The Complete Guide to B2B Lead Profiles: Data Points, Templates, and Tools

65% of marketers say generating traffic and leads is their biggest challenge - and most of them are working with lead profiles that have a handful of fields filled out of the 25-40 that actually matter. That's not a data problem. It's a prioritization problem disguised as a pipeline problem.

What You Need (Quick Version)

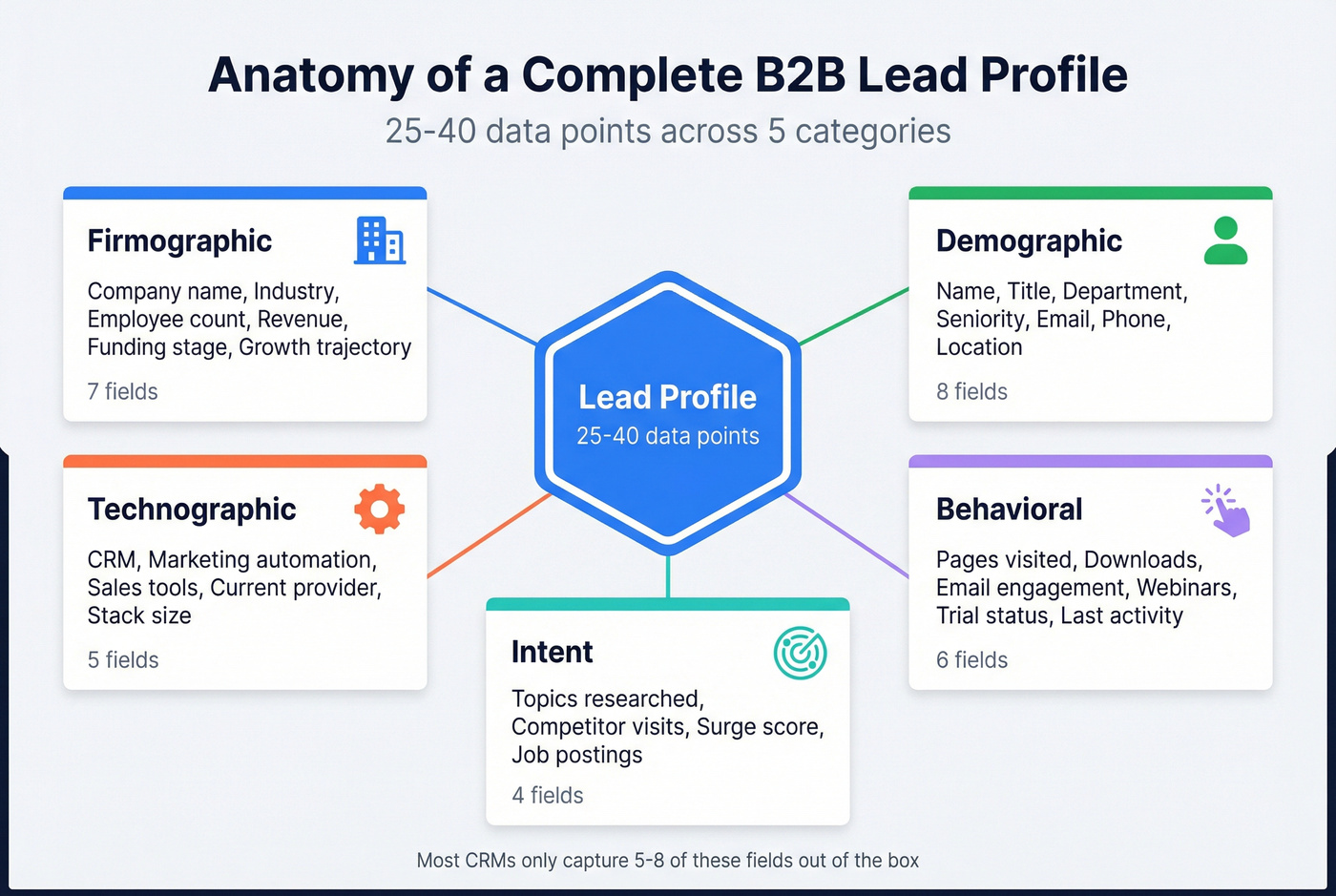

A lead profile isn't a contact card. It's 25-40 data points across five categories - firmographic, demographic, technographic, behavioral, and intent - that tell you whether someone's worth calling and what to say when you do.

Most CRM profiles are half-empty. Reps have a name, an email, maybe a title. That's not enough to prioritize, personalize, or even route leads correctly. And it's why so many "qualified" leads go nowhere.

Here's the thing: if your average deal size sits below $10K, you probably don't need ZoomInfo-level data. But you absolutely need complete profiles for every lead in your pipeline. The difference between a $39/month enrichment tool and a $15,000/year platform isn't data quality - it's features most teams never activate.

What Is a Lead Profile (and What It Isn't)

A lead profile is a structured collection of real data about a specific individual prospect - their identity, their company, their tech stack, their behavior, and their buying signals. Scoring, routing, and personalization all sit on top of it.

