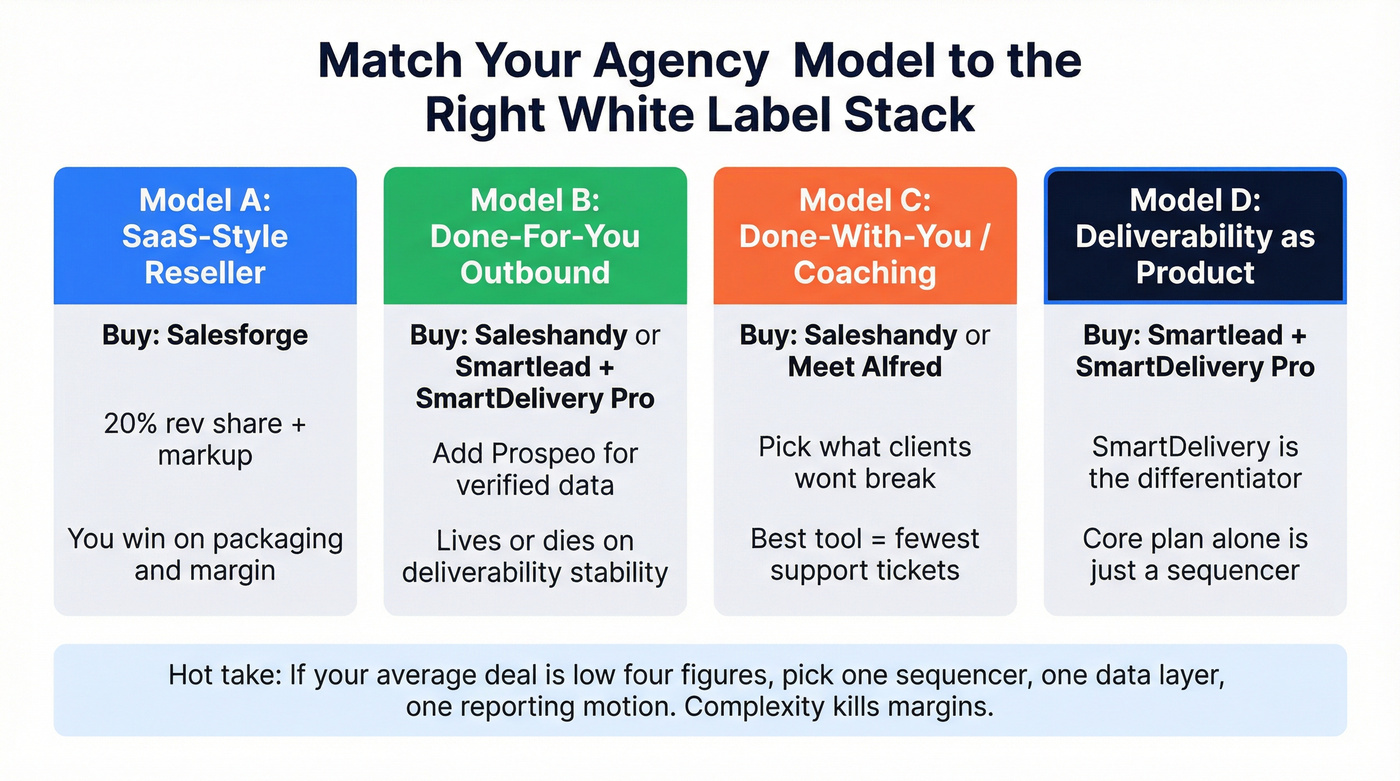

What to buy (decisive mapping by agency model)

Most agencies don't need "the best tool." They need the best operating model. If you're rebuilding your stack, start with a modern B2B sales stack blueprint.

Model A: You resell software access (SaaS-style agency)

Buy: Salesforge (economics-first) + a sending platform your team can support.

Why: you win on packaging + margin, not on custom work.

Model B: Done-for-you outbound (DFY)

Buy: Saleshandy (clean multi-client ops) or Smartlead + SmartDelivery Pro (deliverability testing) + a verification/data layer.

Why: DFY lives or dies on deliverability stability and repeatable provisioning.

If your bounce rate isn't consistently under 3-5%, you don't have a "platform problem." You have a data problem (see B2B contact data decay).

Model C: Done-with-you (DWY) / coaching + enablement

Buy: the tool your clients'll actually use without breaking it: Saleshandy for simplicity, Meet Alfred if multi-channel is the deliverable.

