How to Use Company Announcements for Sales Outreach That Actually Gets Replies

Cold email reply rates dropped from 6.8% to 5.8% in a single year - across 16.5 million emails. Stricter spam filters, inbox fatigue, and a flood of AI-generated templates have made generic sales outreach nearly worthless.

But response rates haven't declined when you reference company announcements that just happened.

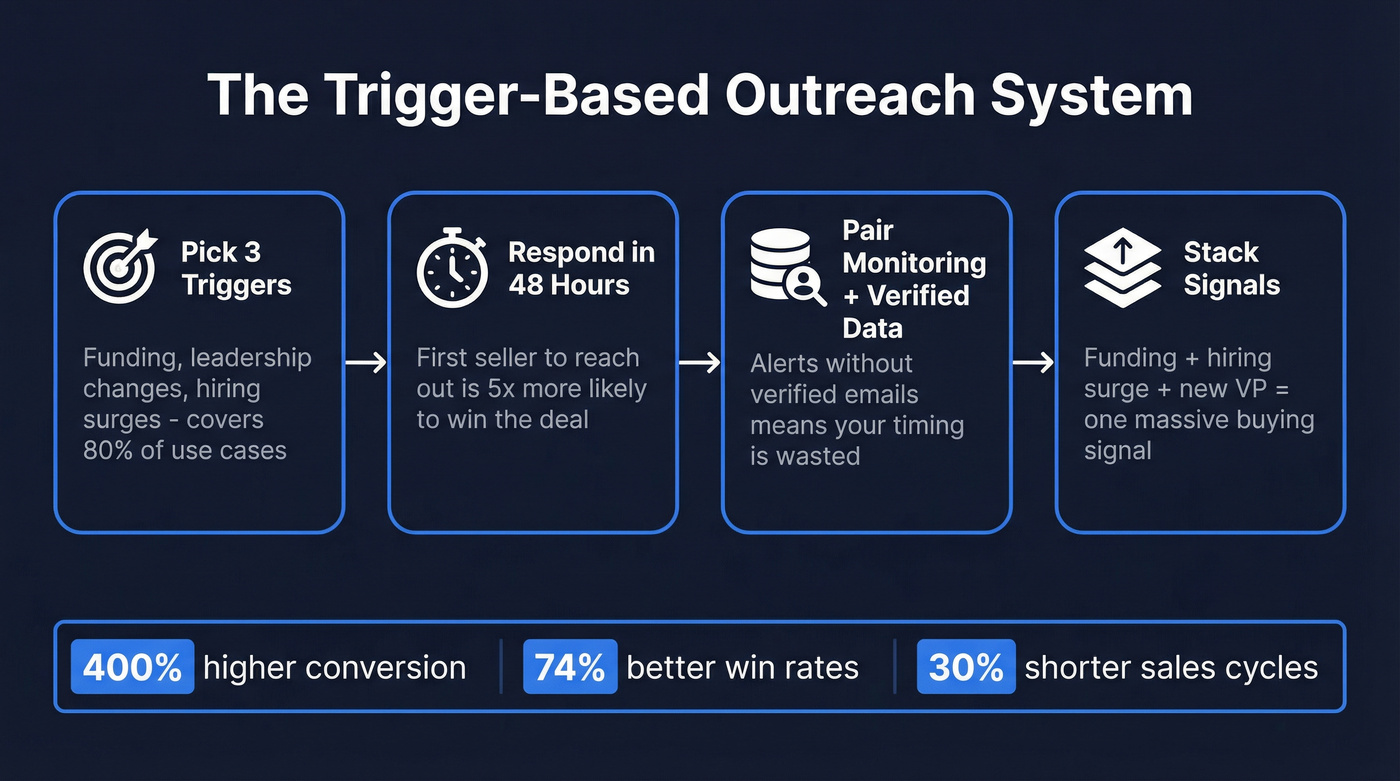

Companies using trigger events - funding rounds, leadership changes, hiring surges - see conversion rates jump by 400% compared to generic outreach. Win rates improve by up to 74% Sales cycles shrink by 30%. And the first seller to contact a decision-maker after a trigger event is 5x more likely to win the deal. This isn't marginal improvement. It's a completely different game.

The problem? Most sales teams know trigger-based outreach works but never build a system for it. They catch a funding announcement on Twitter, fire off a "congrats!" email with no substance, and wonder why it doesn't convert. Or they set up alerts but can't act within the window that matters - because they don't have verified contact data for the right person.