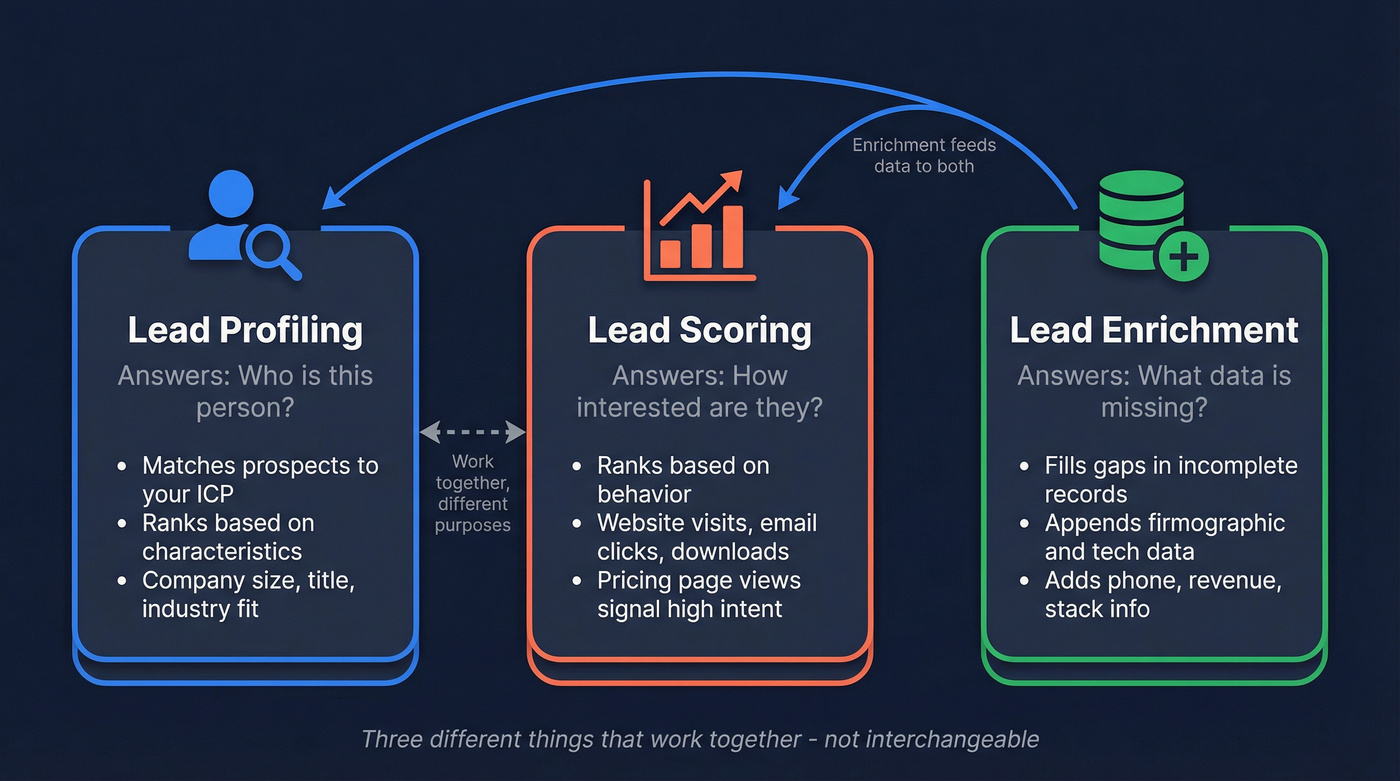

Here's where teams get confused. Lead profiling, lead scoring, and lead enrichment are three different things that work together:

- Lead profiling ranks prospects based on their characteristics - how closely they match your ideal customer. A VP of Sales at a 150-person SaaS company scores higher than an intern at a 10-person agency because the profile matches your ICP.

- Lead scoring ranks them based on behavior - website visits, email engagement, content downloads, pricing page views. That VP visited your pricing page three times this week, bumping their score above a CTO who matched your ICP but hasn't engaged in 60 days. (If you want to go deeper, see lead scoring systems.)

- Lead enrichment fills in the gaps - appending firmographic, technographic, and contact data to incomplete records. A form capture gives you name and email; enrichment adds company revenue, tech stack, direct dial, and department size.

Profiling answers "who is this person?" Scoring answers "how interested are they?" Enrichment is how you get the data for both.

The average B2B buyer conducts 70% of their buying research online before ever talking to sales. By the time a lead hits your CRM, they've already formed opinions. A complete profile lets you meet them where they are instead of starting from scratch. 96% of B2B companies now say lead enrichment is vital to their sales and marketing efforts - this isn't optional anymore.

