RocketReach Pricing in 2026: What You'll Actually Pay (and Why)

RocketReach pricing feels messy because it's really two different systems wearing the same label: monthly plans with hard lookup limits, and annual plans that advertise "unlimited" lookups (fair use) while quietly making exports the real choke point.

Here's the thing: most teams don't lose because they picked the "wrong tier." They lose because they didn't model throughput. (If you want a baseline for modeling, start with lead generation pricing.)

I've watched an SDR team buy annual for the "unlimited" searches, then hit an export wall in week three of a new outbound push and spend the rest of the quarter arguing about who "wasted" credits. Nobody did. The plan just wasn't built for their workflow.

What you need to know (quick version)

Before you pay, check these six items. Print them if you have to.

- ☐ Are you buying monthly (limited lookups + unlimited exports) or annual ("unlimited" lookups under fair use + exports capped as a yearly allocation)?

- ☐ What's your export throughput per month (how many contacts must move to CSV/CRM/sequencer)?

- ☐ Do you need phone numbers (Pro/Ultimate) or email-only (Essentials)? (If phone is core, see our B2B Phone Number guide.)

- ☐ Will you export companies? If yes, budget for Company Export Credits separately. (If you're doing account-first motions, see ABM without expensive tools.)

- ☐ Are you close to the "Unlimited Plans" limits (10,000 searches + 10,000 lookups per rolling 30 days)?

- ☐ What happens if you cancel mid-cycle (credits expire; access ends at renewal)?

Monthly plans: limited lookups, unlimited exports.

Annual plans: "unlimited" lookups, exports become the bottleneck.

And no, "unlimited" isn't unlimited.

RocketReach pricing snapshot (monthly vs annual) - 2026 reference tables

You'll see three "truths" online at the same time:

- directory pricing tables (G2/Capterra)

- RocketReach's own annual per-seat references

- "starts at $34/mo" snippets on certain pages

All of them can be true because term length, packaging, and page context change what you're shown.

Monthly pricing (directory snapshot)

A common directory snapshot shows these self-serve tiers:

| Plan | $/mo | Lookups/mo | Exports/mo |

|---|---|---|---|

| Free Trial | $0 | 5 | 5 |

| Essentials | $69 | 100 | 100 |

| Pro | $119 | 250 | 250 |

| Ultimate | $209 | 500 | 500 |

The same snapshot often lists annual export equivalents for modeling:

- Essentials: 100/mo or 1,200/yr

- Pro: 250/mo or 3,600/yr

- Ultimate: 500/mo or 10,000/yr

Those annual equivalents matter because RocketReach's annual mechanics treat exports like a fixed yearly pool rather than a monthly refill.

Annual billing reference (RocketReach-authored)

RocketReach also publishes an annual "US pricing" reference in its own content:

| Plan (annual) | $/seat/mo | Notes |

|---|---|---|

| Essentials | $33 | Email-only |

| Pro | $75 | Email + phone |

| Ultimate | $175 | More volume |

| Custom Team | from $6,000/yr | Custom Team Plans |

So yes, one person saying "RocketReach is $33/mo" and another saying "$69/mo" can both be right.

What's included at a glance (what's actually gated)

- Essentials = email-only.

- Pro + Ultimate = email + phone numbers.

- Integrations are typically positioned under Pro/Ultimate.

- Team/Custom is where admin controls, pooled usage, and heavier API workflows usually show up.

If you're comparing to ZoomInfo, you're in a different pricing universe. Public comparisons often put ZoomInfo packages in the $14,995/year to $39,995/year range depending on bundle. (If you want a cleaner breakdown, see our ZoomInfo Pricing guide.)

Why RocketReach pricing looks inconsistent online (and how to verify yours)

RocketReach puts "subscriptions start at $34/month" on some pages. Directories show different numbers, and you'll also see different tier names or bundles depending on where you land.

This isn't a conspiracy. It's term length, packaging changes, and sometimes region or testing.

