The Best Winmo Alternatives in 2026: Honest Picks With Real Pricing

You just got the Winmo renewal quote. $18,000 for five seats - and that's before the intent data add-on your VP wants. Meanwhile, half the team uses it as a glorified contact database, and the other half forgot their login. The ad intelligence features are useful for the two reps who actually work agency accounts, but you're paying enterprise pricing for what most of your team treats as a phone book.

If you're shopping for Winmo alternatives, you're not alone. Winmo's a solid product for a narrow use case - over half its G2 reviews come from marketing and advertising professionals, making it a niche tool serving a niche market. But at $14K-$65K/year with annual-only contracts and a 13-month average ROI timeline, a lot of teams are realizing they're overpaying for features they don't fully use.

Here are 10 options sorted by what you actually need, with real pricing for every single one.

Our Picks (TL;DR)

Best for verified contact data without the ad intelligence overhead: Prospeo. 300M+ profiles, 98% email accuracy, ~$0.01/lead. Free tier, no contract. If you're using Winmo as a contact database, this is where you save 90% immediately.

Best all-in-one for budget-conscious teams: Apollo.io. Data plus built-in email sequences and auto-dialer. Free plan available, $49/user/month to start. A 5-person team on Professional runs ~$7,140/year - less than half of Winmo's cheapest plan.

Best true Winmo replacement for ad sales teams: MediaRadar. Tracks ad placements across 30+ media channels, covers 5M+ brands. Average contract ~$37,400/year. The only tool on this list that actually competes with Winmo's core ad intelligence features.

What Winmo Actually Costs (And Why People Leave)

Winmo doesn't publish pricing. That's frustrating by itself - but when you reconstruct the numbers from contract data, the picture gets worse.

Here's what you're actually looking at:

- Core: $13,995+/year - 3 users max, research requests cost $150-$300 each

- Standard: $18,000-$22,000/year - 5 users, 8 research requests included, WinmoEdge alerts

- Explorer: $25,000-$40,000+/year - 10 users, 20 research requests, premium integrations

- Enterprise: $40,000-$65,000+/year - unlimited users and research requests

Then there are the add-ons. Media Insights runs $8,000-$12,000. Intent Data is $15,000-$25,000. Outreach Tools add $5,000-$8,000. Additional users cost $2,500-$3,500 each. A fully loaded Enterprise contract can easily clear $80K.

No monthly option. Annual contracts only. And the average discount is just 9%.

Winmo carries a 4.4/5 on G2 across 423 reviews, and WinmoEdge predictions claim 75% accuracy 3-18 months out - a legitimately impressive feature for ad sales teams who actively work those leads. One TrustRadius reviewer noted they'd "gotten a lead from Winmo that turned into closed sales and more than paid for the annual subscription." The ROI is real for the right team.

But the complaints tell a consistent story too. One reviewer put it bluntly: "We have not seen a financial return on investment." Another said they "had to spend time and money customizing this for it to work, which resulted in a negative impact on ROI." The specific pain points keep repeating: information is buried in the interface, contacts are occasionally outdated (the database runs on a 60-day verification cycle), CRM integration feels limited despite recent improvements, and the learning curve is steep. Reviewers note that the platform has "too many options" with information scattered across multiple places.

Here's the thing: if your team isn't actively using WinmoEdge predictions and brand-agency mapping on a weekly basis, you're paying $14K+ for a $500/year problem. Most teams we've talked to use about 30% of Winmo's features - and that 30% is almost always the contact data.

Most teams use Winmo as a $14K phone book. Prospeo gives you 300M+ profiles with 98% email accuracy, 125M+ verified mobiles, and a 7-day refresh cycle - all at ~$0.01 per lead with no annual contract.

Stop overpaying for 30% of a tool. Start free today.

