What Is Account Development? The 2026 Guide (+ Data)

Beyond $100M ARR, expansion accounts for 67% of growth. Not new logos. Not inbound. Expansion. If you're asking what account development actually is, you're looking at the function that makes that number real - and most companies don't formalize it until they've already left millions on the table.

What You Need (Quick Version)

Account development is the strategic function of growing revenue within existing accounts. That's the dominant definition, and it's the one this guide focuses on.

But here's the wrinkle: some companies use the term to mean net-new prospecting into named accounts. If you're prepping for an ADR interview and aren't sure which version they mean, you're not alone. One sales rep on Reddit put it perfectly: "I thought account development is nurturing existing accounts to drive more revenue. But this interview is for net-new only." The term is genuinely ambiguous, and both interpretations are valid depending on the org.

Existing customers have a 60-70% purchase probability. New prospects sit at 5-20%. Account development is how you stop ignoring the easier money.

What Is Account Development? (The Real Definition)

Account development sits at the intersection of account management and sales - but it isn't either one. It's the deliberate, strategic effort to grow revenue within accounts you already serve. That means upselling, cross-selling, expanding into new departments, new geographies, and new use cases within a customer you've already won.

The confusion comes from the fact that this function means different things at different companies. At some orgs, it's a strategy - a cross-functional motion involving sales, customer success, and marketing, all focused on deepening existing relationships. At others, it's a role title: the Account Development Representative (ADR), who might be doing anything from geographic expansion within current clients to cold-calling net-new named accounts.

I've seen this confusion play out in hiring conversations more times than I can count. A candidate walks into an ADR interview expecting to work existing accounts and discovers the role is pure outbound into a target account list. Another candidate assumes it's cold prospecting and learns they'll be expanding a Fortune 500 relationship across APAC. The title tells you almost nothing without context.

Here's the thing: both interpretations share a common thread. Whether you're growing an existing account or pursuing a named target, the work is about depth over breadth. It's not spray-and-pray prospecting. It's strategic, multi-threaded engagement with specific accounts where you believe there's meaningful revenue potential.

Consider a company selling HR software to a Fortune 500's US operations. Account development is the motion that expands that footprint into their EMEA and APAC divisions - mapping new stakeholders, aligning to regional priorities, and building a business case that resonates with each geography's leadership. That's depth. That's strategic expansion in action.

For this guide, we'll focus primarily on the expansion-revenue definition - growing accounts you already have - because that's where the data says the real opportunity is. We'll cover the named-account prospecting angle where it's relevant, especially in the role breakdown.

Why Account Development Matters in 2026

The math on growing existing accounts has gotten impossible to ignore. Emergence Capital's Beyond Benchmarks report found that beyond $50M ARR, expansion accounts for 58% of growth. Beyond $100M ARR, that number jumps to 67%. At scale, your existing customers aren't just a retention problem - they're your primary growth engine.

Median net revenue retention (NRR) in B2B SaaS sits at 106%. Top-quartile companies exceed 120%. That means the best companies grow 20%+ annually just from their existing base - before a single new deal closes. Bottom-quartile companies? Below 95%, meaning they're shrinking from within even as they chase new logos.

The probability gap is staggering. Existing customers convert at 60-70%. New prospects? 5-20%. That's a 3-14x difference, and yet most sales orgs still allocate 80%+ of their resources to new acquisition.

AI-native companies in Emergence Capital's dataset demonstrate 4x faster growth and 21% higher retention than non-AI peers. They're using product usage data, intent signals, and automated account health scoring to identify expansion opportunities before a human even looks at the account.

Key benchmarks for 2026:

- Expansion = 58-67% of growth at scale

- Median NRR: 106% (top quartile: >120%)

- Existing customer purchase probability: 60-70%

- New prospect purchase probability: 5-20%

- Companies using product usage data report 15% higher retention

Real talk: if you don't have a formalized expansion function by the time you hit $10M ARR, you're leaving the most capital-efficient growth lever on the table. Account development programs typically deliver 3-5x ROI compared to pure new-logo acquisition. That's not a rounding error - it's a strategic gap.