Verify at checkout (don't buy off a snippet):

- ☐ Confirm monthly vs annual billing.

- ☐ Confirm phone access (Pro/Ultimate) vs email-only (Essentials).

- ☐ Confirm your export allowance and whether it's monthly unlimited or a fixed annual allocation.

- ☐ Confirm whether company exports require add-on credits.

- ☐ Confirm whether your workflow needs API/integrations/admin controls (tier gate vs Team/Custom gate). (If you're mapping this to your stack, use a B2B sales stack checklist.)

Do that once and the "inconsistency" stops being a problem.

Tired of modeling lookups vs exports and guessing which RocketReach plan won't bottleneck your team? Prospeo charges ~$0.01/email with 98% accuracy - no "unlimited" fine print, no separate company export SKUs, no fair-use walls at 10,000 lookups.

Pay for contacts you use. Skip the credit rationing entirely.

RocketReach pricing mechanics: lookups vs exports

This only clicks when you separate lookups (revealing data inside RocketReach) from exports (moving data out to where work happens). (Related: email lookup.)

You're not buying "contact discovery." You're buying throughput: how many contacts you can actually push into your CRM and sequences without rationing. (If you're scaling volume, see bulk lead generation.)

Lookups: what consumes them

A lookup is consumed when RocketReach reveals contact data in-product. Lookups get triggered by:

- clicking Get Contact

- running Autopilot

- using Upload List

- using the API

On monthly plans, lookups are explicitly limited (100/250/500 in common tiers). On annual plans, lookups are "unlimited" under fair use, which RocketReach frames as roughly 10,000 lookups/month behavior.

Exports: what consumes them (and why exports become the bottleneck)

An export is consumed when you take data out of RocketReach, including:

- downloading a CSV

- syncing to a CRM (native or via Zapier)

- exporting from My Contacts

- pulling results from Autopilot or Upload List

- API workflows that move data downstream

Exports become the bottleneck because the mechanics flip. Monthly plans tend to be export-friendly, while annual plans tend to make exports the scarce resource, which is exactly backwards for teams running high-volume outbound.

Where to track credits (so you don't get surprised)

Track usage in two places:

- RocketReach billing/usage (lookups, exports, add-ons like company exports)

- Downstream systems (CRM imports, sequencer list sizes, enrichment jobs). If you're seeing drift, use this How to Keep CRM Data Clean framework.

If your CRM import says 2,000 contacts and RocketReach says you exported 2,000, your model's working. If those diverge, you've got leakage somewhere (duplicate exports, re-exports, automation loops, or team members exporting the same list twice).

One procurement question changes everything:

- ☐ Do you get charged when no verified email/phone is returned?

Get that answered in writing before you commit. If "no data" still burns credits, your effective cost per usable contact jumps fast. (For a safer workflow, align this with an email verification step.)

Company Export Credits vs Person Export Credits (separate budget line item)

RocketReach separates person exports from company exports.

If you export from My Companies, RocketReach uses Company Export Credits purchased separately. If your motion is account-first (ABM list building), treat company exports as a second SKU in your budget, not a rounding error. (Related: ABM campaign planning.)

Monthly vs annual: which is cheaper for your workflow?

This is the only question that matters: are you export-heavy or research-heavy?

Best for export-heavy outbound: Monthly.

Best for research-heavy, low-export workflows: Annual.

Two scenarios we've seen play out in the real world:

Scenario A: SDR team feeding sequences Weekly list pulls into Outreach/Salesloft/Instantly-style sequences. Export rate is high because volume is the job. Monthly usually wins because unlimited exports keep the machine moving, even if you have to manage lookup limits. (If you're tuning the motion, use SDR cadence best practices.)

Scenario B: founder-led or AE-led targeted outbound Tight account research, a few decision-makers per account, lots of searching, and only exporting the final shortlist. Annual can work well here because fair-use "unlimited" lookups match the motion and you aren't trying to export thousands a month.

