LeadGibbon Pricing in 2026: What You Actually Pay (and What You Get)

Try Googling "leadgibbon pricing" and you'll get a different number from every source. G2 says the Basic plan is $49. CompareCamp shows $40. SoftwareSuggest lists $49. The actual pricing page says $39. That kind of inconsistency isn't just confusing - it's a signal that nobody's paying close attention to this product, including the company itself.

Here's the real breakdown: what LeadGibbon actually costs in 2026, where the hidden expenses are, and whether the tool is worth your money when competitors are giving away more for less.

LeadGibbon Pricing at a Glance

| Plan | Monthly Price | Email Credits | Phone Credits | Per-Email Cost |

|---|---|---|---|---|

| Free | $0 | ~15/week | - | - |

| Basic | $39/mo | 1,000 | 25 | $0.039 |

| Pro | $99/mo | 10,000 | 50 | $0.0099 |

| Business | $299/mo | 30,000 | 125 | $0.01 |

No annual billing. No credit rollover. A 26M-record database. The pricing looks simple on the surface, but the economics get worse the closer you look.

LeadGibbon Plans Breakdown

Free Tier

LeadGibbon's free tier is confusing on arrival. The FAQ says you get 5 free credits on signup. The header on the same page says "15 credits per week." Both appear to be true - 5 credits immediately, then 15 per week ongoing, which works out to roughly 60 per month.

That's enough to test the Chrome extension on a handful of prospects. One Reddit user noted the free version's 15 contacts per month was "probably enough" for job hunting - and that's about the ceiling for this tier. It's not a pipeline. It's a proof of concept.

Basic ($39/mo)

The entry-level plan gives you 1,000 verified emails and 25 phone numbers per month. Every feature is included - no gated functionality behind higher tiers, which is genuinely nice. The per-email cost works out to $0.039.

One real advantage: LeadGibbon doesn't charge credits for emails below 99% deliverability confidence. You only pay for verified data. That's a policy more tools should adopt.

If you're a solo SDR doing low-volume, targeted outreach - maybe 30-40 emails per day - and you want a simple Chrome extension workflow with Sales Navigator, this plan fits. But if you send more than 200 emails a week, you'll burn through 1,000 credits fast, and there's no way to buy more mid-cycle without upgrading. For context, Apollo's free plan gives you 10,000 email credits per month. Ten times the volume, zero dollars.

Pro ($99/mo) - The Best Value Tier

This is where the per-email economics get interesting. You jump from 1,000 to 10,000 emails - a 10x increase for a 2.5x price bump. That drops the per-email cost to $0.0099, which is competitive with most tools in the market.

Phone credits only go from 25 to 50, though. If you're prospecting for direct dials, that modest bump won't move the needle.

Fifty mobile credits per month is nothing for a team running cold call campaigns.

The verdict: Pro is the only tier where the cost genuinely competes. If you've validated data quality on Basic and need to scale email volume, this is the plan. Skip it if phones matter to you.

Business ($299/mo) - Do the Math First

Here's the thing: the Business plan's per-email cost is essentially identical to Pro. You're paying $0.00997 per email versus $0.0099 on Pro - the math doesn't reward you for spending 3x more.

Let me show you why this tier rarely makes sense:

- Two Pro accounts ($198/mo) = 20,000 emails + 100 phones

- One Business account ($299/mo) = 30,000 emails + 125 phones

- The incremental cost for that last 10,000 emails and 25 phones: $101/mo

That's $0.0101 per email on the marginal volume - no savings at all. Team discounts are available if you email their sales team, but the published pricing actively discourages this tier.

LeadGibbon gives you 25 phone credits on a $39/mo plan and caps at 125 on Business. Prospeo offers 125M+ verified mobile numbers with a 30% pickup rate - plus 300M+ profiles, 98% email accuracy, and credits starting at $0.01/email. No expired credits, no guesswork.

Stop paying more for a database 12x smaller than what's available.