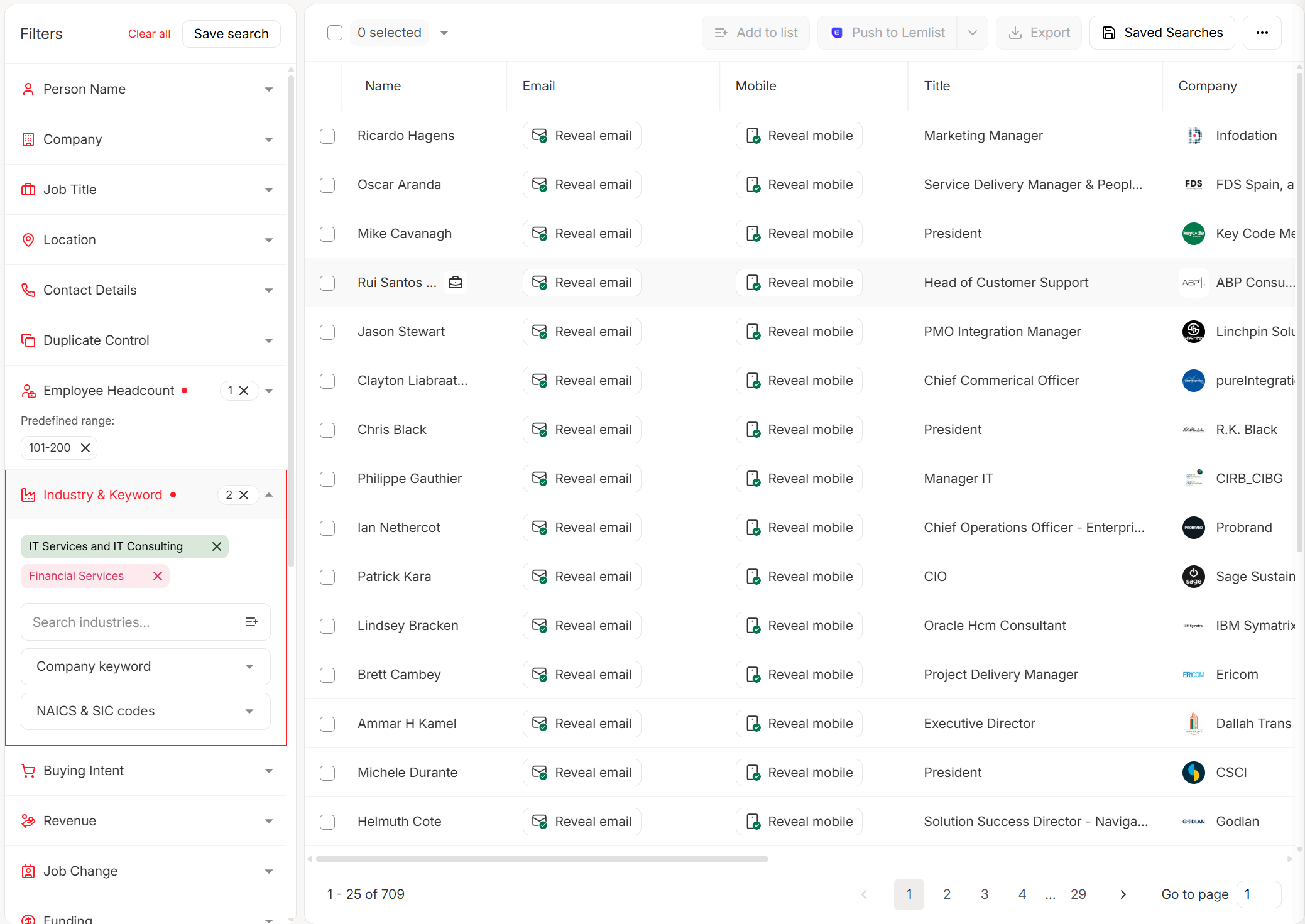

Account development runs on multi-threading - and multi-threading runs on accurate contact data. Prospeo gives you 300M+ profiles with 30+ filters to map new departments, geographies, and decision-makers inside your existing accounts. 98% email accuracy means your expansion outreach actually lands.

Stop leaving expansion revenue on the table because you can't find the right stakeholders.

