The Best Tools for Insurance Lead Generation: What Actually Works in 2026

The average blended cost per lead for business insurance is $424. Four hundred and twenty-four dollars - for a name and a phone number that might not even pick up. Agents on Insurance Forums describe working vendor leads as "akin to simply random cold calling."

That's the state of insurance lead generation right now. You're either overpaying for leads that don't convert, or you're spending hours chasing people who never asked to hear from you. The tools below are the ones that actually move the needle - lead vendors, CRMs, B2B prospecting platforms, and DIY channels - with real pricing, real agent reviews, and honest conversion data so you can stop burning budget.

Our Picks (TL;DR)

If you don't read another word, here's where to start based on what you actually need:

| Tool | Best For | Starting Price | Verdict |

|---|---|---|---|

| Prospeo | Commercial prospecting | Free; ~$0.01/email | Best way to build your own pipeline of verified decision-makers |

| Hometown Quotes | Personal lines leads | ~$15-$35/lead | Only vendor agents consistently rate positively |

| AgencyZoom | CRM / follow-up | $149/mo | Insurance-specific automation with 35K+ users |

| NextGen Leads | Self-serve marketplace | ~$7.50-$20/lead | No minimums, dynamic bidding, flexible |

| Insureio | Budget CRM | $25/mo | Built-in quoting for 30+ carriers at a fraction of AgencyZoom's cost |