The Hidden Costs Most Reviews Miss

Credits That Don't Roll Over

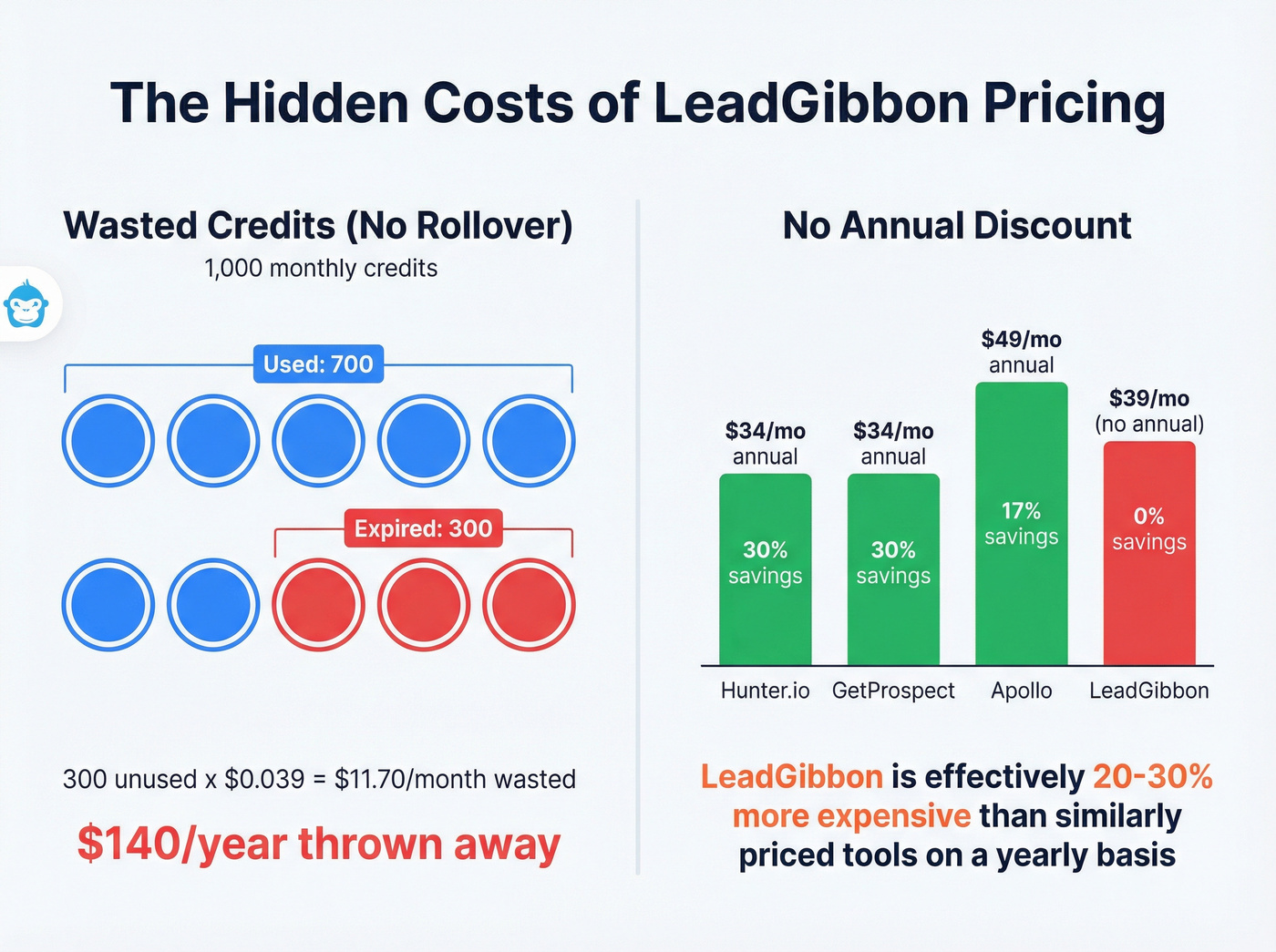

LeadGibbon's FAQ is explicit: unused credits expire at the end of each billing cycle. No rollover. No exceptions.

