Buyer Leads in 2026: Where to Buy Them, What They Cost, and How to Actually Convert Them

You just opened your Zillow Premier Agent bill. $3,200 for last month. You got 60 leads, called every one, and closed exactly zero. The leads weren't bad - half were browsing, a quarter gave fake numbers, and the rest went with the agent who called back in 90 seconds while you were at a showing.

Here's the thing: 71% of agents sold zero properties in 2024. Not one. Meanwhile, 95% of buyers use online tools during their search. The buyer leads exist. The money's there. The problem isn't the leads - it's how agents buy them, what they pay, and what happens after the first call.

I've watched agents burn through five figures on platforms that weren't right for their market, their budget, or their follow-up capacity. This is the guide that would've saved them.

What You Need (Quick Version)

Under $500/month: Market Leader ($189/mo + $30-$50/lead). Exclusive leads, built-in CRM, guaranteed monthly volume. Best entry point for newer agents.

$500-$1,000/month: Zillow Premier Agent in a non-metro ZIP. Highest-intent buyers, massive reach (~227M average monthly unique users), and enough lead volume to build a real pipeline.

$1,000+/month (teams): CINC or Ylopo. Managed ad campaigns, AI-powered follow-up, scalable across multiple agents.

Zero budget: Open houses + Realtor.com ReadyConnect Concierge (pay only at closing) + sphere-of-influence calls every morning.

Now the contrarian take most guides won't give you: you need ONE paid source and ONE organic strategy. That's it. Master both before adding anything else. Agents who spread $500/month across three platforms get mediocre results from all of them.

Should You Even Buy Buyer Leads? The Math Says It Depends

Before you spend a dollar, understand the economics of buyer leads versus seller leads - because they're not even close.