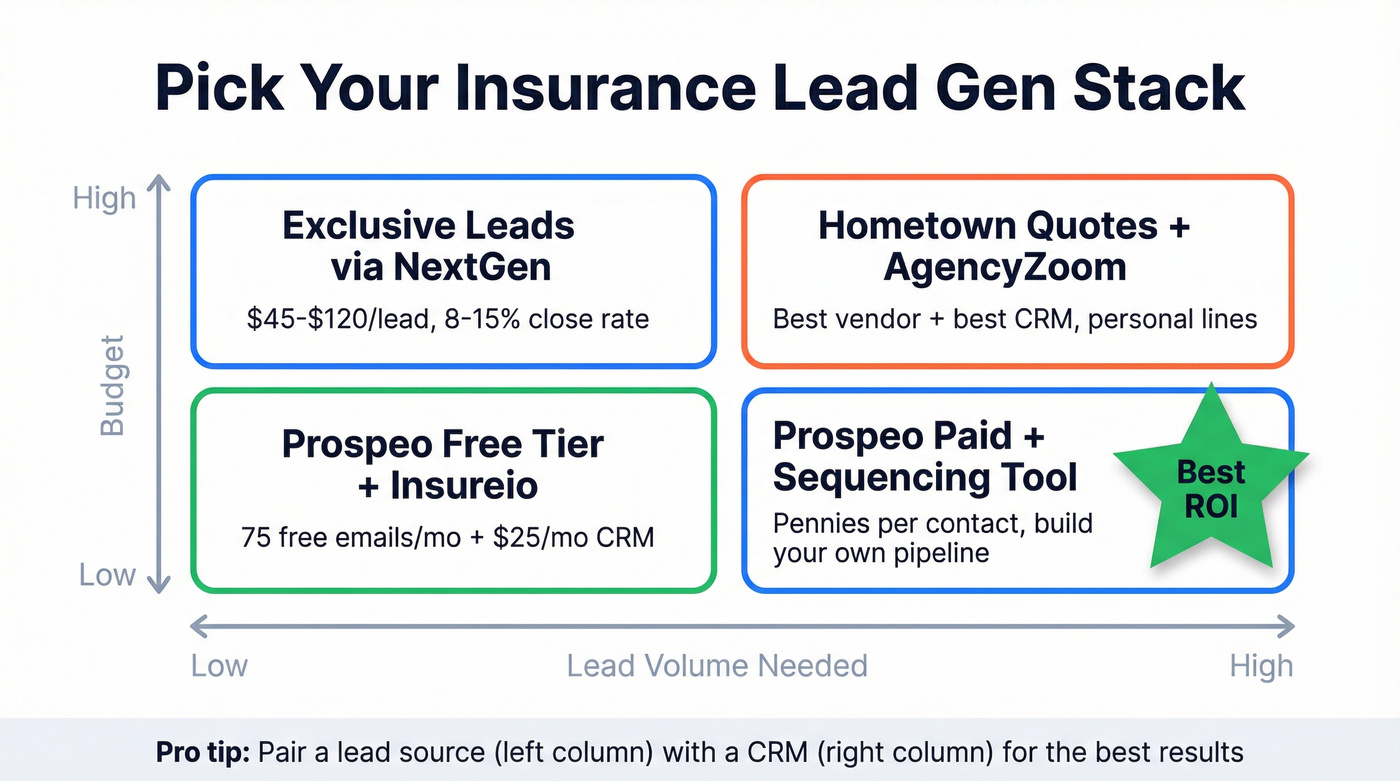

Here's the thing: no single tool solves insurance lead gen. The agents we've seen win are running two or three of these together - a prospecting tool or lead vendor feeding into a CRM with automated follow-up sequences. The tool stack matters more than any individual product.

What You're Actually Paying for Insurance Leads (Cost Benchmarks)

Before you evaluate any tool, you need to know what leads actually cost and what they actually convert:

| Lead Type | Cost Per Lead | Conversion Rate | Effective Cost Per Client |

|---|---|---|---|

| Aged lists (30-90+ days) | $0.50-$15 | 0.5-1.5% | $1,000-$3,000 |

| Shared web leads | $10-$45 | 2-5% | $200-$2,250 |

| Exclusive high-intent | $45-$120 | 8-15%+ | $300-$1,500 |

| Live transfers | $80-$200+ | Varies widely | $400-$2,000+ |

| Warm referrals | $0 (time cost) | 30-50%+ | Lowest |

The math is brutal for shared leads. You're paying $10-$45 per name, converting 2-5%, and competing with three to five other agents calling the same person. After factoring close rates in the 2-3% range, total acquisition cost per life insurance client can hit $2,000-$3,000.

Here's what most agents miss: the cheapest lead isn't the cheapest client. Exclusive leads cost 2-3x more upfront but convert at 3-5x the rate. A $100 exclusive lead that converts at 12% costs you ~$833 per client. A $20 shared lead that converts at 3% costs you ~$667 per client - but you're working five times as many leads to get there. Your time has a cost too.

The real winner? Building your own pipeline. When you're sourcing your own prospects - whether through Facebook ads at $6/lead or B2B prospecting platforms at ~$0.01/email - you control quality, exclusivity, and timing. That's the shift the smartest agencies are making.

Shared leads cost $20-$45 and convert at 3%. Prospeo lets you build exclusive prospect lists of business owners and HR directors for ~$0.01/email - with 98% accuracy and 125M+ verified mobile numbers. That's how agencies cut acquisition costs by 90% and stop competing with five other agents on the same lead.

Build your own insurance pipeline instead of renting someone else's.

The Best Lead Vendors for Insurance Agents

Hometown Quotes

Use this if: You want the most reliable vendor experience in personal lines. You're selling auto, home, renter, or life insurance and want leads that actually know they requested a quote.

Skip this if: You need commercial insurance leads or live transfers. Hometown Quotes doesn't play in those spaces.