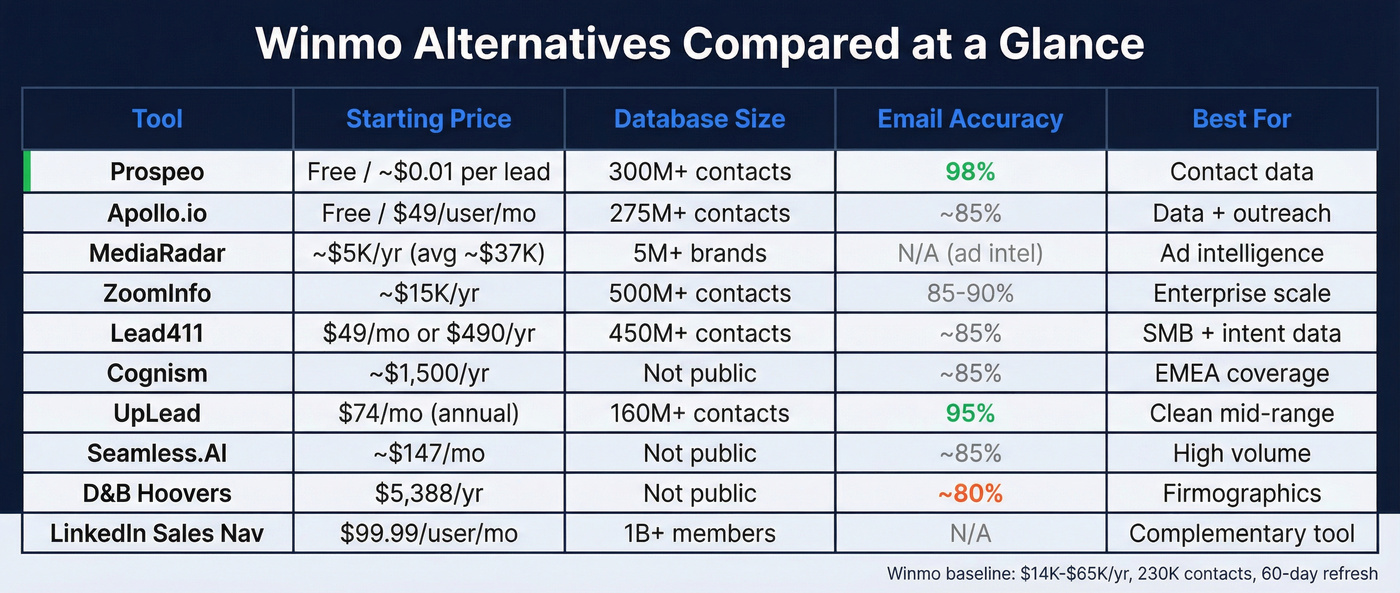

Winmo Competitors Compared at a Glance

Before the individual reviews, here's everything side by side.

| Tool | Starting Price | Database Size | Email Accuracy | Best For |

|---|---|---|---|---|

| Apollo.io | Free / $49/user/mo | 275M+ contacts | ~85% | Data + outreach |

| MediaRadar | ~$5K/yr (avg ~$37K) | 5M+ brands | N/A (ad intel) | Ad intelligence |

| ZoomInfo | ~$15K/yr | 500M+ contacts | 85-90% | Enterprise scale |

| Lead411 | $49/mo | 450M+ contacts | ~85% | SMB + intent |

| Cognism | ~$1,500/yr | Not public | ~85% | EMEA coverage |

| UpLead | $74/mo (annual) | 160M+ contacts | 95% | Clean mid-range |

| Seamless.AI | ~$147/mo | Not public | ~85% | High-volume |

| D&B Hoovers | $5,388/yr | Not public | ~80% | Firmographics |

| Sales Nav | $99.99/user/mo | 1B+ members | N/A | Complementary |

We excluded CRM tools (Nimble, HubSpot) and pure outreach platforms (Outreach, Gong) since they solve different problems than Winmo.

The Best Tools to Replace Winmo in 2026

Prospeo

Use this if: You're paying $14K+/year for Winmo but really just using the contact database.

Prospeo's database covers 300M+ professional profiles with 98% verified email accuracy and 125M+ verified mobile numbers that hit a 30% pickup rate. Compare that to Winmo's 230K hand-verified contacts on a 60-day refresh cycle - Prospeo refreshes every 7 days.

The search filters go deep: 30+ options including Bombora intent data across 15,000 topics, technographics, job changes, headcount growth, funding signals, and department-level headcount. The Chrome extension has 40K+ users and works across company websites, professional profiles, and CRMs. CRM enrichment returns 50+ data points per contact at a 92% match rate.

Real results: Snyk moved their 50-person AE team to Prospeo and watched bounce rates drop from 35-40% to under 5%, generating 200+ new opportunities per month. That's not a marginal improvement - that's a different pipeline.

Pricing starts free (75 emails/month), with paid plans at roughly $0.01 per lead. No contracts, no sales calls, cancel anytime. Native integrations with Salesforce, HubSpot, Smartlead, Instantly, and Lemlist.

Skip this if: You specifically need ad spend tracking and brand-agency relationship mapping. Pair Prospeo with MediaRadar for that.

Apollo.io

Apollo's the obvious starting point for budget-conscious teams leaving Winmo. It's not just a database - it's data plus email sequences, an auto-dialer, and basic workflow automation in one platform.