Why Complete Lead Profiles Matter - The Numbers

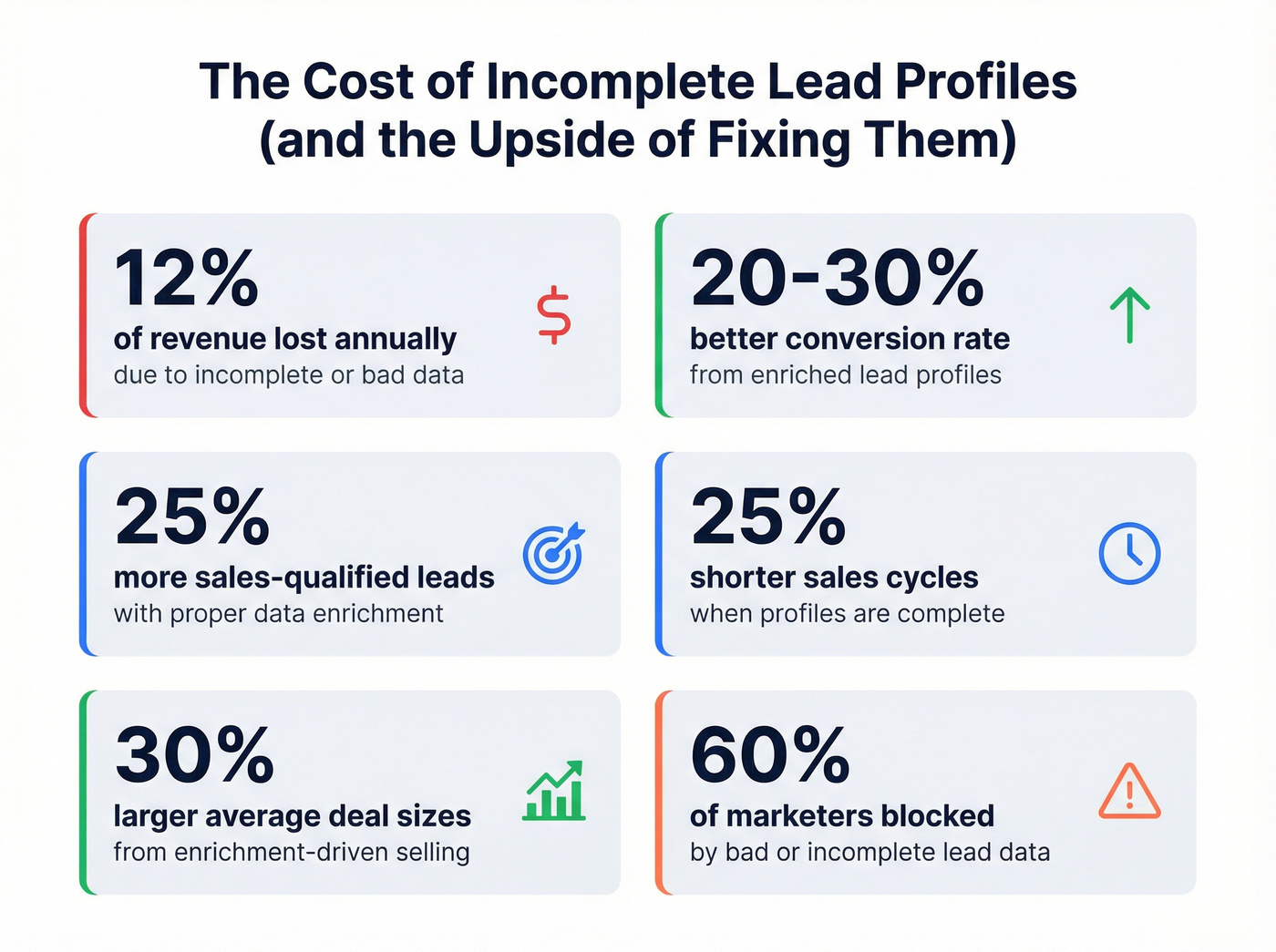

Companies lose roughly 12% of revenue annually. That's not a rounding error.

For a $10M company, that's $1.2M walking out the door because your profiles are incomplete, outdated, or wrong. Companies spend an average of $100,000 yearly on lead generation, and a significant chunk of that investment evaporates when the underlying data is garbage.

The upside of getting this right is equally dramatic. Enriched leads convert 20-30% better than non-enriched leads. Companies using data enrichment see 25% more sales-qualified leads, 25% shorter sales cycles, and 30% larger average deal sizes.

And yet, 60% of marketers say bad or incomplete data blocks effective lead enrichment. 80% say they need better tools to handle lead data. 70% of companies can't properly connect their CRM with marketing automation. The data exists - it's just not making it into the profiles where reps can actually use it.

The data enrichment market hit $2.37 billion in 2023 and is growing at 10.1% CAGR through 2030. Companies are spending real money on this. The question isn't whether prospect profiles matter - it's whether yours are good enough to justify what you're paying for them.

You just read that enriched leads convert 20-30% better. Prospeo returns 50+ data points per contact - firmographic, technographic, intent, and verified contact info - with a 92% match rate and 98% email accuracy. Fill every field in your lead profiles for ~$0.01 per email.

Complete lead profiles shouldn't cost $15K/year. They don't have to.

Anatomy of a Complete B2B Lead Profile

A thorough B2B lead profile contains 25-40 data points across five categories. Most CRMs capture 5-8 fields out of the box. Here's what a complete profile actually looks like.

Firmographic Data

This is the company-level foundation. It tells you whether the account fits your ICP before you ever look at the individual. (More on this in our guide to firmographic data.)

| Field | Example |

|---|---|

| Company name | Acme Corp |

| Industry | SaaS / B2B |

| Employee count | 150 |

| Annual revenue | $25M |

| HQ location | Austin, TX |

| Funding stage | Series B |

| Growth trajectory | Hiring +30% YoY |

Demographic Data

This is the individual. Who are they, what do they do, and do they have the authority to buy?

| Field | Example |

|---|---|

| Full name | Sarah Chen |

| Job title | VP of Sales |

| Department | Revenue |

| Seniority level | VP / Director |

| Email (verified) | sarah@acme.com |

| Direct phone | +1-512-555-0142 |

| Location | Austin, TX |

| Reporting structure | Reports to CRO |

Technographic Data

What tools are they already using? This tells you about compatibility, competitive displacement opportunities, and sophistication level.