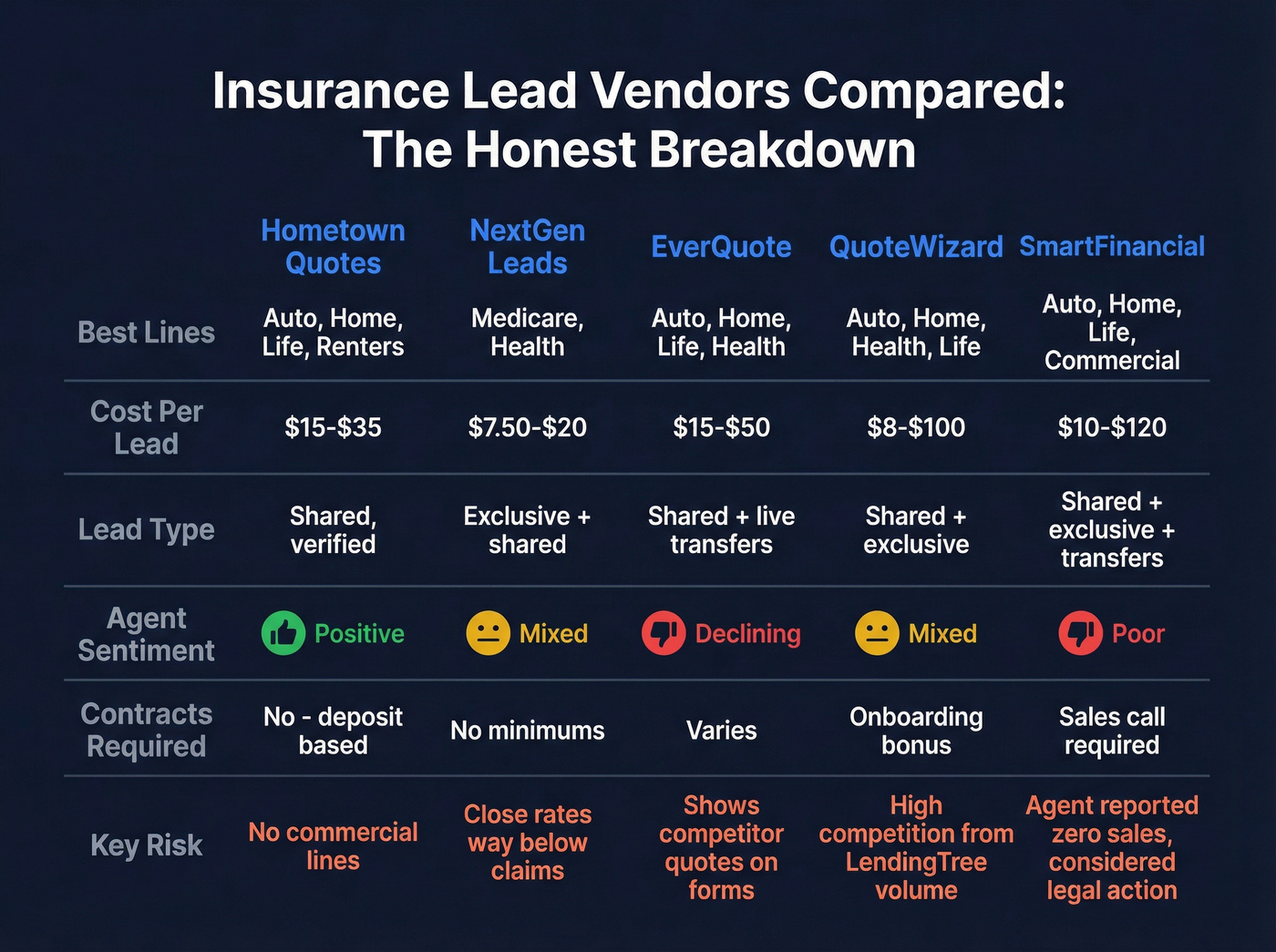

Hometown Quotes is the only lead vendor that consistently gets positive reviews from agents on Insurance Forums. One veteran agent rated them simply: "Solid leads all around." That's high praise in a space where most vendor threads read like horror stories.

They're LeadiD certified, which means every lead is verified as a real consumer action - not recycled data. Their onboarding deal is solid too: a 50% lead funds match up to $500 on your first deposit. Shared leads run roughly $15-$35 depending on line and geography.

The limitation is scope. This is a personal lines play. If you're writing commercial, group health, or anything B2B, you need a different tool entirely. But for P&C and life agents who want to buy leads without getting burned, Hometown Quotes is the safest bet in the market.

NextGen Leads

Use this if: You want full control over your lead spend with no minimums, no contracts, and the ability to adjust bidding in real time. Great for Medicare and health agents testing the waters.

Skip this if: You expect the close rates their reps promise. The gap between marketing and reality here is wide.

NextGen Leads runs a self-serve dashboard with dynamic bidding - you set your price, filters, and volume, and the platform delivers leads in real time. Exclusive Medicare data leads run about $10 on weekdays, $7.50 on weekends. No minimums, no long-term commitments. That flexibility is genuinely rare.

NextGen reps claim 10-40% close rates. Agents on Insurance Forums say "not even close to 10%." One veteran reported closing 25% during the beta period, then watching that drop to 1-2% once the platform went fully live. He tried eight to ten times over two years before walking away.

The platform's liberal return policy for invalid leads is a plus. And the self-serve model means you can test with $200 and see what happens before committing real budget. Just calibrate your expectations: if lead flow is slow, that's actually a good sign (better quality). A flood of leads usually means the filters are too loose.