Most teams get the concept but never build the system. Here's the system.

What You Need (Quick Version)

If you're short on time, here's the framework:

- Pick 3 trigger types that match your ICP. Funding rounds, leadership changes, and hiring surges cover 80% of use cases. Don't try to monitor everything - you'll monitor nothing well. (If you need help defining it, start with your ICP.)

- Respond within 48 hours. The first seller to reach out is 5x more likely to win the deal. 78% of buyers choose the company that responds first Speed isn't a nice-to-have - it's the whole strategy. (More benchmarks: speed to lead metrics.)

- Pair a trigger monitoring tool with verified contact data. Even free Google Alerts work for monitoring. But if you can't find a verified email or direct dial for the right person, your perfectly timed outreach goes nowhere. Nail both layers. (See: business contacts.)

- Stack triggers for compounding signals. A funding round + a hiring surge + a new VP of Sales at the same company isn't three separate triggers - it's one massive buying signal. The teams that win aren't monitoring the most alerts; they're acting fastest on focused, stacked signals. (Related: buying signals.)

Which Company Announcements Actually Signal Buying Intent?

Not every announcement is a buying signal. A new office plant policy doesn't mean someone's evaluating vendors. The trick is knowing which announcements correlate with budget allocation, organizational change, or strategic shifts - the moments when companies actually spend money.

Sales intelligence platforms track 20+ trigger types, but most teams only need 3-5. Here are the ones that matter, grouped by signal strength:

Tier 1 - Strongest buying signals:

- Funding rounds - New capital means new initiatives, new hires, and new tool purchases. Series A through D all create windows, but the outreach angle shifts at each stage.

- Leadership changes - New executives are 10x more likely to bring in new vendors within their first 90 days. They're building their stack, proving their vision, and open to conversations their predecessor would've ignored. (More on timing and messaging: job change sales outreach.)

- Hiring surges - When a company posts 15 SDR roles in a month, they're scaling a function. Whatever tools and services support that function are suddenly in play.

Tier 2 - Strong signals with longer cycles:

- Expansion (new markets, new offices, international growth) - Signals budget and operational complexity.

- Product launches - New products need new go-to-market infrastructure.

- M&A activity - Mergers create chaos, tool consolidation, and new decision-makers. The cycle is longer but the deal sizes are bigger.

Tier 3 - Contextual signals (use for personalization, not as standalone triggers):

- Earnings reports - A great quarter means confidence and budget. A bad quarter means cost-cutting and efficiency tools.

- Awards and recognition - Useful for warm openers, less useful as standalone triggers.

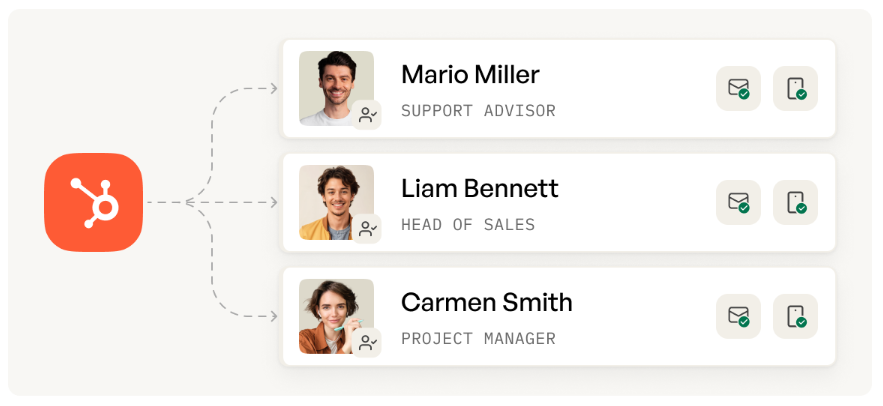

- Technology adoption - A company switching from Salesforce to HubSpot signals a broader stack overhaul.

- Competitive moves - Their competitor launched something? They're feeling pressure.

A practitioner on Reddit nailed the analogy: trigger-based outreach is "like applying for a job right when it's posted." You're not cold - you're contextually relevant. The announcement gives you permission to reach out and a reason to be heard.

Here's the thing: you don't need all 10 categories. If you sell to fast-growing startups, funding + hiring + leadership changes cover you. If you sell to enterprise, M&A + earnings + technology adoption are your signals. Pick your lane.