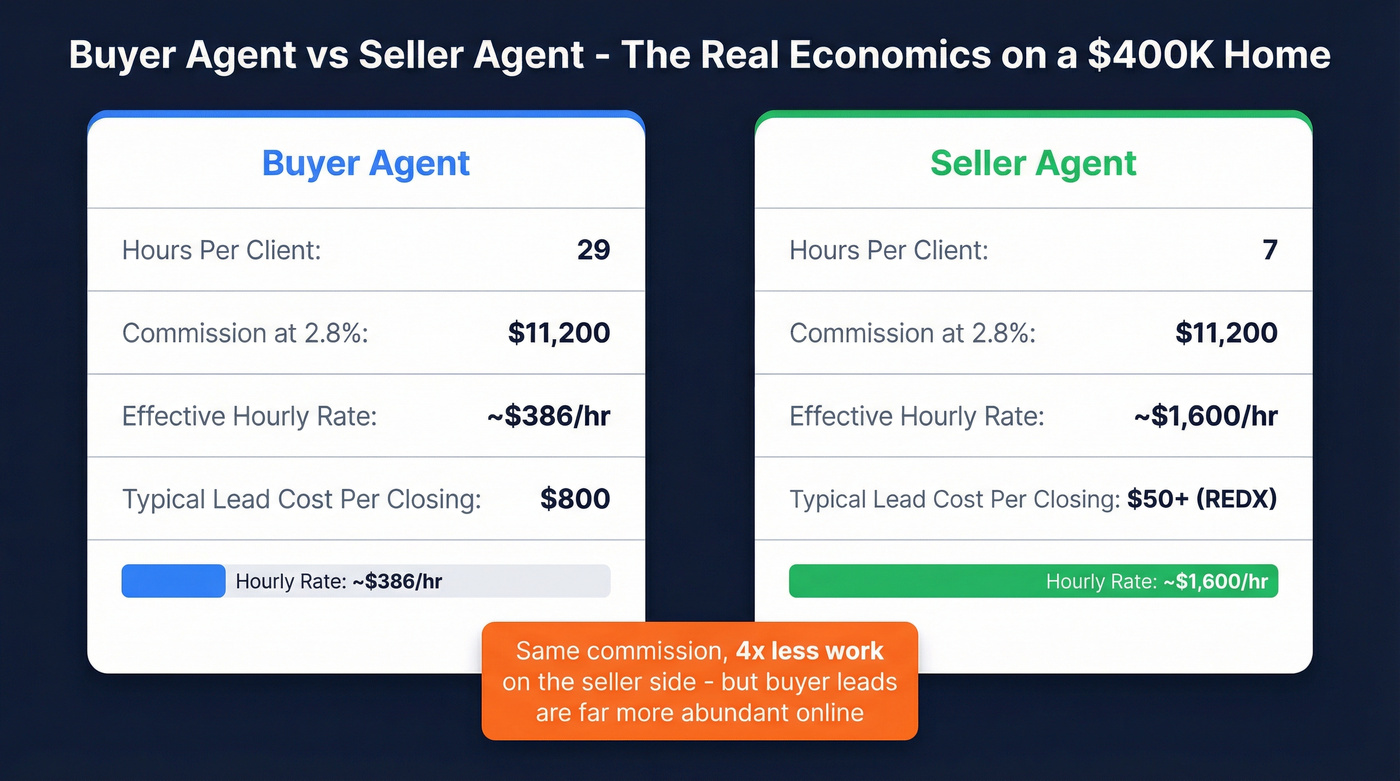

A buyer agent spends an average of 29 hours per client. Driving to showings, writing offers, negotiating inspections, hand-holding through closing. A seller agent? Seven hours. Same commission structure, four times less work.

Run the numbers on a $400,000 home at 2.8% commission. That's $11,200 gross. For a buyer agent, roughly $386/hour. Not bad - until you compare it to the seller agent's $1,600/hour for the same deal.

Now factor in lead costs. If you're paying $40/lead on Zillow and converting at 5%, you're spending $800 in lead costs per closing. Manageable. But Facebook ads at $15/lead with a 2% conversion rate means $750 per closing - and you're waiting 6-18 months for those leads to mature.

The real question isn't "should I invest in buyer leads?" It's "what's my cost per closing, and does the math work at my commission rate in my market?" (If you want a framework for pressure-testing the economics, use a CAC/LTV ratio lens.)

For agents in markets where the average home price sits above $400K, buying on the buyer side absolutely pencils out. For agents selling $200K homes at 2.42% commission ($4,840 gross), the margins get razor-thin after broker splits and lead costs. If you're in a lower-price market, seller leads from expired listings (43% relist rate) or FSBOs (38% conversion) will almost always deliver better ROI per hour. REDX packages start at $50+ for those.

The answer depends on three numbers: your average sale price, your conversion rate, and your cost per lead. Everything else is noise.

You're spending $800-$2,500 per closing on Zillow and Facebook leads. Prospeo gives you 300M+ verified contacts at $0.01/email with 98% accuracy - so you can build your own buyer pipeline without platform markups.

Cut your cost per closing by 90% and own your lead flow.

How the NAR Settlement Changes Buyer Lead Economics

The August 2024 NAR settlement was supposed to crater buyer agent commissions. Every headline predicted the end of the 3% buyer side. Nearly two years later, the data tells a different story.

Commission Data - Less Severe Than Feared

Average buyer agent commission hit 2.36% in Q3 2024 - the post-settlement low. By Q3 2025, it had rebounded to 2.42%. For homes under $500K, commissions actually climbed to 2.52%, the highest level since 2023.

The slow market helped. Fewer buyers means sellers need to attract them, and offering competitive buyer agent compensation is one lever they still pull. Per Redfin data reported by Inman, the settlement's impact has been less severe than initially anticipated.

On a $400K home at 2.42%, you're looking at $9,680 gross commission. At 2.52% (under $500K), it's $10,080. These aren't the 3% days, but they're workable - especially if your lead costs stay under $1,000 per closing.

