Clearbit vs Leadfeeder (2026): Which One Fits Your GTM Workflow?

If your pipeline depends on "who's showing intent," the Clearbit vs Leadfeeder decision comes down to a simple fork: do you want HubSpot-native enrichment and routing (Clearbit - now Breeze Intelligence) or do you want website-visitor company identification (Leadfeeder)?

Here's the thing: most teams don't need a giant all-in-one data platform. They need one clean signal source and a workflow reps won't ignore.

30-second verdict

Use Clearbit (Breeze Intelligence) if...

- You're HubSpot-first and want enrichment + form shortening + intent signals inside the CRM.

- You care more about cleaner records and routing than "who visited which page."

- You're fine with HubSpot Credits (usage-based, monthly reset).

Skip Breeze if...

- You hate credit systems where unused value evaporates monthly.

- You need a standalone tool the whole GTM stack can use without HubSpot as the center of gravity.

Use Leadfeeder if...

- Your core workflow starts with website traffic -> identified companies -> SDR follow-up.

- You want clearer pricing tied to identified companies/month (priced per website).

- You're selling into Europe and like the Dealfront ecosystem direction.

Skip Leadfeeder if...

- You're expecting person-level identity. Leadfeeder is company-level unless someone self-identifies (forms, chat, or identity passed through integrated email marketing clicks).

Skip both if...

- You mainly need verified, outreach-ready contacts (emails + mobiles) to actually run sequences. Tools like Prospeo are built for that "reachability" step.

Pick your scenario (fast chooser)

- "We're HubSpot-first and drowning in messy records." Pick Breeze.

- "We want SDRs working warm accounts from web traffic this week." Pick Leadfeeder.

- "We run multiple domains and want predictable spend." Pick Leadfeeder (then cap volume with ICP filters).

- "We're migrating off HubSpot in 6-12 months." Avoid Breeze; pick Leadfeeder or a standalone data stack.

- "We already have traffic signals; we just need reachability." Add verification before outreach.

Why this comparison is confusing in 2026 (Clearbit isn't the old Clearbit)

Clearbit used to be a "pick your modules" enrichment company with a bunch of beloved free utilities. In 2026, that mental model wastes time and creates the wrong expectations in procurement, implementation, and even basic "who owns this tool?" conversations.

Clearbit was acquired in December 2023, and what you're buying now is effectively Breeze Intelligence inside HubSpot. That's not automatically bad, but it changes the evaluation: you're buying into HubSpot's billing mechanics and admin model, and those choices show up later as workflow constraints, credit governance work, and portability costs if you ever move CRMs.

What changed (the stuff buyers trip on):

- Packaging: Clearbit functionality is now positioned as Breeze Intelligence inside HubSpot (data enrichment, form shortening, and buyer/visitor intent).

- Free tools are gone: Clearbit sunset its legacy free tools on April 30, 2026 (Free Clearbit Platform, Weekly Visitor Report, TAM Calculator, Clearbit Connect, free Slack integration).

- Developer expectations changed: If you built lightweight workflows around old endpoints and freebies, you're now in "migration + credits" land.

The practical takeaway: Leadfeeder is still "website visitor company ID." Breeze is "HubSpot-native enrichment + intent." They overlap in the word intent, but they don't behave the same in production.