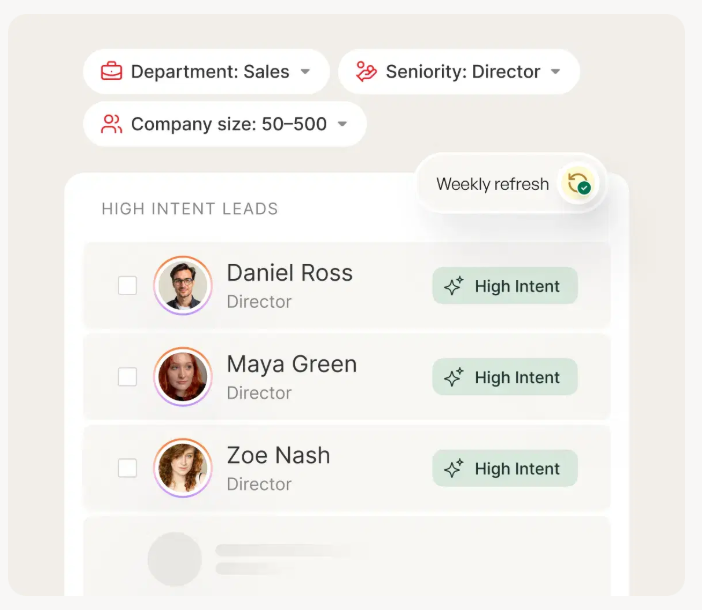

You found the funding announcement. You nailed the timing window. But without a verified email for the new VP, your trigger-based outreach dies on arrival. Prospeo gives you 300M+ profiles with 98% email accuracy and 125M+ verified mobiles - refreshed every 7 days so you're never reaching out to someone who left the company last month.

Be the first seller to reach the right person after every trigger event.