The Buyer Representation Agreement - Your New Conversion Bottleneck

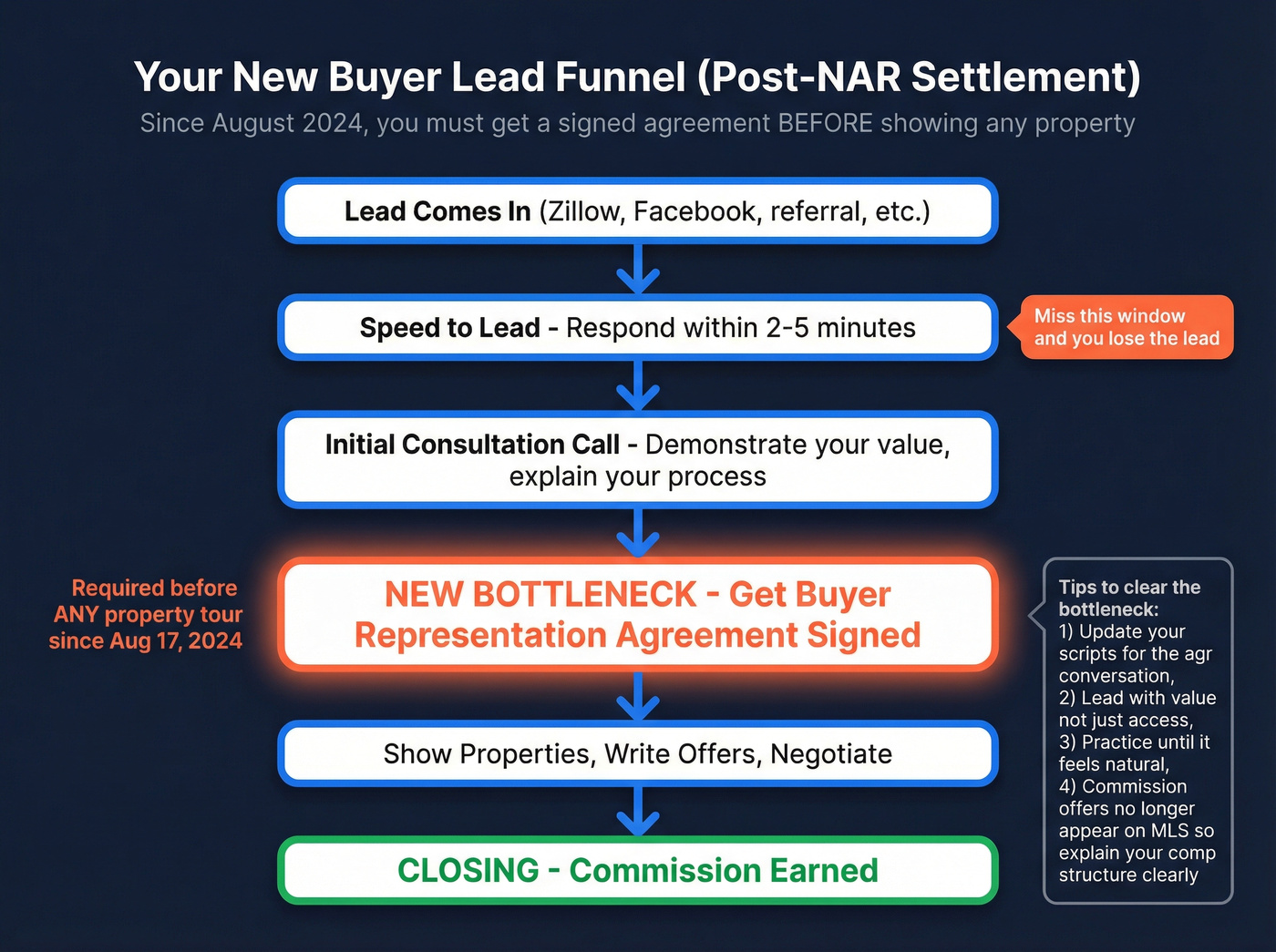

The bigger change isn't commission rates. It's the buyer representation agreement.

Since August 17, 2024, agents must have a written agreement in place before touring any listed property. The agreement outlines your services, your compensation structure, and the buyer's responsibilities. Commission offers from sellers to buyer brokers no longer appear on the MLS.

This changes your conversion funnel entirely. You can't just show houses to a lead and hope they stick. You need to demonstrate enough value on the first call or meeting that a buyer willingly signs a representation agreement before you ever open a front door.

For purchased leads - especially shared leads from Zillow - this means your speed-to-lead and initial consultation skills matter more than ever. The agent who builds trust fastest wins. The one who can't articulate their value before the first showing loses the lead entirely.

Update your scripts. Practice the agreement conversation. This is the new bottleneck, not lead quality.