Why: the best DWY tool is the one that reduces support tickets and keeps clients inside guardrails.

Model D: "We sell deliverability as the product"

Buy: Smartlead + SmartDelivery Pro.

Why: SmartDelivery's the differentiator; the core plan alone is just a sequencer. (For deeper deliverability mechanics, use our email deliverability playbook.)

Hot take: if your average client deal size is in the low four figures, stop shopping like you're building an enterprise sales stack. Pick one sequencer, one verification/data layer, and one reporting motion. Complexity kills margins.

Best white label outreach platform options (ranked)

Saleshandy: best all-around for agencies that need true white-label

Best for: agencies that want a straightforward platform with real multi-client operations you can standardize across accounts.

Saleshandy treats "agency" as a first-class use case. You get unlimited clients, and the white-label answer's clean: it's included in Outreach Scale at $199/mo. No scavenger hunt through add-ons.

Limits that matter (plan reality, not marketing):

- Starter: 2,000 active prospects, 6,000 emails/month

- Pro: 30,000 prospects, 150,000 emails/month

- Scale: 60,000 prospects, 240,000 emails/month

Those caps matter more than "unlimited clients" once you're running 5-15 accounts in parallel, because your bottleneck becomes prospect volume and monthly send ceilings, not whether you can create another workspace.

Pricing: $36/mo Starter, $99/mo Pro, $199/mo Scale (white-label). Annual pricing: $25 / $69 / $139 per month billed annually. Scale adds SSO and unlimited teams; Pro includes API + webhooks.

What teams like (and what annoys them):

- Like: agency workflow and client separation.

- Annoying: deliverability ownership. Saleshandy won't save you from sloppy domain/inbox SOPs, and neither will any sequencer.

Smartlead: best for deliverability testing + scale (white-label via SmartDelivery)

Best for: agencies that treat deliverability as a product and run lots of inboxes, tests, and volume.

Smartlead's core plans are priced like a modern sequencer - $39 / $94 / $174 / $379 - but the agency unlock is SmartDelivery. SmartDelivery Pro ($174/mo) and Export ($599/mo) include Full Whitelabel Access plus the testing layer that makes Smartlead worth buying.

Limits that matter (from the plan grid):

- Base: 2,000 contacts / 6,000 emails per month

- Pro: 30,000 / 90,000

- Smart: unlimited contacts / 150,000

- Prime: unlimited / 500,000 + 3 SmartServers + OAuth

Smartlead also advertises a 17% annual discount, which adds up fast once you're running this across multiple client pods.

What I like (and what I don't):

- Like: it's built for scale and experimentation; it's the closest thing to a "deliverability lab + sequencer" in one ecosystem.

- Don't like: the add-on structure. It's too easy to buy the core plan, then realize later your "white-label" requirement lives in SmartDelivery.

Real talk: if white-label's non-negotiable, don't buy Smartlead without SmartDelivery Pro. Otherwise you're not actually white-label.

Prospeo: best for verified data that protects deliverability (pairs with any platform)

Best for: agencies that want white-label outreach to work in production: low bounces, clean lists, and stable results across clients.

Prospeo is "The B2B data platform built for accuracy". It includes 300M+ professional profiles, 143M+ verified emails, and 125M+ verified mobile numbers, with 98% email accuracy and a 7-day data refresh cycle (industry average: 6 weeks). It's used by 15,000+ companies and 40,000+ Chrome extension users.

Look, you can have the prettiest white-labeled portal on earth. If your inputs are trash, your client's domain reputation pays the price, and then your account team spends the next month explaining why "the platform" isn't broken.

A simple agency workflow that holds up under scale:

- Find + verify contacts before they ever hit a sequencer (use the Email Finder)

- Enrich missing fields so personalization and routing don't break (use Data Enrichment)

- Push to your sending tool through native connectors and automations (see Integrations)

Prospeo also gives you 30+ search filters, intent data across 15,000 topics, and API access for teams that want provisioning and enrichment to run in the background instead of living in someone's Friday spreadsheet. If you're evaluating data sources, start with our list of the best B2B data providers.

Pricing: Free tier (75 emails + 100 extension credits/month). Paid starts around ~$39/mo, with transparent credit pricing at roughly $0.01/email and 10 credits per mobile.

Manyreach: best pay-as-you-go white-label (credit math included)

Best for: agencies that want to start fast, avoid subscriptions, and pay for usage, especially when client work's lumpy.