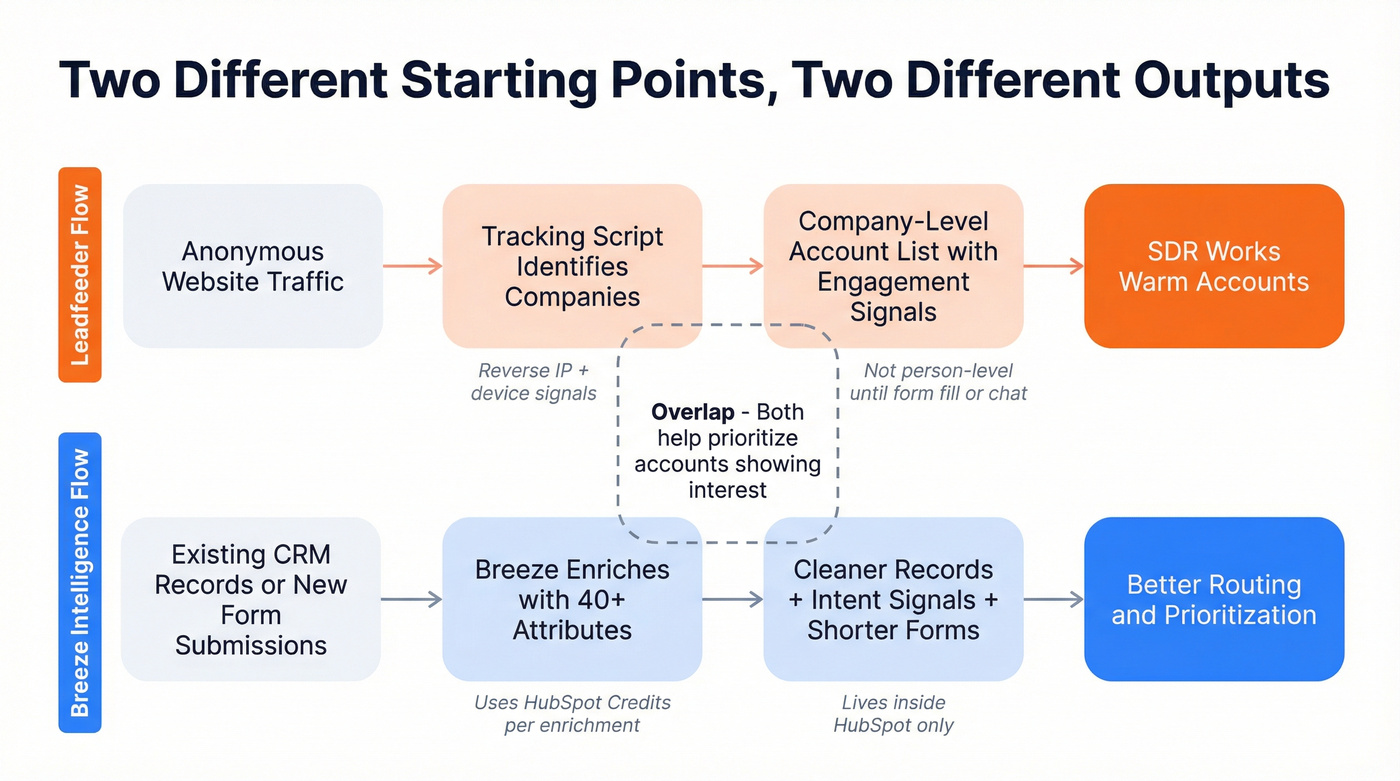

What each tool actually does (and where they overlap)

Leadfeeder output (what you get)

Leadfeeder's job is company-level visitor identification. You install a tracking script, and it turns anonymous sessions into a list of companies that visited, plus on-site activity and engagement signals.

Company-level isn't person-level.

Leadfeeder only gets to "who" after self-identification: a form fill, a chat, or identity passed through integrated email marketing clicks. That's why it works best for account-led motions: "These 30 target accounts were on our site this week - route to SDRs." If you’re building this motion, pair it with an account scoring model so reps don’t chase noise.

Breeze (Clearbit) output (what you get)

Breeze Intelligence is primarily an enrichment and conversion layer inside HubSpot:

- Enrich contacts/companies with 40+ attributes

- Shorten forms (reduce friction while still capturing useful fields)

- Add buyer/visitor intent signals that help with routing and prioritization

- Option to continuously refresh data

It's less "here are the companies on your site" and more "here's the context you need on the records you already have (or are about to create)." If your core pain is hygiene, use a CRM cleanup SOP like this: keep CRM data clean.