Let's do the math on the Basic plan. Say you use 700 of your 1,000 credits in a given month. Those 300 unused credits are gone - that's $11.70 in wasted budget. Over a year, that's roughly $140 you've paid for emails you never found.

No Annual Billing Means You Pay More

LeadGibbon only offers monthly billing. No annual toggle. No discount for commitment.

Here's what that costs you on an annualized basis:

- Basic: $468/year

- Pro: $1,188/year

- Business: $3,588/year

Now compare that to competitors offering 20-30% annual discounts. Hunter.io's Starter plan drops from $49/mo to $34/mo on annual billing - a 30% savings. GetProspect's Starter goes from $49/mo to $34/mo annually. Apollo's Basic drops from $59/mo to $49/mo. The absence of annual billing effectively makes LeadGibbon 20-30% more expensive than similarly priced tools when you zoom out to a yearly view.

Outdated Pricing Across the Web

This is more of an annoyance than a hidden cost, but it matters. G2 lists LeadGibbon's pricing as $49/$99/$199 - data last updated in late 2024. CompareCamp shows $40/$90/$200. SoftwareSuggest lists $49.

Only the official pricing page reflects the current structure: $39/$99/$299. The Business tier actually went up from $199 to $299 at some point, while the Basic tier dropped from $49 to $39.

The G2 profile has been inactive for over a year. Nobody at LeadGibbon is managing it. That's not a great sign for a company you're trusting with your prospecting data.

LeadGibbon Data Accuracy - Does 97% Hold Up?