What Do Buyer Leads Actually Cost? The Full Math

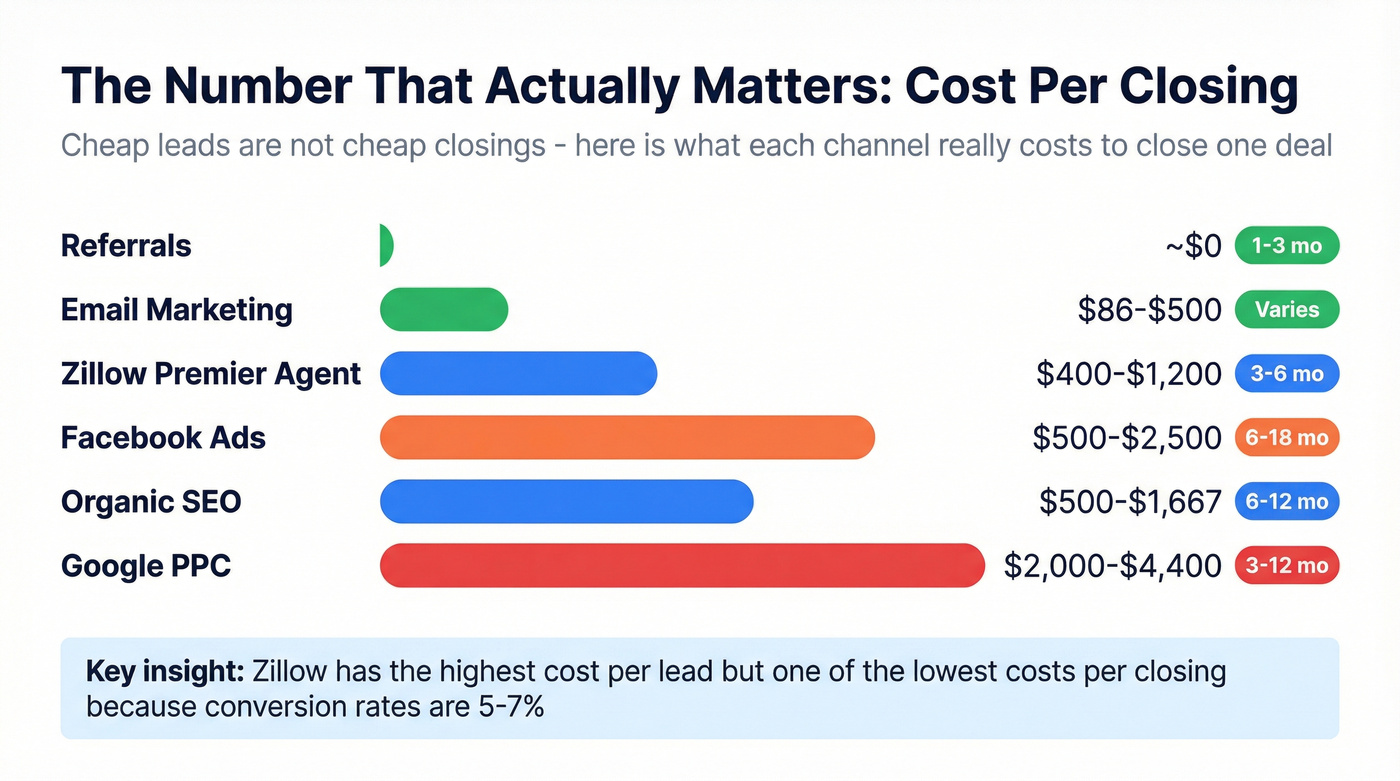

Every platform advertises cost per lead. Nobody talks about cost per closing.

That's the number that actually matters.

Cost Per Lead by Channel

| Channel | CPL | Conv. Rate | Est. Cost/Closing | Time to Close |

|---|---|---|---|---|

| Zillow | $20-$60 | 5-7% | $400-$1,200 | 3-6 months |

| Facebook Ads | $5-$25 | 1-3% | $500-$2,500 | 6-18 months |

| Google PPC | $50-$66 | 1.5-2.5% | $2,000-$4,400 | 3-12 months |

| Organic SEO | $15-$50 | ~3% | $500-$1,667 | 6-12 months |

| Email Marketing | $3-$15 | 3-3.5% | $86-$500 | Varies |

| Referrals | ~$0 | 25%+ | ~$0 | 1-3 months |

The Cost-Per-Closing Calculation Nobody Shows You

Let's walk through a real example. You're running Zillow Premier Agent in a mid-tier market.