| Field | Example |

|---|---|

| CRM | Salesforce |

| Marketing automation | HubSpot |

| Sales engagement | Outreach |

| Current data provider | ZoomInfo (contract renewing Q3) |

| Tech stack size | 15+ sales tools |

Behavioral Data

What have they actually done? This is first-party data from your own properties - and it's increasingly more valuable than third-party enrichment.

| Field | Example |

|---|---|

| Pages visited | Pricing, case studies |

| Content downloaded | ROI calculator |

| Email engagement | Opened 4/5, clicked 2 |

| Webinar attendance | Attended live Q&A |

| Product usage | Free trial, day 7 |

| Last activity date | 2 days ago |

For a real-world benchmark, Follow Up Boss tracks registration source, property views, saved searches, incoming calls, and website visits - all tied to the prospect profile with an 8-tab activity timeline. That's the level of behavioral granularity you should aim for, regardless of your industry.

Intent Data

What are they researching externally? Intent signals tell you someone's in-market before they ever fill out a form. (If you want a practical breakdown, see intent signals.)

| Field | Example |

|---|---|

| Intent topics | "sales intelligence," "data enrichment" |

| Competitor research | Visited G2 comparison pages |

| Category surge score | High (3x baseline) |

| Job postings | Hiring 3 SDRs |

Disqualification Signals

Most teams skip this part. That's a mistake.

- Job titles like "student," "intern," or "freelancer"

- Email-only engagement with zero site visits

- Prolonged inactivity (90+ days, no touchpoints)

- Competitor employees visiting your site

- Company size or revenue below your minimum threshold

- Unsubscribes or spam complaints

Title alone doesn't tell you enough - context matters. A VP of Marketing at a 20-person startup and a VP of Marketing at a Fortune 500 operate in completely different universes. Disqualification signals catch that.

Lead Profile Template You Can Copy

Here's the actual template. Copy this into your CRM as custom fields, or use it as a CSV header row for enrichment uploads. (If you're moving data around, this how to import leads guide can save you a lot of cleanup.)

Full Lead Profile Template (All 35 Fields)

| Field | Priority | Source |

|---|---|---|

| Full name | High | Form / Enrichment |

| Email (verified) | High | Form / Enrichment |

| Direct phone | High | Enrichment |

| Job title | High | Form / Enrichment |

| Seniority level | High | Enrichment |

| Department | Medium | Enrichment |

| Reporting structure | Low | Manual / Enrichment |

| Location | Medium | Enrichment |

| Company name | High | Form / Enrichment |

| Industry | High | Enrichment |

| Employee count | High | Enrichment |

| Annual revenue | High | Enrichment |

| HQ location | Medium | Enrichment |

| Funding stage | Medium | Enrichment |

| Growth trajectory (YoY hiring) | Medium | Enrichment / Job postings |

| CRM in use | Medium | Technographic enrichment |

| Marketing automation | Medium | Technographic enrichment |

| Sales engagement tool | Medium | Technographic enrichment |

| Current data provider | Medium | Technographic enrichment |

| Tech stack size | Low | Technographic enrichment |

| Pages visited | High | Behavioral tracking |

| Content downloaded | Medium | Marketing automation |

| Email engagement (opens/clicks) | Medium | Marketing automation |

| Webinar attendance | Low | Marketing automation |

| Product usage / trial status | High | Product analytics |

| Last activity date | High | CRM / Behavioral tracking |

| Intent topics | Medium | Intent data provider |

| Competitor research signals | Medium | Intent data provider |

| Category surge score | Medium | Intent data provider |

| Relevant job postings | Low | Enrichment / Job boards |

| Buying committee role | Medium | Manual / Sales intel |

| Disqualification flags | High | Automated rules |

| Lead source | High | CRM / UTM tracking |

| Social profile URL | Low | Enrichment |

| Timezone | Low | Enrichment |

Decision-Maker Mapping

Every B2B deal involves multiple stakeholders. Your profile should identify where each contact sits in the buying committee.