Overlap (and the misconception)

They overlap in one place: both can help you prioritize accounts showing interest.

But they're not substitutes:

- Leadfeeder starts with traffic and outputs accounts to work

- Breeze starts with records and outputs better records + better routing

Clearbit and Leadfeeder tell you who's interested. Neither gives you outreach-ready contact data. Prospeo delivers 98% accurate emails and 125M+ verified mobiles - the reachability layer both tools are missing.

Stop identifying accounts you can't actually reach.

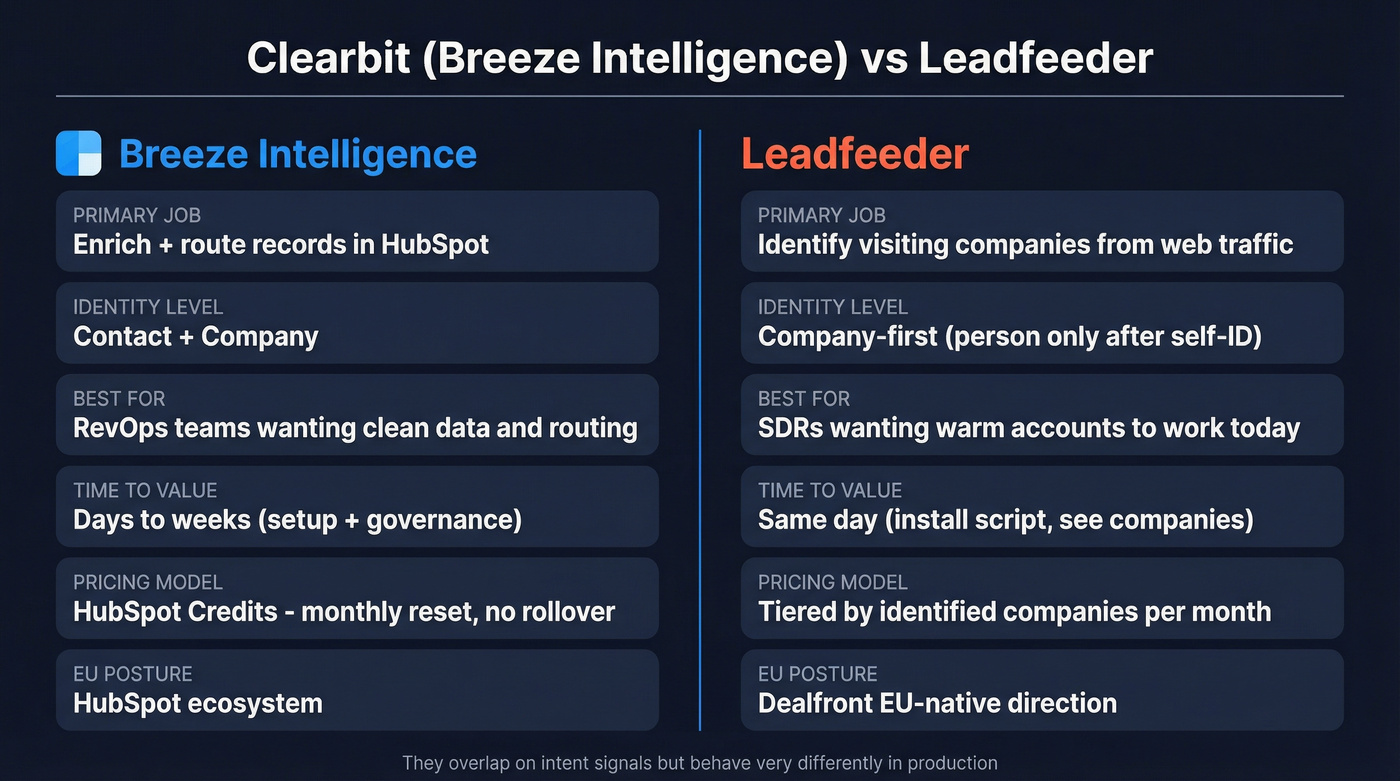

Clearbit vs Leadfeeder: side-by-side table

| Category | Breeze Intelligence (Clearbit) | Leadfeeder |

|---|---|---|

| Primary job | Enrich + route in HubSpot | Identify visiting companies |

| Best trigger | Form/CRM activity | Website visits |

| Identity level | Contact + company | Company-first |

| Primary buyer | RevOps | Sales/SDR lead |

| Time-to-value | Days-weeks | Same day |

| Sales output | Cleaner routing | "Accounts to work" |

| Data export/warehouse | HubSpot-centric | CRM integrations + API available |

| EU posture | HubSpot ecosystem | Dealfront's EU-native direction |

| Pricing model | HubSpot Credits | Companies/month tiers |

Ratings snapshot: Breeze/Clearbit 4.4 (628), Leadfeeder 4.3 (744). Leadfeeder's review base skews more SMB (76.8%), which matches what we've seen: smaller teams want fast "who's on our site" wins, while Breeze shows up more in mid-market ops stacks where enrichment and governance matter.

Winner by category (no "it depends")

- Pricing predictability winner: Leadfeeder

- CRM-native enrichment winner: Breeze

- Fastest time-to-value winner: Leadfeeder

- Governance/data hygiene winner: Breeze (and it helps to formalize data quality metrics so you can prove it)

Pricing in practice: Credits vs tiers

Pricing is where these tools feel totally different. Leadfeeder is a ladder. Breeze is a meter.

Leadfeeder tier ladder (identified companies/month)

Leadfeeder's pricing scales by identified companies per month (priced per website).

- Free: $0, unlimited users, last 7 days, 100 identified companies cap

- Paid (annual billing): $99 -> $1,199/mo depending on volume

- Up to 50: $99

- 51-100: $119