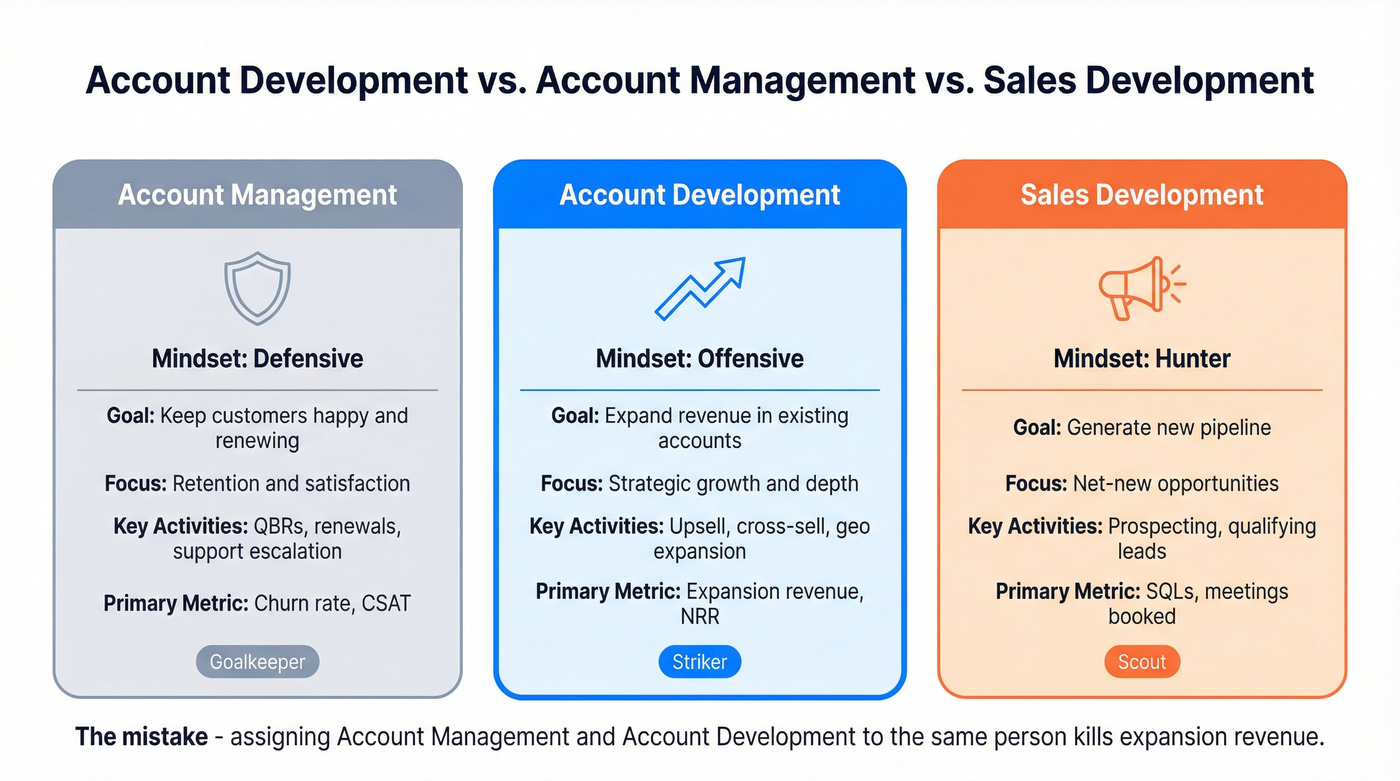

Account Development vs. Account Management vs. Sales Development

Most companies blur these three functions. That's the first problem.

| Function | Primary Focus | Goal | Key Activities |

|---|---|---|---|

| Account Management | Retention & satisfaction | Keep customers happy | QBRs, renewals, support |

| Account Development | Strategic growth | Expand revenue in accounts | Upsell, cross-sell, expand |

| Sales Development | New pipeline | Generate new opportunities | Prospecting, qualifying |

Account management is about maintaining relationships - making sure the customer renews, stays satisfied, and doesn't churn. It's defensive. The account manager is the liaison between the company and the client, and their primary metric is retention.

Account development is offensive. It takes a healthy account and asks: where else can we grow? New departments, new geographies, new products, new use cases. The account developer isn't just keeping the relationship warm - they're actively expanding it.

Sales development (SDRs, BDRs) is about net-new pipeline. They're prospecting into accounts that aren't customers yet. The overlap happens in account-based selling (ABS), where sales and marketing align around targeted, high-value accounts for personalized engagement.