EverQuote

Pros:

- Large-scale marketplace with real-time leads across auto, home, renters, life, and health

- Platform analytics and optimization tools are genuinely best-in-class among lead vendors

- CRM integrations make lead routing straightforward

Cons:

- Quality has been declining - a four-year user on Reddit reports noticeable drops

- Live transfers are "hot garbage" - seniors who don't want to talk, leads outside filter parameters

- EverQuote now shows Progressive, Direct, and Allstate quote links on their forms, so your "lead" has often already gotten a competitor quote before you call

- Estimated CPL: $15-$30 for shared auto/home, $25-$50 for life, $80-$150 for live transfers

EverQuote's analytics dashboard is the one thing agents consistently praise, even when they're frustrated with lead quality. If you're going to use them, lean into the data - optimize your filters aggressively and skip the live transfer program entirely.

QuoteWizard and SmartFinancial

These two get lumped together because they occupy similar territory: high-volume web leads across personal lines, with promotional pricing to get you in the door.

QuoteWizard is a LendingTree subsidiary, which means they've got serious SEM volume driving leads. They cover auto, home, renters, health, and life nationwide. The onboarding offer - up to $500 in bonus leads - is aggressive. Shared web leads run roughly $8-$25, exclusive leads $40-$100. The trade-off is that many leads are shared, and LendingTree's massive funnel means you're competing with volume, not precision.

SmartFinancial recently got added to State Farm's vendor list, which gives them some institutional credibility. They offer shared data leads, exclusive leads, and live-transfer calls across auto, home, life, health, and commercial lines. Pricing requires a sales conversation, but expect $10-$30 for shared data leads and $50-$120 for exclusive.

The warning sign: an agent on Insurance Forums - an attorney in Wisconsin - reported zero sales and almost zero quotes from SmartFinancial P&C leads. He described the leads as "people without any intent, often not knowing why we were calling" and considered litigation to recover his money. Test with a small budget before committing.