Pros:

- 275M+ contacts across 73M+ companies - massive coverage

- Free plan with 10,000 email credits and 5 mobile credits

- Built-in email sequences and auto-dialer eliminate the need for a separate outreach tool

- $49/user/month on Basic (annual), $79 on Professional - a 5-person team on Professional runs ~$7,140/year with typical credit overages

Cons:

- Email bounce rates hit 15-20% on some segments, so you'll want to verify externally

- Credit anxiety is real: teams regularly run out mid-month on Professional plans

- The free plan is generous but the mobile credit limits are tight (5/month)

- Gets expensive at scale - a 15-person team on Organization with credit overages can hit $30K+/year

Rated 4.7/5 on G2. Compared to Winmo, Apollo gives you 1,000x the contacts at a fraction of the cost - but zero ad intelligence.

MediaRadar

MediaRadar is the only tool on this list that actually competes with Winmo on its core turf: ad intelligence. If you're in media sales, publishing, or ad tech and you need to know where brands are spending, how much, and through which agencies - this is your shortlist of two, and MediaRadar is the other one.

The platform tracks ad placements across 30+ media channels and covers 5M+ brands. Where Winmo focuses on brand-agency relationships and predicting account movement, MediaRadar excels at competitive campaign tracking - showing you exactly where a brand's ads are running and how their media mix is shifting.

Rated 4.5/5 across 134 reviews. Winmo scores higher on ease of use and setup, but MediaRadar wins on competitive product support and feature roadmap direction. Both serve mid-market primarily.

Pricing is comparable to Winmo's mid-tier. Data from 17 real deals puts the average contract at $37,441/year, with a range from $5,000 to $128,000 depending on scope. Not cheap - but if you need ad intelligence, there's no budget alternative. This is a two-player market.

The practical gap: MediaRadar's contact data for individual buyers isn't as deep as Winmo's hand-verified database. Many teams pair MediaRadar with a dedicated contact data tool to cover both bases.

ZoomInfo

Skip this if: Price is why you're leaving Winmo. ZoomInfo isn't a budget-friendly swap - it's a lateral move to a different expensive platform.

ZoomInfo's database runs 500M+ contact profiles across 100M companies, with 1B buying signals processed monthly. It's the default enterprise data platform for a reason - rated 4.5/5 across 9,300+ reviews.

But the pricing is brutal. Professional starts at $15,000-$18,000/year for 1-3 seats. Advanced runs $22,000-$28,000. Elite hits $35,000-$45,000+. All annual-only, and renewal increases of 10-20% are standard. I've seen teams sign at $25K and get quoted $35K at renewal with zero additional seats.

Where ZoomInfo wins over Winmo: US database depth, intent data maturity, and workflow breadth. Where Winmo wins: ad-specific intelligence, brand-agency mapping, and WinmoEdge predictions. They're solving different problems - if you're switching from Winmo to ZoomInfo, make sure you actually need what ZoomInfo offers.