The Timing Playbook - When to Reach Out After Each Trigger Event

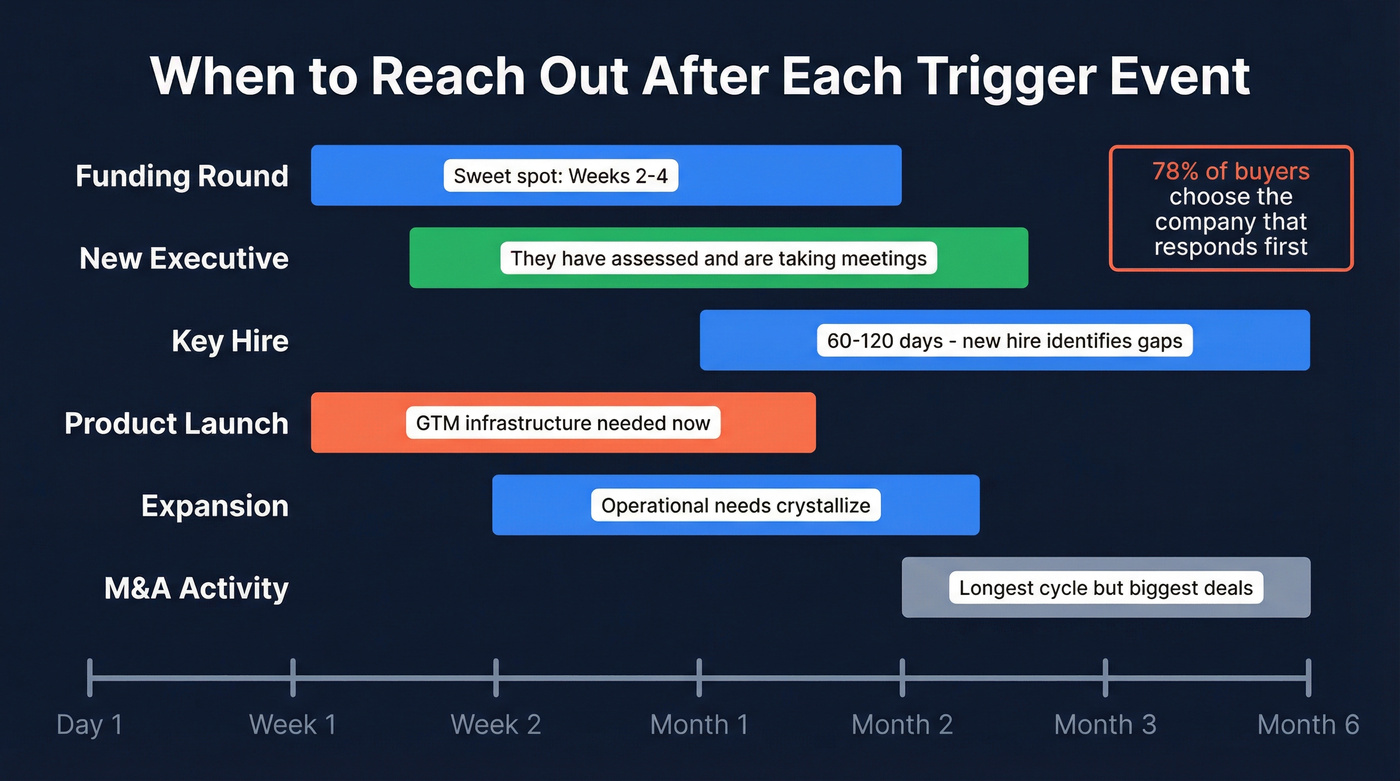

Knowing the trigger isn't enough. Reach out too early and the company hasn't processed the change yet. Too late and three competitors already have meetings booked.

The average B2B lead response time is 42 hours. Only 7% of companies achieve a 5-minute response time. Responding within 5 minutes makes you 100x more likely to convert than waiting 30 minutes. For trigger-based outreach, you're not competing against a 5-minute clock - but you are competing against every other seller who saw the same announcement. (More detail: average lead response time.)

Here's the timing window for each trigger type:

| Trigger Type | Optimal Window | Why This Window | Outreach Angle |

|---|---|---|---|

| Funding round | 2-8 weeks | Capital deployed, hiring starts | "How are you investing in [function]?" |

| New executive | 30-60 days | Settling in, evaluating stack | "Supporting your first 90 days" |

| Key hire | 60-120 days | New hire identifies gaps | "Tools to support your new [role]" |

| M&A activity | 3-6 months | Integration planning begins | "Consolidating [function] post-merger" |

| Earnings report | 1-2 weeks | Narrative is fresh, plans forming | "Capitalizing on [growth/efficiency]" |

| Employee departure | 2-4 weeks | Gap needs filling, processes shift | "Covering the gap in [function]" |

| Product launch | 2-4 weeks | GTM infrastructure needed | "Scaling [launch] distribution" |

| Expansion | 4-8 weeks | Operational needs crystallize | "Supporting your [market] expansion" |

Notice the range on each window. A funding round doesn't need a same-day email - the company is still doing press interviews and internal celebrations in week one. But by week 8, they've already talked to your competitors. The sweet spot is weeks 2-4 for most funding triggers.

New executive hires are different. Reaching out on day 3 feels like ambulance-chasing. Day 30-60 is when they've assessed the situation, identified what they want to change, and started taking meetings. That's your window.

78% of customers buy from the company that responds first. Between one-third and half of all sales are won simply by being first. Yet 55% of companies take more than five days to respond to leads. The bar is shockingly low.