- 101-200: $143

- 201-400: $215

- 401-700: $299

- 701-1000: $329

- 1001-2000: $389

- 2001-3000: $419

- 3001-5000: $509

- 5001-10000: $719

- 10001-20000: $899

- 20001-40000: $1,199

One procurement nuance worth flagging: Leadfeeder's pricing page markets annual savings (30%), while Dealfront's help center references 40%.

The real gotcha isn't hidden fees. It's that your cost rises with traffic and identification success - so if marketing wins, your bill can too. Forecast it.

HubSpot Credits rules (Breeze)

Breeze Intelligence runs through HubSpot Credits, and this is where teams get surprised.

Included monthly credits (by highest HubSpot edition):

- Starter: 500

- Professional: 3,000

- Enterprise: 5,000

Rules that matter operationally:

- Credits reset monthly

- No rollover (unused credits vanish)

- If you buy additional credit packs, exceeding your limit can trigger automatic upgrades for the remainder of your contract (unless pay-as-you-go overages are enabled)

- Added packs typically only downgrade/cancel at the end of the commitment term

One more 2026 reality: HubSpot Credits can also be consumed by things beyond enrichment - like AI actions in workflows and Data Studio syncs (and other credit-gated features). That means your "Breeze budget" can get cannibalized by other teams unless you govern it.

Real talk: I don't love credit systems for enrichment. Usage isn't stable in a fast-moving GTM org, and the first time someone runs a big import on a Friday afternoon, you'll find out how "shared budgets" really work. If you want a deeper breakdown before procurement, see Clearbit pricing.

Pricing mechanics mini-table (what you're actually buying)

| Item | Metered on | Reset/rollover | Surprise risk |

|---|---|---|---|

| Leadfeeder | Companies/month | Monthly | Medium |

| Breeze | Credits usage | Reset, no roll | High |

What Breeze typically costs (realistic ranges)

HubSpot doesn't give a neat Breeze rate card, so set expectations like this:

- Typical small-team add-on: ~$1k-$5k/year

- Aggressive enrichment + intent at scale: ~$10k-$30k/year+

It varies by HubSpot edition, how many objects you enrich, and where credits get consumed (forms, workflows, imports, and other credit-based features).