The trap is buying annual because "unlimited lookups" sounds like freedom, then realizing exports are the thing you actually needed.

"Unlimited" plans: the exact limits (fair use + throttles)

RocketReach uses "unlimited" the way SaaS uses "unlimited": unlimited until you behave like a power user.

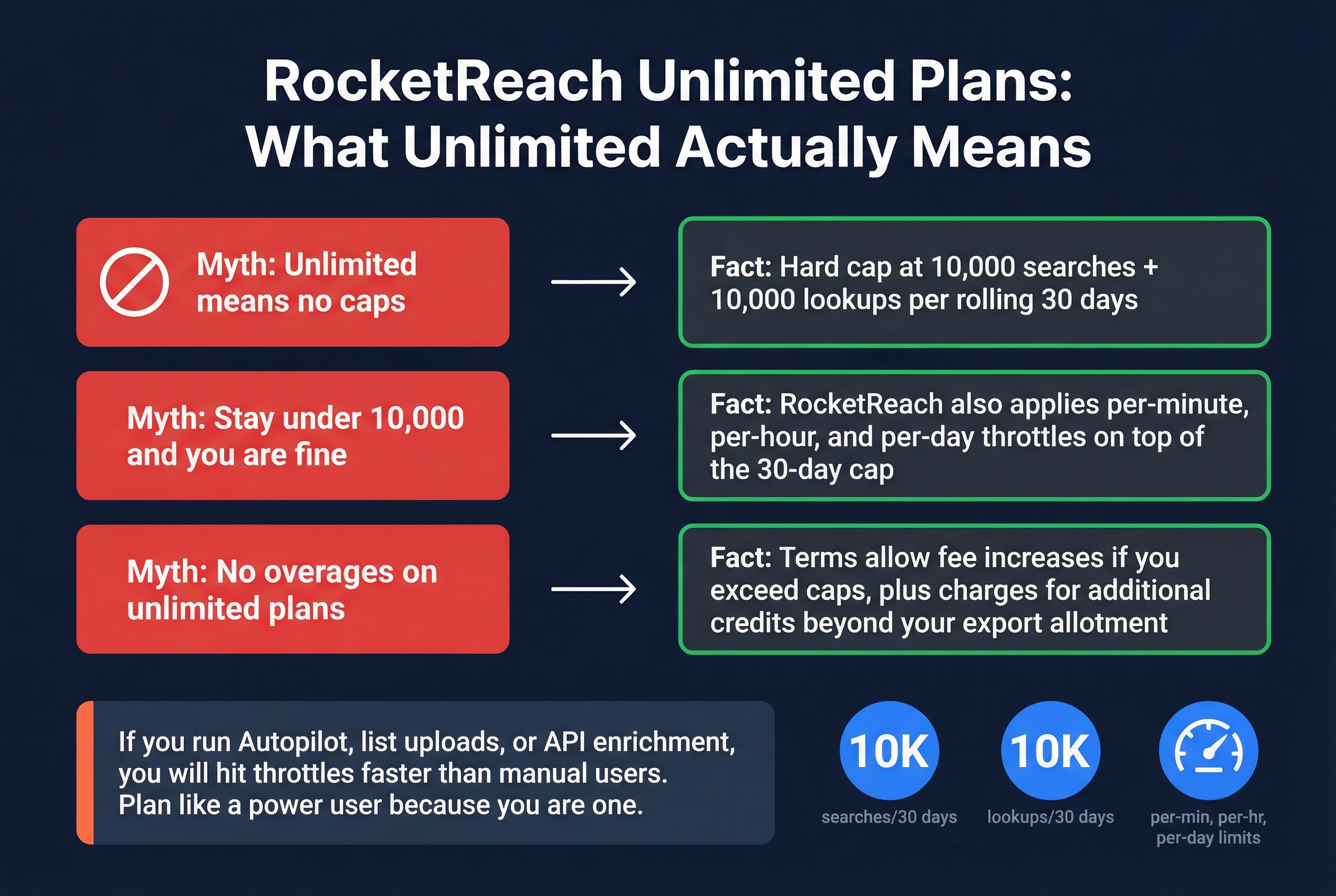

Myth: Unlimited means no caps. Fact: RocketReach caps "Unlimited Plans" at 10,000 searches and 10,000 lookups within a rolling 30-day period.