Trigger Event Sales Email Templates - What to Write for Each Announcement

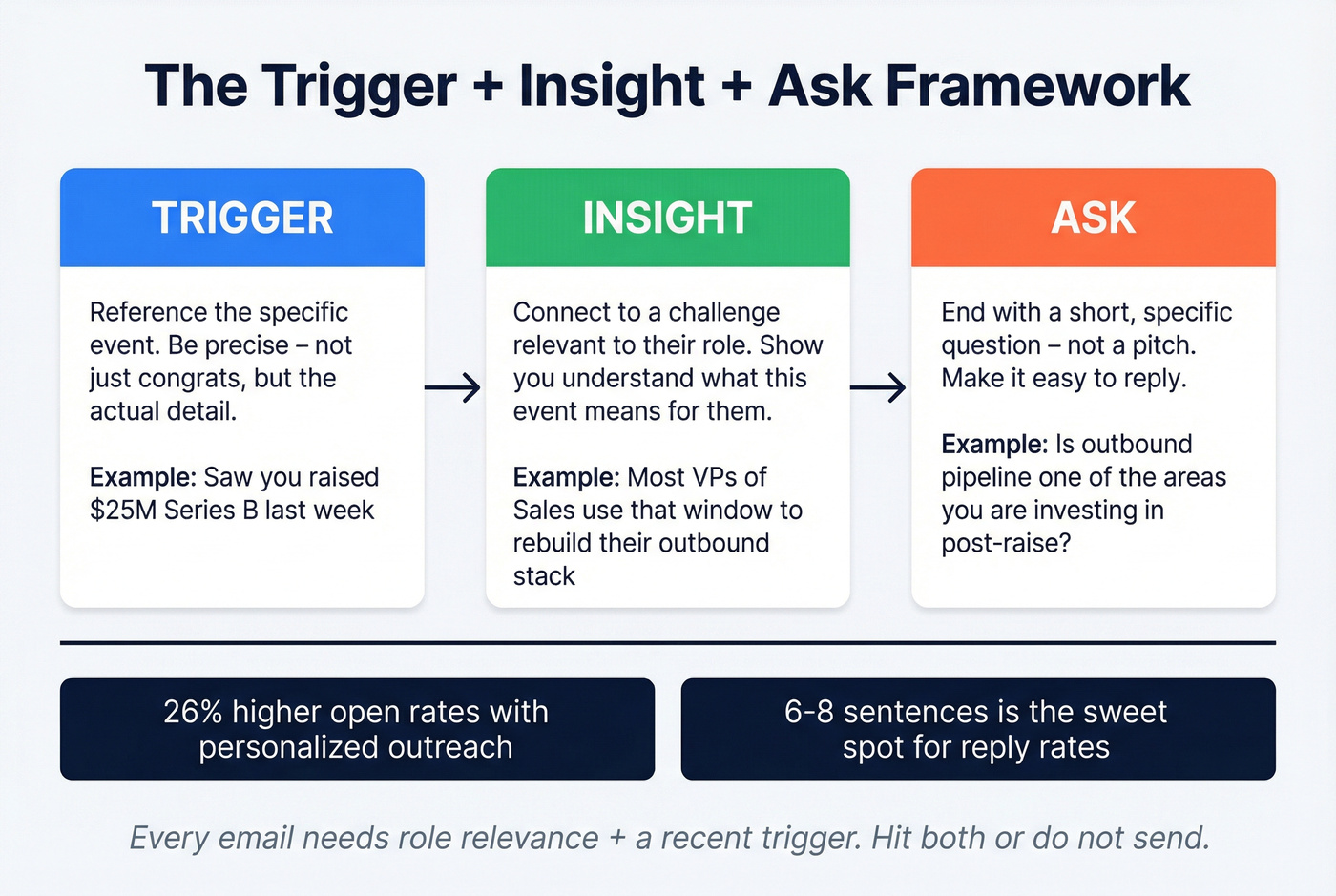

Templates are starting points, not scripts. The Trigger + Insight + Ask framework works for every trigger type: reference the specific event, connect it to a challenge relevant to their role, then ask a short question. Personalized cold outreach templates achieve 26% higher open rates than generic messages, and emails with 6-8 sentences get the best reply rates. Keep it under 200 words. (If you want to pressure-test your follow-ups, use these sales sequence best practices.)

The "Quick question about [Company]'s [recent event]" subject line format consistently outperforms generic alternatives - you'll see it in several templates below. (More options: cold email subject lines.)

One rule from pclub.io's 2-Point Personalization framework: every email needs (1) role relevance - what does this person care about because of their job? - and (2) a recent trigger - what changed that makes this outreach timely? Hit both or don't send. (Common pitfalls: AI cold email personalization mistakes.)

Funding Round

Subject: Quick question about [Company]'s Series [X]

[First Name],

Congrats on the [Series X] - [$ amount] is a serious round. Most [VP of Sales / CRO / Head of Marketing] teams I work with use that window to [scale outbound / rebuild their data stack / hire aggressively].

Curious: is [specific function, e.g., outbound pipeline] one of the areas you're investing in post-raise? We helped [similar company] [specific result] in a similar stage.

Worth a 15-minute call this week?

New Executive

Subject: Supporting your first 90 days at [Company]

[First Name],

Saw you joined [Company] as [Title] - welcome. The first 90 days usually mean evaluating what's working and what needs to change.

One thing [similar title] at [similar companies] tend to revisit early: [specific pain point your product solves]. We helped [reference company] [specific outcome] within their first quarter of using us.

Would it be useful to see how that could work at [Company]?

Hiring Surge

Subject: [Company]'s [department] is growing fast

[First Name],

Noticed [Company] posted [X] [role type] roles in the last month. That kind of growth usually means [specific operational challenge - e.g., "your existing tools are about to get stress-tested"].