B2B Prospecting Tools for Commercial Insurance

Prospeo

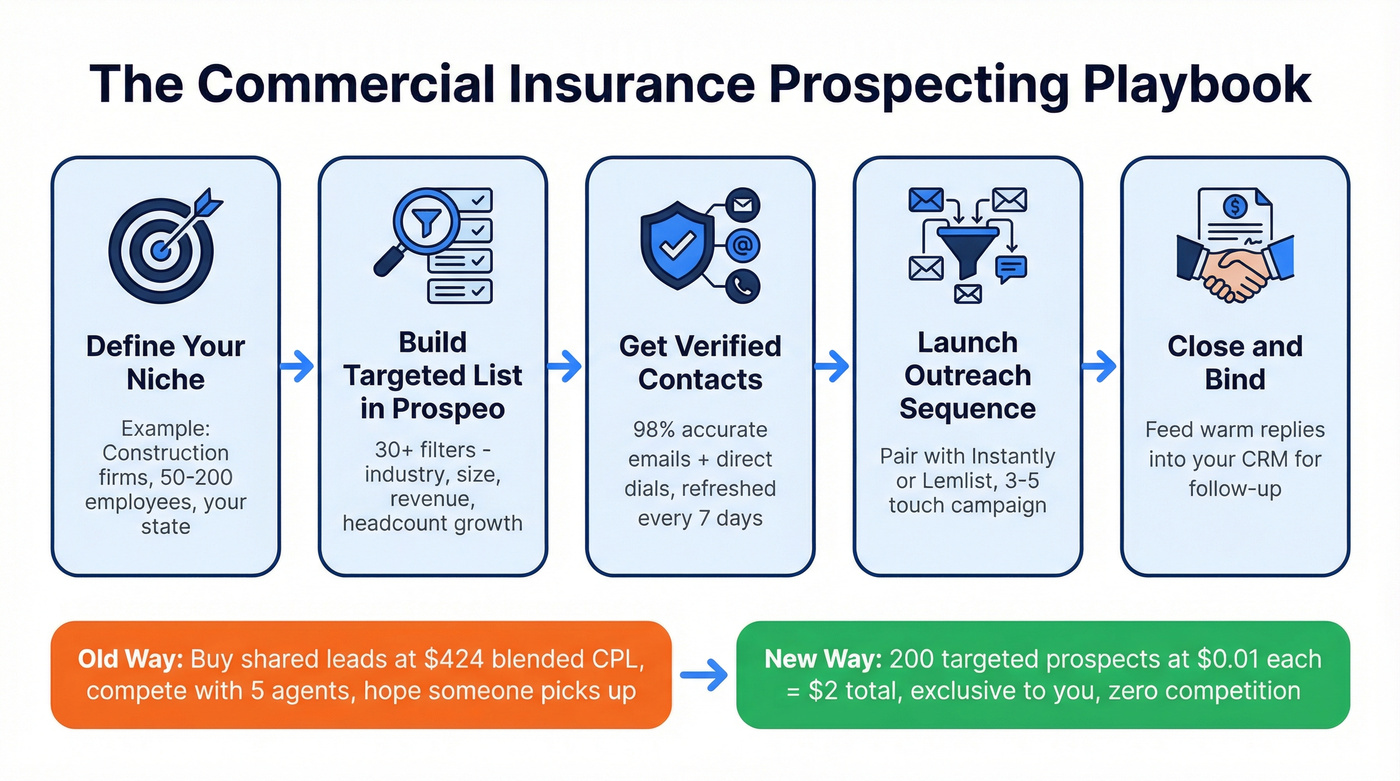

If you're writing commercial lines - BOP, workers' comp, group health, commercial auto - the personal lines lead vendors above won't help you. There's no "QuoteWizard for commercial insurance." The market doesn't work that way.

What does work: building targeted lists of business decision-makers and reaching out directly.

Prospeo's database covers 300M+ professional profiles with 143M+ verified emails (98% accuracy) and 125M+ verified mobile numbers. For a commercial insurance agent, that means you can search for CFOs, HR directors, and business owners at companies matching your ideal client profile - filtered by industry, company size, revenue, headcount growth, and 30+ other criteria.

The economics are hard to argue with. At roughly $0.01 per verified email, you're paying pennies compared to the $424 blended CPL for business insurance leads. Even if your outreach converts at just 2-3%, your cost per client drops dramatically because your input cost is nearly zero.

The platform refreshes data every 7 days (the industry average is 6 weeks), which matters when you're cold emailing - stale data means bounces, and bounces mean domain reputation damage. There are no contracts, no minimums, and a free tier with 75 emails per month to test before spending a dime.

We've seen agencies pair Prospeo with a sequencing tool like Instantly or Lemlist and build a commercial pipeline that outperforms any vendor lead program. The key is specificity: don't blast 10,000 generic business owners. Build a list of 200 construction companies in your state with 50-200 employees and pitch workers' comp savings. That's how commercial lines agents win.

Commercial insurance prospecting doesn't work with lead vendors. You need direct access to decision-makers - CFOs, business owners, HR leaders - with verified emails and direct dials. Prospeo's 300M+ profiles, 30+ filters, and 7-day data refresh give you fresher contacts than any aged list or shared lead marketplace.

Skip the $424 blended CPL. Source your own commercial leads for pennies.

Why Commercial Lines Agents Need a Different Approach

A Reddit practitioner put it perfectly: commercial insurance has "huge potential with low competition." Most agents are fighting over the same personal lines leads from the same vendors. Commercial is wide open - but it requires a fundamentally different playbook.

Personal lines lead vendors work because consumers actively search for quotes online. Commercial insurance doesn't work that way. A business owner isn't Googling "best commercial auto insurance" at 2 AM. You need to find them, build a case, and earn the conversation over multiple touchpoints.

Most insurance sales happen after 5-8 touchpoints. Agents who tightened their ICP - targeting specific industries, company sizes, and decision-maker titles - doubled their appointment-setting rates.

Twenty highly qualified leads outperform 200 random contacts every time.

This is where intent data changes the game. Instead of cold outreach to every business in your zip code, you can identify companies actively researching insurance-related topics - workers' comp, liability coverage, group health plans - and reach out while they're already thinking about what you sell. That's a fundamentally different conversation than a cold call.

CRMs and Follow-Up Automation

The best leads in the world are worthless if your follow-up is slow or inconsistent. Calling within 5 minutes increases contact rates by 500%. Most agents don't call within 5 hours.

AgencyZoom

Use this if: You're an independent agent or small agency that needs insurance-specific automation - prospecting sequences, AMS integration, renewal workflows, and Google Reviews management in one platform.