Myth: If you're under 10,000, you're fine. Fact: RocketReach also applies throttles (limits per minute, hour, and day).

Myth: Overages aren't a thing on unlimited. Fact: Terms typically allow fee increases if you exceed caps and charges for additional credits beyond your export allotment.

Automation hits throttles faster than manual use. If you're running Autopilot, list uploads, or API enrichment, plan like a power user because you are one. (If you're designing automation, see No Code Sales Automation.)

The gotchas that change your total cost (exports, add-ons, overages)

Sticker price isn't your true price. True price is:

subscription + add-on credits + overage buffer + the cost of hitting caps mid-month

| Cost driver | What happens | Budget impact |

|---|---|---|

| Exports | Annual export pool is fixed | Throughput limit |

| Company exports | Separate credits | Add-on SKU |

| Overages | Extra lookups/exports | Variable spend |

| API usage | Can burn exports fast | Hidden drain |

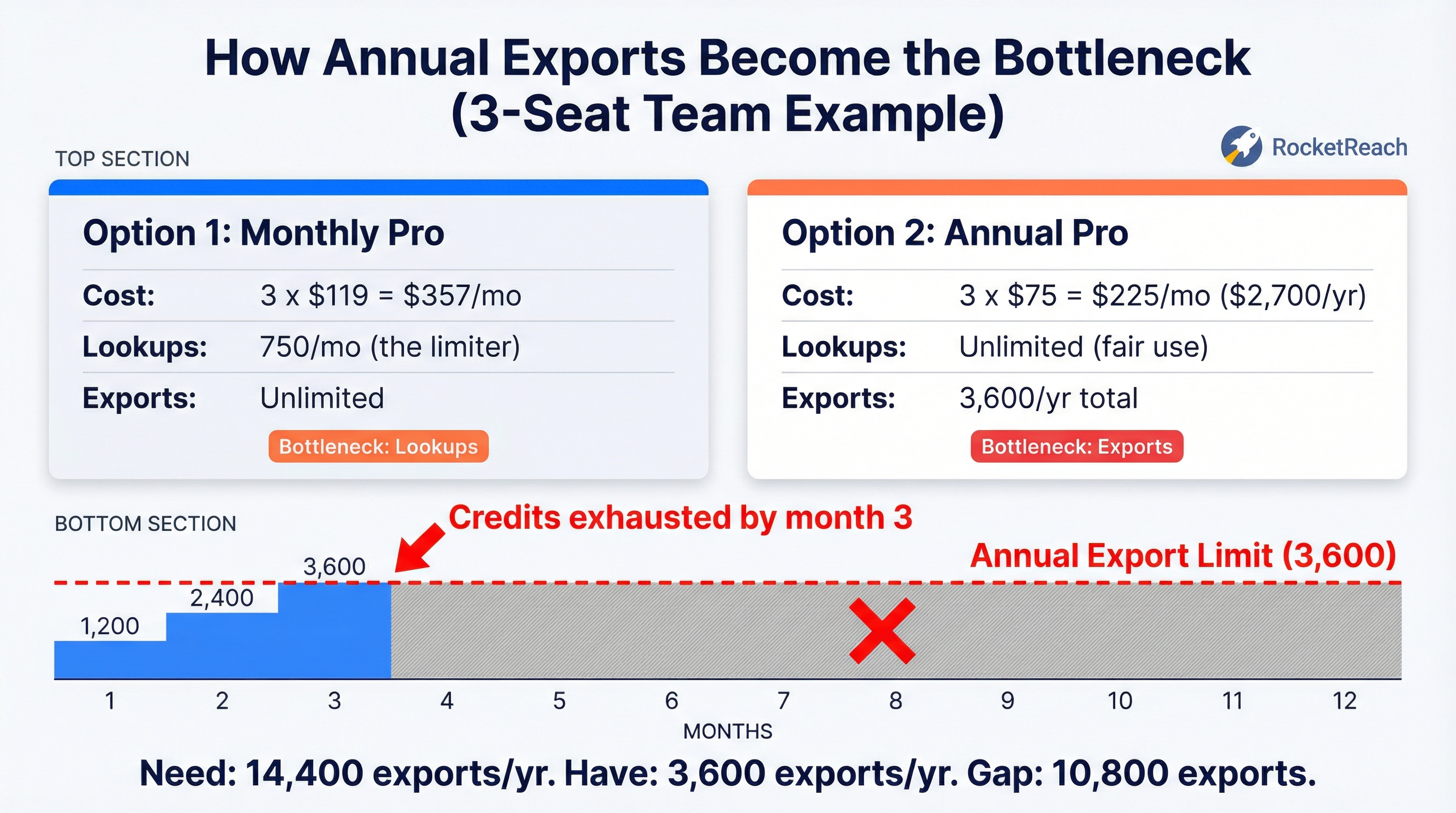

Worked example: how annual exports become the bottleneck (with real numbers)

Let's model a common setup:

- 3 seats

- You run outbound weekly and want 1,200 exported contacts/month total (300/week)

- You do 3,000 lookups/month because you filter and verify before exporting

Option 1: Monthly Pro (directory snapshot)

- Cost: 3 x $119 = $357/month

- Lookups: 3 x 250 = 750 lookups/month (this is the limiter)

- Exports: unlimited (throughput is fine, discovery is constrained)

You'll hit the lookup ceiling quickly unless you change workflow or tier.

Option 2: Annual Pro (RocketReach annual reference)

- Cost: 3 x $75 = $225/month equivalent billed annually -> $2,700/year

- Lookups: "unlimited" under fair use (3,000/month is fine)