We work with [similar companies] to [specific value prop] so new hires ramp faster. [Reference company] cut ramp time from [X] to [Y] weeks.

Is scaling [function] something you're actively solving for?

Product Launch

Subject: [Company]'s [product name] launch

[First Name],

Just saw [Company] launched [product name]. Getting a new product to market is the fun part - scaling distribution is where it gets hard.

We help [similar companies] [specific GTM outcome]. [Reference company] used us to [specific result] within [timeframe] of their launch.

Quick question: how are you planning to scale [product name]'s go-to-market?

M&A

Subject: [Company] + [Acquired Company] - quick thought

[First Name],

Mergers create a unique window where everything's on the table - tool consolidation, process alignment, new vendor evaluations.

Is [specific function] one of the areas you're re-evaluating as the integration takes shape? I've seen [similar companies] use the first 6 months post-acquisition to [specific outcome] - happy to share what worked.

Award or Recognition

Skip this one as a standalone trigger. It works best as a 3-sentence opener:

Subject: [Award name] - well deserved

[First Name], saw [Company] won [Award]. Teams that are winning at [that thing] tend to double down - we help [similar companies] [specific value prop that amplifies their strength]. Worth a quick call to explore how to keep the momentum going?

Five Personalization Mistakes That Kill Trigger-Based Outreach

Trigger-based outreach only works if the personalization is real. 81% of decision-makers engage when outreach is tailored to their company or context. But nearly 20% of cold emails get flagged as spam despite legitimate intent - often because the "personalization" is shallow or tone-deaf.

Here are the five mistakes I see most often:

1. Using only surface-level details. Mentioning someone's job title and company name isn't personalization - it's mail merge. Prospects spot it instantly. Fix: Reference the specific trigger event, the business context it creates, and why it matters for their role. "Congrats on the funding" is surface-level. "Series B usually means scaling outbound - are you rebuilding your data stack?" is personalized.

2. Personalizing the opener but not the offer. Starting with a relevant trigger reference and then pivoting to a generic pitch feels like bait-and-switch. Fix: The trigger should connect directly to your value prop. If you're referencing a hiring surge, your offer should relate to scaling, onboarding, or operational efficiency - not something unrelated.

3. Ignoring their current reality. Pitching growth hacks to a company that just announced layoffs is insensitive and immediately disqualifying. Fix: Check recent news before sending. A 30-second scan of their press page or news feed prevents embarrassing misreads.

4. Overdoing the flattery. "I'm SO impressed by your incredible journey at [Company]!" reads as fake and undermines your credibility. Fix: Be specific and genuine. One concrete observation beats three generic compliments.

5. Over-automating without human review. "Hi [First_Name], I noticed [Company_Name] recently [Trigger_Event]..." - placeholder errors destroy the message and your reputation. Fix: Always re-read before sending. Automation should handle monitoring and enrichment, not the final quality check. Even a 5-second scan catches the worst errors.

The Tool Stack - How to Monitor Trigger Events and Act on Them

Trigger-based outreach has two layers: (1) spotting the announcement, and (2) finding verified contact data for the right person. Most tools do one or the other. Very few do both well. (If you're building this as a repeatable motion, start with a modern B2B sales stack.)

Here's how it breaks down:

| Tool | What It Does | Best For | Price | Key Limitation |

|---|---|---|---|---|

| Google Alerts | Free news monitoring | Budget teams | Free | No contact data |

| Owler | Company news + alerts | Competitive intel | $39/mo (freemium) | Alerts can be broad |

| Crunchbase | Funding + company data | Funding triggers | $99/mo | Limited beyond funding |

| LinkedIn Sales Nav | Social selling signals | Relationship-first teams | $99-159/user/mo | No email/phone data |

| Apollo | Contacts + sequencing | All-in-one SMB | Free tier; $49+/user/mo | Data accuracy varies |

| Clay | Signal orchestration | GTM engineers | ~$149-800/mo (credits) | Learning curve |

| 6sense | Predictive ABM + intent | Enterprise ABM | $50K-120K/yr | 3-6 month onboarding |

| ZoomInfo | Database + signals | Large sales orgs | ~$15K+/yr | Expensive for SMBs |

Now let's break this down by budget:

Free Tier ($0/mo)

Google Alerts + Zapier handles basic trigger monitoring. Set alerts for "[Company name] funding," "[Company name] new hire," or industry-level terms. Zapier routes alerts to Slack or a spreadsheet. It's manual and imperfect, but it works.