The mistake most orgs make: they assign account management and account development to the same person, then wonder why expansion revenue is flat. Retention and growth require different mindsets, different skills, and different incentive structures. You wouldn't ask your goalkeeper to play striker. Stop asking your account managers to drive expansion.

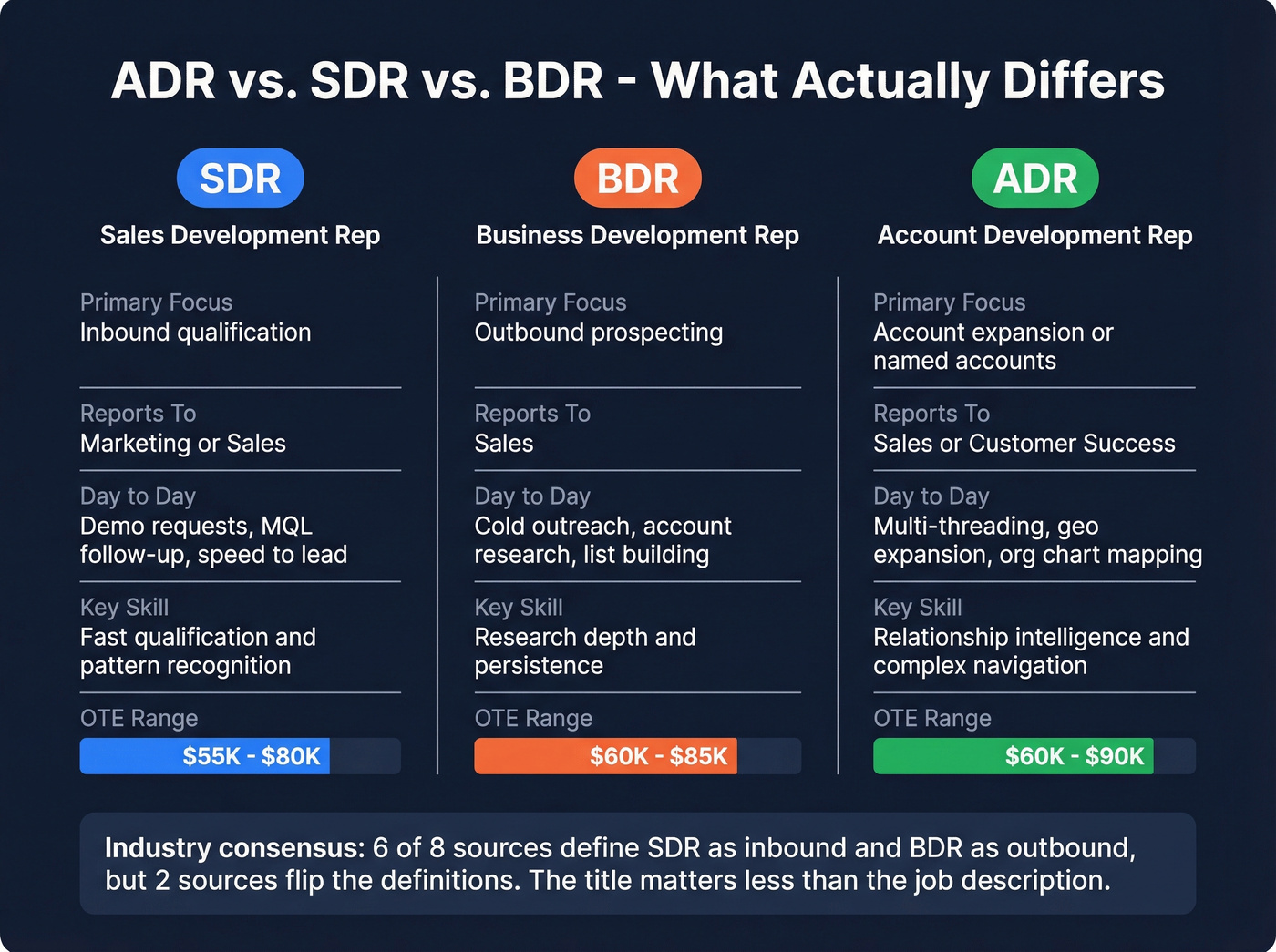

ADR vs. SDR vs. BDR - Role Breakdown

The title confusion in sales development is legendary.