Skip this if: You're a solo agent watching every dollar. At $149-$349/month, AgencyZoom is an investment that makes sense once you've got consistent lead flow to automate.

AgencyZoom has 35,000+ users and is now owned by Vertafore, which gives it deep AMS integration that generic CRMs can't match. The Essential plan ($149/mo) covers prospecting automation, lead management, and AMS sync. Growth ($199/mo) adds two-way email and texting plus renewal automation. Pro ($349/mo) unlocks click-to-call, events automation, and their AgencyHR module. All plans include up to 7 users and come with a 14-day free trial. Annual billing saves 20%.

One agent on their site summed it up: "I can't live without this tool now. My agency has not only grown, we're thriving." The real value is pairing AgencyZoom with a lead source - whether that's Hometown Quotes, Facebook ads, or a B2B data platform for commercial - and letting the automated sequences handle the 5-8 touchpoints most agents drop after two.

Insureio

Pros:

- $25/mo - $25-$75/month - the most affordable insurance-specific CRM on the market

- Built-in quoting for 30+ carriers, e-signature, call scripting, and underwriting guides

- 30-day free trial on all plans

- Designed specifically for insurance agents, not adapted from a generic CRM

Cons:

- No mobile app - a real limitation for agents who work from the field

- The interface feels dated compared to AgencyZoom

- Limited automation compared to higher-priced options

Insureio is the right call for solo agents or small agencies on a budget. The Basic plan at $25/month gets you lead management and automated campaigns. The Marketing & Agency Management bundle at $75/month adds the full quoting engine and policy management. For agents just starting out who can't justify $149/month for AgencyZoom, Insureio gets the job done.

General-Purpose CRMs

If you're already embedded in HubSpot, Zoho, or Monday, you don't necessarily need an insurance-specific CRM. But know what you're giving up:

| CRM | Starting Price | Insurance Features | Best For |

|---|---|---|---|

| HubSpot | Free; full suite ~$103/mo | None built-in | Marketing-led agencies |

| Zoho CRM | Free; paid $16-$60/user/mo | None built-in | Solo agents on a budget |

| Monday CRM | $14-$32/user/mo | None built-in | Fast deployment teams |

These platforms lack AMS integrations, carrier quoting, and insurance-specific workflows. You'll spend time building what AgencyZoom and Insureio give you out of the box. That said, if your agency already runs on HubSpot and you've built custom pipelines, switching to an insurance CRM just for the label doesn't make sense.

DIY Lead Generation - Facebook Ads, SEO, and Referrals

The agents getting the best economics aren't buying leads at all. They're generating their own.

Facebook Ads: One agent on Reddit shared specific numbers - spending $600-$700/month on P&C leads at roughly $6/lead, with an average cost-to-write of $30 (about 5 leads per sale). That's dramatically cheaper than any vendor. The keys: use video (images attract "quote farmers"), sound as local as possible, and accept the special ad category restrictions that limit your targeting to a fixed mileage radius.

The commercial insurance space on Facebook has huge potential with low competition. Most agents are running the same auto/home ads. If you're targeting business owners in specific industries, you'll face far less competition for attention.

SEO and GEO: Organic channels produce lower CPL than paid across the board - $388 for business insurance organically vs $460 paid, per First Page Sage's benchmarks. The emerging channel is GEO (Generative Engine Optimization) - building your agency's presence in ChatGPT, Claude, Perplexity, and Google AI Mode. It's early, but agencies investing in helpful, specific content now will have an edge as AI-driven search grows.

Referrals: Word-of-mouth drives 20-50% of all buying decisions. Referrals convert at 30-50%+. Everyone knows this. The problem is they aren't scalable. You can't build a growth plan around "hope my clients tell their friends." Use referrals as your conversion floor, not your growth ceiling.

The smartest play? Combine channels. Run Facebook ads for personal lines volume, use a B2B data platform for targeted commercial outreach, feed everything into AgencyZoom, and build a referral program on top. That's a real lead generation system, not a vendor dependency.

AI Tools Changing Insurance Prospecting

AI is expected to lower insurance operating costs by 40%, and 9 out of 10 financial advisors believe AI can grow their book by 20% or more. But here's where the hype meets reality.