You spend $1,000/month. At $40/lead, that's 25 leads. At a 5% conversion rate, you close 1.25 deals per month - call it 15 per year. Your lead cost per closing: $800.

Now the commission math. Average home price: $400K. At 2.42%, your gross commission is $9,680. Subtract the $800 in lead costs. You're at $8,880 before your broker split. If your broker takes 30%, you net $6,216 per closing from Zillow leads. That's solid.

Now run the same math with Facebook ads. $15/lead, 2% conversion. You need 50 leads per closing - $750 in ad spend. Sounds cheaper, right? But those leads take 6-18 months to convert. Your cash flow looks very different when you're spending $750/month and not seeing closings for half a year.

The platforms with the highest CPL (Zillow, Google PPC) often have the lowest cost per closing because conversion rates are dramatically higher. A $60 Zillow lead that converts at 7% costs you $857 per closing. A $15 Facebook lead that converts at 1.5% costs you $1,000 per closing - and takes three times longer.

Don't chase cheap leads. Chase cheap closings.

Best Platforms to Buy Buyer Leads in 2026

I've organized this by what actually matters: cost, lead type, exclusivity, and who each platform is built for. The top picks get the deep treatment. The rest get honest summaries.

| Platform | Monthly Cost | CPL | Lead Type | Exclusive? | Contract? | Best For |

|---|---|---|---|---|---|---|

| Zillow | $300-$1,000+ | $20-$60 | Buyer | No | Yes (often 6-month min) | High-intent buyers |

| CINC | $899+/mo | $1.60-$30+ | Both | Yes | Yes | Teams, ad mgmt |

| Market Leader | $189+/mo | $30-$50 | Both | Yes | 6-month | New agents |

| Realtor.com | $0 upfront | 30-35% ref | Buyer | No | No | Zero-risk entry |

| Ylopo | $500-$1,000+ | Varies | Both | Yes | No | AI nurture |

| BoldLeads | $269+/mo | Varies | Both | Yes | 6-month | ZIP exclusivity |

| REDX | $50+/pkg | N/A | Seller | N/A | No | Seller leads |

| SmartZip | ~$500/mo | $0.35 | Both | Yes | Yes | Geo-farming |

| Sierra | $500+/mo | Varies | Both | Yes | Varies | SEO/IDX |

| Real Geeks | $399+/mo | Varies | Both | Yes | Varies | Budget IDX |

Zillow Premier Agent - Best for High-Intent Buyer Leads

Use this if: You're in a market where homes sell above $350K, you can respond to leads within 5 minutes, and you want the highest-intent prospects available anywhere online. Zillow's reach is massive: around 227M average monthly unique users and about 75.8M monthly visitors.

Skip this if: You're in a hyper-competitive metro ZIP where lead costs exceed $60/lead and you're splitting with 5+ other Premier Agents. Shared leads in Manhattan or San Francisco can feel like throwing money into a furnace.

Pricing scales by ZIP code competition and average home values. Non-metro markets: $300-$500/month. Metro markets: $1,000+/month. Leads run $20-$60 each. The sweet spot is mid-tier markets where you can get meaningful volume without competing against mega-teams.

The biggest knock on Zillow? Leads aren't exclusive. Your profile shows alongside other Premier Agents. Speed-to-lead isn't optional here - it's the entire game. We've seen agents in the same ZIP code get wildly different results purely based on response time. The one who calls within two minutes closes. The one who calls at lunch doesn't.

CINC - Best for Teams Running Managed Ad Campaigns

Use this if: You're a team leader or brokerage spending $1,000+/month on lead gen and you want a platform that runs and optimizes Google and social campaigns at scale. CINC manages almost $30M in annual ad spend across 50,000+ clients. Their Google buyer CPL data is some of the best in the industry - as low as $1.60/lead in markets like Bangor, ME.

Skip this if: You're a solo agent with a tight budget. Published pricing starts at $899/month, though some agents report getting intro offers around $499/month for the first two months before jumping to $999/month.

CPL trends matter here: Q1 is cheapest, Q4 is most expensive. If you're signing up, start in January. CINC's product tiers (Solo, Ramp, Pro, Select) scale with your team size, but expect $899-$2,000+/month before ad spend.