| Role | Primary Focus | Reports To | Typical Activities | Salary Range (OTE) |

|---|---|---|---|---|

| SDR | Inbound qualification | Marketing or Sales | Demo requests, MQL follow-up | $55K-$80K |

| BDR | Outbound prospecting | Sales | Cold outreach, account research | $60K-$85K |

| ADR | Account expansion or named accounts | Sales or CS | Multi-thread, geo expansion | $60K-$90K |

Base salary ranges: SDRs typically earn $40K-$55K base, BDRs $42K-$58K, and ADRs $45K-$65K. The OTE figures above include variable compensation.

The industry consensus (6 out of 8 major sources) defines SDR as inbound and BDR as outbound. But two sources flip the definitions entirely. For companies under $50M ARR, the SDR and BDR roles are essentially interchangeable - the title matters less than the job description.

The ADR role is where it gets interesting. Some ADRs focus on expanding current accounts - reaching out to different international branches, new departments, or new business units within existing clients. This is "somewhat warmer than BDR work," as one practitioner described it, since the company already has a relationship. Other ADRs are essentially BDRs with a named account list, doing pure net-new outreach into strategic targets.

In the full lifecycle, SDRs/BDRs generate pipeline, AEs close, and ADRs take over post-sale to expand - creating a continuous revenue loop. Neither SDRs nor BDRs close business. They qualify and hand off to AEs. ADRs sometimes carry a small expansion quota, but the real closing still happens at the AE or account executive level.

AI is reshaping all three roles. Lead scoring, account research, and first-draft emails are now automated. The reps who thrive in 2026 spend less time on manual research and more time on actual conversations - discovery calls, multi-stakeholder engagement, and strategic account mapping.

The key skill difference: SDRs need fast qualification and pattern recognition. BDRs need research depth and persistence. ADRs need relationship intelligence and the ability to navigate complex org charts.

How to Build an Account Development Strategy

Expect 8-12 weeks to stand up an initial program. That's not a guess - it's the typical timeline for defining ICPs, tiering accounts, building plans, and getting the first outreach cadences running.