IntegrityCONNECT launched with impressive marketing - leads scored 0-100 based on conversion likelihood, real-time delivery, integration across 30+ lead systems. The pitch sounds great. The reviews from agents on Insurance Forums tell a different story: "among the worst leads" with the "lowest contact rate I have ever seen." Live transfers included people "looking for $3,000 in groceries" or who thought they were contacting Social Security. When agents asked about others' success, they were "met with silence."

I wouldn't recommend IntegrityCONNECT based on what practitioners are reporting. The concept of AI-scored leads is sound, but the execution isn't there yet.

Where AI actually helps today:

- Speed-to-lead automation: Tools like AgencyZoom trigger instant email/text sequences the moment a lead comes in. This matters - calling within 5 minutes increases contact rates by 500%.

- AI voice agents: CloudTalk starts at $19/user/month and can handle initial outbound call workflows, qualifying leads before they reach a human agent.

- Chatbots: Kenyt.AI ($50/month) handles website visitor qualification 24/7 - useful if your agency site gets traffic but you aren't staffed to respond instantly.

- Intent signals: Bombora-powered intent data tracks 15,000 topics, flagging businesses actively researching insurance. This is AI working behind the scenes to prioritize your outreach list - not replacing your prospecting process, but making it dramatically more efficient.

Look, no AI tool replaces a strong prospecting process. But AI that helps you call faster, prioritize better, and automate the repetitive follow-up? That's worth investing in right now.

Compliance You Can't Ignore - TCPA and the One-to-One Consent Update

The regulatory picture shifted significantly in 2025, and most agents haven't caught up.

The FCC proposed a one-to-one consent rule in December 2023 that would've required consumers to choose specific companies that could contact them - effectively killing the shared lead model. The insurance industry held its breath. Then the Eleventh Circuit Court vacated the rule entirely, finding the FCC exceeded its authority. By August 2025, the FCC formally reinstated the prior standard.

That's good news for agents buying shared leads. But don't get complacent - existing TCPA requirements still apply:

- Written consent with the consumer's signature

- Clear disclosure of who'll be calling and why

- DNC compliance - scrub your lists against the Do Not Call registry

- 5-year record keeping for all consent documentation

The bigger change most agents missed: stricter revocation rules took effect April 2025. Consumers can now revoke consent at any time, and you must honor that revocation within 10 business days. A "revocation-all" requirement - meaning one revocation applies to all companies, not just the one the consumer contacts - has been delayed until January 2027. Plan for it now.

For cold email outreach (commercial prospecting), CAN-SPAM compliance is your baseline: clear sender identification, physical address, and a working unsubscribe mechanism. This is table stakes, not optional.

Frequently Asked Questions

What's a good cost per lead for insurance?

Shared web leads run $10-$45, exclusive leads $45-$120, and live transfers $80-$200+. Business insurance blended CPL averages $424 per First Page Sage. After factoring close rates of 2-3%, total client acquisition cost for life insurance can reach $2,000-$3,000. DIY channels like Facebook ads can bring CPL down to $5-$15 for P&C.

Are shared or exclusive insurance leads better?

Exclusive leads cost 2-3x more but convert at 8-15% versus 2-5% for shared real-time leads. If your speed-to-lead is under 5 minutes, shared leads can still work because you're beating the other three to five agents to the call. Otherwise, exclusive is worth the premium.

How do I generate commercial insurance leads without buying from vendors?

Use a B2B data platform to build targeted lists of business decision-makers - CFOs, HR directors, owners - filtered by industry, company size, and buyer intent. Direct outreach with verified contact data typically converts better than shared vendor leads for commercial lines, at a fraction of the cost.

What CRM is best for insurance agents on a budget?

Insureio starts at $25/month with built-in quoting for 30+ carriers, e-signature, and automated campaigns - the most affordable insurance-specific CRM available. AgencyZoom ($149/month) is worth the upgrade once you have consistent lead flow, thanks to deep AMS integrations and 35,000+ users validating the platform.

Do AI tools actually help insurance agents generate leads?

AI helps most with follow-up speed and lead prioritization, not lead generation itself. Calling leads within 5 minutes increases contact rates by 500% - automation makes that possible at scale. Intent data platforms flag businesses actively researching insurance. But AI-scored lead products like IntegrityCONNECT have gotten poor agent reviews so far.