For contact data, Prospeo's free tier gives you 75 verified emails per month. That's enough to act on 2-3 trigger events per week if you're targeting the right people. (If bounces are hurting you, follow an email verification list SOP.)

SMB ($50-200/mo)

Crunchbase at $99/mo is the gold standard for funding data - round details, investor info, company financials. Owler at $39/mo is better for competitive intelligence and real-time news alerts across a broader set of triggers. LinkedIn Sales Navigator ($99-159/user/mo) adds social selling signals and relationship mapping if your outreach leans heavily on social touches. Pick based on which triggers matter most to your ICP, then pair with a verified contact data tool for emails and direct dials.

Apollo's free tier adds sequencing capability if you don't already have a tool like Instantly or Lemlist. (If you're evaluating options, start with cold email outreach tools.)

Mid-Market ($200-1,000/mo)

Clay is the standout here. It hit $100M ARR in late 2025 and a $5B valuation in early 2026 - and it earned both. Clay consolidates 150+ data providers into a single orchestration layer, monitors buying signals from 3M+ companies, and triggers outreach based on funding rounds, new leadership hires, and product launches. OpenAI used Clay's waterfall enrichment to increase contact coverage from 40% to 80%.

The credit-based pricing can be frustrating - you're paying per lookup, and costs scale with volume. But for teams that need signal-based prospecting at scale, it's the best tool in the category.

Enterprise ($25K+/yr)

6sense ($50K-120K/yr) and Bombora (~$25K/yr) play in the intent data space. 6sense is the full ABM platform - predictive analytics, website deanonymization, built-in advertising. Worth knowing: Bombora is the underlying intent data source that powers many other platforms, including ZoomInfo's intent signals. (More on the model: intent signals.)

ZoomInfo (~$15K+/yr) or Cognism ($15K-30K/yr) handle the contact data layer at enterprise scale. ZoomInfo wins on US database depth; Cognism wins on EMEA compliance and phone-verified mobiles.

The Data Freshness Problem

Here's a stat that should scare you: 28% of B2B emails become invalid every year due to job changes and role shifts. That means if you spotted a perfect trigger event three months ago and are just now reaching out, there's a real chance the contact data you pulled is already stale. (Deep dive: B2B contact data decay.)

Trigger-based outreach only works if your contact data is fresh. Prospeo refreshes its 300M+ professional profiles every 7 days - compared to the 6-week industry average - and verifies emails at 98% accuracy. When you spot a funding round and need the new VP of Sales' email within hours, that refresh cycle is the difference between booking a meeting and bouncing. Pair it with 125M+ verified mobile numbers for the phone step of your sequence, and you've got both channels covered.

And relying on generic switchboard numbers instead of direct dials? That reduces connect rates by as much as 75%. Direct dials aren't optional for trigger-based outreach - they're the whole point. (More: B2B phone number.)

Building Your Trigger-Led Sales Sequence

A single email after a trigger event beats a generic sequence. But a multichannel trigger-led sequence built around a specific announcement beats everything. Multichannel outreach delivers 20% higher close rates and 25% shorter sales cycles compared to single-channel approaches.

Here's the 5-day sequence:

Day 1: Personalized Email Referencing the Trigger

Use one of the templates above. Send within 24-48 hours of the announcement. 80% of buyers prefer first contact via email - don't lead with a cold call.

Day 2: Social Touch

Engage with the announcement post directly. Like it, leave a thoughtful comment, or share it with your own take. LinkedIn outreach delivers double the response rate compared to cold email alone - making this social touch more than a warm-up. It creates a second touchpoint that doesn't feel like selling. (If you want a system here, see how to do social selling.)

Day 3: Follow-Up Email with Additional Insight

Don't just "bump" the first email. Add new value - a relevant case study, a data point about their industry, or a specific observation about how similar companies handled the same trigger. The first follow-up boosts reply rates by 49%. And here's the kicker: nearly half of all sales reps never send a second follow-up. Just sending this email puts you ahead of 50% of your competition.

Day 4: Direct Phone Call (Verified Mobile)

This is where most sequences fall apart. Reps either skip the call or dial a switchboard number and get routed to voicemail purgatory. Use verified mobile numbers - not the company switchboard - to reach the actual person. Reference the trigger and your previous emails: "I sent you a note about [trigger] - wanted to put a voice to it."