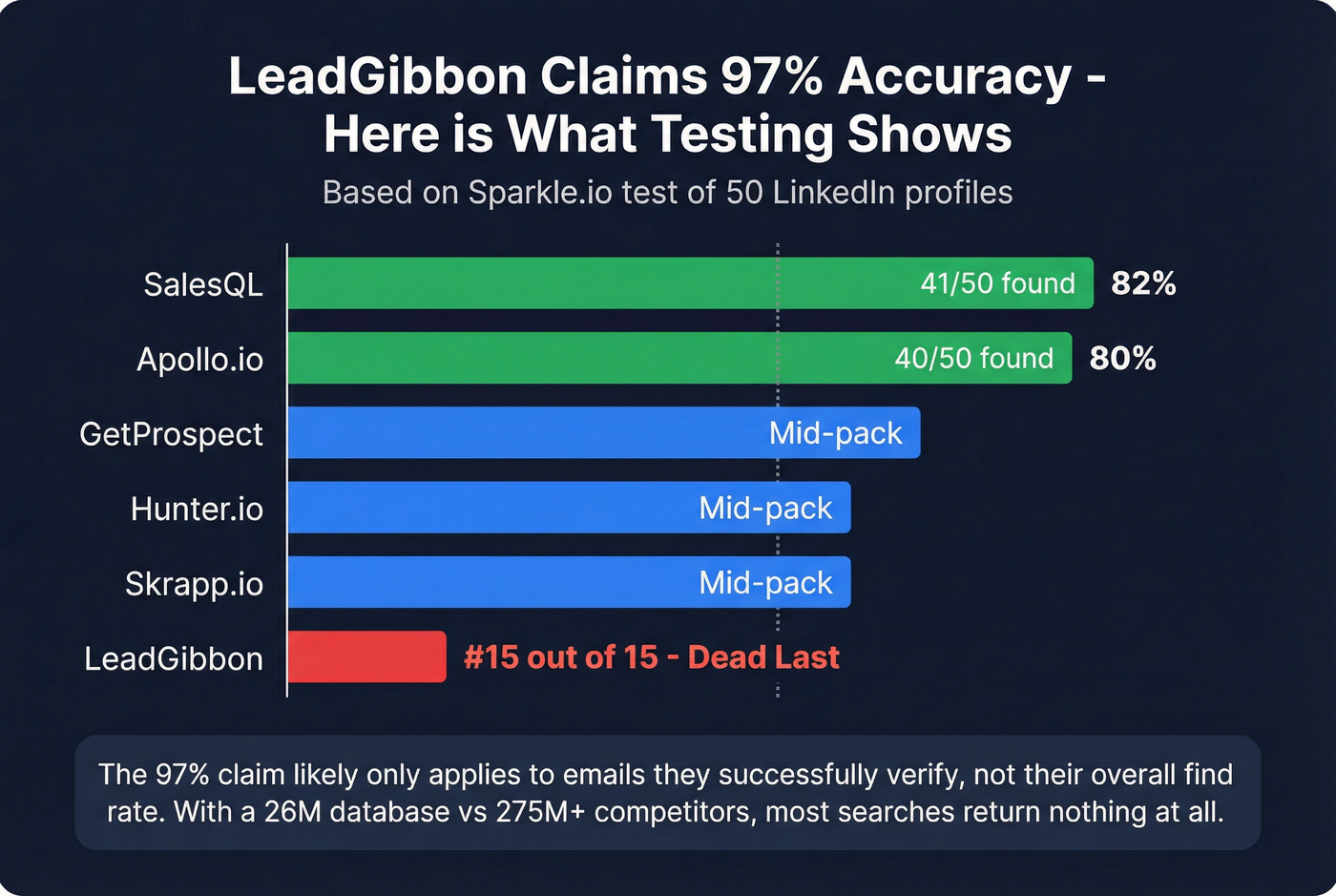

LeadGibbon claims 97% email accuracy. That's a bold number.

It doesn't hold up.

Sparkle.io ran a test of LinkedIn email extractors across 50 profiles. LeadGibbon ranked #15 out of 15 tools tested. Dead last. Apollo found 40 out of 50 emails. SalesQL found 41. LeadGibbon finished behind every single tool in the study.

A separate Saleshandy benchmark tested accuracy across 100 contacts: GetProspect hit 95%, Skrapp.io scored 93%, Apollo landed at 91%, and Hunter came in at 90%. LeadGibbon wasn't included in that test - likely because its database is too small to generate meaningful results at scale.

The G2 reviews tell a similar story. One reviewer wrote: "It doesn't work all that well. Feels like it finds old email addresses, old phone numbers, or, in some cases, maybe guesses at email address based on company format." Another reviewer who gave the tool 4.5 stars still noted an "insufficient database, which frequently results in incorrect contact information."

The 97% accuracy claim likely applies only to emails they successfully verify - not to their overall find rate. That's an important distinction. We've evaluated dozens of email finders over the years, and database size is the single biggest predictor of whether you'll actually find the contact you're looking for.