| Role | Influence | What They Care About |

|---|---|---|

| Economic Buyer | High | Budget, ROI, risk |

| Technical Buyer | Medium-High | Implementation, integrations |

| End User | Medium | Daily workflow, UX |

| Influencer | Low-Medium | Department alignment |

ICP-to-Profile Mapping

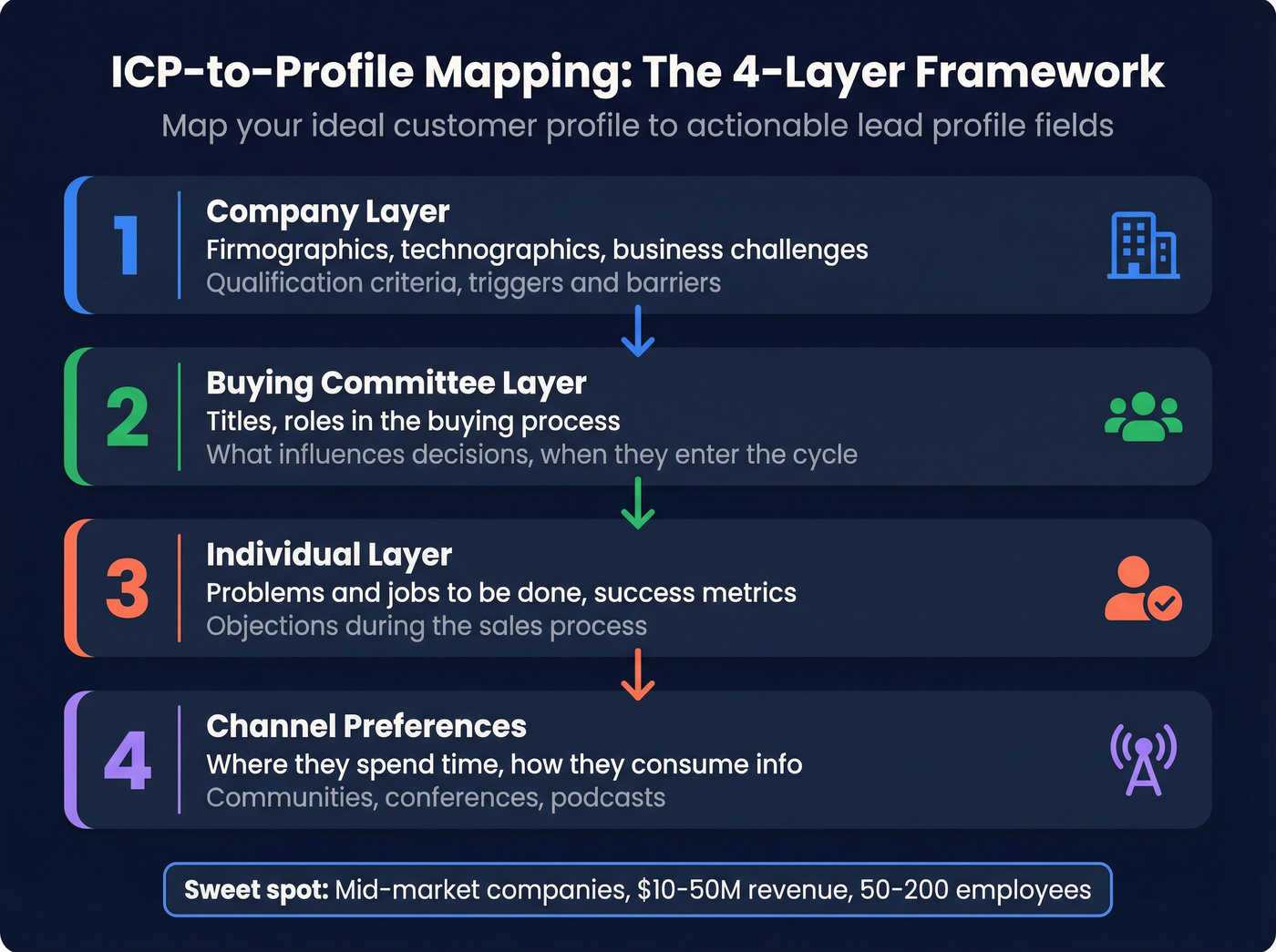

A Reddit practitioner laid out the four layers that matter, and it's the cleanest framework I've seen:

- Company layer: Firmographics, technographics, business challenges, qualification criteria, triggers and barriers

- Buying committee layer: Titles, roles in the buying process, what influences their decisions, when they enter the sales cycle

- Individual layer: Problems and jobs to be done, success metrics, objections during the sales process

- Channel preferences: Where they spend time, how they consume information, communities, conferences, podcasts

The sweet spot for many B2B solutions is mid-market companies with $10-50M annual revenue and 50-200 employees. That's where you'll find enough budget to buy but not so much bureaucracy that deals stall for six months.

How to Build Lead Profiles That Actually Stay Current

Progressive Profiling - Build Profiles Without Killing Conversions

Think of it like a first date - you wouldn't immediately ask about retirement plans and mortgages. Progressive profiling works the same way: collect data incrementally across multiple interactions instead of one massive form.

I've seen teams run 12-field forms on their first touchpoint and wonder why conversion rates are in the single digits. Reducing form fields from 10+ to 3-4 increases conversion by 25-50%. (If you're rebuilding your capture flow, start with the fundamentals of B2B lead capture.)

Here's a B2B sequence that works:

- Touchpoint 1 (ebook download): Name + email only. That's it. Get them in the door.

- Touchpoint 2 (webinar signup, 1 week later): Company name + job title. The platform recognizes them and swaps in new fields.

- Touchpoint 3 (demo request, 2 weeks later): Phone number + company size.

After three short interactions, you've got a complete, high-quality prospect profile - and the lead never felt interrogated.