Where CINC beats Zillow: you own the leads (exclusive), the CRM is built-in, and the system is designed for teams. Where Zillow wins: higher buyer intent and faster time-to-close.

Market Leader - Best for New Agents on a Budget

Use this if: You're a newer agent who needs a guaranteed flow of exclusive leads without spending $1,000+/month. Market Leader runs $189/month for solo agents plus $30-$50 per lead. They guarantee a set number of exclusive leads per month - you won't share them with anyone.

Skip this if: You need high-volume, high-intent leads. Market Leader's leads tend to be earlier in the funnel than Zillow's. You'll need patience and a solid follow-up system.

The Network Boost add-on ($300/month for 30 social media leads at ~$10/lead) is worth testing if you want to supplement your pipeline. Teams pay $329/month. The catch: 6-month minimum contract. That's $1,134 committed before you've closed a single deal. For agents just getting started, Market Leader is the lowest-risk paid option because the exclusive lead guarantee means you're not racing against five other agents to make the first call.

Realtor.com (ReadyConnect Concierge) - Best for Zero Upfront Risk

Use this if: You have zero marketing budget and you're willing to give up a significant chunk of commission in exchange for pre-screened, ready-to-act prospects. ReadyConnect Concierge charges nothing upfront - you pay only at closing.

Skip this if: You're already closing consistently and the referral fee math doesn't work for your market.

Here's the worked example that matters: $500K home, 3% buyer agent commission = $15,000. Realtor.com takes 35% (homes over $150K) = $5,250. You keep $9,750 before your broker split. If your broker takes 30%, you net $6,825. That's a big haircut. But it's a haircut on a deal you wouldn't have had otherwise.

Leads come pre-screened by a concierge team that qualifies for timeline, price range, credit level, and property preferences. Realtor.com's 31M monthly visitors feed the pipeline. Your performance score (80-120) determines the quality of leads you receive - claim referrals quickly, contact them immediately, meet in person within two weeks, and close deals to keep your score high.

The referral fee isn't negotiable. But for agents building from zero, paying 35% of something beats 0% of nothing.

Ylopo - Best for AI-Powered Lead Nurture at Scale

Use this if: You want the most sophisticated lead nurture technology in real estate and you're comfortable spending $500-$1,000+/month plus ad spend. Ylopo's AI Voice add-on calls your leads, follows up for 90 days, and live-transfers warm prospects to you. Their Dynamic Video Ads on Facebook and Instagram use Amazon/eBay-style retargeting to keep your listings in front of buyers.

Skip this if: You want an all-in-one platform. Ylopo doesn't include a CRM - you'll need Follow Up Boss, kvCORE, or another CRM alongside it. That's an extra $50-$400/month.

The frustrating part: Ylopo doesn't publish pricing. You have to request a demo. Based on their tier positioning and what agents report in forums, expect $500-$1,000+/month for the Suite + Marketing package, plus whatever you spend on ads. The good news: month-to-month contracts. No 6-month lock-in. Ylopo's lead scoring notifies you when a lead hits optimal engagement timing, and their Listing Rocket automates Facebook ad campaigns for each listing through its entire lifecycle. For teams that can afford the stack, it's the most tech-forward option available.

BoldLeads - Best for Exclusive ZIP Code Leads

BoldLeads gives you exclusive leads per ZIP code - no competing agents. Leads come from Facebook and Google ads run in your market, with a built-in CRM and automatic text follow-up. The Concierge add-on acts as an ISA, calling and qualifying leads for you.

The downsides are real, though. You're looking at $269+/month for buyer OR seller leads, $500+/month for both, plus $250+/month minimum ad spend - total cost hits $500-$750+ quickly. There's a 6-month minimum contract (12-month for discounts), and lead quality is the most common complaint in reviews. Expected conversion rate is 2-5%, and I'd plan for the lower end. The ZIP code exclusivity is the real differentiator - if you're the only agent getting BoldLeads in your area, you've eliminated the speed-to-lead problem entirely.