- Exports: limited as a yearly allocation (a common annual-equivalent number shown for Pro is 3,600 exports/year)

Now the math that hurts:

- You need 1,200 exports/month x 12 = 14,400 exports/year

- If your plan behaves like the annual-allocation model, 3,600/year is gone in three months

That's the whole story: annual feels great for searching, then you slam into export scarcity right when you try to operationalize.

What users complain about (pricing-related, and why it matters)

Pricing frustration usually shows up in three places:

- Export limits feel tighter than expected on annual, so teams pay for "unlimited" research but can't move enough contacts into systems to run outbound.

- Accuracy mismatches create rework: wasted credits, extra verification steps, and deliverability risk. (If you're fixing this systematically, start with B2B contact data decay.)

- Region coverage gaps force a second vendor, which turns "affordable" into a two-tool stack.

Real talk: the second vendor is what kills your budget, not the first one.

Overages: budget for them (but label them correctly)

Overages aren't free, so budget a buffer. A practical planning range is $0.30-$0.45 per additional lookup/export as an industry-typical estimate. Your actual rate depends on plan and negotiation.

True-cost calculator (simple framework)

Use this to sanity-check any checkout screen or quote.

Inputs:

- Seats:

S - Expected lookups/month:

L - Expected exports/month:

E - Expected company exports/month:

C - Overage buffer:

B(use 10%-20%)

Outputs:

- Subscription cost:

S x plan price - Add-on cost: company export credits pack (model as a monthly line)

- Overage reserve:

(L x B) x $0.30-$0.45(estimate range)

If you can't estimate E (exports), you aren't choosing a plan. You're gambling. (Use a pipeline generation calculator to back into volume.)