Manyreach runs on credits with agency-friendly ops: unlimited active leads, unlimited sending accounts, mailbox rotation, a unified inbox, plus webhooks/APIs. White-label positioning includes your branding, your domain, and a client dashboard, so it can work as a client-facing portal without handing over admin access.

The credit math you should do before you sell packages

- 1 credit = 1 campaign email

- Warmup: 1 credit = 10 warmup emails

Example (so you can forecast margin): if you warm 20 inboxes at 50 warmup emails/day for 14 days, that's 20 x 50 x 14 = 14,000 warmup emails -> 1,400 credits. Warmup isn't "background hygiene" here; it's a real cost center.

Pricing: Packs: $99 (10k credits), $199 (100k), $299 (300k), $699 (600k), $999 (1M). Free includes 250 credits.

My take: Manyreach is great for short bursts (launches, sprints, seasonal pushes). If you're running always-on outbound for 10 clients, subscriptions are simpler to manage and simpler to margin.

Salesforge: best if you want a formal reseller program & clear economics

Best for: agencies that want partner terms you can build a business on.

Salesforge is unusually concrete: 20% revenue share, markup allowed, and up to a 3-year term. That's what you need to forecast cashflow and package offers without guessing.

The operational catch: payments are Stripe only. If your clients require invoicing through other rails, plan the billing workflow up front.

Meet Alfred: best for agencies that want branded multi-channel automation

Best for: agencies selling multi-channel automation and client-facing branding, not just cold email sequencing.

Meet Alfred's Team plan is $79/user/mo monthly (or $39/user/mo annual), and white-label is gated at 5+ users. The white-label package is strong on branding: logo, colors, custom domain, and a custom email address.

HRS Agency: white-label offer exists, but unit economics aren't clear

Best for: teams that want an all-in-one outreach bundle and won't sell packages until they understand the credits model.

HRS Agency shows a white-label offer ("Free White-Label Build for Approved Partners") and pricing at $199/mo (Basic), $249/mo (Growth), and $399/mo (Scale). The risk is forecasting: credits are listed without a clean definition of what consumes them or how overages work.

If you can't model credits -> sends -> cost per client, don't price client packages yet.

Outreach.io: best for enterprise in-house teams (not agency white-label)

Best for: large in-house sales orgs that need enterprise sales engagement, governance, and workflow depth.

Outreach.io is a serious platform for sequencing, tasking, coaching, and analytics. It's not built around agency multi-tenancy and reseller economics, so it's a poor fit for "sell it as ours" offers.

Pricing: Expect ~$1.5k-$4k+/mo+ on annual contracts, depending on seats and modules.

Tier 3: Infrastructure & ESP options (not outreach sequencers)

These show up in "white label outreach platform" searches because they support branded sending and embedded experiences. They don't replace a sequencer; they sit underneath your stack.

BigMailer: ESP-style account management and white-labeling email infrastructure for multiple brands. Starts at $12.5/month per 5,000 contacts on the Agency plan; example pricing shown is $400 for 200,000 contacts.

Brevo: SMB email/SMS platform with partner routes and multi-account management. Published pricing runs $9-$669/mo, and add-ons can increase total.

Mailgun / Mailjet: API-first email infrastructure for teams building their own portal or sending layer. Mailgun ranges $15-$1,250/mo; Mailjet ranges $17-$470/mo.

Reseller economics & packaging (how agencies actually make margin)

White-label outreach margins don't come from reselling software seats. They come from packaging outcomes: deliverability-safe sending + verified leads + reporting.

Three cost lines you should model per client (every time):

- Mailboxes: $6-$10/user/mo per mailbox (per client, per sender)

- Warmup: $10-$40/mo per mailbox when you use dedicated warmup tooling or premium warmup features (see automated email warmup)

- Data + verification: where agencies win or lose; clean lists protect domains, dirty lists burn them

Three packaging templates that sell without turning your team into a help desk:

- Starter outbound (DWY): 1 domain + 3 inboxes, 1 ICP list/month, weekly reporting

- Managed outbound (DFY): 2-3 domains, 10-30 inboxes, list building + verification + sequencing + reply handling

- Outbound engine (performance): multi-ICP, deliverability monitoring, intent-based list refresh, monthly strategy + experiments

My opinion: DFY packages should include list verification as a default line item. If you make it optional, clients'll skip it, bounce rates spike, and you'll eat the churn.

Deliverability + data stack (why white-label outreach fails at scale)

Delivery isn't deliverability. Delivery means the server accepted the email. Deliverability means it landed in the inbox where a human might read it.