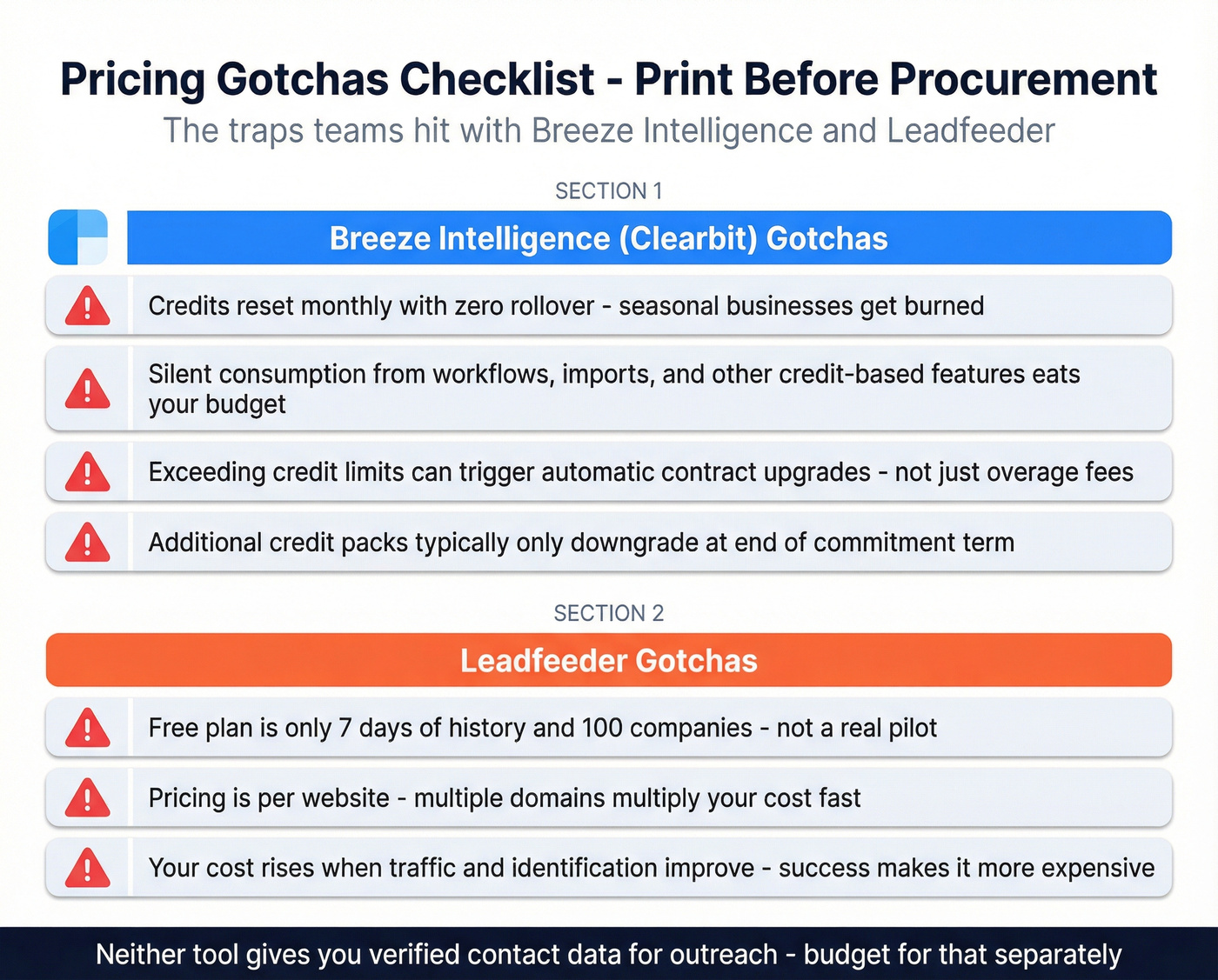

Pricing gotchas checklist (print this before procurement)

- Leadfeeder: Free plan is useful, but it's only 7 days of history and capped at 100 companies. Don't treat it like a real pilot.