The Rest: Quick Takes

REDX isn't a buyer lead platform. It's for seller leads - expired listings, FSBOs, pre-foreclosure, FRBO. Packages start at $50+. I'm including it because it shows up in every "buyer leads" search, and I don't want you wasting money on the wrong thing. That said, if you want to balance your business with seller leads that pay about 4.5x more per hour of work, REDX is the most cost-effective entry point.

SmartZip (~$500/month, $0.35 CPL) uses predictive analytics from 25+ data sources to identify homeowners likely to sell. It delivers 350-7,000+ leads per month depending on territory size. This is a long-game play - you're building a farming pipeline, not getting leads who want to buy next week.

Sierra Interactive (~$500+/month plus ad spend) is strong for agents who want organic leads through SEO-focused IDX websites. Real Geeks (from $399/month) offers a solid IDX website and CRM combo at a lower price point. iHomeFinder (from $169/month plus $250 setup) is the cheapest IDX option if you just need basic lead capture. Sold.com operates on the same pay-at-closing model as Realtor.com ReadyConnect but focuses on seller leads.

Paid Leads vs. Organic Lead Generation - The Real ROI

The paid-vs-organic debate misses the point. You need both.

| Channel | Conv. Rate | CPL | Time to ROI | Key Advantage |

|---|---|---|---|---|

| Portal (Zillow) | 5-7% | $20-$60 | 3-6 months | Highest intent |

| Facebook/Google | 1-3% | $5-$66 | 6-18 months | Scalable volume |

| Organic SEO | ~3% | $15-$50 | 6-12 months | Compounding ROI |

| Email Marketing | 3-3.5% | $3-$15 | Varies | $36-$42 ROI per $1 |

| Referrals | 25%+ | ~$0 | 1-3 months | Highest LTV |

Referrals are the obvious winner on every metric. 65% of sellers choose agents from referrals or past relationships. Referred clients have 25% higher lifetime value. And the CPL is essentially zero.

But you can't scale referrals from zero. That's where paid leads come in - they fill the pipeline while you build the organic engine.

The smartest agents I've seen run one paid source (usually Zillow or CINC) for immediate pipeline, plus one organic strategy (content marketing, open houses, or sphere-of-influence calls) for compounding returns. 92% of realtors use Facebook for marketing, but only a fraction use it well. Mobile drives 73% of property searches, so whatever organic strategy you choose, make sure it's mobile-first.

Email marketing deserves special attention. At $3-$15 CPL and $36-$42 ROI per dollar spent, it's the most underutilized channel in real estate. A monthly newsletter to your database costs almost nothing and keeps you top-of-mind for referrals. (If you want a benchmark-driven breakdown, see B2B email marketing ROI.)

The compounding effect matters. Paid leads give you closings in months 3-6. Organic strategies give you closings in months 6-12. By month 12, the organic pipeline should be supplementing - and eventually replacing - your paid spend.

How to Convert Buyer Leads - The Follow-Up Playbook

Buying leads is the easy part. Converting them is where agents fail.

Speed to Lead - The 5-Minute Rule

Agents who respond within 5 minutes are 21x more likely to convert than those who wait an hour. One-minute response time can increase conversions up to 391%.

Read those numbers again. 21x. Not 21%. Twenty-one times.

If you can't respond to leads within 5 minutes during business hours, you need either an ISA, an AI responder (Ylopo's AI Voice, for example), or a different lead source. Shared leads from Zillow are worthless if you're the third agent to call.

Double-dialing - calling again after 30 seconds if they don't pick up - increases connection rates by 30%. It feels aggressive. It works.

The Follow-Up Cadence That Works

It takes 8-12 touchpoints to convert a lead into a client. Most agents give up after two.

Here's the cadence that consistently produces results:

- Day 1: Immediate response. Call first, text second, email third. All within 5 minutes.

- Day 2: Value follow-up. Send a relevant listing, market update, or neighborhood guide.

- Day 4: Check-in call. "Just wanted to make sure you got that info I sent."

- Day 7: Resource drop. Buyer's guide, mortgage calculator, or school district info.

- Day 14: Casual check-in. "Still looking? Market's shifted a bit - happy to chat."

- Day 30+: Long-term nurture. Monthly market updates, new listings in their criteria.

The Tim & Julie Harris "Two-Hour Power Hour" system works here: 8-10 AM daily, goal of 2 appointments per day. Every new lead gets contacted the same day - calls first, texts and emails second. Their mantra is spot-on: "Unfollowed-up leads don't go cold - they go to another agent."