Lead411

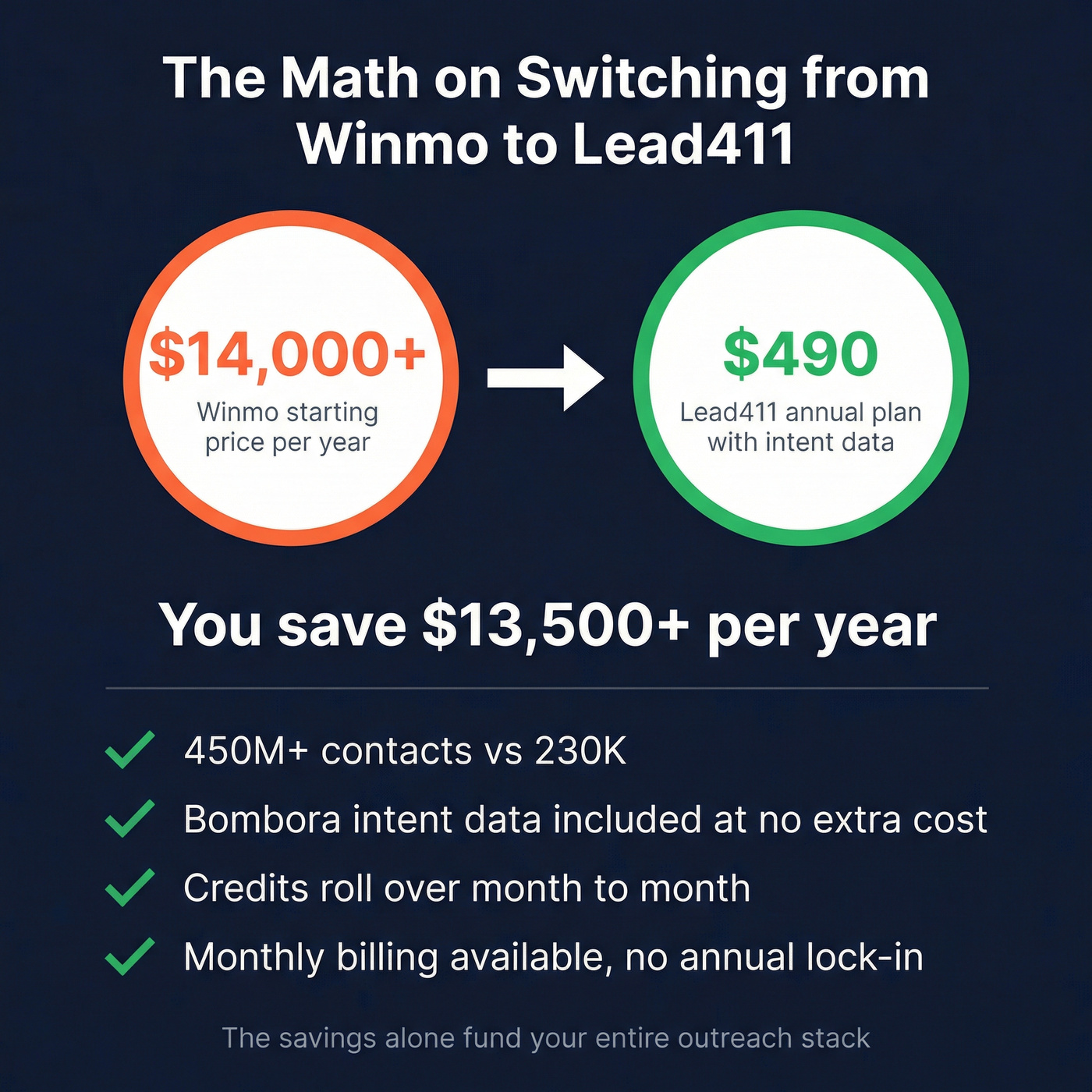

Lead411 is the best value play on this list. Full stop.

- $49/month or $490/year - and the annual plan includes Bombora intent data at no extra charge. That's remarkable value.

- 450M+ contacts across 20M companies with triple-verified emails re-verified every 3-6 months

- Credits roll over to the next billing cycle - a rarity in this space

- Comparison data shows Lead411 is "better at meeting requirements," "easier to set up," and "easier to do business with" than Winmo

- Rated 4.5/5 across 475+ reviews

The trade-offs: the UI feels dated compared to Apollo or ZoomInfo, international coverage is thinner than Cognism or ZoomInfo, and the Blaze (unlimited) plan requires a custom quote - expect $2,500-$5,000/year based on market positioning.

For SMBs spending $14K+ on Winmo, Lead411 at $490/year with intent data is a no-brainer. The savings alone fund your entire outreach stack.

Cognism

Cognism is the play if you're selling into the UK or EMEA. Winmo's user base is 97% North American - that tells you everything about its geographic limitations. Cognism carries 180% more contacts in the UK and 250%+ more in France and Germany than most competitors.

Diamond Data phone-verified mobiles deliver an 87% connection rate - the highest claimed in the industry. The Grow plan starts at $1,500/year for 1-3 users, but scales fast: data from real deals puts a 5-user Elevate plan at ~$37,500/year. Annual contracts are required, and "unlimited" access comes with a fair-use cap of roughly 2,000 records per user per month.

Where Cognism wins over ZoomInfo: EMEA compliance and mobile verification quality. Where ZoomInfo still wins: US database depth and workflow breadth. Rated 4.6/5.

UpLead

UpLead is the "just give me clean data" option. It delivers 95% email accuracy backed by a credit-back guarantee on bounces - put your money where your mouth is, and UpLead does.

Essentials runs $99/month ($74 on annual billing) for 170 credits. Plus at $199/month adds technographics and data enrichment. Additional credits cost $0.50-$0.60 each. Database covers 160M+ contacts. Rated 4.7/5 - one of the highest in the category.

Skip this if: You need mobile numbers at scale, intent data, or outreach automation. UpLead is a focused data tool, not a platform.

Seamless.AI

The Basic plan runs ~$147/month, email accuracy sits around 85%, and phone accuracy drops to roughly 60% per user reports. Credits don't roll over, daily credits expire the same day, and the 4.2/5 rating is the lowest on this list. If data quality matters to you, look elsewhere.