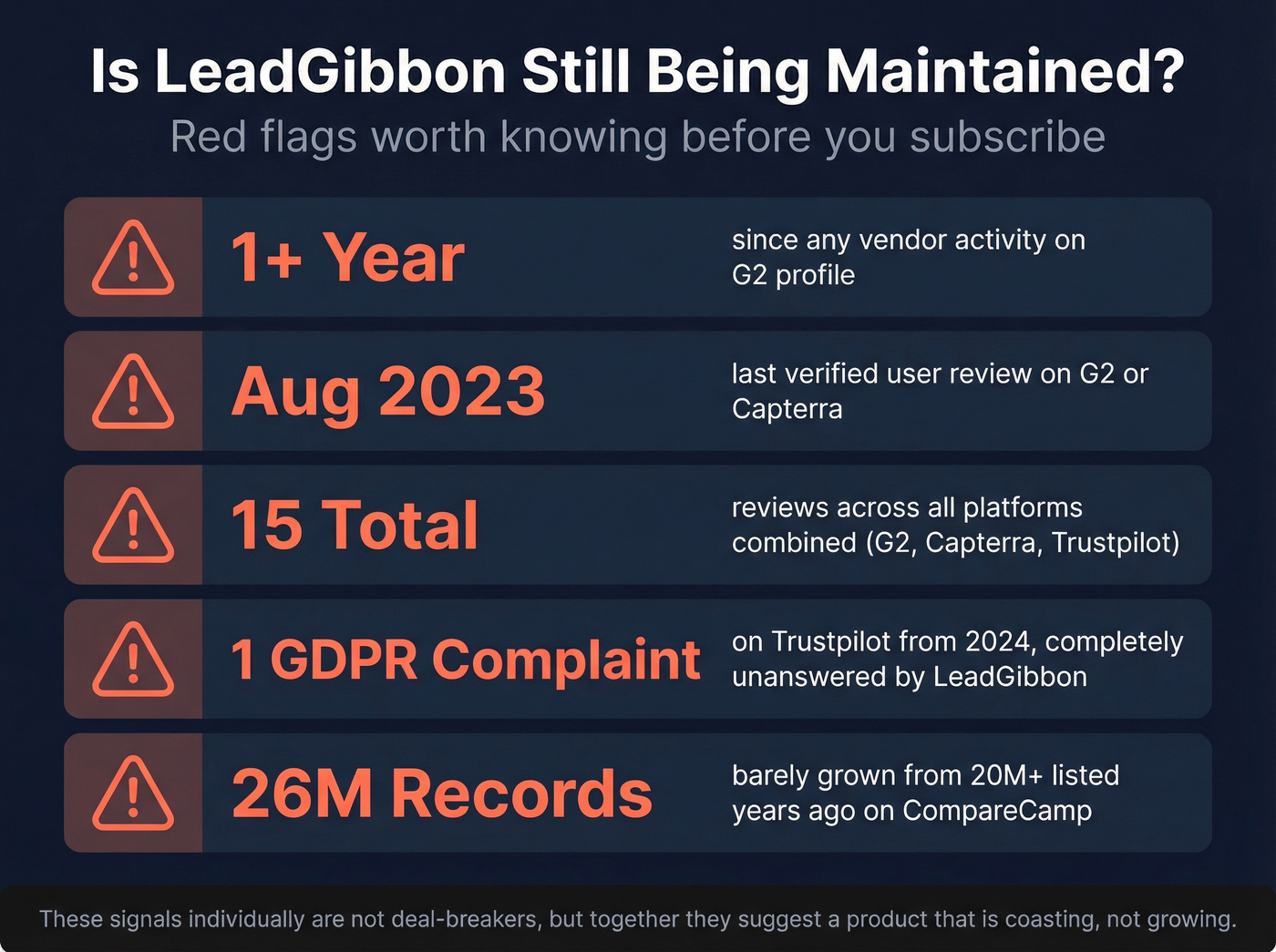

Is LeadGibbon Still Being Maintained?

Here are the red flags, laid out plainly:

- G2 profile inactive for over a year - no vendor responses to reviews

- No G2 or Capterra reviews since August 2023 - the only new entry across any platform is a GDPR complaint on Trustpilot from 2024

- That GDPR complaint went completely unanswered - a user requested data deletion and was ignored

- Total review count across all platforms: 15 - G2 (11), Capterra (3), Trustpilot (1)

- Database growth is glacial - CompareCamp listed 20M+ records years ago; it's now 26M

These aren't deal-breakers individually, but together they paint a picture of a product that's coasting. I've seen this pattern before with small SaaS tools - they work well enough to keep existing users paying, but there's no investment in data, support, or community. If you're evaluating LeadGibbon for a new team deployment, the lack of active development should give you serious pause.

How LeadGibbon Pricing Compares to Alternatives

Real talk: LeadGibbon isn't overpriced for what it does. It's overpriced for what it doesn't do. The per-email cost on the Pro plan is fine. The problem is everything surrounding it - a tiny database, no rollover, no annual discount, no API, and no sign that anyone is actively improving the product.

Pricing Comparison

| Tool | Entry Price | Credits/mo | Per-Email Cost* | Best For |

|---|---|---|---|---|

| Apollo.io | $49/mo (annual) | Unlimited | ~$0.049/export | Free volume |

| LeadGibbon | $39/mo | 1,000 | $0.039 | Simplicity |

| Hunter.io | $34/mo (annual) | 2,000 | $0.017 | Domain search |

| Lusha | $29.90/mo | 250 | $0.12 | Quick lookups |

| GetProspect | $34/mo (annual) | 1,000 | $0.034 | Credit rollover |

| Skrapp.io | $30/mo (annual) | 1,000 | $0.030 | Budget teams |

Per-email costs shown at annual pricing where available. LeadGibbon has no annual option.