RocketReach's annual plans gate exports while advertising unlimited lookups. Prospeo refreshes 300M+ profiles every 7 days and lets you export freely - no annual export pools, no surprise caps mid-quarter. Teams book 35% more meetings vs Apollo and 26% more vs ZoomInfo.

Get verified emails and direct dials without the throughput math.

Team vs Custom plans: when RocketReach becomes sales-led

RocketReach stays self-serve until you start running real workflows: multiple users, shared processes, and API-driven ops.

Team/Custom is where admin needs show up: pooled usage, heavier API patterns, and tighter billing controls. In our experience, this is also where "simple per-seat pricing" turns into contract math. (If you're building the ops layer, see CRM integration for sales automation.)

| Plan type | Team size | Exports | API | Pricing signal |

|---|---|---|---|---|

| Team | 2-5 users | Limited | Limited | ~$996-$2,480 per user/year (common tiers) |

| Custom | 5+ users | Custom | Custom | from $6,000/year |

Those numbers are directional, not a quote. Use them to sanity-check whether you're drifting into sales-led territory.

Who Team is for (2-5 users):

- You want centralized billing and basic admin control.

- You can live within export allocations.

- You're not running heavy API enrichment.

Who Custom is for (5+ users):

- You need custom export volumes or pooled credits across seats.

- You need API usage that won't break when you scale.

- You want a negotiated contract instead of self-serve tiers.

Skip Essentials if you expect clean CRM syncs. If integrations are listed under Pro/Ultimate and you buy email-only anyway, you're choosing pain on purpose. (See: Email Finder CRM Integration.)

RocketReach pricing rules: cancellation, rollover, refunds

Cancellation mechanics are strict, and they punish teams that treat credits like a bank balance.

What happens when you cancel:

- Fees are non-refundable.

- You keep access until the end of the billing cycle, then remaining lookups/export credits expire.

- API keys get invalidated.

- You lose access to My Contacts, My Companies, Autopilot, integrations, and exports.

That My Contacts/My Companies loss is bigger than it sounds. If RocketReach is your work-in-progress system, cancellation wipes your team's active prospecting set unless you export it first. (If you need a safer process, use this How to Import Leads Into Any CRM guide.)

Rollover and pausing (monthly plans):

- Unused monthly lookup credits roll over up to 12 months.

- You must keep an active subscription to use rolled-over credits.

- You can pause up to 3 billing cycles.

Procurement rule: schedule cancellation for right after a heavy export week, not right after a quiet one.

If RocketReach's pricing mechanics don't fit: a more predictable model

If you're tired of modeling lookups vs exports vs fair-use throttles, pick a pricing model that maps directly to outcomes: verified contact data you can actually use. (If you're evaluating options, start with our best B2B data providers roundup.)

Prospeo is The B2B data platform built for accuracy. It includes 300M+ professional profiles, 143M+ verified emails, and 125M+ verified mobile numbers, with 98% verified email accuracy and a 7-day data refresh cycle (the industry average is about 6 weeks). For RevOps, it's clean to run: 30+ search filters, a Chrome extension used by 40,000+ users, API access with a 92% match rate, and CRM/CSV enrichment where 83% of leads come back with contact data and 50+ data points per enrichment.

Final recommendation: verify these 3 things before you commit

RocketReach can be a solid value when your workflow matches the mechanics. Before you commit, get answers to the constraints that govern day-to-day usage:

- Annual export allocation (and whether exports are pooled across seats)

- Company Export Credits (separate add-on line item)

- "Unlimited Plans" limits + throttles + API/export behavior (10,000 searches + 10,000 lookups per rolling 30 days, plus minute/hour/day throttles)

Ask RocketReach to confirm your annual export allocation in writing and whether exports are pooled across seats. Those two lines decide your real cost.

And if you're trying to forecast spend, remember the core issue with RocketReach pricing: the plan that looks cheapest on paper can be the one that blocks your exports when you finally scale.