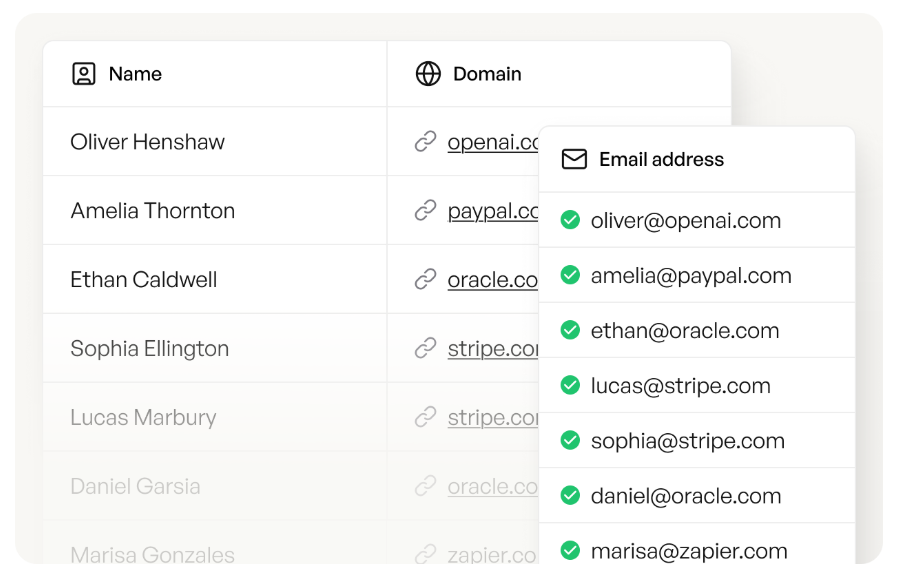

Automate Enrichment Instead of Manual Research

Manual research takes 15-30 minutes per lead. Multiply that by 200 leads a week and you've got an SDR spending their entire week on data entry instead of selling.

That math doesn't work.

B2B contact data decays at roughly 30% per year. People change jobs, companies get acquired, phone numbers rotate. Legacy providers refresh quarterly at best - which means 7-8% of your database is stale at any given time. (Benchmarks + a refresh workflow here: B2B contact data decay.)

The fix is automated enrichment with a fast refresh cycle. Upload a CSV or connect your CRM, get back 50+ verified data points per contact, and set it to refresh weekly instead of quarterly. That's the difference between calling someone who left the company six months ago and reaching them at their new role the week they start.

The real bottleneck isn't finding data - it's connecting it. 70% of companies can't properly sync their CRM with marketing automation. Before you buy another enrichment tool, make sure the one you pick actually integrates with your stack. (If you're diagnosing why syncs break, see CRM integration for sales automation.)

Layer in Intent and Behavioral Data

Here's a genuinely differentiating tactic most teams aren't using yet: AI-powered pre-qualification based on behavioral signals scraped from company websites. Teams are checking whether prospects mention doing consultancy, hiring for specific roles, or using competitor products - all before a human ever reviews the lead. It's a superpower for filtering out bad fits before they enter your pipeline.

The most sophisticated lead profiles combine four scoring dimensions:

- Fit Score: How closely they match your ICP (firmographics, demographics)

- Behavior Score: What they're doing on your site (pricing page visits, content downloads)

- Intent Score: What they're researching externally (Bombora topics, G2 comparisons)

- Interaction Score: How they engage with your outreach (email opens, call connects)

First-party data - what prospects do on your own properties - now surpasses third-party enrichment in importance. A prospect who's visited your pricing page three times this week is hotter than one who matches your ICP perfectly but hasn't engaged.

Tools for Building and Enriching Lead Profiles

| Tool | Best For | Starting Price | Data Refresh | Key Strength |

|---|---|---|---|---|

| Prospeo | Accuracy + freshness | Free; ~$39/mo paid | 7 days | 98% email accuracy, $0.01/email |

| Apollo.io | SMB all-in-one | Free; $49/mo paid | Monthly | Database + sequencing |

| Clay | Custom workflows | $134/mo | Real-time | 100+ data sources |

| ZoomInfo | Enterprise orgs | ~$10,000-15,000/yr | Monthly | 500M+ contacts |

| Lusha | Quick lookups | $22.45/mo | Varies | Browser extension |

| Cognism | EMEA compliance | ~$1,000-3,000/mo | Varies | Phone-verified mobiles |

| HubSpot | Inbound teams | Free CRM; $45/mo | Varies | Native CRM profiles |

For most B2B teams under 50 people, start with Prospeo for data quality and Apollo for sequencing. You don't need ZoomInfo until you're running 200+ seats with dedicated ABM programs. (If you're comparing vendors, start with this roundup of lead enrichment tools.)