Half your outbound never reaches the inbox once you scale. That's the brutal baseline in 2026.

You can white-label the UI, but you can't white-label reputation. If you need to explain the root cause to clients, point them to what is domain reputation.

The agency SOP that keeps client domains alive

1) Provisioning standard (per client)

Domains

- Minimum: 1 sending domain per client

- Better: 2 sending domains per client (one active, one warming/backup)

- Rule: never send from the agency's primary domain

Inboxes

- Minimum: 3 inboxes per client domain

- Standard: 5-10 inboxes per client for DFY programs

- Rule: keep per-inbox daily volume low and consistent; reputation hates spikes

Authentication (do this before anything else)

- Set SPF + DKIM + DMARC on every sending domain.

- DMARC's non-negotiable. If you skip it, you're choosing chaos.

2) Ramp schedule (first 21 days)

This schedule prevents the "week 2 collapse":

- Days 1-7: warmup only; no campaigns

- Days 8-14: 10-20 campaign emails/day/inbox + warmup continues

- Days 15-21: 25-40 campaign emails/day/inbox + warmup continues

- After day 21: scale in small steps; never double volume overnight

If you want one rule to tattoo on your ops doc: consistency beats volume.

3) Bounce triage (what to do when things go wrong)

Hard bounce > 3% (same day):

- Pause the campaign for that client immediately

- Pull the last uploaded list and run verification again (verify before sending; use an Email Finder workflow, not guesswork)

- Remove invalids, risky catch-alls you can't confirm, and duplicates

- Resume at 50% volume for 3 days, then ramp back up

Hard bounce > 5% (any week):

- Treat it as list hygiene failure, not a "sequencer issue."

- Replace the list source, tighten filters, and stop sending until inputs are clean.

Sudden open-rate drop + reply quality tanks:

- Assume placement shifted (inbox -> promotions/spam).

- Reduce volume, rotate inboxes, refresh copy, and tighten targeting. Bad targeting creates spam signals faster than "bad deliverability settings."

4) Weekly monitoring (non-negotiable)

- Bounce rate by client and by inbox

- Spam complaints and negative replies

- Domain health signals (deliverability tests if you run them)

- List freshness: refresh and re-verify continuously; contacts churn every week

Hard call: if your agency doesn't have an owner for deliverability, you don't have a platform. You've got a liability.

This is also where credit models bite: warmup and testing are real usage. Budget them up front or your "cheap" tool becomes your most expensive client.

Running multi-client outreach at scale? Prospeo plugs directly into Saleshandy, Smartlead, Instantly, and Lemlist - feeding 98% accurate emails into every client campaign. At $0.01/email with 143M+ verified addresses, your agency margins stay intact while deliverability stays bulletproof.

Pair Prospeo with your sequencer and never worry about bounce rates again.

FAQ

What's the difference between "white label" and a reseller/partner program?

White label means the product experience is branded as yours (custom domain, no vendor branding, client portal/reporting). A reseller/partner program defines how you get paid (markup rights, revenue share, contract terms). For agencies, aim for both: branding control plus written economics you can forecast.

What counts as "true" white-label for outreach software?

True white-label requires a custom domain with SSL, zero vendor branding in UI/URLs/emails, isolated client workspaces, and client-ready reporting you can share without screenshots. If a client can find the vendor name in links or system notifications, it's not white-label; it's a themed account.

Are credit-based outreach tools cheaper for agencies?

They're cheaper only when your monthly usage is spiky and you model warmup/testing as real consumption. If you're running 8-10 always-on client accounts, subscriptions are usually easier to margin; if you run short sprints, credits can win.

Do I need a separate data tool if I already have an outreach platform?

Yes. Sending tools don't fix bad inputs, and agencies should treat data as a separate layer. If your hard bounces aren't consistently under 3-5%, prioritize verification and freshness first; Prospeo's 98% email accuracy and 7-day refresh cycle are built for that operational reality.

Summary: picking the right white label outreach platform in 2026

If you want a white label outreach platform that doesn't leak branding, break under multi-client ops, or quietly torch deliverability, pick based on your operating model:

- Saleshandy for straightforward agency workflows with white-label included.

- Smartlead + SmartDelivery Pro if deliverability testing is part of what you sell.

- Manyreach if your client work's bursty and credits map cleanly to your packages.

- Prospeo as the data + verification layer that keeps bounce rates down and domains healthy across every client.

The tool matters. The stack (data -> deliverability -> sending -> reporting) is what keeps your margins intact.