- Leadfeeder: Pricing is per website. Multiple domains can multiply cost fast.

- Breeze: Credits don't roll over. Seasonal businesses hate this.

- Breeze: Watch for "silent consumption" via workflows and imports.

- Breeze: Auto-upgrade mechanics can turn a small overage into a contract-level commitment.

Identification & data quality reality check (and how to validate it)

Both tools live or die on identification quality, but they measure "good" differently.

Leadfeeder is blunt: there's no universal identification percentage because it varies by industry, traffic mix, and how many visitors are on corporate networks vs mobile/ISP connections. That's your warning label: validate with your own traffic, not a demo.

The most useful validation method (the one that matches ground truth) is simple: treat a match as accurate only when the identified company matches the domain of a work email submitted on a form. That gives you a clean way to score visitor ID without vibes, and it also exposes which channels are full of junk traffic.

4-step validation micro-playbook (steal this)

- Capture the form email domain (e.g.,

@acme.com) on every conversion. - Compare it to the identified company for that session/account.

- Score accuracy by channel (paid search vs organic vs partners vs retargeting).

- Route only High-confidence matches automatically; everything else becomes "marketing signal," not an SDR task.

Operational rules that keep these tools honest:

Do

- Treat visitor ID as a prioritization signal, not a fact.

- Use confidence tiers (High / Medium / Low) and only route High to SDRs automatically.

- Verify contactability before outreach. Company-level ID doesn't mean you have a reachable person. (If you need the SOP, use an email verification list workflow.)

Don't

- Don't promise sales "we'll know exactly who visited." You won't, unless they self-identify.

- Don't measure success by "accounts identified" alone. Measure ICP rate and pipeline influenced.

- Don't run aggressive outreach to low-confidence IDs. That's how you get "creepy tool" backlash internally.

We've tested this in a pretty normal scenario: a B2B SaaS site running paid search + retargeting, with a pricing page that gets a lot of student/research traffic. The visitor-ID tool "identified" plenty of companies, but the only segment that produced clean, repeatable SDR wins was High-confidence matches from partner referrals and branded search; everything else stayed useful as marketing signal, not a task queue.

Integrations & API constraints (RevOps + engineering view)

This is where the tools stop being "marketing software" and start being systems design.

Leadfeeder integration reality (concrete constraints)

- The product API rate limit is 100 requests/min.

- When you exceed it, you'll hit 429 Too Many Requests.

- If you're syncing visit signals into a warehouse or building routing logic, you need backoff/retry from day one. (This pairs well with a broader CRM integration for sales automation plan.)

Leadfeeder's IP Enrich API is a separate "data service" angle:

- ~200ms response time

- Daily database updates

- 100% uptime since 2021

- Supports IPv4 and IPv6

Pricing isn't public, so budget it like other enrichment APIs: ~$500-$2,000/mo for smaller usage, and ~$10k-$25k/year once it's embedded in product or high-volume routing.

One positioning you'll hear in demos: Leadfeeder emphasizes two-way CRM workflows. If your requirement is pushing visit signals into CRM and syncing dispositions back, don't accept a slide. Ask them to show the exact objects/fields, what happens on failures, and how duplicates are handled.

Breeze integration reality (what's true in production)

- Breeze is best when you can do routing and governance in HubSpot workflows (properties, lists, lifecycle stages, automation).

- Credit consumption can be triggered by forms, workflows, and imports, so "integration" decisions directly affect spend.

- Portability cost is real: if you move off HubSpot, a lot of Breeze's value collapses because the workflows, properties, and admin model are the product.

My recommendation is simple: if HubSpot's your system of record for the next 2-3 years, Breeze is a clean bet. If HubSpot's "for now," don't build a dependency you'll regret.