Prospeo

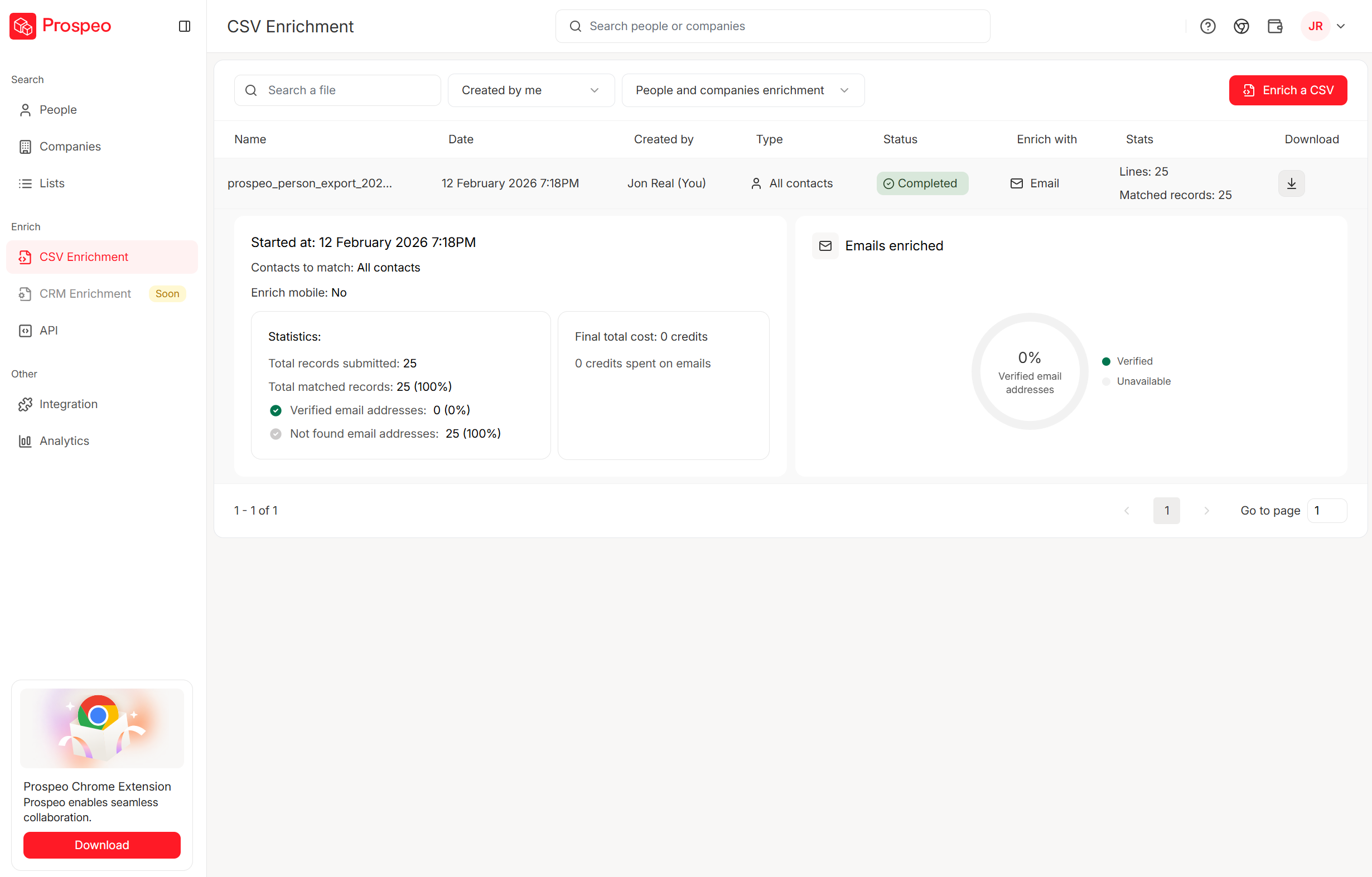

Meritt saw their bounce rate drop from 35% to under 4% after switching - that's the kind of accuracy gap that changes pipeline math overnight. The database covers 300M+ professional profiles with a 7-day refresh cycle (8x faster than the industry average), and at roughly $0.01 per email, it's 90% cheaper than ZoomInfo. Free tier available, paid plans from ~$39/mo, no contracts.

Apollo.io

The most common complaint about Apollo on Reddit: "The emails are great, the phone numbers are garbage." That's a fair summary. We've run lists where Apollo emails verified fine but direct dials connected maybe 40% of the time. If phone outreach is central to your motion, you'll want to verify numbers through a second source.

So why does everyone still recommend it? Because for $49/mo, you get a database, a sequencer, and a dialer in one platform. The free tier is genuinely useful. The learning curve is gentle. For SMB teams who need to start outbound this week without stitching together five tools, nothing else matches the speed to value.

Where Apollo wins over ZoomInfo: price, speed to value, and the built-in sequencer. Where ZoomInfo still wins: data depth for enterprise accounts and intent signal breadth.

Clay

A workflow example that shows why Clay exists:

You have a list of 500 target accounts. You want verified emails from Provider A, mobile numbers from Provider B, technographic data from Provider C, and intent signals from Provider D. Without Clay, that's four separate uploads, four exports, and a nightmare VLOOKUP session.

With Clay, you build this as a single workflow in a spreadsheet-like interface. Upload your list, define your enrichment steps, and Clay waterfalls across 100+ data sources - pulling from whichever provider has the best data for each field. Starting at $134/mo, it's not cheap, but the credit system lets you control costs.

Skip this if you just need verified emails and phones fast. Clay adds complexity you don't need for straightforward enrichment.

ZoomInfo

Let's start with the elephant in the room: price. Starting around $10,000-15,000/year for a basic contract, scaling to $30K+ with intent data and mobile add-ons. The #1 complaint on Reddit, G2, and every sales community is that you're paying for modules you'll never activate.

That said, ZoomInfo is the enterprise default for a reason. 500M+ contacts, 100M+ company profiles, 1B+ monthly buying signals, and a Gartner Magic Quadrant leader position. If you're a 200+ person sales org running outbound, ABM, and intent from one platform, the breadth is hard to beat.

The honest question to ask: are you actually going to use the full GTM suite? If the answer is "we mostly need accurate emails and phones," you're overpaying by an order of magnitude.

Quick Mentions

Lusha: Lightweight browser extension for quick contact lookups. From $22.45/mo with a free tier. Good for individual reps who need a phone number right now, not for bulk enrichment.

Cognism: The GDPR-focused option with phone-verified mobile numbers. Strong in EMEA where compliance matters most. Typically $1,000-3,000/mo for small teams. In our experience, Cognism consistently outperforms on verified European mobiles. Where ZoomInfo wins: US database depth.

HubSpot: Free CRM with native profile management. Marketing Hub from $45/mo adds enrichment features. Best for inbound-heavy teams already in the HubSpot ecosystem - not a standalone enrichment play.