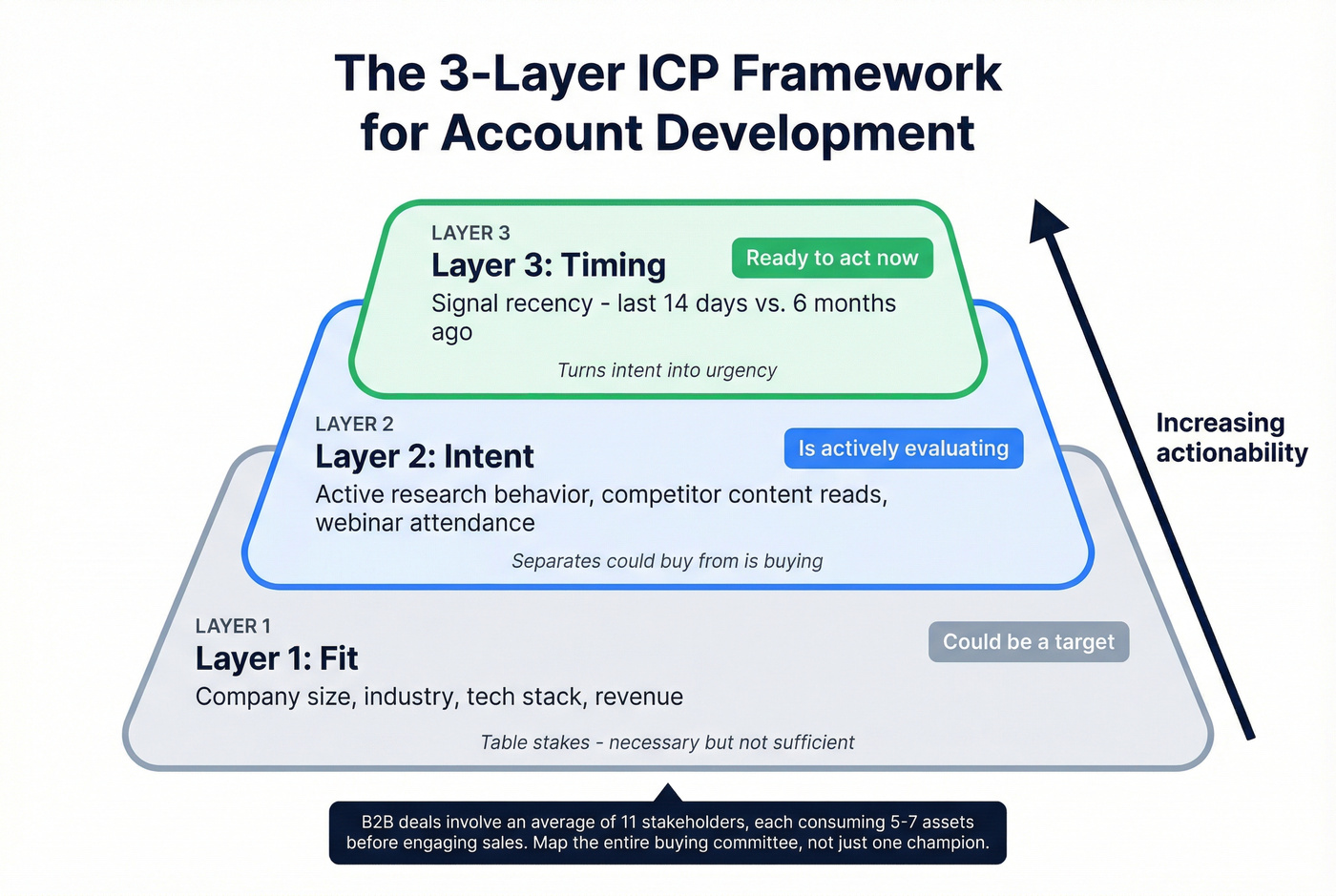

Define Your ICP with Fit, Intent, and Timing Layers

Your ICP for growing existing accounts isn't just firmographics. Modern targeting uses three data layers:

Fit - Firmographic and technographic data. Company size, industry, tech stack, revenue. Table stakes. It tells you whether an account could be a good expansion target.

Intent - Real-time signals showing active research behavior. Are they searching for solutions you offer? Reading competitor content? Attending relevant webinars? Intent data separates "could buy" from "is actively evaluating." (If you're building this layer, start with accounts in market intent data.)

Timing - Recency of signals. An intent spike from 6 months ago is noise. A surge in the last 14 days is actionable. Timing turns intent into urgency.

B2B deals now involve an average of 11 stakeholders, each consuming 5-7 assets before engaging sales. Your team can't just know the champion - they need to map the entire buying committee. That means you need a data enrichment tool that returns verified contacts across the org chart, not just the one person you already know.

Tier Your Accounts by Signal Strength

Not every account deserves the same level of effort. Tier them:

- Tier 1: Surging intent in the last 14 days, strong fit score, existing relationship. These get personalized, multi-threaded outreach. Coverage benchmark: 5+ engaged roles per account.

- Tier 2: Steady intent signals, good fit, but no urgency spike. These get programmatic nurture with periodic personal touches.

- Tier 3: Look-alikes with baseline interest. They match your ICP but haven't shown active buying signals. Awareness-level campaigns only.

The mistake I see constantly: teams treat every account like Tier 1. They burn out their reps writing custom research briefs for accounts that should be in an automated nurture track. Tiering isn't just strategy - it's resource allocation.

Target Clusters, Not Verticals

An enterprise fintech company targeted "banks." Seemed logical. They generated 178 MQLs, converted 2 to opportunities, and closed zero. The problem? Retail banks, investment banks, and commercial banks have completely different needs, buying processes, and decision-makers. "Banks" isn't a segment - it's a category containing multiple distinct markets.

The fix is cluster-based targeting. A cluster is a set of ICP accounts sharing the same use case and challenges, regardless of industry or tier. Instead of "banks," you'd target "mid-market financial institutions migrating from legacy payment rails" - a cluster defined by a specific job-to-be-done, a specific buyer persona, and a clear desired outcome.

To build clusters: export your closed-won deals, categorize by use case, analyze revenue metrics (ACV, LTV, win rate, sales cycle length), and build your program around the clusters with the best economics. AI can extract challenges from call transcripts and inquiry forms, but the manual mapping of challenges to use cases is still essential. Don't skip that step.