Implementation playbook: turning website intent into pipeline (without being creepy)

Company-level intent can be a pipeline cheat code, or it can be a spam cannon. The difference is process.

Step 1: Segment ICP accounts before you route anything

Start with a simple rule: only act on intent when the account is plausibly in your ICP.

- Define ICP filters: industry, employee range, region, tech stack, funding, revenue, etc. (If you need a quick refresher, use this ideal customer guide.)

- Create three buckets: ICP, near-ICP, not ICP

- Only ICP gets automated routing.

Guardrail: company-level isn't person-level. Your SDR task should say "Account showed interest," not "Jane visited pricing."

Step 2: Route with a reason to reach out

Route signals based on motion:

- SMB/high velocity: SDR follows up on ICP accounts with high engagement (pricing page, integrations, docs).

- Mid-market/enterprise: route to account owner and log as "intent touch" for multi-threading. (This is easier with an ABM multi-threading workflow.)

What works is a short internal template like: "Interest from {Company} on {topic/page cluster}. If you're already in convo, use it as a nudge. If not, send a soft opener + relevant resource."

Routing every visit as a task is how you train reps to ignore the whole system.

Step 3: Personalize with on-site intent (without being weird)

Good personalization is about relevance, not surveillance.

- Mention the problem space ("teams evaluating X usually care about Y")

- Offer a resource aligned to the page cluster (security doc, integration guide, ROI model)

- Keep it optional ("happy to send" / "worth a quick chat if helpful")

Avoid: "I saw you visited our pricing page at 2:14pm." That's how you get reported.

Step 4: Measure what matters

Track three metrics weekly:

- Match rate: identified companies / total sessions (by channel)

- ICP rate: ICP companies / identified companies

- Pipeline influenced: opportunities touched by intent within 14-30 days

I've run bake-offs where the "best" identification tool lost because the workflow spammed reps and nobody trusted it. Process beats provider. If you want a more formal model, use website visitor scoring to add decay and thresholds.

Contract & procurement gotchas (the stuff that causes regret)

This is the part nobody reads until it's too late.

Use Leadfeeder if...

- You want pricing you can explain to finance in one sentence.

- You're okay with annual terms and you'll calendar renewal dates.

Skip Leadfeeder if...

- You don't have procurement discipline. Annual cancellation needs to happen 30 days before renewal or you're paying again, and yes, I've seen teams miss it by a week and eat the renewal.

Use Breeze if...

- HubSpot's your system of record and you want enrichment/intent governed centrally.

- You can assign an admin to monitor credit consumption.

Skip Breeze if...

- You hate billing mechanics that can lock you into higher spend mid-term. Added credit packs typically only downgrade at the end of the commitment term, which is brutal if you overshoot once and then want to tighten up.

The "skip-both" move: add a reachability layer so intent doesn't die

If you're reading all of this and thinking, "Cool, but I still don't have verified emails or mobiles to actually run sequences," you're not alone. Visitor ID and enrichment are upstream signals; they don't automatically turn into deliverable outreach. If your bottleneck is bounces, start with a true email verifier website before you scale sending.

Tired of credit systems that reset monthly and bills that spike with traffic? Prospeo costs ~$0.01/email with no contracts. Enrich your CRM with 50+ data points at a 92% match rate - no HubSpot lock-in required.

Get enterprise-grade data without enterprise pricing or platform lock-in.

If you actually meant X: 8 quick alternatives

Tier 1 alternative (when the real need is outreach-ready contacts)

Prospeo (best for verified emails, mobiles, and fresh data you can activate)

If you’re evaluating options here, compare categories in our roundup of the B2B email lookup tool landscape.

Tier 2 alternatives (closest serious options)

Apollo (if you want outbound contacts + sequencing in one place) Apollo is the pick when your real need isn't visitor ID or HubSpot enrichment - it's building lists and running outbound. Expect a broad database, basic enrichment, and workflow features that reduce tool sprawl. Pricing typically lands around $49-$99/user/month for paid plans, with larger teams often ending up in the $5k-$25k/year range depending on seats and add-ons.