D&B Hoovers

Starts at $5,388/year for Essentials, but the median contract across 92 real deals is $41,069/year. The dual-credit system - requiring both company data AND contact data credits per prospect - effectively halves your usable records. Makes sense for firmographic research, not for prospecting. Rated 4.3/5.

LinkedIn Sales Navigator

Sales Nav at $99.99/user/month is a complementary tool, not a standalone replacement. No email or phone export natively - you'll need a separate tool to actually contact anyone you find. Useful for account research and social selling, but it doesn't solve the core data problem.

Which Alternative Is Right for You?

The right tool depends entirely on what you actually used Winmo for. Be honest with yourself.

You're in ad sales and need ad intelligence. MediaRadar is your only real option. It's the sole tool that tracks ad placements, media spend, and competitive campaigns the way Winmo does. Budget ~$37K/year. Pair it with a contact data tool for direct dials.

You want data plus outreach in one tool on a budget. Apollo.io. The free plan is useful, and a 5-person Professional team runs ~$7,140/year. You get email sequences, an auto-dialer, and 275M+ contacts. The trade-off is 15-20% bounce rates on some segments - verify externally before launching sequences.

You're an SMB that needs intent data without enterprise pricing. Lead411 at $490/year with Bombora intent data included. Credits roll over. Triple-verified emails. Best value play for teams under 10 people.

You need EMEA/UK coverage. Cognism. Winmo is 97% North American. If you're selling into the UK, France, or Germany, Cognism's coverage gap is massive - 180%+ more contacts in the UK alone.

You need enterprise scale and can afford it. ZoomInfo. But go in with eyes open: you're signing an annual contract at $15K+ that'll increase 10-20% at renewal.

Snyk's 50 AEs switched and cut bounce rates from 35% to under 5%, generating 200+ new opportunities per month. Prospeo's 30+ filters, Bombora intent data, and CRM enrichment replace everything Winmo does as a contact database - at 90% less cost.

Get enterprise-grade data without the enterprise invoice.

Ad Intelligence vs. Contact Data: Know What You're Buying

Look - most lists comparing Winmo alternatives are comparing apples to oranges. Winmo and MediaRadar are ad intelligence platforms. Everything else on this list - Apollo, ZoomInfo, Lead411, Cognism, UpLead - is general B2B contact data.

These are fundamentally different products solving different problems.

Winmo tells you which brands are shifting agencies, what they're spending on CTV, and when their media review is happening - with 75% prediction accuracy on those 3-18 month forecasts. Apollo tells you the VP of Marketing's email address. Both are useful. They're not interchangeable.

The key insight most teams miss: many Winmo users are overpaying for ad intelligence they don't fully use. They signed up for WinmoEdge predictions and brand-agency mapping, but 80% of their daily usage is pulling contact info for outreach. If that's you, the contact data tools on this list give you broader coverage with fresher data at a fraction of the cost - you just lose the ad spend tracking and brand-agency mapping.

Be honest about which category you actually need. It'll save you thousands.

FAQ

Is Winmo worth the price in 2026?

For ad sales teams actively using WinmoEdge predictions and brand-agency mapping weekly, the $14K-$65K/year can deliver ROI - though it averages 13 months to materialize. If you mainly pull contact data for outreach, tools like Prospeo or Apollo cover that use case at 5-10% of the cost.

What's the cheapest alternative to Winmo for contact data?

Prospeo offers a free tier with 75 verified emails/month and paid plans at ~$0.01/lead, making it the most cost-effective option for verified B2B contacts. Apollo.io also has a free plan, and Lead411 starts at $49/month with Bombora intent data included - all dramatically cheaper than Winmo's $14K minimum.

What's the best Winmo alternative for ad sales specifically?

MediaRadar is the only direct competitor for ad intelligence, tracking placements across 30+ media channels and covering 5M+ brands. Average contracts run ~$37,400/year based on 17 real transactions - comparable to Winmo's mid-tier but with stronger competitive campaign tracking and media-mix analysis.

Can I combine multiple tools to replace Winmo?

Yes, and it's often the smartest move. A common stack is MediaRadar for ad intelligence plus a dedicated contact data tool for outreach. This typically costs less than a single Winmo Enterprise contract while delivering best-in-class capabilities for each function instead of one platform stretching across both.

Does Winmo offer a free trial?

Winmo provides demo access through a sales call but no self-serve free trial. Apollo, Lead411, UpLead, and Prospeo all offer free tiers or self-serve trials you can start using within minutes - no sales conversation required.