The 5-Step Account Planning Process

Account plans are the operational backbone of any expansion program. Without them, you're improvising.

Step 1: Build the Account Snapshot. Document everything: current revenue, key executives, existing relationship history, products in use, contract dates, and growth trajectory. Approach this with a "beginner's mind" - teams often keep focusing on the same strategies, same executives, same value props. Fresh eyes catch expansion opportunities that familiarity misses.

Step 2: Conduct a SWOT Analysis. This is an absolute home run when shared with executives at the account. It transforms the conversation from vendor-client to collaborative partners. Map your strengths and weaknesses within the account, opportunities for expansion, and threats (competitors, budget cuts, champion departure). Share it openly - it builds trust and surfaces information you'd never get from a standard QBR.

Step 3: Identify Key Initiatives. What is the customer trying to accomplish in the next 12-18 months? Not what you want to sell them - what they're actually working on. Digital transformation? Geographic expansion? Cost reduction? Your expansion opportunities live inside their strategic priorities, not yours.

Step 4: Map Relationships. Document every stakeholder: their role, influence level, sentiment toward your company, and relationships with each other. This is where most account plans fall short. You need to know not just who the decision-makers are, but who influences them, who blocks them, and who's quietly championing your solution internally.

Step 5: Build the Action Plan. Specific next steps, owners, timelines, and milestones. "Expand into EMEA" isn't an action plan. "Schedule intro call with EMEA VP of Ops by March 15, through your existing champion in NA" is.

For enterprise accounts, many teams layer MEDDICC qualification criteria into their account plans to ensure expansion opportunities are properly qualified before committing resources. If you're selling six-figure deals, this isn't optional.

The critical rule: account plans must be living documents, updated quarterly at minimum. Most sales account plans fail because they start as a checkbox exercise, get filled out once, and sit forgotten in a folder. Build account planning into your rhythm of business - not as a once-a-year chore. Sales, customer success, and marketing should all align around a single strategic document per account.

Account development programs without executive sponsorship die within two quarters. The CEO or CRO needs to own the NRR metric, not just the VP of Sales. If expansion revenue isn't on the board deck, it won't get the cross-functional support it requires.

Common Account Development Mistakes That Kill Growth

Mistake 1: Playing vending machine instead of advisor. The customer says "we need feature X." You deliver feature X. Repeat until they stop asking. This is order-taking, not strategic growth. Instead: extract the "what and why" behind every customer request. "Why do you need feature X? What problem are you solving? What happens if you don't solve it?" That's how you shift from vendor to trusted advisor - and trusted advisors get invited into expansion conversations.

Mistake 2: Inside-out thinking. Teams start account planning with what they want to sell, not what the customer needs. "We need to upsell the analytics module" is inside-out. "The customer's CEO just announced a data-driven decision-making initiative - our analytics module maps directly to that" is outside-in. Start with customer objectives. Always.

Mistake 3: Being reactive instead of proactive. Reactive teams encounter unwelcome surprises: a competitor gets invited to an RFP you didn't know about, a champion leaves and nobody noticed, a budget gets cut because you weren't tracking the customer's earnings calls. Proactive account development means anticipating trends, monitoring leadership changes, and tracking competitive actions before they become problems.

Mistake 4: Assuming everyone on your team understands the client. Your AE knows the champion. Your CSM knows the technical contact. Your marketing team knows the industry. Nobody has the full picture. Without structured account plans that document objectives, milestones, tactics, and action items, critical context lives in individual heads - and walks out the door when someone changes roles.

Mistake 5: Ignoring existing customers entirely.

This is the most expensive mistake. The conversion probability gap we covered earlier - 3-14x in favor of existing customers - makes this indefensible. Yet we've seen teams allocate 90%+ of their sales resources to new-logo acquisition while their install base quietly churns or stays flat. Every dollar spent on expansion dramatically outperforms a dollar spent on cold prospecting.

Hot take: If your average deal size is under $10K, you probably don't need a dedicated account development team. But you absolutely need an expansion motion - even if it's your CSMs running quarterly plays with a shared playbook. The companies that wait until $50M ARR to formalize this function have already left years of compounding growth on the table.