Tools for Follow-Up

Your CRM is the backbone. Follow Up Boss is a popular choice for lead routing and follow-up automation. BombBomb handles video messages. Curaytor, RealScout, and Fello round out the tech stack for different needs. (If you're tightening your follow-up system, a simple lead qualification process will raise conversions fast.)

The qualifying questions that matter: What's your timeline? Have you been pre-approved? Do you need to sell a home first?

And here's the critical update for 2026: the NAR settlement means you must get a buyer representation agreement signed before the first showing. Build this into your conversion process. Practice the conversation. The agents who can smoothly transition from "let me help you" to "here's our agreement" will close at dramatically higher rates than those who fumble it.

Finding Buyer Leads Others Miss - The B2B Angle

Every agent is fighting over the same Zillow leads, the same Facebook ad clicks, the same open house sign-ins. The highest-ROI lead sources for the buy side? They're B2B relationships that most agents never think to build.

Think about who controls bulk buyer flow:

- Builders with unsold inventory need agents to bring buyers. A single relationship with a regional builder can generate 10-20 buyer transactions per year.

- Corporate relocation managers at companies with 500+ employees move dozens of families annually. One relocation director relationship is worth more than a year of Zillow spend.

- Real estate investors buying 5-15 properties per year need a go-to agent in every market they target.

- Mortgage brokers talk to pre-approved buyers every day. A referral partnership with two active loan officers can fill your pipeline permanently.

- Agents in feeder markets - if you're in Austin, the agent in San Francisco whose clients are relocating to Texas is your best friend.

43% of buyers select agents from referrals. These B2B relationships are how you become the referral.

For this kind of prospecting, you need a data tool - not a real estate lead platform. Prospeo is built for exactly this: search 300M+ professional profiles by industry, job title, and location to find verified contact data for builders, relocation directors, investor group principals, and mortgage company leaders. (If you want to compare options, start with email lookup tools or a dedicated B2B email lookup tool.) At ~$0.01/email on paid plans, the cost is negligible compared to any platform on this list. The free tier gives you 75 verified emails and 100 Chrome extension credits per month - enough to start building these relationships without spending a dollar. (For deliverability, run your list through an email verifier website before you send.)

One builder relationship that sends you 10 buyers per year at $400K average price = $96,800 in gross commission at 2.42%. That's more than most agents' entire annual GCI - from a single B2B contact.

The NAR settlement made speed-to-lead and trust-building critical. Prospeo's 7-day data refresh means you're reaching real buyers with verified emails and direct dials - not chasing fake numbers from shared lead platforms.

Stop competing for shared leads. Start reaching buyers directly.

FAQ

What's a good conversion rate for buyer leads?

Portal leads from Zillow and Realtor.com convert at 5-7%, with top teams reaching 9%. Facebook and Google ad leads average 1-3%. The biggest variable isn't the source - it's follow-up speed. Agents who respond within 5 minutes convert at 21x the rate of those who wait an hour.

How much should I spend on buyer leads per month?

New agents should budget $200-$500/month - enough for Market Leader or a low-competition Zillow ZIP. Solo agents closing consistently can scale to $500-$1,000/month. Teams typically spend $1,000-$3,000+. Target 10-20% of your gross commission income for lead generation annually.

Are buyer leads still worth it after the NAR settlement?

Yes. Buyer agent commissions rebounded to 2.42% by Q3 2025, with homes under $500K at 2.52% - the highest since 2023. The real change is the mandatory buyer representation agreement before showings. Update your scripts and consultation process, not your lead source.

What's the difference between exclusive and shared leads?

Exclusive leads (Market Leader, BoldLeads) go to one agent - higher conversion rates but higher CPL. Shared leads (Zillow) go to multiple agents - lower cost but you're racing to respond first. If you can't consistently reply within 5 minutes, pay more for exclusive leads.

Can B2B data tools help agents find buyer leads?

Yes - for a highly profitable angle most agents ignore. Tools like Prospeo help you find verified contact data for builders, investors, relocation companies, and referral partners who control bulk buyer flow. The free tier (75 emails/month) is enough to start building relationships with decision-makers who send 10-20 transactions per year.