6sense / Bombora: If you're layering intent data onto your profiles, these are the two names you'll hear most. 6sense offers account-level intent with predictive scoring (typically $25K+/year for mid-market). Bombora powers intent signals across many platforms, including several tools on this list.

LeadIQ: Purpose-built for SDR prospecting workflows. Captures contact data during research and pushes it directly to your sequencer. From $39/mo. Good complement to a database tool if your reps live in a browser all day.

Five Lead Profiling Mistakes That Kill Your Pipeline

1. Over-relying on firmographics alone. A VP of Marketing at a 20-person startup and a VP of Marketing at a Fortune 500 have almost nothing in common - different budgets, different buying processes, different pain points. Firmographics get you to the right company. You need technographic, behavioral, and intent data to get to the right person at the right time.

2. Treating every lead the same. Not all lead types deserve the same workflow. Without qualification criteria, your reps spend equal time on a student downloading a whitepaper and a VP requesting a demo. Use ICP scoring and intent signals to prioritize. Not every lead deserves a call.

3. Letting profiles go stale. B2B data decays at ~30% per year. If you're refreshing quarterly, roughly 7-8% of your database is wrong at any given time. That means bounced emails, wrong numbers, and reps calling people who left the company six months ago. Automate refresh cycles or accept the pipeline hit.

4. Buying static lists and calling it a strategy. Purchased lists get sold to thousands of companies. Your "exclusive" leads are getting the same cold emails from five competitors. Build profiles from your own inbound traffic, enrich them with verified data, and you'll have something your competitors don't.

5. Manual profiling that doesn't scale.

Real talk: if your SDRs are spending 15-30 minutes researching each lead in browser tabs, you've got a process problem, not a people problem. Enrichment tools exist specifically to eliminate this. The ROI math is straightforward - even at $0.01-0.10 per lead enriched, you're saving hours of SDR time per day.

Using Lead Filters to Segment and Prioritize

Lead filters are how you turn a bloated database into a workable pipeline. Instead of scrolling through thousands of contacts, set up filters based on firmographic thresholds (revenue, headcount, industry), behavioral triggers (pricing page visits, trial signups), and intent scores. Most CRMs and enrichment platforms let you save filter combinations so your reps start each day with a pre-prioritized list rather than a data dump.

Understanding the distinction between lead source vs. lead method also sharpens your filtering. Lead source tells you where the contact originated - organic search, paid ad, referral, event. Lead method describes how they were acquired - inbound form fill, outbound cold call, connection request. Tracking both in your profiles lets you filter by acquisition channel and measure which combinations produce the highest conversion rates.

Lead Profiles by Industry

Profiling priorities shift dramatically by vertical.

SaaS: Urgency signals and product usage data dominate. Track free trial activity, feature adoption, and integration usage. A lead who's connected their CRM to your free tier is 10x more valuable than one who signed up and never logged in.

Real Estate: Emotional timing and behavioral monitoring matter most. Track property views, saved searches, price range changes, and inquiry patterns. Follow Up Boss captures everything from registration source to viewed properties to incoming calls - all tied to the prospect profile. Past buyer tracking is especially valuable here: when a previous customer re-engages after a dormant period, that signal often indicates a new transaction is imminent and should trigger immediate outreach.

Manufacturing: Product interest tracking and innovation trends. Monitor which product pages leads visit, what technical specs they download, and whether they're researching new materials or processes. Long sales cycles mean profiles need to capture months of engagement.

Financial Services: Needs, agenda, and timing. Understanding each lead's financial goals and communicating at the right moment is everything. Behavioral data reveals what they're reading and researching, which tells you what they care about before the first conversation.

Healthcare: Compliance and role-based access shape everything. Track which clinical vs. administrative content leads engage with, whether they're researching specific regulatory requirements, and what peer-reviewed sources they reference. Decision committees are larger here - expect 6-10 stakeholders per deal, and your profiles need to map every one.

Your lead profiles need 25-40 data points across five categories. Prospeo's database covers all of them - 300M+ profiles, 125M+ verified mobiles, intent data across 15,000 topics, and technographic filters - refreshed every 7 days, not every 6 weeks.

Turn skeleton CRM records into full lead profiles in one click.

FAQ

What's the difference between a lead profile and a buyer persona?

A buyer persona is a fictional composite representing an audience segment; a lead profile is real data about a specific individual - their name, company, tech stack, behavior, and intent signals. Personas guide strategy and messaging. Profiles guide actual outreach to real people with verified contact information.

How many data points should a B2B lead profile have?

A thorough B2B lead profile contains 25-40 data points across five categories: firmographic, demographic, technographic, behavioral, and intent. Most CRMs only capture 5-8 fields, which isn't enough to prioritize or personalize. Start with high-priority fields and use enrichment tools to fill the remaining gaps automatically.

How often should lead profile data be refreshed?

B2B contact data decays at roughly 30% per year, so quarterly refreshes leave 7-8% of your database stale at any given time. Best-in-class tools refresh every 7 days, keeping profiles current enough for reliable outreach. At minimum, refresh before any major campaign launch.

What's the ROI of investing in lead profile enrichment?

Companies using data enrichment see 20-30% higher conversion rates, 25% more sales-qualified leads, and 30% larger average deal sizes. Poor data quality costs roughly 12% of revenue annually. For most teams, enrichment pays for itself within the first quarter - and delaying means paying in bounced emails and wasted SDR hours every week.