Account Development Tools and Software

You don't need a massive tech stack to run this well. You need three things: a CRM, clean data, and a planning framework.

| Tool | Category | Starting Price |

|---|---|---|

| HubSpot CRM | CRM | Free (paid ~$20/user/mo) |

| Salesforce | CRM | $25/user/mo |

| monday CRM | CRM | $10/user/mo |

| Prospeo | Data & Verification | Free (paid ~$0.01/email) |

| Clay | Workflow Automation | Free tier; paid from $149/mo |

CRM Platforms

HubSpot's free tier is the obvious starting point for teams under 20 reps. It covers contact management, deal tracking, and basic reporting without spending a dollar. Once you need custom objects, advanced workflows, or serious reporting, paid plans start around $20/user/month. Modern CRMs now use AI to flag at-risk accounts and predict expansion opportunities - features that were enterprise-only two years ago.

Salesforce is the enterprise standard at $25/user/month to start, though realistic enterprise deployments run $150-$300/user/month once you add the modules you actually need. If you're already on Salesforce, build your expansion workflows there - the ecosystem is unmatched.

monday CRM is underrated at $10/user/month. It's not as deep as Salesforce, but for teams that want visual pipeline management and cross-functional collaboration without the admin overhead, it punches above its weight.

For dedicated account planning software beyond spreadsheets, tools like Arpedio and Revegy offer visual relationship mapping and opportunity tracking - though most teams under 50 reps do fine with a CRM and structured templates.

Data Enrichment and Contact Verification

You can't develop accounts you can't reach. When you're trying to multi-thread across 11 stakeholders in a target account, bad contact data kills momentum faster than anything else.

Prospeo covers 300M+ professional profiles with 98% email accuracy and 125M+ verified mobile numbers. The 7-day data refresh cycle means you're not reaching out to people who changed jobs six weeks ago - a problem that plagues tools refreshing on the typical 6-week cycle. It integrates natively with Salesforce and HubSpot, so enrichment flows directly into your account records. The free tier gives you 75 verified emails per month to test, and paid plans start at roughly $0.01 per email with no contracts.

Workflow Automation and Intent Data

For intent data, you need to know which accounts are actively researching solutions you offer. Combine buyer intent signals (tracked across 15,000 topics via Bombora) with job change alerts and headcount growth signals, and you've got a real-time view of which accounts are ready for expansion conversations.

Clay handles workflow automation - chaining together data sources, enrichment steps, and outreach triggers in a single workflow. It's powerful but has a learning curve. Free tier available; paid plans from $149/month.

Skip Clay if your team is under five reps. The setup time won't pay off at that scale. A simple Zapier integration between your CRM and enrichment tool will cover 80% of what you need.

FAQ

Is account development the same as account management?

No. Account management focuses on retention and customer satisfaction - keeping existing clients happy and renewing contracts. Account development is the strategic function of growing revenue within those accounts through upselling, cross-selling, and expanding into new divisions. Think of management as defense and development as offense.

What does an account development representative (ADR) do?

An ADR identifies and pursues growth opportunities within existing accounts - reaching new stakeholders, expanding into new geographies, and qualifying expansion deals for account executives. Some companies use "ADR" for net-new prospecting into named accounts, so always clarify scope during interviews.

How is account development different from business development?

Business development focuses on new market opportunities, partnerships, and net-new pipeline creation. Account development focuses on deepening relationships within accounts you already serve. Business development looks outward for new markets; account development looks inward at your existing customer base for untapped revenue.

What tools do account development teams need in 2026?

At minimum: a CRM (HubSpot or Salesforce), a data enrichment platform for verified contacts across the buying committee, and an account planning framework. Prospeo's free tier (75 verified emails/month) is a strong starting point for teams building multi-threaded outreach into existing accounts without a large budget.

How do you measure account development success?

Track net revenue retention (NRR), expansion revenue as a percentage of total growth, account penetration (engaged stakeholders per account), and pipeline from existing accounts. Median B2B SaaS NRR is 106%; top-quartile companies exceed 120%, meaning they grow 20%+ annually from their base alone.

Expanding into EMEA? New department? Prospeo's intent data tracks 15,000 topics so you spot which accounts are actively researching your solution. Pair that with verified mobiles (30% pickup rate) and emails at $0.01 each to multi-thread every expansion opportunity.

Turn your 106% NRR into 120%+ with data that connects you to every buyer in the account.