Day 5: Final Email - "Breakup" with Value-Add Resource

Close the loop with a resource that's genuinely useful regardless of whether they reply. A relevant benchmark report, a framework document, or a short video. This isn't a guilt trip - it's a final demonstration of value.

Trigger Stacking: The Compounding Effect

A single trigger is good. Multiple triggers on the same account are a compounded buying signal.

Picture this: a company raises a Series B, posts 3 SDR roles the following week, and a new VP of Sales starts the same month. That's not three separate triggers - it's one massive signal that this company is building an outbound engine and needs tools to support it.

When you stack triggers, your outreach becomes almost impossible to ignore: "I noticed [Company] closed your Series B, brought on [VP Name] to lead sales, and is hiring aggressively for SDRs. Sounds like you're building the outbound machine. We help teams like yours [specific value prop]."

Here's my hot take: if your average deal size is under $10K, you probably don't need a $50K intent data platform. Pick 3 triggers, use free or low-cost monitoring tools, and go deep rather than monitoring 15 signals poorly. The teams we've seen succeed aren't the ones with the most alerts - they're the ones who act fastest and most thoughtfully on a focused set of signals.

Putting It All Together: A Worked Example

Let's walk through exactly how this plays out.

Your ICP is mid-market SaaS companies scaling their sales teams. On Monday morning, you see on Crunchbase that Acme Software just closed a $30M Series B. You check their careers page - 8 new SDR roles posted in the last two weeks. You look up their team and find they hired a new VP of Sales three weeks ago.

That's three stacked triggers. This account goes to the top of your list.

You pull up the new VP of Sales' verified email and direct dial. Within 48 hours of the funding announcement, you send the funding round template: "Congrats on the $30M Series B. Most new VPs of Sales I work with use that window to rebuild their outbound data stack - especially when they're hiring 8 SDRs simultaneously. We helped [similar company] cut rep ramp time from 10 weeks to 4. Worth a 15-minute call?"

Day 2, you comment on the CEO's LinkedIn post about the raise - something substantive about their market, not "congrats!" Day 3, you follow up with a case study about a company at the same stage. Day 4, you call the VP directly on their mobile. Day 5, you send a breakup email with a relevant benchmark report on outbound team ramp times.

One account, five touches, every one relevant. That's how you book meetings in 2026.

Stacking triggers - funding + hiring surge + new exec - only works if you can act within 48 hours. Prospeo's 30+ search filters let you isolate companies by headcount growth, job changes, and intent signals, then pull verified direct dials and emails instantly. At $0.01 per email, speed-to-lead finally costs less than the deal you'd lose waiting.

Stop monitoring triggers you can't act on fast enough.

FAQ

What are the best company announcements to track for sales outreach?

Funding rounds, leadership changes, and hiring surges are the three highest-signal triggers for most B2B teams. New executives are 10x more likely to bring in new vendors within their first 90 days, making leadership changes especially valuable. Start with these three and expand only after you've built a consistent response workflow.

How quickly should I reach out after a trigger event?

Within 24-48 hours for high-value triggers like funding rounds and executive hires. The first seller to respond is 5x more likely to win the deal, and 78% of buyers choose the first company that reaches out. Yet 55% of companies take more than five days - speed alone puts you ahead of most competitors.

What tools do I need to act on company news fast?

Google Alerts (free) handles basic monitoring; Crunchbase ($99/mo) is best for funding data; Clay ($149+/mo) orchestrates signals at scale. Pair any monitoring tool with a verified contact data platform like Prospeo for emails and direct dials - its 7-day data refresh means contacts are current when you need them, not stale from months-old records.

How do I write a trigger event email that gets replies?

Follow the Trigger + Insight + Ask framework: reference the specific event, connect it to a challenge relevant to their role, then ask one short question. Keep it under 200 words and 6-8 sentences. The trigger must connect directly to your value proposition - otherwise it's just small talk with a subject line.

What reply rate should I expect from trigger-based outreach?

Trigger-based sequences typically achieve 12-25% reply rates, compared to the 5.8% cold email average. Teams combining trigger stacking with multichannel sequences (email + social + phone) consistently hit the higher end. Expect 30% shorter sales cycles as well, since you're reaching buyers when the need is already top of mind.