Features Comparison

| Tool | DB Size | Free Tier | Credits Roll Over? |

|---|---|---|---|

| Prospeo | 300M+ | 75/mo | Yes |

| Apollo.io | 275M+ | 10K/mo | No |

| GetProspect | 230M+ | 50/mo | Yes |

| Skrapp.io | 200M+ | 100/mo | Yes |

| Hunter.io | Large | 50/mo | No |

| Lusha | Large | 40/mo | No |

| LeadGibbon | 26M | ~60/mo | No |

The comparison isn't kind to LeadGibbon. Apollo's free tier alone gives you 10,000 email credits per month - that's more than the $99 Pro plan. Hunter and GetProspect both offer 30% annual discounts that LeadGibbon can't match. Skrapp.io matches the entry price but includes credit rollover and annual savings.

On accuracy and data freshness, Prospeo's 300M+ database runs on a 7-day refresh cycle with 98% verified email accuracy - a dataset 11x larger than LeadGibbon's, with credits that don't expire. When bounced emails destroy your sender reputation, the gap between LeadGibbon's last-place Sparkle.io ranking and 98% verified accuracy isn't subtle. If you want to go deeper on verification, start with our guide on verified email accuracy and the best email verifier websites.

Who Should (and Shouldn't) Use LeadGibbon

LeadGibbon makes sense if...

- You need a dead-simple Chrome extension that works inside Sales Navigator

- Your volume is genuinely under 500 emails per month

- You value SIC/NAICS code search and geographic filtering by US city, state, or zip code - LeadGibbon handles this well

- You've tested the free tier and the data quality works for your specific ICP and geography

Skip LeadGibbon if...

- You need more than 1,000 emails per month - Apollo's free tier is objectively better

- You care about data accuracy - a last-place finish in independent testing isn't something you can ignore

- You need credit rollover - any month with variable prospecting volume means wasted money

- You want a tool that's actively maintained - the G2 profile has been dead for over a year

- You're building a team workflow - Google Sheets is the only integration, with no native Salesforce, HubSpot, or API connection

- You need API access - LeadGibbon doesn't offer one

If you’re weighing other databases, here are practical roundups of the best B2B data providers and B2B email lookup tools, plus a broader list of B2B sales tools for 2026 stacks.

LeadGibbon ranked dead last in email finder accuracy tests and hasn't had a G2 review since 2023. Prospeo refreshes all 300M+ records every 7 days, runs 5-step email verification, and delivers 98% accuracy - trusted by 15,000+ companies.

Get data from a platform that's actually maintained. Start with 100 free credits.

FAQ

Does LeadGibbon offer a free plan?

Yes. New accounts get 5 credits immediately, then 15 credits per week - roughly 60 per month. That's enough to test the Chrome extension on a handful of prospects, but nowhere near enough for real outbound campaigns.

Do LeadGibbon credits roll over?

No. Unused credits expire at the end of each billing cycle with no exceptions. On the Basic plan ($39/mo, 1,000 credits), consistently using only 700 means you waste roughly $140 per year.

Does LeadGibbon offer annual billing?

No - monthly billing only, with no annual discount available. This makes LeadGibbon effectively 20-30% more expensive on an annualized basis than Hunter ($34/mo annual), GetProspect ($34/mo annual), and Apollo ($49/mo annual).

Why does G2 show different LeadGibbon pricing?

G2's data was last updated in late 2024 and shows $49/$99/$199. The current official pricing is $39/$99/$299 - the Business tier increased by $100 while Basic dropped $10. Always check LeadGibbon's pricing page for current numbers.

What's a better alternative to LeadGibbon for email finding?

For volume, Apollo's free tier (10,000 emails/month) is unbeatable at $0. For accuracy and data freshness, Prospeo offers 98% verified email accuracy across 300M+ profiles with a 7-day refresh cycle - 11x larger than LeadGibbon's database, with credits that don't expire.