ZoomInfo (if you want the deepest enterprise dataset and can stomach the contract) ZoomInfo's still the heavyweight for large-scale B2B data, intent, and org charts, especially for enterprise sales teams that'll actually use the full platform. It's also the most procurement-heavy. Real-world pricing usually starts around $15k-$30k/year and can run $50k-$150k+/year for bigger deployments.

Leadinfo (if you're EU-focused and want visitor ID with a different UX) Leadinfo's a strong Leadfeeder-style alternative for website visitor identification, often favored by EU teams that want a straightforward "companies on your site" workflow and sales-friendly alerts. Expect pricing broadly similar to other visitor ID tools: roughly EUR69-EUR199/month for smaller packages, and EUR300-EUR1,000+/month as volume and features scale.

Tier 3 alternatives (narrower or more situational)

Lusha (if you mainly need quick contact data for SMB outbound) Lusha's a lightweight contact data tool that's easy for reps to adopt. It's not a visitor ID platform; it's a "get me emails/phones fast" tool. Typical pricing is about $39-$99/user/month, with team plans often landing $1k-$10k/year.

UpLead (if you want list building with simpler pricing than enterprise vendors) UpLead's a straightforward B2B leads database option for teams that want predictable packages and list exports. Expect pricing around $99-$399/month for common tiers, with annual plans often in the $1k-$5k/year range.

Lead Forensics (if you're enterprise and want a high-touch visitor ID program) Lead Forensics is positioned for larger orgs that want visitor identification plus a more managed, enterprise-style motion. It's typically custom/contracted, and a realistic budget is ~$12k-$60k+/year depending on traffic, features, and service level.

Visitor Queue (if you want a budget visitor-ID tool for small sites) Visitor Queue's a simpler visitor identification option that works well for smaller teams that want "companies visiting" without a big platform. Pricing commonly sits around $39-$249/month, with higher tiers for more volume and features.

FAQ

Is Clearbit still available, or is it Breeze Intelligence now?

Clearbit still exists as a brand, but in 2026 the product you're effectively buying is Breeze Intelligence inside HubSpot, with HubSpot packaging and HubSpot Credits billing. The practical call is whether you want HubSpot-native enrichment and routing, not a standalone subscription.

Can Leadfeeder or Clearbit tell me exactly who visited my website?

No. Expect company-level identification, not named people, unless a visitor self-identifies via a form, chat, or tracked click from an integrated email tool. In practice, a good setup routes only high-confidence account matches and treats everything else as a prioritization signal.

What happened to the Clearbit Logo API (logo.clearbit.com)?

The Clearbit Logo API was deprecated on Mar 18, 2026 and fully shut down on Dec 8, 2026, so requests fail after that date. HubSpot's migration path is to swap to logo.dev endpoints, which is usually a straightforward URL change.

What's the biggest pricing gotcha with Breeze/HubSpot Credits?

Credits reset monthly with no rollover, so unused value disappears and spend can spike when workflows/imports silently consume credits. A practical guardrail is to set a monthly credit budget, monitor usage weekly, and set overage rules before you scale.

If I use Leadfeeder or Breeze, what should I add for verified emails?

Prospeo's the clean add-on for activation: it provides verified emails at 98% accuracy plus 125M+ verified mobile numbers, and it refreshes data every 7 days. Most teams use it to turn "account interest" into "reachable decision-makers," then push contacts into their sequencer with fewer bounces.

Summary: which one should you pick?

If you're choosing between Clearbit vs Leadfeeder, anchor on your trigger and your system of record.

Pick Breeze when HubSpot's the center of gravity and you want enrichment, form shortening, and routing governed in one place. Pick Leadfeeder when your motion starts with website traffic and you want a clean list of accounts to work fast. And if the real bottleneck is reachability, add a verification layer so intent doesn't die in a spreadsheet.